Narcolepsy Market

Key Highlights

- Narcolepsy is a chronic neurological disorder characterized by the brain’s inability to regulate sleep-wake cycles due to dysfunction of the orexin (hypocretin) system. This condition presents with excessive daytime sleepiness and, in some cases, cataplexy, distinguishing it biologically and clinically from other sleep disorders and emphasizing the importance of accurate diagnosis through clinical and biomarker assessment.

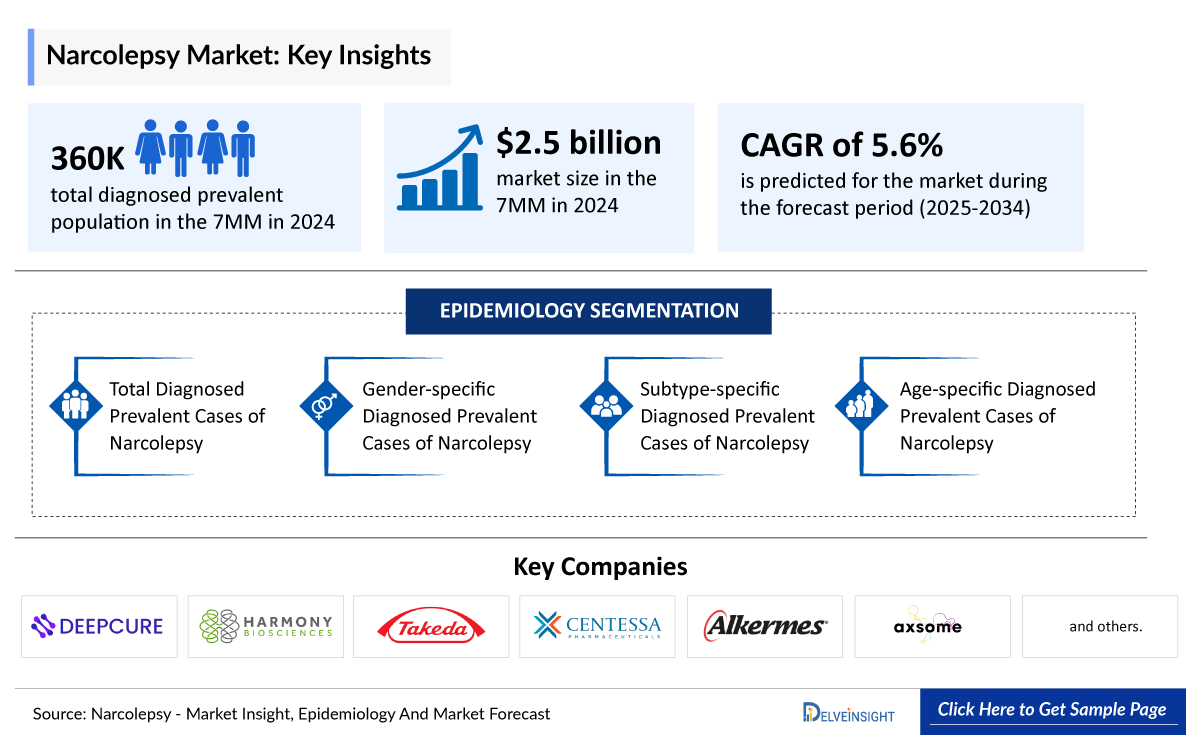

