Excessive Daytime Sleepiness Market

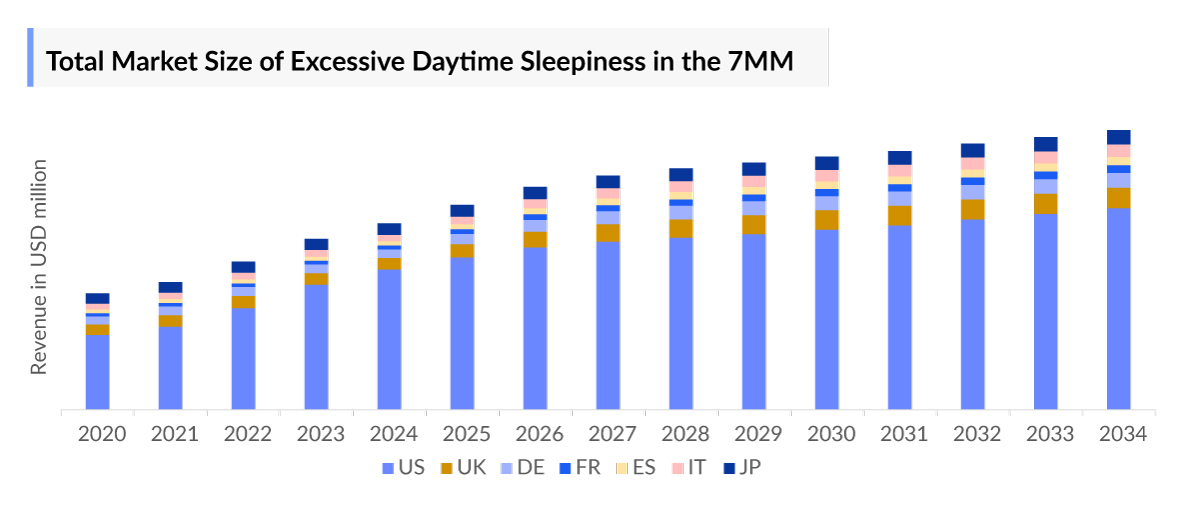

- The total Excessive Daytime Sleepiness market size in the 7MM was approximately USD 6,227 million in 2023 and is projected to increase during the forecast period (2024–2034).

- The Excessive Daytime Sleepiness therapeutic market in the United States was USD 4,690 million in the year 2023.

- The current Excessive Daytime Sleepiness market is mainly covered by SUNOSI, WAKIX, XYREM, XYWAV, and others. The market size of XYREM AND WAKIX was USD 1,163 million and USD 565 million, respectively in 2023, in the 7MM.

- The prevalence of excessive daytime sleepiness has increased in the last decade, due to improvements in disease diagnosis and increased awareness. Further unhealthy life choices like poor diet, lack of exercise, smoking, drug and alcohol abuse, stress, etc increase the risk of developing excessive daytime sleepiness.

- The disease diagnosis though has improved, but still, a lack of standardized guidelines, non-specificity of symptoms, and disease variability often pose challenges leading to delays. There is also a need for improved insight into the neurobiology of sleep and wakefulness.

- The treatment of excessive daytime sleepiness usually starts with the maintenance of good sleep hygiene. Disease management begins with behavioral and nonpharmacological approaches, with pharmacotherapy used as an adjunct, based upon the nature of the problem.

- The current excessive daytime sleepiness market has approved drugs like PROVIGIL/MODIODAL (modafinil), NUVIGIL (armodafinil), SUNOSI (solriamfetol), WAKIX (Pitolisant), XYWAV (calcium, magnesium, potassium, and sodium oxybates), and XYREM (sodium oxybate), etc. But most of these are for excessive daytime sleepiness in narcolepsy.

- The highest number of excessive daytime sleepiness patients in 7MM is mainly attributed to excessive daytime sleepiness in OSA, excessive daytime sleepiness in bipolar disorder, and excessive daytime sleepiness in Parkinson’s disease, yet the major focus of drug development by companies has been in the space of excessive daytime sleepiness in narcolepsy, and even now the clinical pipeline is rich for excessive daytime sleepiness in narcolepsy, with only a few drugs in the pipeline associated with other conditions.

