Group B Streptococcus Market

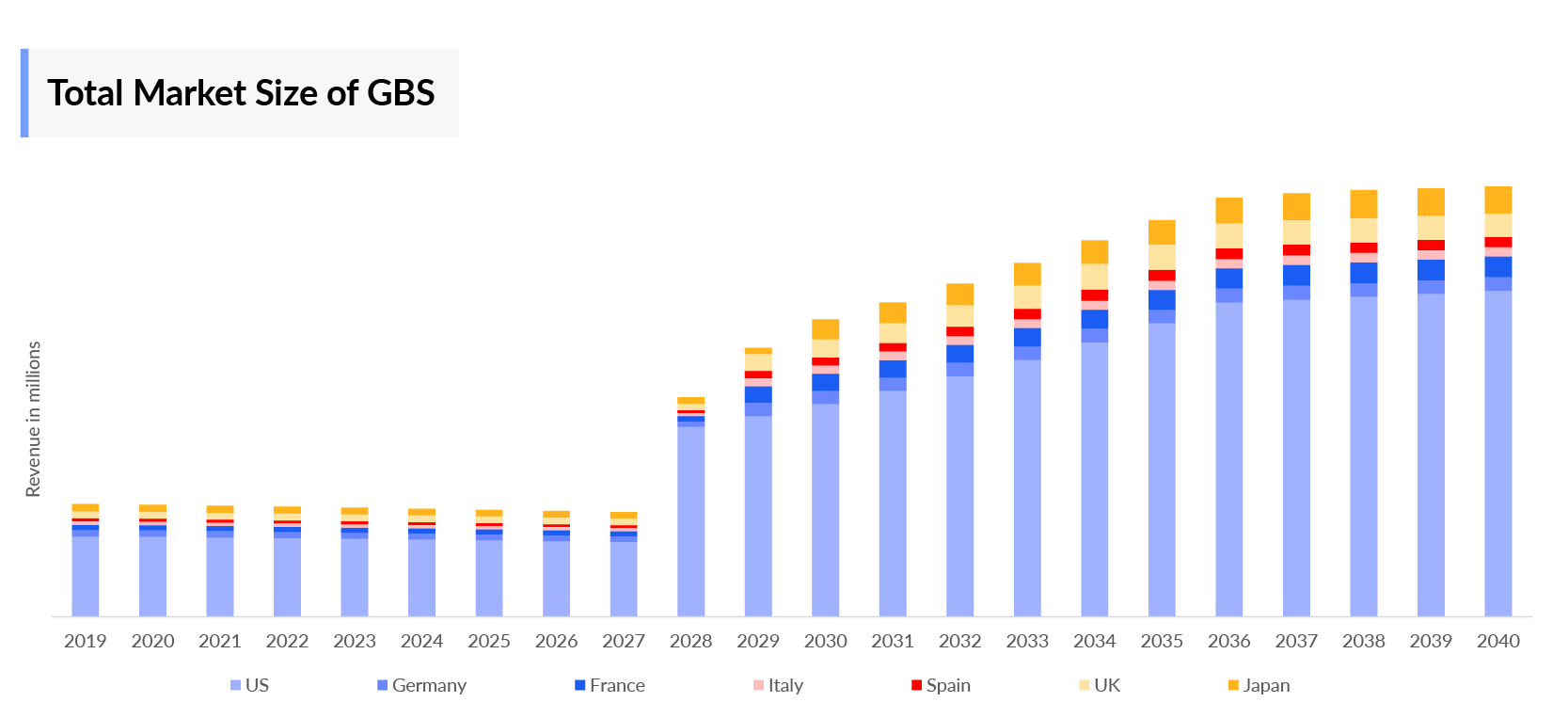

- In 2022, the Group B Streptococcus market size was the highest in the US among the 7MM, accounting for approximately USD 139 million, which is expected to increase by 2040.

