IgA Nephropathy Market Summary

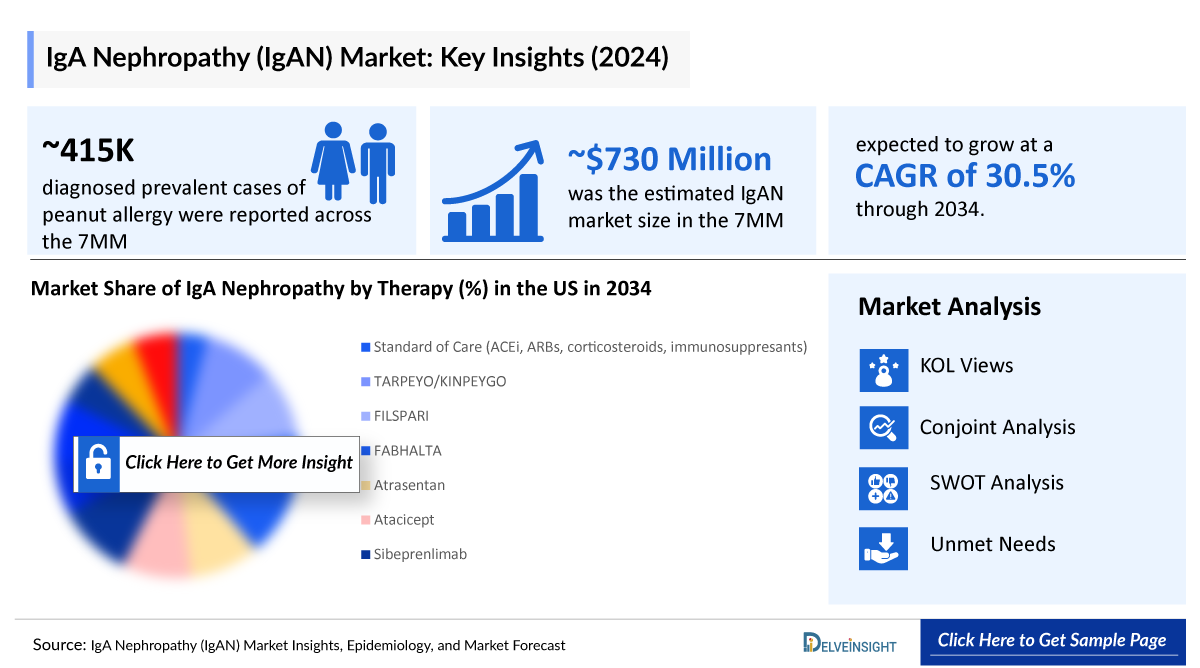

- The IgA Nephropathy market in the 7MM is valued at approximately USD 878 million in 2025.

- The IgA Nephropathy market is projected to grow at a CAGR of 30.50%, reaching USD 9,655 million by 2034 in leading countries (US, EU4, UK and Japan)

