Low-Grade Glioma Market

- In the 7MM the total Low-grade Glioma Market Size was ~ USD 990 million in 2023.

- There were no approved therapies for LGG by 2022; the Low Grade Glioma Drug Market was mainly dominated by the use of Surgery, chemotherapy, and radiation either alone or in combination.

- The standard Low Grade Glioma treatment regimen includes Surgery, Chemotherapy, and Radiation. In June 2022, the US FDA granted accelerated approval to TAFINLAR + MEKINIST by Novartis for the treatment of adult and pediatric patients 6 years of age and older with unresectable or metastatic solid tumors with BRAF V600E mutation who have progressed following prior treatment and have no satisfactory alternative treatment options.

- The Low Grade Glioma Incidence rate of mixed gliomas was stable from 2004 to 2013 and decreased dramatically to nearly zero until 2022.

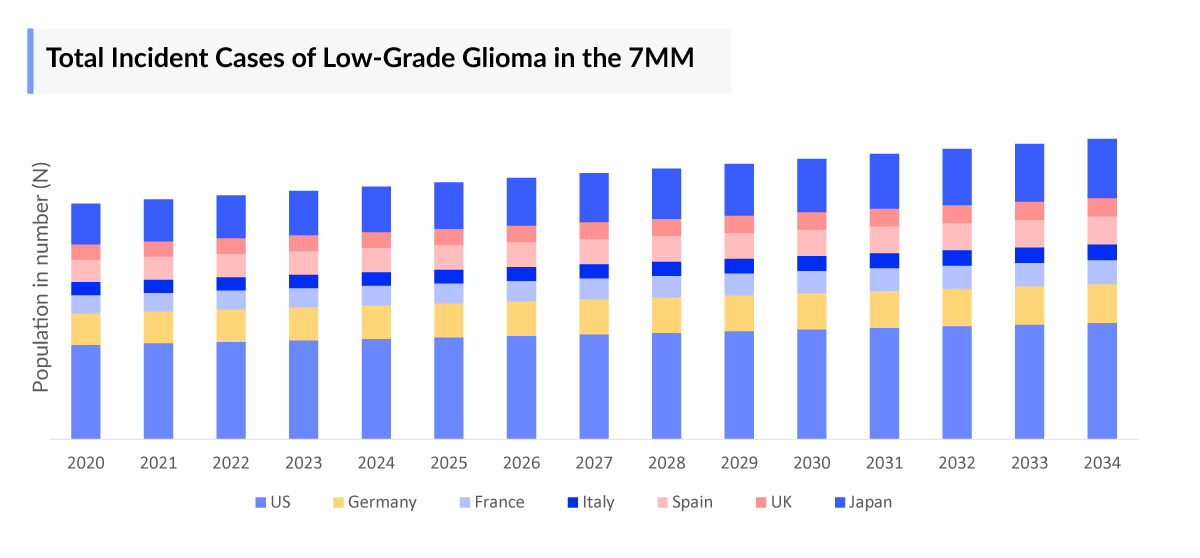

- The total Low Grade Glioma Incident Population in the 7MM in 2023 was more than 9000.

- In April 2024, Day One Biopharmaceuticals announced that OJEMDA (tovorafenib) was approved by the FDA under accelerated approval for patients aged 6 months and older with relapsed or refractory pediatric low-grade glioma (pLGG) harboring a BRAF fusion or rearrangement, or BRAF V600 mutation.

- The US FDA accepted and granted priority review for the new drug application for VORASIDENIB by Servier for the treatment of IDH-mutant diffuse glioma, with a PDUFA action date set for August 20, 2024.

- With the upcoming therapies coming for LGG, the Low Grade Glioma market size is expected to increase giving the patient population some drugs that can act as standard care for the patients. Major Low Grade Glioma Companies include Day One Biopharmaceuticals, Novartis, AnHeart Therapeutics, and others.