- There are currently no approved therapies in the market to treat Group B Streptococcus, antibiotics, and current off-label prophylaxis used for managing the disease accounted for approximately USD 194 million in 2022 in 7MM as per our analysis.

- The emerging vaccines (Group B Streptococcus-NN/NN2 and Group B Streptococcus6) are anticipated to enter the US market by 2028, EU4 and the UK by 2029, and Japan by 2030, which have the potential to reduce the disease burden of Group B Streptococcus in the forecasted years.

Request for unlocking the CAGR of the Group B Streptococcus Market

DelveInsight’s “Group B Streptococcus Market Insights, Epidemiology and Market Forecast – 2040” report delivers an in-depth understanding of the Group B Streptococcus, historical and forecasted epidemiology as well as the Group B Streptococcus therapeutics market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Group B Streptococcus market report provides current treatment practices, emerging vaccines, market share of the individual therapies, current and forecasted 7MM Group B Streptococcus market size from 2019 to 2040. The report also covers current Group B Streptococcus treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assesses the underlying potential of the market.

|

Study Period |

2019 to 2040 |

|

Forecast Period |

2023-2040 |

|

Geographies Covered |

|

|

Group B Streptococcus Market |

|

|

Group B Streptococcuss Market Size | |

|

Group B Streptococcus Companies |

Minervax ApS, Pfizer, and others. |

|

Group B Streptococcus Epidemiology Segmentation |

|

Group B Streptococcus Treatment Market

Streptococcus agalactiae, or Group B Streptococcus, is an opportunistic commensal organism that forms part of the physiological gut and vaginal flora, where maternal colonization is the primary route of its infection. Group B Streptococcus, under certain conditions, can transform from asymptomatic commensal members of mucosal biomes into pathogenic bacteria causing serious health problems, especially in newborns and the elderly. It is a pathogen that transforms from an asymptomatic mucosal transport state to an important bacterial pathogen that causes severe invasive infections. Group B Streptococcus is a persistent cause of morbidity and mortality in all high-risk populations, i.e., pregnant women, neonates, and the elderly. Invasive diseases cause widespread infections and are therefore observed to increase incidence among non-pregnant adults.

Group B Streptococcus Diagnosis

Samples of sterile body fluids such as blood and spinal fluid are taken when Group B Streptococcus is suspected. The internationally recognized ‘Gold Standard’ test used when detecting group B is “Strep carriage.” This test involves taking samples from the low vagina and rectum using one or more swabs and then processing these in a laboratory. To accurately predict Group B Streptococcus colonization status at the time of delivery, the current CDC guidelines recommend a “Strep carriage” test at 35–37 weeks of pregnancy.

American College of Obstetricians and Gynecologists (ACOG) and American Academy of Pediatrics (AAP) are currently responsible for the curation of the guidelines for prophylaxis and treatment of Group B Streptococcus infection in pregnant women and newborns, and the American Society for Microbiology (ASM) is responsible for maintaining and updating guidelines for standard laboratory practices related to detection and identification of Group B Streptococcus. The critical components of preventing early-onset Group B Streptococcus neonatal disease still include universal screening and appropriate intrapartum antibiotic prophylaxis.

Further details related to country-based variations are provided in the report.

Group B Streptococcus Treatment

The current Group B Streptococcus treatment spectra include empiric treatment, specific treatment, supportive treatment, adjunctive treatment, and treatments targeting recurrent infections where the therapeutic management oscillates between prophylaxis and curative treatments. The current treatment landscape lacks approved curative or prophylactic measures and is mainly accredited to off-labels.

There is currently no approved vaccine, and intravenously delivered prophylactic antibiotics provide incomplete protection that can be expensive and unavailable.