IgA Nephropathy Market and Epidemiology Analysis

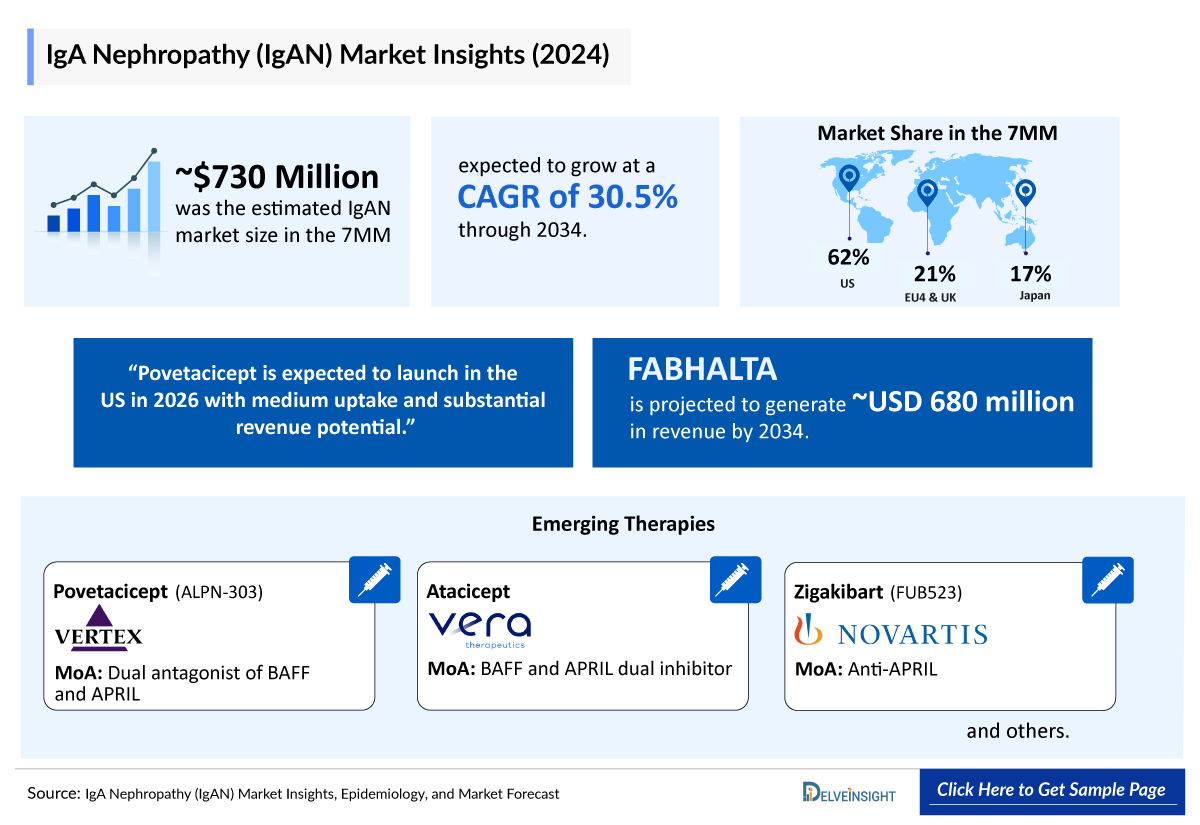

- The IgAN market size in the 7MM was valued ~USD 730 million in 2024 and is anticipated to grow with a significant CAGR of 30.5% during the study period (2020-2034).

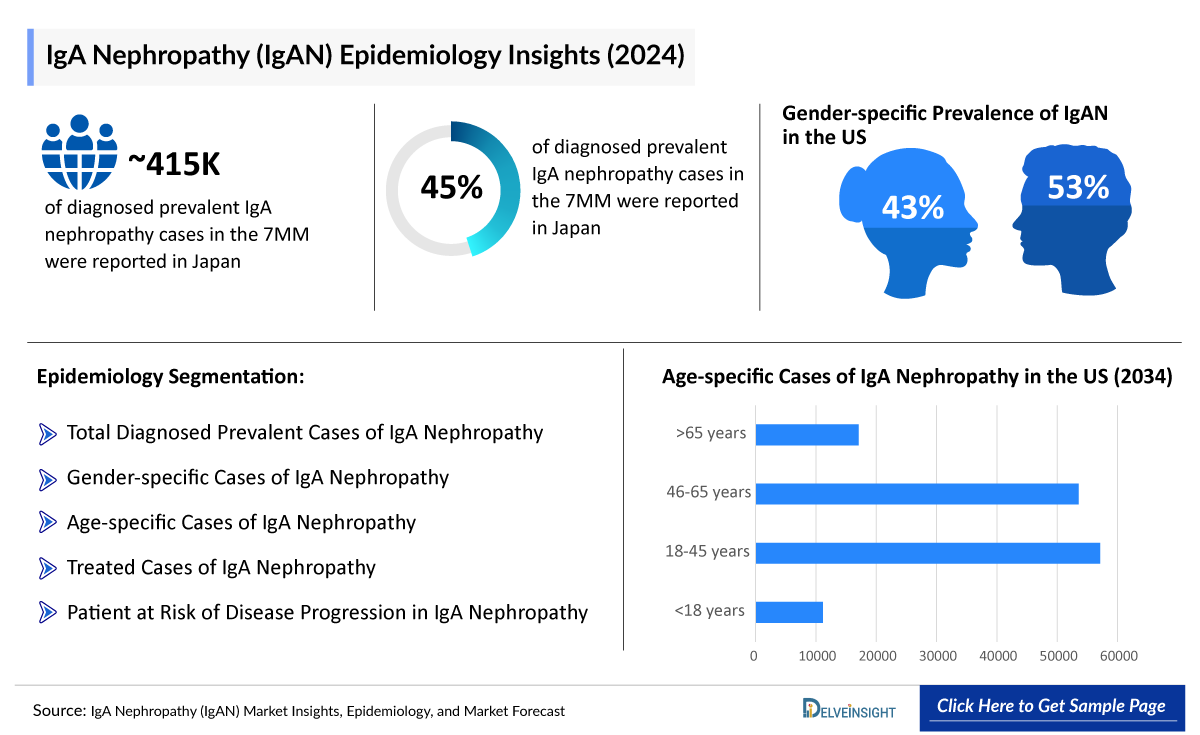

- According to DelveInsight’s estimates, there were approximately 415 thousand total diagnosed prevalent cases of IgAN in the 7MM in 2024.

