Homozygous Familial Hypercholesterolemia Market Summary

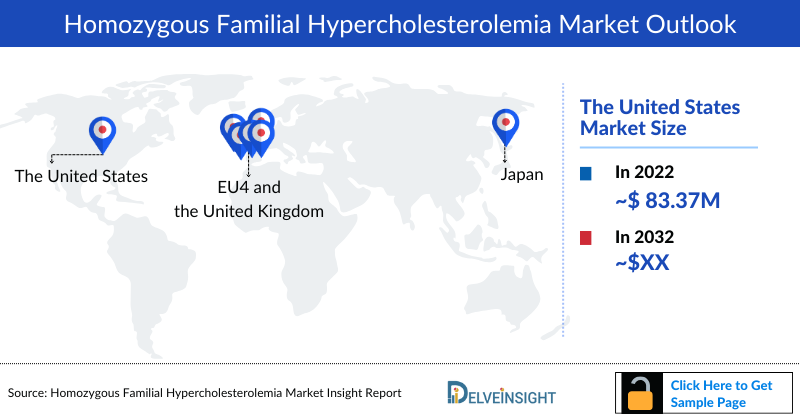

- As per DelveInsight, the Homozygous Familial Hypercholesterolemia Market size in the 7MM was USD 108.23 million in 2022. The Homozygous Familial Hypercholesterolemia Market is expected to expand at a healthy growth rate during the forecast period (2024-2034), owing to the launch of new therapies in the market and the rise in the number of cases.

- The Homozygous Familial Hypercholesterolemia Companies developing therapies include - Arrowhead Pharmaceuticals, Novartis, Alnylam Pharmaceuticals, LIB Therapeutics, and others.

Request a sample to unlock the CAGR for "Homozygous Familial Hypercholesterolemia Market Forecast"

Homozygous Familial Hypercholesterolemia Market & Epidemiology Insights

- In 2022, the homozygous familial hypercholesterolemia market size was highest in the US among the 7MM countries, accounting for approximately USD 83.37 million. It is expected to increase by 2034.

- Among the approved products, Regeneron/Ultragenyx’s EVKEEZA (evinacumab), the first-in-class ANGPTL3 inhibitor for the treatment of children as young as 5 years to control dangerously high levels of LDL-C, was approved in 2021. It generated a revenue of USD 47 million in the US 2022, capturing nearly 56% of the total homozygous familial hypercholesterolemia market in the US.

- Several major pharma and biotech companies such as Arrowhead Pharmaceuticals, Novartis, Alnylam Pharmaceuticals, LIB Therapeuticseveral, among others, are actively working in the Homozygous Familial Hypercholesterolemia Market.

- The diagnosed homozygous familial hypercholesterolemia prevalence has been increasing in the US due to increased population and awareness.

- Updated international diagnostic and clinical guidelines for FH and homozygous familial hypercholesterolemia enable evidence-based therapeutic approaches and screening strategies for early identification.

- The current Homozygous Familial Hypercholesterolemia treatment regimens focus on low-density lipoprotein (LDL)-lowering therapies, with statins being the mainstay. Statins such as simvastatin, rosuvastatin, and atorvastatin are frequently used.

- Non-pharmacological therapies, such as lifestyle modification, low-fat diet, and lipoprotein apheresis, manage low-density lipoprotein cholesterol (LDL-C) levels. A liver transplant is also recommended, as it replaces dysfunctional hepatic LDL receptors, resulting in near-normal lipoprotein metabolism.

- The improvements in disease understanding and pathogenesis have driven the development of novel therapies that are approved as adjuncts to statins and other lipid-lowering therapies as a subsequent line of therapies. These include PCSK9 inhibitors (alirocumab and evolocumab), MTP inhibitors (lomitapide), and ANGPTL3 inhibitors (evinacumab).

- The major concern in understanding the Homozygous Familial Hypercholesterolemia market is a lack of recent epidemiology and a paucity of evidence to validate interventions used in daily managing homozygous familial hypercholesterolemia.

- Limited access to gene testing and lack of cholesterol screening programs delays diagnosis, worsening the LDL-C levels and impacting homozygous familial hypercholesterolemia treatment and care.

- Despite the availability of statins and other lipid-lowering treatments, many high-risk patients remain vulnerable to major cardiovascular events.

- Advances in research have led to the discovery of novel molecules like siRNA and recombinant fusion protein that may offer effective options to lower LDL significantly.

- Emerging therapies LEQVIO (inclisiran), lerodalcibep (LIB003), and ARO-ANG3 can potentially create a positive shift in the market size of homozygous familial hypercholesterolemia.

- LEQVIO (inclisiran) is a small interfering RNA that blocks the translation of PCSK9 messenger RNA, leading to its degradation by the RNA-induced silencing complex, thus decreasing intrahepatic and plasma PCSK9 concentration.

- Arrowhead Pharmaceuticals’ ARO-ANG3 is an ANGPTL3 inhibitor that reduces the expression and circulation levels of ANGPTL3, leading to the clearance of LDL-cholesterol, HDL-cholesterol, and triglycerides.