The antibiotic of choice is either penicillin G or ampicillin. The current CDC guidelines recommend that patients not allergic to penicillin receive penicillin or ampicillin. Individuals with a minor allergy to penicillin should receive cefazolin. Individuals with a major allergy (rash or a history of difficult breathing) should receive clindamycin or vancomycin if the isolate is known to be resistant to clindamycin. However, vancomycin has not been shown to cross the placenta and achieve suitable concentrations in amniotic fluid as well as fetal blood. This tremendous use of ß-lactam antibiotics and exposure to ß-lactams for other reasons can potentially induce the emergence of resistant strains among the resident vaginal microflora. However, as documented in several studies, Group B Streptococcus is universally sensitive to penicillins; therefore, it should be the primary antibiotic for intrapartum prophylaxis.

Group B Streptococcus Epidemiology

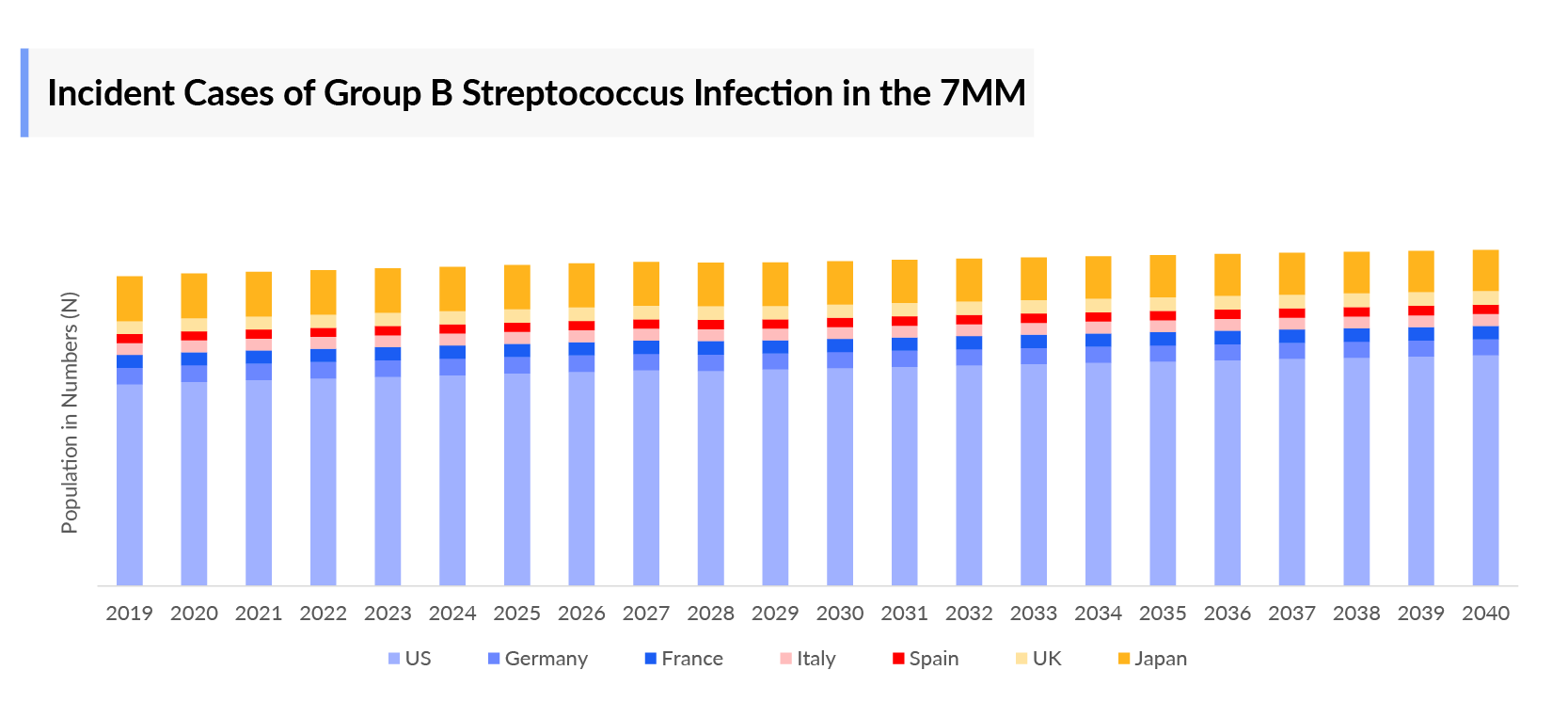

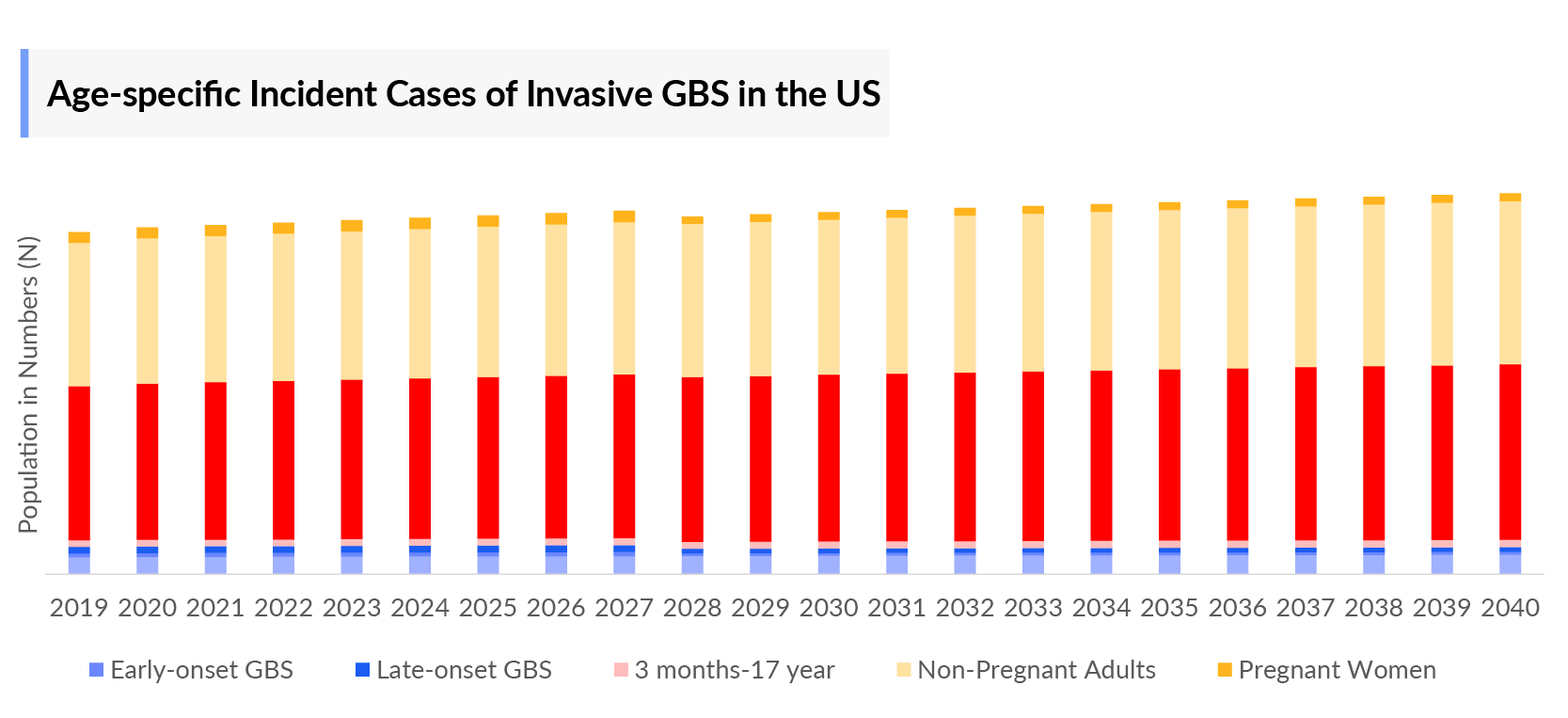

As the market is derived using a patient-based model, the Group B Streptococcus epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total incident cases of Group B Streptococcus infection, type-specific incident cases of Group B Streptococcus infection, age-specific incident cases of Group B Streptococcus infection (invasive and non-invasive), and number of pregnant women with Group B Streptococcus colonization in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), United Kingdom, and Japan from 2019 to 2040.

