Hematopoietic Stem Cell Transplantation Market

- The United States accounts for the largest market size (around 65%) of hematopoietic stem cell transplantation, in comparison to EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

- Myeloablative regimen, Nonmyeloablative/reduced-intensity regimen, filgrastim (G-CSF) + Mozobil, G-CSF + cyclophosphamide (CY) are some of the regimen and therapies currently being used in the market. Myeloablative regimen is expected to capture the largest market followed by potential upcoming drug Iomab-B.

- In September 2023, the US Food and Drug Administration (FDA) approved APHEXDA (motixafortide) in combination with filgrastim (G-CSF) to mobilize hematopoietic stem cells to the peripheral blood for collection and subsequent autologous transplantation in patients with multiple myeloma.

- In April 2024, Actinium Pharmaceuticals announced the results from the Phase III SIERRA trial of Iomab-B, which showed that an Iomab-B led bone marrow transplant (BMT) results in higher rates of remissions and durable Complete Remission (dCR), which is the primary endpoint of the SIERRA trial, as well as significant improvement in overall survival in TP53 positive patients.

- Medac, licensor of Medexus's treosulfan commercialization rights, is addressing FDA inquiries on the treosulfan NDA resubmission following Phase III trial feedback, aiming for FDA acceptance by the first half of 2024.

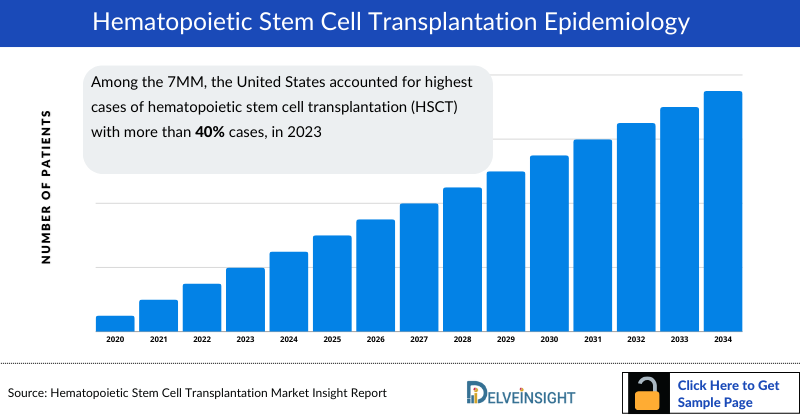

- Among the 7MM, the United States accounted for highest cases of hematopoietic stem cell transplantation (HSCT) with more than 40% cases, in 2023.

- In terms of type-specific cases of HSCT, the percentage of autologous HSCT cases is more in comparison to allogeneic HSCT across the 7MM except for Japan.

DelveInsight's “Hematopoietic Stem Cell Transplantation Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of hematopoietic stem cell transplantation, historical and forecasted epidemiology as well as the hematopoietic stem cell transplantation market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Hematopoietic stem cell transplantation market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM hematopoietic stem cell transplantation market size from 2020 to 2034. The report also covers current hematopoietic stem cell transplantation treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Hematopoietic Stem Cell Transplantation (HSCT) Understanding and Treatment Algorithm

Hematopoietic Stem Cell Transplantation (HSCT) Overview, Country-Specific Treatment Guidelines

Hematopoietic stem cell transplantation (HSCT) administers healthy hematopoietic stem cells (HSC) to patients with defective or depleted bone marrow. This improves bone marrow function and, depending on the disease being treated, leads to either the destruction of malignant tumor cells or the generation of functional cells that can replace the dysfunctional ones, as in the case of immune-deficiency syndromes, hemoglobinopathies, and other diseases. HSCT is mainly classified as autologous or allogeneic based on the origin of hematopoietic cells.

Donor selection is critical for successful hematopoietic cell transplantation. Options include matched sibling donors, matched unrelated donors from registries, or alternative sources like mismatched related donors or umbilical cord blood for patients without suitable sibling donors. Each option aims to minimize immunological reactions and ensure compatibility for transplant patients.

The hematopoietic stem cell transplantation report provides an overview of hematopoietic stem cell transplantation pathophysiology and detailed treatment algorithm along with a real-world scenario of a patient’s journey beginning from the first symptom, the time taken for the entire treatment process.

Further details related to country-based variations are provided in the report...

Hematopoietic Stem Cell Transplantation (HSCT) Treatment

Transplantation of hematopoietic stem cells (HSCT) has become the standard of care for many patients with defined congenital or acquired disorders of the hematopoietic system or with chemo- radio- or immuno- sensitive malignancies. Over the last two decades, HSCT has seen rapid expansion and a constant evolution in technology use. Multiple myeloma and non-Hodgkin's lymphoma remain the most common indications for high-dose chemotherapy and autologous peripheral blood stem cell rescue.