- Preclinical studies have yielded gene therapy and CRISPR-based gene editing approaches as having potential; conducting further research and clinical trials may offer curative therapy. Since the current therapies are insufficient for cholesterol-lowering, pharma players can bring newer and more potent LDL-C lowering therapies to prevent atherosclerotic cardiovascular disease in homozygous familial hypercholesterolemia patients.

Request a sample to unlock the CAGR for "Homozygous Familial Hypercholesterolemia Market Forecast"

Key Factors Driving Homozygous Familial Hypercholesterolemia Market:

- High Disease Severity and Unmet Need: HoFH is a rare but life-threatening condition with extremely elevated LDL-C levels, creating strong demand for effective and advanced therapies.

- Advancements in Novel Therapies: Development of specialized treatments such as PCSK9 inhibitors, ANGPTL3 inhibitors, and gene-based therapies is driving market growth.

- Increasing Diagnosis and Awareness: Improved genetic testing and clinician awareness are leading to earlier diagnosis and higher treatment uptake.

- Regulatory Support and Orphan Drug Designations: Favorable regulatory pathways, including orphan drug incentives, are accelerating drug development and approvals.

- Expansion of Specialized Care Centers: Growth of lipid clinics and specialized cardiovascular centers is improving patient access to HoFH-specific treatments.

DelveInsight’s “Homozygous Familial Hypercholesterolemia Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the homozygous familial hypercholesterolemia historical and forecasted epidemiology as well as the Homozygous Familial Hypercholesterolemia therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The homozygous familial hypercholesterolemia market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted the 7MM homozygous familial hypercholesterolemia market size from 2020 to 2034. The report also covers current homozygous familial hypercholesterolemia treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Heterozygous Familial Hypercholesterolemia Market |

|

|

Heterozygous Familial Hypercholesterolemia Market Size | |

|

Heterozygous Familial Hypercholesterolemia Companies |

Arrowhead Pharmaceuticals, Novartis, Alnylam Pharmaceuticals, LIB Therapeutics, and others |

|

Heterozygous Familial Hypercholesterolemia Epidemiology Segmentation |

|

Homozygous Familial Hypercholesterolemia Disease Understanding

Homozygous Familial Hypercholesterolemia Overview

Homozygous familial hypercholesterolemia is the most serious and rare form of familial hypercholesterolemia. It is a genetic disorder that affects lipid metabolism, leading to extremely high levels of LDL-C in the blood. It is inherited in an autosomal recessive pattern and caused by a genetic mutation that affects the function of the LDL receptor, which normally removes LDL cholesterol from the bloodstream. As a result, individuals with homozygous familial hypercholesterolemia cannot effectively clear LDL cholesterol from their blood, accumulating cholesterol in arteries and other tissues.

The LDLR gene encodes a receptor responsible for removing low-density lipoprotein (LDL) cholesterol from the bloodstream. In homozygous familial hypercholesterolemia, the mutations in both copies of LDLR severely impair the function of these receptors, resulting in extremely high levels of LDL cholesterol in the blood. Individuals have high cholesterol levels despite following a low-cholesterol diet and other lifestyle modifications.

The disease is characterized by plasma cholesterol levels higher than 13 mmol/L (>500 mg/dL), corneal arcus, xanthomas, xanthelasmas, and marked premature and progressive atherosclerotic cardiovascular disease. It is typically diagnosed early in life, and high LDL cholesterol levels increase the risk of cardiovascular complications such as heart attacks and strokes at a young age.

In the US, cholesterol levels are measured in milligrams (mg) of cholesterol per blood deciliter (dL). While in European countries, cholesterol levels are measured in millimoles per liter (mmol/L).

The disease, if untreated, can cause aggressive narrowing and blocking of the blood vessels even before birth, which progresses rapidly, triggering serious cardiac issues for patients much earlier in life than the general population. According to the National Institutes of Health (NIH), patients with homozygous familial hypercholesterolemia have three to six times higher LDL-C levels than normal.

Homozygous Familial Hypercholesterolemia Diagnosis

Diagnosing homozygous familial hypercholesterolemia involves clinical evaluation, family history, and laboratory tests that provide access to the extent of atherosclerosis and cardiovascular involvement.

While genetic testing may provide a definitive diagnosis of homozygous familial hypercholesterolemia, genetic confirmation remains elusive in some patients. It is diagnosed based on an untreated LDL-C plasma concentration >13 mmol/L (>500 mg/dL) or a treated LDL-C concentration of =8 mmol/L (=300 mg/dL) and the presence of cutaneous or tendon xanthomas before the age of 10 years.

Currently, diagnostic criteria developed by the European Atherosclerosis Society, National Institute for Health and Care Excellence, and Japan Atherosclerosis Society are widely used to diagnose homozygous familial hypercholesterolemia.

