Molybdenum Cofactor Deficiency Type-A Market

Key Highlights

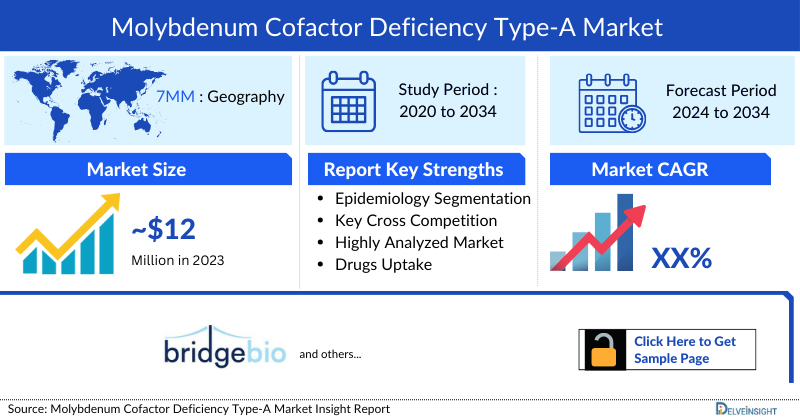

- Attributed to the rising diagnosed prevalent cases and increasing awareness, the Molybdenum Cofactor Deficiency Type A (MoCoD-A) market was valued at nearly USD 12 million in 2023 and is expected to experience consistent growth during the forecast period (2024–2034).

- Analysts at DelveInsight project that approximately 54% of the Total Diagnosed Prevalent Cases of Molybdenum Cofactor Deficiency Type A (MoCoD-A) in the 7MM were in the United States. Our estimations indicate that in 2023, the EU4 and the UK collectively represented nearly 36% diagnosed prevalent cases of MOCOD-A.

- In the 7MM, the market primarily comprised of three categories: Standard of Care which generated a market revenue of approximately USD 0.04 million in 2023.

DelveInsight’s “Molybdenum Cofactor Deficiency Type A (MoCoD-A) – Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the MOCOD-A, historical and forecasted epidemiology and the MOCOD-A market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Molybdenum Cofactor Deficiency Type A (MoCoD-A) market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM MOCOD-A market size from 2020 to 2034. The report also covers current MOCOD-A treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assesses the underlying potential of the market.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

Molybdenum Cofactor Deficiency Type A (MoCoD-A) Overview

Molybdenum cofactor (MoCo) deficiency (MoCoD) is a rare metabolic disorder characterized by severe progressive neurologic damage, disordered autonomic function, exaggerated startle reactions, dysmorphic facial features, alterations in muscle tone, progressive cerebral palsy, microcephaly, seizures, and early death, and caused by the functional loss of sulfite oxidase, one of four molybdenum-dependent enzymes in humans. MoCoD-A is characterized by intractable seizures, feeding difficulties, and severe neurological impairment, leading to death in early childhood. The epidemiology of MoCoD-A is challenging due to its rarity which prevents a challenge in the disease understanding.

Molybdenum Cofactor Deficiency Type A (MoCoD-A) Diagnosis

The diagnosis of MoCoD is established by identifying of biallelic pathogenic variants in GPHN, MOCS1, MOCS2, or MOCS3, or when unavailable, of significantly reduced activity of the enzyme sulfite oxidase in cultured fibroblasts. However, due to the low expression of sulfite oxidase in fibroblasts, differentiation between total and partial loss of enzyme activity is difficult to discern. Because of its high sensitivity, molecular genetic testing typically obviates the need for enzymatic testing and thus is the preferred diagnostic test for MoCoD.

The diagnosis of MoCoD-A is challenging due to its rarity, non-specific symptoms, and the need for genetic testing for confirmation. Confirming the diagnosis requires identifying biallelic mutations in the MOCS1 gene and detecting specific metabolites in blood or urine tests, which necessitates specialized genetic testing and biochemical analyses.

Further details related to diagnosis are provided in the report…

Molybdenum Cofactor Deficiency Type A (MoCoD-A) Treatment

The treatment of Molybdenum Cofactor Deficiency Type A (MoCoD-A) is challenging due to its rarity and the need for specialized care. The primary goal of treatment is to manage symptoms and prevent complications. MoCoD-A with severe neonatal symptoms has very few therapeutic options and overall the outcome is usually poor. Many infants require intubation for supportive ventilation due to seizure activity and/or poor mental status. For the most part, the approach is to inform parents and caregivers of the extremely poor prognosis and offer options of abstaining from aggressive resuscitative medical interventions and/or withdrawing life supportive measures.

