Follicular Lymphoma Market Summary

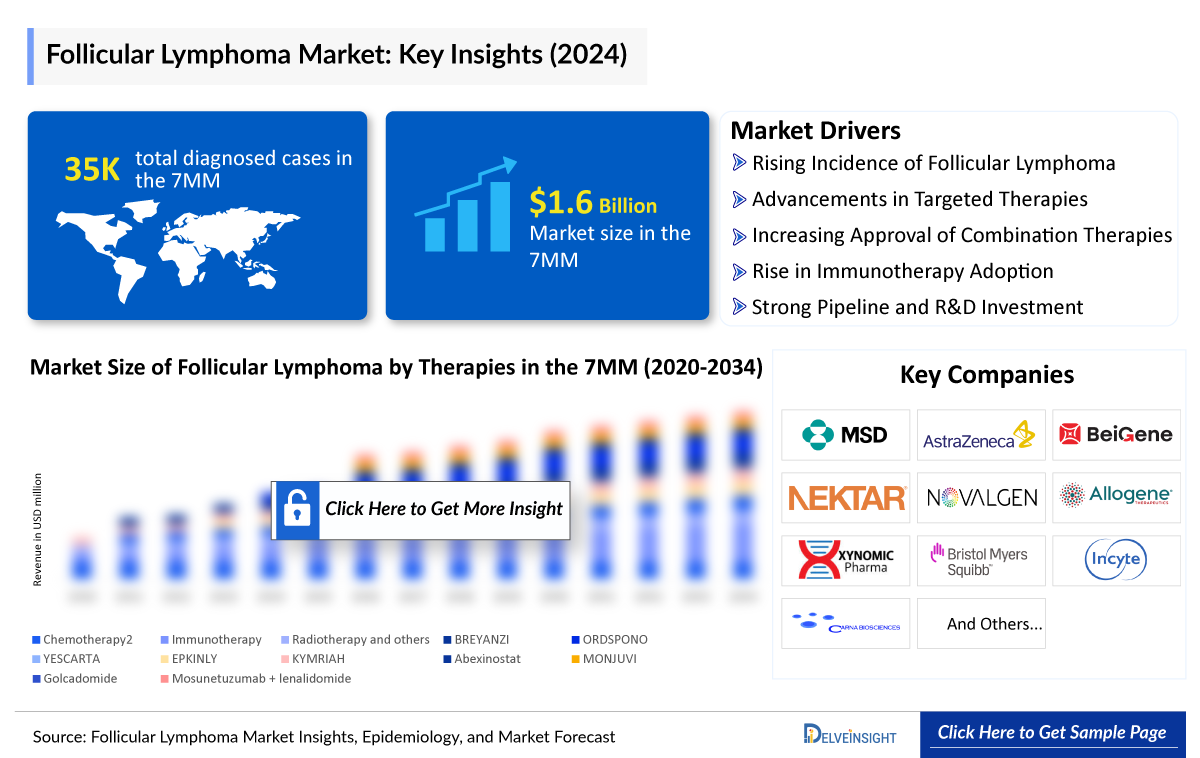

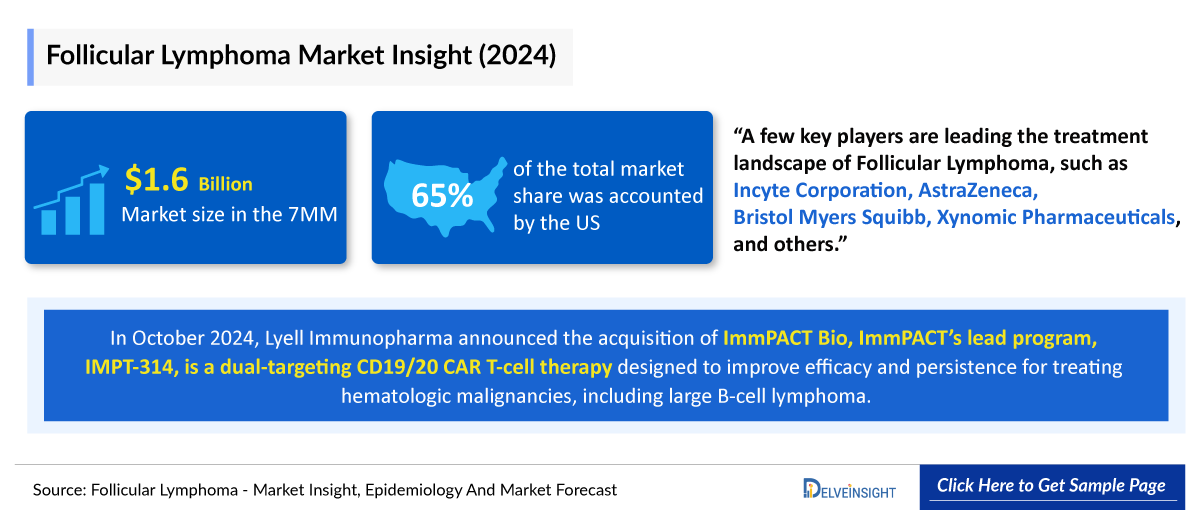

- The Follicular Lymphoma Market Size in the 7MM is expected to grow from USD 1,702 million in 2025 to USD 3,081 million in 2036.

- The Follicular Lymphoma Market is projected to grow at a CAGR of 6.8% by 2036 in leading countries like the US, EU4, UK, and Japan.

Follicular Lymphoma Market and Epidemiological Analysis

- Follicular lymphoma is an indolent variety of non-Hodgkin’s lymphoma (NHL) originating from germinal center B cells. Follicular lymphoma is one of the most prevalent forms of indolent B cell NHL. It has a long disease course due to the chronic incurable nature of the disease in the majority of patients.

- Morphological assessment of a lymph node excisional biopsy is crucial for diagnosing follicular lymphoma. Lymph nodes will show variable-sized, closely packed follicles containing small cleaved cells without nucleoli (centrocytes) and larger noncleaved cells with moderate cytoplasm, open chromatin, and multiple nucleoli (centroblasts).

