Hemophagocytic Lymphohistiocytosis Market

Key Highlights

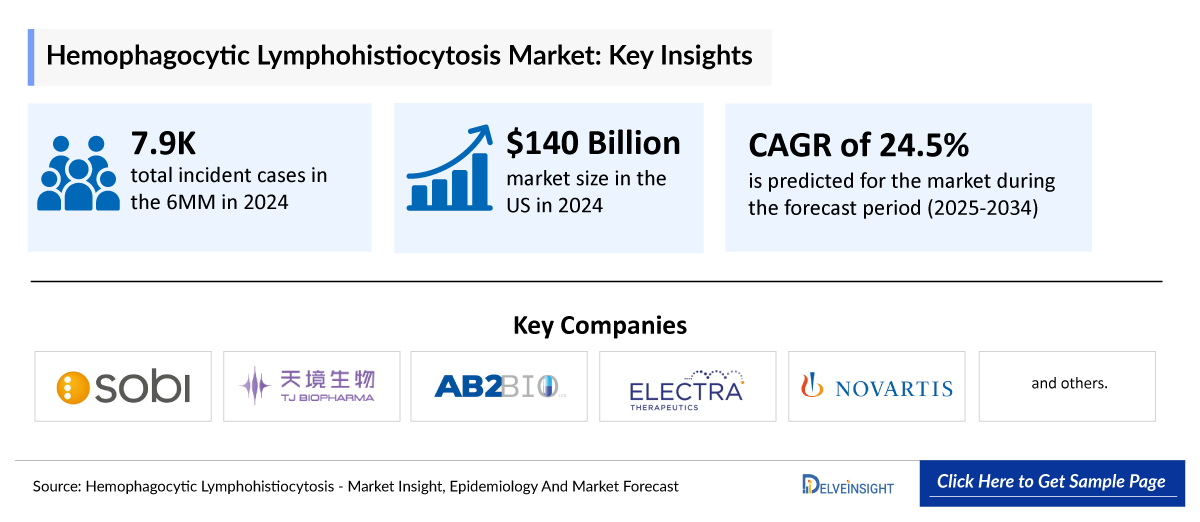

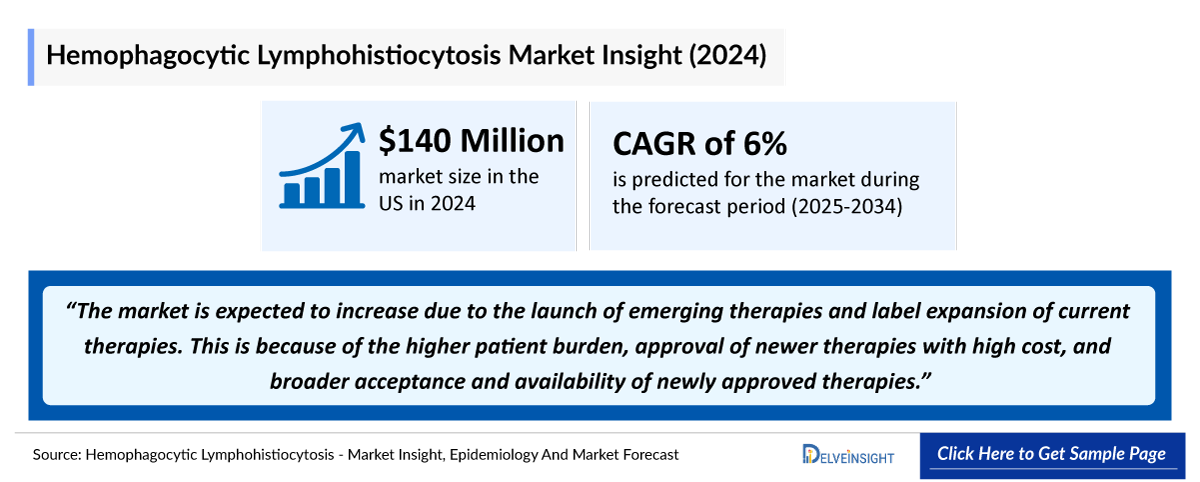

- Among the 7MM, the US had the largest market share of HLH in 2024, which accounted for approximately USD 140 million in 2024, which is expected to increase in the coming years owing to the approval of new agents in frontline and combination settings, rising therapy costs, and increasing testing rates that enable the identification of more patients with HLH.