- The majority of excessive daytime sleepiness patients in 7MM have OSA, bipolar disorder, or Parkinson's disease. However, companies have primarily focused on excessive daytime sleepiness in narcolepsy for many years, and the clinical pipeline for excessive daytime sleepiness in narcolepsy remains robust.

- An affordable therapy covering a broad patient pool is still an unmet need for excessive daytime sleepiness treatment, as the lack of therapies specific for excessive daytime sleepiness in Bipolar disorder, and Parkinson’s disease creates a huge gap in the treatment for a large patient pool, keeping them at risk.

- In 2020, XYWAV (calcium, magnesium, potassium, and sodium oxybate), a lower sodium alternative to XYREM, was approved for the treatment of excessive daytime sleepiness in narcolepsy. The drug generated a revenue of nearly USD 1,006.6 million in 2023 that is projected to grow further, as this low-sodium substitute of XYREM, which loses its patent in 2023, is expected to capture the niche that was dominated by XYREM.

- For excessive daytime sleepiness in obstructive sleep apnea, SUNOSI (solriamfetol) was approved by US FDA, in 2019. The drug generated a revenue of USD 132 million in 2023, which is projected to grow further.

- AXS-12 (reboxetine) is expected to enter the US market by 2025 for the treatment of Excessive Daytime Sleepiness in narcolepsy. With the loss of patents for approved therapies, Axsome Therapeutics has the potential to establish a strong foothold in the crowded market. The drug is projected to have a medium uptake attaining its peak by 7th year.

- The current treatment regime for excessive daytime sleepiness in Parkinson’s disease is mainly based on off-label therapies, with no approved product. Even the pipeline for this niche is limited, with not much being developed.

DelveInsight’s “Excessive Daytime Sleepiness Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of excessive daytime sleepiness, historical and forecasted epidemiology, as well as the excessive daytime sleepiness market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The excessive daytime sleepiness market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Excessive daytime sleepiness market size from 2020 to 2034. The report also covers excessive daytime sleepiness treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Excessive Daytime Sleepiness Treatment Market

Excessive Daytime Sleepiness Overview

Excessive daytime sleepiness is characterized by difficulty in staying awake and alert during the major waking episodes of the day, with sleep occurring unintentionally or at inappropriate times of the wake period. Excessive Daytime Sleepiness is often associated with a wide range of illnesses, including metabolic, cardiovascular, neurological, and psychiatric diseases with voluntary behaviors reflecting poor sleep and sleep debt, leading to disability and increased risk of mortality.

The causes of Excessive Daytime Sleepiness are varied and include inadequate sleep, sleep-disordered breathing, circadian rhythm sleep-wake disorders, and central disorders of hypersomnolence (narcolepsy, idiopathic hypersomnia, and Kleine-Levin syndrome) Additionally, excessive daytime sleepiness could represent a symptom of an underlying medical or psychiatric disorder. The disease occurrence is highest in adolescents, older persons, and shift workers, but determining its actual prevalence is difficult because of the subjective nature of the symptoms, inconsistencies in terminology, and a lack of consensus on methods of diagnosis and assessment.

Sleep plays a vital role in consolidating memory, restoring the immune system, and other vital processes. As a result, a lack of quality sleep may result in a host of symptoms that may not immediately connect to sleep. Thus, excessive daytime sleepiness has diverse and serious consequences, including reduced cognitive function, poor health, impaired professional performance, and increased risk of motor vehicle incidents. Excessive daytime sleepiness is also commonly associated with social and economic consequences, thus constituting a significant public health problem.

Excessive Daytime Sleepiness Diagnosis

If an individual constantly feels drowsy during the day and tends to fall asleep at an awkward time and places that affect the productivity of the individual, then that individual needs to consult with a treating physician and discuss the situation. The physician will inquire about the sleeping habits of the patient. The physician will also inquire about any history of alcohol or drug use or abuse currently or in the past. The individual may also be referred to a psychologist for a counseling session if the individual has some stress or emotional problem in life, which could be interfering with sleep. The physician may also order tests to know about the exact cause of Excessive Daytime Sleepiness.

Sleep studies, such as the polysomnogram (PSG), the multiple sleep latency tests (MSLT), and the maintenance of wakefulness test (MWT), must be performed in a sleep laboratory, and although more labor-intensive, may also help evaluate diminished alertness and excessive sleepiness.

Further details related to country-based variations are provided in the report....

