Glomerulonephritis Market Summary

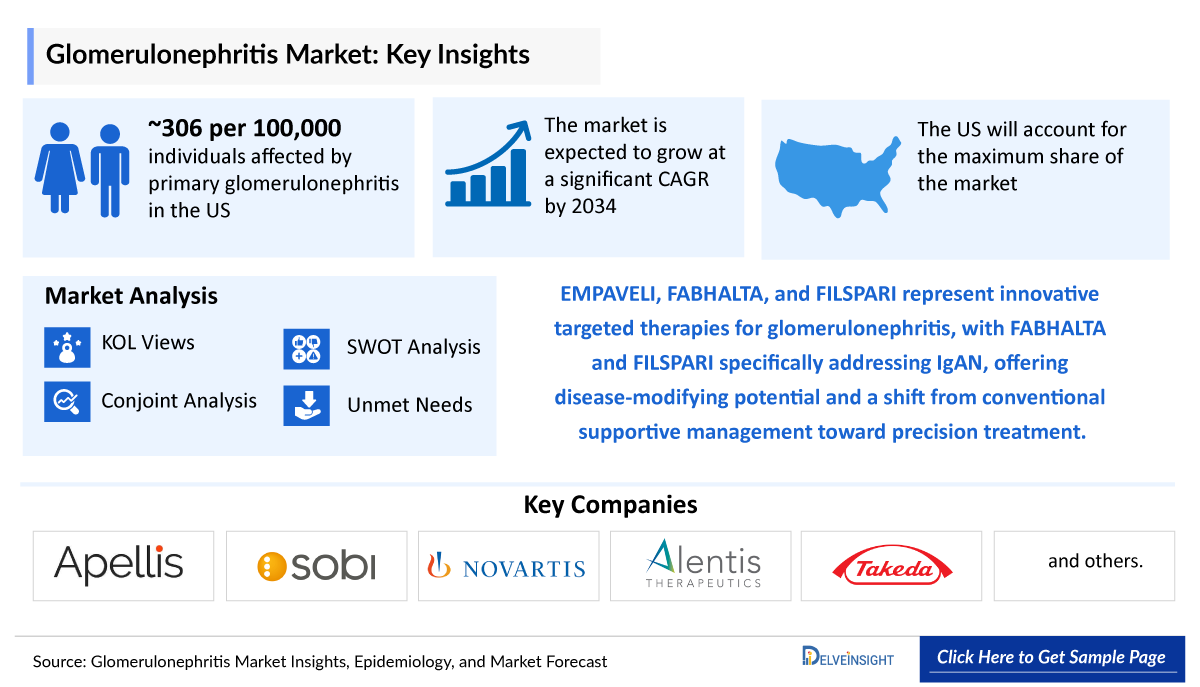

- The Glomerulonephritis Market Size is anticipated to grow with a significant CAGR during the study period (2020-2034).

- Glomerulonephritis is kidney inflammation affecting the glomeruli, leading to blood or protein in urine, swelling, and high blood pressure. Key subtypes include IgA Nephropathy (IgAN), membranous nephropathy, Focal Segmental Glomerulosclerosis (FSGS), and Membranoproliferative Glomerulonephritis (MPGN). Left unmanaged, these conditions may accelerate progression to chronic kidney disease or end-stage renal failure.

Glomerulonephritis Market and Epidemiology Trends:

- Our secondary research indicates that in the US, the prevalence of glomerulonephritis is substantial, with approximately 306 per 100,000 individuals affected by primary glomerulonephritis and around 917 per 100,000 affected by secondary glomerulonephritis, highlighting the significant burden of both primary and systemic forms of kidney inflammation.

- In Germany, the prevalence of glomerulonephritis was 285 per million while the most frequent subtypes of glomerulonephritis were approximately 20.9 per million individuals affected by MPGN and around 11.2 per million affected by FSGS, highlighting the impact of these primary kidney disorders on the population.

- EMPAVELI (pegcetacoplan), FABHALTA (iptacopan), and FILSPARI (sparsentan) represent innovative targeted therapies for glomerulonephritis, with FABHALTA and FILSPARI specifically addressing IgAN, offering disease-modifying potential and a shift from conventional supportive management toward precision treatment.

- There are also emerging therapies in the pipeline for glomerulonephritis, including lixudebart, mezagitamab, and felzartamab (CD38), highlighting a growing focus on innovative, targeted approaches that could significantly expand and reshape treatment options for patients beyond current standards of care.

