Dipeptidyl Peptidase 1 (DPP1) Market Summary

- Oral DPP1 inhibitors block the activation of neutrophil serine proteases, reducing harmful inflammation and tissue damage in diseases like bronchiectasis. Uniquely, they target an upstream enzyme, breaking the cycle of neutrophil-driven damage at its source. This disease-modifying approach distinguishes them from standard anti-inflammatory treatments.

- In February 2025, the US FDA had accepted Insmed’s New Drug Application (NDA) for brensocatib for patients with bronchiectasis and granted it Priority Review designation, setting a Prescription Drug User Fee Act (PDUFA) target action date of August 12, 2025. If approved, Insmed plans to launch brensocatib immediately in the US.

- In 2024, DelveInsight estimated that the 7MM had nearly 1 million diagnosed prevalent cases of Non-Cystic Fibrosis Bronchiectasis (NCFB), highlighting its considerable prevalence and the growing need for better diagnosis, disease management, and targeted therapies for this chronic respiratory condition.

- According to secondary sources, the prevalence of chronic rhinosinusitis without nasal polyps in Spain accounts for nearly 0.8% of the country’s total population, highlighting a notable burden of this subtype within the broader chronic rhinosinusitis landscape.

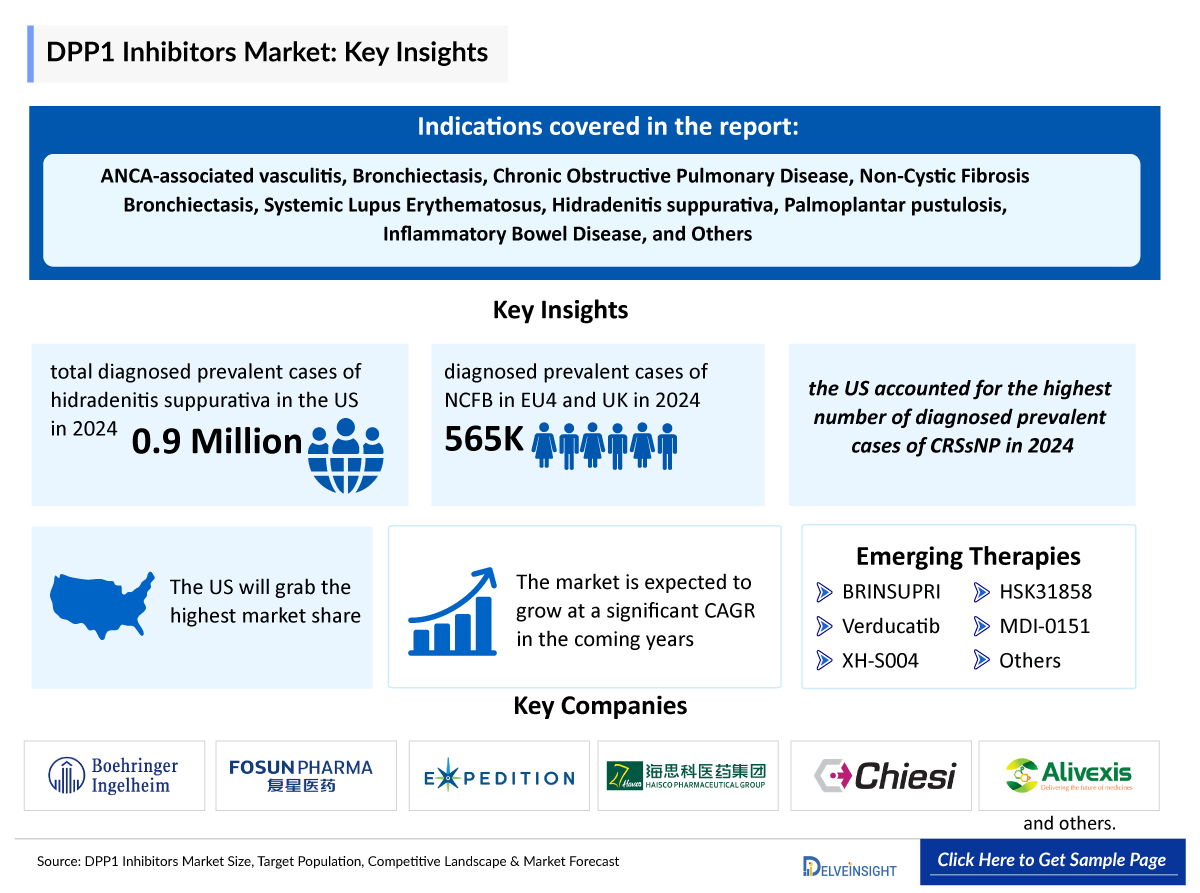

- In 2024, the US accounted for about 390 thousand diagnosed prevalent cases of NCFB, representing 37% of all cases across the 7MM. This emphasizes the US as a key market with a significant share of the disease burden.

- In 2024, there were around 1.8 million diagnosed prevalent cases of hidradenitis suppurativa in the 7MM, and this number is expected to grow over the forecast period (2025-2034).

- Currently, the absence of FDA-approved oral DPP1 inhibitors highlights a clear scarcity of treatment options, presenting a valuable opportunity for novel therapies to meet this unmet medical need and improve patient outcomes.

- Additionally, a number of oral DPP1 inhibitors—such as Brensocatib, BI 1291583, MDI-0151, and others—are progressing in the development pipeline. This advancing pipeline signals strong progress toward addressing this treatment gap and providing new targeted options for patients.

- Boehringer Ingelheim, Insmed, Alivexis and several other companies are currently engaged in the development and production of oral DPP1 inhibitors, which has the potential to significantly impact and enhance the oral DPP1 inhibitors market.

DelveInsight’s “Oral Dipeptidyl Peptidase 1 (DPP1)” – Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the oral DPP1 inhibitors, historical and projected epidemiological data, competitive landscape as well as the oral DPP1 inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The oral DPP1 inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM oral DPP1 inhibitors market size from 2020 to 2034. The report also covers emerging oral DPP1 inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