Request for unlocking the CAGR of the "Low-Grade Glioma Market Outlook"

DelveInsight’s "Low-grade Glioma Market Insight, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of Low-grade Glioma, historical and forecasted epidemiology as well as the Low-grade Glioma market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Low-grade Glioma Drug Market report provides current treatment practices, emerging drugs, Low-grade Glioma market share of individual therapies, and current and forecasted Low-grade Glioma market size from 2020 to 2034, segmented by the seven major markets. The report also covers current Low-grade Glioma treatment market practices/algorithms and Low Grade Glioma unmet needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Low Grade Glioma Drug Market |

|

|

Low Grade Glioma Market Size | |

|

Low Grade Glioma Companies |

|

Low-grade Glioma Treatment Market: Overview

Low-grade gliomas are a diverse group of primary brain tumors that often arise in young, otherwise healthy patients and generally have an indolent course with longer-term survival in comparison with high-grade glioma. Moreover, in this type of brain tumor with a relatively good prognosis and prolonged survival, the potential benefits of treatment must be carefully weighed against potential treatment-related risks. Low-grade astrocytic tumors include diffuse astrocytoma, pilomyxoid astrocytoma, pleomorphic xanthoastrocytoma (WHO grade II), as well as subependymal giant cell astrocytoma (SEGA), and pilocytic astrocytoma (WHO grade I tumors). IDH1 and IDH2 are the most commonly mutated genes in low-grade glioma, with mutations estimated to occur in > 70% of cases. BRAF V600E point mutations are occasionally observed in pilocytic astrocytoma; the mutations are also observed in non pilocytic pediatric low-grade glioma, including ganglioglioma, desmoplastic infantile ganglioglioma, and approximately two-thirds of pleomorphic xanthoastrocytomas.

Low-grade Glioma Diagnosis

Diagnosis of LGG is made through a combination of imaging, histopathology, and molecular diagnostic methods. On computed tomography scans, LGG appears as diffuse areas of low attenuation. In conventional magnetic resonance imaging (MRI), which is currently the imaging modality of choice, LGG is often homogeneous with low signal intensity on T1-weighted sequences and hyperintensity on T2-weighted and Fluid-Attenuated Inversion Recovery (FLAIR) sequences. Calcifications may be evident as areas of T2 hyperintensity/T1 hypointensity in up to 20% of lesions, including oligodendrogliomas and astrocytomas, and are particularly suggestive of oligodendrogliomas. Glioma, in general, infiltrates the surrounding parenchyma despite apparent radiographic margins observed on T2/FLAIR sequences.

Low-grade glioma Treatment

LGGs are usually treated with a combination of surgery, observation, and radiation. If the tumor is located in an area where it is safe to remove, then the neurosurgeon will attempt to remove it as much as possible. Low-grade gliomas are usually treated with a combination of surgery, observation, and radiation. If the tumor is located in an area where it is safe to remove, then the neurosurgeon will attempt to remove it as much as possible. There are two approved drugs for low-grade glioma OJEMDA (tovorafenib) by Day One Biopharmaceuticals and TAFINLAR (dabrafenib) + MEKINIST (trametinib) by Novartis.

