IZERVAY Summary

Key Factors Driving IZERVAY Growth

1. Market Share Gains and New Patient Starts

- IZERVAY is steadily gaining traction in the Geographic Atrophy market, supported by increasing new patient starts following its commercial launch.

- Rising physician confidence in complement inhibition is driving broader adoption among retina specialists.

- Growth in treatment initiation is supported by a large, previously untreated Geographic Atrophy patient population with high unmet need.

- Commercial execution, including targeted physician education and real-world data dissemination, is contributing to improved uptake.

2. Expansion Across Key Indications

- Geographic Atrophy Secondary to AMD: IZERVAY is approved to slow Geographic Atrophy lesion growth, addressing a major unmet need in retinal degeneration.

- Earlier Intervention in Geographic Atrophy: Increasing use in earlier-stage Geographic Atrophy patients reflects a shift toward proactive disease management.

- Potential Label and Lifecycle Opportunities: Ongoing research and post-marketing insights may support optimization of dosing, patient selection, and long-term outcomes.

- While currently focused on Geographic Atrophy, continued scientific advances in complement biology may inform future development strategies.

3. Geographic Expansion

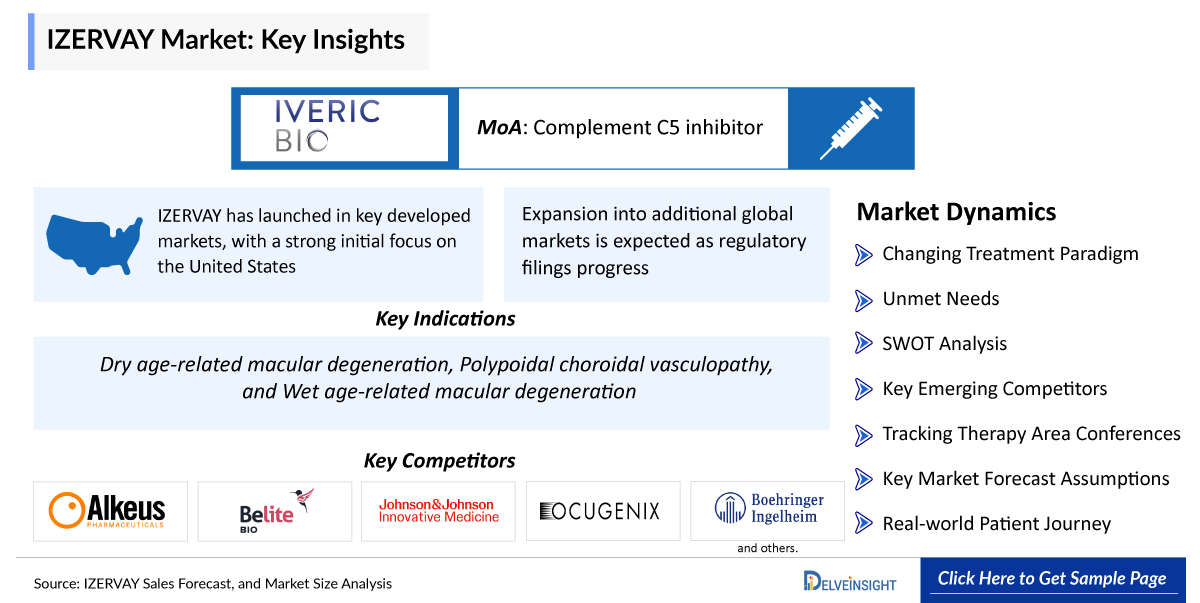

- IZERVAY has launched in key developed markets, with a strong initial focus on the United States.

- Expansion into additional global markets is expected as regulatory filings progress.

- Markets such as Europe and Asia-Pacific represent significant long-term growth opportunities due to aging populations and rising AMD prevalence.

- Commercial partnerships and distribution strategies are being strengthened to support international uptake.

4. New Indication Approvals

- IZERVAY has received regulatory approval for GA secondary to AMD, significantly expanding the therapeutic landscape in retinal disease.

- The approval positions IZERVAY as a key competitor within the complement inhibitor class, alongside other GA therapies.

- Successful regulatory milestones enhance the sponsor’s ophthalmology portfolio and establish a foundation for future lifecycle management.

5. Strong GA Volume Momentum

- GA represents a major volume-driven growth opportunity, given the chronic nature of the disease and lack of curative options.

