Non-Postoperative Acute Pain Market

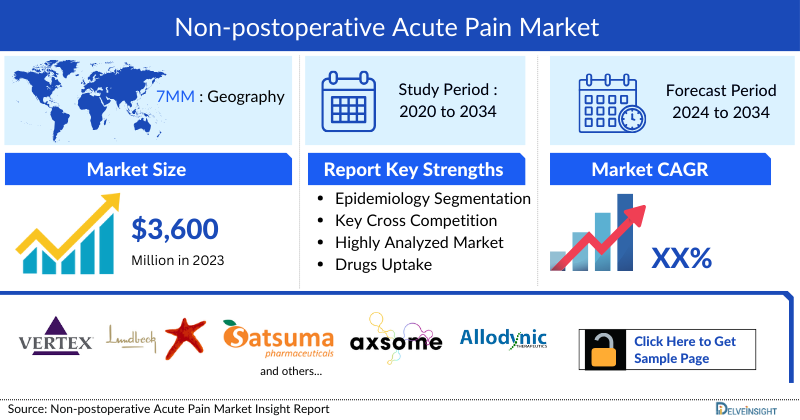

- The Non-postoperative Acute Pain market size in the 7MM was around USD 3,600 million in 2023

- In the United States, about 50% of the individuals diagnosed with non-postoperative acute pain experienced a moderate level of severity.

- In the seven major markets, moderate to severe cases contributed approximately 60% to the total recorded diagnosed cases, in 2023.

- Non-postoperative acute pain cases due to migraine and cluster headaches constituted approximately 40% of total diagnosed cases, in 2023, in the United States

- Incident cases of non-postoperative acute pain in the United States were approximately 50,000,000 in 2023.

- In recent years, extensive changes have been observed in the acute pain management market. Opioid replacement with other more beneficiary approaches has been in talks; opioid was a gold standard but is being replaced by multimodal analgesia (MMA) models.

- NSAIDs provide anti-inflammatory, antipyretic, analgesic, and thrombotic effects by inhibiting cyclooxygenases 1 and 2 (COX-1 and COX-2). Although several generics are available for NSAIDs, and presence of generics in the market is due to patent expiration.

- Moreover, NSAIDs have been recognized to decrease opioid consumption by ~50%, and thus have been proposed as first-line medications for mild-to-moderate pain.

- EMGALITY provides patients with the first FDA-approved drug that reduces the frequency of attacks of episodic cluster headache, an extremely painful and often debilitating condition.

- Calcitonin gene-related peptide (CGRP) plays a vital role in the pathophysiology of migraine and cluster headaches. VYEPTI (eptinezumab), developed by Lundbeck, is a monoclonal immunoglobulin G1 antibody,approved by the FDA for preventive treatment of migraines.

- Some of the most prominent new therapies in the pipeline include VX-548, Dihydroergotamine, AXS-07, VYEPTI, and Naltrexone-acetaminophen.

Report Summary

- The report offers extensive knowledge regarding the epidemiology segments and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies and the elaborative profiles of late-stage (Phase III and Phase II) and prominent therapies that would impact the current treatment landscape and result in an overall market shift has been provided in the report.

- The report also encompasses a comprehensive analysis of the non-postoperative acute pain market, providing an in-depth examination of its historical and projected market size (2020–2034). It also includes the market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The report also includes drug outreach coverage in the 7MM region.

- The report includes qualitative insights that provide an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM non-postoperative acute pain market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Non-postoperative Acute Pain Market |

|

|

Non-postoperative Acute Pains Market Size | |

|

Non-postoperative Acute Pain Companies |

Vertex Pharmaceuticals, H. Lundbeck A/S, Satsuma Pharmaceuticals, Axsome Therapeutics, Allodynic Therapeutics, and others. |

|

Non-postoperative Acute Pain Epidemiology Segmentation |

|

Non-postoperative Acute Pain Disease Treatment Market

Non-postoperative Acute Pain Overview

Non-postoperative pain refers to acute pain that arises from various causes unrelated to surgical procedures. It can result from conditions such as any injury, illness, trauma, burns, cuts, infection, or tissue damage. The pain may manifest in different regions of the body, requiring a systematic diagnostic approach involving patient history, physical examination, and, if necessary, imaging or laboratory tests. The goal is to identify the source and nature of the pain to tailor an appropriate treatment plan. Non-postoperative acute pain management may involve analgesic medications, physical therapy, and addressing the underlying condition. A multidisciplinary approach is often necessary to ensure comprehensive care and effective pain relief for individuals experiencing non-postoperative acute pain.

