Lambert Eaton Myasthenic Syndrome Market

- In December 2023, Catalyst Pharmaceuticals announced that its collaboration partner, DyDo Pharma, has submitted a New Drug Application (NDA) to Japan's Pharmaceuticals and Medical Devices Agency (PMDA) seeking marketing approval for FIRDAPSE (amifampridine) for the treatment of Lambert-Eaton Myasthenic Syndrome (LEMS) in Japan.

- In 2022, The Food and Drug Administration (FDA) expanded the approval of FIRDAPSE (amifampridine) to include patients 6 years of age and older with Lambert-Eaton Myasthenic Syndrome. Previously, the treatment had been approved for adults with Lambert-Eaton Myasthenic Syndrome.

- In February 2022, the FDA has withdrawn approval for RUZURGI, that was granted by the US FDA in May 2019 for treating LEMS in patients 6 to <17 years of age. Previously, in June 2019 Catalyst brought suit against the FDA, challenging the FDA’s approval of RUZURGI stating that it violated the orphan-drug exclusivity (ODE) for FIRDAPSE. In 2022, the Court of Appeals for the Eleventh Circuit sided with Catalyst, therefore, the FDA had to withdraw approval for RUZURGI. Due to the 7-year ODE for FIRDAPSE, RUZURGI may not be approved for marketing until ODE expire on November 28, 2025.

- Presently there are no approved therapies of LEMS in Japan.

Request for unlocking the CAGR of the Lambert Eaton Myasthenic Syndrome Drugs Market

DelveInsight's “Lambert–Eaton Myasthenic Syndrome Drugs Market Insight, Epidemiology and Market Forecast – 2034” report delivers an in-depth analysis of Lambert–Eaton Myasthenic Syndrome epidemiology, market, and clinical development in Lambert–Eaton Myasthenic Syndrome. In addition to this, the report provides historical and forecasted epidemiology and market data as well as a detailed analysis of the Lambert–Eaton Myasthenic Syndrome market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

Lambert–Eaton Myasthenic Syndrome Drugs Market Report provides real-world prescription pattern analysis, emerging drugs assessment, market share, and uptake/adoption pattern of individual therapies, as well as historical and forecasted Lambert–Eaton Myasthenic Syndrome market size from 2020 to 2034 in 7MM. The report also covers current Lambert–Eaton Myasthenic Syndrome treatment market practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

|

|

Lambert–Eaton Myasthenic Syndrome Epidemiology |

Segmented by:

|

|

Lambert–Eaton Myasthenic Syndrome Companies |

|

|

Lambert–Eaton Myasthenic Syndrome Therapies |

|

|

Lambert–Eaton Myasthenic Syndrome Drugs Market |

Segmented by:

|

|

Analysis |

|

Lambert–Eaton Myasthenic Syndrome Treatment Market: Understanding and Algorithm

Lambert–Eaton Myasthenic Syndrome (LEMS) is an autoimmune disease in which the immune system attacks the body's tissues. The attack occurs at the connection between nerve and muscle (the neuromuscular junction) and interferes with the ability of nerve cells to send signals to muscle cells. Specifically, the immune system attacks the calcium channels on nerve endings that are required to trigger the release of chemicals (acetylcholine). There are two types of Lambert–Eaton Myasthenic Syndrome, paraneoplastic, in which the disease is associated with cancer, and non-paraneoplastic with no known underlying cause.

The presence of clinical features such as proximal muscle weakness associated with areflexia and autonomic dysfunction should prompt an evaluation for Lambert–Eaton Myasthenic Syndrome. The diagnosis of Lambert–Eaton Myasthenic Syndrome is often difficult if the disease is not suspected since weakness in the legs with or without arm weakness and fatigue are common complaints in general. The diagnosis is more likely to be suspected in people with cancer. Often, the initial suspected diagnosis is myasthenia gravis (MG), due to an overlap in symptoms. The presence of a dry mouth is also a helpful clue. The diagnosis of Lambert–Eaton Myasthenic Syndrome can be confirmed by the presence of antibodies against P/Q-type voltage-gated calcium channels (VGCC) along with electro diagnostic studies. If a diagnosis of Lambert-Eaton Myasthenic Syndrome is confirmed, a CT scan is obtained to look for small-cell lung cancer. If negative, a PET-CT is considered. If negative, follow-up chest CTs are recommended for up to five years to monitor for underlying cancer.

