Hyperopia Market

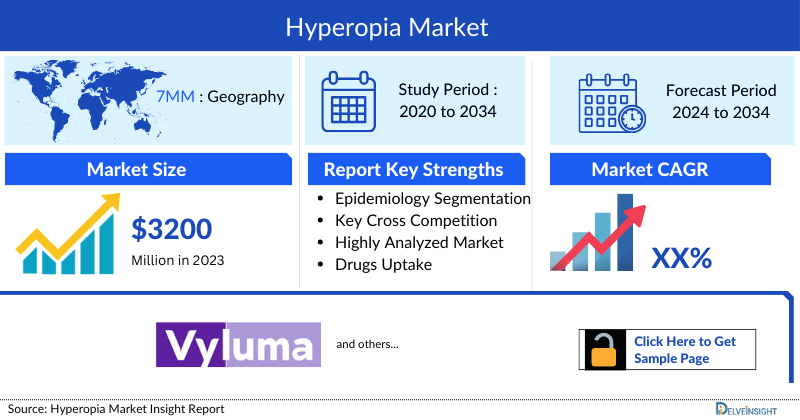

- The total hyperopia market size in the 7MM was around USD 3200 million in 2023.

- The current therapeutic landscape of Hyperopia in the 7MM is driven by prescription lenses and approved surgeries.

- The commonest treatment option for hyperopia is rehabilitation with glasses. Regular follow-ups with cycloplegic refraction are mandatory. Hyperopia can be corrected by laser refractive surgery (LASIK) or by an intraocular lens implantation

- Adult hyperopia should be treated with glasses or cataract surgery if the cataract is the cause. Unilateral/bilateral aphakia should be treated with amblyopia therapy with glasses or contact lenses immediately followed by intraocular lens implantation.

- The competitive landscape for hyperopia is not too much crowded. Currently, there are no approved therapies for hyperopia; however, Vyluma is advancing a drug NVK-033 for the treatment of Hyperopia, which is in the clinical proof-of-principal stage.

- Since hardly any companies have inclined their attention towards this area, the growth of the hyperopia market is expected to be mainly driven by the increasing prevalence of hyperopia mainly due to an increase in the geriatric population and a rise in awareness.

- Factors like weak emerging landscape, shortage of trained ophthalmologists, lack of accessibility of eye care services, and complicated reimbursement policies hinder market growth.

DelveInsight’s "Hyperopia Market Insights, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of Hyperopia, historical and forecasted epidemiology as well as the Hyperopia therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Hyperopia market report provides current treatment practices, emerging drugs, Hyperopia market share of individual therapies, and current and forecasted Hyperopia market size from 2020 to 2034, segmented by seven major markets. The report also covers current Hyperopia treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Hyperopia Market |

|

|

Hyperopias Market Size | |

|

Hyperopia Companies |

Nevakar, Zeimer Ophthalmic Systems AG, Carl Zeiss Meditec AG, AbbVie, Sydnexis, ALCON Inc., Bausch Health Companies Inc., Johnson & Johnson Vision, NIDEK CO. LTD, Topcon Corporation, Essilor Luxottica (Essilor Ltd), Regeneron Pharmaceuticals Inc., Orasis Pharmaceuticals, The Cooper Companies Inc., and others. |

|

Hyperopia Epidemiology Segmentation |

|

Hyperopia Treatment Market

Hyperopia Overview

The refractive error indicates that the eye shape does not correctly bend light, resulting in a blurred image. Myopia (nearsightedness), hyperopia (farsightedness), presbyopia (near vision loss with age), and astigmatism are the major forms of refractive errors. Hyperopia, also known as farsightedness, is a refractive defect in which distant objects are usually seen more clearly, but closer objects appear to be blurred. When the eyeball is shorter than normal or has a cornea (clear front window of the eye) that is too flat, hyperopia appears. As a consequence, instead of on it, light rays focus behind the retina. Conventionally, hyperopia is classified into low, moderate, and high to denote the degree of the condition. An error of +2.00 diopters (D) or less is considered low hyperopia. The error between +2.25 and +5.00 D is considered moderate hyperopia, and above this range, it is regarded as high hyperopia.

Hyperopia Diagnosis

For diagnosis purposes, a basic eye test involving a refraction examination and an eye health exam is generally used to detect hyperopia. The doctor looks for clinical signs like visual acuity and performs tests such as corneal examination, pupil examination, slit-lamp examination, retinal examination, and eyelid and conjunctival examination. However, if the diagnosis is delayed or the condition is left untreated in children, complications can arise and may even permanently impair their vision.

Further details related to diagnosis will be provided in the report...

