mac lung disease market

Key Highlights

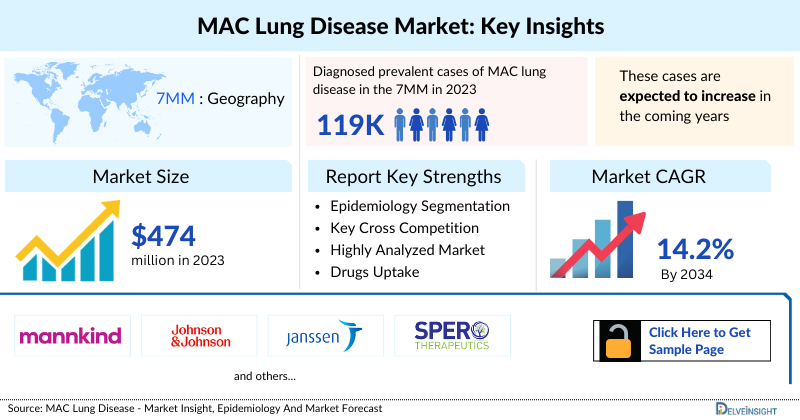

- According to DelveInsight’s estimates, in 2023, there were approximately 119 thousand diagnosed prevalent cases of Mycobacterium avium Complex (MAC) lung disease in the 7MM. Of these, the United States accounted for 64% of the cases, while EU4 and the UK accounted for nearly 8% and Japan represented 28% of the cases, respectively.

- The MAC lung disease market is projected to grow steadily, with a strong compound annual growth rate (CAGR) anticipated from 2024 to 2034. This growth across the 7MM will be driven by the launch of innovative therapies such as MNKD-101, Bedaquiline fumarate (TMC207), and SPR720, among others. Furthermore, the increasing prevalence of MAC lung disease, influenced by host factors like advanced age, COPD, thoracic abnormalities, and environmental exposure to MAC in soil, water, and aerosol-generating activities, is expected to expand the market potential.

- According to DelveInsight’s analysis, the MAC lung disease market in the 7MM was valued at approximately USD 474 million in 2023. Over the forecast period from 2024 to 2034, this market is projected to grow at a CAGR of 14.2%.

- The scarcity of FDA-approved therapies for MAC lung disease, with only ARIKAYCE being the only approved option, limits treatment options, complicates management of resistant strains, and highlights the need for new therapies.

- Mannkind Corporation, Janssen Pharmaceutical, and Spero Therapeutics are progressing through various stages of clinical trials, driving innovation in the MAC lung disease market. This activity is creating a dynamic environment, offering significant opportunities for market expansion and growth.

- Among the emerging therapies, MNKD-101, a nebulized formulation of clofazimine, is currently in Phase III clinical development and is expected to launch in the market by 2027.

Key Factors Driving MAC Lung Disease Market

Mycobacterium avium Complex Lung Disease Patient Pool and Rising Prevalence

In 2023, the diagnosed prevalent cases of Mycobacterium avium Complex (MAC) lung disease in the 7MM were approximately 119K, with the United States accounting for 64% of cases, Japan for 28%, and EU4 and the UK contributing nearly 8%. The prevalence is expected to rise over the forecast period due to factors such as advanced age, COPD, thoracic abnormalities, and environmental exposure to MAC in soil, water, and aerosol-generating activities.

Mycobacterium avium Complex Lung Disease Market Dynamics and Drivers

The MAC lung disease market was valued at approximately USD 474 million in 2023 across the 7MM and is projected to grow at a CAGR of 14.2% from 2024 to 2034. Market expansion is driven by the increasing prevalence of MAC lung disease, limited existing treatment options, and ongoing innovation in therapy development. The scarcity of FDA-approved therapies, with ARIKAYCE as the only approved option, underscores the need for effective new treatments and fuels investment in pipeline candidates.

Mycobacterium avium Complex Lung Disease Treatment Landscape

ARIKAYCE (Amikacin Liposome Inhalation Suspension) by Insmed remains the only FDA-approved therapy for MAC lung disease. Delivered via the Lamira Nebulizer System, ARIKAYCE provides targeted inhalation therapy, minimizing systemic exposure. The therapy has orphan drug designation and is approved in the US, EU, and Japan. The ongoing Phase III ENCORE study evaluates ARIKAYCE in newly diagnosed or recurrent MAC lung infections, with topline data expected in Q1 2026.

Mycobacterium avium Complex Lung Disease Emerging Therapies

Several investigational therapies are advancing the MAC lung disease pipeline. MNKD-101 by Mannkind Corporation, a nebulized clofazimine formulation, is in Phase III clinical development and expected to launch by 2027. Bedaquiline fumarate (TMC207) by Janssen Pharmaceutical and SPR720 by Spero Therapeutics are also in clinical development, addressing unmet treatment needs and targeting resistant MAC strains. MNKD-101 is projected to generate approximately USD 477.7 million in the 7MM by 2034.