The Lambert–Eaton Myasthenic Syndrome report provides an overview of Lambert–Eaton Myasthenic Syndrome pathophysiology, and diagnostic approaches along with a real-world scenario of a patient’s journey beginning from the first symptom, the time taken for diagnosis to the entire treatment process.

Lambert–Eaton Myasthenic Syndrome Treatment

There is no cure for Lambert–Eaton Myasthenic Syndrome and symptomatic treatments for neuromuscular weakness that results from Lambert–Eaton Myasthenic Syndrome are favored. Medications and therapies that may be used to treat Lambert–Eaton Myasthenic Syndrome include 3, 4-diamino pyridine (enhances acetylcholine release), anticholinesterase agents (e.g., pyridostigmine), plasma exchange, intravenous immunoglobulins (IVIG), and medications that suppress the immune system (e.g., prednisone, azathioprine).

Lambert–Eaton Myasthenic Syndrome Epidemiology

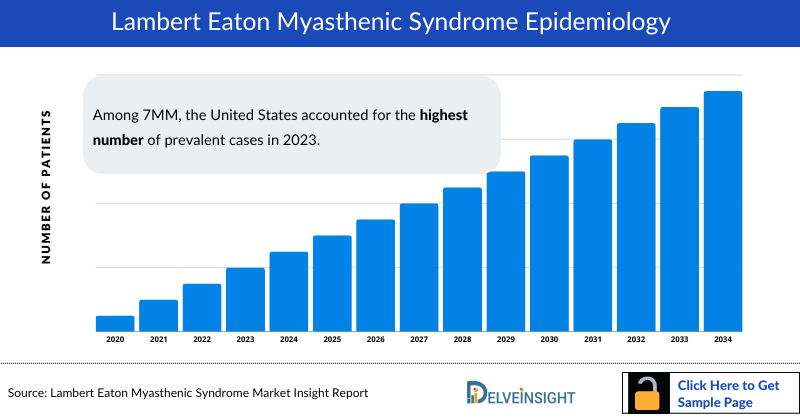

The Lambert–Eaton Myasthenic Syndrome epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as Total Prevalent Cases of Lambert–Eaton Myasthenic Syndrome, Total Diagnosed Prevalent Cases of Lambert–Eaton Myasthenic Syndrome, Gender-specific Diagnosed Prevalent Cases of Lambert–Eaton Myasthenic Syndrome, Type-specific Diagnosed Prevalent Cases of Lambert–Eaton Myasthenic Syndrome, Diagnosed Prevalent Cases of Lambert–Eaton Myasthenic Syndrome by Malignancy in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain)and the United Kingdom, and Japan from 2020 to 2034.

- Among 7MM, the United States accounted for the highest number of prevalent cases in 2023.

- Amongst EU4 and the UK, Germany had the highest number of prevalent cases of Lambert–Eaton Myasthenic Syndrome followed by France and the UK. On the other hand, Spain had the lowest prevalent cases in 2023.

- Based on the etiology, Lambert–Eaton Myasthenic Syndrome is divided into two types; paraneoplastic and idiopathic.