Get More Insights of this report @ TAFINLAR + MEKINIST Market

Low-grade glioma Epidemiology

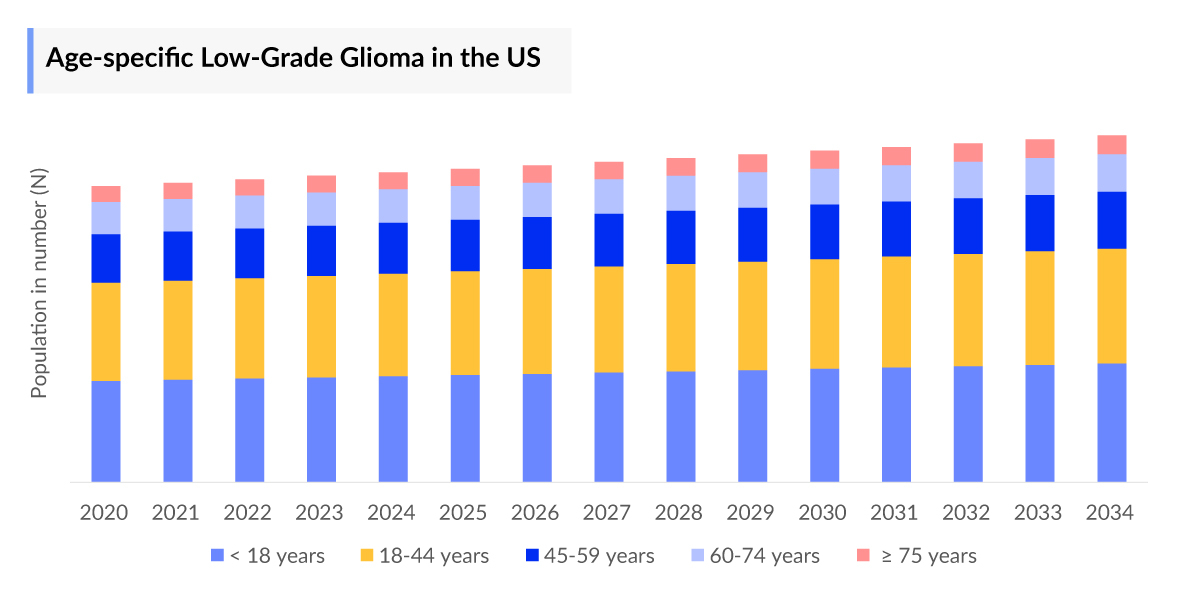

The Low-grade glioma epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the total incident cases of Low-grade glioma, stage-specific incident cases of Low-grade glioma, total Low-grade glioma Incidence Cases, total incident cases of Low-grade glioma, total diagnosed incident cases of Low-grade glioma, age-specific cases of low-grade glioma in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- The total Low Grade Glioma Incident cases in the 7MM was more than 9000 in 2023.

- Among the 7MM, the US accounted for the highest number of Low Grade Glioma incidence cases in 2023, with more than 3700 cases; these cases are expected to increase during the forecast period.

- In the United States, the number of Grade 2 glioma cases was higher than the Grade I glioma in 2023

- Among the type-specific cases, the cases of Diffuse Astrocytoma accounted for the highest number in the US, followed by Pilocytic Astrocytoma in 2023.

- Among EU4 and the UK, Germany accounted for the highest number of cases of Low-grade Glioma, followed by France, while Spain occupied the bottom of the ladder in 2023.

Unlock comprehensive insights! Click Here to Purchase the Full Report @ Low Grade Glioma Prevalence

Low-grade glioma Drug Chapters

The drug chapter segment of the Low-grade glioma drug market report encloses a detailed analysis of the late-stage (Phase III ) and mid-stage (Phase II/III and Phase II) Low Grade Glioma pipeline drugs. The current key Low Grade Glioma Companies include Servier (Vorasidenib), Nuvation Bio (Safusidenib), Novartis (Everolimus), Merck (Pembrolizumab + Olaparib and Temozolomide), Incyte Corporation (Pemigatinib), SpringWorks Therapeutics (Mirdametinib) and others.The drug chapter also helps understand the Low-grade glioma clinical trial details, pharmacological action, agreements and collaborations, approval, and patent details, and the latest Low Grade Glioma news and press releases.

Low Grade Glioma Marketed Drugs

- TAFINLAR (dabrafenib) + MEKINIST (trametinib): Novartis

Trametinib + dabrafenib is an oral small-molecule inhibitor that inhibits the MAPK pathway and cell growth of various BRAFV600E-positive tumors. In June 2022, Novartis announced that the US FDA granted accelerated approval to TAFINLAR (dabrafenib) + MEKINIST (trametinib) for the treatment of adult and pediatric patients 6 years of age and older with unresectable or metastatic solid tumors with BRAF V600E mutation who have progressed following prior treatment and have no satisfactory alternative treatment options.

Get More Insights of the Report @ MEKINIST API Insight

- OJEMDA (tovorafenib): Day One Biopharmaceuticals

Tovorafenib is an investigational, oral, selective, central nervous system–penetrant, type II RAF inhibitor with activity against monomeric and dimeric forms of RAS signaling. Unlike type I BRAF inhibitors, tovorafenib does not lead to paradoxical activation of the MAPK pathway. On 23 April 2024, the US FDA granted accelerated approval to tovorafenib for patients aged 6 months and older with relapsed or refractory pediatric low-grade glioma harboring a BRAF fusion, rearrangement, or a BRAF V600 mutation. This approval was based on results from the Phase II FIREFLY-1 trial.

