Gamma Secretase Inhibitors (GSIs) Market Forecast

- Gamma secretase inhibitors (GSIs) are Notch-targeted therapies initially explored in Alzheimer’s but now gaining traction in oncology. Their ability to inhibit aberrant Notch signaling has shown promise in desmoid tumors, led by OGSIVEO and AL102.

- Most recently, gamma-secretase inhibitors have shown significant clinical benefit in patients with desmoid tumors, bringing forth an entirely new mechanistic approach. The crosstalk between Wnt and Notch signaling pathways provides a scientific rationale for targeting gamma secretase.

- Market size of OGSIVEO was USD 172 million in the US, in 2024. It has the strongest uptake in the market of desmoid tumors in the landscape of GSIs primarily due to its status as the only approved therapy in this class.

- In June 2025, the European Medicines Agency (EMA) recommended the Committee for Medicinal Products for Human Use (CHMP) for the approval of OGSIVE as monotherapy in adult patients with progressing desmoid tumors requiring systemic treatment.

- With a limited pipeline, currently, Immunome is the only potential key player, evaluating varegacestat in the Phase III. Its data is anticipated the second half of 2025.

- Overall, this is a potential class that holds opportunity for the development of treatment for various indications. The failure of previous trials investigating GSIs in various indications comes as a hindrance factor for the industry to explore more. However, the approval of varegacestat in near future is anticipated to change the dry landscape of GSIs.

DelveInsight’s “Gamma Secretase Inhibitors (GSIs) – Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the GSIs, historical and competitive landscape as well as its market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The GSIs’ market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM GSIs’ market size from 2020 to 2034. The report also covers current GSIs’ treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

Gamma Secretase Inhibitors (GSIs) Epidemiology |

Segmented by:

|

|

Gamma Secretase Inhibitors (GSIs) Key Companies |

|

|

Gamma Secretase Inhibitors (GSIs) Key Therapies |

|

|

Gamma Secretase Inhibitors (GSIs) Market |

Segmented by:

|

|

Analysis |

|

Gamma Secretase Inhibitors (GSIs) Understanding and Treatment Algorithm

Gamma Secretase Inhibitors (GSIs) Inhibitors Overview

Gamma secretase is a multi-substrate transmembrane protease, and is widespread in a variety of cells. It consists of four different integral membrane proteins: Presenilin (PS1 or PS2), Anterior Pharynx-defective 1 (APH1A or APH1B), presenilin enhancer Protein 2 (Pen-2), and nicastrin, containing 20 Transmembrane Domains (TMDs) and a large Extracellular Domain (ECD). Gamma secretase engages in various biological pathways through substrate cleavage. Inhibition of Gamma secretase activity has been considered as a potential therapeutic strategy for cancer. Gamma Secretase Inhibitors (GSIs) have shown encouraging performance in preclinical models; however, their performance in clinical trials has been unsatisfactory. This may be partly attributed to a poor understanding of the γ-secretase and its inhibitors.

Further details related to country-based variations are provided in the report.

Gamma Secretase Inhibitors (GSIs) Market Overview

In recent years, interest in exploring GSIs has been steadily increasing, largely driven by the repeated failures of earlier clinical trials. However, the approval of a recent therapy has renewed optimism and is expected to further stimulate research in this area.

Further details related to country-based variations are provided in the report…

Gamma Secretase Inhibitors (GSIs) Epidemiology

The epidemiology chapter of GSIs in the report provides historical as well as forecasted epidemiology segmented as total cases in selected indication for GSIs, total eligible patient pool in selected indications for GSIs, and total treated cases in selected indications for GSIs in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