Key Factors Driving the Growth of the Glomerulonephritis Market

- Rising Prevalence of Glomerulonephritis: Increasing cases of glomerular diseases worldwide, driven by diabetes, hypertension, and autoimmune disorders, are expanding the patient population requiring effective treatment options.

- Advancements in Diagnostics and Early Detection: Improved diagnostic technologies, including biomarker-based tests and advanced imaging, enable early identification of glomerulonephritis, supporting timely interventions and better patient outcomes.

- Emergence of Novel Therapies: Development of targeted therapies, biologics, and innovative immunosuppressants is enhancing treatment efficacy, reducing disease progression, and increasing adoption among healthcare providers.

- Growing Awareness and Screening Programs: Increased awareness among patients and clinicians, along with regular screening programs for high-risk populations, is boosting diagnosis rates and treatment uptake.

- Favorable Regulatory Support and Reimbursement Policies: Regulatory incentives for orphan drugs and better insurance coverage for advanced therapies encourage pharmaceutical companies to invest in R&D, accelerating market growth.

DelveInsight’s comprehensive report titled “Glomerulonephritis Market Insights, Epidemiology, and Market Forecast – 2034” offers a detailed analysis of glomerulonephritis. The report presents historical and projected epidemiological data covering total prevalent cases of glomerulonephritis, total diagnosed prevalent cases of glomerulonephritis, gender- specific diagnosed prevalent cases of glomerulonephritis, subtype-specific diagnosed prevalent cases of glomerulonephritis, and total treated cases of glomerulonephritis. In addition to epidemiology, the market report encompasses various aspects related to the patient population. These aspects include the diagnosis process, prescription patterns, physician perspectives, market accessibility, treatment options, and prospective developments in the market across seven major markets: the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan, spanning from 2020 to 2034.

The report analyzes the existing treatment practices and unmet medical requirements glomerulonephritis. It evaluates the market potential and identifies potential business prospects for enhancing therapies or interventions. This valuable information enables stakeholders to make well-informed decisions regarding product development and strategic planning for the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Glomerulonephritis Market |

|

|

Glomerulonephritis Market Size | |

|

Glomerulonephritis Companies |

Apellis Pharmaceuticals, Swedish Orphan Biovitrum AB (Sobi), Novartis, Travere Therapeutics, Alentis Therapeutics, Takeda Pharmaceutical, Biogen, and others |

|

Glomerulonephritis Epidemiology Segmentation |

|

Glomerulonephritis Disease Understanding

Glomerulonephritis Overview

Glomerulonephritis is a group of kidney disorders characterized by inflammation of the glomeruli, the tiny filtering units of the kidneys. It can result from primary kidney disease or secondary to systemic conditions such as autoimmune disorders, infections, or metabolic diseases. Clinical manifestations vary widely, ranging from asymptomatic hematuria or proteinuria to full nephrotic or nephritic syndromes with edema, hypertension, and impaired kidney function. Glomerulonephritis can affect individuals of all ages, with certain subtypes more prevalent in children or adults. While the underlying mechanisms differ by subtype, immune-mediated injury, complement activation, and podocyte dysfunction are central to disease development. Early detection and appropriate management are critical, as untreated or progressive cases may lead to chronic kidney disease or end-stage renal failure.

Glomerulonephritis Diagnosis

Glomerulonephritis is diagnosed primarily through clinical evaluation, supported by a detailed patient history, urinalysis, and assessment of kidney function. While there is no single test that confirms all forms of glomerulonephritis, laboratory investigations such as serum creatinine, estimated glomerular filtration rate, complement levels, and specific autoantibodies help identify underlying causes. Imaging studies, including renal ultrasound, may assist in evaluating kidney structure, and kidney biopsy remains the gold standard for definitive diagnosis and subtype classification.

Glomerulonephritis Treatment

Treatment for glomerulonephritis varies based on subtype, disease severity, and underlying etiology, with no single approach universally effective. Most therapies focus on reducing inflammation, controlling blood pressure, minimizing proteinuria, and preventing progression to chronic kidney disease. Management often requires a personalized plan developed collaboratively by patient and clinician, considering disease burden, comorbidities, and treatment goals. Core options include immunosuppressive agents, targeted therapies under investigation, supportive measures such as angiotensin-converting enzyme inhibitors or angiotensin receptor blockers, and lifestyle modifications including dietary sodium restriction and optimized fluid management. These treatments may be used alone or in combination to preserve kidney function, manage complications, and improve long-term outcomes.

