Galsulfase Summary

Key Factors Driving Galsulfase Growth

1. Market Share Gains and New Patient Starts

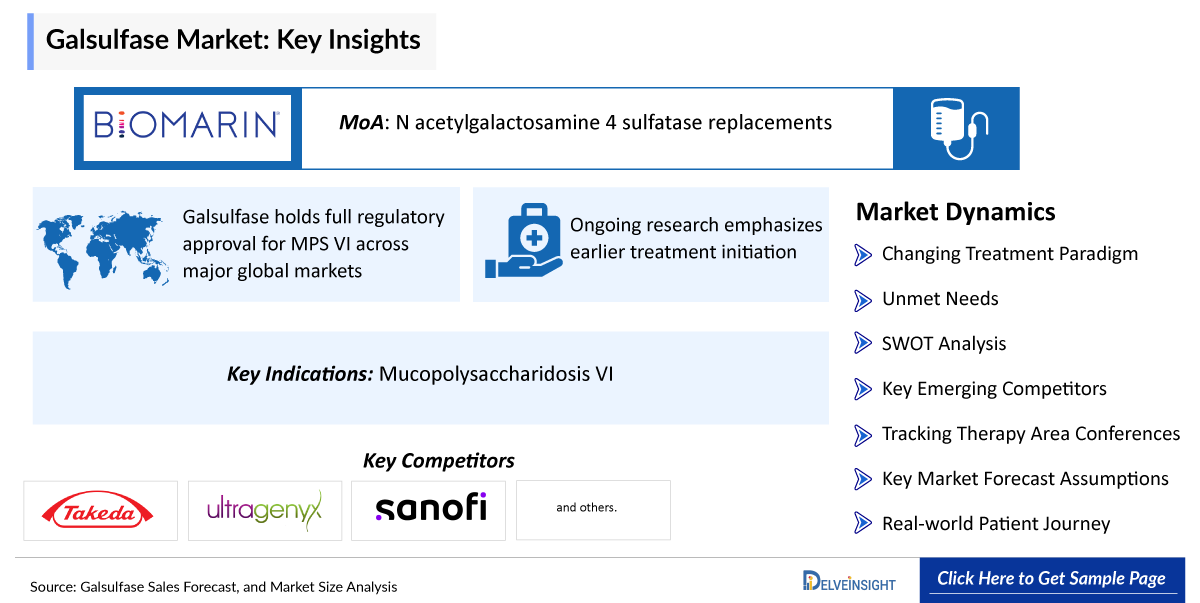

- Galsulfase (Naglazyme) is the established standard-of-care enzyme replacement therapy (ERT) for Mucopolysaccharidosis type VI (MPS VI, Maroteaux–Lamy syndrome), holding a dominant position in this ultra-rare lysosomal storage disorder.

- New patient starts are driven by improved diagnostic awareness, expanded genetic testing, and earlier referral to metabolic specialists, particularly in pediatric populations.

- BioMarin’s long-standing engagement with rare disease centers, clinicians, and patient advocacy groups continues to support steady global adoption.

2. Expansion Across Key Indications

- Primary indication - MPS VI (Maroteaux–Lamy syndrome): Naglazyme is approved for the treatment of patients with confirmed arylsulfatase B deficiency, addressing the underlying metabolic cause of the disease.

- Ongoing research emphasizes earlier treatment initiation, which has been associated with better long-term outcomes in mobility and organ function.

- While use remains specific to MPS VI, Naglazyme has reinforced the broader role of enzyme replacement therapies in lysosomal storage disorders, serving as a reference model for similar programs.

3. Geographic Expansion

- United States and Europe: Core commercial markets with well-established regulatory approvals and reimbursement frameworks.

- Asia-Pacific: Increasing uptake driven by improved healthcare infrastructure, rare disease funding initiatives, and better diagnostic capacity, especially in Japan, China, and Southeast Asia.

- Latin America and Middle East: Gradual expansion through government access programs and BioMarin’s strategic distribution partnerships.

- Market growth remains inherently limited by the ultra-rare prevalence of MPS VI, but penetration among diagnosed patients continues to improve.

4. New Indication Approvals

- Galsulfase holds full regulatory approval for MPS VI across major global markets.

- No additional disease indications have been approved; its clinical use remains highly specific to Maroteaux–Lamy syndrome, with regulatory efforts focused on early diagnosis and access expansion rather than label diversification.

5. Strong MPS VI Treatment Momentum

- Clinical studies demonstrated improvements in endurance, pulmonary function, and overall physical capacity, as measured by standardized walk tests and respiratory assessments.

- Long-term extension and registry data indicate sustained stabilization of disease progression, particularly when therapy is initiated early.

- Real-world evidence supports a favorable long-term safety profile, reinforcing clinician confidence in chronic intravenous administration.

6. Competitive Differentiation and Market Trends

- First-in-class ERT for MPS VI: Naglazyme remains the only approved disease-modifying therapy for Maroteaux–Lamy syndrome.

- Proven long-term clinical experience: Over a decade of global use has established strong trust among metabolic specialists.

- Rare disease trends: Expansion of newborn screening, genomic diagnostics, and orphan drug incentives continues to support long-term market stability.

- Growing research into gene therapy and next-generation enzyme delivery systems is shaping the future competitive landscape, but Naglazyme remains the current standard of care.

Galsulfase Recent Developments

Galsulfase have focused primarily on long-term real-world data and registry-based outcome studies, confirming durable improvements in mobility, respiratory function, and quality of life over extended treatment durations. BioMarin continues to position Naglazyme as a benchmark therapy for MPS VI, frequently referenced in comparative analyses with emerging gene therapy and substrate reduction programs. Ongoing scientific discourse increasingly emphasizes early genetic diagnosis and treatment initiation, with advocacy for broader newborn screening policies to maximize long-term benefits and sustain Naglazyme’s role as the foundational therapy in MPS VI management.

“Galsulfase Sales Forecast, and Market Size Analysis – 2034” report provides comprehensive insights of Galsulfase for approved indication like Mucopolysaccharidosis VI in the 7MM. A detailed picture of Galsulfase’s existing usage in anticipated entry and performance in approved indications in the 7MM, i.e., the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan for the study period 2020 –2034 is provided in this report along with a detailed description of the Galsulfase for approved indications. The Galsulfase market report provides insights about Galsulfase’s sales forecast, mechanism of action (MoA), dosage and administration, as well as research and development including regulatory milestones, along with other developmental activities. Further, it also consists of historical and current Galsulfase performance, future market assessments inclusive of the Galsulfase market forecast analysis for approved indications in the 7MM, SWOT, analysts’ views, comprehensive overview of market competitors, and brief about other emerging therapies in respective indications. It also provides analysis of Galsulfase sales forecasts, along with factors driving its market.

Galsulfase Drug Summary

Galsulfase is a recombinant human N-acetylgalactosamine 4-sulfatase enzyme, produced using Chinese hamster ovary (CHO) cells and marketed as Naglazyme by BioMarin Pharmaceutical, for weekly intravenous infusion as long-term enzyme replacement therapy in patients with mucopolysaccharidosis VI (MPS VI; Maroteaux-Lamy syndrome). It catalyzes the hydrolysis of sulfate ester groups from the N-acetylgalactosamine 4-sulfate residues of glycosaminoglycans chondroitin 4-sulfate and dermatan sulfate, reducing their lysosomal accumulation that drives progressive cellular dysfunction, organomegaly, skeletal dysplasia, and cardiopulmonary complications. FDA-approved in 2005 (followed by EMA and other approvals), Galsulfase at 1 mg/kg weekly improves endurance (e.g., walking distance), pulmonary function, and urinary GAG levels without addressing corneal or cognitive issues, as it relies on mannose-6-phosphate receptor-mediated cellular uptake. The report provides Galsulfase’s sales, growth barriers and drivers, post usage and approvals in multiple indications.

Scope of the Galsulfase Market Report

The report provides insights into:

- A comprehensive product overview including the Galsulfase MoA, description, dosage and administration, research and development activities in approved indication like Mucopolysaccharidosis VI.

- Elaborated details on Galsulfase regulatory milestones and other development activities have been provided in Galsulfase market report.

- The report also highlights Galsulfase‘s cost estimates and regional variations, reported and estimated sales performance, research and development activities in approved indications across the United States, Europe, and Japan.

- The Galsulfase market report also covers the patents information, generic entry and impact on cost cut.

- The Galsulfase market report contains current and forecasted Galsulfase sales for approved indications till 2034.

- Comprehensive coverage of the late-stage emerging therapies for respective indications.

- The Galsulfase market report also features the SWOT analysis with analyst views for Galsulfase in approved indications.

Methodology

The Galsulfase market report is built using data and information sourced primarily from internal databases, primary and secondary research and in-house analysis by DelveInsight’s team of industry experts. Information and data from the secondary sources have been obtained from various printable and nonprintable sources like search engines, news websites, global regulatory authorities websites, trade journals, white papers, magazines, books, trade associations, industry associations, industry portals and access to available databases.

Galsulfase Analytical Perspective by DelveInsight

In-depth Galsulfase Market Assessment

This Galsulfase sales market forecast report provides a detailed market assessment of Galsulfase for approved indication like Mucopolysaccharidosis VI in the seven major markets, i.e., the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan. This segment of the report provides current and forecasted Galsulfase sales data uptil 2034.

Galsulfase Clinical Assessment

The Galsulfase market report provides the clinical trials information of Galsulfase for approved indications covering trial interventions, trial conditions, trial status, start and completion dates.

Galsulfase Competitive Landscape

The report provides Insights on competitors and marketed products within the domain, along with a summary of emerging products and their respective launch dates, posing significant competition in the market.

Galsulfase Market Potential & Revenue Forecast

Projected market size for the Galsulfase and its key indications

- Estimated Galsulfase sales potential (Galsulfase peak sales forecasts)

- Galsulfase Pricing strategies and reimbursement landscape

Galsulfase Competitive Intelligence

- Number of competing drugs in development (pipeline analysis)

- Galsulfase Market positioning compared to existing treatments

- Galsulfase Strengths & weaknesses relative to competitors

Galsulfase Regulatory & Commercial Milestones

- Galsulfase Key regulatory approvals & expected launch timelines

- Commercial partnerships, licensing deals, and M&A activity

Galsulfase Clinical Differentiation

- Galsulfase Efficacy & safety advantages over existing drugs

- Galsulfase Unique selling points

Galsulfase Market Report Highlights

- In the coming years, the Galsulfase market scenario is set to change due to strong adoption, increased prescriptions and broader uptake in multiple immunological indications; which would expand the size of the market.

- The Galsulfase companies are developing therapies that focus on novel approaches to treat/improve the disease condition, assess challenges, and seek opportunities that could influence Galsulfase’s dominance.

- Other emerging products for Mucopolysaccharidosis VI are expected to give tough market competition to Galsulfase and launch of late-stage emerging therapies in the near future will significantly impact the market.

- A detailed description of regulatory milestones, and developmental activities, provide the current development scenario of Galsulfase in approved indications.

- Analyse Galsulfase cost, pricing trends and market positioning to support strategic decision-making in the immunology landscape.

- Our in-depth analysis of the forecasted Galsulfase sales data uptil 2034 will support the clients in decision-making process regarding their therapeutic portfolio by identifying the overall scenario of Galsulfase in approved indications.

Key Questions Answered In The Galsulfase Market Report

- What is the class of therapy, route of administration and mechanism of action of Galsulfase? How strong is Galsulfase’s clinical and commercial performance?

- What is Galsulfase’s clinical trial status in each individual indications such as Mucopolysaccharidosis VI and study completion date?

- What are the key collaborations, mergers and acquisitions, licensing and other activities related to the Galsulfase Manufacturers?

- What are the key designations that have been granted to Galsulfase for approved indications? How are they going to impact Galsulfase’s penetration in various geographies?

- What is the current and forecasted Galsulfase market scenario for approved indications? What are the key assumptions behind the forecast?

- What are the current and forecasted sales of Galsulfase in the seven major countries, including the United States, Europe (Germany, France, Italy, Spain) and the United Kingdom, and Japan?

- What are the other emerging products available and how are these giving competition to Galsulfase for approved indications?

- Which are the late-stage emerging therapies under development for the treatment of approved indications?

- How cost-effective is Galsulfase? What is the duration of therapy and what are the geographical variations in cost per patient?