Further details related to treatment are provided in the report…

Molybdenum Cofactor Deficiency Type A (MoCoD-A) Epidemiology

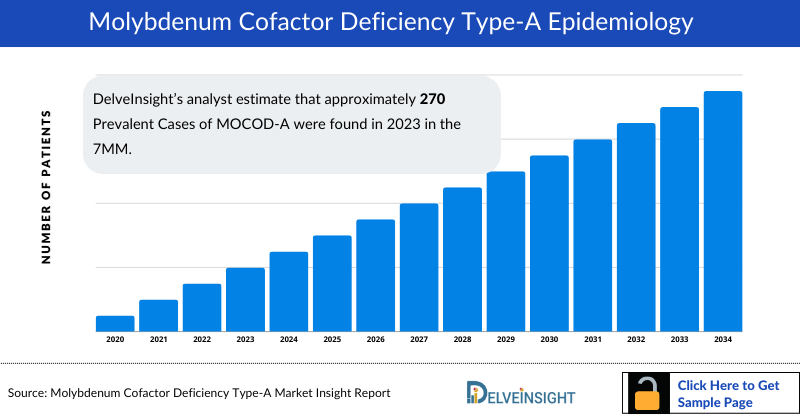

As the market is derived using the patient-based model, the Molybdenum Cofactor Deficiency Type A (MoCoD-A) epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Prevalent cases of MoCoD, Diagnosed Prevalent Cases of MoCoD, and Type-specific Diagnosed Prevalent Cases of MoCoD in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan, from 2020 to 2034.

- DelveInsight’s analyst estimate that approximately 270 Prevalent Cases of MOCOD-A were found in 2023 in the 7MM.

- The United States exhibited the highest diagnosed prevalent cases of MOCOD-A, as compared to other 7MM countries. As per DelveInsight’s estimations, the Total Diagnosed Prevalent Cases of MOCOD-A in the US was around 30 in 2023 and is projected to increase during the forecast period owing to the increasing awareness among the patient population.

- According to DelveInsight’s estimates, the Total Diagnosed Prevalent Cases of MOCOD-A in EU4 and the UK were found to be ~20 in 2023. Throughout the study period, it is anticipated that there will be a substantial increase in cases for all contributing countries. The least proportion of MOCOD-A cases was reported in Spain among the EU4 countries.

- The data indicates that Japan had the lowest number of Total Diagnosed Prevalent Cases of MOCOD-A among the 7MM in 2023, accounting for just 9% of the overall cases. However, it is projected to experience substantial growth by 2034, with a notable CAGR.

- The Type-specfic Diagnosed Prevalence of MOCOD-A was categorized into ‘MoCoD Type A’ and ‘MoCoD Type B and Type C’. MoCoD Type-A accounted for more cases than MoCoD Type B and Type C, owing to the fact that MOCS1 gene mutations are more common than mutations in the MOCS2 or GPHN genes, which are responsible for MoCoD Type B and Type C, respectively.

Molybdenum Cofactor Deficiency Type A (MoCoD-A) Drug Chapters

The drug chapter segment of the MOCOD-A report encloses a detailed analysis of MOCOD-A marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also understands MOCOD-A clinical trial details, expressive pharmacological action, agreements and collaborations, approval, and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed Drugs

Nulibry (Fosdenopterin): BridgeBio Pharma

Nulibry (fosdenopterin) is cyclic pyranopterin monophosphate (cPMP), a substrate replacement therapy that provides an exogenous source of cPMP, which is converted to molybdopterin. It is the first-in-class approved cPMP substrate replacement therapy to reduce the risk of mortality in patients with molybdenum cofactor deficiency (MoCoD) Type-A. It is the first and only FDA-approved therapy for MoCoD Type A. The mechanism of action of fosdenopterin is to provide an exogenous source of cPMP. Patients with MoCoD Type-A have mutations in the MOCS1 gene leading to deficient MOCS1A/B dependent synthesis of the intermediate substrate, cPMP.

Note: Detailed marketed therapies assessment will be provided in the final report of Molybdenum Cofactor Deficiency Type A (MoCoD-A).

Molybdenum Cofactor Deficiency Type A (MoCoD-A) Market Outlook

MOCOD-A has a diverse treatment classification associated with the disease landscape. The management of MOCOD-A primarily revolves around the utilization of Standard of care as needed.