- Approved therapies for follicular lymphoma include GAZYVA, TAZVERIK, EPKINLY/ TEPKINLY, LUNSUMIO, YESCARTA, BREYANZI, KYMRIAH, BRUKINSA, ORDSPONO, and RITUXAN HYCELA.

- In February 2025, Regeneron Pharmaceuticals announced that it had resubmitted the Biologics License Application (BLA) for odronextamab in relapsed/refractory follicular lymphoma to the FDA. The company anticipates a decision from the FDA by the second half of 2025.

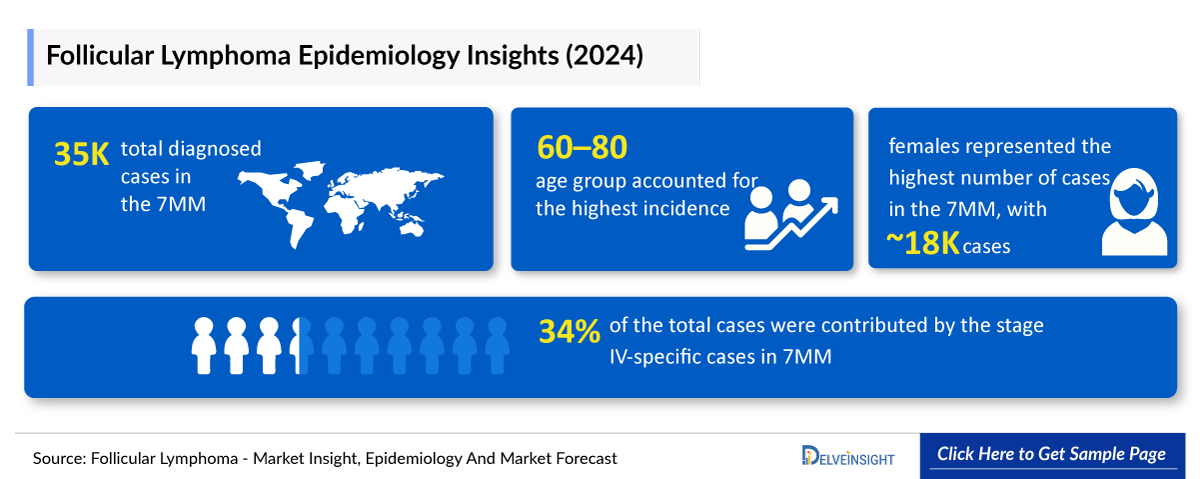

- In 2024, there are a total of ~35,000 diagnosed cases of follicular lymphoma across the 7MM.

- In 2024, females represented the highest number of cases in the 7MM, with ~18,000 cases.

- In 2024, the United States accounted for the largest market share for follicular lymphoma in the 7MM, with approximately USD 1,000 million.