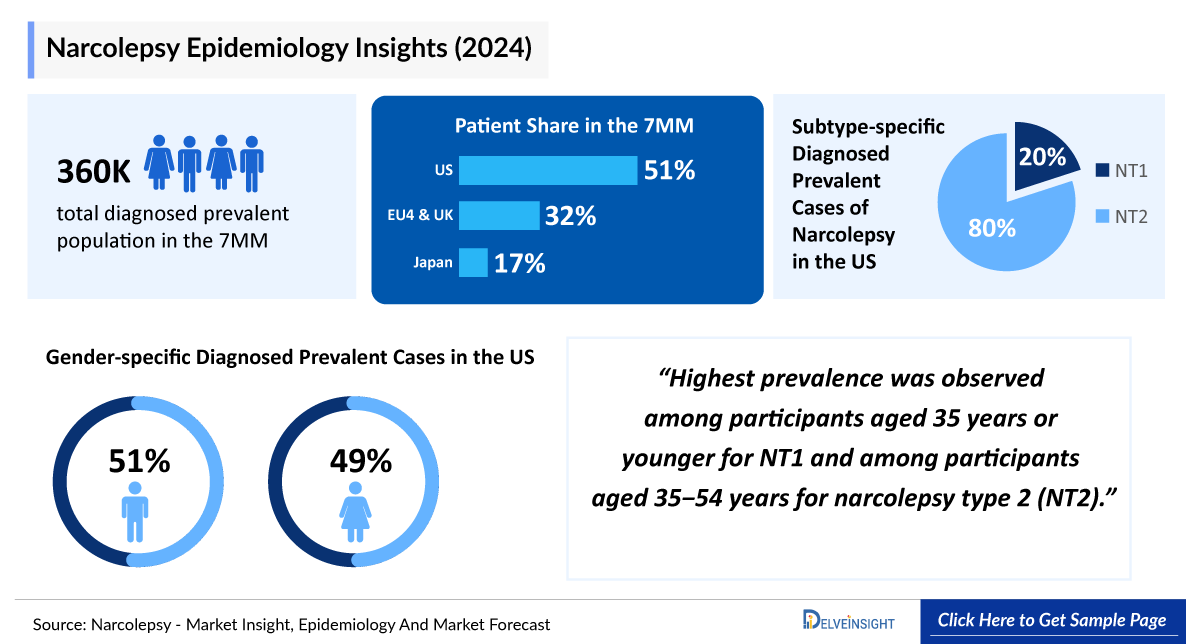

- In 2024, DelveInsight estimated around 360,000 diagnosed prevalent cases of narcolepsy across the 7MM, underscoring its significant clinical burden and growing recognition as a distinct neurological disorder.

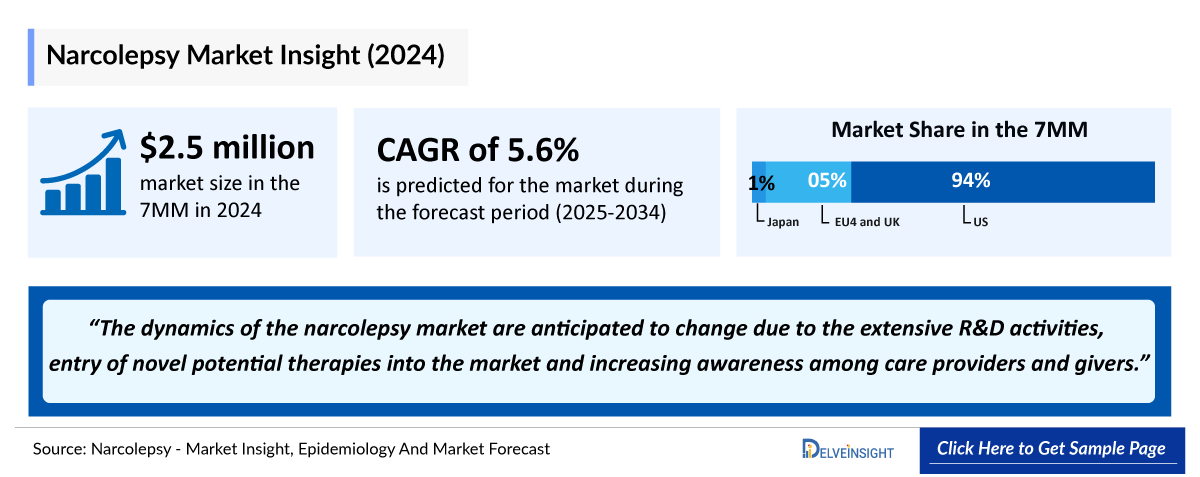

- According to DelveInsight’s 2024 analysis, the narcolepsy market across the 7MM was valued at approximately USD 2.5 billion, reflecting increasing disease awareness, improved diagnosis, and expanding therapeutic options.

