Neuropathic Ocular Pain Market

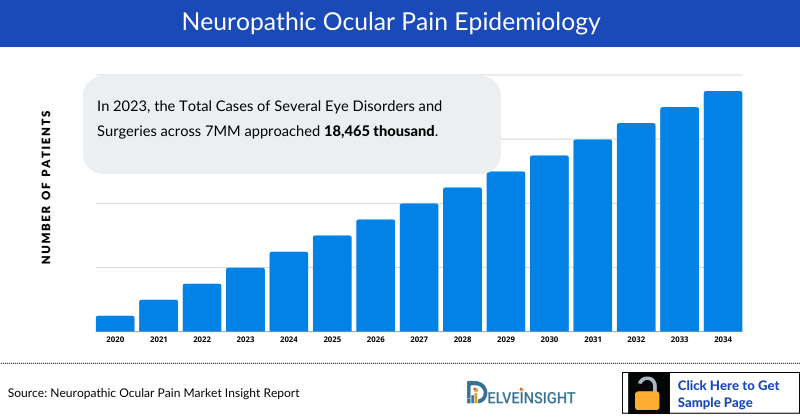

- In 2023, the Total Cases of Several Eye Disorders and Surgeries across 7MM approached 18,465 thousand. This figure underscores the significant burden of ocular conditions and the extensive need for medical interventions in these regions, reflecting the considerable healthcare demand and highlighting the critical focus areas for eye health management and treatment strategies.

- In 2023, the Total Cases of Neuropathic Ocular Pain (NOP) in Several Eye Disorders and Surgeries was approximately 3,075 thousand in the 7MM, which is further expected to increase by 2034.

- In the US, the incidence rates for various eye disorders in 2023 are as follows; severe Dry Eye Disease approximately at 8%, refractive surgeries nearly at 13%, cataract surgery approximately at 57%, and other conditions, including infections, systemic diseases, and other ocular surface disorders, at 22%. These statistics illustrate the incidence of these conditions and the ongoing need for targeted healthcare interventions and management strategies in the ophthalmic field.

- In 2023, the market for NOP comprises off-label therapies offering only temporary, nonspecific relief, contributing to a market size of approximately USD 100 million across the 7MM.

- The market size is expected to increase with a significant Compound annual growth rate (CAGR) of 5.2% contributing to projected launch of emerging therapies during the study period (2020–2034).

- The neuropathic ocular pain (NOP) market is propelled by heightened awareness and the demand for effective, targeted therapies, as well as a rising incidence of related ocular disorders. Key market drivers include advancements in drug development and growing recognition of the condition's impact on quality of life. Nevertheless, challenges persist, including a lack of treatment options, diagnostic complexities, high development costs, and limited research, which hinder effective management and progress in the market.

- In February 2024, OKYO Pharma received FDA approval for an IND for OK-101, marking the first such clearance for a drug targeting neuropathic corneal pain (NCP), an area with significant unmet need. NCP is classified as an orphan disease. This milestone highlights OK-101's potential in addressing NCP and NOP, a condition currently lacking an FDA-approved treatment.

DelveInsight’s “Neuropathic Ocular Pain Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the NOP, historical and forecasted epidemiology as well as the NOP market trends in the United States, EU4 and the UK (Germany, France, Italy, Spain), the United Kingdom, and Japan.

The NOP market report provides current treatment practices, emerging drugs, and market share of the individual therapies, current and forecasted 7MM NOP market size from 2020 to 2034. The Report also covers current NOP treatment practice, market drivers, market barriers, SWOT analysis, reimbursement and market access, and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

Disease Understanding and Treatment Market

Neuropathic Ocular Pain Overview

Neuropathic ocular pain (NOP), also referred to as corneal neuropathic pain, is a condition marked by intense corneal pain triggered by stimuli that would normally be non-painful. This disorder arises from recurrent direct injury to the ocular nerves, leading to a heightened pain response. Patients often experience symptoms such as persistent, sharp, or burning pain in the eye, which can be exacerbated by everyday activities like blinking or exposure to light. In addition to pain, individuals may report symptoms such as dryness, irritation, and a sensation of a foreign body in the eye.

The discomfort may not correlate with visible damage to the cornea, complicating diagnosis and treatment. The pain associated with NOP can significantly impact daily functioning and quality of life, making effective management essential for those affected.