Glomerulonephritis Epidemiology

The glomerulonephritis epidemiology section of market report offers information on the patient populations, including historical and projected trends for each of the seven major markets. Examining key opinion leader views from physicians or clinical experts can assist in identifying the reasons behind historical and projected trends. The diagnosed patient pool, their trends, and the underlying assumptions are all included in this section of the report.

This section also presents the total prevalence rate of glomerulonephritis, supported by relevant tables and graphs to provide a clear and concise understanding of the data. Additionally, the report discloses the assumptions made during the analysis, ensuring data interpretation and presentation transparency. This epidemiological data is valuable for understanding the disease burden and its impact on the patient population across various regions.

Glomerulonephritis Epidemiology Insights

-

In the United States, among individuals affected by glomerulonephritis, approximately 364 per 100,000 men and 264 per 100,000 women are affected by primary glomerulonephritis, while secondary glomerulonephritis impacts around 894 per 100,000 men and 935 per 100,000 women, highlighting a substantial disease burden that may affect kidney function and overall health outcomes.

-

In Spain, the prevalence of IgAN, the most common form of glomerulonephritis, was found to be 1.14 per 10,000 individuals, highlighting a significant health burden that emphasizes the need for early detection, effective management, and expanded treatment options.

-

In Japan, among individuals with glomerulonephritis, approximately 3% are affected by Primary MPGN, 11% by FSGS, and 43% by membranous nephropathy, highlighting the diverse subtype distribution and the need for tailored diagnostic and therapeutic strategies.

Glomerulonephritis Epidemiology Segmentation

- Total Prevalent Cases of Glomerulonephritis

- Total Diagnosed Prevalent Cases of Glomerulonephritis

- Gender- Specific Diagnosed Prevalent Cases of Glomerulonephritis

- Subtype-Specific Diagnosed Prevalent Cases of Glomerulonephritis

- Total Treated Cases of Glomerulonephritis

Glomerulonephritis Market Outlook

The glomerulonephritis therapeutics market is further expected to increase by the major drivers, such as the rising prevalent population, technological advancements, and upcoming therapies in the forecast period (2025–2034).

Glomerulonephritis is managed primarily through therapies that reduce inflammation, control blood pressure, and protect kidney function. Standard treatments include immunosuppressive agents and supportive therapies such as angiotensin-converting enzyme inhibitors and angiotensin receptor blockers. Targeted therapies, including EMPAVELI (pegcetacoplan), FABHALTA (iptacopan), and FILSPARI (sparsentan), offer novel approaches by modulating specific immune or complement pathways, providing potential disease-modifying effects for different Glomerulonephritis subtypes. Emerging candidates such as lixudebart, mezagitamab, and felzartamab (CD38) further highlight innovative strategies in development. Supportive measures, including dietary modifications, optimized fluid management, and careful monitoring of kidney function, complement pharmacologic therapy. Together, these advances expand treatment options beyond conventional supportive care and address the diverse needs of individuals affected by Glomerulonephritis.

With ongoing research and continued dedication, the future holds promise for even more effective treatments and, ultimately, a potential cure for this challenging condition. According to DelveInsight, the glomerulonephritis market in the 7MM is expected to change significantly during the forecast period (2025–2034).

Glomerulonephritis Drug Chapters

Glomerulonephritis Marketed Drugs

EMPAVELI (pegcetacoplan): Apellis Pharmaceuticals/ Swedish Orphan Biovitrum AB (Sobi)

EMPAVELI, developed by Apellis Pharmaceuticals and generically known as pegcetacoplan, is a targeted therapy approved for complement-mediated disorders. By selectively inhibiting complement C3, it addresses the underlying immune-mediated injury in glomerulonephritis, helping to reduce inflammation and prevent further kidney damage. Unlike conventional supportive treatments that primarily manage symptoms, EMPAVELI works at the disease mechanism level, offering a potential disease-modifying approach and representing a significant advancement in the management of patients with complement-driven glomerulonephritis.

- In July 2025, the US FDA approved EMPAVELI (pegcetacoplan) for the treatment of complement-mediated glomerulonephritis, including C3 glomerulopathy (C3G) and primary immune-complex MPGN, marking it as the first therapy targeting complement C3 approved for patients aged 12 and older.