Low Grade Glioma Emerging Drugs

- Vorasidenib: Servier

Servier is developing Vorasidenib an investigational, oral, selective, brain-penetrant dual inhibitor of mutant IDH1 and IDH2 enzymes. The drug is currently being evaluated in the registration-enabling Phase III INDIGO study as a potential treatment for patients with residual or recurrent Grade 2 low-grade glioma with an IDH1 or IDH2 mutation (NCT04164901). The company has also announced promising Phase I data for Vorasidenib in IDH mutant low-grade glioma. The study data demonstrated a median progression-free survival of 36.8 months (3.1 years) for patients with non-enhancing low-grade glioma and demonstrated a favorable safety profile. This drug is also being evaluated in a Phase I trial for grade II/III glioma with an IDH1 R132H mutation (NCT03343197).

- Safusidenib/AB-218: Nuvation Bio

Nuvation Bio is currently studying AB-218 in patients with IDH1 mutant Glioma. AB-218 is a novel, potent, highly selective mutant IDH-1 inhibitor, which has high permeability of the blood-brain barrier and has demonstrated encouraging safety and efficacy signals in a Phase I trial of glioma patients. The company has initiated a Phase II trial in participants with recurrent or progressive histologically confirmed IDH1 mutant WHO Grade 2/3 glioma for which the recruitment has not yet started. The drug was originally developed by Daiichi Sankyo but in 2020 AnHeart Therapeutics acquired this drug. The Phase I clinical trial of AB-218 in glioma patients has demonstrated promising efficacy and safety profiles in 12 non-enhancing and 35 enhancing glioma patients.

- Mirdametinib: SpringWorks Therapeutics

Mirdametinib is an oral, allosteric, brain-penetrant small molecule designed to inhibit MEK1 and MEK2, which are proteins that occupy pivotal positions in the MAPK pathway. SpringWorks Therapeutics reported the initiation of a Phase I/II clinical trial to evaluate Mirdametinib, an investigational MEK inhibitor, for the treatment of children, adolescents, and young adults with LGG.

|

Comparison of Emerging Drugs Under Development for Low-Grade Glioma | ||||||

|

Product |

Company |

Phase |

Indications |

RoA |

MOA |

Molecule Type |

|

Vorasidenib |

Servier |

III |

IDH1/2 mutant low-grade glioma |

Oral |

Inhibit mutant IDH protein |

Small molecule |

|

AB-218/ Safusidenib |

Nuvation Bio |

II |

Grade II glioma with IDH mutation |

Oral |

Isocitrate dehydrogenase 1 inhibitors |

Small molecule |

|

Mirdametinib |

SpringWorks Therapeutics |

I/II |

Recurrent/ progressive Low-grade glioma |

Oral, Nasogastric tube or Gastrostomy tube) |

MEK1 AND MEK2 inhibitor |

Small molecule |

|

Everolimus |

Novartis |

II |

Recurrent or Progressive Low-grade Glioma in Children |

Oral |

Binds to FKBP-12 and inhibits mTOR kinase activity |

Small molecule |

|

Pembrolizumab+ Olaparib and Temozolomide |

Merck |

II |

Recurrent enhancing grade II and III IDH-mutated glioma |

Pembrolizumab -IV Olaparib-Oral |

Olaparib: Inhibits poly (ADP-ribose) polymerase Pembrolizumab: Inhibits lymphocytes PD- 1 receptor |

Olaparib: N- acylpiperazines Pembrolizumab : Monoclonal antibody |

|

Pemazyre (Pemigatinib) |

Incyte Corporation |

II |

Glioblastoma, Adult type diffuse glioma |

Oral |

Blocks phosphorylation and signaling of FGFR1-3 |

Small molecule |

|

GDC-0084 |

Kazia Therapeutics |

II |

Diffuse Intrinsic Pontine Glioma, Diffuse Midline Glioma, H3 K27M- Mutant, Recurrent Diffuse Intrinsic Prontine |

Oral |

PI3K and mTOR inhibitor |

Small molecule |

Low Grade Glioma Drug Market: Class Insight

Tovorafenib was approved as a treatment for patients 6 months of age and older with certain relapsed or refractory pediatric low-grade glioma (pLGG). The nod sanctions the type 2 RAF inhibitor to be used in tumors with a BRAF fusion or rearrangement, or BRAF V600 mutation. Low-grade glioma is the most common pediatric brain cancer. BRAF V600 mutations are present in 15-20% of pediatric Low-grade glioma and are associated with poor survival outcomes and less favorable response to chemotherapy. BRAF mutations have been identified as drivers of cancer growth, the FDA has also previously approved TAFINLAR + MEKINIST by Novartis to treat pediatric patients with LGG with a BRAF V600E mutation who require systemic therapy; however, this indication is for patients who are 1 year of age and older.