Myeloablative conditioning regimens are commonly used in both autologous and allogenic transplants. Myeloablative conditioning (MAC) is utilized in allogeneic hematopoietic stem cell transplantation (HSCT) to maximize disease control and provide adequate immune suppression to prevent graft rejection. The combination of cyclophosphamide (CY) with ablative doses of total body irradiation (TBI) was the first MAC regimen successfully used in HSCT. However, due to the difficulty in administering TBI uniformly in many centers and the high transplant-related mortality (TRM) with these early regimens, non-radiation based combination chemotherapy regimens were developed. The three most commonly used MAC regimens are the alkylating agent busulfan (Bu) (as an antileukemic agent), used with CY to maximize immunosuppression (BuCy) was shown to be effective.

Further details related to country-based variations in treatment are provided in the report...

Hematopoietic Stem Cell Transplantation (HSCT) Epidemiology

The hematopoietic stem cell transplantation epidemiology chapter in the report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. The hematopoietic stem cell transplantation epidemiology is segmented with detailed insights into Total Cases of Hematopoietic Stem Cell Transplantation (HSCT), Type-specific Cases of Hematopoietic Stem Cell Transplantation (HSCT), and Total Cases of Hematopoietic Stem Cell Transplantation (HSCT) by Indications.

- Based on DelveInsight's estimates, the number of hematopoietic stem cell transplantation (HSCT) cases in the United States accounted for over 40% of the total prevalent cases reported in the 7MM in 2023.

- HSCT mainly includes two types of transplants, autologous and allogeneic. DelveInsight’s consultant estimates that maximum number of type-specific cases of HSCT belonged to the autologous HSCT. There were around 60% cases of autologous HSCT in the United States in 2023.

- Multiple myeloma/plasma cell disorders bags the largest prevalent patient pool among all the considered indications where HSCT procedure was used, in the 7MM except for Japan (AML patients account for maximum HSCT cases).

- Among the EU4 and the UK, Germany had the highest cases of hematopoietic stem cell transplantation (HSCT).

Hematopoietic Stem Cell Transplantation (HSCT) Drug Chapters

The drug chapter segment of the hematopoietic stem cell transplantation report encloses a detailed analysis of hematopoietic stem cell transplantation marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into the hematopoietic stem cell transplantation pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Marketed Drugs

Motixafortide (BL-8040): BioLineRx

Motixafortide (formerly known as BL-8040/BKT140) is a novel selective inhibitor of the CXCR4 chemokine receptor. CXCR4 is a well-validated therapeutic target involved in the mobilization and trafficking of hematopoietic stem cells, immune cells, and cancer cells from the bone marrow and the lymph nodes to the peripheral blood. In September 2023, the FDA granted approval to APHEXDA (motixafortide) in combination with filgrastim (G-CSF) to mobilize hematopoietic stem cells to the peripheral blood for collection and subsequent autologous transplantation in patients with multiple myeloma. The FDA approval of APHEXDA is based on results from Phase III GENESIS trial.

MOZOBIL (plerixafor): Sanofi

MOZOBIL is a mobilization agent for those who have been diagnosed with non-Hodgkin’s lymphoma (NHL) or multiple myeloma (MM) and are expected to undergo autologous hematopoietic cell transplantation (autologous HCT) eventually. In December 2008, Genzyme Corporation announced that the US FDA has granted marketing approval for Mozobil (plerixafor injection), a drug intended to be used in combination with granulocyte-colony stimulating factor (G-CSF) to mobilize hematopoietic stem cells to the bloodstream for collection and subsequent autologous transplantation in patients with non-Hodgkin's lymphoma (NHL) and multiple myeloma (MM).

Note: Detailed marketed therapies assessment will be provided in the final report...

Emerging Drugs

Iomab-B (CD45) (apamistamab-I-131): Actinium Pharmaceuticals

Iomab-B, via the monoclonal antibody apamistamab, targets CD45, an antigen widely expressed on all types of blood cancer cells and immune cells, including bone marrow progenitor stems cells. Iomab-B is currently being studied in the pivotal Phase III SIERRA (Study of Iomab-B in Elderly Relapsed or Refractory AML) trial, a 150-patient, randomized controlled clinical trial in patients with relapsed or refractory acute myeloid leukemia (AML) who are age 55 and above. Recently, in April 2024, the SIERRA results demonstrated Iomab-B's ability to overcome the negative impact of a TP53 mutation in patients who otherwise would have limited treatment options and dismal prognosis.