- There were 0.2 million incident cases of Group B Streptococcus estimated to have occurred in the 7MM in 2022, of which 0.15 million cases come from the US alone and are projected to increase during the forecasted period.

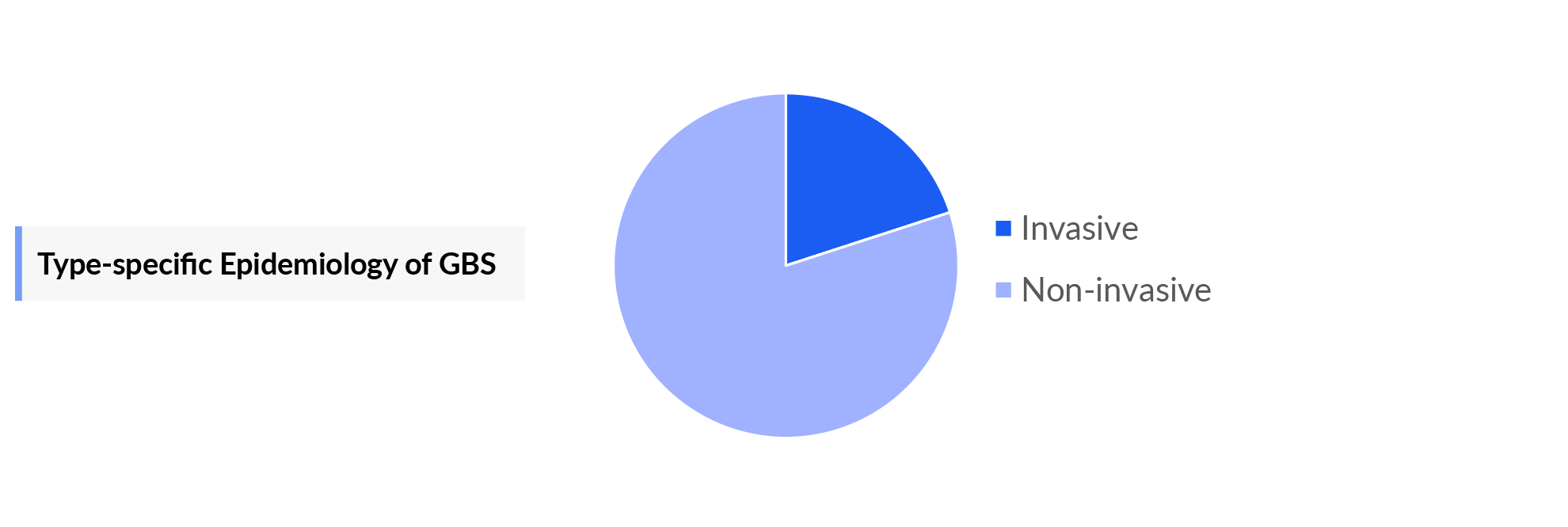

- Type-specific incident cases of Group B Streptococcus infection are segmented into invasive and non-invasive Group B Streptococcus infection, among which the non-invasive pool has a higher incidence.

- Age-specific incident cases of invasive Group B Streptococcus infection are categorized into 0–17 years and 18+ years.

- Nearly 2 million pregnant women were estimated to have Group B Streptococcus colonization in the 7MM, which is expected to reduce in the forecasted years due to decreasing pregnancy trends in the 7MM.