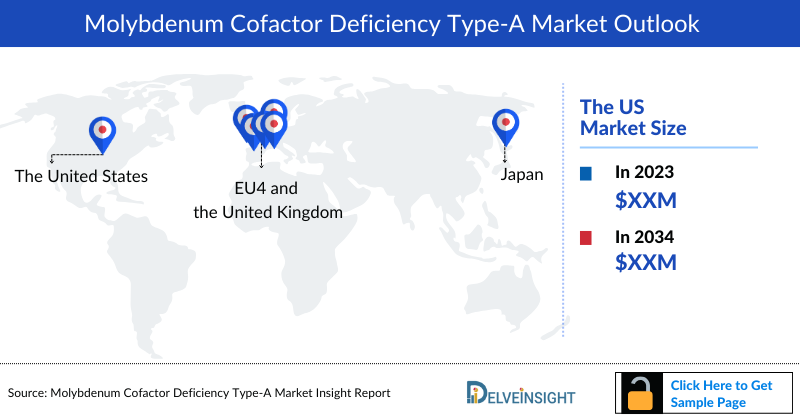

- The total market size of MOCOD-A in the 7MM reached approximately USD 12.20 million in 2023. Projections indicate a substantial growth during the forecast period.

- Out of the 7MM, the United States dominated the market in 2023, representing the largest share at nearly 68%.

- In 2023, EU4 and the UK captured an estimated USD 3.9 million, which is anticipated to increase at a substantial CAGR. Among the European countries, Germany and France covered the largest market share in 2023, followed by the UK and Italy. Spain accounted for the least market in the same year.

- Japan alone represented approximately 0.03% of the total MOCOD-A market in 2023, projected to increase at a substantial CAGR during the study period.

The total market size of the MOCOD-A treatment market is anticipated to experience growth during the forecast period at a significant Compound Annual Growth Rate (CAGR).

Molybdenum Cofactor Deficiency Type A (MoCoD-A) Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to launch in the market during 2020–2034.

Further detailed analysis of emerging therapies drug uptake in the report…

Molybdenum Cofactor Deficiency Type A (MoCoD-A) Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I stage. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for MOCOD-A emerging therapies.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on MOCOD-A evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including KOL from Children's Hospital Colorado, University of Colorado Denver, United States, University of Cologne, Germany, Department of Pediatrics, Seirei-Mikatahara General Hospital, Japan, and others.

Delveinsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or MOCOD-A market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Report

- The report covers a segment of key events, an executive summary, descriptive overview of Molybdenum Cofactor Deficiency Type A (MoCoD-A), explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Molybdenum Cofactor Deficiency Type A (MoCoD-A) market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Molybdenum Cofactor Deficiency Type A (MoCoD-A) market.

Molybdenum Cofactor Deficiency Type A (MoCoD-A) Report Insights

- Patient Population

- Therapeutic Approaches

- Molybdenum Cofactor Deficiency Type A (MoCoD-A) Pipeline Analysis

- Molybdenum Cofactor Deficiency Type A (MoCoD-A) Market Size and Trends

- Existing and Future Market Opportunity

Molybdenum Cofactor Deficiency Type A (MoCoD-A) Report Key Strengths

- 11 years Forecast

- 7MM Coverage

- Molybdenum Cofactor Deficiency Type A (MoCoD-A) Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Drugs Uptake and Key Market Forecast Assumptions

Molybdenum Cofactor Deficiency Type A (MoCoD-A) Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

Market Insights

- What was the Molybdenum Cofactor Deficiency Type A (MoCoD-A) total market size, the market size by therapies, and market share (%) distribution in 2020, and how would it all look in 2034? What are the contributing factors for this growth?

- What unmet needs are associated with the current treatment market of Molybdenum Cofactor Deficiency Type A (MoCoD-A)?

- What are the patents of emerging therapies for Molybdenum Cofactor Deficiency Type A (MoCoD-A)?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of Molybdenum Cofactor Deficiency Type A (MoCoD-A)? What will be the growth opportunities across the 7MM concerning the patient population of Molybdenum Cofactor Deficiency Type A (MoCoD-A)?

- What is the historical and forecasted Molybdenum Cofactor Deficiency Type A (MoCoD-A) patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- Why do only limited patients appear for diagnosis?

- Which country is more prevalent for Molybdenum Cofactor Deficiency Type A (MoCoD-A) and why?

- What factors are affecting the diagnosis of the indication?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for treating Molybdenum Cofactor Deficiency Type A (MoCoD-A)? What are the current guidelines for treating Molybdenum Cofactor Deficiency Type A (MoCoD-A) in the US and Europe?

- How many companies are developing therapies for treating Molybdenum Cofactor Deficiency Type A (MoCoD-A)?

- How many emerging therapies are in the mid-stage and late stage of development for treating Molybdenum Cofactor Deficiency Type A (MoCoD-A)?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the key designations that have been granted for the emerging therapies for Molybdenum Cofactor Deficiency Type A (MoCoD-A)?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies? Focus on reimbursement policies.

- What are the 7MM historical and forecasted markets of Molybdenum Cofactor Deficiency Type A (MoCoD-A)?

Reasons to Buy

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Molybdenum Cofactor Deficiency Type A (MoCoD-A) Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies that will help get ahead of competitors.

- Detailed analysis and ranking of potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-market.png&w=256&q=75)