- The treatment landscape for narcolepsy has evolved considerably with the approval of key therapies, including LUMRYZ (sodium oxybate), WAKIX (pitolisant), SUNOSI (solriamfetol), and XYWAV (calcium, magnesium, potassium, and sodium oxybates). These agents have improved disease management by enhancing wakefulness, reducing cataplexy episodes, and offering tailored options to address diverse patient needs.

- The narcolepsy pipeline is witnessing robust growth, with several promising candidates advancing through clinical development. Notable among these are AXS-12 (reboxetine), QUILIENCE (Mazindol ER), and Oveporexton (TAK-861), which exemplify the expanding innovation aimed at enhancing symptom control and addressing persistent unmet needs in this disorder.

DelveInsight’s “Narcolepsy – Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the narcolepsy, historical and projected epidemiological data, competitive landscape as well as narcolepsy market tends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The narcolepsy market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM narcolepsy market size from 2020 to 2034. The report also covers emerging narcolepsy treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

Narcolepsy Epidemiology |

|

|

Narcolepsy Key Companies |

|

|

Market Analysis |

|

|

Narcolepsy Key Companies |

|

|

Future opportunity |

The future of narcolepsy treatment holds substantial promise as the field advances toward precision, mechanism-based therapies grounded in a deeper understanding of orexin biology. Beyond traditional stimulants and wake-promoting agents, emerging approaches such as selective orexin receptor agonists, monoaminergic modulators, and novel neurotransmitter-targeted strategies aim to more precisely restore sleep–wake balance and improve daytime functioning. Innovative formulations, including once-nightly and extended-release therapies, are enhancing patient convenience and adherence while minimizing adverse effects. Furthermore, advances in biomarker-driven diagnosis, digital sleep tracking, and personalized medicine are enabling earlier and more accurate identification of patients. Collectively, these innovations signal a transformative shift toward durable, targeted, and individualized care for those living with narcolepsy. |

Key Factors Driving the Growth of the Narcolepsy Market

Rising Diagnosed Narcolepsy Prevalence

In 2024, DelveInsight estimated around 360,000 diagnosed prevalent cases of narcolepsy across the 7MM, underscoring its significant clinical burden and growing recognition as a distinct neurological disorder. These number are further expected to grow by 2034.

Advancements in Narcolepsy Therapeutics

The treatment landscape for narcolepsy has evolved considerably with the approval of key therapies, including LUMRYZ (Avadel Pharmaceuticals and Jazz Pharmaceuticals), WAKIX (Harmony Biosciences), SUNOSI (Axsome Therapeutics/Pharmanovia), and XYWAV (Jazz Pharmaceuticals). These agents have improved disease management by enhancing wakefulness, reducing cataplexy episodes, and offering tailored options to address diverse patient needs.

Emergence of Novel Narcolepsy Drug Classes

Emerging drug classes that act on the orexin and monoaminergic systems are transforming the treatment landscape for narcolepsy. Orexin agonists like Oreporexton (Takeda), along with next-generation agents such as Reboxetine (Axsome Therapeutics) and Quilience (NLS Pharmaceutics), are designed to restore normal wakefulness regulation at the neurobiological level. Unlike traditional therapies that mainly provide symptomatic relief, these novel agents target the underlying disease mechanisms, addressing excessive daytime sleepiness, cataplexy, and sleep–wake instability with greater precision, signaling a major advancement in narcolepsy care.