- The IgAN market is projected to see consistent growth, with a robust compound annual growth rate (CAGR) anticipated from 2025 to 2034. This expansion across the 7MM will be driven by the introduction of innovative therapies, povetacicept, atacicept, zigakibart, and ULTOMIRIS, among others. Furthermore, the rising prevalence of IgAN will be fueled by factors such as improved diagnostic practices, greater disease awareness, and wider use of kidney biopsies.

- Currently, only a few drugs have been approved for IgAN treatment, including VANRAFIA (Atrasentan) and FABHALTA (Iptacopan) by Novartis, FILSPARI (Sparsentan) by Travere Therapeutics, and TARPEYO/KINPEYGO (budesonide) by Asahi Kasei (Calliditas Therapeutics), among others.

- Safety concerns continue to be a significant challenge in IgAN treatment, despite recent progress. Approved therapies often have severe side effects, such as corticosteroids causing hypertension and infections, or complement inhibitors raising infection risks. These issues hinder long-term adherence, particularly in vulnerable groups like children and older adults. As treatment increasingly focuses on chronic management, the need for safer, more targeted therapies is critical to maintaining efficacy while minimizing side effects.

- The leading IgA Nephropathy companies such as Vertex Pharmaceuticals, Vera Therapeutics, Novartis, and AstraZeneca (Alexion Pharmaceuticals), among others are dveloping therapies for IgA Nephropathy treatment.

- In April 2025, Novartis announced that the FDA has granted accelerated approval for Vanrafia® (atrasentan), an oral endothelin A receptor antagonist, to reduce proteinuria in adults with primary immunoglobulin A nephropathy (IgAN) at risk of rapid progression (UPCR ≥1.5 g/g). Vanrafia is taken once daily alongside standard supportive care.

- In April 2025, Vera Therapeutics completed full enrollment in the pivotal ORIGIN Phase III trial evaluating atacicept in patients with IgAN.

IgA Nephropathy Market size and forecast

- 2025 IgA Nephropathy Market Size: USD 878 million

- 2034 Projected IgA Nephropathy Market Size: USD 9,655 million

- IgA Nephropathy Growth Rate (2025-2034): 30.50% CAGR

- Largest IgA Nephropathy Market: United States

Key Factors Driving IgA Nephropathy Market

Rising Prevalence of IgA Nephropathy

IgA Nephropathy (IgAN) is one of the most common primary glomerular diseases worldwide and remains a leading cause of chronic kidney disease (CKD) and end-stage renal disease (ESRD). According to DelveInsight’s estimates, there were approximately 415,000 diagnosed prevalent cases of IgAN across the 7MM in 2024, a number expected to increase by 2034 at a CAGR of 0.6%. The growth of this patient pool is supported by improved diagnostic practices, greater awareness among healthcare providers, and wider use of kidney biopsies.

Current Market Landscape and Emerging Competitors

The IgAN market has begun to expand with the approval of targeted therapies, including VANRAFIA (Atrasentan) and FABHALTA (Iptacopan) by Novartis, FILSPARI (Sparsentan) by Travere Therapeutics, and TARPEYO/KINPEYGO (budesonide) by Asahi Kasei (Calliditas Therapeutics). Novel therapies such as povetacicept, atacicept, zigakibart, and ULTOMIRIS are expected to drive significant competition and reshape the treatment landscape.

Increased IgA Nephropathy Clinical Trial Activity

The IgAN pipeline is robust, with several emerging therapies in clinical development targeting key disease pathways. Key investigational drugs include Povetacicept (Vertex Pharmaceuticals), Atacicept (Vera Therapeutics), Zigakibart (Novartis), ULTOMIRIS/Ravulizumab (AstraZeneca/Alexion Pharmaceuticals), and others. These candidates represent diverse mechanisms, including B-cell modulation, APRIL pathway inhibition, and complement inhibition, reflecting the growing focus on targeted and safer therapeutic approaches for long-term disease management.