Further details related to country-based variations are provided in the report…

Homozygous Familial Hypercholesterolemia Treatment

Homozygous familial hypercholesterolemia is challenging to manage due to the severe elevation of LDL cholesterol levels and the increased risk of early-onset cardiovascular complications. Treatment for homozygous familial hypercholesterolemia typically involves a combination of lipid-lowering medications, lifestyle modifications, and in some cases, advanced interventions. Statins are the first-line pharmacological therapies for homozygous familial hypercholesterolemia that help reduce LDL cholesterol levels in the blood. Some statins were approved in the US, like LIPITOR (atorvastatin), CRESTOR (rosuvastatin), and ZOCOR (simvastatin), but now their generics are available. ATORVALIQ (atorvastatin) was approved in 2024 by the US FDA, but it is an oral suspension of the already approved atorvastatin.

Ezetimibe is another medication that inhibits cholesterol absorption from the intestine, leading to further reductions in LDL cholesterol levels and is the first-line lipid-lowering therapy recommended for homozygous familial hypercholesterolemia. Bile acid sequestrates are also recommended but are limited mostly due to poor tolerance and low efficacy.

In those with homozygous familial hypercholesterolemia, despite the first line of therapy, various therapies like PCSK9 Inhibitors (alirocumab and evolocumab), Anti-Apo-B Therapies (lomitapide and mipomersen), and ANGPTL3 Inhibitors (evinacumab) are recommended as adjuncts to the first-line of lipid-lowering therapies. Besides these interventions to lower LDL independent of LDL-receptor lipoprotein, apheresis, and liver transplantation are also recommended.

Homozygous Familial Hypercholesterolemia Epidemiology

As the Homozygous Familial Hypercholesterolemia market is derived using a patient-based model, the homozygous familial hypercholesterolemia epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by diagnosed prevalent cases of homozygous familial hypercholesterolemia and mutation-specific cases of homozygous familial hypercholesterolemia in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Homozygous Familial Hypercholesterolemia Epidemiology Key Insights

- In 2022, the total diagnosed homozygous familial hypercholesterolemia prevalent cases were estimated to be approximately 2,845 cases in the 7MM. These cases are projected to increase during the forecast period.

- In 2022, among the 7MM, the US accounted for the highest diagnosed homozygous familial hypercholesterolemia prevalent cases, contributing nearly 47%, while Spain accounted for the least with nearly 4% of the total diagnosed prevalent cases.

- In the US, approximately 1,349 diagnosed homozygous familial hypercholesterolemia prevalence in 2022. The Homozygous Familial Hypercholesterolemia prevalence cases are expected to increase by 2034.

- In 2022, Germany ranked first among EU4 and the UK, with approximately 281 diagnosed homozygous familial hypercholesterolemia cases, followed by the UK and France with nearly 271 and 228 cases, respectively. The total Homozygous Familial Hypercholesterolemia prevalence in EU4 and the UK is expected to increase by 2034.

- In EU4 and the UK, among the homozygous familial hypercholesterolemia mutation-specific cases, a mutation in the LDLR gene accounted for the highest number of cases (nearly 947 cases), while PCSK9 had the least cases in 2022. These mutation-specific cases are expected to increase by 2034.

- Among EU4 and the UK, Germany accounted for the highest LDLR mutation-specific homozygous familial hypercholesterolemia cases in 2022, followed by the UK, France, and others.

- In Japan, the mutation in the LDLR gene was the most common, reporting approximately 289 cases, while the APOB mutation was the least common, with around 12 cases in 2022.

Homozygous Familial Hypercholesterolemia Epidemiology Segmentation

- Homozygous Familial Hypercholesterolemia Epidemiology by Total Prevalent Population

- Homozygous Familial Hypercholesterolemia Epidemiology by Diagnosed Prevalent Cases

- Homozygous Familial Hypercholesterolemia Epidemiology by Age-Based Segmentation

- Homozygous Familial Hypercholesterolemia Epidemiology by Gender-Wise Segmentation

- Homozygous Familial Hypercholesterolemia Epidemiology by Genetic Mutation Type

Homozygous Familial Hypercholesterolemia Recent Developments

- In April 2025, Esperion (NASDAQ: ESPR) announced it has reached an agreement with the FDA to begin Phase 3 trials of bempedoic acid—both as monotherapy and in combination with ezetimibe—for pediatric patients with heterozygous and homozygous familial hypercholesterolemia (HeFH and HoFH). The trials are expected to launch this year, and bempedoic acid holds orphan drug designation for HoFH.