- Sobi holds the commercial rights for the therapy outside the US, where it is marketed under the brand name ASPAVELI.

- In February 2025, the European Medicines Agency (EMA) validated the indication extension application for ASPAVELI for the treatment of C3G and primary immune-complex membranoproliferative Glomerulonephritis (IC-MPGN), initiating the formal review process for this expanded use.

FABHALTA (iptacopan): Novartis

FABHALTA is an innovative, first-in-class oral therapy in development for the treatment of glomerulonephritis. By selectively inhibiting factor B in the complement alternative pathway, it directly targets the underlying immune-mediated kidney injury that drives disease progression. This mechanism offers the potential to modify disease course rather than merely managing symptoms, positioning FABHALTA as a promising next-generation therapy for patients with complement-mediated glomerulonephritis.

- In April 2025, US FDA approved FABHALTA (iptacopan) for the treatment of adults with C3G, to reduce proteinuria.

- In February 2025, Novartis’ oral FABHALTA (iptacopan) received a positive CHMP opinion for the treatment of adults living with C3G.

FILSPARI (sparsentan): Travere Therapeutics

FILSPARI, generically known as sparsentan, is an innovative, first-in-class oral therapy developed by Travere Therapeutics for the treatment of glomerulonephritis. By dual-blocking the angiotensin II type 1 receptor and endothelin A receptor, it directly targets the underlying hemodynamic and fibrotic pathways that contribute to kidney damage. This mechanism offers the potential to slow disease progression rather than merely managing symptoms, positioning FILSPARI as a promising next-generation therapy for patients with proteinuric glomerulonephritis.

- In April 2025, Travere Therapeutics reported that the European Commission approved the conversion of the Conditional Marketing Authorization (CMA) into a standard marketing authorization for FILSPARI for the treatment of adults with primary IgAN.

- In February 2023, Travere Therapeutics reported that the US FDA granted accelerated approval to FILSPARI (sparsentan) to reduce proteinuria in adults with primary IgAN who are at risk of rapid disease progression.

|

Drug |

MoA |

RoA |

Company |

Logo |

|

EMPAVELI (pegcetacoplan) |

Complement C3 inhibitor |

SC |

Apellis Pharmaceuticals/ Sobi |

|

|

FABHALTA (iptacopan) |

Complement pathway inhibitor |

Oral |

Novartis |

|

|

FILSPARI (sparsentan) |

Dual endothelin-angiotensin receptor antagonist |

Oral |

Travere Therapeutics |

|

|

XX |

XX |

XX |

XXX |

|

Note: Detailed marketed therapies assessment will be provided in the final report....

Glomerulonephritis Emerging Drugs

Lixudebart: Alentis Therapeutics

Lixudebart, developed by Alentis Therapeutics, is a first-in-class monoclonal antibody being investigated for the treatment of liver, lung, and kidney fibrosis. It specifically targets a unique CLDN1 epitope exposed in fibrotic tissue to halt disease progression and potentially reverse existing fibrosis. As an investigational therapy, Lixudebart has been well tolerated without any serious safety concerns in a Phase 1 single- and multiple-ascending dose study in healthy volunteers, offering a mechanism-driven approach aimed at addressing the underlying pathology rather than merely managing symptoms.

-

In January 2025, Alentis Therapeutics reported positive topline results from two clinical trials of lixudebart (ALE.F02), a monoclonal antibody targeting Claudin-1 (CLDN1) developed to reverse organ fibrosis, including liver, lung, and kidney fibrosis.

Mezagitamab: Takeda Pharmaceutical

Mezagitamab, developed by Takeda Pharmaceutical, is an innovative, intravenous, investigational therapy being explored for the treatment of persistent or chronic primary immune thrombocytopenia (ITP). As a monoclonal antibody targeting CD38, it directly modulates immune-mediated platelet destruction, addressing the underlying mechanism driving the disease. This targeted approach offers the potential to improve platelet counts, reduce bleeding risk, and enhance overall patient outcomes, moving beyond symptomatic management toward a disease-modifying strategy.

- In June 2024, Takeda presented positive Phase IIb results for mezagitamab (TAK-079) in patients with persistent or chronic primary ITP, a rare disorder causing low platelet counts and bleeding. Data were showcased at the 32nd ISTH Congress in Bangkok.