- IZERVAY is benefiting from sustained prescription momentum, driven by growing diagnosis rates and increased treatment persistence.

- Clinical trial outcomes demonstrating statistically significant slowing of GA progression continue to support physician adoption.

- Real-world experience is reinforcing the role of complement inhibition in long-term GA management.

6. Competitive Differentiation and Market Trends

- C5 complement inhibition provides mechanistic differentiation from other GA therapies targeting upstream complement components.

- Monthly intravitreal administration aligns with established retina clinic workflows.

- Favorable risk–benefit perception supports adoption in a chronic, elderly patient population.

- Broader market trends such as earlier treatment initiation, imaging-driven monitoring, and value-based ophthalmic care—support IZERVAY’s positioning.

- Growing reliance on real-world evidence (RWE) is strengthening payer and prescriber confidence in long-term disease modification.

IZERVAY Recent Developments

- In December 2025, Astellas Pharma announced the first results from the open-label extension trial of the Phase III GATHER2 study, which demonstrated monthly treatment with IZERVAY (avacincaptad pegol intravitreal solution) in patients with Geographic Atrophy (GA) secondary to age-related macular degeneration (AMD) continued to reduce GA lesion growth for up to 3.5 years, with earlier intervention resulting in greater protection of retinal tissue area. IZERVAY was well tolerated, with no cases of retinal vasculitis or occlusive vasculitis. These findings, which indicate a cumulative treatment benefit with IZERVAY, were presented at the American Academy of Ophthalmology 2025 Annual Meeting (AAO 2025).

“IZERVAY Sales Forecast, and Market Size Analysis – 2034” report provides comprehensive insights of IZERVAY for approved indication like Dry age-related macular degeneration; as well as potential inidcations like Polypoidal choroidal vasculopathy; and Wet age-related macular degeneration in the 7MM. A detailed picture of IZERVAY’s existing usage in approved and anticipated entry and performance in potential indications in the 7MM, i.e., the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan for the study period 2020 –2034 is provided in this report along with a detailed description of the IZERVAY for approved and potential indications. The IZERVAY market report provides insights about IZERVAY’s sales forecast, mechanism of action (MoA), dosage and administration, as well as research and development including regulatory milestones, along with other developmental activities. Further, it also consists of historical and current IZERVAY performance, future market assessments inclusive of the IZERVAY market forecast analysis for approved and potential indications in the 7MM, SWOT, analysts’ views, comprehensive overview of market competitors, and brief about other emerging therapies in respective indications. It also provides analysis of IZERVAY sales forecasts, along with factors driving its market.

IZERVAY Drug Summary

IZERVAY (Avacincaptad pegol) is a complement C5 inhibitor indicated for treating Geographic Atrophy (GA) secondary to age-related macular degeneration (AMD). This RNA aptamer, covalently bound to a branched polyethylene glycol (PEG) structure for stability, specifically binds and inhibits complement protein C5 to prevent cleavage into C5a and C5b-9 (membrane attack complex), thereby reducing retinal inflammation, photoreceptor loss, and GA lesion growth by 18-35% over one year in Phase III trials (GATHER1/2). Administered as a 2 mg (0.1 mL of 20 mg/mL) intravitreal injection every month by qualified ophthalmologists following aseptic technique, it carries warnings for endophthalmitis, neovascular AMD conversion, and intraocular inflammation, with contraindications for active ocular infections. The report provides IZERVAY’s sales, growth barriers and drivers, post usage and approvals in multiple indications.

Scope of the IZERVAY Market Report

The report provides insights into:

- A comprehensive product overview including the IZERVAY MoA, description, dosage and administration, research and development activities in approved indications like Dry age-related macular degeneration; as well as potential inidcations like Polypoidal choroidal vasculopathy; and Wet age-related macular degeneration.

- Elaborated details on IZERVAY regulatory milestones and other development activities have been provided in IZERVAY market report.

- The report also highlights IZERVAY‘s cost estimates and regional variations, reported and estimated sales performance, research and development activities in approved and potential indications across the United States, Europe, and Japan.

- The IZERVAY market report also covers the patents information, generic entry and impact on cost cut.

- The IZERVAY market report contains current and forecasted IZERVAY sales for approved and potential indications till 2034.

- Comprehensive coverage of the late-stage emerging therapies for respective indications.