Oral DPP1 inhibitors Epidemiology |

Segmented by:

|

|

Oral DPP1 inhibitors Key Companies |

|

|

Oral DPP1 inhibitors Emerging Key Therapies |

|

|

Oral DPP1 inhibitors Market |

Segmented by:

|

|

Analysis |

|

Oral Dipeptidyl Peptidase 1 (DPP1) Inhibitors Understanding and Treatment Algorithm

Oral Dipeptidyl Peptidase 1 (DPP1) Inhibitors Overview

Oral DPP1 inhibitors are agents that block the activity of DPP1, an enzyme that activates neutrophil serine proteases during neutrophil development. By inhibiting DPP1, these compounds reduce excessive protease activity, which drives tissue damage and chronic inflammation. They are being investigated across multiple inflammatory and respiratory diseases where neutrophilic inflammation plays a central role.

These inhibitors work by preventing the activation of enzymes that cause airway damage, mucus overproduction, and recurrent infections. By targeting this upstream mechanism, oral DPP1 inhibitors aim to interrupt the cycle of inflammation and tissue destruction, potentially modifying disease progression rather than just alleviating symptoms. Their novel mechanism and oral administration make them an important emerging approach for conditions marked by unchecked neutrophil-driven damage.

Oral Dipeptidyl Peptidase 1 (DPP1) Inhibitors Treatment

Oral DPP1 inhibitors are a class of targeted therapies that block the activation of neutrophil serine proteases, which play a key role in inflammation and tissue damage. These drugs are being developed to treat chronic inflammatory and respiratory conditions driven by excessive neutrophil activity. By inhibiting DPP1, they prevent the activation of proteases such as neutrophil elastase, which contribute to airway damage, mucus overproduction, and recurrent infections.

In diseases like NCFB or COPD, oral DPP1 inhibitors work by reducing protease-mediated tissue destruction and inflammation, aiming to slow disease progression and improve lung function. By targeting this upstream mechanism, they help break the vicious cycle of chronic inflammation and structural lung damage, offering a disease-modifying approach rather than just symptom relief.

Further details related to country-based variations are provided in the report…

Oral Dipeptidyl Peptidase 1 (DPP1) Inhibitors Epidemiology

The oral DPP1 inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases in selected indications for oral DPP1 inhibitors, total eligible patient pool in selected indications for oral DPP1 inhibitors, and total treated cases in selected indications for oral DPP1 inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

- In 2024, the total diagnosed prevalent cases of hidradenitis suppurativa were approximately 0.9 million cases in the US, which are expected to grow during the forecast period (2025-2034).

