Mucopolysaccharidosis I Market Summary

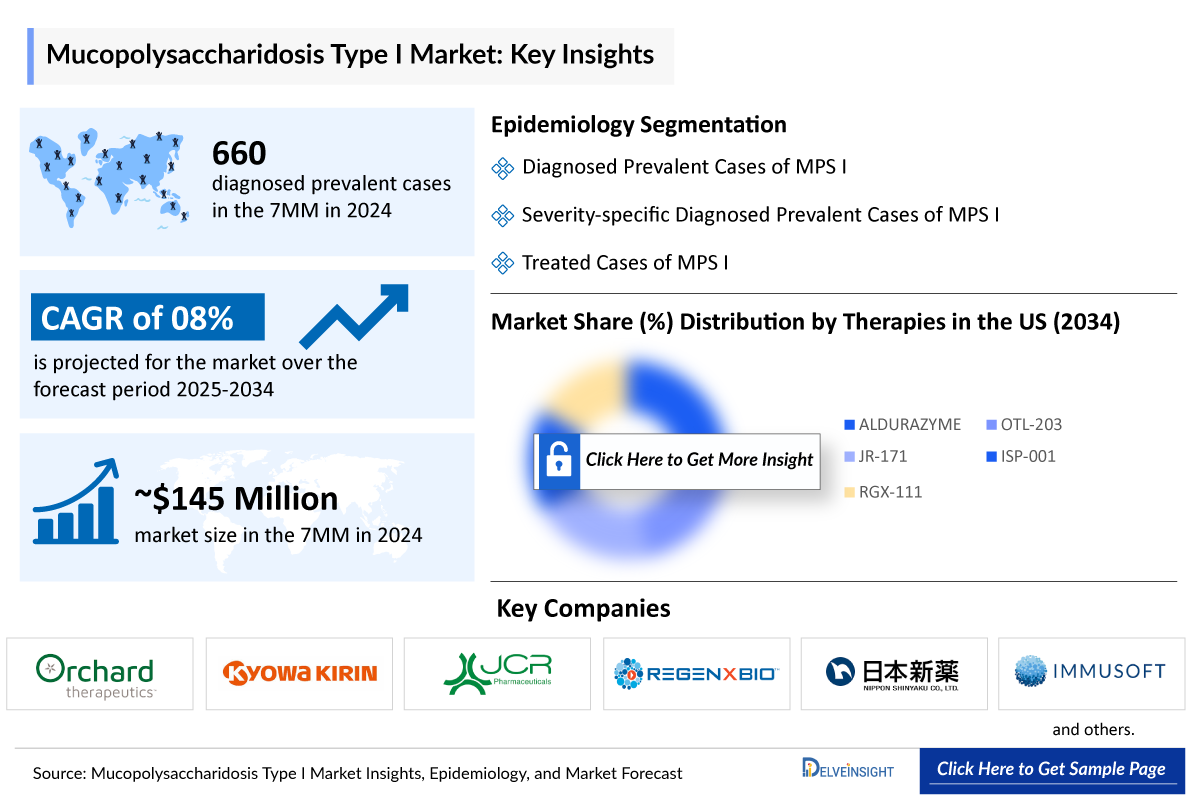

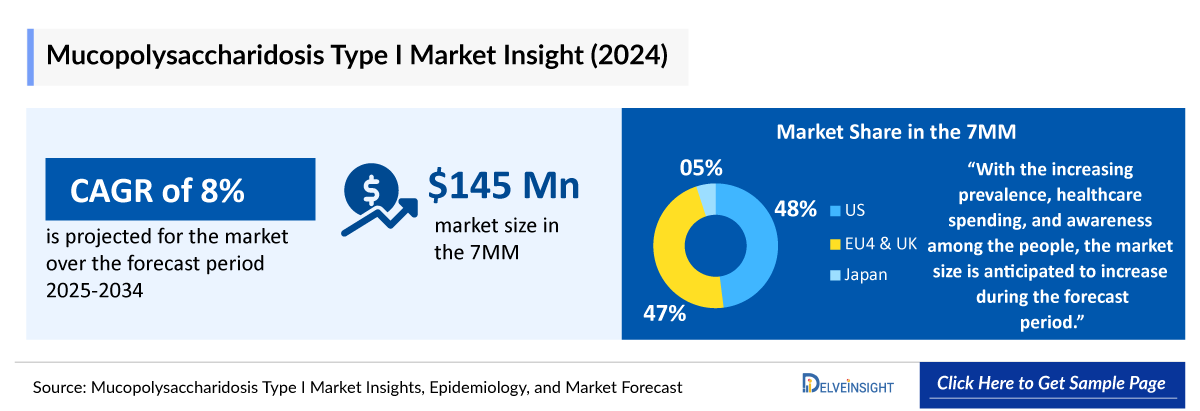

- The Mucopolysaccharidosis I market size in the 7MM is expected to grow from USD 149 million in 2025 to USD 297 million in 2034.

- The Mucopolysaccharidosis I market is projected to grow at a CAGR of 8% by 2034 in leading countries like US, EU4, UK and Japan.

Mucopolysaccharidosis I Market and Epidemiology Analysis:

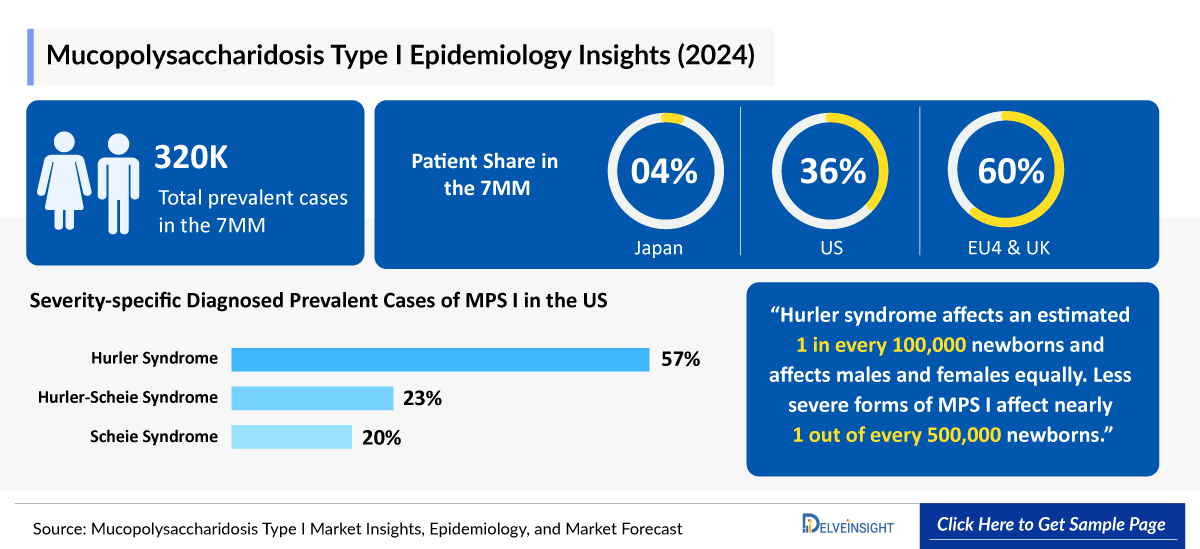

- According to DelveInsight’s estimates, in 2024, there were approximately 660 Mucopolysaccharidosis I Diagnosed Prevalent Cases in the 7MM. Of these, the United States accounted for 36% of the cases, while EU4 and the UK accounted for nearly 60%, and Japan represented 4% of the cases, respectively.

- The Mucopolysaccharidosis I Treatment Market is poised for steady growth, with a strong compound annual growth rate (CAGR) projected from 2025 to 2034. This expansion across the 7MM is anticipated to be driven by the launch of innovative Mucopolysaccharidosis I Therapies, including OTL-203, Lepunafusp alfa (JR-171), and RGX-111.