- HLH presents as familial (nearly 25%, inherited) or secondary, which is linked to infections (EBV, Cytomegalovirus [CMV], and others), cancers (leukemias, lymphomas), autoimmune/immune-mediated diseases (Systemic Lupus Erythematosus [SLE], rheumatoid arthritis, polyarteritis nodosa, sarcoidosis, progressive systemic sclerosis, Sjögren syndrome, Kawasaki disease), and solid-organ transplants; when driven by autoimmune/autoinflammatory disorders it is classified as MAS-HLH.

- Current treatments for HLH include corticosteroids (Dexamethasone and Methylprednisolone), etoposide, anakinra, biologics (rituximab and tocilizumab), anticancer or immunosuppressive drugs (cyclosporine, methotrexate, and doxorubicin), as well as intravenous immunoglobulins.

- GAMIFANT (Sobi) remains the only approved therapy for primary HLH (since 2018) and has recently expanded its label, gaining US FDA approval in June 2025 for MAS associated with Still’s disease. Following this approval, GAMIFANT has demonstrated stronger-than-projected market uptake, with double-digit Constant Exchange Rates (CER) growth. The company plans to pursue EU regulatory submission in 2026, indicating continued strategic expansion of its HLH and MAS portfolio.

- The pipeline of HLH is very scarce, with only three emerging therapies: plonmarlimab (TJ Biopharma), ELA026 (Electra Therapeutics), MAS825 (Novartis), and tadekinig alfa (r-hIL-18BP) (AB2 Bio). Despite all being in late-stage development, this underscores the scarcity of therapeutic innovation in this space.

- In primary HLH, tadekinig alfa could emerge as a strong competitor to GAMIFANT due to its SC route, though its thrice-weekly dosing may limit uptake versus GAMIFANT’s twice-weekly IV schedule. In secondary HLH, GAMIFANT is the most infusion-intensive (biweekly IV), while plonmarlimab offers once-weekly IV dosing, ELA026 requires a more complex daily-to-weekly IV/SC regimen, and tadekinig alfa remains the only SC-only option, but with higher dosing frequency.

- Trial discontinuation remains a persistent threat in the HLH landscape, as seen with the halted Phase I study (NCT04326348) of rovadicitinib, which was ended for business reasons rather than safety or efficacy concerns.

DelveInsight’s “Hemophagocytic lymphohistiocytosis (HLH) – Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of HLH, historical and forecasted epidemiology, as well as HLH market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The HLH market report provides current treatment practices, emerging drugs, market share of individual therapies, and the current and forecasted 7MM HLH market size from 2020 to 2034. The report also covers current HLH treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

HLH Epidemiology

|

Segmented by:

|

|

HLH Key companies |

|

|

HLH Key therapies |

|

|

HLH Market |

Segmented by:

|

|

Analysis |

|

Hemophagocytic Lymphohistiocytosis (HLH) Understanding and Treatment Algorithm

HLH Overview

HLH is a rare, rapidly progressive, and often fatal hyperinflammatory syndrome caused by uncontrolled activation of cytotoxic T cells, NK cells, and macrophages. This dysregulated immune response triggers massive cytokine release, hemophagocytosis, and multiorgan failure.

HLH is categorized into primary and secondary forms:

Primary (familial) HLH results from inherited defects in genes that regulate cytotoxic lymphocyte function (e.g., PRF1, UNC13D, STXBP2, STX11, RAB27A, LYST, SH2D1A, XIAP). These mutations impair immune downregulation, leading to persistent cytokine overproduction and tissue injury. It usually presents in infancy or early childhood but can rarely manifest later.

