Hospital-Acquired and Ventilator-Associated Bacterial Pneumonia Market

- Ventilator-associated pneumonia refers to lung infection occurring in patients who have undergone mechanical ventilation for over 48 hours. It ranks as the second most frequent hospital-acquired infection in pediatric and neonatal intensive care units.

- Hospital-acquired pneumonia (HAP) is pneumonia that manifests 48 hours or later after hospital admission and was not evident upon admission.

- Ventilator-associated pneumonia commonly involves bacterial infections caused by a single organism. Staphylococcus aureus is the most prevalent pathogen, followed by Pseudomonas aeruginosa and other gram-negative bacteria.

- According to the analysis, hospital-acquired bacterial pneumonia (HABP) is more prevalent in hospital settings compared to ventilator-associated bacterial pneumonia (VABP).

- Despite the availability of effective antibiotics, the mortality associated with hospital-acquired pneumonia is high. The various therapies approved by the US FDA for the treatment of HABP/VABP include Merck’s ZERBAXA and RECARBRIO, Shionogi’s FETROJA, Melinta Therapeutics’ VABOMERE, Cumberland Pharmaceuticals’ VIBATIV, and AbbVie’s/ Pfizer’s AVYCAZ/ ZAVICEFTA. However there is still a need for therapies that address the increasing antimicrobial resistance and are effective treatments against a wide spectrum of bacteria.

- XACDURO is the first pathogen-targeted therapy approved for the treatment of hospital-acquired and ventilator-associated bacterial pneumonia caused by susceptible strains of Acinetobacter baumanniicalcoaceticus complex.

- Beginning on October 1, 2023, hospitals are eligible to receive an additional payment, known as NTAP, alongside the standard MS-DRG reimbursement, totaling up to USD 13,680 per qualifying case of patients treated with XACDURO.

- Furthermore, many key players including Aridis Pharmaceuticals, Bioversys, Omnix Medical, and others are investigating their drugs in different Phases of clinical trial.

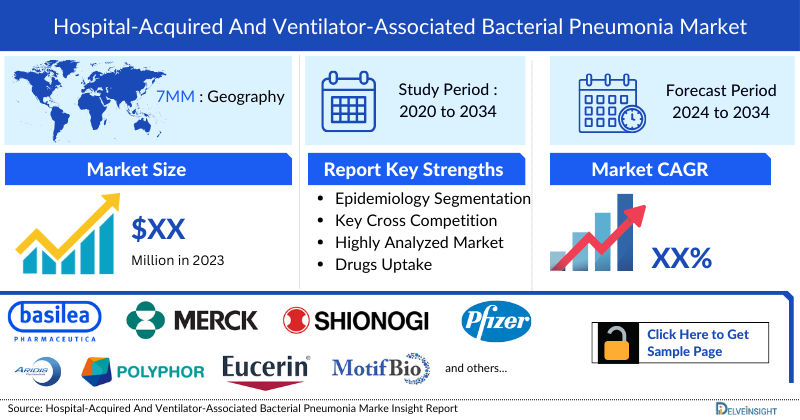

DelveInsight's “Hospital-acquired and Ventilator-associated Bacterial Pneumonia Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of Hospital-acquired and Ventilator-associated Bacterial Pneumonia, historical and forecasted epidemiology as well as the HABP/VABP market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Hospital-acquired and Ventilator-associated Bacterial Pneumonia market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM Hospital-acquired and Ventilator-associated Bacterial Pneumonia market size from 2020 to 2034. The report also covers current HABP/ VABP treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

Hospital-Acquired and Ventilator-Associated Bacterial Pneumonia Treatment Market

Hospital-Acquired and Ventilator-Associated Bacterial Pneumonia Overview, Country-Specific Treatment Guidelines and Diagnosis

Hospital-acquired bacterial pneumonia (HABP) and ventilator-associated bacterial pneumonia (VABP) represent prevalent infections among hospitalized patients, especially those in intensive care units. These conditions are linked to significant mortality rates, financial burdens, and challenges related to antibacterial resistance.