Homozygous Familial Hypercholesterolemia Drugs Analysis

The drug chapter segment of the homozygous familial hypercholesterolemia market report encloses a detailed analysis of homozygous familial hypercholesterolemia, currently used drugs, and mid-stage (Phase II and Phase I) Homozygous Familial Hypercholesterolemia pipeline drugs. It also helps understand the homozygous familial hypercholesterolemia clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Homozygous Familial Hypercholesterolemia Marketed Drugs

EVKEEZA (evinacumab): Regeneron/Ultragenyx

EVKEEZA (evinacumab) is a recombinant human monoclonal antibody used in treating adult and pediatric patients aged 5 years and older with homozygous familial hypercholesterolemia. It is a novel lipid-lowering therapy for homozygous familial hypercholesterolemia that binds and blocks the function of ANGPTL3, a protein that plays a key role in lipid metabolism. ANGPTL3 inhibits the breakdown of these triglyceride-rich lipoproteins (LDL and chylomicrons). By inhibiting ANGPTL3, EVKEEZA allows these lipoproteins to be degraded, ultimately reducing LDL, HDL, and triglycerides.

In February 2021, the US FDA approved EVKEEZA (evinacumab) as an adjunct to other LDL-C lowering therapies to treat adult and pediatric patients aged 12 years and older with homozygous familial hypercholesterolemia, while in March 2023, it extended the approval to treat homozygous familial hypercholesterolemia in children aged 5–11 years also. In 2021, the EMA also approved EVKEEZA as an adjunct for the treatment of adult and adolescent patients aged 12 years and older with homozygous familial hypercholesterolemia.

In January 2022, Ultragenyx collaborated with Regeneron to clinically develop, commercialize and distribute EVKEEZA (evinacumab) outside of the US.

JUXTAPID/LOJUXTA (lomitapide): Chiesi Farmaceutici/Recordati

Lomitapide, sold under the brand name JUXTAPID in the US and LOJUXTA in the EU, is an oral, selective inhibitor of microsomal triglyceride transfer protein (MTP), a protein necessary for the proper assembly and secretion of cholesterol-containing molecules in the liver and the intestines.

Inhibition of MTP reduces cholesterol-containing molecules, including cholesterol, LDL-C, and triglycerides in the blood. Unlike other therapies, lomitapide does not clear the high cholesterol levels but reduces the production and release of cholesterol from the liver by reducing cholesterol absorption from the intestines. In December 2012, the US FDA approved JUXTAPID (lomitapide) capsules as an adjunct to a low-fat diet and other lipid-lowering treatments, including LDL apheresis, to treat patients with homozygous familial hypercholesterolemia. The drug received approval from the EMA in July 2013 and MHLW in September 2016. In April 2023, Chiesi Farmaceutici acquired Amryt Pharma and made an upfront payment of USD 1.25 billion.

PRALUENT (alirocumab): Regeneron/Sanofi

PRALUENT (alirocumab) is a novel injectable human monoclonal antibody that inhibits PCSK9 from binding to LDLRs, increasing the number of LDLRs available to remove LDL-C from circulation. Alirocumab is used as an adjunct to manage clinical atherosclerotic cardiovascular disease in patients who require additional LDL-C when diet and statin treatment have not worked. In April 2021, the US FDA approved PRALUENT (alirocumab) for treating homozygous familial hypercholesterolemia as an adjunct to other LDL-C-lowering therapies in adult patients.

REPATHA (evolocumab): Amgen

REPATHA (evolocumab) is a humanized monoclonal antibody that helps the liver clear LDL cholesterol by limiting the actions of a protein called PCSK9 and inhibits PCSK9 from binding to LDL receptors on the liver surface, resulting in more LDL receptors on the surface of the liver to remove LDL-C from the blood. Evolocumab is a cholesterol-lowering SC injection used as an adjunct to diet and other LDL-lowering therapies. In July 2015, the EC granted marketing approval to REPATHA (evolocumab) for the treatment of adults and adolescents aged 12 years and over with homozygous familial hypercholesterolemia in combination with other lipid-lowering therapies. In August 2015, the US FDA also approved Amgen’s REPATHA (evolocumab) injection as an adjunct to treat homozygous familial hypercholesterolemia, while in 2016, MHLW was approved in Japan.

Emerging Homozygous Familial Hypercholesterolemia Drugs

ARO-ANG3: Arrowhead Pharmaceuticals

ARO-ANG3 is an investigational, subcutaneously administrated, hepatocyte-targeted RNA interference (RNAi) therapeutic designed to specifically silence angiopoietin-like protein 3 (ANGPTL3) mRNA expression and mimic ANGPTL3 deficiency. Further, given the inhibitory role of ANGPTL3 in the metabolism of various lipoproteins and triglycerides, reduced expression and reduced circulating levels of ANGPTL3 may increase the clearance of LDL-cholesterol, HDL-cholesterol, and triglycerides. It is administrated subcutaneously and is being developed to treat dyslipidemia and metabolic diseases.

The drug is undergoing Phase II (GATEWAY) trial in patients with homozygous familial hypercholesterolemia already on stable, maximally tolerated lipid-lowering therapy, besides being developed for dyslipidemia and hypertriglyceridemia. Further, the company plans to meet with regulatory authorities in the second half of 2023 to discuss the proposed study design for the Phase III trial to investigate ARO-ANG3 in homozygous familial hypercholesterolemia.