Hyperopia Treatment

The primary goal of treating hyperopia is to allow the eyes to focus on objects up close. Eyeglasses or contact lenses are the most widely used options for correcting hyperopia. In other cases, people may choose to correct hyperopia with refractive surgery. The purpose of treating hyperopia with the use of corrective lenses or refractive surgery is to help concentrate light on the retina. The most widely used surgeries are laser-assisted in situ keratomileusis (LASIK), laser-assisted subepithelial keratectomy (LASEK), photorefractive keratectomy (PRK), conductive Keratoplasty (CK), phakic Intraocular Lens (IoLs), and refractive lens exchange. LASIK remains one of the safest forms of laser eye surgery.

Further details related to treatment will be provided in the report...

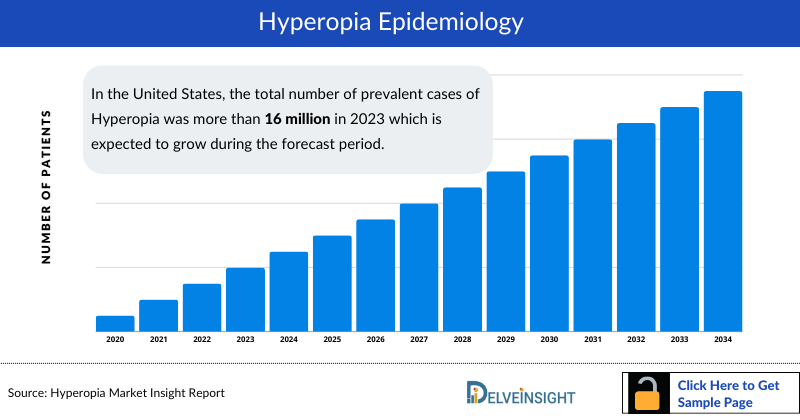

Hyperopia Epidemiology

The Hyperopia epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the Total Prevalent Cases of Hyperopia, Total Diagnosed Prevalent cases of Hyperopia, Gender-specific Cases of Hyperopia, Age-specific Cases of Hyperopia, Severity-specific Cases of Hyperopia and Total Treated cases of Hyperopia, in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- In the United States, the total number of prevalent cases of Hyperopia was more than 16 million in 2023 which is expected to grow during the forecast period.

- In 2023, Among the EU4 and the UK, Germany accounted for the highest number of diagnosed prevalent cases of Hyperopia, followed by Italy.

- It was observed that Hyperopia was more prevalent in females than males.

- As per the analysis, In the US, hyperopia was found to occur more in the age group of 60–69 years, accounting for nearly 25% of the total cases.

Hyperopia Recent Developments

- In January 2025, ZEISS Medical Technology announced that the MEL® 90 received FDA approval for myopia, hyperopia, and mixed astigmatism. The excimer laser integrates into the Corneal Refractive Workflow, providing U.S. surgeons with a fast, reliable, and streamlined surgery experience, complementing the VISUMAX® 800 with SMILE® pro to enhance refractive practices and improve patient outcomes.

Hyperopia Drug Chapters

The drug chapter segment of the Hyperopia report encloses a detailed analysis of the pipeline drugs. The drug chapter also helps understand the Hyperopia clinical trial details, pharmacological action, agreements and collaborations, approval, and patent details, and the latest news and press releases.

Hyperopia Emerging Drugs

The pipeline of hyperopia is not robust. The existing emerging pipeline of Hyperopia is poor, there is hardly any drug in the pipeline, and the ones in the emerging pipeline are either lens or surgical options. The existing unmet need for safe and efficient long-term treatment provides great potential for the advancement of new therapies.

NVK-033: Vyluma

Vyluma is developing NVK-033, directed toward targeting refractive errors I and II, respectively. It is a novel topical eye drop that temporarily improves the ability to see up close while simultaneously preserving distance vision and reducing the symptoms associated with hyperopia. Although there is not much information available publicly giving an idea about their developmental activities, looking at their progression concerning their phases, it is anticipated that they will turn out to be a potential treatment option for hyperopic patients, if and when approved.

