Eteplirsen Sales Forecast Summary

Key Factors Driving Eteplirsen Growth

Market Share Gains and New Patient Starts

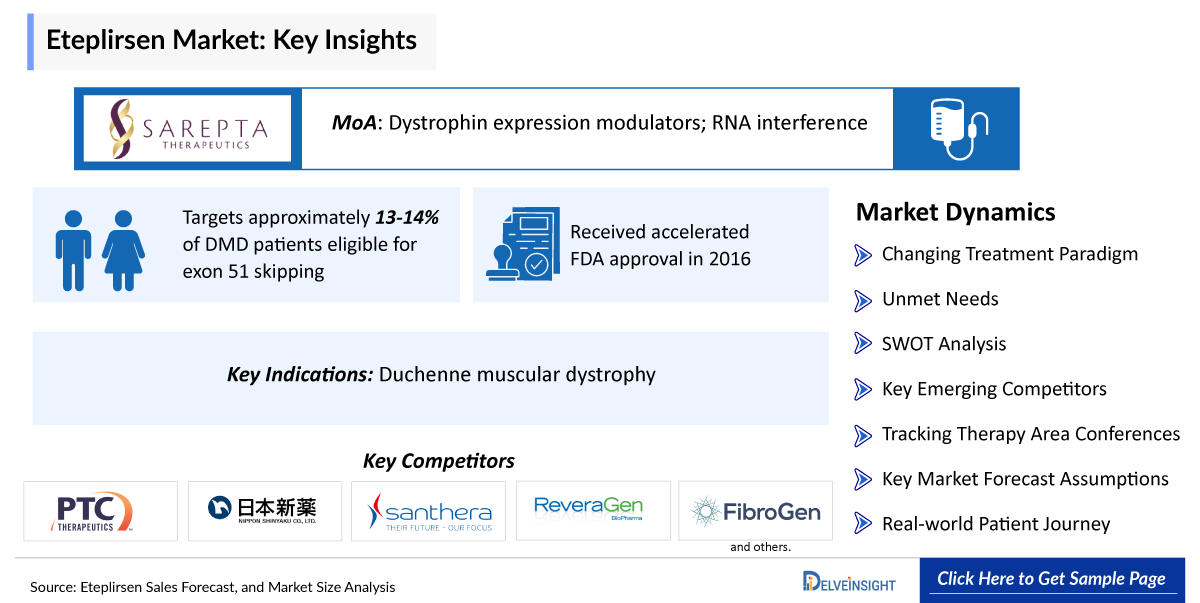

- Eteplirsen (Exondys 51) holds a leading position in the Duchenne muscular dystrophy (DMD) treatment segment for patients with specific exon 51 skip-amenable mutations, representing a large share of this narrow genetic subgroup in the US market.

- Adoption has been driven by its status as the first FDA-approved exon-skipping therapy targeting dystrophin restoration, establishing early market penetration among eligible DMD patients.

- Genetic testing and specialist referral patterns largely influence new patient starts, as only patients with confirmed exon 51 mutations (~13–14% of DMD population) are recommended for treatment. Because DMD and exon-specific therapies treat small populations, broad volume growth is more modest than typical autoimmune or inflammatory indications.

Expansion Across Key Indications

- Primary indication – Duchenne Muscular Dystrophy: Eteplirsen is used to treat patients with genetically confirmed exon 51 skip-amenable DMD, aiming to increase dystrophin production and slow disease progression.

- Ongoing clinical research is evaluating safety, tolerability, and functional outcomes in younger age groups and broader DMD phenotypes, supporting potential future label expansions (e.g., earlier intervention).

- Unlike broad chronic diseases, Eteplirsen’s focus remains niche by genetic subtype; expansion into additional DMD subtypes currently depends on development of other exon-skipping agents or approval of similar modalities.

Geographic Expansion

- United States: The main commercial market with FDA approval and established prescribing for eligible patients; substantial share within the DMD exon skipping treatment space.

- Europe & Other Regions: Eteplirsen has historically been refused marketing authorization by the European Medicines Agency (EMA), and broad ex-U.S. uptake remains limited.

- Emerging markets: Awareness and genetic testing infrastructure are increasing, potentially enhancing eligibility identification and future uptake—pending regulatory approvals in more countries.