Excessive Daytime Sleepiness Treatment

The treatment of Excessive Daytime Sleepiness includes nonpharmacological and pharmacological treatment options. The management of Excessive Daytime Sleepiness depends on the underlying condition. Addressing the underlying cause is the mainstay of treatment of excessive daytime sleepiness. The first step in treating Excessive Daytime Sleepiness is always the optimization and maintenance of good sleep hygiene. In OSA—the most dangerous and physiologically disruptive cause of excessive daytime sleepiness—treatment with positive pressure devices (e.g., CPAP) during sleep improves symptoms of daytime sleepiness for most patients.

Typically, a patient is started on a low dose, which is then increased progressively to obtain satisfactory results. Studies have shown that daytime sleepiness can be greatly improved subjectively, but sleep variables are never completely normalized by stimulant treatments. Milder stimulants with low efficacy and potency, such as modafinil or armodafinil, are usually tried first. More effective amphetamine-like stimulants (methylphenidate, D-amphetamine, and methamphetamine) are then used if needed.

There are few drugs approved in the 7MM for the treatment of Excessive Daytime Sleepiness such as PROVIGIL/MODIODAL (modafinil), NUVIGIL (armodafinil), SUNOSI (solriamfetol), WAKIX (Pitolisant), XYWAV (calcium, magnesium, potassium, and sodium oxybates), AND XYREM (sodium oxybate). The generics of PROVIGIL/MODIODAL (modafinil) and NUVIGIL (armodafinil) are available in the US market.

Excessive Daytime Sleepiness Epidemiology

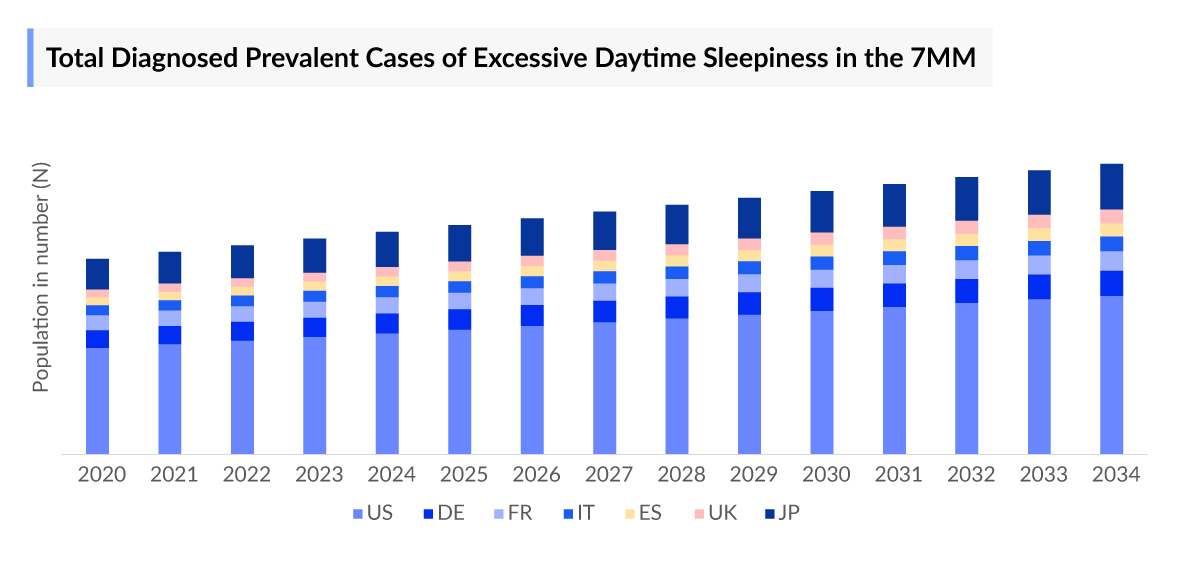

As the Excessive daytime sleepiness market is derived using a patient-based model, the excessive daytime sleepiness epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent cases of excessive daytime sleepiness, and diagnosed prevalent cases of excessive daytime sleepiness in different disorders in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- Total diagnosed prevalent cases of excessive daytime sleepiness in the 7MM were found to be around 7 million cases in 2023, which are expected to increase during the study period (2020–2034), due to a rise in the prevalence of associated conditions.

