Lyme Disease Market

Key Highlights

- Lyme disease, also called Lyme borreliosis, is an infectious illness caused primarily by the bacterium Borrelia burgdorferi and, in rare cases, Borrelia mayonii. It is transmitted to humans through the bite of infected blacklegged ticks..

- There is a gender disparity in the incidence of Lyme disease, with men being more likely to be affected than women.

- There are no vaccines currently being marketed for Lyme disease. There is now a greater demand for Lyme disease vaccines. This is due to the rise in infections in the US and Europe, arising from factors such as climate change. Alongside a predominant dive in prevention by various leading names, Moderna’s recent interest in the condition raises the prospect of additional prophylactic options over the longer term.

- The US FDA has not approved any therapies specifically indicated for Lyme disease; instead, treatment relies on antibiotics approved for other bacterial infections that are commonly used off-label to manage the condition.

- Key emerging therapies for Lyme disease include VLA15 (Valneva and Pfizer), TP-05 (Tarsus Pharmaceuticals, Inc.), mRNA-1982 and mRNA-1975 (Moderna), and others.

- In April 2025, Researchers have engineered a modified version of the Lyme bacterial protein CspZ, which in preclinical studies triggered a strong immune response and showed potential as a next-generation vaccine target. The breakthrough, published in Nature Communications, could pave the way for the first effective human Lyme disease vaccine.

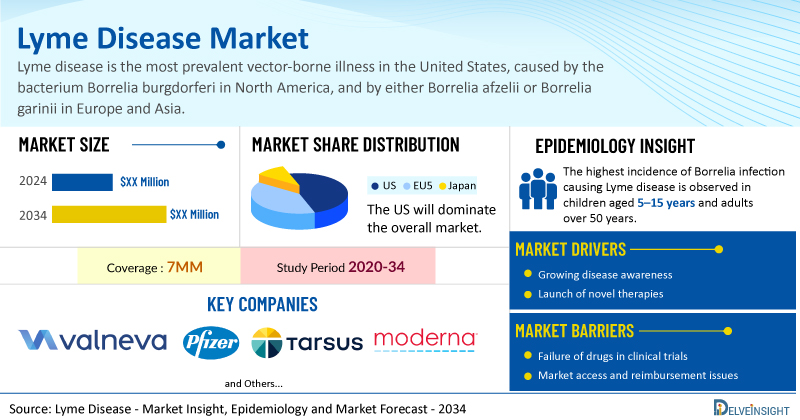

DelveInsight's “Lyme Disease – Market Insight, Epidemiology and Market Forecast – 2034” report delivers an in-depth analysis of Lyme disease, market, and clinical development in Lyme disease. In addition to this, the report provides historical and forecasted epidemiology and market data as well as a detailed analysis of the Lyme disease market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

Lyme disease market report provides real-world prescription pattern analysis, emerging drugs assessment, market share, and uptake/adoption pattern of individual therapies, as well as historical and forecasted Lyme disease market size from 2020 to 2034 in 7MM. The report also covers current Lyme disease treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan |

|

Lyme disease Epidemiology |

Segmented by:

|

|

Lyme disease Key Companies |

|

|

Lyme disease Key Therapies |

|

|

Lyme disease Market |

Segmented by:

|

|

Analysis |

|

Key Factors Driving the Growth of the Lyme Disease Market

Rising Case Numbers and Expanded Surveillance

The increasing number of reported cases and broader surveillance are driving demand for diagnostics, treatments, and prevention tools, thereby fueling the growth of the Lyme disease market across testing, therapeutics, and public health services.

Growing Diagnostics Market

Demand for more accurate, faster, and higher-volume testing (ELISA, modified two-tier algorithms, PCR, point-of-care assays) is pushing market expansion and investment in new platforms. Recent market analyses show multi-billion-dollar global testing markets and mid-single-digit to low-double-digit CAGRs.

Launch of Emerging Lyme Disease Therapies

Companies worldwide are diligently working to develop novel therapies, achieving considerable success over the years. Key players, such as Valneva/Pfizer (VLA15), Tarsus Pharmaceuticals (TP-05), Moderna (mRNA-1982 and mRNA-1975), and others, are developing therapies for the management of Lyme disease.