Mycobacterium avium Complex Lung Disease Clinical Trials and Competitive Landscape

The MAC lung disease market is dynamic, with key players such as Mannkind Corporation, Janssen Pharmaceutical, and Spero Therapeutics driving innovation through clinical trials. These efforts are aimed at expanding treatment options, improving patient outcomes, and addressing gaps left by the limited availability of approved therapies.

DelveInsight’s “MAC Lung Disease – Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of MAC lung disease, historical and forecasted epidemiology, as well as the MAC lung disease market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The MAC lung disease market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM MAC lung disease market size from 2020 to 2034. The report also covers MAC lung disease treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

MAC Lung Disease Understanding and Treatment Algorithm

MAC lung disease overview

Mycobacterium avium Complex (MAC) is a group of bacteria that causes MAC lung disease, primarily consisting of Mycobacterium avium and Mycobacterium intracellulare, which require genetic testing for identification. It is the most common cause of nontuberculous mycobacterial (NTM) lung disease in the US and affects individuals of all ages, with higher risk in older adults, postmenopausal women, smokers, and those with weakened immune systems or existing lung conditions like bronchiectasis, COPD, cystic fibrosis, emphysema, and a history of tuberculosis.

MAC lung disease has two forms: Nodular Bronchiectatic, which affects non-smoking older women with slowly growing lung nodules, and Fibrocavitary Disease, a more severe form seen in smokers and individuals with emphysema.

MAC is primarily acquired through inhalation or ingestion, infecting macrophages and spreading through lymphatic vessels. Symptoms include chronic cough, fatigue, shortness of breath, night sweats, hemoptysis, and weight loss, often worsening despite treatment for other lung conditions.

MAC lung disease diagnosis

Diagnosing MAC lung disease requires a clinical examination, chest X-ray or CT scan, sputum culture, and bronchoscopy. This comprehensive approach helps ensure an accurate diagnosis by identifying symptoms, visualizing lung abnormalities, isolating the bacteria, and obtaining direct samples. While a chest X-ray may be adequate for diagnosing fibrocavitary disease, High-resolution CT (HRCT) is essential for assessing nodular bronchiectatic disease.

Further details related to country-based variations are provided in the report…

MAC lung disease treatment

Treatment for MAC lung disease involves a prolonged regimen of multiple antibiotics, including macrolides, clofazimine, rifampin, rifabutin, ethambutol, fluoroquinolones, linezolid, and aminoglycosides. While no definitive link has been established between in-vitro susceptibility and clinical outcomes, macrolides and amikacin may offer some clinical benefit. The primary goal of therapy is to achieve culture negativity for 12 months. However, the complexity and duration of treatment, coupled with the need for a combination of drugs, present challenges in terms of patient adherence and potential side effects. Currently, ARIKAYCE is the only approved therapy specifically for MAC lung disease, highlighting a significant treatment gap and the need for more effective and convenient treatment options.

MAC Lung Disease Epidemiology

As the market is derived using a patient-based model, the MAC lung disease epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent cases of NTM lung disease, gender-specific diagnosed prevalent cases of NTM lung disease, species-specific diagnosed prevalent cases of NTM infection, and total diagnosed prevalent cases of MAC lung disease in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- In 2023, there were an estimated 151 thousand diagnosed prevalent cases of NTM lung disease across the 7MM, with the number expected to rise by 2034.

- In 2023, the US reported approximately 40 thousand diagnosed prevalent cases of NTM lung disease in males and 55 thousand in females.

- Among the 7MM in 2023, the species-specific prevalent cases of NTM lung disease included approximately 119 thousand cases for MAC, 6 thousand cases for Mycobacterium abscessus, and 27 thousand cases for other species.

- In 2023, the US reported the highest number of diagnosed prevalent cases of MAC lung disease among the 7MM, with approximately 76 thousand cases. This figure is projected to increase by 2034.

- In 2023, Germany recorded the highest number of diagnosed prevalent cases of MAC lung disease among the EU4 and the UK, with approximately 26 hundred cases, followed by Italy with nearly 22 hundred cases. In contrast, Spain had the fewest cases, with approximately 7 hundred cases.

- In 2023, Japan had approximately 33 thousand diagnosed prevalent cases of MAC lung disease, with expectations for this number to change by 2034.