- According to DelveInsight’s analysis, the Mucopolysaccharidosis I Market in the 7MM was valued at approximately USD 145 million in 2024. Over the forecast period from 2025 to 2034, this market is projected to grow at a CAGR of 8.0%.

- In the Mucopolysaccharidosis I Market, BioMarin Pharmaceutical and Sanofi are the only players, offering ALDURAZYME (laronidase). This Enzyme replacement therapy (ERT) is approved for patients with Hurler and Hurler-Scheie forms of MPS I, as well as those with the Scheie form who experience moderate to severe symptoms.

- Many MPS I cases often go undiagnosed for years due to diverse symptoms resembling other conditions. The lack of universal newborn screening delays detection, leading to fatal outcomes in severe cases. Early Mucopolysaccharidosis I Diagnosis is vital to prevent complications. Raising awareness and implementing newborn screening can enable timely treatment and improve patient outcomes.

- Research on Mucopolysaccharidosis I Treatment is limited and outdated, hindering access to innovative therapies. The lack of ongoing studies slows progress in addressing complications like bone deformities and neurodegeneration, underscoring the need for continuous research, clinical trials, and updated treatment guidelines.

- On October 21, 2025, the FDA granted Fast Track designation to Immusoft’s ISP-001 for mucopolysaccharidosis type I (MPS I).

Request a sample to unlock the CAGR for "Mucopolysaccharidosis Type I Market Forecast"

Mucopolysaccharidosis I Market size and forecast

- 2025 Market Size: USD 149 million in 2025

- 2034 Projected Market Size: USD 297 million in 2034

- Growth Rate (2025-2034): 8% CAGR

- Largest Market: United States

Key factors driving the Mucopolysaccharidosis Type I (MPS I) Market

- Rising disease awareness and diagnosis: Improved genetic screening and diagnostic tools are leading to earlier detection of MPS I, increasing treatment uptake.

- Advancements in enzyme replacement therapies (ERT): Availability of approved ERTs, such as laronidase, and ongoing development of next-generation therapies are driving market growth.

- Emerging gene therapies: Innovative gene therapy approaches targeting the underlying genetic defect are expanding treatment options and fueling market potential.

- Supportive regulatory environment: Orphan drug designations and accelerated approval pathways are encouraging pharmaceutical investment and rapid therapy development.

- Growing patient population and unmet medical need: Increasing recognition of MPS I cases globally and the lack of curative treatment options are boosting demand for effective therapies.

DelveInsight’s “Mucopolysaccharidosis Type I Treatment Market Insights, Epidemiology, and Market Forecast 2034” report delivers an in-depth understanding of MPS I, historical and forecasted epidemiology, as well as the MPS I therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The Mucopolysaccharidosis I Treatment Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Mucopolysaccharidosis I Market Size from 2025 to 2034. The report also covers Mucopolysaccharidosis I Treatment Market practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Mucopolysaccharidosis Type I Market |

|

|

Mucopolysaccharidosis Type I Market Size | |

|

Mucopolysaccharidosis Type I Companies |

BioMarin Pharmaceutical, Sanofi, Orchard Therapeutics, JCR Pharmaceuticals, and others |

|

Mucopolysaccharidosis Type I Epidemiology Segmentation |

|

Mucopolysaccharidosis I Disease Understanding

MPS I is a rare, inherited lysosomal storage disorder caused by a deficiency of the enzyme alpha-L-iduronidase (IDUA), which is crucial for breaking down glycosaminoglycans (GAGs) like dermatan sulfate and heparan sulfate. The accumulation of these substances leads to progressive cellular and tissue dysfunction, affecting multiple organ systems, including the skeletal, cardiovascular, respiratory, and nervous systems. MPS I manifests as a clinical spectrum, ranging from severe Hurler syndrome to milder Scheie syndrome. Severity depends on residual IDUA activity, with severe cases leading to early mortality without treatment, while milder forms cause significant but manageable complications. MPS I results from IDUA gene mutations, leading to enzyme deficiency and GAG accumulation, causing progressive organ damage. Inherited autosomal recessively, risk factors include parental carrier status and consanguinity. Symptoms emerge by 6 months, including facial changes, hernias, kyphosis, hepatosplenomegaly, respiratory issues, hearing loss, and cognitive decline. Without early intervention, worsening organ dysfunction severely impacts mobility, vision, and lifespan.

