house dust mite disease market

Key Highlights

- The major allergenic HDM species include Dermatophagoides pteronyssinus (D. pteronyssinus), Dermatophagoides farinae (D. farinae), and Euroglyphus maynei (E. maynei). Among these, D. pteronyssinus and D. farinae are recognized as the primary allergen sources worldwide, responsible for the majority of sensitization cases in allergic individuals.

- In contrast, Blomia tropicalis (B. tropicalis) thrives only in hot and highly humid climates, making it prevalent in tropical and subtropical regions while remaining rare in temperate zones.

- To date, approximately 40 groups of HDM allergens have been identified and registered by the World Health Organization (WHO)/International Union of Immunological Societies (IUIS) Allergen Nomenclature Sub-Committee.

- HDM allergy is present in up to 90% of Asian atopic patients, far exceeding that which is seen in Western populations which report prevalence of only 50 to 70%.

- The optimal management of allergic rhinitis involves a combination of allergen avoidance, pharmacotherapy, and Allergen Immunotherapy (AIT). Standard pharmacological options—such as antihistamines, leukotriene receptor antagonists, and inhaled or intranasal corticosteroids are generally effective and safe for symptom control; however, they do not modify the underlying course of HDM-related allergic disease.

- AIT remains the only causal and disease-modifying treatment for allergies. It can be administered as Subcutaneous Immunotherapy (SCIT) via injections or as Sublingual immunotherapy (SLIT) in tablet or drop form, typically over a minimum treatment duration of 3 years.

- Currently, ODACTRA (ALK-Abelló) and ACTAIR (Stallergenes Greer) are the only available treatments that use a similar way of administration. Both products are well-established options for sublingual allergen immunotherapy in patients with allergic rhinitis.

- The absence of approved therapies for HDM-associated atopic dermatitis and the lack of innovation in the development pipeline leave this indication significantly underserved, emphasizing a major unmet medical need and a strong opportunity for future therapeutic development.

- Tregalizumab, developed by T-Balance Therapeutics, uniquely activates Tregs with high specificity and a well-defined pharmacokinetic profile, underscoring its innovative therapeutic potential.

- Few late- and mid-stage therapies like PURETHAL Mites, BELTAVAC, MM09, and tregalizumab are being evaluated for HDM-induced allergic rhinitis; however, the absence of recent clinical progress, limited efficacy and safety data, and lack of advanced-stage results make their therapeutic potential and regulatory prospects uncertain compared to established products.