- Numerous drugs are currently in development for the treatment of follicular lymphoma, including promising therapies like MONJUVI (tafasitamab), AZD0486, Golcadomide, Abexinostat, NKTR-255, CTX112, IMPT-314, and others, which are set to launch in the 7MM during the forecast period (2026–2036).

Follicular Lymphoma Market Size and Forecasts

- 2025 Follicular Lymphoma Market Size: USD 1702 million in 2025

- 2036 Projected Malignant Pleural Effusion Market Size: USD 3081 million in 2036

- Growth Rate (2026-2036): 6.8 % CAGR

- Largest Malignant Pleural Effusion Market: United States

DelveInsight’s “Follicular Lymphoma Market Insights, Epidemiology, and Market Forecast – 2036” report delivers an in-depth understanding of Follicular Lymphoma, historical and forecasted epidemiology, as well as the Follicular Lymphoma market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Follicular Lymphoma Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Follicular Lymphoma Market Size from 2022 to 2036. The report also covers Follicular Lymphoma Treatment practices and unmet medical needs to curate the best opportunities and assess the market’s potential.

Scope of the Follicular Lymphoma Market Report | |

|

Study Period |

2022–2036 |

|

Forecast Period |

2026–2036 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

Epidemiology |

Segmented by: · Total Diagnosed Incidence Cases of Follicular Lymphoma · Gender-specific Cases of Follicular Lymphoma · Age-specific cases of Follicular Lymphoma · Stage-Specific Cases of Follicular Lymphoma · Grade-Specific Cases of Follicular Lymphoma · Treated Case by Line of therapy of Follicular lymphoma |

|

Market |

Segmented by: · Region · Therapies |

|

Market Analysis |

· KOL Views · SWOT Analysis · Reimbursement · Conjoint Analysis · Unmet needs |

Key Factors Driving the Follicular Lymphoma Market

Follicular Lymphoma incidence fueling market growth

Follicular Lymphoma, the most common indolent NHL subtype, accounts for about 20–22% of cases. In 2024, an estimated 35K cases were diagnosed in the 7MM, with females higher at 18K. Cases are expected to rise by 2034 due to aging populations, better diagnostics, and longer survival, expanding the market and increasing demand for new treatments.

Follicular Lymphoma Follicular Lymphoma treatment paradigm

Current FL treatment mainly involves rituximab-based immunochemotherapy, radioimmunotherapy (e.g., ibritumomab tiuxetan), and targeted agents like PI3K inhibitors and CAR-T therapies in relapsed cases. Approved therapies include GAZYVA, TAZVERIK, EPKINLY/TEPKINLY, LUNSUMIO, YESCARTA, BREYANZI, KYMRIAH, BRUKINSA, ORDSPONO, and RITUXAN HYCELA.

Follicular Lymphoma pipeline spotlight

The Follicular Lymphoma pipeline is robust, featuring bispecific antibodies, next-generation ADCs, and off-the-shelf CAR constructs designed to achieve deeper, more durable remissions with better tolerability. Key pipeline therapies include MONJUVI, AZD0486, Golcadomide, Abexinostat, NKTR-255, CTX112, IMPT-314, and others. Leading companies driving these developments are Roche, Gilead/Kite, Novartis, AstraZeneca, BeiGene, Regeneron, and MEI Pharma. In January 2025, CRISPR Therapeutics announced plans to engage regulators on CTX112 for B-cell malignancies, with updates expected mid-2025. These advances build upon established treatments that define the current standard of care.

Follicular Lymphoma Market Dynamics and Opportunity

Adoption of newer therapies will hinge on demonstrating superior survival and quality-of-life benefits versus standard immunochemotherapy, balanced against cost, toxicity profile, and payer restrictions—defining the competitive commercial outlook of the Follicular Lymphoma market.

Follicular Lymphoma Disease Understanding

Follicular Lymphoma Overview

Follicular lymphoma is a generally indolent, slow-growing B-cell lymphoproliferative disorder arising from transformed follicular center B cells. Follicular lymphoma is characterized by diffuse lymphadenopathy, bone marrow involvement, and splenomegaly. Extranodal involvement is less common. Cytopenias are relatively common, but constitutional symptoms of fever, night sweats, and weight loss are uncommon in the absence of transformation to diffuse large B cell lymphoma. Follicular lymphoma is typically not considered curable but is instead categorized as a chronic disease.

