Mismatch Repair Deficiency Market

Key Highlights

- Mismatch Repair Deficiency causes failure in DNA repair, leading to accumulation of mutations, including in oncogenes and tumor suppressor genes. This promotes uncontrolled cell proliferation and tumor development.

- dMMR/MSI-H therapies are currently approved for unresectable or metastatic colorectal cancer in adults and pediatric patients aged 12 years and older, as well as for recurrent or advanced endometrial cancer. Gastric cancer is an emerging field where dMMR/MSI-H immunotherapy is under active clinical investigation.

- dMMR status is routinely determined for most solid tumors, as it predicts strong response to immunotherapy, with first-line recommendations from NCCN and ESMO for metastatic/unresectable or locally advanced colorectal, gastric, and other solid tumors.

- Zimberelimab + Domvanalimab is currently being evaluated in Phase II clinical trials for the treatment of locally advanced gastric adenocarcinoma, MSI-H/dMMR gastric cancer, and MSI-H/dMMR gastroesophageal junction cancer.

- Currently, HRO-761 is in Phase I clinical development for the treatment of MSI-H or dMMR advanced unresectable or metastatic solid tumors, including colorectal cancer.

- Currently, FDA-approved therapies for dMMR include OPDIVO (Bristol Myers Squibb), KEYTRUDA (Merck), and JEMPERLI (GSK).

- The pipeline for treating dMMR is robust, with emerging therapies such as Zimberelimab + Domvanalimab (Arcus Biosciences/Gilead Sciences), HRO761 (Novartis), MDNA11 (Medicenna Therapeutics), RO7589831 (Roche), and others currently in development to provide safe and effective treatment options.

DelveInsight's “Mismatch Repair Deficiency (dMMR) Market– Market Insight, Epidemiology and Market Forecast – 2034” report delivers an in-depth analysis of dMMR epidemiology, market, and clinical development in dMMR. In addition to this, the report provides historical and forecasted epidemiology and market data as well as a detailed analysis of the dMMR market trends in the United States, EU4 (Germany, France, Italy, and Spain ), and the United Kingdom, and Japan.

The dMMR market report provides real-world prescription pattern analysis, emerging drugs assessment, market share, and uptake/adoption pattern of individual therapies, as well as historical and forecasted dMMR market size from 2020 to 2034 in 7MM. The report also covers current dMMR treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

Mismatch Repair Deficiency (dMMR) Epidemiology

|

Segmented by:

|

|

Mismatch Repair Deficiency (dMMR) Key companies |

|

|

Mismatch Repair Deficiency (dMMR) Key therapies |

|

|

Mismatch Repair Deficiency (dMMR) Market |

Segmented by:

|

|

Analysis |

|

Mismatch Repair Deficiency (dMMR) Understanding and Treatment Algorithm

Mismatch Repair Deficiency (dMMR) Overview and Diagnosis

dMMR refers to a defect in the cellular machinery responsible for correcting errors that arise during DNA replication. The normal mismatch repair (MMR) system identifies and repairs mismatches incorrect base pairings or small insertions/deletions that can occur during DNA synthesis or recombination. Loss of function in this pathway leads to the accumulation of DNA mutations, genomic instability, and an increased risk of cancer.

dMMR is diagnosed by testing tumor tissue for the loss of key mismatch repair proteins (MLH1, MSH2, MSH6, PMS2) using immunohistochemistry, or for microsatellite instability (MSI) using molecular assays. If dMMR is detected, further tests such as analysis for MLH1 promoter methylation or BRAF mutation help distinguish between inherited and sporadic causes. Germline genetic testing may be done to confirm hereditary conditions like Lynch syndrome. This stepwise approach allows precise identification of dMMR, guides cancer treatment, and helps inform family risk.

Further details related to country-based variations in diagnosis are provided in the report.

Mismatch Repair Deficiency (dMMR) Treatment

Treatment of dMMR tumors, often characterized by microsatellite instability-high (MSI-H), is centered on immune checkpoint inhibitors (ICIs), which have transformed outcomes due to the high immunogenicity of these cancers. Pembrolizumab is FDA-approved for any unresectable or metastatic MSI-H/dMMR solid tumor, while nivolumab (alone or with ipilimumab) and dostarlimab are approved for colorectal and endometrial cancers, respectively. Surgery remains key for localized disease, but ICIs are moving into earlier settings. Ongoing trials are exploring next-generation ICIs, combinations with CTLA-4 inhibitors, PARP inhibitors, vaccines, and cell therapies to expand benefit and overcome resistance.