Narcolepsy Understanding and Treatment Algorithm

Narcolepsy Overview

Narcolepsy is a chronic neurological disorder characterized by dysregulation of the sleep–wake cycle, primarily caused by the loss or dysfunction of orexin-producing neurons in the hypothalamus. This biological deficit disrupts the brain’s ability to maintain stable wakefulness and sleep, leading to excessive daytime sleepiness, cataplexy, and disturbed nighttime sleep. Though relatively rare, narcolepsy represents a clinically significant condition due to its profound impact on daily functioning, cognition, and quality of life. Advances in neurobiology and sleep research have enhanced understanding of its molecular basis, enabling diagnosis that is more accurate and the development of targeted orexin-based therapies. Despite remaining challenges in disease awareness and long diagnostic delays, narcolepsy continues to be a key area of neurological innovation, shaping the future of sleep medicine and personalized therapeutic approaches.

Narcolepsy Treatment

Narcolepsy treatment focuses on restoring wakefulness and stabilizing the sleep–wake cycle by addressing the underlying orexin deficiency or modulating related neurotransmitter pathways. Current therapeutic approaches aim to alleviate excessive daytime sleepiness, cataplexy, and disrupted nighttime sleep through mechanisms that enhance wake-promoting signals or normalize REM sleep regulation. Emerging therapies are increasingly targeting the orexin system directly, offering the potential to correct the root neurochemical imbalance rather than only managing symptoms. This precision-based shift represents a major advancement in disease understanding and management, leading to sustained wakefulness, improved daily functioning, and better overall quality of life for individuals living with narcolepsy.

Further details related to disease overview are provided in the report…

Narcolepsy Epidemiology

The Narcolepsy epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented total diagnosed prevalent cases of narcolepsy, gender-specific diagnosed prevalent cases of narcolepsy, subtype-specific diagnosed prevalent cases of narcolepsy and age-specific diagnosed prevalent cases of narcolepsy in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

- In 2024, DelveInsight estimated approximately 115,000 total diagnosed prevalent cases of narcolepsy across the EU4 and the UK, underscoring the significant disease burden in these regions and their vital role in shaping the clinical and therapeutic landscape of narcolepsy.

- In 2024, DelveInsight estimated approximately 95,000 female and 90,000 male patients with narcolepsy in the US, highlighting a slight female predominance and emphasizing gender-specific variations that may influence disease recognition and therapeutic approaches.

- In 2024, DelveInsight estimated that between the EU4 and the UK, Germany recorded the highest number of narcolepsy cases by subtype, with approximately 21,000 cases of NT1 and 7,000 cases of NT2, underscoring the country’s significant contribution to the regional disease burden and the clinical relevance of subtype-specific characterization.

- In 2024, DelveInsight estimated that in Japan, narcolepsy cases were distributed across all age groups, with approximately 8,000 cases in individuals under 18, 14,000 in those aged 18–29, 24,000 in the 30–49 group, 9,000 in the 50–69 group, and 4,200 among those aged 70 and above, highlighting the predominance of the 30–49 age group within the overall narcolepsy population.

Narcolepsy Drug Chapters

The drug chapter segment of the narcolepsy reports encloses a detailed analysis of narcolepsy late-stage (Phase III and Phase I) and early stage pipeline drugs. It also helps understand the narcolepsy clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest news and press releases.

Marketed Drugs

LUMRYZ (sodium oxybate): Avadel Pharmaceuticals and Jazz Pharmaceuticals

LUMRYZ (sodium oxybate), developed by Avadel Pharmaceuticals, is a once-nightly, extended-release oxybate that maintains sustained plasma levels overnight, eliminating the need for a second dose. Acting as a GABAB receptor agonist, it promotes deep sleep, reduces cataplexy, and improves daytime alertness in narcolepsy, with strong efficacy and a well-tolerated safety profile demonstrated in clinical studies.

- In October 2025, Alkermes reported it would acquire Avadel Pharmaceuticals in a deal valued at up to USD 2.1 billion, gaining an approved sleep-disorder therapy and accelerating its entry into the sleep medicine sector. The transaction was approved by the boards of both companies and is expected to close in the first quarter of 2026.