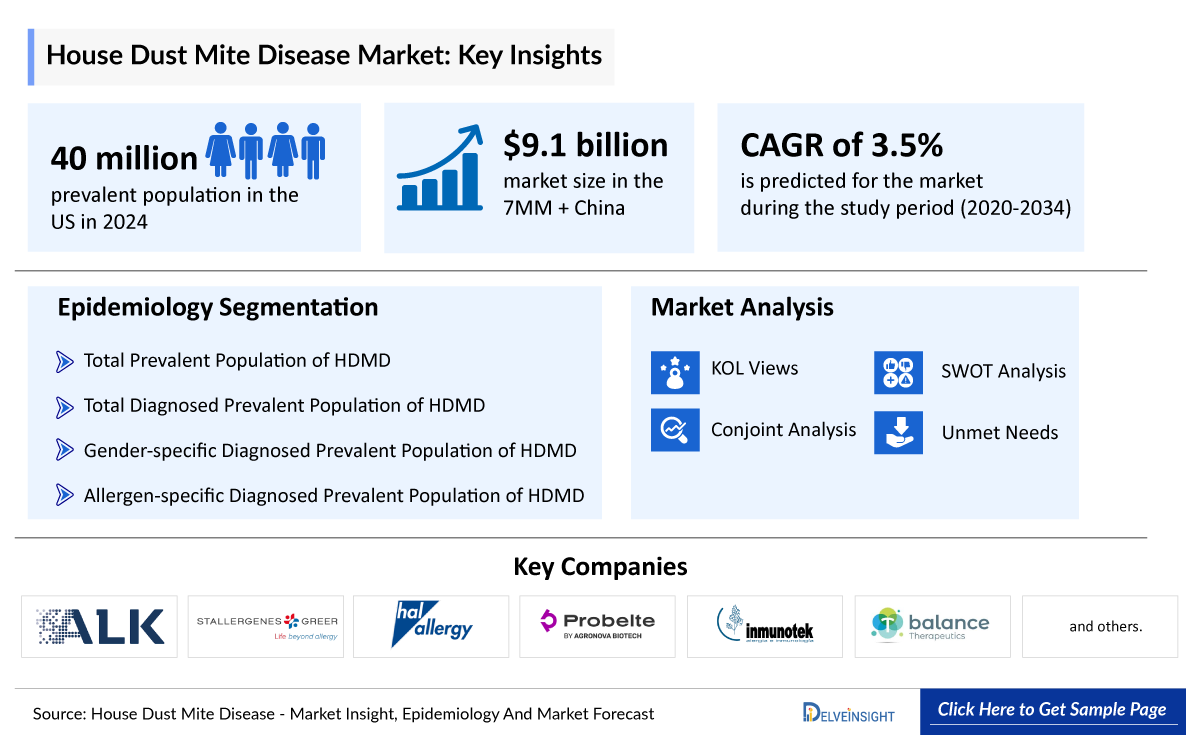

DelveInsight’s “House Dust Mite Disease (HDMD) – Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of house dust mite disease, historical and forecasted epidemiology, as well as house dust mite disease market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, Japan, and China.

The house dust mite disease market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM + China house dust mite disease market size from 2020 to 2034. The report also covers current house dust mite disease treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

- China

Study Period: 2020–2034

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, Japan, and China |

|

HDMD Epidemiology |

Segmented by:

|

|

HDMD Key Companies |

|

|

HDMD Key Therapies |

|

|

HDMD Market |

Segmented by:

|

|

Analysis |

|

House Dust Mite (HDM) Disease Understanding and Treatment Algorithm

House Dust Mite Disease (HDMD) Overview

Dust mite allergy is an allergic condition that occurs as a reaction to the dust mite allergens that commonly live in household dust. It is also known as house dust allergy. It is a sensitization and an allergic reaction to the droppings of the dust mites. The droppings are an indoor aeroallergen, which, on inhalation, triggers the allergic reaction. The HDM is a predominant source of indoor aeroallergens. Some of the allergic diseases that have been associated with the HDM are allergic rhinoconjunctivitis, allergic asthma, and atopic dermatitis. The best treatment strategy for allergic rhinitis consists of allergen avoidance first, in conjunction with pharmacotherapy and allergen immunotherapy. The untreated HDM allergy may lead to the development of severe disease manifestations such as atopic dermatitis or asthma. Diagnosis and immunotherapy of HDM allergic patients are well established, but are often hampered by the use of mite extracts that are of poor quality and lack important allergens.

House Dust Mite Disease (HDMD) Diagnosis

Diagnosis of HDM allergy is based on a combination of clinical evaluation and allergen-specific testing. A detailed medical history and symptom assessment help establish a link between exposure to dust and allergic manifestations such as rhinitis, asthma, or dermatitis. Diagnostic confirmation typically involves skin prick testing or measurement of serum-specific IgE antibodies against HDM allergens, such as D. pteronyssinus and D. farinae. In certain cases, component-resolved diagnostics may be used to identify sensitization to specific allergenic proteins, improving diagnostic precision. Environmental exposure assessment and, when needed, nasal or bronchial provocation tests can further support diagnosis. Accurate identification of HDM sensitization is essential for guiding targeted treatment strategies, including allergen immunotherapy and environmental control measures.

House Dust Mite Disease (HDMD) Treatment

Treatment of house dust mite (HDM) allergy involves a combination of pharmacological therapy, allergen immunotherapy, and environmental control measures aimed at reducing allergen exposure. Pharmacological options include antihistamines, intranasal or inhaled corticosteroids, leukotriene receptor antagonists, and bronchodilators to manage allergic rhinitis and asthma symptoms. For patients with persistent or severe disease, AIT either SCIT or SLIT offers the only disease-modifying approach by inducing immune tolerance to HDM allergens. However, AIT requires long-term treatment and may be limited by safety concerns, adherence issues, and variability in efficacy. Environmental interventions such as regular cleaning, humidity control, use of mite-proof bedding, and minimizing dust accumulation remain essential supportive measures. Emerging therapies, including targeted biologics and small molecules, are under investigation to provide safer, faster-acting, and more durable relief for HDM-associated conditions.