- Among the two forms, the paraneoplastic form constitutes more than half of the cases and is mostly associated with intrathoracic neoplasms. Most of the cases Lambert–Eaton Myasthenic Syndrome were seen with small cell lung cancer, other subtypes of lung cancer are extremely rare.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Lambert–Eaton Myasthenic Syndrome Prevalence

Lambert–Eaton Myasthenic Syndrome Drugs Market Chapters

The drug chapter segment of the Lambert–Eaton Myasthenic Syndrome drugs market report encloses a detailed analysis of Lambert–Eaton Myasthenic Syndrome marketed drugs and late-stage (Phase III and Phase II) Lambert–Eaton Myasthenic Syndrome pipeline drugs. It also deep dives into the pivotal Lambert–Eaton Myasthenic Syndrome clinical trials details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Lambert–Eaton Myasthenic Syndrome Marketed Drugs

- FIRDAPSE (amifampridine): Catalyst Pharmaceuticals

Firdapse (amifampridine) is a potassium channel blocker used to treat Lambert–Eaton Myasthenic Syndrome in adults. The active ingredient of FIRDAPSE is amifampridine phosphate, which is a voltage-gated potassium channel blocker. Amifampridine phosphate is described chemically as 3, 4-diaminopyridine phosphate. Each FIRDAPSE tablet contains 10 mg amifampridine (equivalent to 18.98 mg amifampridine phosphate). The drug was developed by BioMarin Pharmaceutical and is marketed by Catalyst Pharmaceutical, which secured the marketing rights to Firdapse in North America. The US Food and Drug Administration approved FIRDAPSE in November 2018.

|

Drug Name |

Company |

MoA |

RoA |

Approval |

|

FIRDAPSE |

Catalyst Pharmaceuticals |

potassium channel blocker |

Oral |

US:2018 EU: 2022 |

Lambert–Eaton Myasthenic Syndrome Emerging Drugs

The Lambert–Eaton Myasthenic Syndrome pipeline is not robust as there is no drug under clinical trials for the development process.

Lambert–Eaton Myasthenic Syndrome Market Outlook

Currently, there is no cure for Lambert–Eaton Myasthenic Syndrome, and treatment is mainly symptomatic. This includes 3, 4-diamino pyridine phosphate (DAP), which is usually well-tolerated and effective. In some patients, the combination of pyridostigmine with 3, 4-diaminopyridine phosphate has been suggested to have an additional positive effect. If symptomatic treatment is insufficient, immunosuppressive therapy with prednisone, alone or in combination with azathioprine, can achieve long-term control of the disorder. Plasmapheresis and high-dose administration of intravenous immunoglobulins (IVIGs) have a short effect. An effective treatment against any tumor present is mandatory, both to control the tumor and to improve the clinical symptoms of Lambert–Eaton Myasthenic Syndrome. One-half of the patients suffering from LEMS have an idiopathic form, the other half a tumor-associated form of the disease. In general, LEMS responds well to symptomatic and immunosuppressive treatments.

So far, the FDA had approved two medications for Lambert-Eaton Myasthenic Syndrome, i.e., FIRDAPSE and RUZURGI. However, RUZURGI was withdrawn by the FDA in 2022. The FDA’s approval of FIRDAPSE is a potentially transformative milestone in the lives of patients in the US suffering from Lambert–Eaton Myasthenic Syndrome, as it now gives adult Lambert–Eaton Myasthenic Syndrome patients access to a new first-in-class-therapy. FIRDAPSE is approved in the US and the European Union for use by patients with Lambert–Eaton Myasthenic Syndrome.

- The Lambert–Eaton Myasthenic Syndrome Market Size shall grow during the forecast period owing to the increased awareness among patients, updated diagnosis and treatment guidelines, and growth in the diseased population.

- Among 7MM, the United States accounts for the largest Lambert–Eaton Myasthenic Syndrome Market Size in 2023.

- The current Lambert–Eaton Myasthenic Syndrome Market Size is mainly dependent on symptomatic treatment regimens.

- Given the absence of therapies available in Japan for this rare neuromuscular disorder, it is believed that if approved, FIRDAPSE holds the potential to be a novel treatment option for Japanese individuals grappling with this condition.