Further details are provided in the report…

Follicular Lymphoma Diagnosis

Diagnosis of follicular lymphoma is based on histology from a biopsy of a lymph node or other affected tissue. An incisional biopsy is preferred over needle biopsies to provide adequate tissue to assign a grade and assess for transformation. Immunohistochemical staining is positive in virtually all cases for cell surface CD19, CD20, CD10, and monoclonal immunoglobulin, as well as cytoplasmic expression of bcl-2 protein. The overwhelming majority of cases have the characteristic t(14;18) translocation involving the IgH/bcl-2 genes. A CT scan of the chest, abdomen, and pelvis can determine whether abdominal or pelvic adenopathy is present. Positron emission tomography (PET) scanning may also be useful in certain clinical settings, such as localized disease or when transformed disease is suspected. Bone marrow aspiration and chromosome analysis can also help establish the diagnosis because the chromosomal t(14;18) translocation is found in the majority of patients with follicular lymphoma.

Further details related to country-based variations are provided in the report…

Follicular Lymphoma Treatment

Treatment for follicular lymphoma varies based on the stage of the disease. Observation is appropriate for asymptomatic patients with low bulk disease and no cytopenias; there is no overall survival (OS) advantage for early treatment with either chemotherapy or single-agent rituximab. For patients needing therapy, most are treated with chemoimmunotherapy, which has improved overall response rates, duration of response, and overall survival. Randomized studies have shown additional benefits for the maintenance of rituximab. Lenalidomide was non-inferior to chemoimmunotherapy in a randomized front-line study and, when combined with rituximab, was superior to rituximab alone in relapsed follicular lymphoma. Kinase inhibitors, stem cell transplantation (SCT), and chimeric antigen receptor T cells (CAR-T) are also considered for recurrent disease. Early-stage, localized disease may be treated with radiation therapy or excision in certain cases.

Follicular Lymphoma Epidemiology

The Follicular Lymphoma epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Diagnosed Incidence Cases, Gender-specific Cases, Age-specific Cases, Stage Specific Cases, Grade Specific Cases, and Treated Cases by Line of therapy of Follicular lymphoma in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2022 to 2036.

Key Findings from Follicular Lymphoma Epidemiological Analyses and Forecast

- Among the 7MM, the United States accounted for the highest number of cases of Follicular Lymphoma in 2024, with nearly 17,000 cases. These cases are anticipated to increase by 2034.

- In 2024, the highest incidence of follicular lymphoma was observed in the 60–80 age group with ~9000 cases, followed by individuals aged 40–59 with ~4000 cases.

- In 2024, stage IV specific cases of follicular lymphoma made up around 35% of the total cases.

- The incidence of follicular lymphoma in the EU4 and the UK was ~14,000 in 2024, with Germany having the highest cases.

Follicular Lymphoma Epidemiology Segmentation

- Total Diagnosed Incidence Cases

- Gender-specific Cases

- Age-specific Cases

- Stage Specific Cases

- Grade Specific Cases

- Treated Cases by Line of therapy

Follicular Lymphoma Market

A few key players are leading the treatment landscape of Follicular Lymphoma, such as Incyte Corporation, AstraZeneca, Bristol Myers Squibb, Xynomic Pharmaceuticals, and others. The details of the country-wise and therapy-wise market size have been provided below.

- In the 7MM, the United States accounted for the highest market share, i.e. more than 65% in 2024, followed by France and Germany.

- The United States generated a revenue of approximately USD 1,000 million in 2024.

- Among the EU4 and the UK, Germany accounted for the highest market size in 2024 with approximately USD 100 million.

- Spain accounted for the least market size, approximately USD 60 million, among the EU4 and the UK in 2024.

Follicular Lymphoma Drug Analysis

The section dedicated to drugs in the Follicular Lymphoma report provides an in-depth evaluation of late-stage pipeline drugs (Phase III) related to Follicular Lymphoma. The drug chapters section provides valuable information on various aspects related to clinical trials of Follicular Lymphoma, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting Follicular Lymphoma.

Follicular Lymphoma Marketed Drugs

LUNSUMIO (mosunetuzumab): Roche

LUNSUMIO (mosunetuzumab) is a bispecific antibody therapy designed to treat adults with R/R follicular lymphoma who have already received two or more prior treatments. It works by binding to both T cells and B cells, activating the immune system to target and destroy cancerous B cells. However, LUNSUMIO may also affect healthy cells. The most significant risk associated with LUNSUMIO is Cytokine Release Syndrome (CRS), a common and potentially life-threatening side effect. It is not known if LUNSUMIO is safe or effective in children.