Non-postoperative Acute Pain Diagnosis

Diagnosing non-postoperative acute pain involves a comprehensive approach. A detailed medical history is obtained, including the onset, duration, and characteristics of the pain, along with relevant patient information. A thorough physical examination is conducted to identify visible signs of injury or inflammation, assess tenderness and swelling, and evaluate range of motion. Diagnostic tests, such as X-rays or MRI scans, may be employed to visualize internal structures. Specialized consultations with relevant specialists may be sought, and nerve blocks or injections could be used for diagnostic purposes. Lifestyle factors, psychosocial elements, and any exacerbating or alleviating factors are considered. The goal is to systematically gather information to pinpoint the source of pain and formulate an effective treatment plan.

Further details related to diagnosis will be provided in the report...

Non-postoperative Acute Pain Treatment

Acute pain is caused by injury, surgery, illness, trauma, or painful medical procedures. It serves as a warning of disease or a threat to the body. It generally lasts briefly and disappears when the underlying cause has been treated or healed. Multimodal treatment is crucial for optimizing pain relief. Because different modalities may be additive or synergistic, this approach can also reduce the potential for side effects. The cornerstones of multimodal treatment include nerve blocks or epidurals, opioids or other analgesics, adjunctive medications, physical modalities (RICE), and rehabilitation; psychosocial interventions, including distraction, meditation, and deep breathing, are also central components. The treatment pattern currently consists of different approaches classified into pharmacologic and nonpharmacological therapies.The current market offers treatment with opioids, NSAIDs, and other anesthetics. The effectiveness of pain relief is of the utmost importance to anyone treating patients undergoing surgery. Consequently, the pain market is looking forward to new therapies that contribute substantially to ease the pain.

Further details related to treatment will be provided in the report...

Non-postoperative Acute Pain Epidemiology

The Non-postoperative acute pain epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Diagnosed Incident Cases of Non-postoperative acute Pain, Type-specific Cases of Non-postoperative acute Pain, Severity-specific Cases of Non-postoperative acute Pain, and Total Treated Cases of Non-postoperative acute Pain in the United States, EU4 (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

- In 2023, the United States had the highest number of incident cases of non-postoperative acute pain among the seven major markets.

- In 2023, total type-specific incident cases of Non-postoperative acute pain in the United States comprised of ~60% and ~40% cases for trauma pain and others, respectively.

- In the United States, severity-specific incident cases of Non-postoperative acute pain were highest in moderate pain, accounting for ~ 25,000,000 cases in 2023.

- In the seven major markets, moderate to severe cases contributed approximately 60% to the total recorded diagnosed cases, in 2023.

Non-postoperative Acute Pain Drug Chapters

The drug chapter segment of the Non-postoperative acute pain report encloses a detailed analysis of the marketed and late-stage (Phase III) pipeline drug. The marketed drugs segment encloses drugs such as ELYXYB (Scilex Holding), ZAVZPRET (Pfizer), NURTEC ODT (Pfizer/Biohaven Pharmaceutical), and others. Furthermore, the current key players for emerging drugs and their respective drug candidates include VYEPTI (H. Lundbeck A/S), AXS-07 (Axsome Therapeutics), and others. The drug chapter also helps understand the Non-postoperative acute pain clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases.

Non-postoperative Acute Pain Marketed Drugs

ELYXYB (celecoxib): Scilex Holding

ELYXYB is a nonsteroidal anti-inflammatory drug (NSAID) and the first and only ready-to-use oral solution designed to deliver fast and long-lasting migraine relief with the proven safety of COX-2 selectivity that is FDA-approved for acute treatment of migraine, with or without aura, in adults. ELYXYB oral solution is made using a self-micro emulsifying drug delivery system that enables celecoxib to be absorbed better and work faster. The product works within 1 h to provide relief from a migraine attack. It is thought to work by inhibiting an enzyme called cyclooxygenase-2 (COX-2), which inhibits the production of a group of lipids called prostaglandins. Prostaglandins can cause inflammation and pain. In February 2023, Scilex Holding announced the commercial launch of ELYXYB in the US.