Neuropathic Ocular Pain (NOP) Diagnosis

Diagnosing neuropathic ocular pain (NOP), or corneal neuropathic pain, can be challenging due to its complex nature and the absence of visible corneal damage. The diagnosis primarily involves a comprehensive clinical evaluation including patient history, symptom assessment, and exclusion of other ocular conditions. Diagnostic tests may include corneal sensitivity tests, such as the Cochet-Bonnet esthesiometer, to assess nerve function and confirm neuropathic involvement. Additional evaluations, such as tear film assessments and ocular surface staining, help rule out other potential causes of ocular discomfort. Despite these methods, NOP often remains underdiagnosed or misdiagnosed, partly due to the lack of specific diagnostic criteria and the overlap with other eye disorders.

The unmet need in NOP is significant, as current treatment options offer limited relief and are predominantly off-label, providing only temporary and nonspecific alleviation. There is a pressing demand for targeted therapies that address the underlying neuropathic mechanisms and provide more sustained pain relief for affected individuals.

Further details related to diagnosis are provided in the report...

Neuropathic Ocular Pain (NOP) Treatment

Treatment options for neuropathic ocular pain (NOP), or corneal neuropathic pain, are currently limited and largely off-label, targeting symptom relief rather than addressing the underlying cause. Commonly used treatments include topical medications such as anti-inflammatory agents, corticosteroids, and various lubricants to alleviate symptoms. Neuropathic pain medications, such as oral anticonvulsants (e.g., gabapentin) and antidepressants (e.g., amitriptyline), may be employed to manage pain perception. Other options include physical therapies like neurostimulation and novel approaches like platelet-rich plasma (PRP) eye drops.

Despite these options, the unmet need is substantial. Many treatments offer only temporary relief and do not address the root neuropathic mechanisms of NOP. The lack of targeted therapies for this condition results in inadequate and inconsistent pain management. There is an urgent need for innovative treatments that can effectively manage the underlying neuropathic pain and provide long-term relief to improve the quality of life for affected individuals.

Further details related to treatment are provided in the report...

Neuropathic Ocular Pain Epidemiology

As the market is derived using a patient-based model, the NOP epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by, Number of Cases of Several Eye Disorders and Surgeries and Number of Cases of NOP in Several Eye Disorders and Surgeries in the 7MM covering, the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

- In the assessment done by DelveInsight, in Japan, the incidence rates for different eye disorders in 2023 accumulated to be 3,352 thousand cases among which, severe Dry Eye Disease at 36%, post-operative complications at 13%, cataract surgery at 29%, and other conditions such as infections, systemic diseases, and various ocular surface disorders at 21%. These figures highlight the prevalence of these eye conditions and underscore the necessity for focused healthcare interventions and effective management strategies within the ophthalmic sector.

- EU4 and the UK accounted for approximately 1,625 thousand number of cases from the Total Number of Neuropathic Ocular Pain Cases in the 7MM in 2023. Among the European countries, Italy had the highest number of neuropathic ocular pain cases with ~ 535 thousand cases, followed by France accounting for nearly 350 thousand cases.

- DelveInsight’s projections for 2023 reveal that the EU4 and the UK account for 44% of the total cases of several eye disorders and surgeries across the 7MM, surpassing the US at 38% and Japan at 18%. These percentages are expected to grow during the forecast period from 2024 to 2034, indicating a projected rise in the prevalence of these conditions.

Neuropathic Ocular Pain Drug Chapters

The drug chapter segment of the NOP report encloses a detailed analysis of NOP off-label drugs and early-stage (Phase-I) pipeline drugs. It also helps to understand the NOP clinical trial details, expressive pharmacological action, agreements and collaborations,

approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Emerging Neuropathic Ocular Pain Drugs

OK-101: OKYO Pharma Limited

OK-101, developed by OKYA Pharma, represents a promising therapeutic approach for neuropathic corneal pain (NCP), a condition characterized by chronic pain in the cornea in response to stimuli that are normally non-painful. OK-101 is designed to target the underlying pathophysiological mechanisms of NCP, aiming to provide relief by addressing the specific nerve pain pathways involved in this disorder.