- Mezagitamab is currently in the Phase III of clinical trial.

Felzartamab: Biogen

Felzartamab, developed by Biogen, is an investigational therapy for the treatment of kidney disorders such as primary membranous nephropathy (PMN), IgAN, Lupus Nephritis, and late antibody-mediated rejection in transplant recipients. It is a monoclonal antibody targeting CD38, designed to directly modulate immune-mediated processes driving kidney injury, with the aim of providing a more targeted, mechanism-based alternative to conventional immunosuppressive therapies.

In June 2025, Biogen initiated dosing in the global Phase III PROMINENT trial evaluating felzartamab, an anti-CD38 antibody, versus tacrolimus in adults with PMN. With no approved therapies for PMN, this 180-patient trial aims to deliver results by 2029, highlighting felzartamab’s differentiated potential.

OMS-906 (zaltenibart)

OMS-906 (zaltenibart) is a humanized IgG4 monoclonal antibody that inhibits MASP-3, suppressing the alternative complement pathway upstream by blocking factor D activation. Developed by Omeros and acquired by Novo Nordisk in 2025, it has shown potent control of intra- and extravascular hemolysis in PNH with favorable Phase Ib results. The therapy is in Phase II development for PNH and glomerulonephritis.

|

Drug |

MoA |

RoA |

Company |

Logo |

Phase |

|

Lixudebart |

Anti-CLDN1 monoclonal antibody |

IV |

Alentis Therapeutics |

|

III |

|

Mezagitamab |

Anti-CD38 monoclonal antibody |

IV |

Takeda Pharmaceutical |

|

II |

|

Felzartamab |

Anti-CD38 monoclonal antibody |

IV |

Biogen |

|

III |

|

XX |

XX |

X |

XXX |

|

XXX |

Note: Detailed marketed/emerging therapies assessment will be provided in the final report....

Glomerulonephritis Market Segmentation

DelveInsight’s “Glomerulonephritis – Market Insights, Epidemiology, and Market Forecast – 2034” report provides a detailed outlook of the current and future glomerulonephritis market, segmented within countries, by therapies, and by classes. Further, the market of each region is then segmented by each therapy to provide a detailed view of the current and future market share of all therapies.

Glomerulonephritis Market Size by Countries

The glomerulonephritis market size is assessed separately for various countries, including the US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan. In 2024, the United States held a significant share of the overall 7MM (Seven Major Markets) glomerulonephritis market, primarily attributed to the country’s higher prevalence of the condition and the elevated cost of the available treatments. This dominance is projected to persist, especially with the potential early introduction of new products.

Glomerulonephritis Market Size by Therapies

Glomerulonephritis Market Size by Therapies is categorized into current and emerging markets for the study period 2020–2034.

Note: Detailed market segment assessment will be provided in the final report.

Glomerulonephritis Drugs Uptake

This section focuses on the sales uptake of potential glomerulonephritis drugs that have recently been launched or are anticipated to be launched in the glomerulonephritis market between 2025 and 2034. It estimates the market penetration of glomerulonephritis drugs for a given country, examining their impact within and across classes and segments. It also touches upon the financial and regulatory decisions contributing to the probability of success (PoS) of the drugs in the glomerulonephritis market.

The emerging glomerulonephritis therapies are analyzed based on various attributes such as efficacy and safety in randomized clinical trials, order of entry and other market dynamics, and the unmet need they fulfill in the glomerulonephritis market.

Glomerulonephritis Pipeline Activities

The Glomerulonephritis pipeline report offers an analysis of Glomerulonephritis clinical trials within Phase II and III stages and examines companies involved in developing targeted therapeutics for glomerulonephritis. It provides valuable insights into the advancements and progress of potential treatments in clinical development for this condition.

Glomerulonephritis Pipeline Development Activities

The Glomerulonephritis clinical trials analysis report covers information on collaborations, acquisition and merger, licensing, patent details, and other information for emerging glomerulonephritis therapies.

Note: Detailed assessment of drug uptake and attribute analysis will be provided in the full report on glomerulonephritis...

Glomerulonephritis Market Access and Reimbursement

DelveInsight’s “Glomerulonephritis – Market Insights, Epidemiology, and Market Forecast – 2034” report provides a descriptive overview of the market access and reimbursement scenario of glomerulonephritis. This section includes a detailed analysis of the country-wise healthcare system for each therapy, enlightening the market access, reimbursement policies, and health technology assessments.