Secondary (acquired) HLH occurs in response to strong triggers, most commonly infections (especially EBV), hematologic malignancies, and autoimmune diseases (also termed MAS). Other triggers include transplantation, certain biologics, and pregnancy. Although not classically genetic, about 14% of cases show partial variants in primary HLH-related genes, increasing susceptibility. It is more common in adults and reflects a severe, trigger-driven hyperimmune reaction rather than an inherited defect.

HLH Diagnosis

Diagnosis of HLH is based on clinical features, physical findings, and characteristic laboratory abnormalities, with persistent fever, organomegaly, cytopenias, hyperinflammation, and coagulopathy serving as key early clues. Blood tests typically show high ferritin, elevated triglycerides, low fibrinogen, and reduced NK-cell activity, while bone-marrow biopsy may reveal hemophagocytosis but is no longer required. Diagnosis traditionally follows the HLH-2004 criteria, whereas tools like the HScore offer a validated, probability-based approach in adults using common markers such as ferritin, cytopenias, liver enzymes, and organomegaly. Because secondary HLH/MAS often mimics infections, rheumatologic flares, malignancy, or other cytokine-storm syndromes, clinicians rely on careful assessment, serial ferritin trends, and specialized biomarkers such as sCD25, IL-18, and CXCL9. A high index of suspicion, rapid evaluation of triggers, and multidisciplinary input from hematology, infectious diseases, and rheumatology are essential for timely and accurate diagnosis.

Further details related to diagnosis are provided in the report…

HLH Treatment and Management

Management of HLH depends on the trigger, age, and disease severity, with secondary HLH often improving once the underlying infection, malignancy, or autoimmune disorder is controlled, while familial HLH almost always requires definitive therapy. Treatment centers on rapid immunosuppression and cytotoxic therapy, typically dexamethasone, etoposide, cyclosporine, and intrathecal therapy when needed, following established protocols such as HLH-94 or HLH-2004. In refractory or genetically driven disease, hematopoietic stem-cell transplantation is the only curative option. Supportive care, antimicrobials, and antivirals are often required, and therapy must be balanced carefully in patients with active infections. Although routine newborn screening is not performed, siblings of affected children require genetic testing because of the 25% recurrence risk. Advances in targeted immunomodulators and improved transplant strategies continue to enhance survival and long-term outcomes.

Further details related to treatment are provided in the report…

Hemophagocytic Lymphohistiocytosis (HLH) Epidemiology

The HLH epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total incident cases of HLH, total incident cases of HLH by type, incident cases of HLH by gender, incident cases of familial HLH by mutation, incident cases of acquired HLH by etiology, and total treated cases of HLH in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