- In 2024, EU4 and UK together accounted for approximately 565 thousand diagnosed prevalent cases of NCFB, with the UK alone contributing around 230 thousand cases. This underscores the UK’s substantial disease burden within EU4 and the UK landscape and need for targeted interventions.

- According to secondary sources, the prevalence of chronic rhinosinusitis without nasal polyps in Spain accounts for nearly 0.8% of the country’s total population, highlighting a notable burden of this subtype within the broader chronic rhinosinusitis landscape.

- In 2024, the US accounted for the highest number of diagnosed prevalent cases of Chronic Rhinosinusitis without Nasal Polyps followed by EU4 and the UK and Japan estimating approximately 42% and 7% cases the 7MM. This trend is likely to be followed during the forecast period as well.

- Within EU4 and the UK, Germany reported the highest prevalence of hidradenitis suppurativa cases, whereas Spain had the lowest number of cases among these countries.

- In 2024, Japan reported an estimated 98 thousand diagnosed prevalent cases of NCFB, reflecting a considerable patient population. This underscores the growing recognition of the disease in Japan and highlights opportunities for improved diagnosis and treatment strategies in this market.

|

Table 1: Epidemiology of Selected Indications | |

|

Indication |

Estimated Cases in 7MM (2024) |

|

NCFB |

~1 million (Prevalence) |

|

Hidradenitis Suppurativa |

~1.8 million (Prevalence) |

|

Chronic Rhinosinusitis Without Nasal Polyps |

~72 million (Prevalence) |

Note: Indications are selected based on pipeline activity

Oral Dipeptidyl Peptidase 1 (DPP1) Inhibitors Drug Chapters

The drug chapter segment of the oral DPP1 inhibitors reports encloses a detailed analysis of oral DPP1 inhibitors late-stage (Phase III and Phase I) and early stage pipeline drugs. It also helps understand the oral DPP1 inhibitor's clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest news and press releases.

Emerging Drugs

Brensocatib: Insmed

Brensocatib is an oral, small-molecule, reversible inhibitor of dipeptidyl peptidase 1 (DPP1) being developed by Insmed to treat bronchiectasis, chronic rhinosinusitis without nasal polyps, hidradenitis suppurativa, and other conditions driven by neutrophil-mediated inflammation.

- Insmed had finished enrolling 288 patients in its Phase IIb BiRCh trial evaluating brensocatib for chronic rhinosinusitis without nasal polyp. The company expects to share topline results from this study by the end of 2025, as planned.

- Insmed had continued enrolling patients in the Phase IIb CEDAR trial of brensocatib for hidradenitis suppurativa. Based on enrollment progress, an interim futility analysis from the first 100 patients who completed Week 16 was anticipated in the first half of 2026.

- Regulatory submissions in EU4 and UK have already been accepted, and a filing in Japan is expected in 2025. Subject to approvals, Insmed aims to roll out commercial launches in these markets by 2026.

BI 1291583: Boehringer Ingelheim

BI 1291583 is an innovative DPP1 inhibitor, also known as a cathepsin C (CatC) inhibitor, designed to help improve symptoms and quality of life for people with bronchiectasis. By blocking CatC, it aims to lower neutrophilic inflammation, which is central to the development of bronchiectasis.

- BI 1291583 has received Breakthrough Therapy Designation (BTD) and Fast Track Designation (FTD) from the US FDA. Boehringer Ingelheim is currently evaluating its efficacy, safety, and tolerability versus placebo in people with bronchiectasis, regardless of underlying causes, through the AIRTIVITY study [NCT06872892].

- This Phase III, multicenter, multinational, randomized, double-blind, placebo-controlled trial includes a treatment period lasting from one year up to one and a half years. The primary endpoint is the annualized rate of pulmonary exacerbations through week 76.

MDI-0151: Alivexis/Melodia Therapeutics

MDI-0151 is a clinical candidate from Alivexis’ MOD-A discovery program, which focuses on inhibiting Cathepsin C, also known as DPP-1. This enzyme activates proteases that play a major role in neutrophil-driven tissue damage. The program, currently in the preclinical stage, is being developed collaboratively by Melodia Therapeutics and Alivexis.