Group B Streptococcus Vaccine Chapters

The vaccine chapter segment of the Group B Streptococcus report encloses a detailed analysis of Group B Streptococcus off-label vaccines and late-stage (Phase-III and Phase-II) pipeline vaccines. It also helps to understand the Group B Streptococcus clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included vaccine, and the latest news and press releases.

Group B Streptococcus Emerging Vaccines

- Group B Streptococcus-NN/NN2: Minervax ApS

MinervaX is developing a novel, innovative, adjuvanted protein-only vaccine based on bacterial antigens derived from the family of alpha-like surface proteins of Group B Streptococcus. The vaccine consists of two fusion proteins consisting of either AlpCN or RibN (Group B Streptococcus-NN) or Alp1N and Alp2/3N (Group B Streptococcus-NN2), formulated with AlOH adjuvant. It will likely demonstrate superior properties compared to other Group B Streptococcus vaccine candidates in development based on traditional capsular polysaccharide (CPS) conjugation technology. Group B Streptococcus-NN/NN2 was granted FTD by the US FDA and PRIME status by EMA for the treatment of Group B Streptococcus.

Note: Detailed emerging therapies assessment will be provided in the final report…

Group B Streptococcus Market Outlook

Group B Streptococcus infections pose a significant threat to neonatal survival and well-being. Despite the fact that the large public health burden posed by Group B Streptococcus infections, current treatment and management paradigms lack approved prophylactic or curative treatments. Current treatment paradigms are largely off-label and majorly oscillate between different broad-spectrum antibiotics. Approval of curative and prophylactic treatments dedicated to managing Group B Streptococcus is highly desirable.

The current market has been segmented accordingly into different commonly used therapeutics based on the prevailing treatment pattern across the 7MM, presenting minor variations in the overall prescription pattern. The market covered in our forecast model includes intrapartum antibiotic prophylaxis and antibiotics that are used off-label in current treatment.

The current preventive strategies are insufficient, and there is an urgent need for a maternal vaccine to reduce the burden of Group B Streptococcus globally. The market awaits the launch of the two potential entities Group B Streptococcus-NN/NN2 and Multivalent Group B Streptococcus 6 by MinervaX and Pfizer, respectively that would be a game-changer in the reduction of newborn and maternal deaths for the affected population, accomplishing a critical global public health need if proven to be efficacious.

- The total Group B Streptococcus Market Size in the 7MM is approximately USD 194 million in 2022 and is projected to increase during the forecast period (2023–2040).

- The Group B Streptococcus market size in the 7MM will increase at a CAGR of 6.6% due to increasing awareness of the disease and the launch of emerging vaccines.

- Among EU4 countries, the UK accounts for the maximum market size in 2022, while Spain occupies the bottom of the ladder in the same year.

- Japan and the UK had comparable market sizes in 2022, but these dynamics are expected to change in the forecasted years.

Group B Streptococcus Vaccines Uptake

This section focuses on the rate of uptake of the potential vaccines expected to get launched in the market during the study period 2019–2040. For example, we estimate that both vaccines will be launched in the same year. Both vaccines are under development in the Phase II stage, and the efficacy results are currently unavailable.

Further detailed analysis of emerging therapies vaccines uptake in the report…

Group B Streptococcus Pipeline Development Activities

The Group B Streptococcus pipeline segment provides insights into Group B Streptococcus clincial trials within Phase III, Phase II, and Phase I. It also analyzes Group B Streptococcus companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Group B Streptococcus pipeline segment covers detailed information on collaborations, acquisition and merger, licensing, and patent details for Group B Streptococcus emerging therapies.