MAC Lung Disease Drug Chapters

The drug chapter segment of the MAC lung disease report encloses a detailed analysis of MAC lung disease-marketed drugs and mid to late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the MAC lung disease clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed Drugs

ARIKAYCE (Amikacin Liposome Inhalation Suspension): Insmed

ARIKAYCE is the first FDA-approved treatment for MAC lung disease, offered as a once-daily inhaled amikacin formulation using Insmed’s PULMOVANCE technology. This delivery method targets the infection directly while minimizing systemic exposure, administered through the Lamira Nebulizer System. The treatment received orphan drug designation from the US FDA in 2013. In May 2024, late-breaking data from the ARISE study was presented at ATS 2024, focusing on MAC lung infections in patients who had not previously received antibiotic treatment. Approved in the US, EU, and Japan, ARIKAYCE is also part of the ongoing Phase III ENCORE study, evaluating patients with newly diagnosed or recurrent MAC lung infection who have not yet started antibiotics, with topline data expected in Q1 2026.

Emerging Drugs

MNKD-101 (clofazimine inhalation suspension): Mannkind Corporation

MNKD-101, a nebulized clofazimine formulation, is being developed for severe chronic and recurrent pulmonary infections, including NTM lung disease. This inhaled version is expected to offer clinical advantages over the current oral form. MannKind is also exploring a dry-powder formulation using its technosphere technology. In May 2024, the US FDA granted Fast Track Designation (FTD) to MNKD-101 for NTM lung disease, after previously designating it as an orphan drug and QIDP.

The US FDA cleared the IND application for MNKD-101 in April 2024, enabling a Phase III trial. Additionally, Japan’s PMDA approved the Phase III ICoN-1 trial in September 2024, allowing the global study to proceed.

Bedaquiline fumarate (TMC207): Johnson and Johnson (Janssen Pharmaceutical K.K.)

Bedaquiline fumarate, sold under the brand name SIRTURO, is a diarylquinoline antimycobacterial medication used in combination therapy for adults and pediatric patients (aged 5 years and older, weighing at least 15 kg) with pulmonary tuberculosis (TB) caused by Mycobacterium tuberculosis resistant to at least rifampin and isoniazid.

Currently, bedaquiline is being investigated in a Phase II/III clinical trial as part of a treatment regimen with clarithromycin and ethambutol for adult patients with treatment-refractory MAC lung disease (MAC-LD).

SPR720 (fobrepodacin): Spero Therapeutics

Spero is advancing SPR720, an oral treatment for NTM pulmonary disease (NTM-PD). This stable prodrug rapidly converts to its active form, SPR719, which targets the ATPase subunits of gyrase and topoisomerase, distinct from fluoroquinolones. Preclinical studies have shown SPR720’s broad activity against major NTM pathogens, including MAC, M. kansasii, and M. abscessus, in both refractory and nonrefractory patients. The US FDA has granted SPR720 Fast Track Designation, orphan drug status, and Qualified Infectious Disease Product (QIDP) designation. A Phase IIa trial (SPR720-202) is ongoing for the treatment of MAC PD, with results expected in Q4 2024.

Drug Class Insights

MAC lung disease treatment primarily involves a multidrug regimen, typically combining macrolides (azithromycin or clarithromycin), rifamycin (rifampin or rifabutin), and ethambutol. This approach targets mycobacterial infections through protein synthesis inhibition, cell wall disruption, and bacterial replication prevention, with therapy lasting 12–18 months based on disease severity and drug susceptibility.

Adjunctive therapies, including chest physiotherapy, mucolytics, and bronchodilators, are crucial for patients with underlying lung conditions, helping with sputum clearance and mucus obstruction. Devices like PEP masks and HFCWO devices also aid in reducing bacterial load. Emerging therapies, such as clofazimine inhalation suspension, bedaquiline, and SPR720, offer potential improvements in efficacy and safety.

MNKD-101, a nebulized formulation of clofazimine developed by Mannkind, is being investigated for severe chronic and recurrent pulmonary infections, including NTM lung disease. This inhaled formulation is expected to offer clinical advantages over the current oral dosage by delivering the drug directly to the lungs, enhancing efficacy while minimizing systemic side effects.

Continued in report…

Market Outlook

The treatment for MAC lung disease relies on a multidrug regimen, typically including macrolides (azithromycin or clarithromycin), rifamycins (rifampin or rifabutin), and ethambutol. This combination targets the infection by inhibiting protein synthesis, cell wall formation, and bacterial replication. Treatment duration is usually 12-18 months, depending on disease severity and drug susceptibility. Macrolides are essential, but resistance is a concern, requiring close monitoring and potential adjustments. In refractory cases, aminoglycosides like amikacin may be used.

Adjunctive therapies are crucial, particularly for those with structural lung disease. Techniques like chest physiotherapy, mucolytics, and bronchodilators help clear sputum and reduce obstruction. Mechanical devices, such as PEP masks and HFCWO devices, support airway clearance and bacterial load reduction, improving quality of life and preventing further damage.

For patients with localized disease or those unresponsive to medical treatment, surgery may be considered. Lobectomy or segmentectomy can remove the most affected areas of the lung, reducing disease spread. Surgery, though, carries risks and is typically reserved for patients with focal disease, minimal underlying lung damage, and good functional status. Recent advances in less invasive techniques and perioperative management have improved surgical outcomes, though it remains a high-risk option.