OK-101 is a selective ion channel modulator designed to address neuropathic corneal pain (NOP) by altering nerve signal transmission. This novel approach aims to provide more effective and targeted relief compared to existing treatments, which often offer only temporary relief for NOP. As clinical trials advance, OK-101 could significantly enhance management strategies for NOP, addressing a critical gap in effective, long-lasting pain relief.

Recently Novartis finalized the divestment of its 'front of eye' ophthalmology assets, including investigational medicine SAF312 (libvatrep), to Bausch + Lomb for an upfront cash payment of USD 1.75 billion. Despite this transaction, SAF312 has been removed from Bausch + Lomb's pipeline, and its future availability remains uncertain. Consequently, forecasting for SAF312 is not feasible at this time.

Note: Detailed emerging therapies assessment will be provided in the final report of Neuropathic Ocular Pain (NOP)...

Neuropathic Ocular Pain Market Outlook

Current treatments for neuropathic ocular pain (NOP) encompass both pharmacological and non-pharmacological approaches. Pharmacological options include topical anesthetics, such as lidocaine and tetracaine, which provide temporary relief by numbing the corneal surface. Additionally, nerve growth factor (NGF) inhibitors, like cenegermin, are used to promote corneal healing and alleviate pain by targeting underlying nerve damage. Antidepressants, such as amitriptyline, and anticonvulsants, like gabapentin, are sometimes prescribed off-label to manage chronic pain through their central pain-modulating effects.

Non-pharmacological treatments include corneal neurostimulation techniques, such as intense pulsed light therapy and autologous serum eye drops, which aim to support nerve repair and reduce pain. Lubricating eye drops and ointments can also help by keeping the corneal surface moist and minimizing discomfort. Despite these options, many treatments provide only partial or temporary relief, highlighting a need for more effective, long-term solutions.

The pipeline for neuropathic ocular pain (NOP) treatments is notably limited. Few drug candidates are currently under development, reflecting the significant gap in addressing this condition. Despite ongoing research, the lack of innovative therapies means that effective, long-term solutions for NOP remain sparse, underscoring the urgent need for advancements in this area.

However the pharmaceutical landscape is expected to evolve with ongoing clinical trials exploring novel treatments, including OK-101, and other drugs. Despite the absence of curative options, advancements in research and development, alongside a comprehensive approach is crucial for addressing the unmet needs in NOP treatment.

With ongoing research and continued dedication, the future holds hope for even more effective treatments and, ultimately, a cure for this challenging condition. According to DelveInsight, the NOP market in the 7MM is projected to grow significantly during the study period 2020–2034.

Neuropathic Ocular Pain Drugs Uptake

This section examines the anticipated market uptake of potential new drugs slated for release between 2020 and 2034. It details the expected launch year for each drug, their projected peak market share percentage, and the estimated time required to reach this peak. The analysis also outlines the expected pattern of uptake for these drugs.

The market for neuropathic ocular pain (NOP) across the 7MM shows the largest share in the US, accounting for 71%, followed by the EU4 and the UK at 23%. Japan holds the smallest market share, representing 6%. This distribution underscores the US as the leading market for NOP, with significant but comparatively smaller markets in Europe and minimal presence in Japan.

Further detailed analysis of emerging therapies drug uptake in the report...

Neuropathic Ocular Pain (NOP) Pipeline Development Activities

The report provides insights into Neuropathic Ocular Pain clinical trials within Preclinical stage. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for NOP emerging therapies.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on NOP evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including KOL from Baylor College of Medicine, USA Miami Miller School of Medicine, USA; Massachusetts Eye and Ear, US; Consultant Ophthalmic Physician, UK; Institute of Neurosciences in Alicante, Spain; and others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or NOP market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Neuropathic Ocular Pain Market Report

- The report covers a segment of key events, an executive summary, descriptive overview of NOP, explaining its causes, signs and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the NOP market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM NOP market.