TRECONDI (treosulfan): Medexus Pharmaceuticals /medac Pharma

Treosulfan is part of a preparative regimen for allo-HSCT to be used in combination with fludarabine, used in treating eligible patients with acute myeloid leukemia and myelodysplastic syndromes. Treosulfan is a prodrug of a bifunctional alkylating agent with cytotoxic activity to hematopoietic precursor cells. In September 2023, Medexus Pharmaceuticals announced that the company entered into a third amendment to its February 2021 exclusive license agreement with medac GmbH relating to commercialization of treosulfan in the United States. Currently, medac, as Medexus's licensor for treosulfan, is addressing FDA inquiries regarding the NDA resubmission based on Phase III trial feedback. They anticipate FDA acceptance by the first half of 2024, aligning with Medexus's expectations.

|

Drugs |

Company |

RoA |

MoA |

Phase |

Designation |

|

TRECONDI (treosulfan) |

Medac GmbH|Celerion|Syneos Health |

Intravenous infusion |

Has cytotoxic activity to hematopoietic |

Registration |

Orphan Drug Designation for conditioning treatment |

|

Iomab-B (I-131 apamistamab) |

Actinium Pharmaceuticals |

Intravenous infusion |

lomab-B is an antibody radiation conjugate (ARC) targeting CD45 |

III |

Orphan Drug Designation for relapsed or refractory AML in patients 55 and above |

Note: Detailed emerging therapies assessment will be provided in the final report...

Hematopoietic Stem Cell Transplantation (HSCT) Market Outlook

Key players, such as Actinium Pharmaceuticals, Medexus Pharmaceuticals /medac Pharma, and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of hematopoietic stem cell transplantation.

- The United States represents approximately 65% of the market size for hematopoietic stem cell transplantation, surpassing the market size of EU4 and the UK, and Japan.

- Among the emerging therapies, Iomab-B (I-131 apamistamab) is expected to garner the highest market size by 2034.

- Germany accounts for the second highest market size in the 7MM during the forecast period 2024–2034.

Hematopoietic Stem Cell Transplantation (HSCT) Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report...

Hematopoietic Stem Cell Transplantation (HSCT) Activities

The report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for hematopoietic stem cell transplantation emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Centers such as New York Presbyterian Hospital, International Myeloma Foundation, Memorial Sloan Kettering Cancer Center, etc., were contacted. Their opinion helps understand and validate current and emerging treatment patterns of hematopoietic stem cell transplantation. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

Region |

KOL Views |

|

United States |

“Treosulphan regimen has the potential to become a standard preparative regimen before allogeneic HSCT in patients with acute myeloid leukemia and myelodysplastic syndrome at increased mortality risk for myeloablative conditioning.” |

|

“There are approximately 1000-3000 patients upto the age of 30 who have undergone hematopoietic stem cell transplantation and the survival rate is 95% in case of patients suffering from Sickle cell disease. And in those 95% survival cases 95% of the patients are disease free. Those results are possible if you have an HLA matched sibiling.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Allogeneic HSCT is covered under Medicare for the treatment of any of the following conditions:

Leukemia, leukemia in remission, or aplastic anemia when it is reasonable and necessary

Severe combined immunodeficiency disease (SCID) and for the treatment of Wiskott–Aldrich syndrome.

Allogenic HSCT is only covered pursuant to Coverage with Evidence Development (CED) in the context of a Medicare-approved, prospective clinical study with certain criteria for the treatment of the following conditions: Myelodysplastic Syndromes (MDS), Multiple myeloma, Myelofibrosis, Sickle cell disease, and Autologous Stem Cell Transplantation (ASCT).

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Report

- The report covers a segment of key events, an executive summary, descriptive overview of hematopoietic stem cell transplantation, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the hematopoietic stem cell transplantation market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM hematopoietic stem cell transplantation market.

Hematopoietic Stem Cell Transplantation (HSCT) Report Insights

- Patient Population

- Therapeutic Approaches

- Hematopoietic Stem Cell Transplantation (HSCT) Pipeline Analysis

- Hematopoietic Stem Cell Transplantation (HSCT) Market Size and Trends

- Existing and Future Market Opportunity

Hematopoietic Stem Cell Transplantation (HSCT) Report Key Strengths

- Eleven-year Forecast

- 7MM Coverage

- Hematopoietic Stem Cell Transplantation (HSCT) Epidemiology Segmentation

- Inclusion of Country Specific Treatment Guidelines

- KOL’s Feedback on Approved and Emerging Therapies

- Key Cross Competition

- Conjoint Analysis

- Drugs Uptake and Key Market Forecast Assumptions

Hematopoietic Stem Cell Transplantation (HSCT) Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the growth rate of the 7MM hematopoietic stem cell transplantation treatment market?

- What was the hematopoietic stem cell transplantation total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the current and emerging options for the treatment of hematopoietic stem cell transplantation?

- How many companies are developing therapies for the treatment of hematopoietic stem cell transplantation?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient/physician acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the hematopoietic stem cell transplantation market.

- Insights on patient burden/disease prevalence and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-market-Goutieres-Syndrome.png&w=256&q=75)