LEQVIO (inclisiran/KJX839): Novartis/Alnylam Pharmaceuticals

LEQVIO (inclisiran/KJX839) is a potential first-in-class small interfering RNA that targets the PCSK9 enzyme, delivering effective and sustained LDL-C reduction. It reduces the production of PCSK9 through gene silencing. It consists of two nucleotide strands conjugated to the triantennary N-acetylgalactosamine (GaINAc) ligand. This ligand targets the drug in the liver by binding specifically to the asialoglycoprotein receptors (ASGPR), which are almost exclusively expressed in hepatocytes. Once bound, inclisiran is rapidly taken in by the cell, which then binds to the RNA-induced silencing complex (RISC) and the mRNA encoding PCSK9. The siRNA RISC complex cleaves the PCSK9 mRNA, preventing the synthesis of the PCSK9 protein. The drug is already approved for treating clinical atherosclerotic cardiovascular disease or heterozygous familial hypercholesterolemia.

It is undergoing two Phase III trials (adolescent and adults) and has completed multiple trials in patients with homozygous familial hypercholesterolemia already on a maximally tolerated statin dose with or without other lipid-lowering therapy. Further, the drug is also being investigated for the secondary and primary prevention of cardiovascular events and pediatric hyperlipidemia.

Note: Detailed emerging therapies assessment will be provided in the final report...

Homozygous Familial Hypercholesterolemia Drug Class Insights

According to most guidelines, the treatment should start with conventional statin therapy, and depending on the response, combination therapy should be added and/or non-pharmacologic interventions considered. Statins and ezetimibe are still the first-line therapy for patients with homozygous familial hypercholesterolemia, although their mechanism of action is LDL-receptor dependent. In those with homozygous familial hypercholesterolemia, despite the first line of therapy, PCSK9 Inhibitors (alirocumab and evolocumab), Anti-Apo-B Therapies (lomitapide and mipomersen), ANGPTL3 Inhibitors (evinacumab) are recommended. Besides these interventions to lower LDL independent of LDL-receptor lipoprotein, apheresis, and liver transplantation are also recommended.

Statins reduce LDL-C by diminishing hepatic cholesterol synthesis, acting on the 3-hydroxy-3-methylglutaryl coenzyme-A (HMG-CoA)-reductase. This leads to the upregulation of hepatic LDLR expression and the increased uptake of circulating LDL particles with consequent higher biliary cholesterol excretion in the feces. Reductions in cholesterol synthesis result in less VLDL, a precursor of LDL. Statins reduce the hepatic output of cholesterol to peripheral arteries, hence decreasing cholesterol plaque buildup.

Ezetimibe is a cholesterol-absorption inhibitor that acts at the “brush border” of the inner wall of the small intestines. The drug binds to the sterol transporter protein, called Niemann–Pick C1 like 1 (NPC1L1) protein, thereby reducing intestinal cholesterol absorption and increasing its fecal excretion

PCSK9 inhibitors are a new class of cholesterol-lowering drugs currently used as a third-line treatment for homozygous familial hypercholesterolemia or statin-intolerant or very-high atherosclerotic cardiovascular disease risk patients. PCSK9 is an enzyme produced mainly in the liver and secreted into the plasma and plays a critical role in LDL catabolism. LDL normally clears from peripheral blood as a complex with the LDLR that enters the hepatocyte. PCSK9 binds the LDLR at the hepatocyte surface, reducing its recycling from cytoplasm to cell membrane and consequently diminishing LDL clearance. Thus, inhibition of PCSK9 increases LDL-receptor expression on the cell membrane, thereby increasing LDL-C clearance.

ANGPTL3 is an endogenous inhibitor of lipoprotein and endothelial lipases. Loss-of-function variants of the ANGPTL3 gene are associated with lower serum cholesterol and triglyceride levels and a lower ASCVD risk.

Microsomal triglyceride-transfer protein (MTP), a cellular protein responsible for transporting neutral lipids between membrane vesicles, acts as a chaperone for synthesizing ApoB-containing triglyceride-rich lipoproteins. MTP is critical in the assembly and secretion of ApoB-containing lipoproteins in the liver and intestines.

Homozygous Familial Hypercholesterolemia Market Outlook

Homozygous familial hypercholesterolemia is a rare, treatment-resistant genetic disorder that affects cholesterol metabolism and is characterized by early-onset atherosclerotic and aortic valvular cardiovascular disease if left untreated. Due to the severe elevation of LDL cholesterol levels, it is challenging to manage. There are at least four genes, including LDLR, APOB, PCSK9, and LDLRAP1, that cause homozygous familial hypercholesterolemia with phenotypic variation.