In December 2024, Chugai announced receiving regulatory approval for LUNSUMIO in Japan for intravenous infusion, marking a significant milestone in treating R/R follicular lymphoma. This approval allows LUNSUMIO monotherapy for patients who have had at least two prior therapies. Earlier, in December 2022, the FDA granted accelerated approval to LUNSUMIO for adult patients with R/R follicular lymphoma after two or more lines of systemic therapy. In June 2022, Roche announced that the European Commission granted conditional marketing authorization for LUNSUMIO to treat adult patients with R/R follicular lymphoma who have already received at least two prior systemic therapies.

BRUKINSA (zanubrutinib): BeiGene

BRUKINSA (zanubrutinib) is a small-molecule Bruton's tyrosine kinase (BTK) inhibitor approved for the treatment of adult patients with r/r follicular lymphoma in combination with obinutuzumab, after two or more lines of systemic therapy. It is the first and only BTK inhibitor specifically indicated for follicular lymphoma. Zanubrutinib works by covalently binding to BTK, inhibiting B-cell signaling pathways involved in B-cell proliferation, adhesion, and migration, ultimately reducing tumor growth.

In March 2024, the FDA granted accelerated approval to BRUKINSA in combination with obinutuzumab for the treatment of adult patients with r/r follicular lymphoma after two or more lines of systemic therapy. In August 2022, BRUKINSA was granted orphan-drug designation for the treatment of follicular lymphoma by US FDA.

|

Marketed Therapies |

Company |

RoA |

MoA |

|

LUNSUMIO |

BeiGene |

Intravenous |

Antibody-dependent cell cytotoxicity; Cytotoxic T lymphocyte stimulants |

|

BRUKINSA |

Roche |

Oral |

BTK inhibitor |

|

YESCARTA |

Kite Pharma |

Intravenous |

T-lymphocyte replacements |

Follicular Lymphoma Emerging Therapies

MONJUVI (tafasitamab): Incyte Corporation

MONJUVI (tafasitamab) is a humanized Fc-modified cytolytic CD19 targeting monoclonal antibody. The drug candidate binds to CD19 on the surface of B-cells, blocking its activity and causing lysis of B-cells. In 2010, MorphoSys licensed exclusive worldwide rights to develop and commercialize tafasitamab from Xencor, Inc. Tafasitamab incorporates an XmAb-engineered Fc domain, which mediates B-cell lysis through apoptosis and immune effector mechanism including Antibody-dependent Cell-mediated Cytotoxicity (ADCC) and Antibody-dependent Cellular Phagocytosis (ADCP).

In December 2024, Incyte presented late-breaking data at the ASH Annual Meeting, showcasing the results of the pivotal Phase III inMIND trial. The study demonstrated that MONJUVI (tafasitamab), when combined with lenalidomide and rituximab, significantly improved Progression-free Survival (PFS) in patients with R/R follicular lymphoma. The trial met its primary endpoint of PFS and key secondary endpoints.

AZD0486: AstraZeneca

AZD0486 (formerly TNB-486) is a novel, IgG4 fully human CD19xCD3 bispecific TCE incorporating a unique low-affinity anti-CD3 moiety designed to reduce cytokine release while retaining potent T-cell mediated cytotoxicity of malignant B cells. A silenced Fc prevents nonspecific binding and antibody-dependent cellular cytotoxicity and confers a long half-life suitable for intermittent administration. Currently, the drug is in the Phase III stage of its development for the treatment of follicular lymphoma.

In November 2024, At ASH 2024, AstraZeneca highlighted the strength of its hematology portfolio with two oral presentations on AZD0486, a novel CD19xCD3 bispecific T-cell engager. Phase I results show promising efficacy in patients with R/R follicular lymphoma, with a 96% ORR and 85% CRR at doses of 2.4 mg and above.

|

Emerging Therapies |

Company |

Patient Segment |

Phase |

Molecule type |

ROA |

MOA |

|

AZD0486 |

AstraZeneca |

Previously untreated follicular lymphoma |

III |

Bispecific antibody |

Intravenous |

CD19xCD3 bispecific T-cell engager |

|

MONJUVI (tafasitamab) |

Incyte Corporation |

relapsed/refractory (R/R) follicular lymphoma |

III |

Monoclonal antibody |

Intravenous |

Antibody-dependent Cell-mediated Cytotoxicity |

|

Abexinostat |

Xynomic Pharmaceuticals |

Relapsed/refractory follicular lymphoma |

II |

Small molecule |

Oral |

Histone Deacetylase (HDAC) inhibitor |

Follicular Lymphoma Market Outlook

Frontline therapy for follicular lymphoma is well established, with most patients achieving long-lasting responses to Chemoimmunotherapy (CIT). For localized disease, treatment options include radiotherapy (RT) alone or in combination with immunochemotherapy, while RT alone may also be suitable for relapsed localized cases.