Mucopolysaccharidosis I Diagnosis

Mucopolysaccharidosis I Diagnosis involves GAG analysis, enzyme assays, and genetic testing, enabling early treatment, prognosis assessment, and genetic counseling. Screening programs support early detection, while comprehensive evaluations, such as pulmonary function tests, polysomnography, audiometry, ocular exams, skeletal imaging, and cognitive assessments, aid in disease monitoring. Newborn screening and molecular testing play a crucial role in optimizing patient management and improving long-term outcomes.

Mucopolysaccharidosis I Treatment

Mucopolysaccharidosis I Treatment varies by severity. Hematopoietic stem cell transplantation (HSCT) is preferred for severe cases, particularly in young children, as it preserves cognitive function by replacing defective cells, though it offers limited skeletal benefits. ERT primarily addresses somatic symptoms. Early intervention is crucial, as timely treatment significantly enhances patient outcomes and helps manage disease progression more effectively.

Mucopolysaccharidosis I Epidemiology

As the market is derived using a patient-based model, the Mucopolysaccharidosis I Epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Mucopolysaccharidosis I Diagnosed Prevalent Cases, Mucopolysaccharidosis I Severity-specific Diagnosed Prevalent Cases, and Mucopolysaccharidosis I Treated Cases in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from study period (2020 to 2034).

Key Findings from Mucopolysaccharidosis I Epidemiological Analysis and Forecast:

- According to DelveInsight's estimates, the Mucopolysaccharidosis I Diagnosed Prevalent Cases in the 7MM were nearly 660 in 2024.

- In 2024, EU4 and the UK recorded the highest Mucopolysaccharidosis I Diagnosed Prevalent Cases, accounting for 60% of the total cases in the 7MM, with approximately 400 reported cases.

- In 2024, the US accounted for the second highest Mucopolysaccharidosis I Diagnosed Prevalent Cases with approximately 240 cases, which are expected to increase by 2034 at a CAGR of 0.6% over the forecast period from 2025 to 2034.

- In 2024, the UK reported the highest number of Mucopolysaccharidosis I Diagnosed Prevalent Cases among EU4 and the UK, with approximately 110 cases. Italy followed with nearly 75 cases, while Spain recorded the lowest diagnosed prevalent cases, with nearly 60 cases.

- In 2024, Japan recorded around 20 treated cases of MPS I, with the number expected to rise by 2034.

- In Germany, severity-specific data from 2024 showed that MPS IH had the highest number of cases at ~45, followed by MPS IS with ~10 cases and MPS IH/S with ~15 cases. This number is projected to rise by 2034.

- In 2024, France reported 70 Mucopolysaccharidosis I Diagnosed Prevalent Cases. This number is expected to increase by 2034.

Mucopolysaccharidosis I Epidemiology Segmentation:

- Mucopolysaccharidosis I Diagnosed Prevalent Cases

- Mucopolysaccharidosis I Severity-specific Diagnosed Prevalent Cases

- Mucopolysaccharidosis I Treated Cases

Mucopolysaccharidosis I Drugs Market Chapter Analysis

The drug chapter segment of the Mucopolysaccharidosis I Pipeline Drugs Market Report encloses a detailed analysis of Mucopolysaccharidosis I marketed drugs and mid to late-stage (Phase III and Phase I/II) Mucopolysaccharidosis I Pipeline Drugs analysis. It also helps understand the Mucopolysaccharidosis I Clinical Trials details, expressive pharmacological action, agreements and collaborations and approval, advantages, and disadvantages of each included drug, and the latest news and press releases.