Lyme disease: Understanding and Treatment Algorithm

Lyme disease Overview

Lyme disease is the most common vector-borne illness in the U.S, caused by Borrelia burgdorferi in North America and Borrelia afzelii or Borrelia garinii in Europe and Asia. Transmitted through bites of infected black-legged ticks (Ixodes species), the infection progresses from early localized disease with erythema migrans and flu-like symptoms to disseminated and late stages that may affect the joints, nervous system, or heart. Diagnosis relies on clinical features, exposure history, and serologic testing, with early antibiotic treatment (doxycycline, amoxicillin, or cefuroxime) preventing long-term complications. Most patients recover fully, but delayed or inadequate therapy can cause persistent symptoms. Prevention centers on minimizing tick exposure through protective clothing, repellents, prompt removal, and habitat management.

Lyme disease Diagnosis

The diagnosis of lyme disease is established through an integrated assessment of clinical manifestations, most notably the pathognomonic erythema migrans rash, in conjunction with a history of potential exposure to Ixodes tick habitats. Given that tick bites frequently go unrecognized due to their minimal local symptoms, reliance on exposure risk is essential. Laboratory confirmation is achieved via a standardized two-tier serologic testing algorithm, wherein an initial enzyme immunoassay (EIA) or immunofluorescence assay (IFA) is followed by a confirmatory Western blot or equivalent immunoassay if results are positive or equivocal. Definitive diagnosis requires concordant results across both stages, thereby ensuring high specificity and reducing false-positive outcomes. This rigorous diagnostic framework facilitates accurate differentiation of Lyme disease from clinically overlapping conditions and informs the timely initiation of appropriate antimicrobial therapy.

Further details related to country-based variations in diagnosis are provided in the report.

Lyme Disease Treatment

Most cases of lyme disease respond well to a 10–14 day course of antibiotics, with early treatment usually resulting in rapid and complete recovery. Commonly prescribed agents include doxycycline, amoxicillin, and cefuroxime axetil, with the choice of regimen guided by clinical presentation, patient age, allergy profile, pregnancy status, and other individual factors. Prompt diagnosis and timely initiation of therapy are critical to preventing progression to more severe disease. While routine antibiotic use after tick bites is not recommended, a single prophylactic dose of doxycycline may be considered in high-risk situations, such as bites acquired in areas of high lyme disease prevalence. Decisions regarding prophylaxis should follow established clinical guidelines and be informed by epidemiological context.

Further details related to treatment will be provided in the report…

Lyme disease Epidemiology

The Lyme disease epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as Incident cases of lyme disease, Gender-specific incident cases of lyme disease, Age-specific incident cases of lyme disease, and Treatable cases of lyme disease in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- The highest incidence of Borrelia infection causing Lyme disease is observed in children aged 5–15 years and adults over 50 years.

- In the UK, the age distribution of lyme disease shows the highest incidence in the 30–49 and 50–69 year age groups

- According to the Centers for Disease Control and Prevention, approximately 476,000 Americans are diagnosed and treated for Lyme disease each year with at least a further 130,000 cases in Europe.

- In Germany, the incidence of Lyme borreliosis was estimated at 37.2 cases per 100,000 person-years.

- Of the reported Lyme disease cases, 58% occurred in men.

- According to the Infectious Agents Surveillance Report, the incidence rate of lyme disease per 100,000 people in Japan was 0.008.

Lyme disease Drug Chapters

The drug chapter segment of Lyme disease report encloses a detailed analysis of Lyme disease-marketed drugs and emerging pipeline drugs. It also deep dives into Lyme disease’s pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Emerging Drugs

VLA15: Valneva and Pfizer

VLA15 is an investigational multivalent recombinant protein vaccine targeting six serotypes of Borrelia commonly associated with lyme disease in the United States and Europe. It acts by inducing antibodies against outer surface protein A (OspA), which is expressed by the bacterium within the tick; blocking OspA prevents transmission to humans.