Neuropathic Ocular Pain (NOP) Report Insights

- Neuropathic Ocular Pain Patient Population

- Neuropathic Ocular Pain Therapeutic Approaches

- Neuropathic Ocular Pain Pipeline Analysis

- Neuropathic Ocular Pain Market Size and Trends

- Existing and Future Market Opportunity

Neuropathic Ocular Pain (NOP) Report Key Strengths

- 11 years Forecast

- The 7MM Coverage

- NOP Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Neuropathic Ocular Pain Drugs Uptake

- Key Neuropathic Ocular Pain Market Forecast Assumptions

Neuropathic Ocular Pain (NOP) Report Assessment

- Current Neuropathic Ocular Pain Treatment Practices

- Neuropathic Ocular Pain Unmet Needs

- Neuropathic Ocular Pain Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Neuropathic Ocular Pain Market Drivers

- Neuropathic Ocular Pain Market Forecast

Key Questions Neuropathic Ocular Pain Answered In The Neuropathic Ocular Pain Market Report

Neuropathic Ocular Pain Market Insights

- What was the Neuropathic Ocular Pain (NOP) market share (%) distribution in 2020 and how it would look like in 2034?

- What would be the NOP total market size as well as market size by therapies across the 7MM during the forecast period (2024–2034)?

- What are the key findings pertaining to the market across the 7MM and which country will have the largest NOP market size during the forecast period (2024–2034)?

- At what CAGR, the NOP market is expected to grow at the 7MM level during the forecast period (2024–2034)?

- What would be the NOP market outlook across the 7MM during the forecast period (2024–2034)?

- What would be the NOP market growth till 2034 and what will be the resultant market size in the year 2034?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Neuropathic Ocular Pain Epidemiology Insights

- What is the disease risk, burden, and unmet needs of Neuropathic Ocular Pain (NOP)?

- What is the historical NOP patient population in the United States, EU5 (Germany, France, Italy, Spain, and the UK), and Japan?

- What would be the forecasted patient population of NOP at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to NOP?

- Out of the above-mentioned countries, which country would have the highest prevalent population of NOP during the forecast period (2024–2034)?

- At what CAGR the population is expected to grow across the 7MM during the forecast period (2024–2034)?

Current Neuropathic Ocular Pain Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of NOP along with the approved therapy?

- What are the current treatment guidelines for the treatment of NOP in the US, Europe, And Japan?

- What are the NOP marketed drugs and their MOA, regulatory milestones, product development activities, advantages, disadvantages, safety, and efficacy, etc.?

- How many companies are developing therapies for the treatment of NOP?

- How many emerging therapies are in the mid-stage and late stages of development for the treatment of NOP?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, licensing activities related to the NOP therapies?

- What are the recent therapies, targets, mechanisms of action and technologies developed to overcome the limitation of existing therapies?

- What are the clinical studies going on for NOP and their status?

- What are the key designations that have been granted for the emerging therapies for NOP?

- What are the 7MM historical and forecasted market of NOP?

Reasons to Buy Neuropathic Ocular Pain Market Report

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the NOP Market.

- Insights on patient burden/disease incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and potential of current and emerging therapies under the conjoint analysis section to provide visibility around leading emerging drugs.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in future.

- Detailed insights on the unmet need of the existing market so that the upcoming players can strengthen their development and launch strategy.

Frequently Asked Questions

1. What is the forecast period covered in the report?

The Neuropathic Ocular Pain (NOP) Epidemiology and Market Insight report for the 7MM covers the forecast period from 2024 to 2034, providing a projection of market dynamics and trends during this timeframe.

2. Who are the key players in the Neuropathic Ocular Pain (NOP) market?

The NOP market is relatively underdeveloped. Key players include OKYO Pharmaceuticals and a few others, all of which are in the process of developing new treatments for neuropathic ocular pain.

3. How is the market size estimated in the forecast report?

The market size is estimated through data analysis, statistical modeling, and expert opinions. It may consider factors such as incident cases, treatment costs, revenue generated, and market trends.

4. What is the key driver of the NOP market?

The increase in awareness of NOP and the launch of emerging therapies are attributed to be the key drivers for increasing the NOP market.

5. What is the expected impact of emerging therapies or advancements in NOP treatment on the market?

Introducing new therapies, advancements in diagnostic techniques, and innovations in treatment approaches can significantly impact the NOP treatment market. Market forecast reports may provide analysis and predictions regarding the potential impact of these developments.

6. Does the report provide insights into the competitive landscape of the market?

The market forecast report may include information on the competitive landscape, profiling key market players, their product offerings, partnerships, and strategies, and helping stakeholders understand the competitive dynamics of the NOP market.