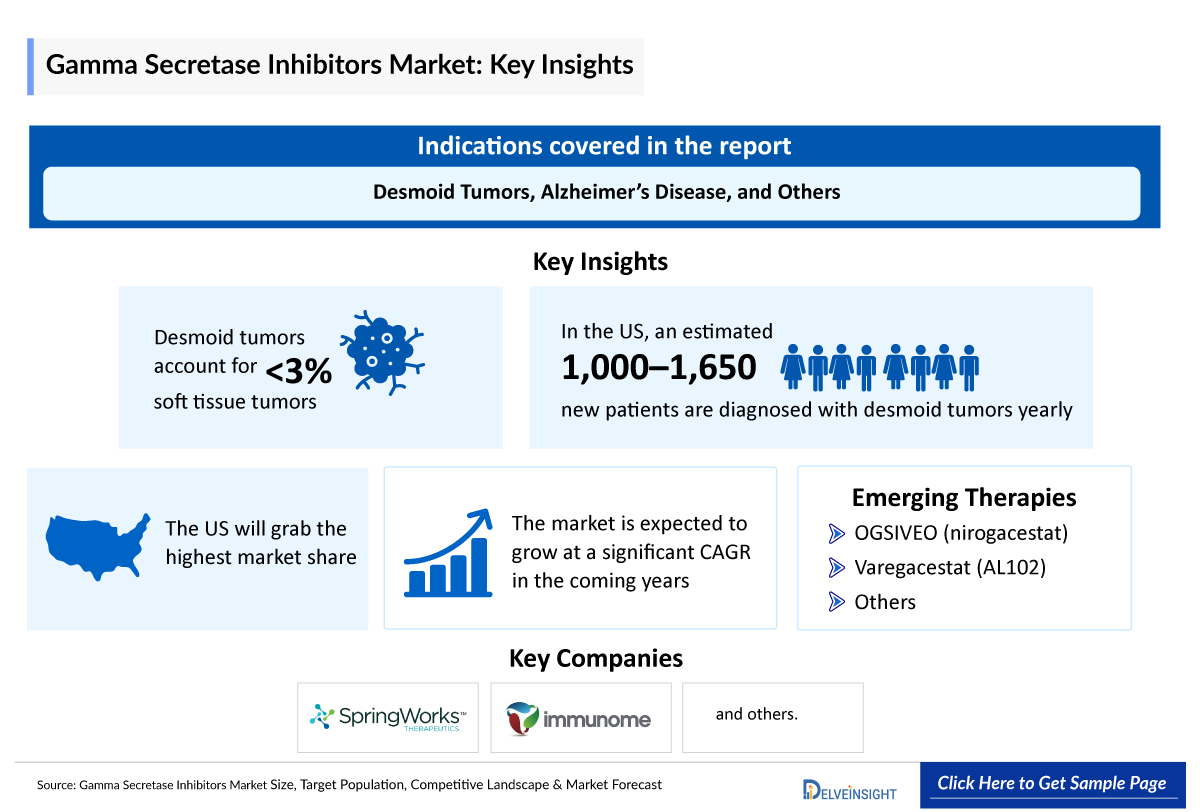

- Desmoid tumors account for <3% of soft tissue tumors. Their annual incidence is estimated to range between 1/250,000–1/500,000.

- In the US, an estimated 1,000–1,650 new patients are diagnosed with desmoid tumors yearly.

- In EU4 and the UK, the 10-year prevalent cases of desmoid tumors were ~4,600 cases in males and ~8,500 cases in females in 2024.

The list is indicative and not exhaustive…

Gamma Secretase Inhibitors (GSIs) Drug Chapters

The drug chapter segment of the GSIs report encloses a detailed analysis of approved GSIs and emerging GSIs. It also helps understand the clinical trial details of GSIs, expressive pharmacological action, agreements and collaborations, approval, and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed Gamma Secretase Inhibitors (GSIs)

OGSIVEO (nirogacestat): SpringWorks Therapeutics

OGSIVEO (nirogacestat) is an oral, selective, small molecule gamma secretase inhibitor developed by SpringWorks Therapeutics for the treatment of adult patients with progressing desmoid tumors who require systemic treatment. OGSIVEO is a highly innovative therapy with efficacy data demonstrating both meaningful antitumor activity and a significant improvement in desmoid tumor symptoms.

In November 2023, the US FDA approved OGSIVEO (nirogacestat) for the treatment of adult patients with progressing desmoid tumors who require systemic treatment. In February 2024, EMA validated the MAA for nirogacestat for the treatment of adults with desmoid tumors. In June 2025, the EMA recommended the CHMP for the approval of OGSIVE as monotherapy in adult patients with progressing desmoid tumors requiring systemic treatment.

Emerging Gamma Secretase Inhibitors (GSIs)

Varegacestat (AL102): Immunome/Ayala Pharmaceuticals

AL102 is an investigational small molecule GSI designed to potently and selectively inhibit Notch 1, 2, 3, and 4. It is currently being evaluated in the Phase II/III RINGSIDE clinical studies in patients with progressing desmoid tumors. AL102 is designed to inhibit the expression of Notch gene targets by blocking the final cleavage step by the gamma-secretase required for Notch activation. Ayala obtained an exclusive, worldwide license to develop and commercialize AL102 from Bristol-Myers Squibb Company in November 2017. In March 2024, Immunome reported the successful completion of its purchase of AL102 and related drug candidate AL101 from Ayala Pharmaceuticals.