Further details related to treatment are provided in the report…

House Dust Mite Disease (HDMD) Epidemiology

The disease epidemiology covered in the report provides historical as well as forecasted epidemiology segmented by total prevalent population of HDMD, total diagnosed prevalent population of HDMD, gender-specific diagnosed prevalent population of HDMD, allergen-specific diagnosed prevalent population of HDMD, and total treated cases of HDMD in the 7MM + China market covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, Japan, and China from 2020 to 2034.

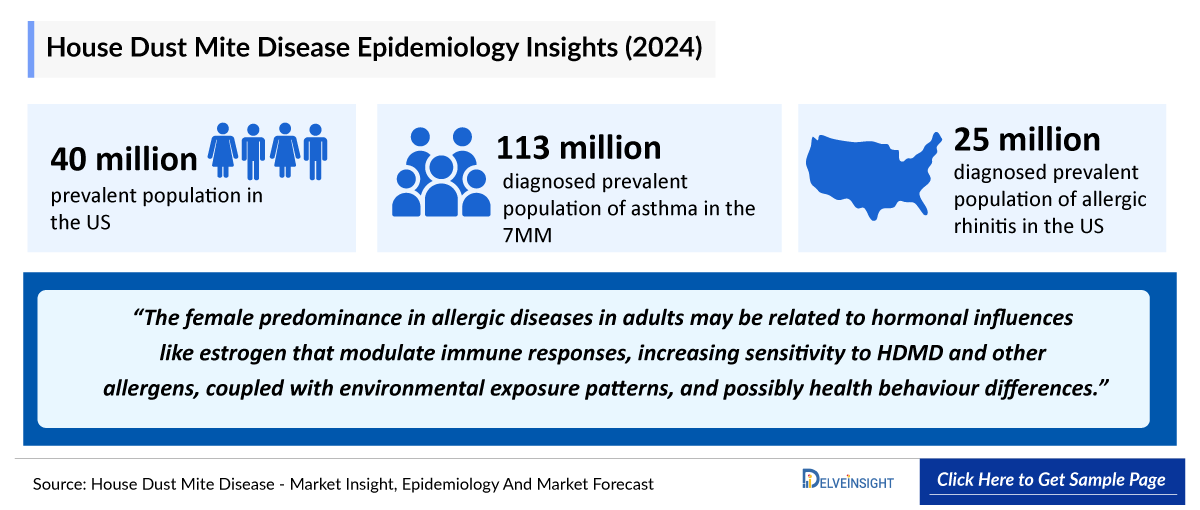

- In 2024, the diagnosed prevalent population of asthma in the 7MM was approximately 113 million. This number is expected to rise through 2034, driven by advances in complement biology, improved diagnostics, and wider use of genetic testing, complement assays, and multidisciplinary biopsy evaluation.

- The diagnosed prevalent population of allergic rhinitis, in the United States, was found to be 25 million in 2024.

- In 2024, the prevalent population of HDMD was estimated at 40 million cases. This prevalence is influenced by widespread exposure to HDM in indoor environments, increasing rates of atopy, urbanization, and changing lifestyles that favour prolonged indoor activities.

- The female predominance in allergic diseases in adults may be related to hormonal influences like estrogen that modulate immune responses, increasing sensitivity to HDMD and other allergens, coupled with environmental exposure patterns, and possibly health behaviour differences.

- In EU4 and the UK, among allergen-specific diagnosed HDM cases, Der p 2 was the most prevalent allergen, detected in approximately 92% of allergic individuals, while Der p 23 accounted for a lower share, at nearly 82%.

House Dust Mite Disease (HDMD) Drug Chapters

The drug chapter segment of the HDMD report encloses a detailed analysis of the marketed and the late-stage (Phase III and Phase II) pipeline drugs. Furthermore, the current approved drugs include ALK-Abello (ODACTRA/ACARIZAX/MITICURE), Stallergenes Greer (ACTAIR/ORYLMYTE/AITMYTE), while the emerging drugs include HAL Allergy (PURETHAL Mites), Probelte Pharma (BELTAVAC), Inmunotek (MM09), T-Balance Therapeutics (tregalizumab), and others. The drug chapter also helps understand the HDMD clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases.