- In October 2025, Avadel Pharmaceuticals reported a global settlement with Jazz Pharmaceuticals, resolving all ongoing litigation between the two companies. Under the agreement, Jazz Pharmaceuticals will pay USD 90 million to Avadel and waive its rights to receive royalties or damages on past LUMRYZ (sodium oxybate) sales through September 2025.

- In October 2024, the US FDA approved LUMRYZ (sodium oxybate) extended-release oral suspension (CIII) by Avadel Pharmaceuticals for the treatment of cataplexy or EDS in patients 7 years of age and older with narcolepsy.

- In May 2023, Avadel Pharmaceuticals reported the final US FDA approval of LUMRYZ (sodium oxybate) extended-release oral suspension as the first and only once-at-bedtime oxybate for the treatment of cataplexy or EDS in adults with narcolepsy.

- In January 2018, the US FDA granted Orphan Drug Designation (ODD) to LUMRYZ (sodium oxybate) for the treatment of narcolepsy, recognizing its potential safety advantage over the existing twice-nightly sodium oxybate formulation.

SUNOSI (solriamfetol): Axsome Therapeutics/Pharmanovia

SUNOSI (solriamfetol), developed by Axsome Therapeutics, is a dual dopamine and norepinephrine reuptake inhibitor that promotes sustained daytime wakefulness in narcolepsy and sleep apnea. It significantly reduces sleepiness on the ESS and MWT, with durable efficacy, low abuse potential, and a well-tolerated safety profile.

- In February 2023, Pharmanovia entered an in-licensing agreement with Axsome Therapeutics to market and further develop SUNOSI (solriamfetol), a first-in-class treatment for EDS in people with narcolepsy.

- In May 2022, Jazz Pharmaceuticals completed the US divestiture of SUNOSI (solriamfetol) to Axsome Therapeutics.

- In January 2020, Jazz Pharmaceuticals reported that the EMA granted approval for SUNOSI (solriamfetol) for the treatment of EDS in adults with narcolepsy.

- In June 2019, Jazz Pharmaceuticals received Schedule IV designation from the Drug Enforcement Administration (DEA) for SUNOSI (solriamfetol).

- In March 2019, Jazz Pharmaceuticals reported that the US FDA approved SUNOSI (solriamfetol) for the treatment of EDS associated with narcolepsy.

XYWAV (calcium, magnesium, potassium, and sodium oxybates): Jazz Pharmaceuticals

XYWAV (calcium, magnesium, potassium, and sodium oxybates) by Jazz Pharmaceuticals is a low-sodium oxybate formulation that treats cataplexy and EDS in narcolepsy and idiopathic hypersomnia. It enhances slow-wave sleep, reduces cataplexy frequency, and improves daytime alertness with strong efficacy and a favorable cardiovascular safety profile.

- In September 2025, Jazz Pharmaceuticals showcased Phase IV data highlighting the treatment effects and real-world evidence of XYWAV (calcium, magnesium, potassium, and sodium oxybates) oral solution at the World Sleep and Psych Congresses.

- In June 2021, the US FDA granted ODD Exclusivity to XYWAV (calcium, magnesium, potassium, and sodium oxybates) for the treatment of cataplexy or EDS in patients 7 years and older with narcolepsy.

- In July 2020, Jazz Pharmaceuticals received US FDA approval for XYWAV (calcium, magnesium, potassium, and sodium oxybates) oral solution for the treatment of cataplexy or EDS associated with narcolepsy.