Bacterial pneumonia is often classified according to where it is acquired. Hospital-acquired pneumonia, also known as nosocomial pneumonia, occurs 48 hours or more after admission to the hospital and was not likely developing at the time of admission. Ventilator-associated pneumonia is a subtype of hospital-acquired pneumonia that emerges more than 48 hours after endotracheal intubation.

It develops in the hospital environment, so causative pathogens do include multidrug-resistant organisms that require novel antimicrobials. Common pathogens of HABP/VABP include aerobic gram-negative bacilli (Pseudomonas aeruginosa, Escherichia coli, Klebsiella pneumoniae, Enterobacter spp, Acinetobacter spp) and gram-positive cocci (Staphylococcus aureus, which includes methicillin-resistant S.aureus, Streptococcus spp). Differences in host factors and the hospital flora affect the patterns of the causative pathogens. Of these, S.aureus, P.aeruginosa, E.coli, Klebsiella, Acinetobacter, and Enterobacter species cause nearly 80% of all HABP or VABP episodes.

Further details related to country-based variations in diagnosis are provided in the report...

Hospital-Acquired and Ventilator-Associated Bacterial Pneumonia Treatment

The current standard of care for hospital-acquired pneumonia is antibiotic therapy, many times given as a combination of up to three different drugs. However, the recent emergence of virulent, antibiotic-resistant bacteria has severely limited the effectiveness of modern antibiotics, leading to increased morbidity and mortality.

Antibodies are crucial elements of the human immune system, primarily designed to combat infections. Their excellent safety profile and substantially longer in vivo half-life compared to antibiotics (lasting up to three weeks versus just hours) make them an appealing class of anti-infective agents. This longer duration of protection and less frequent dosing requirement make antibodies an attractive option for patients. Combining monoclonal antibodies with standard antibiotics as adjunctive treatment utilizes the complementary actions of both types of drugs, resulting in superior outcomes compared to either drug used alone. This approach presents a valuable treatment strategy for hospital-acquired infections and addresses the emerging healthcare challenges posed by antimicrobial resistance.

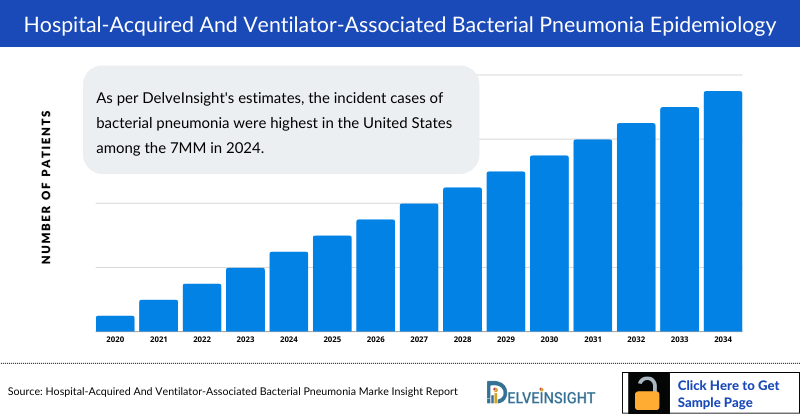

Hospital-acquired and Ventilator-associated Bacterial Pneumonia Epidemiology

The Hospital-acquired and Ventilator-associated Bacterial Pneumonia epidemiology chapter in the report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. The Hospital-acquired and Ventilator-associated Bacterial Pneumonia epidemiology is segmented with detailed insights into Total Incident Cases of Bacterial Pneumonia, Total Incident Cases of HABP/VABP, Etiology-specific Cases of HABP/VABP, and Treated Cases of HABP/VABP.

- As per DelveInsight's estimates, the incident cases of bacterial pneumonia were highest in the United States among the 7MM in 2024.