Mucopolysaccharidosis I Marketed Drugs

-

ALDURAZYME (laronidase): BioMarin Pharmaceutical/Sanofi

ALDURAZYME (laronidase) is a recombinant form of the human enzyme IDUA, produced using recombinant DNA technology in Chinese hamster ovary cells. It was approved in the US and EU4 and the UK in 2003 and in Japan in 2006. ALDURAZYME is indicated for patients with Hurler and Hurler-Scheie forms of MPS I, as well as those with the Scheie form who exhibit moderate to severe symptoms. The Mucopolysaccharidosis I Treatment carries a boxed warning, highlighting potential risks. While its patent has expired, no biosimilar versions are currently available, making it the only enzyme replacement therapy for MPS I on the market.

Mucopolysaccharidosis I Emerging Drugs

OTL-203: Orchard Therapeutics/Kyowa Kirin

OTL-203 is a one-time gene therapy for MPS IH, using a patient’s own hematopoietic stem and progenitor cells (HSPCs). These cells are collected from mobilized peripheral blood and genetically modified ex vivo with a lentiviral vector carrying functional IDUA complementary DNA, restoring enzyme expression and reducing GAG accumulation. Developed with the San Raffaele-Telethon Institute for Gene Therapy (SR-Tiget), it is in Phase III trials in North America and Europe. The anticipated US application is in 2028, with potential approval in 2029 with priority review. OTL-203 has received Fast Track Designations (FTD), Orphan Drug Designations (ODD), and Rare Pediatric Disease Designations (RPDD) from the FDA, along with EMA Priority Medicines designation (PRIME) status.

- In February 2024, Orchard Therapeutics reported the first patient’s randomization in the registrational trial of OTL-203 for MPS IH, marking a key milestone in the therapy’s clinical development.

Lepunafusp alfa (JR-171): JCR Pharmaceuticals

JR-171 (lepunafusp alfa) is an advanced ERT designed to address central nervous system (CNS) complications in MPS I. This recombinant fusion protein combines an antibody targeting the human transferrin receptor with IDUA, the deficient enzyme in MPS I patients. Utilizing transferrin receptor-mediated transcytosis, JR-171 efficiently crosses the Blood-Brain Barrier (BBB), targeting a key unmet need in CNS treatment. Developed using the J-Brain Cargo and J-MIG System platform, it has completed a 13-week Phase I/II clinical trial in Japan and the US, with an extension study ongoing. JR-171 is being developed through licensing partnerships, with collaboration discussions in progress. It has received FTD and ODD from both the FDA and EMA.

- In September 2024, JCR Pharmaceuticals presented data at the Society for the Study of Inborn Errors of Metabolism (SSIEM) Annual Symposium, showcasing investigational treatments for lysosomal storage disorders, including neurobehavioral and somatic improvements in MPS I patients treated with JR-171

RGX-111: REGENXBIO/Nippon Shinyaku

RGX-111 is an investigational gene therapy developed to treat MPS I, a rare genetic disorder caused by IDUA enzyme deficiency. RGX-111 delivers a functional IDUA gene directly to the CNS, promoting enzyme production in brain cells. This approach aims to slow or prevent cognitive decline and neurological impairments associated with MPS I. Interim results from an ongoing Phase I/II trial indicate promising biological activity and safety. Recognized for its potential, RGX-111 has received ODD, RPDD, and FTD from the US FDA.

- In January 2025, REGENXBIO partnered with Nippon Shinyaku to further develop and commercialize RGX-111 for MPS treatment.

ISP-001: Immusoft

ISP-001 is an autologous engineered B cell therapy that delivers continuous secretion of α-L-iduronidase (IDUA) via a Sleeping Beauty transposon delivery system. This therapy was granted orphan drug designation and rare pediatric disease designation in 2018 and is currently in a trial evaluating patients with MPS I.