ZAVZPRET (zavegepant): Pfizer

ZAVZPRET is a third-generation, high affinity, selective, and structurally unique, small molecule CGRP receptor antagonist and the only CGRP receptor antagonist in clinical development with both intranasal and oral formulations. CGRP receptor antagonists work to treat migraine by reversibly blocking CGRP receptors, thereby inhibiting the biologic activity of the CGRP neuropeptide, which is thought to play a causal role in migraine. ZAVZPRET is a nasal spray administered as a single spray in one nostril, as needed. It may provide an important alternative for patients who need a quick onset of action or those who cannot take oral treatments due to nausea and vomiting at the time of migraine onset. In March 2023, the US FDA approved ZAVZPRET for the acute treatment of migraine with or without aura in adults.

|

Comparison of Marketed Drugs | ||||||

|

Drugs |

Company Name |

MoA |

RoA |

Patient Segment |

Approval | |

|

ELYXYB |

Scilex |

Cyclo-oxygenase 2 inhibitors |

Oral |

Acute migraine |

US: 2020 | |

|

ZAVZPRET |

Pfizer |

Calcitonin gene-related peptide receptor antagonists |

Topical |

Acute migraine |

US: 2023 | |

|

NURTEC ODT |

Pfizer/Biohaven |

Calcitonin gene-related peptide receptor antagonists |

Oral |

Acute migraine |

US: 2020 | |

Non-postoperative Acute Pain Emerging Drugs

VYEPTI (eptinezumab): H. Lundbeck A/S

VYEPTI (eptinezumab) is a monoclonal immunoglobulin G1 (IgG1) antibody that binds to human calcitonin gene-related peptide (CGRP) with high specificity and affinity for the CGRP α- and β-form. CGRP is a signaling molecule in the pathophysiology of migraine and cluster headaches. In February 2020, VYEPTI (eptinezumab) was approved by the US FDA for the preventive treatment of migraine in adults. Currently, it is under Phase III development for cluster headache.

AXS-07: Axsome Therapeutics

AXS-07 is a novel, oral, rapidly absorbed, multi-mechanistic, investigational medicine for the acute treatment of migraine. The drug consists of MoSEIC (Molecular Solubility Enhanced Inclusion Complex) meloxicam and rizatriptan. AXS-07 is thought to act by inhibiting calcitonin gene-related peptide (CGRP) release, reversing CGRP-mediated vasodilation, and inhibiting neuroinflammation, pain signal transmission, and central sensitization. Meloxicam is a new molecular entity for migraine enabled by MoSEIC technology, which results in rapid absorption of meloxicam while maintaining a long plasma half-life. AXS-07 is covered by more than 80 issued the US and international patents which provide protection out to 2036. Manufacturing activities related to the planned resubmission of the New Drug Application (NDA) for AXS-07 for the acute treatment of migraine continue to progress.

Detailed emerging therapies assessment will be provided in the final report...

Non-postoperative Acute Pain Drug Class Insight

The ongoing and future avenues include efforts to de-escalate therapy in Non-postoperative acute pain, improve the sequencing of available CGRP inhibitor, and introduce new biomarker-guided therapies into the armamentarium for Non-postoperative acute pain. There has also been considerable interest in improving the benefit conferred by Cyclo-oxygenase 2 (COX-2) inhibitor, particularly ELYXYB, after the agent’s establishment as a standard of care in Non-postoperative acute pain.

Calcitonin gene-related peptide (CGRP) inhibitor

CGRP is involved in several of the pathophysiologic processes underpinning migraine attacks. Therapies that target CGRP or its receptor have shown efficacy as preventive or acute treatments for migraine. CGRP plays a role in gastrointestinal nociception, inflammation, gastric acid secretion, and motility. Small-molecule CGRP receptor antagonists (rimegepant and ubrogepant) are approved for the acute treatment of migraine. In March 2023, the US FDA also approved ZAVZPRE (zavegepant), the first and only calcitonin gene-related peptide (CGRP) receptor antagonist nasal spray for the acute treatment of migraine with or without aura in adults.