|

Drug |

MoA |

RoA |

Company |

|

LUMRYZ (sodium oxybate) |

GABAB receptor agonists |

Oral |

Avadel Pharmaceuticals/Jazz Pharmaceuticals |

|

SUNOSI (solriamfetol) |

Dopamine and Norepinephrine Reuptake Inhibitor (DNRI) |

Oral |

Axsome Therapeutics/Pharmanovia |

|

XYWAV (calcium, magnesium, potassium, and sodium oxybates) |

GABA receptor agonist |

Oral |

Jazz Pharmaceuticals |

Emerging Drugs

Reboxetine (AXS-12): Axsome Therapeutics

AXS-12, developed by Axsome Therapeutics, is an oral selective norepinephrine reuptake inhibitor designed to address the underlying neurochemical imbalance contributing to EDS and cataplexy in patients with narcolepsy. By enhancing central norepinephrine signaling, AXS-12 aims to improve wakefulness, reduce cataplexy frequency, and stabilize sleep-wake cycles, offering a targeted, mechanistically distinct approach compared to traditional stimulant-based therapies.

- In August 2025, Axsome Therapeutics reported that the New Drug Application (NDA) submission for AXS-12 (reboxetine) for cataplexy in patients with narcolepsy is anticipated in the fourth quarter of 2025.

- In June 2025, Axsome Therapeutics presented positive Phase III data for AXS-12 (reboxetine) in narcolepsy at the SLEEP 2025 conference.

- In November 2024, Axsome Therapeutics reported that AXS-12 (reboxetine) achieved its primary endpoint in the ENCORE long-term Phase III trial for narcolepsy.

- In September 2020, Axsome Therapeutics reported the expedited development of AXS-12 (reboxetine) for narcolepsy following an FDA BTD.

- In October 2018, Axsome Therapeutics received ODD from the FDA for AXS-12 (reboxetine) for the treatment of narcolepsy.

Oveporexton (TAK-861): Takeda

Oveporexton (TAK-861) is an investigational, selective agonist of the orexin receptor 2 (OX2R) that aims to restore orexin signaling and address the underlying orexin deficiency responsible for narcolepsy type 1 (NT1). Through targeted activation of OX2Rs, oveporexton is designed to enhance wakefulness and reduce REM sleep–like disturbances, such as cataplexy, thereby addressing the full range of both daytime and nighttime symptoms associated with NT1.

- In July 2025, Takeda reported positive Phase III results for oveporexton (TAK-861) in NT1, meeting all efficacy endpoints with robust symptom improvement and good tolerability. The company is expediting regulatory submissions and launch preparations to advance this potential first-in-class therapy.

- In May 2025, results published in The New England Journal of Medicine showed that oveporexton (TAK-861) produced significant improvements in NT1 symptoms and was well-tolerated.

- In September 2024, Takeda presented new data from the Phase IIb TAK-861-2001 trial in NT1 at Sleep Europe 2024, showing improvements in daily functioning, cognition, and sleep quality, along with findings from a long-term extension study.

- In June 2024, Takeda presented late-breaking Phase IIb data at SLEEP 2024, showing that TAK-861 achieved statistically significant and clinically meaningful improvements across all endpoints in NT1 up to 8 weeks.

- In February 2024, Takeda outlined plans to begin global Phase III trials of TAK-861 in NT1, following Phase IIb results that met all key endpoints and confirmed the therapy was safe and well-tolerated.

- In November 2023, the EMA granted orphan drug designation (ODD) to oveporexton for the treatment of narcolepsy, recognizing its potential to address an unmet medical need in this rare sleep disorder.

Quilience (Mazindol ER): NLS Pharmaceutics

Mazindol ER is a once-daily, extended-release formulation of mazindol, a dual serotonin norepinephrine dopamine reuptake inhibitor and partial OX2R agonist that enhances wakefulness and reduces cataplexy. Previously used as SANOREX and through France’s 17-year Compassionate Use Program for refractory narcolepsy, it has demonstrated strong efficacy, rapid onset, and low abuse potential. The ongoing AMAZE Phase III trials (NLS-1031, NLS-1032) are evaluating its impact on weekly cataplexy episodes, with a 12-month open-label extension. Supported by prior clinical experience, NLS Pharmaceutics plans to submit a new NDA for QUILIENCE based on comprehensive efficacy and safety data.

- In March 2023, NLS Pharmaceutics held an end-of-Phase II meeting with the US FDA, which subsequently authorized the Phase III AMAZE program for Mazindol ER in May 2023, followed by approval of the first trial protocol by an Independent Review Board (IRB) in July 2023.

- In September 2022, NLS Pharmaceutics reported top-line data from its Phase II POLARIS trial evaluating Mazindol ER in narcolepsy, including patients with both excessive daytime sleepiness and cataplexy, confirming advancement of its once-daily therapy for this indication.

- In March 2021, NLS Pharmaceutics entered an agreement with Novartis to license historical preclinical and clinical data on mazindol. This data may help streamline and reduce development costs for Mazindol ER, depending on the US FDA’s acceptance of scientific bridging between the original and extended-release formulations.

- QUILIENCE (Mazindol ER) has received ODD from both the US FDA and the European Commission for the treatment of narcolepsy.

|

Drug |

MoA |

RoA |

Company |

Phase |

|

Reboxetine (AXS-12) |

Norepinephrine reuptake inhibitor |

Oral |

Axsome Therapeutics |

III |

|

Oveporexton (TAK-861) |

OX2R agonist |

Oral |

Takeda |

II/III |

|

Quilience (Mazindol ER) |

SNDRI/OX2R agonist |

Oral |

NLS Pharmaceutics |

II |

|

XXX |

XXX |

X |

XXX |

III |

Note: Detailed emerging therapies assessment will be provided in the final report.

Drug Class Insights

The narcolepsy treatment landscape is evolving from symptomatic management toward targeted, mechanism-based approaches that address the underlying neurochemical dysregulation of the orexin system. Traditional therapies, including stimulants and antidepressants, primarily alleviate excessive daytime sleepiness and cataplexy but offer limited impact on disease modification, underscoring the need for more precise and durable treatment options.

New drug classes targeting the orexin and monoaminergic systems are redefining narcolepsy treatment. Orexin agonists such as Oreporexton (TAK-861), along with next-generation agents like Reboxetine (AXS-12) and Quilience (mazindol ER), aim to restore wakefulness regulation at its neurobiological root. These therapies go beyond symptomatic relief addressing excessive daytime sleepiness, cataplexy, and sleep–wake instability through precision, disease-modifying mechanisms that mark a transformative shift in narcolepsy management.

Narcolepsy Market Outlook

The narcolepsy market is poised for substantial growth over the coming years, driven by expanding disease awareness, improved diagnostic accuracy, and the introduction of novel orexin-targeted and wake-promoting therapies. Current treatment options such as LUMRYZ (sodium oxybate), XYWAV (calcium, magnesium, potassium, and sodium oxybates), and SUNOSI (solriamfetol) form the backbone of care, addressing excessive daytime sleepiness and cataplexy with differentiated mechanisms and favorable safety profiles. Traditional stimulant and antidepressant classes, including dextroamphetamine, amphetamine, armodafinil, venlafaxine, fluoxetine, and sertraline, continue to play a role in symptom management but are gradually being complemented by more targeted therapies.

On the innovation front, emerging candidates such as reboxetine (AXS-12), oveporexton (TAK-861), and quilience (Mazindol ER) represent the next wave of mechanistically distinct therapies, focusing on orexin receptor modulation, monoamine balance, and sustained wakefulness. These agents are expected to reshape treatment paradigms by offering improved efficacy, lower abuse potential, and once-daily convenience. Supported by robust R&D investment and an expanding understanding of orexin biology, the narcolepsy market is transitioning toward precision, mechanism-driven therapies that promise enhanced clinical outcomes and long-term disease control.

- The total market size of narcolepsy in the 7MM was approximately USD 2.5 billion in 2024 and is projected to grow steadily throughout the forecast period (2025–2034).

- The market size for narcolepsy in the US exceeded USD 2 billion in 2024 and is projected to expand further with the introduction of novel, mechanism-based therapies targeting the underlying neurobiology of the disorder.