- The IZERVAY market report also features the SWOT analysis with analyst views for IZERVAY in approved and potential indications.

Methodology

The IZERVAY market report is built using data and information sourced primarily from internal databases, primary and secondary research and in-house analysis by DelveInsight’s team of industry experts. Information and data from the secondary sources have been obtained from various printable and nonprintable sources like search engines, news websites, global regulatory authorities websites, trade journals, white papers, magazines, books, trade associations, industry associations, industry portals and access to available databases.

IZERVAY Analytical Perspective by DelveInsight

In-depth IZERVAY Market Assessment

This IZERVAY sales market forecast report provides a detailed market assessment of IZERVAY for approved indication like Dry age-related macular degeneration; as well as potential inidcations like Polypoidal choroidal vasculopathy; and Wet age-related macular degeneration in the seven major markets, i.e., the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan. This segment of the report provides current and forecasted IZERVAY sales data uptil 2034.

IZERVAY Clinical Assessment

The IZERVAY market report provides the clinical trials information of IZERVAY for approved and potential indications covering trial interventions, trial conditions, trial status, start and completion dates.

IZERVAY Competitive Landscape

The report provides Insights on competitors and marketed products within the domain, along with a summary of emerging products and their respective launch dates, posing significant competition in the market.

IZERVAY Market Potential & Revenue Forecast

- Projected market size for the IZERVAY and its key indications

- Estimated IZERVAY sales potential (IZERVAY peak sales forecasts)

- IZERVAY Pricing strategies and reimbursement landscape

IZERVAY Competitive Intelligence

- Number of competing drugs in development (pipeline analysis)

- IZERVAY Market positioning compared to existing treatments

- IZERVAY Strengths & weaknesses relative to competitors

IZERVAY Regulatory & Commercial Milestones

- IZERVAY Key regulatory approvals & expected launch timelines

- Commercial partnerships, licensing deals, and M&A activity

IZERVAY Clinical Differentiation

- IZERVAY Efficacy & safety advantages over existing drugs

- IZERVAY Unique selling points

IZERVAY Market Report Highlights

- In the coming years, the IZERVAY market scenario is set to change due to strong adoption, increased prescriptions and broader uptake in multiple immunological indications; which would expand the size of the market.

- The IZERVAY companies are developing therapies that focus on novel approaches to treat/improve the disease condition, assess challenges, and seek opportunities that could influence IZERVAY’s dominance.

- Other emerging products for like Dry age-related macular degeneration; as well as potential inidcations like Polypoidal choroidal vasculopathy; and Wet age-related macular degeneration are expected to give tough market competition to IZERVAY and launch of late-stage emerging therapies in the near future will significantly impact the market.

- A detailed description of regulatory milestones, and developmental activities, provide the current development scenario of IZERVAY in approved and potential indications.

- Analyse IZERVAY cost, pricing trends and market positioning to support strategic decision-making in the immunology landscape.

- Our in-depth analysis of the forecasted IZERVAY sales data uptil 2034 will support the clients in decision-making process regarding their therapeutic portfolio by identifying the overall scenario of IZERVAY in approved and potential indications.

Key Questions Answered In The IZERVAY Market Report

- What is the class of therapy, route of administration and mechanism of action of IZERVAY? How strong is IZERVAY’s clinical and commercial performance?

- What is IZERVAY’s clinical trial status in each individual indications such as like Dry age-related macular degeneration; as well as potential inidcations like Polypoidal choroidal vasculopathy; and Wet age-related macular degeneration and study completion date?

- What are the key collaborations, mergers and acquisitions, licensing and other activities related to the IZERVAY Manufacturers?

- What are the key designations that have been granted to IZERVAY for approved and potential indications? How are they going to impact IZERVAY’s penetration in various geographies?

- What is the current and forecasted IZERVAY market scenario for approved and potential indications? What are the key assumptions behind the forecast?

- What are the current and forecasted sales of IZERVAY in the seven major countries, including the United States, Europe (Germany, France, Italy, Spain) and the United Kingdom, and Japan?

- What are the other emerging products available and how are these giving competition to IZERVAY for approved and potential indications?

- Which are the late-stage emerging therapies under development for the treatment of approved and potential indications?

- How cost-effective is IZERVAY? What is the duration of therapy and what are the geographical variations in cost per patient?