Emerging therapies in development, including MannKind Corporation’s MNKD-101, Janssen’s bedaquiline fumarate, and Spero Therapeutics’ SPR720, offer hope for improving treatment outcomes and addressing unmet clinical needs.

- The total market size of MAC lung disease in the 7MM was approximately USD 474 million in 2023 and is projected to increase during the forecast period (2024–2034).

- The market size for MAC lung disease in the US was approximately USD 343.6 million in 2023 and is anticipated to increase due to the launch of emerging therapies.

- The total market size of EU4 and the UK was calculated to be approximately USD 18.5 million in 2023, which was nearly 3.9% of the total market revenue for the 7MM.

- In 2023, Germany led the market among the EU4 countries and the UK, generating approximately USD 5.2 million, followed by France and Italy, both contributing around USD 4.3 million each.

- In 2023, the total market size of MAC lung disease was approximately USD 111.8 million in Japan which is anticipated to increase during the forecast period (2024-2034).

- Estimates indicate that MNKD-101 is projected to generate around USD 477.7 million in the 7MM by 2034.

MAC lung disease Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034.

Further detailed analysis of emerging therapies drug uptake in the report…

MAC lung disease Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline development activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for MAC lung disease.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on MAC lung disease evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the University of Texas Health Sciences Center, US, University of Colorado School of Medicine, US, CARITAS Health Care, Mary Immaculate Hospital-Pulmonary Division, US, Respiratory Medicine and Allergology, Frankfurt am Main, Germany, Respiratory Medicine, Université Paris Cité, Inserm U1016, Institut Cochin, France, Department of Biomedical Sciences, Humanitas University, Italy, Spanish Society of Infectious Diseases and Clinical Microbiology (SEIMC), Spain, Royal Brompton Hospital, and NHLI, Imperial College, UK, Department of Pulmonary Medicine, Higashinagoya National Hospital, Japan and Department of Respiratory Medicine, Kumagaya, Japan, among others, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or MAC lung disease market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

As per the KOLs from the US, current therapies for MAC lung disease demonstrate limited efficacy, with a considerable proportion of patients experiencing suboptimal responses or developing resistance to standard antibiotic regimens. This underscores the urgent need for more effective, targeted treatments to improve patient outcomes and combat antibiotic resistance in this challenging condition

As per the KOLs from Germany, the need for enhanced patient adherence and compliance with long-term MAC treatment protocols remains pressing, as high pill counts and extended durations burden existing regimens. Developing more patient-friendly formulations is crucial to improving adherence, reducing treatment fatigue, and enhancing overall quality of life for patients.

As per the KOLs from Japan, inappropriate prescription practices and deviations from standard treatment protocols due to adverse drug reactions are significant contributors to macrolide resistance. Implementing drug sensitivity testing at the time of diagnosis is crucial to identify macrolide resistance and to pinpoint patients who may benefit from alternative therapeutic options. This approach will enhance treatment efficacy and mitigate the risk of further resistance development.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

DelveInsight’s ‘MAC Lung Disease—Market Insights, Epidemiology, and Market Forecast—2034’ report provides a descriptive overview of the market access and reimbursement scenario of MAC lung disease.

This section includes a detailed analysis of the country-wise healthcare system for each therapy, enlightening the market access, reimbursement policies, and health technology assessments.

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of MAC lung disease, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the MAC lung disease market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM MAC lung disease market.

MAC lung disease report insights

- Patient Population

- Therapeutic Approaches

- MAC lung disease Pipeline Analysis

- MAC lung disease Market Size and Trends

- Existing and Future Market Opportunity

MAC lung disease report key strengths

- 11 years Forecast

- The 7MM Coverage

- MAC lung disease Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- Drugs Uptake and Key Market Forecast Assumptions

MAC lung disease report assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

Key Questions

Market Insights

- What was the total market size of MAC lung disease, the market size of MAC lung disease by therapies, and market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will MNKD-101 affect the treatment paradigm of MAC lung disease?

- How will ARIKAYCE compete with other upcoming products and marketed therapies?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed therapies?

- How would future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of MAC lung disease? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to MAC lung disease?

- What is the historical and forecasted MAC lung disease patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent MAC lung disease population during the study period (2020–2034)?

- What factors are contributing to the growth of MAC lung disease cases?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of MAC lung disease? What are the current clinical and treatment guidelines for treating MAC lung disease?

- How many companies are developing therapies for the treatment of MAC lung disease?

- How many emerging therapies are in the mid-stage and late stage of development for treating MAC lung disease?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted market of MAC lung disease?

Reasons to Buy

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the MAC lung disease market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying upcoming solid players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for MAC lung disease, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.