New Indication Approvals

- Eteplirsen’s Approval Status: It holds accelerated FDA approval for the treatment of exon 51 amenable DMD patients based on dystrophin increase as a surrogate endpoint; ongoing studies aim to verify clinical benefit.

- No additional major indications beyond the exon 51 DMD target have been approved to date.

Strong DMD Outcome Momentum

- Clinical data continues to show stable dystrophin expression and functional measures—including walking test performance and pulmonary function—through extended treatment periods in lighter trials, supporting continued confidence among clinicians.

- Real-world analyses suggest slowed disease progression compared with historical natural history cohorts.

- Eteplirsen’s safety profile in long-term observational and extension studies has generally been consistent and well tolerated.

Competitive Differentiation and Market Trends

- Genetic precision: Eteplirsen’s exon-specific mechanism (antisense exon 51 skipping) differentiates it from non-targeted supportive care and corticosteroids in DMD.

- Niche positioning: While newer exon skipping drugs (e.g., those targeting exon 53) exist, Eteplirsen remains one of the earliest and established therapies in its specific genetic subset.

- Market trends in rare disease: Increase in genetic diagnostics, personalized therapy approaches, and payer recognition of targeted modalities support its ongoing relevance within a specialized care pathway.

Eteplirsen Recent Developments

- FDA Review Delay: Sarepta recently disclosed that the FDA will not complete its review of the Eteplirsen new drug application (NDA) by an expected deadline, potentially delaying broader regulatory clarity or decisions on confirmatory evidence requirements.

- Ongoing Clinical Updates: Sarepta has continued to report long-term efficacy and safety data from Phase IIb studies (e.g., 120-week pulmonary function stability and extended ambulation outcomes), reinforcing therapeutic value for exon 51 patient subsets.

- Pricing & Access Considerations: Eteplirsen remains a high-cost therapy, consistent with rare genetic treatments, which impacts payer negotiations and access decisions.

- Competitive Landscape: Emerging gene therapies and exon-skipping variants for other mutation sites continue to reshape the DMD treatment market; regulatory setbacks in related assets (e.g., Elevidys gene therapy programs) underscore shifting dynamics in this rare disease space.

“Eteplirsen Sales Forecast, and Market Size Analysis – 2034” report provides comprehensive insights of Eteplirsen for approved indication like Duchenne muscular dystrophy in the 7MM. A detailed picture of Eteplirsen’s existing usage in anticipated entry and performance in approved indications in the 7MM, i.e., the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan for the study period 2020 –2034 is provided in this report along with a detailed description of the Eteplirsen for approved indications. The Eteplirsen market report provides insights about Eteplirsen’s sales forecast, mechanism of action (MoA), dosage and administration, as well as research and development including regulatory milestones, along with other developmental activities. Further, it also consists of historical and current Eteplirsen performance, future market assessments inclusive of the Eteplirsen market forecast analysis for approved indications in the 7MM, SWOT, analysts’ views, comprehensive overview of market competitors, and brief about other emerging therapies in respective indications. It also provides analysis of Eteplirsen sales forecasts, along with factors driving its market.

Eteplirsen Drug Summary

Eteplirsen is a synthetic antisense oligonucleotide of the phosphorodiamidate morpholino oligomer (PMO) class, designed for intravenous administration to treat Duchenne muscular dystrophy (DMD) in patients with a confirmed mutation in the DMD gene amenable to exon 51 skipping. It binds specifically to exon 51 of pre-mRNA transcribed from the dystrophin gene, inducing skipping of this exon during mRNA processing, which restores the open reading frame and enables production of a truncated, internally deleted dystrophin protein similar to that seen in the milder Becker muscular dystrophy. Marketed as Exondys 51, eteplirsen received accelerated FDA approval in 2016 based on increased dystrophin levels in skeletal muscle, though it slows disease progression without curing DMD and targets approximately 13-14% of DMD patients eligible for exon 51 skipping. The report provides Eteplirsen’s sales, growth barriers and drivers, post usage and approvals in multiple indications.

Scope of the Eteplirsen Market Report

The report provides insights into:

- A comprehensive product overview including the Eteplirsen MoA, description, dosage and administration, research and development activities in approved indication like Duchenne muscular dystrophy.

- Elaborated details on Eteplirsen regulatory milestones and other development activities have been provided in Eteplirsen market report.

- The report also highlights Eteplirsen‘s cost estimates and regional variations, reported and estimated sales performance, research and development activities in approved indications across the United States, Europe, and Japan.