Mucopolysaccharidosis I Drugs Market

The Mucopolysaccharidosis I treatment typically begins with early interventions such as ERT or HSCT, depending on disease severity. For severe cases, HSCT is preferred to preserve cognitive function, while ERT primarily manages somatic symptoms. Emerging therapies include OTL-203, Lepunafusp alfa (JR-171), and RGX-111. OTL-203, developed by Orchard Therapeutics and Kyowa Kirin, it is a HSC gene therapy. Administered via IV infusion, it is currently in Phase III clinical trials for the treatment of MPS IH. The anticipated application timeline is 2028, with potential US approval in 2029, assuming priority review.

Lepunafusp alfa (JR-171), developed by JCR Pharmaceuticals, is an ERT (Iduronidase replacement) administered via IV infusion. It is currently in Phase I/II Mucopolysaccharidosis I Clinical Trials for the treatment of MPS IH. RGX-111, developed by REGENXBIO and Nippon Shinyaku, is an IDUA Gene Delivery. It is currently in Phase I/II clinical trials for the treatment of MPS I.

Mucopolysaccharidosis I Market Outlook

MPS I management depends on disease severity, with treatment approaches varying between severe (MPS IH) and attenuated (MPS IH/S, MPS IS) forms. HSCT is the standard of care for severe MPS I, particularly in children under two, and an option for attenuated cases. HSCT enables donor-derived cells to produce IDUA, cross the blood-brain barrier, and reduce CNS involvement. It slows disease progression, preserves cognition, and improves survival, but has limited effects on skeletal abnormalities and carries transplant risks. ERT with laronidase primarily addresses somatic symptoms but has minimal CNS benefits due to restricted BBB penetration.

ERT primarily targets non-CNS symptoms, improving hepatosplenomegaly, respiratory function, mobility, and joint flexibility, with better outcomes when initiated early. However, immune responses may reduce ERT effectiveness. Research suggests that HSCT can mitigate these immune reactions, potentially enhancing treatment efficacy. Despite its benefits, HSCT is limited to severe cases due to procedural risks, including morbidity and mortality. Early diagnosis is crucial, as treatment success depends on disease progression at initiation. Combining ERT with HSCT is an emerging strategy, where short-term ERT before HSCT stabilizes patients, reduces glycosaminoglycan accumulation, and improves engraftment success, leading to better long-term outcomes.

Currently, ALDURAZYME (laronidase) is the only approved ERT for MPS I, underscoring the critical need for alternative treatments. Developed by BioMarin Pharmaceutical and Genzyme (Sanofi), this recombinant glycoprotein enzymatically breaks down glycosaminoglycans by hydrolyzing a-L-iduronic acid residues in dermatan and heparan sulfate, helping to reduce systemic disease burden. ALDURAZYME was first approved in the US (April 2003), followed by EU4 and the UK (June 2003), and Japan (2006). Although its patent has expired, no biosimilar or alternative biologic has been approved yet, highlighting a significant gap in treatment options for MPS I patients.

There is a significant need for new Mucopolysaccharidosis I Treatments, as current Mucopolysaccharidosis I Therapies have some limitations, like boxed warning. Innovative drug development could offer more effective options, improving outcomes for patients. Promising Mucopolysaccharidosis I Drugs are currently in the pipeline, including OTL-203, Lepunafusp alfa (JR-171), RGX-111, and Iduronicrin genleukocel-T (ISP-001), among others.

- In 2024, the Mucopolysaccharidosis I Market Size in the 7MM was valued at approximately USD 145 million and is projected to grow by 2034 over the forecast period (2025-2034).

- In 2024, the Mucopolysaccharidosis I Market Size in the US was around USD 70 million, accounting for 48% of the total market of 7MM. This figure is expected to grow significantly with the introduction of emerging Mucopolysaccharidosis I Therapies.

- The Mucopolysaccharidosis I Market Size of EU4 and the UK was estimated to be approximately USD 68 million in 2024, which was nearly 47% of the Mucopolysaccharidosis I Market revenue for the 7MM.