KOL Views

To keep up with current market trends, we take KOLs and ’SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on Group B Streptococcus evolving treatment landscape, patient reliance on conventional therapies, patient’s therapy switching acceptability, vaccine uptake along with challenges related to accessibility include the Department of International Health, Johns Hopkins Bloomberg School of Public Health, Baltimore, Maryland, Institute of Medical Microbiology and Hygiene, University Hospital Ulm, Ulm, Germany, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers such as the Department of Bacteriology, Neonatal Intensive Care Unit, etc. were contacted. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or Group B Streptococcus market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the safety of the vaccine is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed. It sets a clear understanding of the side effects posed by the vaccines in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Group B Streptococcus Market Access and Reimbursement

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription vaccine programs, etc.

Group B Streptococcus Market Research Report Scope

- The report covers a segment of key events, an executive summary, descriptive overview of Group B Streptococcus, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Group B Streptococcus market, historic and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM vaccine outreach.

- The patient-based Group B Streptococcus Market forecasting report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Group B Streptococcus market.

Group B Streptococcus Market Forecast Report Insights

- Patient-based Group B Streptococcus Market Forecasting

- Group B Streptococcus Therapeutic Approaches

- Group B Streptococcus Pipeline Analysis

- Group B Streptococcus Market Size and Trends

- Existing and future Market Opportunity

Group B Streptococcus Market Forecast Report Key Strengths

- 18 years Group B Streptococcus Market Forecast

- 7MM Coverage

- Group B Streptococcus Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- Vaccines Uptake and Key Market Forecast Assumptions

Group B Streptococcus Treatment Market Report Assessment

- Group B Streptococcus Treatment Market Practices

- Group B Streptococcus Unmet Needs

- Group B Streptococcus Pipeline Product Profiles

- Group B Streptococcus Market Attractiveness

- Group B Streptococcus Market Drivers

- Group B Streptococcus Market Barriers

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions Answered In The Group B Streptococcus Market Report:

Group B Streptococcus Market Insights

- What were the Group B Streptococcus market size, the market size by therapies, and market share (%) distribution in 2019, and how would it all look in 2040? What are the contributing factors for this growth?

- Will the coverage of vaccines depend on their efficacy in Group B Streptococcus?

- What is the likelihood of the CDC including the upcoming vaccines in the immunization schedule for pregnant women in the coming 18 years?

- What will impact the market with the launch of emerging vaccines?

- How is Group B Streptococcus-NN/NN2 going to compete with Group B Streptococcus 6 being launched in the same year?

- Which is going to be the largest contributor to the market in 2040?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the Group B Streptococcus market dynamics and subsequent analysis of the associated trends?

Group B Streptococcus Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of Group B Streptococcus? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Group B Streptococcus?

- What is the historical and forecasted Group B Streptococcus patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Why do only limited patients appear with symptoms? Why is the current year diagnosis rate not high?

- Which type of mutation is the largest contributor in patients affected with Group B Streptococcus?

- What factors are affecting the increase in the diagnosis of symptomatic cases?

Current Group B Streptococcus Treatment Scenario, Marketed Vaccines, and Emerging Therapies

- What are the current options for the Group B Streptococcus treatment? What are the current treatment guidelines for the treatment of Group B Streptococcus in the US and Europe?

- How many companies are developing therapies for the treatment of Group B Streptococcus?

- How many emerging therapies are in the mid-stage and late stage of development for the treatment of Group B Streptococcus?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What key designations have been granted for the emerging therapies for Group B Streptococcus?

- What will impact the market after the expected patent expiry of the emerging vaccines?

- What is the cost burden of off-label therapies on patients?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of recommended therapies? Focus on reimbursement policies.

- What are the 7MM historical and Group B Streptococcus forecasted market?

Reasons to Buy Group B Streptococcus Market Report

- The patient-based Group B Streptococcus Market Forecasting report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Group B Streptococcus Market.

- Insights on patient burden/disease incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and potential of current and emerging therapies under the conjoint analysis section to provide visibility around leading emerging vaccines.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the Group B Streptococcus unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Read Related Post-

For More In-depth Information @ Latest DelveInsight Blog

-epidemiology.png&w=256&q=75)

.png&w=3840&q=75)