Dupuytren's Disease Market

- The Dupuytren’s Disease market is expected to experience significant growth during the forecast period (2024–2034). This growth is a direct consequence of various market-driving factors such as advancements in diagnosis and treatment, increased awareness and research, and increasing prevalence of Dupuytren's disease.

- Currently, there is only one US FDA-approved product for Dupuytren’s Disease which is XIAFLEX (clostridium histolyticum) by Endo Pharmaceuticals, and is anticipated to experience significant growth in the coming years.

- To propel the market in the coming years, several companies like 180 Life Sciences and Ventoux Biosciences developing their assets like Anti-TNF drug adalimumab and VEN201 for Dupuytren’s Disease. Due to the anticipated approval of some emerging therapies that are under development in the coming years, the overall Dupuytren’s Disease therapeutics market is expected to grow at a significant CAGR over the forecast period (2024–2034).

- The available therapeutics treatment options are mostly restrictive, with associated side effects and high rates of recurrence. They only slow the progression or provide temporary relief. With the increasing prevalence of the disease, there is a need for curative therapy. However, with the limited emerging pipeline, the market will be driven by both approved and emerging therapies during the forecast period (2024–2034).

DelveInsight’s comprehensive report titled “Dupuytren’s Disease Market Insights, Epidemiology, and Market Forecast – 2034” offers a detailed analysis of Dupuytren’s Disease. The report presents historical and projected epidemiological data covering total diagnosed prevalent cases of Dupuytren’s disease, age-specific diagnosed prevalent cases of Dupuytren's disease, gender-specific diagnosed prevalent cases of Dupuytren’s disease, and treated cases of Dupuytren’s disease In addition to epidemiology, the market report encompasses various aspects related to the patient population. These aspects include the diagnosis process, prescription patterns, physician perspectives, market accessibility, treatment options, and prospective developments in the market across seven major markets: the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan, spanning from 2020 to 2034.

The report analyzes the existing treatment practices and unmet medical requirements for Dupuytren’s Disease. It evaluates the market potential and identifies potential business prospects for enhancing therapies or interventions. This valuable information enables stakeholders to make well-informed decisions regarding product development and strategic planning for the market.

Dupuytren’s Disease Overview

Dupuytren's disease also known as Dupuytren contracture or Palmar fibromatosis is a chronic, debilitating, irreversible benign fibroproliferative disorder. It is a fixed flexion contracture of the hand where the fingers bend towards the palm and cannot be fully extended. The disease is caused by underlying contractures of the palmar fascia and is the most common genetic disorder in connective tissues. Although the disease is not dangerous, it can cause disability in patients.

The ring finger and little finger are most commonly affected, that impacts everyday activities. The contracture progresses slowly and is usually painless. In patients with this condition, the tissues under the skin on the palm of the hand thicken and shorten so that the tendons connected to the fingers cannot move freely. Subcutaneous fibrous nodules arise within the palmar fascia of the hand, forming cord like attachments with the adjacent flexor tendons. The palmar aponeurosis becomes hyperplastic and undergoes contracture. The disease is classified into proliferative, involutional, and residual stage according to the histological appearance.

Dupuytren disease worsens with time. The condition begins with a lump or nodule in the palm of the hand, that extends into a hard cord under the skin, up into the finger, that gradually leads to contractures. The cause is unknown. The condition is genetic mostly, and the incidence increases with age, with men are affected more often than women. The disease most commonly occurs in 5-7th decade of life. The risk factors for Dupuytren’s disease include age, gender, family history, occupation, diabetes, etc. When a finger is involved in a Dupuytren’s contracture, the metacarpophalangeal (MCP) joint is the most common joint to be affected. The next most common joint to be affected is the proximal interphalangeal (PIP) joint.

Dupuytren’s Disease Diagnosis and Treatment Algorithm

Diagnosis can be made by physical examination which shows painful nodules in the palm with associated digital contracture. Hueston's tabletop test is the recommended diagnostic method. There is a specific test called the Hueston tabletop test which can also be conducted, where the patient is asked to lay their palm flat on a tabletop. If the patient is not able to fully flatten the hand on the table need for treatment is indicated.

The current treatment regime is not curative, and is specific to disease stage. Conservative treatment includes physical therapy or stretching exercises, splinting, ultrasonic or heat treatment, and corticosteroid injections. Even radiation, collagenase injection, and needle aponeurotomy are also recommended. In severe cases, surgical procedures of fasciotomy, and partial palmar fasciectomy may be recommended. For severe cases, the US FDA has approved Endo Pharmaceuticals’ XIAFLEX treatment of adult patients with Dupuytren’s contracture with a palpable cord.