DelveInsight’s “IgA Nephropathy (IgAN) Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of IgAN, historical and forecasted epidemiology, as well as the IgAN market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The IgAN market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM IgAN market size from 2020 to 2034. The report also covers IgAN treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2025-2034 |

|

Geographies Covered |

|

|

IgA Nephropathy Market |

|

|

IgA Nephropathy Market Size | |

|

IgA Nephropathy Companies |

Novartis, F. Hoffmann-La Roche, Ionis Pharmaceuticals, AstraZeneca (Alexion Pharmaceuticals), Vertex Pharmaceuticals, Otsuka Pharmaceutical, Biogen, Arrowhead Pharmaceuticals, NovelMed, Q32 Bio, Walden Biosciences, Takeda Pharmaceutical, Vera Therapeutics, and others |

|

IgA Nephropathy Epidemiology Segmentation |

|

IgA Nephropathy Understanding

IgAN overview

IgAN is an autoimmune disease characterized by the accumulation of IgA antibodies in the kidneys, leading to inflammation and progressive damage. These immune deposits primarily affect the glomeruli, which are the tiny blood vessels responsible for filtering blood. This damage causes leakage of blood and protein into the urine and, over time, results in scarring of the nephrons, the functional units of the kidneys. As the disease progresses, it impairs kidney function, potentially leading to chronic kidney disease or kidney failure. The underlying mechanism of IgAN is multi-faceted, with genetic factors contributing to the overproduction of galactose-deficient IgA1, which triggers autoantibody formation, immune complex deposition, and complement activation, particularly through the lectin and alternative pathways. Environmental factors such as infections, obesity, and hypertension further exacerbate glomerular inflammation and fibrosis.

The exact cause of IgAN remains unclear, but research suggests a combination of genetic and environmental influences. In many cases, the disease is triggered by respiratory infections that cause an abnormal immune response, leading to elevated IgA antibody levels that accumulate in the glomeruli. Risk factors for IgAN include a family history of the condition or related diseases, such as Henoch–Schönlein purpura. Though it can occur at any age, IgAN most commonly affects males in their teenage years to late 30s. The disease often goes undetected for years due to the absence of obvious symptoms, with diagnosis typically occurring incidentally through routine tests. Key signs include blood in the urine, proteinuria, elevated blood pressure, and increased creatinine levels, indicating impaired kidney function.

Further details related to country-based variations are provided in the report…

IgAN Diagnosis

Early diagnosis of IgAN is hindered in Western healthcare systems by the absence of structured screening—routine urinalysis and renal biopsy are not widely implemented—leading to delayed intervention. In contrast, Japan’s systematic screening enables earlier detection. Globally, the lack of reliable noninvasive biomarkers further complicates prompt diagnosis and monitoring. Current evaluation relies on urinalysis to detect hematuria and proteinuria, urine protein-creatinine ratio (UPCR), estimated glomerular filtration rate (eGFR), and, when indicated, kidney biopsy for definitive histological confirmation.

IgAN Treatment

Treatment of IgAN focuses on reducing proteinuria, controlling blood pressure and slowing disease progression. First-line therapy comprises angiotensin-converting enzyme inhibitors (ACE inhibitors) or angiotensin receptor blockers (ARBs), with sodium-glucose co-transporter 2 inhibitors (SGLT2 inhibitors) offering additional renal protection. Novel targeted agents such as sparsentan, which combines endothelin receptor antagonism with angiotensin receptor blockade, and targeted-release budesonide have shown promise. Approved options include VANRAFIA (Atrasentan), FABHALTA (Iptacopan), FILSPARI (Sparsentan) and TARPEYO/KINPEYGO (budesonide). IgA Nephropathy clinical trials are advancing rapidly, focusing on innovative therapies that target disease progression, reduce proteinuria, and improve kidney function in patients affected by this chronic glomerular condition.

IgA Nephropathy Epidemiology

As the market is derived using a patient-based model, the IgAN epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent cases of IgAN, gender-specific diagnosed prevalent cases of IgAN, age-specific diagnosed prevalent cases of IgAN, in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

Key Findings from IgA Nephropathy Epidemiological Analyses and Forecast

- DelveInsight estimates that there were approximately 415 thousand prevalent cases of IgAN across the 7MM in 2024. These diagnosed prevalent cases are projected to rise by 2034 at a CAGR of 0.6%.

- In 2024, the US accounted for around 133 thousand diagnosed prevalent cases of IgAN, expected to increase by 2034.

- Between EU4 and the UK, Germany had the highest number of diagnosed prevalent cases of IgAN in 2024, with approximately 30 thousand cases, while Spain had the lowest, with around 5 thousand cases.