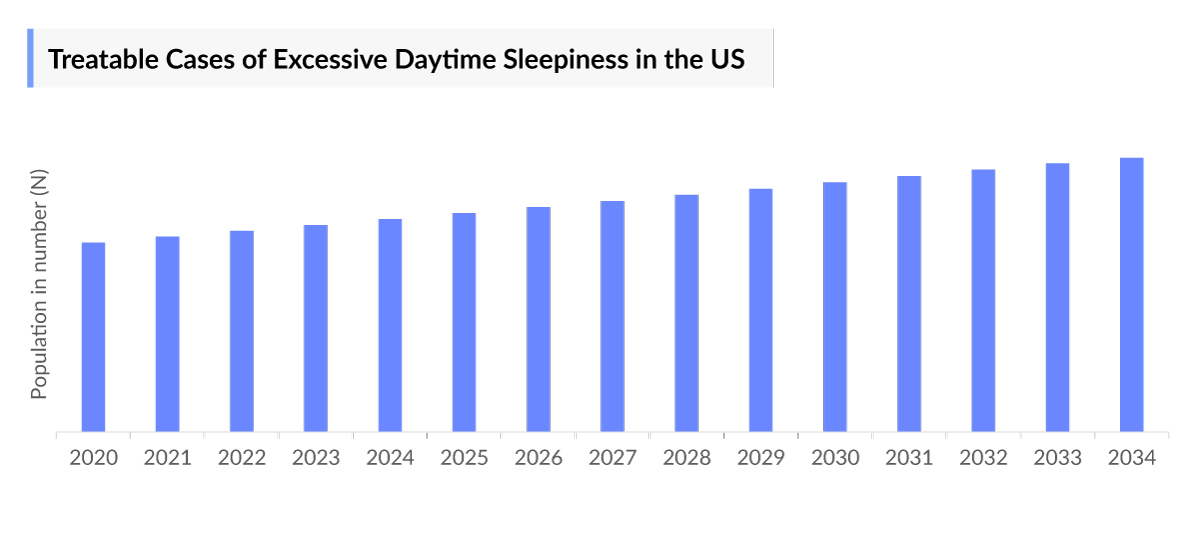

- According to DelveInsight estimates, in 2023, the diagnosed prevalent cases of excessive daytime sleepiness in the United States were estimated to be around 3.9 million, and these are projected to rise by 2034, with increased focus on improving disease awareness, improved differential diagnosis from conditions like fatigue, and a rise in awareness of lifestyle and mental health conditions like stress and depression.

- As per our epidemiology assessment, there were around 2 million total diagnosed prevalent cases of excessive daytime sleepiness, in EU4 and the UK, in 2023. Among these, Germany had the highest diagnosed prevalent cases, followed by France. Though Excessive Daytime Sleepiness is a common issue in Europe, affecting a significant proportion of individuals and potentially impacting their daily functioning and quality of life, there was a scarcity of data for disease diagnosis, and associated conditions like OSA, or high misdiagnosis for conditions like bipolar.

- Among the various conditions associated with excessive daytime sleepiness, in 2023 in the US, there were approximately the highest cases of excessive daytime sleepiness, nearly 2 million were diagnosed with OSA, followed by bipolar disorder with about 1 million cases, and approximately 611 thousand cases of Parkinson’s disease.

- It was observed that Japan accounted for approximately 16% diagnosed prevalent population of excessive daytime sleepiness, among 7MM, in the year 2023. There is high misdiagnosis as often the symptoms are non-specific. The lack of understanding of the clinical course and clinical relevance, further adds to difficulties in assessing disease prevalence.

Excessive Daytime Sleepiness Recent Developments

- In September 2025, Amneal Pharmaceuticals announced that the U.S. FDA approved its sodium oxybate oral solution 500 mg/mL under an Abbreviated New Drug Application (ANDA), referencing Jazz Pharmaceuticals' Xyrem®. Amneal had previously distributed an authorized generic of the solution in limited quantities. Sodium oxybate is a CNS depressant used to treat cataplexy and excessive daytime sleepiness (EDS) in narcolepsy patients, helping consolidate nighttime sleep and reduce cataplexy episodes, making it a standard treatment for the condition.