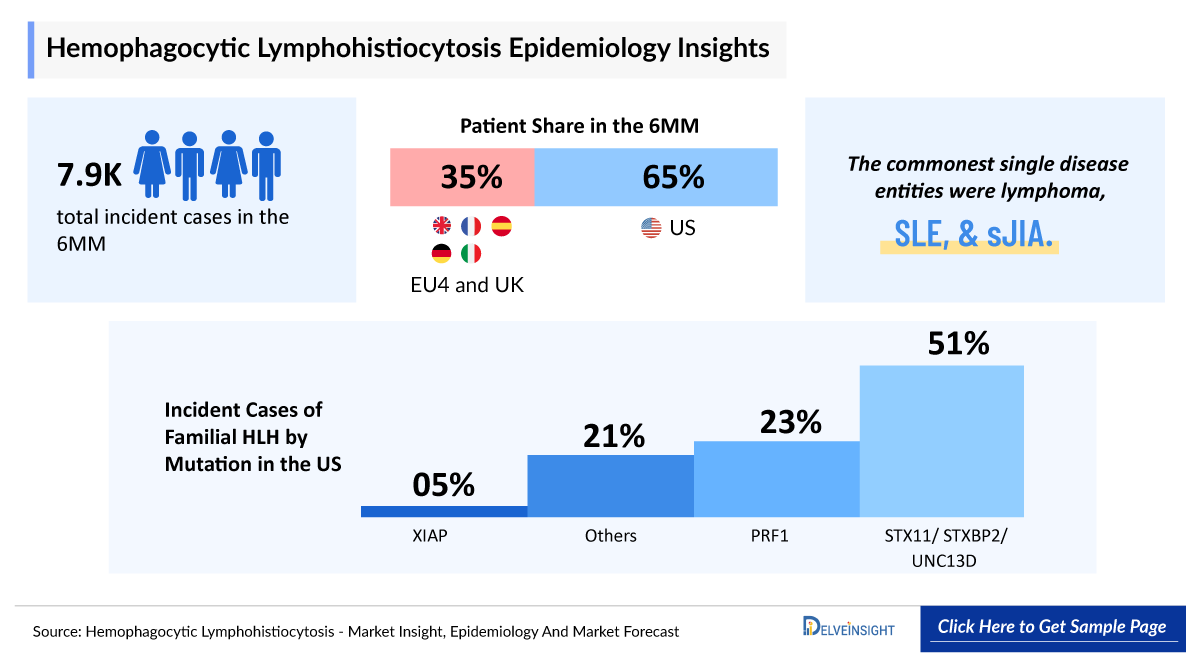

- Among the 7MM countries, there were 5,100 incident cases of HLH in the US in 2024.

- The total number of cases in EU4 and the UK for HLH was estimated to be nearly 2,800 cases in 2024.

- The commonest single disease entities were lymphoma, SLE, and sJIA. There has been evidence of clinically diagnosed HIV, EBV, or CMV infection either in the health record or on the death certificate in 2.3%, 8.9%, and 3.3%, respectively. In 2024, Spain had 109 incident cases of infection-associated HLH.

- There are numerous mutations responsible for familial (primary) HLH. In 2024, the US accounted for 761 incident cases of primary HLH associated with STX11/ STXBP2/UNC13D mutations.

Hemophagocytic Lymphohistiocytosis (HLH) Drug Chapters

The drug chapter segment of the HLH report encloses a detailed analysis of the marketed and the late-stage (Phase III) pipeline drugs. The marketed drugs segment encloses Emapalumab (GAMIFANT), currently, the only approved therapy. Furthermore, the current key players for the upcoming emerging drugs and their respective drug candidates include Electra Therapeutics (ELA026), AB2 Bio (Tadekinig alfa), and others. The drug chapter also helps understand the HLH clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases.

Marketed Drugs

Emapalumab-lzsg (GAMIFANT): Swedish Orphan Biovitrum AB (Sobi)

Emapalumab is a monoclonal antibody designed to specifically bind and inhibit IFN?. Its FDA approval was supported by results from the pivotal Phase II/III trial (NCT01818492). It remains currently the only authorized monoclonal antibody targeting IFN?. By neutralizing excess IFN?, GAMIFANT helps prevent the uncontrolled immune activation and hyperinflammation associated with elevated levels of this cytokine.

In June 2025, Sobi announced that the US FDA approved emapalumab for the treatment of adult and pediatric (newborn and older) patients with HLH/MAS in known or suspected Still’s disease, including sJIA, with an inadequate response or intolerance to glucocorticoids, or with recurrent MAS.

In November 2018, Sobi announced that the US FDA approved emapalumab for the treatment of paediatric (newborn and older) and adult patients with primary HLH with refractory, recurrent, or progressive disease or intolerance to conventional HLH.

Note: Detailed list will be provided in the final report…

Emerging Drugs

Tadekinig Alfa (r-hIL-18BP): AB2 Bio

Tadekinig alfa is a novel, recombinant human IL-18 BP that binds and inhibits IL-18, a major proinflammatory cytokine. In healthy people, a large excess of naturally occurring endogenous IL-18 BP keeps levels of systemic free IL-18 undetectable. Dysregulation of this balance in certain autoinflammatory diseases results in high systemic levels of free IL-18, leading to dangerous pathological hyperinflammation. Tadekinig alfa treatment restores the IL-18 BP/IL-18 balance by capturing excess free IL-18, thereby reducing inflammation. This is a novel and promising approach for the treatment of several autoimmune diseases and conditions characterized by high systemic IL-18 levels. The drug is currently undergoing a Phase III clinical trial.