The currently approved therapies for follicular lymphoma represent a diverse and evolving treatment landscape, offering a range of options for both frontline and R/R disease. Among the most significant therapies is GAZYVA/GAZYVARO (obinutuzumab), which, in combination with chemotherapy, has become a cornerstone in the frontline treatment of follicular lymphoma. Its efficacy in both untreated and relapsed settings has solidified its role in therapy regimens. Similarly, RITUXAN (rituximab), along with its combination form RITUXAN HYCELA (a fixed-dose combination of rituximab and hyaluronidase human), remains one of the most widely used therapies, particularly for patients with relapsed disease. The availability of RITUXAN generics has made it a more accessible and cost-effective option, ensuring its continued relevance in the management of follicular lymphoma.

In the realm of targeted therapies, TAZVERIK (tazemetostat), an EZH2 inhibitor, offers an exciting option for patients with specific mutations, adding a precision medicine approach to the treatment landscape. BRUKINSA (ibrutinib) represents a key Bruton’s tyrosine kinase inhibitor, which, while primarily indicated for other B-cell malignancies, also plays a role in the treatment of follicular lymphoma. Furthermore, the recent approvals of EPKINLY/TEPKINLY (epcoritamab), a bispecific antibody targeting CD3 and CD20, and BRUKINSA, alongside the Chimeric Antigen Receptor (CAR) T-cell therapies KYMRIAH (tisagenlecleucel), LUNSUMIO (mosunetuzumab), YESCARTA (axicabtagene ciloleucel), and BREYANZI (lisocabtagene maraleucel), are ushering in a new era of immunotherapies in follicular lymphoma management. These therapies are showing promising results, especially in R/R settings. They are expected to transform the way follicular lymphoma is treated, providing more durable responses with the potential for long-term remission.

In summary, numerous therapies have already been approved for the management of follicular lymphoma, with several effective medications currently available. While ongoing research continues to explore new treatments, many approved therapies are already making a significant impact in the Follicular Lymphoma treatment landscape. The forecast period (2026–2036) is expected to bring further advancements, with emerging therapies enhancing existing treatment options. As healthcare spending continues to increase worldwide, the Follicular Lymphoma treatment space is anticipated to see a positive shift, with more accessible and effective therapies becoming available to patients in need.

Latest KOL Views on Follicular Lymphoma

To stay abreast of the latest trends in the market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research.

We have reached out to industry experts to gather insights on various aspects of Follicular Lymphoma, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at Delveinsight connected with more than 15 KOLs across the 7MM. We contacted institutions. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the Follicular Lymphoma market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Follicular Lymphoma Report Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in trials for Follicular Lymphoma, one of the most important primary endpoints was achieving Maximum tolerated dose, PFS, Incidence of AEs, OR, and others.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Follicular Lymphoma Market Access and Reimbursement

Follicular lymphoma, also known as follicle center lymphoma or nodular lymphoma, is a common type of non-Hodgkin’s lymphoma, a slow-growing cancer, which affects the body’s immune system. It may appear in your lymph nodes, bone marrow, or other organs. In January 2024, the PAN Foundation announced to opening of a new follicular lymphoma fund, providing up to USD 4,600 per year to help eligible patients pay for out-of-pocket deductible, copay, and coinsurance costs.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Follicular Lymphoma Market Report Insights

- Patient Population

- Therapeutic Approaches

- Follicular Lymphoma Market Size and Trends

- Existing Market Opportunity

Follicular Lymphoma Market Report Key Strengths

- 11-year Forecast

- The 7MM Coverage

- Follicular Lymphoma Epidemiology Segmentation

- Key Cross Competition

Follicular Lymphoma Market Report Assessment

- Current Treatment Practices

- Reimbursements

- Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet needs)

Key Questions Answered in the Follicular Lymphoma Market Report

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in Follicular Lymphoma management recommendations?

- Would research and development advances pave the way for future tests and therapies for Follicular Lymphoma?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of Follicular Lymphoma?

- What kind of uptake will the new therapies witness in the coming years in Follicular Lymphoma patients?