Excessive Daytime Sleepiness Drug Chapters

The drug chapter segment of the excessive daytime sleepiness market report encloses a detailed analysis of Excessive Daytime Sleepiness-marketed drugs and mid to late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the excessive daytime sleepiness clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Marketed Excessive daytime sleepiness Drugs

WAKIX/ OZAWADE (pitolisant): Bioprojet Pharma/Harmony Biosciences

Pitolisant, a histamine H3 receptor (H3R) antagonist, was developed for its awakening effect in the treatment of narcolepsy with or without cataplexy. Approval from the European marketing authorization was obtained for this indication in March 2016 (under the brand name WAKIX). A pediatric investigation plan is underway, and studies are being carried out in narcoleptic children.

SUNOSI (Solriamfetol): Jazz Pharmaceuticals.

SUNOSI is a dual-acting dopamine and norepinephrine reuptake inhibitor (DNRI) that is indicated to improve wakefulness in adults living with Excessive Daytime Sleepiness due to narcolepsy or OSA. In 2014, Jazz Pharmaceuticals acquired a license to develop and commercialize Sunosi from Aerial Biopharma. Jazz Pharmaceuticals has worldwide development, manufacturing, and commercialization rights to SUNOSI, excluding certain jurisdictions in Asia. SK Biopharmaceuticals, the discoverer of the compound, maintains rights in 12 Asian markets, including Korea, China, and Japan. SUNOSI has received Orphan Drug designation for narcolepsy in the US.

Note: Further marketed drugs and their details will be provided in the report....

Excessive daytime sleepiness Emerging Drugs

AXS-12 (Reboxetine): Axsome Therapeutic

AXS-12 (reboxetine) is a highly selective and potent norepinephrine reuptake inhibitor under development for the treatment of narcolepsy. It modulates noradrenergic activity to promote wakefulness, maintain muscle tone, and enhance cognition. Reboxetine has an extensive safety record in Europe and in over 40 countries, including the US, where it is approved for the treatment of depression. AXS-12 in narcolepsy is supported by positive preclinical and preliminary clinical results. It significantly reduced narcoleptic episodes in the hypocretin (orexin)-deficient mice and improved daytime sleepiness with reduced cataplexy in patients with narcolepsy in an open-label pilot trial. The drug is presently being evaluated in the Phase III clinical trials for the treatment of narcolepsy. In its SYMPHONY Phase III trial, AXS-12 reduced excessive daytime sleepiness severity, improved cognitive function, and reduced overall narcolepsy severity as compared to placebo, and an open-label safety extension trial of AXS-12 is ongoing.

Samelisant (SUVN-G3031): Suven Life Sciences

Samelisant (SUVN-G3031) is an oral, potent, selective, and well-differentiated histamine H3 receptor inverse agonist. Its efficacy has been established in nonclinical sleep models. The drug has shown excellent ADME properties with no drug-drug interaction liability. It enhanced the in vivo release of several neurotransmitters in the cortex and showed robust wake-promoting effects in various animal models. SUVN-G3031 has an excellent safety profile in preclinical models with no propensity to induce abuse liability. The drug candidate was evaluated in two Phase I studies in the US in 72 healthy adult and elderly male/female populations with no serious adverse events.

The company recently announced the results of a Phase II proof-of-concept study, assessing the safety and efficacy of Samelisant for the treatment of excessive daytime sleepiness in adult narcolepsy patients with and without cataplexy. The study met the primary endpoint, with Samelisant demonstrating a statistically significant and clinically meaningful reduction in Excessive Daytime Sleepiness measured by the Epworth Sleepiness Scale (ESS) total score compared to the placebo at Day 14. The company plans a global Phase III study in the second half of 2024.

Note: Further emerging therapies and their detailed assessment will be provided in the final report....

Excessive Daytime Sleepiness Drug Class Insights

The American Academy of Sleep Medicine (AASM) recommends using sodium oxybate, as the first-line treatment of excessive daytime sleepiness and cataplexy. The most commonly used amphetamine-like compounds are methylphenidate, methamphetamine, D-amphetamine (all schedule II compounds), and mazindol (a schedule IV compound). The clinical use of stimulants in narcolepsy often has been the subject of standards of practice. Typically, a patient is started on a low dose, which increases progressively to obtain satisfactory results.