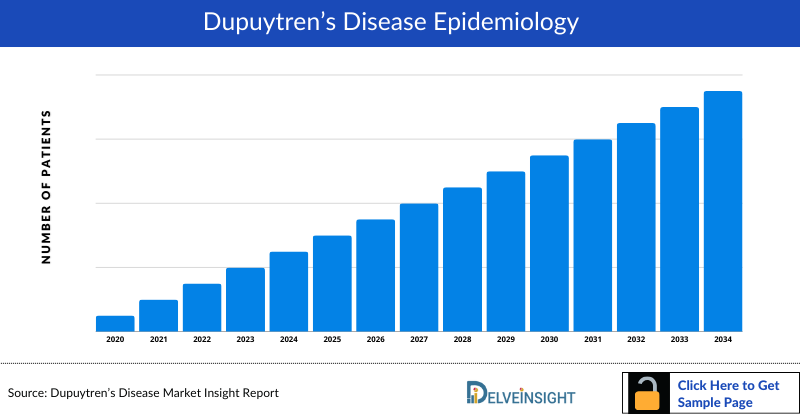

Dupuytren’s Disease Epidemiology

The epidemiology section on the Dupuytren’s Disease market report offers information on the patient populations, including historical and projected trends for each of the seven major markets. Examining key opinion leader views from physicians or clinical experts can assist in identifying the reasons behind historical and projected trends. The diagnosed patient pool, their trends, and the underlying assumptions are all included in this section of the report.

This section also presents the data with relevant tables and graphs, offering a clear and concise view of the prevalence of Dupuytren’s Disease. Additionally, the report discloses the assumptions made during the analysis, ensuring data interpretation and presentation transparency. This epidemiological data is valuable for understanding the disease burden and its impact on the patient population across various regions.

Key Findings

- As per analysis, the prevalence of Dupuytren’s disease globally was found to be around 8%. According to the subgroup analysis, in terms of underlying diseases, the highest prevalence was obtained in patients with type 1 diabetes at around 34%, particularly higher in alcoholic patients with diabetes. The second highest rate was among patients with type II diabetes with around 25%.

- Based on our analysis around 19% of the male and 4% of the female participants had clinical signs of Dupuytren's disease.

- According to analysis based on available literature, Dupuytren’s disease has a prevalence rate of approximately 4%, in Japan. The prevalence was around 8% among the men and around 1% among the women.

- Various sources state that disease prevalence increases with age, from around 7% among males in the age group 45–49 years up to about 40% in those 70–74 years old. The more severe form of the disease, finger contractures, was found in about 5% of the men and about 1% had required operation, while this was rarely seen among women.

Dupuytren’s Disease Market Outlook

The treatment for Dupuytren's contracture relies upon the seriousness or severity of the condition. All through Dupuytren's disease, fibrous tissue in the palm thickens and tightens. This makes one or more fingers progressively stiffen, bend, and lose flexibility. The objective of treatment is to lessen the symptoms and disability caused by the disease. At this time, however, there is no treatment to stop contracture from getting worse/deteriorating.

Treatment options consist of conservative management, needle aponeurotomy, collagenase injection, and/or surgical resection and fasciectomy. As of now, surgery, needling, and enzyme injection are primarily utilized.

Corticosteroids are powerful anti-inflammatory medications that can be injected into a painful nodule. In some cases, a corticosteroid injection may slow the progression of a contracture. The effectiveness of a steroid injection varies from patient to patient. Cortisone injections are occasionally used to inject the nodular type of Dupuytren's (not the cords) and it can help to shrink down nodules. Unfortunately, the steroid injections do not work in all patients, and recurrence of up to 50% have been reported.

Collagenase injections are also recommended. They provide a minimally invasive treatment derived from clostridium histolyticum. The injected enzyme is a metalloprotease that lyses collagen (sparing Type IV collagen which is needed in the basement membrane of blood vessels and nerves). The US FDA approved collagenase clostridium histolyticum, for this purpose.

With ongoing research and continued dedication, the future holds hope for even more effective treatments and, ultimately, a cure for this challenging condition. According to DelveInsight, the Dupuytren’s Disease market in the 7MM is expected to change significantly during the study period 2020–2034.

Dupuytren’s Disease Drug Chapters

Marketed Dupuytren’s Disease Drugs

XIAFLEX (clostridium histolyticum): Endo Pharmaceuticals/ Asahi Kasei Pharma

XIAFLEX (clostridium histolyticum) is marketed by Endo Pharmaceuticals. In February 2010, the US FDA approved Endo Pharmaceuticals’ XIAFLEX for the treatment of adult Dupuytren’s contracture patients with a palpable cord. In May 2015, a label expansion for XIAFLEX to include the indication of treatment of recurrent contractures was included. XIAFLEX is currently approved in the US and Japan, among other jurisdictions, for the treatment of Dupuytren’s contracture. In Japan, Asahi Kasei Pharma obtained approval for the manufacture and sale of XIAFLEX injection for the treatment of Dupuytren’s contracture.