- Among EU4 and the UK, the UK accounted for the highest Mucopolysaccharidosis I Drugs Market Share with approximately USD 20 million in 2024. Spain accounted for the smallest market share, with nearly USD 10 million in the same year.

- In 2024, the Mucopolysaccharidosis I Market Size was approximately USD 10 million in Japan which is anticipated to increase during the forecast period (2025–2034).

- As per the estimates, among the current Mucopolysaccharidosis I Treatment options, ALDURAZYME held the largest Mucopolysaccharidosis I Drugs Market Share, generating approximately USD 145 million in revenue in 2024 across the 7MM.

Mucopolysaccharidosis I Drugs Uptake

This section focuses on the uptake rate of potential Mucopolysaccharidosis I drugs expected to be launched in the market during study period 2020–2034.

Mucopolysaccharidosis I Pipeline Development Activities

The Mucopolysaccharidosis I pipeline Report provides insights into Mucopolysaccharidosis I clinical trails within candidates in Phase III, Phase II, and Phase I. It also analyzes key Mucopolysaccharidosis I Companies involved in developing targeted therapeutics.

Mucopolysaccharidosis I Pipeline Activities

The Mucopolysaccharidosis I Therapeutics clinical trials analysis Report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for MPS I.

Latest Mucopolysaccharidosis I KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on MPS I evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the University of California, USA, University of Minnesota, USA, Washington University School of Medicine, USA, University Medical Center Hamburg-Eppendorf, Germany, Hôpital Femme Mère Enfant, France, Hos ASST Monza e Brianza, Italy, Catalan Institution for Research and Advanced Studies (ICREA), Spain, Royal Manchester Children's Hospital, the UK, Gifu University, Japan among others, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or MPS I market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

As per the KOLs from the US, “Existing therapies for MPS I face significant limitations in sustaining long-term IDUA expression and effectively clearing GAG in the CNS. The progressive neurological decline in untreated patients underscores the urgent need for innovative treatment strategies. Gene therapy and advanced targeted approaches hold promise in addressing these gaps, potentially offering durable enzymatic correction and improved clinical outcomes, particularly for neurocognitive and skeletal manifestations of the disease.”

As per the KOLs from Spain, “Severe MPS IH presents early with subtle signs such as hernias and recurrent infections, evolving into progressive multisystem involvement, including skeletal dysplasia, cognitive decline, and fatal cardiorespiratory failure by age ten. In contrast, attenuated MPS I emerges later with variable progression, primarily impacting joints, cardiac function, and hearing. At the same time, cognitive impairment is uncommon, often permitting a near-normal lifespan with appropriate management.”

As per the KOLs from Japan, “MPS are lysosomal storage disorders marked by deficient GAG degradation, leading to progressive multisystem involvement. The endorsement of MPS I for universal newborn screening highlights the critical need for precise diagnostic tools. Early detection is essential, as most newborns are asymptomatic, necessitating reliable biomarkers. Advances in tiered screening methodologies enhance sensitivity and specificity, enabling timely intervention. Implementing newborn screening optimizes therapeutic efficacy, facilitates immune tolerance induction, and underscores the evolving landscape of early disease identification and management strategies.”

Mucopolysaccharidosis I Therapeutics Market Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Mucopolysaccharidosis I Treatment Market Landscape.

Conjoint Analysis analyzes multiple emerging Mucopolysaccharidosis I Therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated, wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Mucopolysaccharidosis I Therapeutics Market Access and Reimbursement

-

ALDURAZYME Co-pay Program

The CareConnect Co-pay Program provides financial assistance to eligible US patients prescribed ALDURAZYME, helping cover out-of-pocket drug costs and infusion-related expenses, including co-pays, coinsurance, and deductibles, up to a specified limit. To qualify, patients must have primary commercial insurance, as those with state or federally funded healthcare plans (e.g., Medicare, Medicaid, and TRICARE) are not eligible. Enrollment requires applying, and upon approval, Sanofi covers 100% of eligible expenses up to the program’s maximum limit. This initiative aims to ease the financial burden of treatment, ensuring greater access to ALDURAZYME for patients managing MPS I.