Modafinil is a chemically unique compound developed in France. Armodafinil, the R-enantiomer of racemic modafinil, with a longer half-life, was also approved by the US FDA for excessive daytime sleepiness associated with narcolepsy as well as for residual sleepiness in nasal continuous positive airway pressure-treated individuals and sleepiness in shift work sleep disorder. Importantly, the R-enantiomer of modafinil has a half-life of 10–15 h, which is longer than that of the S-enantiomer of modafinil (3–4 h). The dual pharmacokinetic properties of the racemic mixture may explain why modafinil is often more potent when taken twice per day at the beginning of therapy, during the period of drug accumulation. In terms of plasma concentrations, armodafinil is higher than modafinil late in the day on a milligram-to-milligram basis. That is the reason why modafinil is given twice a day at the beginning of therapy, and armodafinil is given once a day.

Methylphenidate, the piperazine derivative of amphetamine, was introduced for the treatment of narcolepsy in 1959, and both compounds share similar pharmacologic properties. Phenylisopropylamine (amphetamine) has a simple chemical structure resembling endogenous catecholamines. Amphetamine-like compounds, such as methylphenidate, pemoline, and fencamfamine, are structurally similar to amphetamines; all compounds include a benzene core with an ethylamine group side chain (phenethylamine derivatives). Methylphenidate has been commonly used for the treatment of excessive daytime sleepiness in narcolepsy, and a racemic mixture of both the D-enantiomer and L-enantiomer is used, but D-methylphenidate mainly contributes to clinical effects, especially after oral administration. The side effects of methylphenidate are reduced appetite, nausea, headache, insomnia, and psychosis.

Sodium oxybate is the first-line treatment for cataplexy and improves excessive daytime sleepiness, especially when combined with modafinil. It is a GABA receptor agonist, but the specific mechanism by which sodium oxybate exerts its effects in narcolepsy is uncertain. The drug is taken in two divided doses before sleep and 2–4 hours later. The total daily dose is 6–9 g. Side effects associated with the use of sodium oxybate include sedation, nausea, weight loss, nocturnal enuresis, and sleepwalking. It is a respiratory depressant and should never be combined with alcohol or hypnotics or used in patients with untreated OSA, moderate to severe lung disease, or other causes of hypoventilation. It is a Schedule I controlled substance that requires special registration for providers and is dispensed through a single pharmacy in the US.

Pitolisant is a US FDA-approved treatment for excessive daytime sleepiness in narcolepsy and also decreases the frequency of cataplexy. It is unique in its mechanism of action compared with the other medications discussed in that it acts as a histamine H3 receptor antagonist/inverse agonist. Its action is mediated at the presynaptic level and leads to the activation of histaminergic neurons. Pitolisant also modulates the release of other wakefulness-promoting neurotransmitters such as dopamine, noradrenaline, and acetylcholine.

Continued in report…

Excessive Daytime Sleepiness Market Outlook

The evaluation and management of excessive daytime sleepiness are based on the identification and treatment of underlying conditions (particularly Narcolepsy, Parkinson's disease, Obstructive sleep apnea (OSA), Idiopathic hypersomnia (IH), Bipolar Disorder, etc.). For all the indications, the mainstay of treatment is supportive care and approved therapies to alleviate the symptoms. Supportive therapies include armodafinil (R-enantiomer of modafinil), amphetamine, methamphetamine, dextroamphetamine, and methylphenidate, etc.

Sleepiness is usually treated using amphetamine-like CNS stimulants (i.e., methylphenidate or modafinil and its R-enantiomer, armodafinil), which are wake-promoting compounds unrelated to amphetamines. More recently, the American Academy of Sleep Medicine (AASM) recommended the use of sodium oxybate, a short-lasting sedative of unknown mechanisms, as the first-line treatment of Excessive Daytime Sleepiness and cataplexy. The most commonly used amphetamine-like compounds are methylphenidate, methamphetamine, D-amphetamine (all schedule II compounds), and mazindol (a schedule IV compound). The clinical use of stimulants in narcolepsy often has been the subject of standards of practice published by AASM.