VLA15 is the most advanced Lyme disease vaccine candidate currently in clinical development. Pfizer, in partnership with Valneva, plans to submit a BLA to the FDA and a MAA to the EMA in 2026, pending positive trial outcomes. The vaccine received FDA Fast Track Designation in 2017

TP-05: Tarsus Pharmaceuticals

TP-05 is an oral systemic formulation of lotilaner under development for the prevention of Lyme disease, believed to be the only non-vaccine, drug-based preventive therapy in progress that targets and kills infected tick vectors before they can transmit Borrelia bacteria. Designed to rapidly achieve systemic blood levels of lotilaner, a well-characterized anti-parasitic agent it offers on demand protection and is currently being assessed in a Phase IIa trial according to the company’s pipeline.

|

Drug Name |

Company |

Highest Phase |

Indication |

RoA |

MoA |

Molecule Type |

|

VLA15 |

Valneva and Pfizer |

III |

Lyme disease |

Intramuscular |

Immunostimulants |

Bacterial vaccines |

|

TP-05 |

Tarsus Pharmaceuticals |

II |

Lyme disease |

Subcutaneous |

GABA A receptor antagonists |

Small molecules |

Note: A Detailed emerging therapies assessment will be provided in the final report.

Lyme Disease Market Outlook

The current preventive landscape for Lyme disease is largely dominated by vaccine-based approaches, with no approved drug-based prophylaxis available. TP-05, an oral systemic formulation of lotilaner, represents a novel market entrant and is believed to be the only non-vaccine, drug-based candidate in development targeting infected tick vectors before they can transmit Borrelia bacteria. Designed to rapidly achieve systemic blood levels of lotilaner, a well-characterized anti-parasitic agent, TP-05 offers on-demand protection and is currently in Phase IIa clinical evaluation. The introduction of such an innovative therapeutic has the potential to reshape the Lyme disease prevention market by addressing unmet needs in populations where vaccination may be unsuitable or unavailable, thereby expanding prevention options and potentially driving market growth in the coming years.

Lyme disease Drug Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2025–2034. The landscape of Lyme disease treatment has experienced a profound transformation with the uptake of novel medicines. These innovative therapies are redefining standards of care.

Further detailed analysis of emerging therapies' drug uptake in the report.

Lyme Disease Pipeline Development Activities

The report provides insights into different therapeutic candidates in the marketed and emerging stages. It also analyses key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Lyme disease therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Professors, and others.

DelveInsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as University Medical Center Hamburg-Eppendorf, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Lyme disease market trends.

|

KOL Views |

|

“The incidence of lyme disease has significantly increased in recent years, particularly following changes in surveillance methods. This surge indicates a growing public health concern, necessitating a comprehensive understanding of the disease's epidemiology. There is a need for enhanced tracking systems to monitor outbreaks and identify at-risk populations effectively.”

|

Qualitative Analysis

We perform qualitative and market intelligence analysis using various approaches, such as SWOT and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and a payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug. In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Medicaid, Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs) and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Report

- The report covers a segment of key events, an executive summary, a descriptive overview of Lyme disease, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of the diagnosis rate, and treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborate profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Lyme disease market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT and conjoint analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Lyme disease market.

Lyme Disease Report Insights

- Patient Population

- Therapeutic Approaches

- Lyme Disease Pipeline Analysis

- Lyme Disease Market Size and Trends

- Existing and Future Market Opportunity

Lyme Disease Report Key Strengths

- Ten-Year Forecast

- 7MM Coverage

- Lyme Disease Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- Drugs Uptake and Key Market Forecast Assumptions

Lyme Disease Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint)

FAQs

- What was the lyme disease total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors for this growth?

- At what CAGR, lyme disease market expected to grow at the 7MM level during the study period (2020–2034)?

- How is Japan's lyme disease competitive landscape evolving?

- What are the disease risks, burdens, and unmet needs of lyme disease?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to lyme disease?

- What is the historical and forecasted lyme disease patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- What factors are affecting the increase in the diagnosis of symptomatic cases?

- What are the current options for the treatment of lyme disease? What are the current treatment guidelines for the treatment of lyme disease in the US and Europe?

- How many companies are developing therapies for the treatment of lyme disease?

- Which key designations have been granted for the emerging therapies for lyme disease?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies? Focus on reimbursement policies.

Reasons to Buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics and driving factor for Lyme disease market.

- Insights on patient share/disease burden, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying upcoming players in the market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand KOLs’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-pipeline.png&w=256&q=75)