Marketed Drugs

Dermatophagoides farinae and Dermatophagoides pteronyssinus (ODACTRA/ACARIZAX/MITICURE): ALK-Abello

ODACTRA is an allergen extract indicated as immunotherapy for the treatment of HDM-induced allergic rhinitis, with or without conjunctivitis.

- In February 2025, the US FDA approved ALK’s ODACTRA tablet for use in young children with HDM allergy. ODACTRA is now indicated to treat HDM-induced allergic rhinitis, with or without conjunctivitis, in children aged 5–11 years, in addition to patients aged 12 through 65.

- In January 2025, the NICE recommended the use of ACARIZAX for the treatment of persistent, moderate to severe HDM allergic rhinitis in adults and adolescents. The recommendation paves the way for patients to gain access to ACARIZAX through the NHS systems in England, Wales, and Northern Ireland, now making it eligible for general reimbursement.

- In September 2025, ALK entered into a partnership agreement with China-based Changchun GeneScience Pharmaceutical to develop and commercialize ALK’s HDM allergy immunotherapy products in Mainland China.

- Under the agreement, GenSci has been granted exclusive rights to ALK’s injectable ALUTARD HDM product, skin prick tests, and the ACARIZAX SLIT-tablet in Mainland China until the end of 2039.

House dust mite allergen extract (ACTAIR/ORYLMYTE/AITMYTE): Stallergenes Greer

ACTAIR is Stallergenes Greer’s sublingual immunotherapy tablet for the treatment of patients suffering from HDM-induced allergic rhinitis.

- In September 2025, Stallergenes Greer and Nuance Pharma entered into an exclusive long-term partnership agreement regarding the development and commercialization of ACTAIR, Stallergenes Greer’s sublingual allergen immunotherapy tablet for the treatment of HDM-induced allergic rhinitis.

- In July 2025, Stallergenes Greer and CEOLIA Pharma announced the transition of promotional activities for ACTAIR in Japan. After ending the license agreement established in 2010 with Shionogi, which had been responsible for developing, registering, and commercializing ACTAIR in Japan, Stallergenes Greer has appointed CEOLIA as its new promotional partner in the country, starting July 3.

|

Marketed Drug Key Competitors | ||||||

|

Drug |

Developer |

MoA |

RoA |

Molecule Type |

Patient segment |

Approval |

|

Dermatophagoides farinae and Dermatophagoides pteronyssinus (ODACTRA/ACARIZAX/MITICURE) |

ALK-Abello |

Immunomodulator |

SLIT tablet |

Immunotherapy |

HDM-induced allergic rhinitis, with or without conjunctivitis, for patients aged 5 through 65 years |

US: 2017 EU: 2015 JP: 2015 |

|

House dust mite allergen extract (ACTAIR/ORYLMYTE/AITMYTE) |

Stallergenes Greer |

Immunomodulator |

SLIT tablet |

Immunotherapy |

HDM induced allergic rhinitis in patients 12 years of age and older |

EU: 2021 JP: 2015 |

Emerging Drugs

House Dust Mite Allergy Vaccine (PURETHAL Mites): HAL Allergy

PURETHAL Mites is a subcutaneous allergen immunotherapy treatment that uses a chemically modified extract of HDMs (Dermatophagoides pteronyssinus and Dermatophagoides farinae) adsorbed to aluminum hydroxide. The drug is currently undergoing a Phase III clinical trial.

Alternaria Allergy Immunotherapy (BELTAVAC): Probelte Pharma

BELTAVAC is a type of subcutaneous immunotherapy for Alternaria mold allergy. Probelte Pharma has developed a safer allergen immunotherapy treatment based on a dust mite (Dermatophagoides pteronyssinus) allergen extract that has been modified through polymerization with glutaraldehyde. The drug is currently undergoing a Phase III clinical trial.

|

Comparison of Emerging Drugs Under Development for HDMD | ||||||

|

Drug Name |

Company |

Highest Phase |

Indication |

RoA |

MoA |

Molecular Type |

|

House dust mite allergy vaccine (PURETHAL Mites) |

HAL Allergy |

III |

Moderate-to-severe allergic rhinitis/rhinoconjunctivitis with or without asthma induced by HDM |

SC |

Immunomodulator |

Immunotherapy |

|

Alternaria allergy immunotherapy (BELTAVAC) |

Probelte Pharma |

III |

HDM in patients with allergic rhinitis/rhinoconjuntivitis |

SC |

Immunomodulator |

Immunotherapy |

|

MM09 |

Inmunotek |

III |

Allergy against mites (rhinitis/rhinoconjunctivitis with or without mild to moderate asthma sensitized to Dpt. and/or D. Farinae) |

SC |

Immunomodulator |

Immunotherapy |

|

Tregalizumab |

T-Balance Therapeutics |

II |

HDM |

IV and SC |

Anti-CD4 |

Monoclonal antibody |

Drug Class Insights

Most approved and emerging candidates for HDMD therapy fall under the immunomodulator class; however, tregalizumab is the only agent that specifically belongs to the anti-CD4 subclass.