Get More Insights of the Report @ BRAF V600 Inhibitors Pipeine

Low-grade glioma Market Outlook

The standard of care consists of maximum safe resection, the potential use of chemoradiation for high-risk patients, and lifelong radiographic surveillance, with the goal of treatment to delay malignant transformation and maximize the quality of life. The optimal treatment of low-grade glioma (particularly the timing) is controversial, and treatment decisions must balance the benefits of therapy against the potential for treatment-related complications. Surgery, radiation therapy, and chemotherapy may be used to treat a low-grade glioma, either separately or in combination. Tumor shrinkage has been seen in selected patients using various drugs or combinations, such as temozolomide or the “PCV” combination (procarbazine, lomustine, and vincristine). Patients with the oligodendroglioma subtype (especially those with the chromosome 1p deletion) are most likely to benefit from chemotherapy. DCVax-L was the sole key marketed drug involving LGG. In March 2014, DCVax-L received the approval of the “Hospital Exemption” in Germany, which allowed Northwest to sell DCVax-L through hospitals and their outpatient clinics for patients with all severities of cancer that begin in the brain, even though it is only being tested in patients newly diagnosed with Glioblastoma multiforme. In 2018, the company transferred European manufacturing to the UK and terminated such activities in Germany. Many pharmaceutical companies are working to develop a novel approach to treat LGG. Some of the key players are Day One Biopharmaceuticals, Novartis, AnHeart Therapeutic, SpringWorks Therapeutics, Servier, and others.

Key Findings

- The total Low Grade Glioma Market Size in the US was estimated to be more than USD 550 million in 2023, which is expected to grow during the forecast period (2024–2034).

- Among the second-line therapies, chemotherapy accounted for the maximum Low Grade Glioma market share in the US in 2023.

- Among EU4 and the UK, Germany accounted for the maximum market size in 2023, while Spain occupied the bottom of the ladder.

Low-grade Glioma Drug Uptake

This section focuses on the uptake rate of potential Low Grade Glioma drugs expected to be launched in the market during 2024–2034. The landscape of Low-grade glioma treatment market has experienced a transformation with the uptake of novel drugs. These innovative therapies are redefining standards of care. Furthermore, the increased uptake of these transformative drugs is a testament to the unwavering dedication of hematologists, oncologists, professionals, and the entire healthcare community in their tireless pursuit of advancing healthcare. This momentous shift in treatment paradigms is a testament to the power of research, collaboration, and human resilience.

Low-grade Glioma Pipeline Development Activities

The Low Grade Glioma market size report provides insight into therapeutic candidates in Phase III, Phase II/III, and Phase II. It also analyzes key Low Grade Glioma companies involved in developing targeted therapeutics. Low Grade Glioma Companies like Incyte, Kazia Therapeutics, Novartis, and Merck actively engage in late and mid-stage research and development efforts for Low-grade glioma. The pipeline of Low-grade glioma possesses potential drugs. However, there is a positive outlook for the therapeutics market, with expectations of growth during the forecast period (2024–2034).

Pipeline Development Activities

The Low Grade Glioma pipeline segment report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Low-grade glioma emerging therapy.

KOL Views

To keep up with current Low Grade Glioma market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders are – M.D., senior vice president of the Center for Neuroscience and Behavioral Medicine, director of Brain Tumor Institute, Children’s National Hospital, and Senior Associate Scientist Emeritus at The Hospital for Sick Children. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or LGG market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views | |

|

United States |

“The management of low-grade glioma patients has evolved over the years. Traditionally, it was maximum safe surgery and then considering if the patient was low risk based on age, degree of surgery, and how the patient is doing, we would either consider holding off on radiation or doing radiation treatment upfront. But actually in the last 2 or 3 years, with the publication of RTOG 9802 that randomized patients after surgery, and these are intermediate risk patients defined as older than 40 or subtotally resected, to radiation after surgery or radiation plus chemotherapy, showed a significant survival benefit with a combination addition of chemotherapy. So it’s more or less standard of care at this point to get that maximum safe surgery, and usually radiation chemotherapy add-on also for the majority of patients.”

-MD, Department of Radiation Oncology, Massachusetts General Hospital |

Qualitative Analysis

We perform Qualitative and Low Grade Glioma drug market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Low Grade Glioma treatment market landscape.