- In 2024, Japan recorded the highest number of diagnosed prevalent cases of IgAN among the 7MM, nearly 175 thousand, which is expected to rise by 2034.

- In terms of gender-specific diagnosed prevalent cases of IgAN, France had approximately 16 thousand male and 8 thousand female cases in 2024, with these numbers expected to rise by 2034.

- Regarding age-specific diagnosed prevalent cases of IgAN, the UK reported nearly 2 thousand, 11 thousand, 11 thousand, and 3 thousand cases in the <18 years, 18–45 years, 46–65 years, and >65 age groups in 2024. These numbers are expected to grow by 2034.

IgA Nephropathy Epidemiology Segmentation

- Total Diagnosed Prevalent Cases of IgAN

- Gender-specific Diagnosed Prevalent Cases of IgAN

- Age-specific Diagnosed Prevalent Cases of IgAN

IgA Nephropathy Market Recent Developments and Breakthroughs

- In August 2025, Travere Therapeutics announced FDA approval of updated REMS labeling for FILSPARI® (sparsentan), used to treat IgA nephropathy (IgAN). The update reduces liver function monitoring to every three months and removes the embryo-fetal toxicity monitoring requirement.

- In May 2025, Otsuka and OPDC announced that the FDA has accepted the Biologics License Application for sibeprenlimab, an investigational antibody targeting APRIL, for the treatment of adults with IgA nephropathy (IgAN).

- In April 2025, Novartis announced that the FDA has granted accelerated approval for Vanrafia® (atrasentan), an oral endothelin A receptor antagonist, to reduce proteinuria in adults with primary immunoglobulin A nephropathy (IgAN) at risk of rapid progression (UPCR ≥1.5 g/g). Vanrafia is taken once daily alongside standard supportive care.

IgA Nephropathy Drug Analysis

The IgAN drug chapter segment encloses a detailed analysis of IgAN marketed drugs and pipeline drugs. It also helps understand the IgAN clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases. The IgA Nephropathy drugs market is witnessing significant growth due to increasing prevalence, emerging therapies, and rising R\&D investments focused on improving outcomes for patients with this chronic kidney condition.

IgA Nephropathy Marketed Drugs

VANRAFIA (atrasentan): Novartis

Atrasentan, a selective oral Endothelin A Receptor (ETAR) antagonist, is being developed for IgAN and other rare kidney disorders. Acquired by Novartis through the Chinook Therapeutics acquisition, atrasentan aims to reduce proteinuria and slow kidney function decline, aligning with Novartis' precision nephrology focus. Additionally, Novartis received US FDA accelerated approval for VANRAFIA, based on its ability to reduce proteinuria in IgAN patients, though its effect on kidney function decline remains unproven. Continued approval depends on results from an ongoing Phase III trial, with final data expected in Q1 2026.

In April 2025, Novartis received US FDA accelerated approval for VANRAFIA, the first selective ETAR antagonist approved to reduce proteinuria in patients with primary IgAN at risk of rapid disease progression, based on early efficacy data. Continued approval depends on results from the ongoing Phase III ALIGN trial, assessing its impact on disease progression through eGFR changes, with final data expected in 2026. Additionally, in December 2021, Atrasentan received Orphan Drug Designation (ODD) from the European Medicines Agency (EMA) for primary IgAN, recognizing its potential in treating this rare kidney condition. In May 2024, Novartis reported positive Phase III data for Atrasentan, showing a clinically meaningful reduction in proteinuria in IgAN patients.

FILSPARI (sparsentan): Travere Therapeutics

FILSPARI is the first and only oral, once-daily, non-immunosuppressive therapy approved in both the US and Europe for IgAN. It targets glomerular injury by blocking endothelin-1 and angiotensin II, offering a long-term solution to preserve kidney function. Available through the FILSPARI Risk Evaluation and Mitigation Strategies (REMS) program due to potential risks, it is marketed in Europe by CSL Vifor and in Japan by Renalys Pharma, with registration-enabling study results expected in the second half of 2025.

In February 2023, the US FDA granted accelerated approval to FILSPARI (sparsentan) to reduce proteinuria in adults with primary IgAN at risk of rapid progression, with priority review. In April 2024, CSL Vifor and Travere Therapeutics received Conditional Marketing Authorization (CMA) from the European Commission for FILSPARI in the EU, targeting adults with IgAN and significant proteinuria. September 2024 saw the FDA grant full approval for FILSPARI to slow kidney function decline in IgAN patients, based on positive long-term results from the PROTECT Study. In November 2024, FILSPARI was approved by the MHRA for primary IgAN treatment, and sparsentan received approval in Germany for the same indication.