The Mucopolysaccharidosis I Therapeutics Market Report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Mucopolysaccharidosis I Therapeutics Market Report Scope

- The Mucopolysaccharidosis I Therapeutics Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available Mucopolysaccharidosis I Therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of Mucopolysaccharidosis I Diagnosed Prevalence rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborate profiles of late-stage and prominent therapies will impact the current Mucopolysaccharidosis I Treatment Market Landscape.

- A detailed review of the Mucopolysaccharidosis I Treatment Market, historical and forecasted Mucopolysaccharidosis I Market Size, Mucopolysaccharidosis I Drugs Market Share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Mucopolysaccharidosis I Therapeutics Market Report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM MPS I.

Mucopolysaccharidosis I Treatment Market Report Insights

- Patient-based Mucopolysaccharidosis I Market Forecasting

- Therapeutic Approaches

- Mucopolysaccharidosis I Pipeline Drugs Analysis

- Mucopolysaccharidosis I Market Size and Trends

- Existing and Future Mucopolysaccharidosis I Clinical Trials Market Opportunities

Mucopolysaccharidosis I Treatment Market Report Key Strengths

- 10 years Mucopolysaccharidosis I Market Forecast

- The 7MM Coverage

- Mucopolysaccharidosis I Epidemiology Segmentation

- Key Cross Competition

- Attribute Analysis

- Mucopolysaccharidosis I Drugs Uptake

- Key Mucopolysaccharidosis I Market Forecast Assumptions

Mucopolysaccharidosis I Treatment Market Report Assessment

- Current Mucopolysaccharidosis I Treatment Practices

- Mucopolysaccharidosis I Unmet Needs

- Mucopolysaccharidosis I Pipeline Drugs Profiles

- Mucopolysaccharidosis I Clinical Trials Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

Key Questions answered through our Mucopolysaccharidosis I Market Report:

Mucopolysaccharidosis I Market Insights

- What was the Mucopolysaccharidosis I Treatment Market Size, the Mucopolysaccharidosis I Market Size by Therapies, and Mucopolysaccharidosis I Drugs Market Share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will OTL-203 affect the treatment paradigm of MPS I?

- How will ALDURAZYME compete with other upcoming Mucopolysaccharidosis I Products and marketed therapies?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed therapies?

- How would future opportunities affect the Mucopolysaccharidosis I market dynamics and subsequent analysis of the associated trends?

Mucopolysaccharidosis I Epidemiology Insights

- What are the disease risks, burdens, and Mucopolysaccharidosis I Unmet Needs? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to MPS I?

- What is the historical and forecasted Mucopolysaccharidosis I, patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalence cases of MPS I population during the forecast period (2025–2034)?

- What factors are contributing to the growth of MPS I cases?

Current Mucopolysaccharidosis I Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of Mucopolysaccharidosis I? What are the current clinical and treatment guidelines for treating Mucopolysaccharidosis I?

- How many Mucopolysaccharidosis I Companies are developing therapies for the treatment?

- How many emerging therapies are in the mid-stage and late-stage of development for treating Mucopolysaccharidosis I?

- What are the recent novel therapies, targets, Mucopolysaccharidosis I Mechanisms of Action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of the current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved Mucopolysaccharidosis I Therapy in the US?

- What is the 7MM historical and forecasted Mucopolysaccharidosis I Market?

Reasons to Buy

- The Mucopolysaccharidosis I Therapeutics Market Report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Mucopolysaccharidosis I Pipeline Drugs Market.

- Insights on patient burden/disease Mucopolysaccharidosis I Prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Mucopolysaccharidosis I Pipeline Drugs Market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying upcoming solid Mucopolysaccharidosis I Companies in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging Mucopolysaccharidosis I Therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for MPS I, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming Mucopolysaccharidosis I Companies can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles: