mRNA Synthesis and Manufacturing Market

mRNA Synthesis and Manufacturing Market by Product Type (Instruments and Reagents & Kits), Application (Research and Manufacturing), End-User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutions, and CROs & CDMOs), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the increase in prevalence of infectious diseases, cancer, and chronic conditions, increase in demand for mRNA vaccines, advancements in gene therapies, increase in demand for personalized medicine, and growing product development activities across the globe.

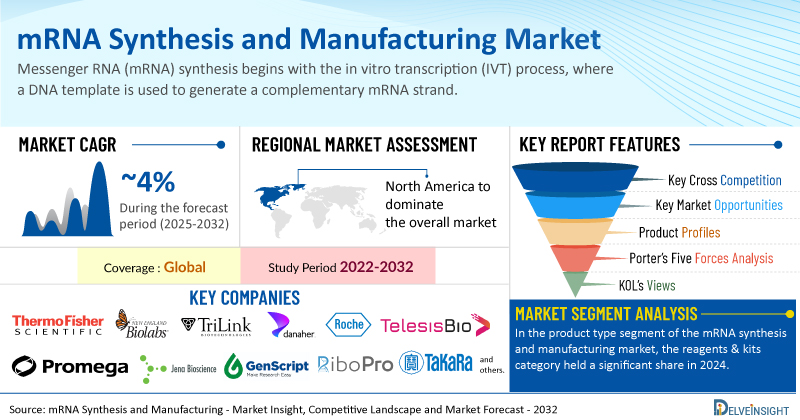

The global mRNA synthesis and manufacturing market is estimated to grow at a CAGR of 4.32% during the forecast period from 2025 to 2032. The increasing prevalence of infectious diseases, cancer, and chronic conditions has significantly boosted demand for innovative mRNA-based solutions. Additionally, the rising demand for mRNA vaccines, particularly post-COVID-19, has established mRNA as a critical technology for combating infectious diseases. Advancements in gene therapies further drive this market, as mRNA plays a vital role in delivering therapeutic proteins for genetic disorders and cancer treatments. Personalized medicine also relies heavily on mRNA for its flexibility in tailoring therapies to individual needs. Combined with increased global product development activities, these factors are accelerating innovations, scaling manufacturing capabilities, and creating a robust market for mRNA synthesis and production worldwide. These factors collectively contribute to the increasing need for mRNA synthesis and manufacturing, boosting the overall market of mRNA synthesis and manufacturing during the forecast period from 2025 to 2032.

mRNA Synthesis and Manufacturing Market Dynamics:

According to the recent data provided by the International Agency for Research on Cancer (2024), in 2022, globally, the estimated number of new cases of cancer was 20 million and the projections were indicated to increase by 32.6 million by 2045. Unlike traditional treatments, mRNA-based therapies offer the ability to encode tumor-specific antigens and stimulate the immune system to recognize and destroy cancer cells. This has opened new avenues in cancer immunotherapy, particularly in the development of mRNA cancer vaccines and individualized neoantigen-based treatments.

Additionally, the increase in demand for mRNA vaccines and advancements in gene therapies are significantly boosting the overall market for mRNA synthesis and manufacturing. The success of mRNA vaccines against COVID-19 has established a solid foundation for the growth of the mRNA synthesis and manufacturing market. Companies are now expanding their capabilities to meet the rising demand for both existing vaccines and new candidates targeting other infectious diseases. For instance, in August 2024, Pfizer and BioNTech provided an update on an mRNA-based combination vaccine program against influenza and COVID-19 in individuals 18-64 years of age. In a Phase 3 trial, Pfizer and BioNTech's combination vaccine candidate for influenza and COVID-19 met one primary immunogenicity goal but failed to achieve non-inferiority for the influenza B strain. Despite this, it showed higher responses to influenza A and comparable COVID-19 responses. Separately, Pfizer's Phase 2 trial for a trivalent influenza mRNA vaccine demonstrated robust immunogenicity across all strains, surpassing a standard influenza vaccine.

Furthermore, the growing demand for personalized medicine is significantly boosting the mRNA synthesis and manufacturing market by driving the development of targeted therapies. mRNA technology's adaptability allows it to address patient-specific needs, from cancer treatments to rare genetic disorders. For instance, in February 2023, Moderna and Merck announced mRNA-4157/V940, an investigational personalized mRNA cancer vaccine, in combination with KEYTRUDA(R) (pembrolizumab), was granted breakthrough therapy designation by the FDA for adjuvant treatment of patients with high-risk melanoma following complete resection. Thus, these activities underscore the increasing reliance on mRNA technology for tailored medical solutions, fueling manufacturing innovations and capacity expansion.

Thus, the factors mentioned above are expected to boost the overall market of mRNA synthesis and manufacturing across the globe during the forecast period from 2025 to 2032.

However, the complexity of manufacturing processes along with limited accessibility to GMP-grade raw materials and stringent regulatory concerns may result in slight obstacles to the growth of mRNA synthesis and manufacturing market.

mRNA Synthesis and Manufacturing Market Segment Analysis:

mRNA Synthesis and Manufacturing Market by Product Type (Instruments and Reagents& Kits), Application (Research and Manufacturing), End-User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutions, and CROs & CDMOs), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product type segment of the mRNA synthesis and manufacturing market, the reagents & kits category is expected to hold a significant share in 2024. Reagents and kits play a pivotal role in boosting the overall market of mRNA synthesis and manufacturing by providing the essential building blocks and streamlined protocols required for efficient, reproducible, and scalable mRNA production. These components include enzymes such as T7 RNA polymerase, nucleotides (ATP, CTP, GTP, UTP), capping reagents, and modified bases like pseudouridine, which are critical for enhancing mRNA stability and translational efficiency. The increasing complexity and specificity of mRNA-based therapeutics, especially in oncology, infectious diseases, and rare genetic disorders, demand high-quality reagents that meet stringent regulatory standards for clinical and commercial use.

Additionally, ready-to-use mRNA synthesis kits, which combine all necessary reagents into a single, standardized solution, are also reducing technical barriers and accelerating R&D timelines for biotech companies and academic institutions. This ease of use is enabling even small-scale labs to participate in mRNA innovation, thereby expanding the customer base. Moreover, as personalized medicine and individualized vaccines gain traction, especially in cancer treatment, the need for fast and efficient mRNA production using reliable reagent systems becomes even more critical. Suppliers such as Thermo Fisher Scientific, Merck KGaA, New England Biolabs, and TriLink BioTechnologies are expanding their product lines to include GMP-grade reagents and scalable kit formats, further fueling market growth. Additionally, the increasing use of automated synthesis platforms relies heavily on compatible, high-performance reagents and kits to maintain consistency and regulatory compliance. Together, these advancements in reagents and kits are not only enhancing the quality and scalability of mRNA synthesis but are also significantly accelerating the commercialization of mRNA-based therapies and vaccines, thereby driving robust growth in the global mRNA synthesis and manufacturing market.

Moreover, many reagents and kits are designed for specific modifications or applications, such as capping or tailing, catering to diverse research needs. For instance, in November 2021, New England Biolabs (NEB®) recently introduced a new HiScribe T7 mRNA Kit featuring TriLink Biotechnologies' CleanCap Reagent AG. This kit facilitates the synthesis of high-yield mRNA with a Cap 1 structure in a single-step reaction, ideal for research and preclinical applications. Designed for scalability, it supports seamless transitions to large-scale therapeutic mRNA production, including vaccine manufacturing. NEB also made its kits, enzymes, and reagents available in GMP-grade quality to meet the increasing demand for high-quality RNA synthesis in therapeutic settings.

Thus, the factors mentioned above are expected to boost the segment thereby boosting the overall market of mRNA synthesis and manufacturing across the globe.

North America is expected to dominate the overall mRNA synthesis and manufacturing market:

North America is expected to account for the highest proportion of the mRNA synthesis and manufacturing market in 2024, out of all regions. The region is home to a robust ecosystem of leading biotechnology and pharmaceutical companies, such as Moderna and Pfizer, which are at the forefront of mRNA vaccine development and production. Additionally, the region has benefited from advanced research infrastructure, strong regulatory support such as the FDA's expedited approvals, and growing demand for mRNA therapies in areas like cancer immunotherapy and infectious diseases. Furthermore, investments in manufacturing facilities and industry collaborations further enhance production and innovation, solidifying North America's dominance in the sector.

As per the recent data provided by the International Agency for Research on Cancer (2024), in 2022, the estimated new cases of cancer in North America was 2.67 million and the projections were estimated to increase by 3.83 million by 2045. The rising incidence of cancer in North America is significantly driving the demand for mRNA synthesis and manufacturing. mRNA-based therapies, such as cancer immunotherapies, are gaining prominence due to their ability to stimulate targeted immune responses against tumors. In the U.S., pharmaceutical companies like Moderna and BioNTech are accelerating investments in mRNA technology for innovative treatments. This surge in cancer cases, coupled with advancements in mRNA manufacturing infrastructure, is boosting market growth by meeting the increasing need for precision cancer therapies.

Additionally, the scalability and versatility of mRNA synthesis and manufacturing for developing vaccines targeting various diseases creates a ripple effect in the market by driving investment in research, innovation, and infrastructure to support expanded production capabilities. Additionally, the approval of mRNA based vaccines boosts confidence in mRNA-based therapies, attracting new stakeholders and accelerating the adoption of mRNA technology globally. For instance, in May 2024, Moderna, Inc. announced that the U.S. Food and Drug Administration (FDA) had approved mRESVIA (mRNA-1345), an mRNA vaccine for respiratory syncytial virus (RSV), to protect adults aged 60 and older from lower respiratory tract disease caused by RSV infection. The approval was granted under a breakthrough therapy designation and marked the second mRNA product approved for Moderna.