PROVIGIL (modafinil), which was launched by Cephalon in 1999, is indicated for the treatment of excessive sleepiness associated with narcolepsy, obstructive sleep apnea (OSA), and shift work disorder (SWD). Outside the US, Provigil is approved, under various trade names, in more than 30 countries, including France, the United Kingdom, Ireland, Italy, and Germany, for the treatment of Excessive Daytime Sleepiness associated with narcolepsy. In January 2007, modafinil was approved by PMDA for the treatment of Excessive Daytime Sleepiness associated with narcolepsy. It was later approved in Japan for the treatment of Excessive Daytime Sleepiness in OSA who receive treatment of airway obstruction with continuous positive airway pressure (2011) and Excessive Daytime Sleepiness in idiopathic hypersomnia (2020).

NUVIGIL (armodafinil), the R-isomer of modafinil, is indicated for the treatment of excessive sleepiness associated with narcolepsy, OSA, and SWD. Cephalon launched it in June 2009.

In March 2019, the US FDA approved SUNOSI (solriamfetol) for Excessive Daytime Sleepiness associated with narcolepsy or OSA. Sunosi is the first and only dual-acting dopamine and norepinephrine reuptake inhibitor approved by the FDA to improve wakefulness in adults living with Excessive Daytime Sleepiness associated with narcolepsy or obstructive sleep apnea. In January 2020, the company also received EU Marketing Authorisation for Sunosi (solriamfetol) for Excessive Daytime Sleepiness in adults with narcolepsy or OSA. It is also being evaluated for the treatment of Excessive Daytime Sleepiness in pediatric patients. Sunosi is the only licensed therapy in Europe for the treatment of Excessive Daytime Sleepiness in adults living with OSA.

Excessive Daytime Sleepiness companies are Axsome Therapeutics, Suven Life Sciences, and others are evaluating their lead candidates in different stages of clinical development. They aim to investigate their products to treat excessive daytime sleepiness.

- The total Excessive Daytime Sleepiness market size in the 7MM was approximately USD 6,227 million in 2023 and is projected to increase during the forecast period (2024–2034).

- The Excessive Daytime Sleepiness therapeutic market in the United States was USD 4,690 million in the year 2023.

- The current Excessive Daytime Sleepiness market is mainly covered by SUNOSI, WAKIX, XYREM, XYWAV, and others. The market size of XYREM AND WAKIX was USD 1,163 million and USD 565 million, respectively in 2023, in the 7MM.

- In 2020, XYWAV (calcium, magnesium, potassium, and sodium oxybate), a lower sodium alternative to Xyrem, was approved for the treatment of Excessive Daytime Sleepiness in narcolepsy. It generated a revenue of USD 1,007 million in 2023.

- In 2023, Japan with a Excessive Daytime Sleepiness revenue of approximately USD 382.8 million, which is expected to increase by 2034.

- AXS-12 (reboxetine) is expected to enter the Excessive Daytime Sleepiness US market by 2025 for the treatment of Excessive Daytime Sleepiness in narcolepsy. With the loss of patents for approved therapies, Axsome Therapeutics has the potential to establish a strong foothold in the crowded market. The drug is projected to have a medium uptake attaining its peak by 7th year.

Excessive Daytime Sleepiness Drugs Uptake

This section focuses on the uptake rate of potential Excessive Daytime Sleepiness drugs expected to be launched in the market during 2020–2034. For example, Axsome Therapeutics AXS-12 (reboxetine) is expected to enter the US market by 2025 and is projected to have a medium uptake during the forecast period.

Further detailed analysis of emerging therapies drug uptake in the report....

Excessive Daytime Sleepiness Pipeline Development Activities

The Excessive Daytime Sleepiness market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline development activities

The Excessive Daytime Sleepiness market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for Excessive Daytime Sleepiness.

KOL Views

To keep up with current Excessive Daytime Sleepiness market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on Excessive Daytime Sleepiness evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the University of Washington, Johns Hopkins University School of Medicine, University Heart Centre Hamburg, Germany, Careggi University Hospital, Italy, and the Royal Brompton Hospital, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Excessive Daytime Sleepiness market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

According to our primary research analysis, most of the time, narcolepsy remains very difficult to diagnose due to unawareness present among physicians. Symptoms of narcolepsy include cataplexy and excessive daytime sleepiness but sometimes patients only have sleepiness as a symptom. These patients are the ones who are most difficult to diagnose and thus the condition often remains underdiagnosed or diagnosis is delayed.