In January 2025, AB2 Bio announced that it had entered into an option and licensing agreement with Nippon Shinyaku in the US. Under the terms of the agreement, Nippon Shinyaku would have the exclusive right to commercialize tadekinig alfa for its lead indication, primary monogenic IL-18 driven hyperinflammatory syndrome in patients with NLRC4 mutation and XIAP deficiency, in the US (including Guam, Puerto Rico, and the US Virgin Islands). AB2 Bio retains rights to tadekinig alfa for all other indications in the US (including Guam, Puerto Rico, and US Virgin Islands) and all indications in the rest of the world.

ELA026: Electra Therapeutics

ELA026 is a monoclonal antibody specifically designed to address severe inflammatory disorders with aberrant myeloid cell and T-lymphocyte activity. It induces rapid, potent, and targeted depletion of the circulating myeloid cells and T lymphocytes that drive inflammation, without disrupting the CD47/SIRPa immune checkpoint function. It is currently in Phase II/III of clinical trials.

In October 2025, Electra Therapeutics announced that the first patients had been dosed in the SURPASS study, a pivotal Phase II/III clinical trial evaluating ELA026, the first investigational therapy designed to broadly treat secondary HLH.

|

Comparison of Emerging Drugs Under Development for HLH | ||||||

|

Product |

Company |

Mechanism of Action |

Phase |

Indication |

RoA |

Molecular Type |

|

Plonmarlimab (TJM2/TJ003234) |

TJ Biopharma |

Targets human-Granulocyte-macrophage-Colony-Stimulating Factor (GM-CSF) |

III |

MAS/secondary HLH |

IV |

Monoclonal antibody |

|

Tadekinig alfa (r-hIL-18BP) |

AB2 Bio |

IL-18 inhibitor |

III |

NLRC4-MAS mutation |

SC |

Recombinant protein |

|

ELA026 |

Electra Therapeutics |

Signal Regulatory Proteins (SIRP) inhibitor |

II/III |

Secondary HLH |

IV/SC |

Monoclonal antibody |

|

MAS 825 |

Novartis |

IL-1β and IL-18 inhibitor |

II |

Pediatric and adult participants with Still's disease, including MAS |

IV |

Bispecific MAb |

Note: Detailed emerging therapies assessment will be provided in the final report…

Drug Class Insights

The current HLH treatment landscape is dominated by immunosuppressive and cytotoxic therapies that target the underlying hyperinflammatory pathways driving the disease. Key immune-dysregulation mechanisms such as impaired cytotoxic lymphocyte function or excessive cytokine signalling are central to both primary and secondary HLH. Conventional regimens like HLH-94 and HLH-2004 form the backbone of therapy, while newer targeted agents (e.g., IFN-? blockade) are emerging to address specific pathogenic drivers. Multiple FDA-approved and investigational therapies now aim to modulate cytokine release, restore immune control, or support curative stem-cell transplantation.

Note: Detailed insights will be provided in the final report…

Hemophagocytic Lymphohistiocytosis (HLH) Market Outlook

Therapeutic management of HLH requires a multifaceted approach that integrates immunosuppressive, cytotoxic, and targeted therapies to control hyperinflammation, suppress aberrant immune activation, and re-establish immune homeostasis. Treatment strategies are tailored to disease severity and underlying etiology, with early initiation being critical to prevent irreversible organ damage. Corticosteroids, particularly high-dose dexamethasone, serve as a cornerstone of therapy due to their potent anti-inflammatory effects and ability to reduce cytokine-mediated tissue injury. Etoposide-based chemotherapy remains a standard component of initial treatment, effectively targeting hyperactivated cytotoxic lymphocytes and macrophages. Immunomodulatory agents such as cyclosporine are often employed to inhibit T-cell activation and cytokine production, while biologic therapies, including rituximab for EBV-associated HLH and mAbs like alemtuzumab or antithymocyte globulin for refractory disease, offer targeted mechanisms to dampen immune overactivation. Concurrent antimicrobial therapy, including antibiotics and antivirals, is essential when infectious triggers are identified, addressing both the precipitating cause and the hyperinflammatory state. Collectively, these interventions aim not only to achieve disease control but also to stabilize patients sufficiently to allow for definitive curative therapy, such as HSCT, when indicated.