- The total market size of narcolepsy in the EU4 and the UK was approximately USD 120 million in 2024, accounting for around 5% of the total 7MM market revenue, and is expected to grow steadily by 2034.

- In 2024, the total market size of narcolepsy in Japan was approximately USD 15 million, which is anticipated to increase during the forecast period.

Narcolepsy Uptake

This section focuses on the uptake rate of potential emerging narcolepsy expected to be launched in the market during 2020–2034.

Narcolepsy Pipeline Development Activities

The report provides insights into different therapeutic candidates in preregistration, Phase III, and early stage molecule. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for narcolepsy market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for narcolepsy emerging therapies.

KOL Views

To keep up with current and future market trends, we take industry experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on narcolepsy evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers like the Albert Einstein College of Medicine, US; Institute of Immunology, Germany; Gui-de-Chauliac Hospital, France; –Parma University Hospital, Italy; Hospital Clínic of Barcelona, Spain; Ninewells Hospital, United Kingdom; and T –Shiga University of Medical Science, Japan; among others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or narcolepsy market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

As per KOL from the US, ““Patients with narcolepsy continue to face substantial diagnostic delays and persistent symptom burden despite available therapies. Greater emphasis on understanding the lived patient experience is essential to refine clinical decision-making and optimize individualized management strategies.”

As per KOL from the UK, “Narcolepsy, while uncommon, remains a leading cause of excessive daytime sleepiness but continues to be widely under-recognized, resulting in significant diagnostic delays. Advances in biomarkers such as CSF hypocretin-1 levels and neuroimaging are improving diagnostic precision and clarifying differences between NT1 and NT2. The therapeutic landscape has evolved, offering new pharmacologic agents, individualized care strategies, and greater emphasis on lifestyle and behavioral approaches. Growing recognition of the stigma associated with narcolepsy is also contributing to improved quality of life and more holistic management for affected individuals.”

As per KOL from Japan, “Narcolepsy in Japan is associated with a significant clinical and economic burden, characterized by high rates of comorbidities such as insomnia, depression, and anxiety. Patients demonstrate notably greater healthcare utilization, including increased hospitalizations, prescription use, and outpatient visits, leading to substantially higher overall healthcare costs compared to the general population.”

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

Reimbursement for narcolepsy is well established in the United States, with Avadel Pharmaceuticals ensuring broad access to LUMRYZ through its RYZUP Support Services. The program offers personalized assistance for insurance navigation, financial aid, and compliance with LUMRYZ REMS requirements. Each patient is paired with a dedicated Nurse Care Navigator who facilitates benefit verification, approvals, and pharmacy coordination. LUMRYZ currently achieves coverage for over 90% of commercially insured patients, supported by financial programs such as the Co-pay Assistance (USD 0 out-of-pocket for eligible patients), Quick Start, Bridge, and Patient Assistance Programs, ensuring affordability and continuity of therapy.

The report further details country-wise reimbursement and accessibility status, cost-effectiveness assessments, patient assistance initiatives that improve affordability, and insights into coverage under government prescription drug programs.

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of narcolepsy, explaining their mechanism and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the narcolepsy market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM narcolepsy market.

Narcolepsy Report Insights

- Narcolepsy Targeted Patient Pool

- Narcolepsy Therapeutic Approaches

- Narcolepsy Pipeline Analysis

- Narcolepsy Market Size and Trends

- Existing and Future Market Opportunity

Narcolepsy Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Key Cross Competition

- Attribute Analysis

- Drugs Uptake and Key Market Forecast Assumptions

Narcolepsy Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the narcolepsy total market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for narcolepsy?

- Which drug accounts for maximum narcolepsy sales?

- What are the risks, burdens, and unmet needs of treatment with narcolepsy? What will be the growth opportunities across the 7MM for the patient population narcolepsy?

- What are the key factors hampering the growth of the narcolepsy market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for narcolepsy?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the narcolepsy market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the attribute analysis section to provide visibility around leading indications.

- To understand key opinion leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.