Further details related to treatment are provided in the report…

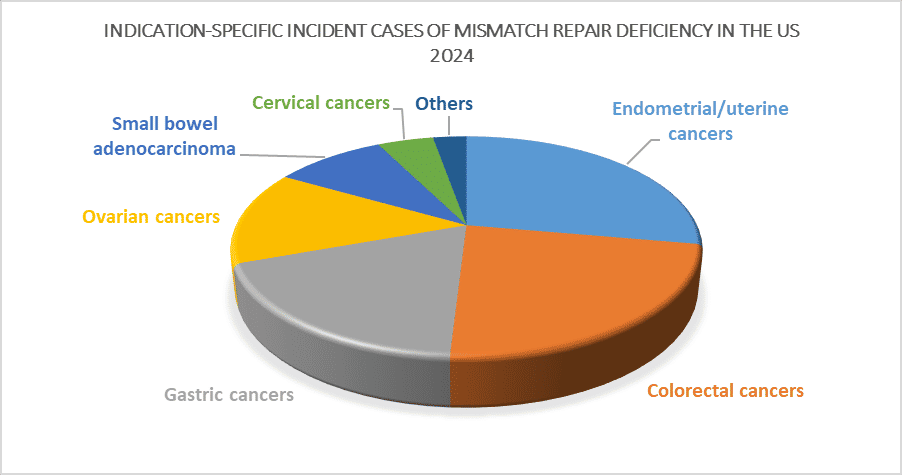

Mismatch Repair Deficiency (dMMR) Epidemiology

As the market is derived using a patient-based model, the dMMR epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by indication-specific incident cases of mismatch repair deficiency, total incident cases of mismatch repair deficiency, stage-specific incident cases of mismatch repair deficiency, total treatable cases of mismatch repair deficiency in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- In 2024, total incident cases of cervical cancer were ~40,100 in the 7MM.

- In 2024, total incident cases of gastric cancer were ~44,700 in the 7MM.

- In 2024, the highest number of incident cases of ovarian cancer was observed in the United States, with ~19,700 cases, followed by Japan, which accounted for ~12,700 cases.

- Endometrial cancer has the highest rate, with dMMR found in about 20–30% of cases, and some reports up to 40%.

- Gastric cancer generally shows dMMR in 8–10% of cases.

- Colorectal cancer shows dMMR in about 10–15% of cases, with variations depending on cohort and geography; some studies report up to 26% in some settings, but typically 13–15% is most consistent for unselected CRC.

- Among the Stage-specific HGSOC, advanced-Stage (III-IV) had the highest contribution from ~10,000 in 2024.

Mismatch Repair Deficiency (dMMR) Drug Chapters

The drug chapter segment of the dMMR report encloses a detailed analysis of dMMR marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into the dMMR pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Marketed Drugs

KEYTRUDA (pembrolizumab): Merck

KEYTRUDA, developed by Merck, is a PD-1 immune checkpoint inhibitor that has become a cornerstone in modern oncology, approved across a wide range of cancers including melanoma, lung, head and neck, and MSI-H/dMMR solid tumors. It works by blocking the PD-1 pathway, restoring T-cell activity against cancer cells.

In May 2017, FDA approved KEYTRUDA for adult and pediatric patients with unresectable or metastatic, (MSI-H) or (dMMR) solid tumors.

OPDIVO (nivolumab): Bristol Myers Squibb

OPDIVO is a fully human IgG4 monoclonal antibody that targets the programmed death-1 (PD-1) receptor, restoring T-cell activity and enhancing anti-tumor immune responses. Developed by Bristol Myers Squibb, it is one of the most widely used immune checkpoint inhibitors and is approved for multiple cancers, including melanoma, non-small cell lung cancer, renal cell carcinoma, hepatocellular carcinoma, Hodgkin lymphoma, and gastrointestinal cancers. Importantly, in the setting of dMMR or microsatellite instability–high colorectal cancer, nivolumab has demonstrated significant clinical benefit.

In April 2025, US FDA Approves OPDIVO (nivolumab) plus YERVOY (ipilimumab) as a treatment for patients with previously untreated MSI-H or dMMR unresectable or metastatic colorectal cancer.

Emerging Drugs

Zimberelimab + Domvanalimab: Arcus Biosciences/Gilead Sciences

Zimberelimab is a PD-1 inhibitor and domvanalimab is a TIGIT inhibitor, both developed by Arcus Biosciences in collaboration with Gilead, and they are being studied in combination as a novel dual checkpoint blockade strategy. While zimberelimab restores T-cell activity by blocking PD-1 signaling, domvanalimab targets the TIGIT pathway. This dual immunotherapy strategy is also being explored in biomarker-driven cancers such as those with dMMR or MSI-H.

In November 2024, Arcus Biosciences announced that Domvanalimab Plus Zimberelimab improved overall survival in ARC-10, a randomized study in patients with PD-L1-high NSCLC.

HRO761: Novartis

HRO761 is a first-in-class WRN helicase inhibitor being developed by Novartis for the treatment of cancers with dMMR and MSI-H. dMMR/MSI-H tumors accumulate DNA errors and become highly dependent on the WRN helicase for survival, creating a synthetic lethality vulnerability. By selectively blocking WRN activity, HRO761 is designed to kill dMMR/MSI-H tumor cells while sparing normal tissue, offering a precision therapy approach beyond immunotherapy.

|

Drug Name |

Company |

Phase |

Indication |

RoA |

MoA |

|

Zimberelimab + Domvanalimab |

Arcus Biosciences/Gilead Sciences |

II |

MSI-H/dMMR Gastric Cancer |

IV |

PD-L1 inhibitor + TIGIT inhibitor |

|

MDNA11 |

Medicenna Therapeutics |

I/II |

MSI and/or dMMR advanced solid tumors |

IV |

Interleukin 2 replacements |

|

HRO761 |

Novartis |

I |

dMMR Advanced Unresectable or Metastatic Solid Tumors, Including Colorectal Cancers |

Oral |

Allosteric Werner syndrome ATP-dependent helicase (WRN) inhibitor |

|

RO7589831 |

Roche |

I |

Advanced solid tumors harboring MSI and/or dMMR |

Oral |

WRN inhibitor |

Note: Detailed emerging therapies assessment will be provided in the final report.