Lambert–Eaton Myasthenic Syndrome Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapy drug uptake in the report…

Lambert–Eaton Myasthenic Syndrome Cancer Activities

The Lambert–Eaton Myasthenic Syndrome drugs market report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key Lambert–Eaton Myasthenic Syndrome Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Lambert–Eaton Myasthenic Syndrome drugs market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Lambert–Eaton Myasthenic Syndrome emerging therapies.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ New Lambert–Eaton Myasthenic Syndrome Drugs

KOL Views

To keep up with the real-world scenario in current and emerging Lambert–Eaton Myasthenic Syndrome drugs market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including Medical/scientific writers, Doctors, Professors, and Others.

DelveInsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Carnegie Mellon University, and others were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Lambert–Eaton Myasthenic Syndrome market trends.

|

KOL Views |

|

“This disease is rare usually 1 to 100,000, and this disease can mimic Myasthenia gravis (MG).” |

|

“Normally, all patients who are diagnosed with Lambert-Eaton Myasthenic Syndrome would consult a specialist. In addition, misdiagnoses occur in large number.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Lambert–Eaton Myasthenic Syndrome Drugs Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug. In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Medicaid, Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Lambert–Eaton Myasthenic Syndrome Therapeutics Market Report Scope

- The Lambert–Eaton Myasthenic Syndrome therapeutics market report covers a segment of key events, an executive summary, descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along Lambert–Eaton Myasthenic Syndrome treatment market guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current Lambert–Eaton Myasthenic Syndrome treatment market landscape.

- A detailed review of the Lambert–Eaton Myasthenic Syndrome therapeutics market, historical and forecasted Lambert–Eaton Myasthenic Syndrome market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Lambert–Eaton Myasthenic Syndrome therapeutics market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Lambert–Eaton Myasthenic Syndrome drugs market.

Lambert–Eaton Myasthenic Syndrome Therapeutics Market Report Insights

- Patient-based Lambert–Eaton Myasthenic Syndrome Market Forecasting

- Therapeutic Approaches

- Lambert–Eaton Myasthenic Syndrome Pipeline Analysis

- Lambert–Eaton Myasthenic Syndrome Market Size and Trends

- Existing and future Lambert–Eaton Myasthenic Syndrome Therapeutics Market Opportunity

Lambert–Eaton Myasthenic Syndrome Therapeutics Market Report Key Strengths

- 11 Years Lambert–Eaton Myasthenic Syndrome Market Forecast

- 7MM Coverage

- Lambert–Eaton Myasthenic Syndrome Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- Lambert–Eaton Myasthenic Syndrome Drugs Uptake

- Lambert–Eaton Myasthenic Syndrome Market Forecast Assumptions

Lambert–Eaton Myasthenic Syndrome Treatment Market Report Assessment

- Current Lambert–Eaton Myasthenic Syndrome Treatment Market Practices

- Lambert–Eaton Myasthenic Syndrome Unmet Needs

- Lambert–Eaton Myasthenic Syndrome Pipeline Product Profiles

- Lambert–Eaton Myasthenic Syndrome Treatment Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the historical and forecasted Lambert–Eaton Myasthenic Syndrome patient pool/patient burden in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- What was the Lambert–Eaton Myasthenic Syndrome market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- What are the pricing variations among different geographies for approved therapy?

- What are the current and emerging options for the Lambert–Eaton Myasthenic Syndrome treatment?

- How many companies are developing therapies for the treatment of Lambert–Eaton Myasthenic Syndrome?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The Lambert–Eaton Myasthenic Syndrome therapeutics report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Lambert–Eaton Myasthenic Syndrome Treatment Market.

- Insights on patient burden/disease Lambert–Eaton Myasthenic Syndrome prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Lambert–Eaton Myasthenic Syndrome treatment market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Patient-based forecast model which uses bottom-up forecasting techniques is accepted as a gold standard in pharma forecasting.

- Identifying strong upcoming players in the Lambert–Eaton Myasthenic Syndrome treatment market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Lambert–Eaton Myasthenic Syndrome treatment market so that the upcoming players can strengthen their development and launch strategy.

Click Here for New Article:-

-pipeline.png&w=256&q=75)