Thus, the above-mentioned factors are expected to escalate the market of mRNA synthesis and manufacturing in the region.

mRNA Synthesis and Manufacturing Market Key Players:

Some of the key market players operating in the mRNA synthesis and manufacturing market include Thermo Fisher Scientific Inc., New England Biolabs, TriLink BioTechnologies, DH Life Sciences, LLC., F. Hoffmann-La Roche Ltd., Telesis Bio Inc., Promega Corporation, Jena Bioscience, GenScript, RiboPro, Takara Bio, Lonza, Sigma-Aldrich, Agilent Technologies, Integrated DNA Technologies, Inc., and others.

Recent Developmental Activities in the mRNA Synthesis and Manufacturing Market:

- In August 2024, the U.S. Food and Drug Administration approved and granted emergency use authorization (EUA) for the updated mRNA COVID-19 vaccine (2024-2025 formula) to include a monovalent (single) component that corresponds to the Omicron variant KP.2 strain of SARS-CoV-2.

- In April 2024, TriLink BioTechnologies (TriLink®), a Maravai LifeSciences company and global provider of life science reagents and services, announced the grand opening of its new cGMP mRNA manufacturing facility.

- In September 2023, PackGene Biotech and Kudo Biotechnology partnered to offer customized mRNA manufacturing services.

- In August 2022, New England Biolabs® introduced Faustovirus Capping Enzyme, a novel enzymatic mRNA capping solution for mRNA manufacturing.

Key Takeaways From the mRNA Synthesis and Manufacturing Market Report Study

- Market size analysis for current mRNA synthesis and manufacturing size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the mRNA synthesis and manufacturing market.

- Various opportunities available for the other competitors in the mRNA synthesis and manufacturing market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current mRNA synthesis and manufacturing market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for mRNA synthesis and manufacturing market growth in the coming future?

Target Audience Who Can be Benefited From This mRNA Synthesis and Manufacturing Market Report Study

- mRNA synthesis and manufacturing product providers

- Research organizations and consulting companies

- mRNA synthesis and manufacturing-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in mRNA synthesis and manufacturing

- Various end-users who want to know more about the mRNA synthesis and manufacturing market and the latest technological developments in the mRNA synthesis and manufacturing market.

Frequently Asked Questions for the mRNA Synthesis and Manufacturing Market:

1. What are mRNA synthesis and manufacturing?

- mRNA synthesis and manufacturing involve creating messenger RNA (mRNA) in the lab for applications like vaccines, gene therapies, and research. The process uses in vitro transcription (IVT) to produce RNA from DNA templates with RNA polymerases. Manufacturing large quantities of high-quality mRNA, often with added features like capping for stability, enables its use in treating diseases such as cancer, viral infections, and genetic disorders by instructing cells to produce specific proteins.

2. What is the market for mRNA synthesis and manufacturing?

- The global mRNA synthesis and manufacturing market is estimated to grow at a CAGR of 4.32% during the forecast period from 2025 to 2032.

3. What are the drivers for the global mRNA synthesis and manufacturing market?

- The increasing prevalence of infectious diseases, cancer, and chronic conditions has significantly boosted demand for innovative mRNA-based solutions. Additionally, the rising demand for mRNA vaccines, particularly post-COVID-19, has established mRNA as a critical technology for combating infectious diseases. Advancements in gene therapies further drive this market, as mRNA plays a vital role in delivering therapeutic proteins for genetic disorders and cancer treatments. Personalized medicine also relies heavily on mRNA for its flexibility in tailoring therapies to individual needs. Combined with increased global product development activities, these factors are accelerating innovations, scaling manufacturing capabilities, and creating a robust market for mRNA synthesis and production worldwide. These factors collectively contribute to the increasing need for mRNA synthesis and manufacturing, boosting the overall market of mRNA synthesis and manufacturing during the forecast period from 2025 to 2032.

4. Who are the key players operating in the global mRNA synthesis and manufacturing market?

- Some of the key market players operating in mRNA synthesis and manufacturing are Thermo Fisher Scientific Inc., New England Biolabs, TriLink BioTechnologies, DH Life Sciences, LLC., F. Hoffmann-La Roche Ltd., Telesis Bio Inc., Promega Corporation, Jena Bioscience, GenScript, RiboPro, Takara Bio, Lonza, Sigma-Aldrich, Agilent Technologies, Integrated DNA Technologies, Inc., and others.

5. Which region has the highest share in the global mRNA synthesis and manufacturing market?

- North America is expected to account for the highest proportion of the mRNA synthesis and manufacturing market in 2024, out of all regions. The region is home to a robust ecosystem of leading biotechnology and pharmaceutical companies, such as Moderna and Pfizer, which are at the forefront of mRNA vaccine development and production. Additionally, the region has benefited from advanced research infrastructure, strong regulatory support such as the FDA's expedited approvals, and growing demand for mRNA therapies in areas like cancer immunotherapy and infectious diseases. Furthermore, investments in manufacturing facilities and industry collaborations further enhance production and innovation, solidifying North America's dominance in the sector.