Mismatch Repair Deficiency (dMMR) Market Outlook

dMMR/MSI-H cancers remain a high-value immuno-oncology segment driven by broad testing uptake and durable responses to PD-1 inhibitors. On the marketed side, KEYTRUDA (pembrolizumab, Merck) anchors the category with a tumor-agnostic US approval now fully converted, enabling use across unresectable/metastatic MSI-H/dMMR solid tumors OPDIVO (nivolumab, BMS) including its nivolumab + ipilimumab regimen has expanded in dMMR/MSI-H metastatic colorectal cancer, further entrenching PD-1 leadership and dostarlimab (GSK) and durvalumab (AstraZeneca) approvals in dMMR endometrial cancer are pushing checkpoint therapy earlier and in combinations, widening addressable patients. Looking ahead, competition intensifies from next-gen combos like zimberelimab (anti-PD-1) + domvanalimab (anti-TIGIT) and novel mechanisms such as HRO761 (Novartis), a first-in-class WRN helicase inhibitor biomarker-matched to MSI-H/dMMR biology. With MSI testing penetration rising and multiple first-line and peri-operative studies reading out, revenue should stay resilient despite PD-1 class crowding; differentiation will hinge on earlier-line use, combo efficacy, and biomarker-guided selection. Headwinds include pricing pressure/biosimilars in PD-1s and IP challenges around formulation life-cycle strategies, but overall the dMMR franchise is poised for continued growth and label breadth across tumor types.

Mismatch Repair Deficiency (dMMR) Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2025–2034, which depends on the competitive landscape, safety, and efficacy data, along with the order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Mismatch Repair Deficiency (dMMR) Pipeline Activities

The report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for dMMR emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry Leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including Medical/scientific writers, Professors, and Others.

DelveInsight’s analyst dMMR connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Harvard Medical School, University of Cambridge University of Michigan, and Sarcoma Oncology Center etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or dMMR market trends.

|

KOL Views |

|

“dMMR is no longer just a biomarker of genetic instability, it is a clinically actionable signature. Immunotherapy has transformed outcomes in this subgroup, with response rates far exceeding those seen in mismatch repair proficient tumors." MD, Harvard Medical School, USA |

|

"The efficacy of PD-1 inhibitors in dMMR tumors highlights the power of leveraging neoantigen load to drive immune response. Future strategies must focus on expanding this success to MMR-proficient cancers through rational combinations." MD, University of Cambridge, UK |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy evaluation for dMMR, both primary and secondary outcome measures are assessed; for instance, primary endpoints often include reduction in infarct size, improvement in tissue viability, and preservation of organ function, while secondary outcomes may involve biomarkers of oxidative stress, inflammatory response, and overall survival rates.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Antibiotics are typically prescribed for short durations, often just two weeks, and face reimbursement challenges. Government and private insurers generally use bundled payments for antibiotic treatments, covering the entire course rather than itemizing costs for the drug, administration, and other services. Hospitals receive a fixed amount, so if they manage treatment at a lower cost, they can keep the savings, improving margins. However, this system has led to poor returns for antibiotic developers, resulting in numerous company failures, bankruptcies, and low-value acquisitions in the sector.

Market Access and Reimbursement Key Developments in 2025

|

Region/Country |

Key 2025 Developments |

|

United States |

|

|

Europe (EU-wide) |

|

|

Germany |

|

|

France |

|

|

Italy |

|

|

Spain |

|

|

United Kingdom |

|

|

China |

|

|

Japan |

|

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Further detailed analysis will be provided in the report….

Scope of the Report

- The report covers a segment of key events, an executive summary, descriptive overview of dMMR, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts dMMR, the future growth potential of diagnosis rate, and disease progression along treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the dMMR market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM dMMR market.

Mismatch Repair Deficiency (dMMR) Report Insights

- Patient Population

- Therapeutic Approaches

- dMMR Pipeline Analysis

- dMMR Market Size and Trends

- Existing and future Market Opportunity

Mismatch Repair Deficiency (dMMR) Report Key Strengths

- 10-Years Forecast

- 7MM Coverage

- dMMR Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- Drugs Uptake and Key Market Forecast Assumptions

Mismatch Repair Deficiency (dMMR) Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the historical and forecasted dMMR patient pool/patient burden in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- Which combination treatment approaches will have a significant impact on the dMMR drug treatment market size?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the current and emerging options for the treatment of dMMR?

- How many companies are developing therapies for the treatment of dMMR?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the dMMR market.

- Insights on patient burden/disease Incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.