TARPEYO/KINPEYGO (budesonide): Asahi Kasei (Calliditas Therapeutics)

Budesonide delayed-release capsules, marketed as TARPEYO in the US, are approved to reduce proteinuria in adults with primary IgAN at risk of rapid progression. Targeted for ileal release, the drug modulates immune responses involved in IgA pathogenesis, significantly reducing proteinuria and stabilizing kidney function. In Europe, it is sold as KINPEYGO through a partnership with STADA Arzneimittel, with orphan drug status and market exclusivity until 2032. In Japan, Viatris is developing it as NEFECON (VR-205), with Phase III results expected in 2026.

In July 2024, Calliditas Therapeutics' partner, STADA, received full approval from the European Commission (EC) for KINPEYGO to treat IgAN, with orphan medicinal product status and market exclusivity until 2032. In December 2023, TARPEYO (budesonide) received full US FDA approval to reduce kidney function loss in adults with IgAN at risk of progression, following December 2021’s accelerated approval for treating primary IgAN. Additionally, in February 2023, the UK MHRA granted CMA for KINPEYGO for IgAN treatment.

IgA Nephropathy Emerging Drugs

Povetacicept (ALPN-303): Vertex Pharmaceuticals

Povetacicept (ALPN-303) is a dual antagonist of B-cell activating factor (BAFF) and a proliferation-inducing ligand (APRIL), key cytokines involved in B cell, T cell, and innate immune cell function. Engineered with a transmembrane activator and CAML interactor (TACI) domain, it demonstrates enhanced potency and superior binding affinity in preclinical studies compared to existing BAFF/APRIL inhibitors. Clinical data in IgAN have shown best-in-class efficacy, supporting its potential as a disease-modifying therapy.

Vertex Pharmaceuticals is advancing the global Phase III RAINIER trial of povetacicept in patients with IgAN across the US, Europe, and Asia. Enrollment for the interim analysis cohort is expected to conclude in 2025; with plans to pursue the US accelerated approval based on 36-week treatment data. This strategic program follows Vertex’s May 2024 acquisition of Alpine Immune Sciences for approximately USD 5 billion, securing povetacicept as a lead asset in its immunology pipeline.

Atacicept: Vera Therapeutics

Atacicept is an investigational recombinant fusion protein designed to inhibit BAFF and APRIL, two cytokines central to B-cell survival and autoantibody production. By targeting these immune pathways, atacicept addresses a key pathogenic mechanism in IgAN driven by abnormal B-cell activity. In May 2024, the US FDA granted atacicept Breakthrough Therapy Designation for IgAN, recognizing its potential to offer significant clinical benefit.

Vera Therapeutics is advancing atacicept through the pivotal ORIGIN Phase III trial, with full enrollment completed in April 2025 and primary endpoint cohort enrollment finalized early in September 2024. This 200-patient cohort will provide 36-week urine protein-to-creatinine ratio (UPCR) data, expected to support a planned Biologics License Application (BLA) submission to the US FDA following topline results in Q2 2025. Additionally, the PIONEER study is set to begin in 2025 to evaluate atacicept in broader IgAN populations, including patients with significantly reduced kidney function, atypical proteinuria levels, and recurrent disease post–kidney transplant.

Zigakibart (FUB523): Novartis

Zigakibart (FUB523; formerly BION-1301) is a subcutaneous monoclonal antibody targeting APRIL, currently in Phase III development for IgAN, with regulatory filing anticipated in 2027. The therapeutic approach is based on modulating APRIL-mediated immune activity, which contributes to disease pathogenesis. Zigakibart was previously evaluated in a Phase I/II study: Parts 1 and 2 confirmed safety in healthy volunteers, while Part 3 investigated efficacy in IgAN patients. In November 2022, interim data from Cohorts 1 and 2 presented at ASN Kidney Week supported the selection of a 600 mg biweekly subcutaneous dose for advancement into Phase III trials.

In July 2022, the EC granted ODD to BION-1301 for the treatment of primary IgAN, providing regulatory incentives to support its development in Europe. Further bolstering its IgAN pipeline, Novartis acquired Chinook Therapeutics in August 2023 in a deal worth up to USD 3.5 billion, integrating zigakibart and other renal-focused assets into its late-stage portfolio.