KOL Views on Glomerulonephritis Market Report

To keep up with current glomerulonephritis market trends and to fill gaps in secondary findings, we interview KOLs’ and SMEs’ working in the glomerulonephritis domain. Their opinion helps understand and validate current and emerging therapies and treatment patterns or glomerulonephritis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the glomerulonephritis unmet needs.

Glomerulonephritis: KOL Insights

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. These KOLs were from organizations, institutes, and hospitals, such as University of Texas MD Anderson Cancer Center, US; University Medical Center Hamburg-Eppendorf, Germany; PSL Research University, France; University of Campania "Luigi Vanvitelli, Italy; Complutense University, Spain; Liverpool John Moores University, UK; and Keio University School of Medicine, Japan; among others.

As per KOLs from the US, “Glomerulonephritis significantly impacts patient health and quality of life, with clinical manifestations ranging from mild proteinuria to severe kidney dysfunction. Experts emphasize that targeted therapies, such as complement inhibitors and receptor modulators, are reshaping management by addressing underlying immune-mediated and hemodynamic pathways. Leading voices also highlight the importance of personalized approaches, given the heterogeneity of glomerulonephritis subtypes and varying patient treatment needs.”

As per KOLs from Germany, “despite advances in glomerulonephritis management, a substantial unmet need remains for therapies that effectively slow disease progression while minimizing adverse effects. Experts highlight the importance of combining pharmacologic treatment with supportive care, including blood pressure control, dietary modifications, and regular monitoring, to address the complex and multi-system impact of glomerulonephritis on patient health and quality of life.”

As per KOLs from Japan, “the relatively low reported prevalence of glomerulonephritis may reflect underdiagnoses and limited awareness of early kidney disease. Specialists emphasize the need for improved screening, timely diagnosis, and access to innovative therapies to address both the clinical and long-term renal health challenges faced by patients, aiming to prevent progression to chronic kidney disease.”

Note: Detailed assessment of KOL Views will be provided in the full report on glomerulonephritis....

Glomerulonephritis Competitive Intelligence Analysis

We conduct a Competitive and Market Intelligence analysis of the glomerulonephritis. Market, utilizing various Competitive Intelligence tools such as SWOT analysis and Market entry strategies. The inclusion of these analyses is contingent upon data availability, ensuring a comprehensive and well-informed assessment of the market landscape and competitive dynamics.

Glomerulonephritis Market Report Insights

- Glomerulonephritis Patient Population

- Glomerulonephritis Therapeutic Approaches

- Glomerulonephritis Pipeline Analysis

- Glomerulonephritis Market Size and Trends

- Glomerulonephritis Market Opportunities

- Impact of Upcoming Glomerulonephritis Therapies

Glomerulonephritis Market Report Key Strengths

- 10 Years Forecast

- The 7MM Coverage

- Glomerulonephritis Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Glomerulonephritis Market

- Glomerulonephritis Drugs Uptake

Glomerulonephritis Market Report Assessment

- Glomerulonephritis Current Treatment Practices

- Glomerulonephritis Unmet Needs

- Glomerulonephritis Product Profiles

- Glomerulonephritis Market Attractiveness

- Glomerulonephritis Market Drivers

- Glomerulonephritis Market Barriers

Key Questions Answered In The Glomerulonephritis Market Report:

- How common is glomerulonephritis?

- What are the key findings of glomerulonephritis epidemiology across the 7MM, and which country will have the highest number of patients during the study period (2020–2034)?

- What are the currently available treatments for glomerulonephritis?

- What are the disease risk, burden, and unmet needs of glomerulonephritis?

- At what CAGR is the glomerulonephritis market and its epidemiology is expected to grow in the 7MM during the forecast period (2025–2034)?

- How would the unmet needs impact the glomerulonephritis market dynamics and subsequently influence the analysis of the related trends?

- What would be the forecasted patient pool of glomerulonephritis in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- Among EU4 and the UK, which country will have the highest number of patients during the forecast period (2025–2034)?

- How many companies are currently developing therapies for the treatment of glomerulonephritis?

Reasons to buy Glomerulonephritis Market Forecast Report

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the glomerulonephritis market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of current treatment in the US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the attribute analysis section to provide visibility around leading classes.

- Highlights of Market Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-epidemiology-report.png&w=256&q=75)