- As per the analysis, HABP is more common as compared to VABP in the United States.

- According to the findings, S.aureus, P.aeruginosa, Klebsiella, E.coli, Acinetobacter species and Enterobacter species are pathogens, which are most likely to cause HABP or VABP.

Hospital-acquired and Ventilator-associated Bacterial Pneumonia Drug Chapters

The drug chapter segment of the report encloses a detailed analysis of Hospital-acquired and Ventilator-associated Bacterial Pneumonia marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into the Hospital-acquired and Ventilator-associated Bacterial Pneumonia pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Hospital-acquired and Ventilator-associated Bacterial Pneumonia Marketed Drugs

XACDURO: Innoviva

XACDURO, a combination of sulbactam, a beta-lactam antibacterial, and durlobactam, a beta-lactamase inhibitor, was approved in May 2023 for treating hospital-acquired bacterial pneumonia and ventilator-associated bacterial pneumonia caused by susceptible strains of Acinetobacter baumannii-calcoaceticus complex (Acinetobacter). The FDA designated it as a Qualified Infectious Disease Product. In July 2022, Innoviva acquired Entasis Therapeutics, the developer of sulbactam-durlobactam.

FETROJA (cefiderocol): Shionogi

FETROJA (cefiderocol) is a cephalosporin antibiotic with a novel mechanism for penetrating the outer cell membrane of Gram-negative pathogens by acting as a siderophore. In addition to entering cells by passive diffusion through porin channels, FETROJA binds to ferric iron and is actively transported into bacterial cells through the outer membrane via the bacterial iron transporters, which function to incorporate this essential nutrient for bacteria. These mechanisms allow FETROJA to achieve high concentrations in the periplasmic space where it can bind to penicillin-binding proteins and inhibit cell wall synthesis in the bacterial cells. FETROJA has also demonstrated in vitro activity against certain bacteria that contain very problematic resistant enzymes such as ESBLs, AmpC, serine- and metallo-carbapenemases. The drug was approved in September 2020 for the treatment of patients 18 years of age or older with HABP/VABP caused by the following susceptible Gram-negative microorganisms: Acinetobacter baumannii complex, Escherichia coli, Enterobacter cloacae complex, Klebsiella pneumoniae, Pseudomonas aeruginosa and Serratia marcescens.

Note: Detailed current therapies assessment will be provided in the full report..

Hospital-acquired and Ventilator-associated Bacterial Pneumonia Emerging Drugs

AR-301: Aridis Pharmaceuticals

AR-301 (tosatoxumab) is a fully human monoclonal IgG1 antibody that targets the alpha-toxin produced by S. aureus, a significant virulence factor in both MRSA and MSSA infections. By neutralizing alpha-toxin, AR-301 prevents the destruction of host cells, thereby preserving immune function. Importantly, its mechanism of action is not impacted by the antibiotic resistance of the S. aureus strain, making it effective against both MRSA and MSSA infections.

In ongoing Phase III trials, AR-301 is being investigated as an adjunctive therapy alongside standard antibiotics for ventilator-associated pneumonia (VAP) caused by S. aureus. The results show a notable improvement in the clinical cure rate, with a ≥10% increase observed with the addition of AR-301 to standard treatment regimens. Furthermore, the safety profile of AR-301 appears to be satisfactory.

BV100: Bioversys

BV100 is a novel formulation of rifabutin suitable for intravenous administration, with a recently discovered novel mode of action showing an active uptake of rifabutin into the Gram-negative bacterial species, Acinetobacter baumannii. The candidate allows to target RNA-polymerase in Gram-negative bacteria for the first time with a human-suitable dose.