IgA Nephropathy Drug Class Analysis

Two drug classes primarily define the treatment landscape for IgAN: endothelin receptor antagonists (ERA) and immunosuppressive agents. ERAs like VANRAFIA (atrasentan) and FILSPARI (sparsentan) have emerged as key options for managing proteinuria, a critical marker of IgAN progression. VANRAFIA targets the endothelin-1 pathway, which contributes to inflammation and fibrosis, while FILSPARI offers a dual-target approach by combining endothelin receptor A antagonism with angiotensin II receptor blockade. These treatments offer a non-immunosuppressive alternative, addressing proteinuria with fewer safety concerns than traditional immunosuppressive therapies.

Immunosuppressive drugs, such as corticosteroids and other agents, remain essential for managing more aggressive IgAN but are often limited by their risk profiles, including infections and long-term complications. This has led to the increasing use of targeted treatments like TARPEYO, which modulates immune pathways to reduce proteinuria and slow disease progression, and FABHALTA, which targets T-cell responses. These drugs reflect a shift towards precision medicine in IgAN, offering treatments that focus on specific disease mechanisms while minimizing the broad immunosuppressive effects typical of older therapies. Together, these marketed options provide a more nuanced and individualized approach to managing IgAN, improving outcomes with a greater emphasis on safety.

Continued in report…

IgA Nephropathy Market Outlook

IgAN, the most common primary glomerulonephritis, can progress to renal failure, driven by glomerular deposition of galactose-deficient IgA1–autoantibody complexes and subsequent inflammatory damage. Management centers on optimized supportive care—blood pressure control, proteinuria reduction, and lifestyle interventions—while the role of immunosuppressive therapy remains selective and risk-based. Despite advances, no cure exists, and treatment remains individualized based on disease severity and progression risk. The evolving landscape increasingly integrates targeted therapies, reflecting a shift toward precision medicine. Continued unmet needs in efficacy, safety, and personalization are expected to fuel sustained market growth.

Pharmacologic therapy is central to IgAN management, with Renin–angiotensin System Blockers (RASB), including ACE inhibitors and ARBs, as first-line agents to reduce proteinuria and blood pressure, even in normotensive patients with proteinuria >0.5 g/day. Corticosteroids remain the most established immunosuppressants but are limited by safety concerns, especially in advanced disease. Mycophenolate mofetil may benefit select populations, while cyclophosphamide is reserved for severe crescentic forms. Non-pharmacologic measures—sodium restriction, weight control, exercise, smoking cessation, and statin use—complement pharmacotherapy, supporting renal and cardiovascular health. Omega-3 fatty acids, tonsillectomy, and plasma exchange are considered in specific high-risk or refractory cases.

TARPEYO/KINPEYGO (budesonide) received full US FDA approval in December 2023 and conditional authorization in the EU and UK in July 2024 and June 2024, respectively. As a gut-targeted corticosteroid, it broadens access to all primary IgAN patients regardless of proteinuria, though glucocorticoid-related risks like hypertension and hypercortisolism remain. FILSPARI (sparsentan), approved in the US in September 2024 and EU in April 2024, offers a dual ETA/AT1 mechanism but faces access challenges due to REMS, boxed warnings, and missed eGFR targets. VANRAFIA (atrasentan), FDA-approved in April 2025, showed strong proteinuria reduction without REMS but carries similar safety warnings, requiring ongoing liver and pregnancy monitoring.

Key IgA Nephropathy players like Vertex Pharmaceutical’s Povetacicept, Vera Therapeutic’s Atacicept, Novartis’s Zigakibart, and AstraZeneca’s ULTOMIRIS (ravulizumab), among others are involved in the development of Phase III, Phase II and Phase I drugs.

- The total market size of IgAN in the 7MM was approximately USD 730 million in 2024 and is projected to increase during the forecast period (2025–2034).

- The market size for IgAN in the US was approximately USD 455 million in 2024 and is anticipated to increase due to the launch of emerging therapies.

- The total market size of EU4 and the UK was calculated to be approximately USD 150 million in 2024, which was nearly 21% of the total market revenue for the 7MM and is expected to increase by 2034.

- In 2024, Germany dominated the market between EU4 and the UK, generating around USD 45 million. France followed closely with approximately USD 35 million, while Italy recorded around USD 30 million.

- In 2024, the total market size of IgAN was approximately USD 125 million in Japan, which is anticipated to increase during the forecast period (2025-2034).

- Estimates suggest that povetacicept is expected to launch in the US in 2026 and is expected to generate a substantial revenue with a medium uptake.

IgA Nephropathy Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034.