Anti-CD4: Anti-CD4 monoclonal antibodies, such as tregalizumab, bind selectively to the CD4 receptor on T cells and modulate their activity without causing depletion. This interaction downregulates overactive Th2 responses while enhancing regulatory T-cell (Treg) function, restoring immune tolerance to HDM allergens. By dampening the excessive cytokine release and suppressing allergen-specific T-cell activation, anti-CD4 agents help reduce inflammation, mucus production, and tissue remodeling associated with chronic allergic disease. Thus, anti-CD4 therapy represents a targeted approach to reprogram immune balance in HDMD, offering potential benefits in reducing symptom severity and preventing disease progression, particularly in patients unresponsive to standard immunotherapy.

Note: Detailed insights will be provided in the final report.

House Dust Mite Disease (HDMD) Market Outlook

The management of HDMD primarily relies on symptomatic control using off-label and supportive therapies, underscoring the lack of approved, disease-modifying options. Current treatment strategies include antihistamines, intranasal corticosteroids, leukotriene receptor antagonists, and allergen immunotherapy (AIT) formulations. Despite being a mainstay, AIT’s efficacy varies across individuals, and its use is often limited by long treatment duration, adherence challenges, and safety concerns such as systemic allergic reactions.

The treatment landscape for HDMD has recently begun to evolve with the development of targeted immunotherapies and peptide-based vaccines designed to desensitize patients while minimizing adverse reactions. The approval of ODACTRA marked a milestone as the first SLIT tablet for HDM-induced allergic rhinitis, yet its black box warning and limited pediatric safety data highlight ongoing challenges in optimizing long-term management.

Drugs including PURETHAL Mites, BELTAVAC, and MM09 are in advanced phases of clinical development; however, recent updates on their progress are limited, indicating a lack of notable developmental activity. Since none of these candidates have yet advanced to regulatory submission or commercialization, it suggests that timelines for market entry remain uncertain. Additionally, Tregalizumab, currently in mid-stage development, demonstrates innovative therapeutic potential through its unique specificity in selectively activating Tregs and is supported by well characterized pharmacokinetic profiles, highlighting its innovative therapeutic potential.