The prevention of early ASCVD in patients with homozygous familial hypercholesterolemia depends on early diagnosis and efficient LLT. On-treatment LDL-C levels are shown to be the best predictor of survival, and the sooner the onset of the treatment, the lower the cardiovascular consequences. However, due to absent or defective LDL-receptor activity, most individuals with homozygous familial hypercholesterolemia resist conventional therapies that lead to LDL-C clearance by upregulating LDL receptors. Statins and ezetimibe are still the first-line therapy for patients with homozygous familial hypercholesterolemia, although their mechanism of action is LDL-receptor dependent. In those with homozygous familial hypercholesterolemia, despite the first line of therapy, PCSK9 Inhibitors (alirocumab and evolocumab), Anti-Apo-B Therapies (lomitapide and mipomersen), ANGPTL3 Inhibitors (evinacumab) are recommended. Besides these interventions to lower LDL independent of LDL-receptor lipoprotein, apheresis, and liver transplantation are also recommended.

The current treatment regimens focus on LDL-lowering therapies, with statins being the mainstay. Statin therapy is a long-term preventive treatment of choice for individuals with homozygous familial hypercholesterolemia. Various statins were approved decades back; these include simvastatin, rosuvastatin, and atorvastatin, among others. Most of these approved statins market is awash with cheap generics. CMP Pharma’s ATORVALIQ (atorvastatin) recently received approval from the US FDA for its oral suspension; however, the drug has been in the market for decades but in a different formulation. In those who persist with inadequate LDL-C concentrations, ezetimibe is prescribed as a second-line therapy for LDL-C lowering, as it reduces intestinal cholesterol absorption and increases fecal excretion. It usually adds 10–15% additional LDL-C reduction to isolated statin therapy.

PCSK9 inhibitors are a new class of cholesterol-lowering drugs currently used as a third-line treatment for homozygous familial hypercholesterolemia or statin-intolerant. These are marketed as REPATHA (evolocumab) (Amgen) and PRALUENT (alirocumab) (Regeneron/Sanofi), which got approved by the US FDA in 2015 and 2021, respectively. Both drugs are well tolerated with comparable safety profiles. Besides having a first-mover advantage over PRALUENT, REPATHA also enjoys broader geographic coverage, as it is approved in Europe and Japan for homozygous familial hypercholesterolemia. However, the biggest disadvantage of PCSK9 inhibitors is the cost, which patients and insurers are reluctant to pay.

EVKEEZA (evinacumab), developed by Regeneron and Ultragenyx, is a novel first-in-class ANGPTL3 inhibitor indicated for the treatment of children as young as 5 years old to control dangerously high levels of LDL-C caused by homozygous familial hypercholesterolemia. The US FDA and EMA have already approved the drug, and there are plans for development in Japan. As a first-in-class medicine for this relentless disease, EVKEEZA exemplifies genetics-based research to transform treatment paradigms. The drug provides Regeneron a separate niche in the homozygous familial hypercholesterolemia market space as a pharmacologic agent acting independently of the LDL receptor.

However, EVKEEZA has competition though not in the same class as another pharmacologic agent acting independently of the LDL receptor. Lomitapide, another novel molecule available to treat homozygous familial hypercholesterolemia, is an MTP inhibitor used as a lipid-lowering agent approved for treating homozygous familial hypercholesterolemia patients. JUXTAPID/LOJUXTA (lomitapide) by Chiesi Farmaceutici/Recordati is the approved product of the class. Lomitapide inhibits microsomal triglyceride-transfer protein (MTP). MTP is critical in the assembly and secretion of ApoB-containing lipoproteins in the liver and intestines. Therefore, besides triglycerides, lomitapide effectively reduces LDL-C levels in patients lacking or with defective LDL receptors. However, it is associated with Hepato-steatosis, a well-known adverse effect of lomitapide therapy. The drug contains a boxed warning citing the risk of hepatic toxicity. But this is a unique consequence of all Apo-B targeting therapies.

Despite approvals, lipid-lowering therapies are not being used enough, as homozygous familial hypercholesterolemia is systemically underdiagnosed and underrated.

Besides these, non-pharmacological are also used. Lipoprotein apheresis, which has been used for more than 45 years, is the most effective way to lower LDL-C levels in patients with homozygous familial hypercholesterolemia. Several lipid apheresis methods are almost equal in selectively removing the circulating Apo-B containing atherogenic lipoproteins, including lipoprotein. However, apheresis is an intermittent therapy that leads to a saw-tooth-like pattern of LDL-C levels. Therefore, the extent of the rebound of the LDL-C levels may diminish the expected benefits of apheresis therapy. Even liver transplantation is considered a last resort for homozygous familial hypercholesterolemia, but there are noticeable drawbacks associated with it due to the scarcity of donors and the high risk of surgical complications.

The current Homozygous Familial Hypercholesterolemia market has been covered by various lipid-lowering therapies, statins, and adjuncts like PCSK9 inhibitor, ANGPTL3 inhibitor, and MTP inhibitor that are used across the 7MM, which presents minor variations in the overall prescription pattern. Statins, other lipid-lowering therapies (ezetimibe, etc.), PCSK9 inhibitors (REPATHA and PRALUENT), MTP inhibitors (JUXTAPID/LOJUXTA), and ANGPTL3 inhibitors (EVKEEZA) the major drug classes considered for the current treatment in the forecast model.