- The Eteplirsen market report also covers the patents information, generic entry and impact on cost cut.

- The Eteplirsen market report contains current and forecasted Eteplirsen sales for approved indications till 2034.

- Comprehensive coverage of the late-stage emerging therapies for respective indications.

- The Eteplirsen market report also features the SWOT analysis with analyst views for Eteplirsen in approved indications.

Methodology

The Eteplirsen market report is built using data and information sourced primarily from internal databases, primary and secondary research and in-house analysis by DelveInsight’s team of industry experts. Information and data from the secondary sources have been obtained from various printable and nonprintable sources like search engines, news websites, global regulatory authorities websites, trade journals, white papers, magazines, books, trade associations, industry associations, industry portals and access to available databases.

Eteplirsen Analytical Perspective by DelveInsight

In-depth Eteplirsen Market Assessment

This Eteplirsen sales market forecast report provides a detailed market assessment of Eteplirsen for approved indication like Duchenne muscular dystrophy in the seven major markets, i.e., the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan. This segment of the report provides current and forecasted Eteplirsen sales data uptil 2034.

Eteplirsen Clinical Assessment

The Eteplirsen market report provides the clinical trials information of Eteplirsen for approved indications covering trial interventions, trial conditions, trial status, start and completion dates.

Eteplirsen Competitive Landscape

The report provides Insights on competitors and marketed products within the domain, along with a summary of emerging products and their respective launch dates, posing significant competition in the market.

Eteplirsen Market Potential & Revenue Forecast

- Projected market size for the Eteplirsen and its key indications

- Estimated Eteplirsen sales potential (Eteplirsen peak sales forecasts)

- Eteplirsen Pricing strategies and reimbursement landscape

Eteplirsen Competitive Intelligence

- Number of competing drugs in development (pipeline analysis)

- Eteplirsen Market positioning compared to existing treatments

- Eteplirsen Strengths & weaknesses relative to competitors

Eteplirsen Regulatory & Commercial Milestones

- Eteplirsen Key regulatory approvals & expected launch timelines

- Commercial partnerships, licensing deals, and M&A activity

Eteplirsen Clinical Differentiation

- Eteplirsen Efficacy & safety advantages over existing drugs

- Eteplirsen Unique selling points

Eteplirsen Market Report Highlights

- In the coming years, the Eteplirsen market scenario is set to change due to strong adoption, increased prescriptions and broader uptake in multiple immunological indications; which would expand the size of the market.

- The Eteplirsen companies are developing therapies that focus on novel approaches to treat/improve the disease condition, assess challenges, and seek opportunities that could influence Eteplirsen’s dominance.

- Other emerging products for Duchenne muscular dystrophy are expected to give tough market competition to Eteplirsen and launch of late-stage emerging therapies in the near future will significantly impact the market.

- A detailed description of regulatory milestones, and developmental activities, provide the current development scenario of Eteplirsen in approved indications.

- Analyse Eteplirsen cost, pricing trends and market positioning to support strategic decision-making in the immunology landscape.

- Our in-depth analysis of the forecasted Eteplirsen sales data uptil 2034 will support the clients in decision-making process regarding their therapeutic portfolio by identifying the overall scenario of Eteplirsen in approved indications.

Key Questions

- What is the class of therapy, route of administration and mechanism of action of Eteplirsen? How strong is Eteplirsen’s clinical and commercial performance?

- What is Eteplirsen’s clinical trial status in each individual indications such as Duchenne muscular dystrophy and study completion date?

- What are the key collaborations, mergers and acquisitions, licensing and other activities related to the Eteplirsen Manufacturers?

- What are the key designations that have been granted to Eteplirsen for approved indications? How are they going to impact Eteplirsen’s penetration in various geographies?

- What is the current and forecasted Eteplirsen market scenario for approved indications? What are the key assumptions behind the forecast?

- What are the current and forecasted sales of Eteplirsen in the seven major countries, including the United States, Europe (Germany, France, Italy, Spain) and the United Kingdom, and Japan?

- What are the other emerging products available and how are these giving competition to Eteplirsen for approved indications?

- Which are the late-stage emerging therapies under development for the treatment of approved indications?

- How cost-effective is Eteplirsen? What is the duration of therapy and what are the geographical variations in cost per patient?