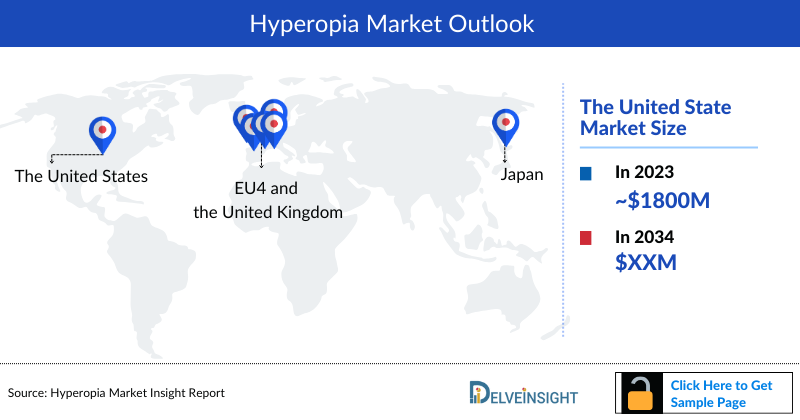

Hyperopia Market Outlook

Hyperopia is a refractive error that causes distant objects to appear clearer than nearby objects. This condition affects people of all ages and can lead to difficulties in tasks such as reading, writing, and using digital devices. The surge in the prevalence of hyperopia is one of the major factors driving the growth of the market during the forthcoming years. Depending on the degree of farsightedness, the patient may need prescription lenses to improve his near vision. For mild-to-moderate hyperopia, the options currently consist of eyeglasses and contact lenses, which are corrected within a set time frame. In 2018, the US FDA cleared Acuvue Oasys Contact Lenses, the first contact lens that immediately darkens the lens when subjected to bright light. If prescription lenses are not helpful enough then the patient can choose and shift to a surgical way of treatment. Refractive surgery options for hyperopia are designed to increase focusing power (either by changing the cornea’s shape or by placing an artificial lens inside the eye). RLE and LASIK are safe and efficacious for hyperopia when performed on the right patient population. Since each procedure has potential benefits and drawbacks, detailed informed consent is required regardless of the procedure chosen. Other surgical procedures include Laser-assisted subepithelial keratectomy (LASEK), Photorefractive keratectomy, Conductive Keratoplasty, Refractive Lens Exchange surgery, and others.

Apart from these surgical techniques, there is no drug that has been approved for the treatment of hyperopia. Contrary to other refractive errors like myopia, the emerging pipeline for hyperopia is not too much crowded. Not many companies have inclined their attention toward this area or are involved in the development of pharmaceutical assets in this indication. Currently, Vyluma is the only company to be actively involved in developing a therapeutic drug for hyperopia.

Key Findings

- Among the 7MM, the United States accounted for the highest market size i.e. approximately USD 1800 million in 2023, and is expected to grow during the forecast.

- The growing prevalence of hyperopia has been a significant driver in the hyperopia glasses market.

- In 2023, Germany held the largest market share among the EU4 and the UK, followed by the UK.

- Limited pipeline activities have been observed in this space. In the past, a few companies have tried to evaluate the potential of their product in this space but not had much success.

Hyperopia Pipeline Development Activities

The report provides insights into therapeutic candidates in different stages. It also analyzes key players involved in developing targeted therapeutics. Companies like Vyluma actively engage in research and development efforts Hyperopia. The pipeline Hyperopia possesses potential drugs. However, there is a positive outlook for the therapeutics market, with expectations of growth during the forecast period (2024–2034).

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Hyperopia emerging therapy.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on Hyperopia's evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including MDs, P ophthalmologists, and others.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. The opinion helps understand and validate current and emerging therapy treatment patterns or hyperopia market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided. Market Access and Reimbursement

The cost of LASIK surgery will depend on many variables, including the surgeon’s experience and reputation and the kind of technology used for the procedure. For all vision correction procedures performed with an excimer laser to reshape the eye’s cornea, most refractive surgeons in the US charge one fee. In other words, this extensive fee requires additional automated technology such as the use of a femtosecond laser to produce the flap in the cornea for bladeless LASIK, and is not separately priced as an “extra.” But, depending on the particular technology used, some LASIK surgeons have variable costs. For example, for a more customized procedure, they can charge more for all-laser LASIK or custom LASIK that employs wavefront technology.

Scope of the Hyperopia Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of Hyperopia, explaining its causes, signs, symptoms, pathogenesis, and currently used therapies.

- Comprehensive insight into the epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Hyperopia market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive Hyperopia.

Hyperopia Report Insights

- Hyperopia Patient Population

- Hyperopia Therapeutic Approaches

- Hyperopia Pipeline Analysis

- Hyperopia Market Size and Trends

- Existing and Future Market Opportunity

Hyperopia Report Key Strengths

- Eleven Years Forecast

- The 7MM Coverage

- Hyperopia Epidemiology Segmentation

- Key Cross Competition

- Hyperopia Drugs Uptake

- Key Hyperopia Market Forecast Assumptions

Hyperopia Report Assessment

- Current Hyperopia Treatment Practices

- Hyperopia Unmet Needs

- Hyperopia Pipeline Product Profiles

- Hyperopia Market Attractiveness

- Qualitative Analysis (SWOT and Analyst Views)

- Hyperopia Market Drivers

- Hyperopia Market Barriers

FAQs

- What was the Hyperopia market size, the market size by therapies, market share (%) distribution in 2023, and what would it look like by 2034? What are the contributing factors for this growth?

- What can be the future treatment paradigm for Hyperopia?

- What are the disease risks, burdens, and unmet needs of Hyperopia? What will be the growth opportunities across the 7MM concerning the patient population with Hyperopia?

- What are the current options for the treatment of Hyperopia? What are the current guidelines for treating Hyperopia in the 7MM?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

- What is the patient's share of Hyperopia?

Reasons to Buy Hyperopia Market Forecast Report:

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving Hyperopia.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis ranking of class-wise potential current and emerging therapies under the analyst view section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of current therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.