Some of the key Homozygous Familial Hypercholesterolemia companies such as Arrowhead Pharmaceuticals’ ARO-ANG3, LIB Therapeutics’ Lerodalcibep (LIB003), and Novartis and Alnylam Pharmaceuticals’ LEQVIO (inclisiran/KJX839) and others are evaluating their lead candidates in different stages of clinical development. They aim to investigate their products for the treatment of homozygous familial hypercholesterolemia.

- The total homozygous familial hypercholesterolemia market size in the 7MM was approximately USD 108.23 million in 2022 and is projected to increase during the forecast period (2024–2034).

- According to DelveInsight’s estimates, among the 7MM, the US had the largest homozygous familial hypercholesterolemia market share, with a revenue of USD 83.37 million in 2022, and will increase at a CAGR of 8.5% during the study period due to increasing awareness of the disease, the growth of currently approved therapies and the launch of the emerging therapies.

- Among EU4 and the UK countries, Germany accounted for the maximum homozygous familial hypercholesterolemia market size in 2022, followed by the UK, while Spain occupied the bottom of the ladder.

- Japan accounted for the second largest homozygous familial hypercholesterolemia market among the 7MM, with a revenue of approximately USD 6.73 million in 2022, expected to change during the forecast period.

- The US FDA has approved various adjunct therapies with novel mechanisms of action, like PCSK9 inhibitors, ANGPTL3 inhibitors, and MTP inhibitors. These were approved for treating homozygous familial hypercholesterolemia in individuals despite using statins and other lipid-lowering agents. Among these, the MTP inhibitor class with one approved product JUXTAPID/LOJUXTA (lomitapide), occupied nearly 50% of the homozygous familial hypercholesterolemia market in the 7MM, which was highest among all therapies in the 7MM in 2022. EVKEEZA (evinacumab), an ANGPTL3 inhibitor followed by lomitapide, captured nearly 43% of the total Homozygous Familial Hypercholesterolemia market in 2022.

- Though the pipeline is limited, few therapies will enter the Homozygous Familial Hypercholesterolemia market in these already-approved classes during the forecast period. These include Arrowhead Pharmaceuticals’ ARO-ANG3, LIB Therapeutics’ Lerodalcibep (LIB003), and Novartis/Alnylam Pharmaceuticals’ LEQVIO (inclisiran/KJX839).

- Arrowhead Pharmaceuticals’ ARO-ANG3 is a novel subcutaneously administered RNA interference-based investigational medicine targeting ANGPTL3 inhibitor. It is projected to enter the Homozygous Familial Hypercholesterolemia US market by 2027, generating a revenue of USD 0.02 million in the same year.

Homozygous Familial Hypercholesterolemia Drugs Uptake

This section focuses on the uptake rate of potential Homozygous Familial Hypercholesterolemia drugs expected to be launched in the Homozygous Familial Hypercholesterolemia market during 2020–2034. For example, Arrowhead Pharmaceuticals’ ARO-ANG3, an ANGPTL3 inhibitor, with an anticipated entry by 2027 in the US, is predicted to have a slow–medium uptake during the forecast period.

Further detailed analysis of emerging therapies drug uptake in the report…

Homozygous Familial Hypercholesterolemia Pipeline Development Activities

The Homozygous Familial Hypercholesterolemia pipeline report provides insights into Homozygous Familial Hypercholesterolemia clinical trials within Phase II and Phase I. It also analyzes Homozygous Familial Hypercholesterolemia companies involved in developing targeted therapeutics.

Homozygous Familial Hypercholesterolemia Pipeline Activities

The Homozygous Familial Hypercholesterolemia clinical trials analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging homozygous familial hypercholesterolemia therapies.

KOL Views on Homozygous Familial Hypercholesterolemia Market

To keep up with current Homozygous Familial Hypercholesterolemia market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the homozygous familial hypercholesterolemia evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like Southern Illinois University School of Medicine, the University of Washington, the University Hospital of Tours, Navarra Institute for Health Research, the University of Tokyo School of Medicine, and the National Center of Neurology and Psychiatry were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or homozygous familial hypercholesterolemia market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Homozygous Familial Hypercholesterolemia Report Physician’s View

According to our primary research analysis, lipid-lowering therapies are not being used enough despite approvals. High-dose statins were the highest of all the therapies recommended to treat homozygous familial hypercholesterolemia and were the treatment of choice for homozygous familial hypercholesterolemia, but very few patients achieved current LDL cholesterol recommendations with this approach. The use of three or more LLTs was associated with lower LDL cholesterol levels and a greater likelihood of goal achievement. There is a need to improve disease awareness and increase diagnosis and treatment, as most cases are not diagnosed or not treated properly.

Homozygous Familial Hypercholesterolemia Report Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. To analyze the effectiveness of these therapies, we have calculated their attributed analysis by giving them scores based on the percentage change from baseline in LDL-C.

The therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Homozygous Familial Hypercholesterolemia Market Access and Reimbursement Scenario

Reimbursement of rare disease therapies can be limited due to lack of supporting policies and funding, challenges of high prices, lack of specific approaches to evaluating rare disease drugs given limited evidence, and payers’ concerns about budget impact. The high cost of rare disease drugs usually has a limited effect on the budget due to the small number of eligible patients being prescribed the drug. The US FDA has approved several rare disease therapies in recent years. From a patient perspective, health insurance and payer coverage guidelines surrounding rare disease treatments restrict broad access to these treatments, leaving only a small number of patients who can bypass insurance and pay for products independently.

Medicare does not have an NCD for EVKEEZA (evinacumab); however, private insurers and patient support programs are available. On approval of EVKEEZA (evinacumab) for homozygous familial hypercholesterolemia patients in February 2021, Regeneron developed the myRARE patient support program to offer financial assistance to eligible patients who need help with the out-of-pocket cost of EVKEEZA. For eligible patients, the program covers up to USD 25,000 in assistance per calendar year toward EVKEEZA out-of-pocket treatment costs, including deductibles, copays, and co-insurance for drug and administration charges. Private insurers like Cigna Healthcare, United Healthcare, and others provide coverage as EVKEEZA (evinacumab) is proven and medically necessary for treating homozygous familial hypercholesterolemia patients who fulfill eligibility criteria for homozygous familial hypercholesterolemia.

The Homozygous Familial Hypercholesterolemia market report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Homozygous Familial Hypercholesterolemia Market Report

- The Homozygous Familial Hypercholesterolemia market report covers a segment of key events, an executive summary, descriptive overview of homozygous familial hypercholesterolemia, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies in the homozygous familial hypercholesterolemia market and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the homozygous familial hypercholesterolemia market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Homozygous Familial Hypercholesterolemia market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM homozygous familial hypercholesterolemia market.

Homozygous Familial Hypercholesterolemia Market Report Insights

- Homozygous Familial Hypercholesterolemia Patient Population

- Homozygous Familial Hypercholesterolemia Therapeutic Approaches

- Homozygous Familial Hypercholesterolemia Pipeline Analysis

- Homozygous Familial Hypercholesterolemia Market Size

- Homozygous Familial Hypercholesterolemia Market Trends

- Existing and Future Homozygous Familial Hypercholesterolemia Market Opportunity

Homozygous Familial Hypercholesterolemia Market Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Homozygous Familial Hypercholesterolemia Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Homozygous Familial Hypercholesterolemia Drugs Uptake

- Key Homozygous Familial Hypercholesterolemia Market Forecast Assumptions

Homozygous Familial Hypercholesterolemia Market Report Assessment

- Current Homozygous Familial Hypercholesterolemia Treatment Practices

- Homozygous Familial Hypercholesterolemia Unmet Needs

- Homozygous Familial Hypercholesterolemia Pipeline Product Profiles

- Homozygous Familial Hypercholesterolemia Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Homozygous Familial Hypercholesterolemia Market Drivers

- Homozygous Familial Hypercholesterolemia Market Barriers

Key Questions Answered In The Homozygous Familial Hypercholesterolemia Market Report:

Homozygous Familial Hypercholesterolemia Market Insights

- What was the total homozygous familial hypercholesterolemia market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will ARO-ANG3 and LEQVIO (inclisiran/KJX839) affect the homozygous familial hypercholesterolemia treatment paradigm?

- How will EVKEEZA (evinacumab) compete with other off-label symptomatic treatments?

- Which drug is going to be the largest contributor to the homozygous familial hypercholesterolemia market by 2034?

- What are the pricing variations among different geographies for off-label therapies in the homozygous familial hypercholesterolemia market?

- How would future opportunities affect the Homozygous Familial Hypercholesterolemia market dynamics and subsequent analysis of the associated trends?

Homozygous Familial Hypercholesterolemia Epidemiology Insights

- What are the disease risk, burdens, and unmet needs in the homozygous familial hypercholesterolemia market? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to homozygous familial hypercholesterolemia?

- What is the historical and forecasted patient pool of homozygous familial hypercholesterolemia in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent homozygous familial hypercholesterolemia population during the forecast period (2024–2034)?

- What factors are contributing to the growth of homozygous familial hypercholesterolemia cases?

Current Homozygous Familial Hypercholesterolemia Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options to treat homozygous familial hypercholesterolemia?

- How many Homozygous Familial Hypercholesterolemia companies are developing therapies for the homozygous familial hypercholesterolemia treatment?

- How many emerging therapies are in the mid-stage and early stage of development for treating homozygous familial hypercholesterolemia?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitation of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted homozygous familial hypercholesterolemia market trends?

Reasons to Buy Homozygous Familial Hypercholesterolemia Market Forecast Report

- The Homozygous Familial Hypercholesterolemia market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the homozygous familial hypercholesterolemia market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming Homozygous Familial Hypercholesterolemia companies in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet need of the existing Homozygous Familial Hypercholesterolemia market so that the upcoming Homozygous Familial Hypercholesterolemia companies can strengthen their development and launch strategy.