Further detailed analysis of emerging therapies drug uptake in the report…

IgA Nephropathy Pipeline Development Activities

The IgA Nephropathy pipeline report provides insights into IgA Nephropathy clinical trials within Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

IgA NephropathyPipeline development activities

The IgA Nephropathy clinical trials analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for IgAN.

Latest KOL Views IgA Nephropathy

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on IgAN evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the Geffen School of Medicine at UCLA, US, Washington University, US, American Kidney Fund, US, Institute for Molecular Cardiovascular Research, Aachen, Germany, Service de néphrologie, Hôpital Nord CHU Saint Etienne, France, University of Bari, Italy, Hospital Universitario 12 de Octubre, Madrid, Spain, Cambridge University Hospital NHS Trust, UK, and Juntendo University Faculty of Medicine, Japan, among others, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or IgAN market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

What KOLs are saying on IgA Nephropathy Patient Trends?

As per the KOLs from the US, the harmful and potentially dangerous side effects of the present steroid-based regimens for IgAN cannot be ignored, and efforts need to be made to define the optimal dosing strategies and regimens better if steroids are to become a mainstay of treatment for patients who fail to achieve the threshold of proteinuria that defines high risk for progression to kidney failure after a program of ‘supportive’ therapy.

As per the KOLs from France, renal biopsy findings, including the MEST-C score and C4d deposits on immunofluorescence, offer critical insights into disease activity. When combined with clinical indicators, these pathological features can help identify patients likely to benefit from early intervention, enabling more precise, personalized treatment strategies and potentially improving long-term kidney outcomes.

As per the KOLs from Japan, a significant number of IgAN cases likely go undiagnosed, often remaining silent without noticeable symptoms. Findings from healthy kidney donors suggest many individuals may unknowingly live with the disease. Diagnosis typically occurs by chance, often prompted by visible hematuria, indicating missed opportunities for earlier detection and intervention.

IgA Nephropathy Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

IgA Nephropathy Market Access and Reimbursement

TARPEYO Touchpoints Copay Assistance Program

Financial assistance programs

The TARPEYO Touchpoints program in the US offers comprehensive support to patients, including personalized guidance from Care Navigators to identify financial assistance options. Commercially insured patients may qualify for the Copay Assistance Program, potentially reducing out-of-pocket costs to as little as USD 0 per prescription. For uninsured or underinsured individuals, the Patient Assistance Program (PAP) may provide TARPEYO at no cost, based on residency, prescription validity, insurance status, and income verification.

Eligibility excludes those with government-funded insurance. Notably, between January 2022 and February 2024, assistance was extended broadly across all insurance types.

Further details will be provided in the report.

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the IgA Nephropathy Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of IgAN, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will affect the current treatment landscape.

- A detailed review of the IgAN market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM IgAN market.

IgA Nephropathy Market Report Insights

- IgA Nephropathy Patient Population

- IgA Nephropathy Therapeutic Approaches

- IgAN Pipeline Analysis

- IgAN Market Size and Trends

- Existing and Future Market Opportunity

IgA Nephropathy Market Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- IgAN Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- IgA Nephropathy Drugs Uptake

- Key IgA Nephropathy Market Forecast Assumptions

IgA Nephropathy Market Report Assessment

- Current IgA Nephropathy Treatment Practices

- IgA Nephropathy Unmet Needs

- IgA Nephropathy Pipeline Product Profiles

- IgA Nephropathy Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

- IgA Nephropathy Market Drivers

- IgA Nephropathy Market Barriers

Key Questions Answered In The IgA Nephropathy Market Report:

IgA Nephropathy Market Insights

- What was the total market size of IgAN, the market size of IgAN by therapies, and market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will povetacicept affect the treatment paradigm of IgAN?

- How will TARPEYO/KINPEYGO compete with other upcoming products and marketed therapies?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed therapies?

- How would future opportunities affect the market dynamics and subsequent analysis of the associated trends?

IgA Nephropathy Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of IgAN? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to IgAN?

- What is the historical and forecasted IgAN patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent IgAN population during the forecast period (2025–2034)?

- What factors are contributing to the growth of IgAN cases?

Current IgA Nephropathy Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of IgAN? What are the current clinical and treatment guidelines for treating IgAN?

- How many IgA Nephropathy companies are developing therapies for the treatment of IgAN?

- How many emerging therapies are in the mid-stage and late stage of development for treating IgAN?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted market of IgAN?

Reasons to Buy IgA Nephropathy Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the IgAN market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying upcoming solid players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis, ranking of class-wise potential current, and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for IgAN, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-market.png&w=256&q=75)

-epidemiology.png&w=256&q=75)