It is very difficult for patients to address the problem and think of it as a clinical problem, due to which patients tend to wait for a longer period of time to address the problem before going to the clinician. This causes delayed diagnosis in patients. In children, Excessive Daytime Sleepiness is often misdiagnosed as ADHD.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

The scores are analyzed based on efficacy which evaluates the outcome measures from the trial that define the acceptability and tolerability of the molecule by the patients enrolled in the trial. Also measures the change in the Epworth Sleepiness Scale (ESS) score/Improvement in CGI sleepiness scores.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Excessive Daytime Sleepiness Market Access and Reimbursement

SUNOSI (solriamfetol) is a dual-acting dopamine and norepinephrine reuptake inhibitor (DNRI) that improves wakefulness in adults living with Excessive Daytime Sleepiness due to narcolepsy or obstructive sleep apnea (OSA). Jazz Pharmaceuticals is offering a SUNOSI Savings Card by which eligible patients can get their prescription for as little as USD 9 a month. The card is limited to 15 uses per year. Under the JazzCares Program, uninsured patients can get Jazz products at no cost.

SUNOSI is usually not covered under Medicare, but some private health insurance companies cover this drug under their health plans. HealthPartners’ Medicaid List of Covered Drugs includes SUNOSI within a quantity limit of one tablet a day. To avail of the reimbursement, the patient must get prior authorization before filling a prescription for this drug. HealthPartners is an integrated, nonprofit healthcare provider and health insurance company located in Bloomington, Minnesota, offering care, coverage, research, and education to its members, patients, and the community

Further details will be provided in the report....

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Excessive Daytime Sleepiness Market Report

- The Excessive Daytime Sleepiness market report covers a segment of key events, an executive summary, and a descriptive overview of Excessive Daytime Sleepiness, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Excessive Daytime Sleepiness market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Excessive Daytime Sleepiness market report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Excessive Daytime Sleepiness market.

Excessive Daytime Sleepiness Market Report Insights

- Excessive Daytime Sleepiness Patient Population

- Therapeutic Approaches

- Excessive Daytime Sleepiness Pipeline Analysis

- Excessive Daytime Sleepiness Market Size

- Excessive Daytime Sleepiness Market Trends

- Existing and Future Excessive Daytime Sleepiness Market Opportunity

Excessive Daytime Sleepiness Market Report Key Strengths

- 11 years Forecast

- The 7MM Coverage

- Excessive Daytime Sleepiness Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Excessive Daytime Sleepiness Drugs Uptake

- Key Excessive Daytime Sleepiness Market Forecast Assumptions

Excessive Daytime Sleepiness Market Report Assessment

- Current Excessive Daytime Sleepiness Treatment Practices

- Excessive Daytime Sleepiness Unmet Needs

- Excessive Daytime Sleepiness Pipeline Product Profiles

- Excessive Daytime Sleepiness Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

Excessive Daytime Sleepiness Market Insights

- What was the total Excessive Daytime Sleepiness market size, the market size of Excessive Daytime Sleepiness by therapies, and market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will AXS-12 affect the treatment paradigm of Excessive Daytime Sleepiness?

- How will AXS-12 compete with other upcoming products and marketed Excessive Daytime Sleepiness therapies?

- Which Excessive Daytime Sleepiness drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed Excessive Daytime Sleepiness therapies?

- How would future opportunities affect the Excessive Daytime Sleepiness market dynamics and subsequent analysis of the associated trends?

Excessive Daytime Sleepiness Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of Excessive Daytime Sleepiness? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Excessive Daytime Sleepiness?

- What is the historical and forecasted Excessive Daytime Sleepiness patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent Excessive Daytime Sleepiness population during the forecast period (2024–2034)?

- What factors are contributing to the growth of Excessive Daytime Sleepiness cases?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of excessive daytime sleepiness? What are the current clinical and treatment guidelines for treating excessive daytime sleepiness?

- How many companies are developing therapies for the treatment of excessive daytime sleepiness?

- How many emerging therapies are in the mid-stage and late stage of development for treating excessive daytime sleepiness?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved Excessive Daytime Sleepiness therapy in the US?

- What is the 7MM historical and forecasted Excessive Daytime Sleepiness market?

Reasons to Buy

- The Excessive Daytime Sleepiness market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the excessive daytime sleepiness market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying upcoming solid players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for excessive daytime sleepiness, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Excessive Daytime Sleepiness market so that the upcoming players can strengthen their development and launch strategy.

-market.png&w=256&q=75)