Low Grade Glioma Drug Market Access and Reimbursement

A brain tumor represents a group of diseases that have abnormal development of mass lesions in the brain, spinal cord, or its coverings. The disease carries a high economic burden for patients and caregivers, much of which is associated with initial surgery. The National Brain Tumor Society (2018) reported that brain cancer has the highest per-patient initial cost of care for any cancer group, with an annualized mean net cost of care approaching around USD 150,000. It also had the highest annualized mean net costs for the last year of life care. This high cost of care could be attributed to the high cost of drugs and the various treatments available for a brain tumor as well as the additional costs incurred during the care of the patients. Since the patients’ healthcare payments are substantial and such high healthcare expenditure is burdensome for the patients and their families. To help these patients, various third parties and nonprofits also have reimbursement schemes based on the demonstration of acceptable cost-effectiveness.

Low Grade Glioma Market Size Report Scope

- The Low Grade Glioma market size report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs, symptoms, pathogenesis, and currently used therapies.

- Comprehensive insight into the Low Grade Glioma epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current Low Grade Glioma treatment market landscape.

- A detailed review of the Low-grade glioma drug market, historical and forecasted Low Grade Glioma market size, Low Grade Glioma market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Low Grade Glioma market size report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insight/KOL views, patient journey, and treatment preferences that help shape and drive Low-grade Glioma.

Low-grade Glioma Market Forecast Report Insights

- Patien-based Low Grade Glioma Market Forecasting

- Therapeutic Approaches

- Low-grade glioma Pipeline Analysis

- Low-grade glioma Market Size

- Low Grade Glioma Market Trends

- Existing and Future Low Grade Glioma Drug Market Opportunity

Low-grade Glioma Market Forecast Report Key Strengths

- 11 Years- Low Grade Glioma Market Forecast

- The 7MM Coverage

- Low-grade Glioma Epidemiology Segmentation

- Key Cross Competition

- Low Grade Glioma Drugs Uptake

- Key Low Grade Glioma Market Forecast Assumptions

Low-grade Glioma Treatment Market Report Assessment

- Current Low Grade Glioma Treatment Market Practices

- Low Grade Glioma Unmet Needs

- Low Grade Glioma Pipeline Product Profiles

- Low Grade Glioma Drug Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What was the Low-grade glioma market size, the market size by therapies, Low Grade Glioma market share (%) distribution in 2023, and what would it look like by 2034? What are the contributing factors for this growth?

- What can be the future treatment paradigm for Low-grade glioma?

- What are the disease risks, burdens, and unmet needs of Low-grade glioma? What will be the Low Grade Glioma drug market growth opportunities across the 7MM concerning the Low-grade glioma patient population?

- What are the current options for the Low-grade glioma treatment? What are the current guidelines for treating Low-grade glioma in the 7MM?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

- What is the patient share in Low-grade glioma?

Reasons to Buy

- The Low Grade Glioma market outlook report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving Low-grade glioma.

- Insight on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming Low Grade Glioma Companies in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis ranking of class-wise potential current and emerging therapies under the analyst view section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of current therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insight on the unmet needs of the existing Low Grade Glioma drug market so that the upcoming Low Grade Glioma Companies can strengthen their development and launch strategy.

Stay Updated with Us

- Phase III RUBY Trial of Jemperli Plus Chemotherapy Updates; FDA Approves Roche’s Vabysmo for RVO; FDA Grants Priority Review to Tovorafenib Low-Grade Glioma; FDA Approves Lilly’s Omvoh; FDA Approves Toripalimab for Nasopharyngeal Carcinoma; FDA Fast Track Designation to ONCT-534 R/R mCRPC

- AbbVie Announces Results of Study Evaluating SKYRIZI; FDA Fast Track Designation to Arrowhead’s ARO-APOC3; FDA Approves Dabrafenib Plus Trametinib for BRAF V600E–Mutated Low-Grade Glioma; FDA Grants ODD to Novel BRAF Inhibitor for Brain/CNS Malignancies; EP0042 Wins FDA Orphan Drug Status; Karuna Therapeutics Announces Results from Phase 3 EMERGENT-3 Trial of KarXT in Schizophrenia

- Low-Grade Glioma Market: Infograhics

- Latest DelveInsight Blogs

.jpg)