GAMIFANT delivered exceptional performance in Q3 2025, generating USD 66.6 million in sales, a 98% year-over-year increase, driven by higher patient uptake, favorable mix, and the successful US launch for MAS in Still’s disease, the first approved treatment for both adults and children. This approval validates GAMIFANT’S potential across the HLH/MAS spectrum and positions it for continued expansion. Regulatory momentum remains strong. Meanwhile, the company continues to provide compassionate access in Europe, supported by robust clinician interest. Looking ahead, revenue is projected to grow at a low double-digit rate at CER, supported by global rollout, broader patient access, and sustained uptake in MAS and HLH indications.

- The total market size in the US for HLH was estimated to be nearly USD 140 million in 2024, which is expected to increase due to the launch of emerging therapies and label expansion of current therapies. This is because of the higher patient burden, approval of newer therapies with high cost, and broader acceptance and availability of newly approved therapies.

- There is a difference in the market dynamics of the US and EU4, and the UK. The reason is that GAMIFANT has been approved in the US since 2018. However, in Europe, GAMIFANT did not receive marketing authorization in Europe due to insufficient evidence of its effectiveness and concerns regarding data reliability from the primary clinical study. The eventual patent expiry of GAMIFANT in the coming years (around 2032) is expected to trigger a "patent cliff," introducing biosimilars that will make this essential, life-saving medication more accessible and affordable for patients worldwide.

- The HLH market remains highly unmet, with conventional therapies leading to high mortality (20–30% before HSCT) and only about 60% long-term survival due to toxicity, treatment failure, and relapse risk.

Hemophagocytic Lymphohistiocytosis Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry.

In 2024, the highest market was captured by GAMIFANT. Other than that, among the off-label therapies, anakinra, biologics, and other therapies (methotrexate, abatacept, cyclophosphamide, doxorubicin, etc.) also gave a fine boost.

It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake. By overcoming the resistance and providing better efficacy. GAMIFANT became the market leader in the HLH market.

Further detailed analysis of emerging therapies, drug uptake in the report…

Hemophagocytic Lymphohistiocytosis Activities

The report provides insights into different therapeutic candidates in the Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for HLH emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including endocrinologists, neuroscientists, neurologists, Professors, epidemiologists, and others.

Delveinsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Centres such as California Northstate University, Newcastle University, Ludwig Maximilian University, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or HLH market trends.

|

KOL Views |

|

“The UCLH HLH service has grown exponentially, as HLH is identified in more and more patients. The service has had to adapt to this demand with colleagues having time recognised in job plans, and formalised support from the admin team.” ̶ Professor, University of Southern California, US |

|

“Many patients, particularly adults and those with liver impairment, tolerate conventional HLH regimens, noting that etoposide-related toxicity remains a major barrier to optimal care. They also emphasise that profound immunosuppression frequently precipitates life-threatening infections, complicating already fragile clinical trajectories. Compounding these issues is the limited availability and variable access to advanced therapies such as anti-IFNγ agents, which experts believe could meaningfully improve outcomes if more broadly accessible.” ̶ PhD King's College London, UK |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most crucial primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and this clearly explains the drug's side effects in the trials. In addition, the scoring is also based on the probability of success and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of HLH, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of the diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the HLH market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM HLH market.

Hemophagocytic Lymphohistiocytosis (HLH) Report Insights

- Patient Population

- Therapeutic Approaches

- HLH Pipeline Analysis

- HLH Market Size and Trends

- Existing and Future Market Opportunity

Report Key Strengths

- Ten-Year Forecast

- The 7MM Coverage

- HLH Epidemiology Segmentation

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

Hemophagocytic Lymphohistiocytosis (HLH) Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and conjoint Analysis)

FAQs

- What is the historical and forecasted HLH patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- What was the HLH total market size, the market size by therapies, market share (%), distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- Which class is going to be the largest contributor by 2034?

- What will be the impact of GAMIFANT’s expected patent expiry?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the HLH Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights into the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.