- In June 2024, Melodia Therapeutics and Alivexis signed an exclusive licensing agreement for the Cathepsin C inhibitor program, MDI-0151.

Note: Detailed emerging therapies assessment will be provided in the final report.

|

List of Emerging Drugs | ||||

|

Drug Name |

Company |

Indication |

Mechanism of Action |

Highest Phase |

|

Brensocatib |

Insmed |

Bronchiectasis; chronic rhinosinusitis without nasal polyps; hidradenitis suppurativa |

DPP1 inhibitor |

Preregistration |

|

BI 1291583 |

Boehringer Ingelheim |

Bronchiectasis |

DPP1 inhibitor |

Phase III |

|

MDI-0151 |

Alivexis/Melodia Therapeutics |

Bronchiectasis |

DPP1 inhibitor |

Preclinical |

|

XX |

XX |

XX |

XX |

XX |

Note: The emerging drug list is indicative, the full list will be given in the final report.

Oral Dipeptidyl Peptidase 1 (DPP1) Inhibitors Market Outlook

The market for DPP1 inhibitors is expected to expand significantly in the coming years. This growth is driven by the rising prevalence of neutrophil-driven inflammatory diseases, increasing awareness of the therapeutic potential of DPP1 inhibition, a growing number of DPP1 inhibitors progressing through clinical trials, and heightened interest from major pharmaceutical companies.

DPP1 inhibitors represent a promising treatment class that targets the upstream activation of neutrophil serine proteases, which are key mediators of tissue damage and chronic inflammation. In respiratory diseases like NCFB and COPD, these agents help reduce protease activity that drives airway destruction and exacerbations. Emerging applications also include dermatological and autoimmune conditions where excessive neutrophil activity plays a critical role.

Novel compounds in this class aim to provide disease-modifying benefits by intervening early in the inflammatory cascade, offering a more targeted approach compared to conventional anti-inflammatory therapies. By reducing neutrophilic inflammation and protease-mediated tissue injury, DPP1 inhibitors hold promise for improving outcomes in conditions with significant unmet needs.

Overall, this is an exciting therapeutic area with strong potential for advancement. As ongoing studies mature in the coming years, they will provide deeper insights into the clinical value of DPP1 inhibitors and help define their role in managing neutrophil-driven diseases in the therapy of cancer.

Oral Dipeptidyl Peptidase 1 (DPP1) Inhibitors Uptake

This section focuses on the uptake rate of potential emerging oral DPP1 inhibitors expected to be launched in the market during 2020–2034.

Oral Dipeptidyl Peptidase 1 (DPP1) Inhibitors Pipeline Development Activities

The report provides insights into different therapeutic candidates in preregistration, Phase III, and early satge molecule. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for oral DPP1 inhibitors market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for oral DPP1 inhibitors emerging therapies.

KOL Views

To keep up with current and future market trends, we take industry experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on oral DPP1 inhibitors evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM.

Their opinion helps understand and validate current and emerging therapy treatment patterns or oral DPP1 inhibitors market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Oral Dipeptidyl Peptidase 1 (DPP1) Inhibitors Report Insights

- Oral DPP1 Inhibitors Targeted Patient Pool

- Oral DPP1 Inhibitors Therapeutic Approaches

- Oral DPP1 Inhibitors Pipeline Analysis

- Oral DPP1 Inhibitors Market Size and Trends

- Existing and Future Market Opportunity

Oral Dipeptidyl Peptidase 1 (DPP1) Inhibitors Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

Oral Dipeptidyl Peptidase 1 (DPP1) Inhibitors Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the oral DPP1 inhibitors total market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for oral DPP1 inhibitors?

- Which drug accounts for maximum oral DPP1 inhibitors sales?

- What are the risks, burdens, and unmet needs of treatment with oral DPP1 inhibitors? What will be the growth opportunities across the 7MM for the patient population on oral DPP1 inhibitors?

- What are the key factors hampering the growth of the oral DPP1 inhibitors market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for oral DPP1 inhibitors?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the oral DPP1 inhibitors Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the attribute analysis section to provide visibility around leading indications.

- To understand key opinion leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.