Cyclo-oxygenase 2 (COX-2) inhibitor

COX-2 inhibitors are a type of nonsteroidal anti-inflammatory drug (NSAIDs). NSAIDs relieve pain and fever and reduce inflammation. ELYXYB (celecoxib) is a NSAID and the first and only ready-to-use oral solution designed to deliver fast and long-lasting migraine relief with the proven safety of COX-2 selectivity that is FDA-approved for acute treatment of migraine, with or without aura, in adults. ELYXYB oral solution is made using a self-micro emulsifying drug delivery system that enables celecoxib to be absorbed better and work faster.

Non-postoperative Acute Pain Market Outlook

Treatment of acute pain is generally tailored to the individual patient’s assessment and requirements. Acute pain usually lasts for less than 7 days but often extends up to 30 days for some conditions; acute pain episodes may recur periodically. In some patients, acute pain persists to become chronic. Pain is the most common reason for emergency department visits and is commonly encountered in primary care, other outpatient, and inpatient settings.

The treatment pattern currently consists of different approaches classified into pharmacologic and nonpharmacological therapies. The pharmacological therapies include analgesics that are further segregated into opioids, nonsteroidal anti-inflammatory drugs (NSAIDs), acetaminophen, corticosteroids, anesthetics, etc. Acute pain is also managed by the use of benzodiazepines, muscle relaxants, antidepressants, alpha-2 agonists, gamma-aminobutyric agonists, and cannabinoids. Further, nonpharmacological therapies include acupuncture, psychological approaches (cognitive behavioral therapy, mindfulness-based stress reduction), chiropractic manipulation, physical therapy, transcutaneous electrical stimulation, massage therapy, exercise, and other complementary and alternative medicine therapies (CAM). All these involve the concept known as multimodal analgesia.

In recent years, extensive changes have been observed in the acute pain management market. Opioid replacement with other more beneficiary approaches has been in talks; opioid was a gold standard but is being replaced by multimodal analgesia (MMA) models.

Among the approved drugs, UBRELVY is indicated for the acute treatment of migraine with or without aura in adults by the US FDA. REYVOW, which has a unique mechanism of action, is the first and only FDA-approved medicine in a new class of acute treatment for migraine. The US FDA has also approved EMGALITY solution for treating episodic cluster headaches in adults.

Many companies are working toward this therapeutic area, including Vertex, Charleston Laboratories, Allodynic Therapeutics, Axsome Therapeutics, ALGOMEDIX, PULMATRIX, Relevium Medical, Neumentum Pharmaceuticals, Medical Developments International (MVP), H. Lundbeck, and others.

Non-postoperative Acute Pain Market

- The total market size in the United States for Non-postoperative acute pain was estimated to be nearly USD 3,600 million in 2023.

- The US market for Non-postoperative acute pain holds therapies like LICART, UBRELVY, REYVOW, NURTEC ODT, and others.

- Among the marketed therapies , the majority of the share was held by UBRELVY, in 2023.

- The emerging pipeline of non-postoperative acute pain contains promising therapies expected to enter the United States market during the forecast period (2024–2034). By 2034, among all the therapies, the highest revenue is expected to be generated by VYEPTI (eptinezumab).

Non-postoperative Acute Pain Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034. The landscape of Non-postoperative acute pain treatment has experienced a profound transformation with the uptake of novel drugs. These innovative therapies are redefining standards of care. Furthermore, the increased uptake of these transformative drugs is a testament to the unwavering dedication of physicians, neurologyic professionals, and the entire healthcare community in their tireless pursuit of acute pain care. This momentous shift in treatment paradigms is a testament to the power of research, collaboration, and human resilience.

Non-postoperative Acute Pain Pipeline Development Activities

The report provides insights into therapeutic candidates in Phase III and Phase II. It also analyzes key players involved in developing targeted therapeutics. Companies like Vertex Pharmaceuticals, Axsome Therapeutics, and Allodynic Therapeutics actively engage in mid and late-stage research and development efforts for Non-postoperative acute pain. The pipeline of Non-postoperative acute pain possesses few potential drugs. However, there is a positive outlook for the therapeutics market, with expectations of growth during the forecast period (2024–2034).