Note: Detailed marketed therapies assessment will be provided in the final report...

Emerging Dupuytren’s Disease Drugs

The pipeline of Dupuytren’s Disease is quite robust with several products available in the developmental stage. There are several key players involved in the development of promising products such as Tonix Pharmaceutical and UCB Biopharma SRL and others.

Anti-TNF drug adalimumab: 180 Life Sciences

180 Life Sciences is repurposing the anti-TNF therapeutic adalimumab, approved and used under the brand name HUMIRA for several autoimmune conditions, for the treatment of early-stage Dupuytren’s contracture. Research at Oxford University has indicated an anti-TNF mechanism can slow or prevent the proliferation of myoblast cells that lead to the formation and growth of the fibrous nodules or cords in the palm and possible finger contracture.

The company is developing the drug for the treatment and prevention of early-stage Dupuytren’s. The company has completed Phase IIb trials, the first trial of any targeted therapy in early Dupuytren’s contracture. In August 2023, the Company met with the UK Medicines and Healthcare Products Regulatory Agency regarding a proposed marketing authorization application in the UK. Following the meeting, the company received correspondence from the MHRA that a substantially completed Phase III trial would be required before a marketing authorization is potentially granted, adding significant time to the approval and commercialization process. Therefore, the company is planning to conduct a Phase III trial and our licensing partner in 2024.

VEN201: Ventoux Biosciences

Ventoux Biosciences is developing VEN-201 for Dupuytren’s Disease and Ledderhose Disease with unmet medical needs. VEN-201 is an undisclosed small molecule, it has been previously approved by the US FDA and EMEA for use in other indications, with a proven safety profile.

Recently the company posted positive pre-clinical results for VEN-201 demonstrating anti-fibrotic effects in a bleomycin-induced dermal fibrosis model. Bleomycin-treated mice when administered with daily VEN-201 exhibited reduced tissue remodeling, as demonstrated by decreased epidermal and dermal fibrosis, collagen density, and epidermal and dermal thickness, relative to bleomycin-treated mice administered with vehicle control.

These improvements were achieved with a benign safety profile that is consistent with the known human safety of VEN-201. However, VEN-202; the previous Ventoux Bioscience compound did not demonstrate the desired effects therefore, the company does not plan to advance this compound. Furthermore, the company has launched a fundraising round to support further development of VEN-201 including formulation optimization, pre-clinical studies, intellectual property, and regulatory activities, based on its promising successful pre-clinical results.

With these funds, the company will be able to expedite the development timelines for VEN-201 and advance the compound as a repurposed, reformulated, disease-modifying agent with a novel route of administration – via an expedited regulatory pathway all to bring this promising treatment to patients suffering from Dupuytren's disease.

Note: Detailed emerging therapies assessment will be provided in the final report....

Dupuytren’s Disease Market Segmentation

DelveInsight’s ‘Dupuytren’s Disease Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a detailed outlook of the current and future Dupuytren’s Disease market, segmented within countries, by therapies, and by classes. Further, the market of each region is then segmented by each therapy to provide a detailed view of the current and future market share of all therapies.

Dupuytren’s Disease Market Size by Countries

The Dupuytren’s Disease market size is assessed separately for various countries, including the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan. In 2022, the United States held a significant share of the overall 7MM (Seven Major Markets) Dupuytren’s Disease market, primarily attributed to the country's higher prevalence of the condition and the elevated cost of the available treatments. This dominance is projected to persist, especially with the potential early introduction of new products.

Country-wise Market Size Distribution of Dupuytren’s Disease

Dupuytren’s Disease Market Size by Therapies

Dupuytren’s Disease Market Size by Therapies is categorized into current and emerging markets for the study period 2020–2034. One of the emerging drugs anticipated to launch during the forecast period is the anti-TNF drug adalimumab by 180 Life Sciences.

Market Share Distribution of Dupuytren’s Disease by Therapies in 2034

Note: Detailed market segment assessment will be provided in the final report...

Dupuytren’s Disease Drugs Uptake

This section focuses on the sales uptake of potential Dupuytren’s disease drugs that have recently been launched or are anticipated to be launched in the Dupuytren’s disease market between 2020 and 2034. It estimates the market penetration of Dupuytren’s disease drugs for a given country, examining their impact within and across classes and segments. It also touches upon the financial and regulatory decisions contributing to the probability of success (PoS) of the drugs in the Dupuytren’s disease market.

The emerging Dupuytren’s disease therapies are analyzed based on various attributes such as safety and efficacy in randomized clinical trials, order of entry and other market dynamics, and the unmet need they fulfill in the Dupuytren’s disease market.

Note: Detailed assessment of drug uptake and attribute analysis will be provided in the full report on Dupuytren’s Disease....