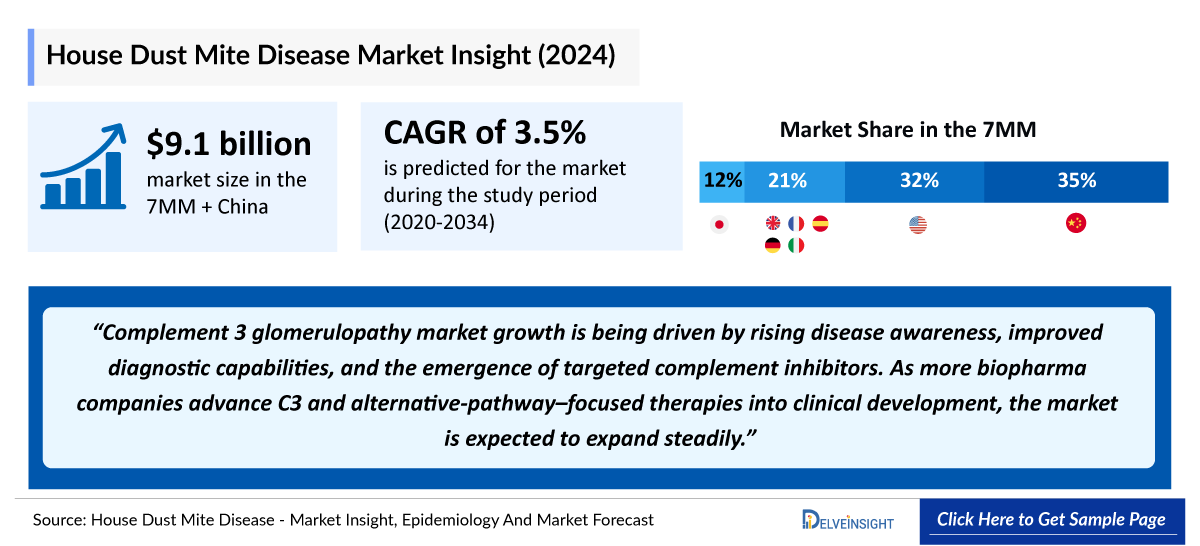

- The market size of HDMD in the 7MM + China was approximately USD 9.2 billion in 2024.

- China accounts for the largest market size of HDMD, in comparison to the United states, EU4 and the UK, and Japan, i.e., ~35% of the 7MM + China.

- The emerging pipeline of HDMD holds a few products in development by prominent key players such as HAL Allergy (PURETHAL Mites), Probelte Pharma (BELTAVAC), Inmunotek (MM09), T-Balance Therapeutics (tregalizumab), and others.

House Dust Mite Disease (HDMD) Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake. Within the approved therapies of HDMD, ODACTRA continues to experience strong market uptake, owing to its proven efficacy, convenience of sublingual administration, and growing physician confidence in managing its safety profile.

Further detailed analysis of emerging therapies, drug uptake in the report…

House Dust Mite Disease (HDMD) Activities

The report provides insights into therapeutic candidates in Phase III and II. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for house dust mite disease emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, nephrologists, Consultant Nephrologists, and Honorary Associate Professor at University Hospitals of Leicester NHS Trust, and Others.

Delveinsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM + China. Their opinion helps understand and validate current and emerging therapy treatment patterns or house dust mite disease market trends.

|

Region |

KOL Views |

|

United States |

“Patients who have perennial rhinitis, asthma, or atopic dermatitis that is not controlled by simple topical or inhaled treatment and who are allergic to dust mites should be advised to control their exposure to mite allergens. Advice about exposure should be adapted according to the severity of the patient’s disease, the climatic conditions of the area where the patient is living, and personal circumstances.” - MD, University of Virginia, US |

|

Japan |

“Pediatric allergic rhinitis by updating existing guidelines. Allergic rhinitis can be effectively treated using pharmacotherapy with H1- antihistamines or intranasal corticosteroids, in addition to allergen-specific immunotherapy (including subcutaneous or sublingual immunotherapy).”.” - MD, University of Fukui, Japan |

Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc. Reimbursement is a crucial factor that affects the drug’s access to the market. Often, the decision to reimburse comes down to the price of the drug relative to the benefit it produces in treated patients. To reduce the healthcare burden of these high-cost therapies, many payment models are being considered by payers and other industry insiders.

ALK Savings Program

The ALK Savings Program may be able to help eligible privately insured patients save on ODACTRA prescriptions at regular retail pharmacies (eg, CVS, Walgreens), specialty/mail-order pharmacies, or at an ALK Network Pharmacy.

ALK Specialty Pharmacy Network

- ALK Network Pharmacies offer specialized support for ODACTRA prescriptions, including a range of benefits for your patients and practice.

- Enhanced patient experience through automatic application of maximum savings offerings, personalized communications, and educational resources.

- Enhanced prior authorization support with specialized staff that works directly with your office.

- Enhanced fulfillment through expedited processing and shipping, and options to add other prescriptions or over-the-counter medications to the shipment

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of house dust mite disease, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborate profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the house dust mite disease market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM + China drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM + China house dust mite disease market.

House Dust Mite Disease (HDMD) Report Insights

- Patient Population

- Therapeutic Approaches

- House Dust Mite Disease Pipeline Analysis

- House Dust Mite Disease Market Size and Trends

- Existing and future Market Opportunity

House Dust Mite Disease (HDMD) Report Key Strengths

- 10 Years Forecast

- The 7MM + China Coverage

- House Dust Mite Disease Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- Drugs Uptake and Key Market Forecast Assumptions

House Dust Mite Disease (HDMD) Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Analyst Views

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the historical and forecasted house dust mite disease patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, Japan, and China?

- What was the house dust mite disease total market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- Which immunotherapy generated the highest revenue by 2034?

Reasons to Buy

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the house dust mite disease market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, Japan, and China.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights into the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.