BV100 is currently in Phase II clinical trial undergoing development for the treatment of infections caused by the Acinetobacter baumannii calcoaceticus complex (ABC), including Carbapenem-Resistant ABC (CRAB), in critical indications such as ventilator-associated bacterial pneumonia (VABP), hospital-acquired bacterial pneumonia (HABP), and bloodstream infections (BSI). It received Qualified Infectious Diseases Product Designation from the US FDA in May 2019 for its potential use in treating VABP, HABP, and BSI.

|

Therapy Name |

Company Name |

ROA |

Phases |

Any Special Status |

|

AR-301 (tosatoxumab) |

Aridis Pharmaceuticals |

IV |

III |

Fast-track Designation, Qualified Infectious Diseases Product |

|

BV100 |

Bioversys |

IV |

II |

Qualified Infectious Diseases Product |

|

OMN6 |

Omnix Medical |

IV |

II |

Fast-track Designation |

Note: Detailed emerging therapies assessment will be provided in the final report..

Hospital-acquired and Ventilator-associated Bacterial Pneumonia Market Outlook

Key players, such as Aridis Pharmaceuticals, Bioversys, Omnix Medical, and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of HABP/ VABP.

The United States accounts for the largest market size of Hospital-acquired and Ventilator-associated Bacterial Pneumonia, in comparison to EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

Hospital-acquired and Ventilator-associated Bacterial Pneumonia Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report...

Hospital-acquired and Ventilator-associated Bacterial Pneumonia Activities

The report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Hospital-acquired and Ventilator-associated Bacterial Pneumonia emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging treatment patterns of HABP? VABP. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement of rare disease therapies can be limited due to lack of supporting policies and funding, challenges of high prices, lack of specific approaches to evaluating rare disease drugs given limited evidence, and payers’ concerns about budget impact. The high cost of rare disease drugs usually has a limited effect on the budget due to the small number of eligible patients being prescribed the drug. The US FDA has approved several rare disease therapies in recent years. From a patient perspective, health insurance and payer coverage guidelines surrounding rare disease treatments restrict broad access to these treatments, leaving only a small number of patients who can bypass insurance and pay for products independently.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Report

- The report covers a segment of key events, an executive summary, descriptive overview HABP/ VABP, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the HABP/ VABP market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM HABP/ VABP market.

Hospital-acquired and Ventilator-associated Bacterial Pneumonia Report Insights

- HABP/ VABP Patient Population

- HABP/ VABP Therapeutic Approaches

- Hospital-acquired and Ventilator-associated Bacterial Pneumonia Pipeline Analysis

- Hospital-acquired and Ventilator-associated Bacterial Pneumonia Market Size and Trends

- Existing and future Market Opportunity

Hospital-acquired and Ventilator-associated Bacterial Pneumonia Report Key Strengths

- Eleven Years Forecast

- 7MM Coverage

- Hospital-acquired and Ventilator-associated Bacterial Pneumonia Epidemiology Segmentation

- Inclusion of Country specific treatment guidelines

- KOL’s feedback on approved and emerging therapies

- Key Cross Competition

- Conjoint analysis

- HABP/ VABP Drugs Uptake

- Key HABP/ VABP Market Forecast Assumptions

Hospital-acquired and Ventilator-associated Bacterial Pneumonia Report Assessment

- Current HABP/ VABP Treatment Practices

- HABP/ VABP Unmet Needs

- HABP/ VABP Pipeline Product Profiles

- HABP/ VABP Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- HABP/ VABP Market Drivers

- HABP/ VABP Market Barriers

FAQs

- What is the growth rate of the 7MM Hospital-acquired and Ventilator-associated Bacterial Pneumonia treatment market?

- What was the Hospital-acquired and Ventilator-associated Bacterial Pneumonia total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends? Although multiple expert guidelines recommend testing for targetable mutations before therapy initiation, why do barriers to testing remain high?

- What are the current and emerging options for the treatment of Hospital-acquired and Ventilator-associated Bacterial Pneumonia?

- How many companies are developing therapies for the treatment of Hospital-acquired and Ventilator-associated Bacterial Pneumonia?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Hospital-acquired and Ventilator-associated Bacterial Pneumonia Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.