In November 2023, AL102 was granted Orphan Drug Designation (ODD) by the US FDA for the treatment of desmoid tumors. In September 2022, Ayala Pharmaceuticals reported that the US FDA has granted Fast Track Designation (FTD) for AL102 for the treatment of progressing desmoid tumors. As per Immunome’s May 2025 corporate presentation, top-line data for AL102, a gamma secretase inhibitor being developed for desmoid tumors, is anticipated in the second half of 2025.

Note: Detailed emerging therapies assessment will be provided in the final report.

Gamma Secretase Inhibitors (GSIs) Market Outlook

The prevailing treatment landscape of with active GSIs contains treatment for desmoid tumors. The approval of OGSIVEO offers a much-needed alternative to traditional treatments like surgery and chemotherapy, particularly for patients with inoperable or recurrent tumors. However, Data from clinical trials have shown AL102 may be more effective in treating desmoid tumors than OGSIVEO.

When traced back, gamma secretase was identified as a membrane-embedded aspartyl protease complex, with presenilin as its catalytic core, following inhibitor studies targeting Amyloid Precursor Protein (APP) cleavage, supporting the amyloid hypothesis of Alzheimer’s disease. Although GSIs initially showed promise due to brain penetration, their development was hindered by off-target effects, especially Notch inhibition, causing severe toxicities. Despite these concerns, development continued, but Eli Lilly’s semagacestat failed in Phase III trials, showing Notch-related side effects and no cognitive benefit.

Notch‑sparing GSIs, such as avagacestat from Bristol‑Myers Squibb, initially showed promise for selective APP inhibition. However, conflicting data on its selectivity and Phase II trial failures, marked by Notch-related toxicities and cognitive decline, ultimately ended gamma secretase inhibition as a viable Alzheimer’s disease strategy.

The serious toxicities that halted clinical studies of GSIs demonstrated that there were many knowledge gaps about gamma secretase biology and underestimation of its nuanced proteolysis before the compounds were evaluated in humans. The shifted focus on GSM in the research aimed to stimulate gamma secretase’s carboxypeptidase-like trimming of Aβ peptides to their shorter, less pathogenic forms.

Several GSMs were introduced in the pipeline, including PF-06648671 (Pfizer). It did not progress beyond early-stage clinical trials for Alzheimer's disease, despite showing promising preclinical results. While it demonstrated the ability to reduce amyloid-beta (Aβ) levels in cerebrospinal fluid (CSF), particularly Aβ42, and had a favorable pharmacokinetic profile, it ultimately did not lead to a successful drug for treating Alzheimer's.

Scientists from Bristol-Myers Squibb reported the design and phase I studies for the bicyclic pyrimidine GSM BMS-932,481. However, it was discontinued due to safety concerns related to unexpected liver toxicity, specifically ALT elevations, observed during clinical trials. While preclinical studies showed promise in reducing amyloid-β (Aβ) peptides, a hallmark of Alzheimer's disease, the inability to safely escalate the dose to achieve greater Aβ reduction led to the termination of its development.

As the exploration, experimentation, analyses, and hope do not stop here, the global GSIs market witness substantial growth in the coming years, driven by the increasing prevalence of desmoid tumors and Alzheimer’s disease, and the need for a better treatment.

The present active pipeline is very limited to only one promising emerging therapy by Immunome. This is an exciting new class with great potential for development.

Gamma Secretase Inhibitors (GSIs) Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging GSIs expected to be launched in the market during 2025–2034.

Gamma Secretase Inhibitors (GSIs) Pipeline Development Activities

The report provides insights into different therapeutic candidates. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for GSIs market growth over the forecast period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for GSIs therapies.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on GSIs' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Washington University and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or GSIs’ market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“Although the failures with GSIs resulted in skittishness for advancing into the clinic, any small molecule that targets gamma secretase. Nevertheless, a recent report showed promising preclinical validation for a new gamma secretase modulator.” PhD, University of Kansas, US |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health Technology Assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs) and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

The abstract list is not exhaustive. will be provided in the final report

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of the GSIs, explaining its mechanism and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the GSIs market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM GSIs market.

Gamma Secretase Inhibitors (GSIs) Inhibitors Report Insights

- GSIs Targeted Patient Pool

- Therapeutic Approaches

- GSIs Pipeline Analysis

- GSIs Market Size and Trends

- Existing and future Market Opportunities

Gamma Secretase Inhibitors (GSIs) Report Key Strengths

- Ten years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

Gamma Secretase Inhibitors (GSIs) Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the total market size of GSIs, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved therapy?

- How has the reimbursement landscape for GSIs evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with GSIs? What will be the growth opportunities across the 7MM for the patient population of GSIs?

- What are the key factors hampering the growth of the market for GSIs?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for GSIs?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the GSIs market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.