Dupuytren’s Disease Market Access and Reimbursement

DelveInsight’s ‘Dupuytren’s Disease – Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a descriptive overview of the market access and reimbursement scenario of Dupuytren’s Disease.

This section includes a detailed analysis of the country-wise healthcare system for each therapy, enlightening the market access, reimbursement policies, and health technology assessments.

KOL Views

To keep up with current Dupuytren’s Disease market trends and fill gaps in secondary findings, we interview KOLs and SMEs working in the Dupuytren’s Disease domain. Their opinion helps understand and validate current and emerging therapies and treatment patterns or Dupuytren’s Disease market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the Dupuytren’s Disease unmet needs.

Dupuytren’s Disease: KOL Insights

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. These KOLs were from organizations, institutes, and hospitals, such as Stanford Medicine, Mayo Clinic, and Lifespan/Brown University among others.

“Many patients with early-stage Dupuytren's Disease may not be aware of non-surgical treatment options or may have misconceptions about their effectiveness. Improved patient education and support are needed to increase awareness, enhance treatment adherence, and empower patients to participate actively in their care”.

“Injection-based therapy has the benefit of being minimally invasive, but there is a greater risk of damage to surrounding structures and incomplete release of contractures. Recurrence of the disorder is common with all treatments”.

Note: Detailed assessment of KOL Views will be provided in the full report on Dupuytren’s Disease....

Competitive Intelligence Analysis

We conduct a Competitive and Market Intelligence analysis of Dupuytren’s Disease Market, utilizing various Competitive Intelligence tools such as SWOT analysis and Market entry strategies. The inclusion of these analyses is contingent upon data availability, ensuring a comprehensive and well-informed assessment of the market landscape and competitive dynamics.

Dupuytren’s Disease Pipeline Development Activities

The report offers an analysis of therapeutic candidates in Phase II and III stages and examines companies involved in developing targeted therapeutics for Dupuytren’s Disease. It provides valuable insights into the advancements and progress of potential treatments in clinical development for this condition.

Pipeline Development Activities

The report covers information on collaborations, acquisition and merger, licensing, patent details, and other information for emerging Dupuytren’s Disease therapies.

Dupuytren’s Disease Report Insights

- Dupuytren’s Disease Patient Population

- Therapeutic Approaches

- Dupuytren’s Disease Pipeline Analysis

- Dupuytren’s Disease Market Size and Trends

- Dupuytren’s Disease Market Opportunities

- Impact of Upcoming Therapies

Dupuytren’s Disease Report Key Strengths

- 11 Years Forecast

- The 7MM Coverage

- Dupuytren’s Disease Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Dupuytren’s Disease Market

- Dupuytren’s Disease Drugs Uptake

Dupuytren’s Disease Report Assessment

- Dupuytren’s Disease Current Treatment Practices

- Unmet Needs

- Dupuytren’s Disease Pipeline Product Profiles

- Dupuytren’s Disease Market Attractiveness

Key Questions

- How common is Dupuytren’s Disease?

- What are the key findings of Dupuytren’s Disease epidemiology across the 7MM, and which country will have the highest number of patients during the study period (2020–2034)?

- What are the currently available treatments for Dupuytren’s Disease?

- What are the disease risks, burdens, and unmet needs of Dupuytren’s Disease?

- At what CAGR is the Dupuytren’s Disease market and its epidemiology is expected to grow in the 7MM during the forecast period (2024–2034)?

- How would the unmet needs impact Dupuytren’s Disease market dynamics and subsequently influence the analysis of the related trends?

- What would be the forecasted patient pool of Dupuytren’s Disease in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan?

- Among EU4 and the UK, which country will have the highest number of patients during the forecast period (2020–2034)?

- How many companies are currently developing therapies for the treatment of Dupuytren’s Disease?

Frequently Asked Questions

1. Is Dupuytren’s Disease hereditary?

Yes, Dupuytren's disease is hereditary. It is the most common hereditary disease of the connective tissue.

2. Are there any treatments for Dupuytren’s Disease?

Currently, there is one approved pharmacological therapy for Dupuytren’s Disease which is XIAFLEX (clostridium histolyticum).

3. Are there any clinical trials for Dupuytren’s Disease treatments?

Research and clinical trials are ongoing to explore potential treatments for Dupuytren’s Disease. Some experimental treatments, such as VEN201 and anti-TNF drug adalimumab have shown promise in slowing disease progression.

4. How is the market size estimated in the forecast report?

The market size is estimated through data analysis, statistical modeling, and expert opinions. It may consider factors such as prevalent cases, treatment costs, revenue generated, and market trends.

5. Is there an analysis of the market’s competitive landscape in the report?

The market forecast report will likely offer insights into key market players, their product offerings, partnerships, and strategies, providing stakeholders with a comprehensive understanding of the competitive dynamics in the Dupuytren’s Disease market.