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Non-postoperative acute pain emerging therapy.

KOL- Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the Non-postoperative acute pain evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including neurologists, physician, and others.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the United States. Centers such as the Headache and Neurologic Institute, NJ Society of Physical Medicine & Rehabilitation (PM&R), David Geffen School of Medicine, Center for Autonomic and Peripheral Nerve Disorders, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Non-postoperative acute pain therapeutics market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“STS101 DHE nasal powder was significantly more effective in providing sustained efficacy, which is freedom from pain and the most bothersome symptom, starting at 2 hours and on, as well as pain relief with lower use of rescue medication.” -MD, professor of neurology at David Geffen School of Medicine |

|

“EMGALITY provides patients with the first FDA-approved drug that reduces the frequency of attacks of episodic cluster headache, an extremely painful and often debilitating condition.” -Deputy Director of the division of neurology products |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis, Conjoint Analysis and Analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyses multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyse the effectiveness of therapy.

Furthermore, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, a final weightage score is decided, based on which the emerging therapies are ranked.

Market Access and Reimbursement

LICART is the only once-a-day topical nonsteroidal anti-inflammatory therapy available to treat acute pain due to minor strains, sprains, and contusions. Its patented next-generation patch technology works fast for powerful pain relief that starts within 1–3 h of the first application and can last all day with once-daily dosing. If patients have commercial insurance, can use the LICART Copay Savings Card at any retail pharmacy to get instant savings on their LICART prescription, paying as little as USD 15 for a one-month supply.

In UBRELVY (ubrogepant) savings program, eligible commercially insured patients may pay as little as USD 0 per monthly prescription fill. The patient's out-of-pocket expense will vary; check with the pharmacist for the copay discount. Restrictions, including monthly, quarterly, and/or annual maximums, may apply.

Scope of the Non-postoperative Acute Pain Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of Non-postoperative acute pain, explaining its causes, signs, symptoms, pathogenesis, and currently used therapies.

- Comprehensive insight into the epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Non-postoperative acute pain therapeutics market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Non-postoperative acute pain market.

Non-postoperative Acute Pain Report Insights

- Non-postoperative acute pain Patient Population

- Non-postoperative acute pain Therapeutic Approaches

- Non-postoperative acute pain Pipeline Analysis

- Non-postoperative acute pain Market Size and Trends

- Existing and Future Market Opportunity

Non-postoperative Acute Pain Report Key Strengths

- Eleven Year Forecast

- The 7MM Coverage

- Non-postoperative acute pain Epidemiology Segmentation

- Key Cross Competition

- Non-postoperative acute pain Drugs Uptake

- Key Non-postoperative acute pain Market Forecast Assumptions

Non-postoperative Acute Pain Report Assessment

- Current Non-postoperative acute pain Treatment Practices

- Non-postoperative acute pain Unmet Needs

- Non-postoperative acute pain Pipeline Product Profiles

- Non-postoperative acute pain Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, and Analyst Views)

- Non-postoperative acute pain Market Drivers

- Non-postoperative acute pain Market Barriers

FAQs

- What was the Non-postoperative acute pain market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like by 2034? What are the contributing factors for this growth?

- What are the pricing variations among the United States for approved therapies?

- What can be the future treatment paradigm for Non-postoperative acute pain?

- What are the disease risks, burdens, and unmet needs of Non-postoperative acute pain? What will be the growth opportunities in the United States concerning the patient population with Non-postoperative acute pain?

- Who is the major competitor of ELYXYB in the market?

- How much market share will Calcitonin gene-related peptide (CGRP) inhibitors capture by 2034?

- What are the current options for the treatment of Non-postoperative acute pain? What are the current guidelines for treating Non-postoperative acute pain in the 7MM?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

- What is the patient share in Non-postoperative acute pain?

Reasons to Buy Non-postoperative Acute Pain Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Non-postoperative acute pain therapeutics market.

- Insights on patient burden/disease incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the 7MM.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis ranking of class-wise potential current and emerging therapies under the analyst view section to provide visibility around leading classes.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.