OX40 Ligand Inhibitors Market Insights

Key Highlights

- OX40 ligand inhibitors are therapeutic agents designed to block the interaction between OX40 (CD134), a co-stimulatory receptor on activated T cells, and its ligand OX40L (CD252), expressed primarily on antigen-presenting cells (APCs) such as dendritic cells, B cells, and macrophages.

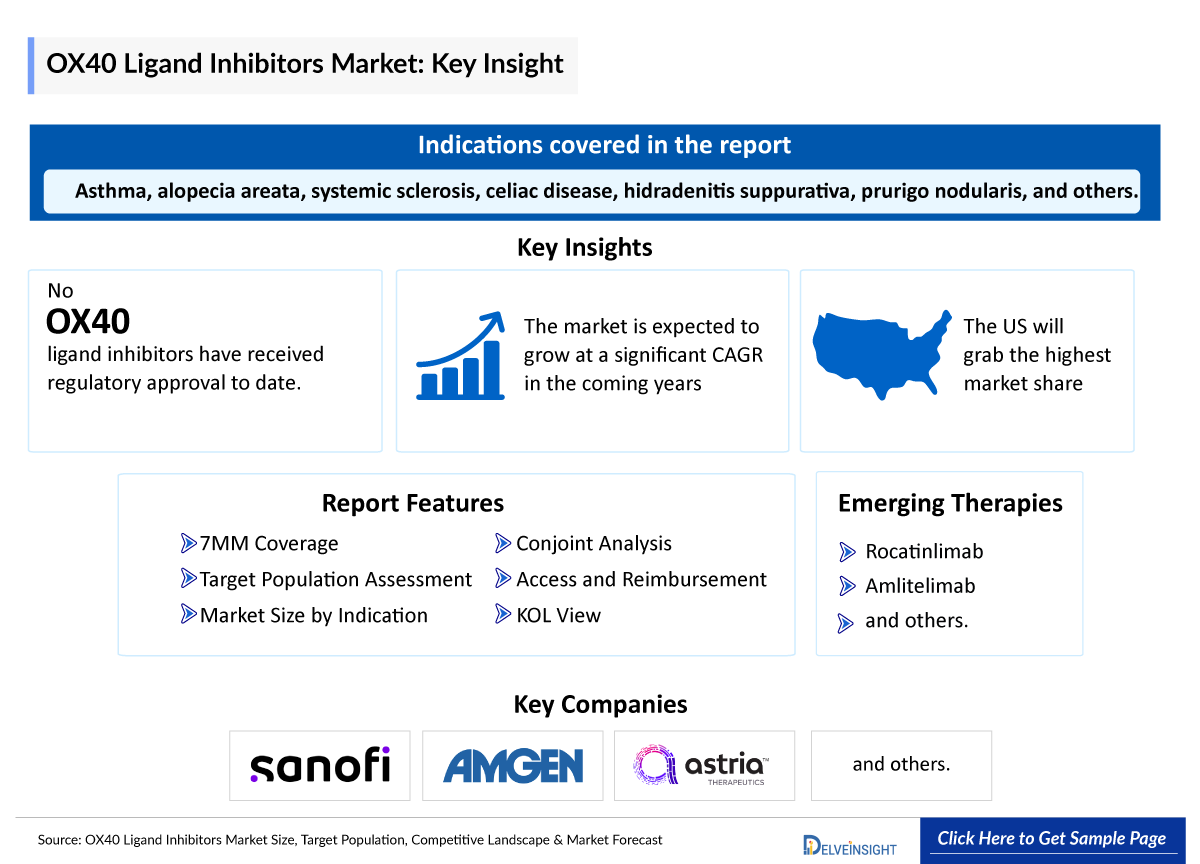

- OX40 and OX40L are expressed at higher levels in patients with moderate to severe atopic dermatitis, contributing to chronic T-cell-driven inflammation—a mechanism also implicated in other immune-mediated diseases such as asthma, alopecia areata, systemic sclerosis, celiac disease, hidradenitis suppurativa, and prurigo nodularis.

- Sanofi, Amgen, and Astria Therapeutics are at the forefront of the OX40 ligand landscape, spearheading efforts to unlock its potential in treating immune-driven diseases.

- Currently, no OX40 ligand inhibitors have received regulatory approval, but rocatinlimab, amlitelimab, STAR-0310, and others are the leading candidates expected to potentially become approved drugs targeting the OX40-OX40L pathway.

- In April 2025, Sanofi announced preliminary Phase II results for amlitelimab in moderate-to-severe asthma. While the primary endpoint was not met at the highest dose, the medium dose showed nominally significant and clinically meaningful reductions in exacerbations. Notably, a biomarker-defined subgroup saw over 70% reduction in exacerbations and improvements in lung function and asthma control. These findings support amlitelimab’s potential in treating heterogeneous inflammatory asthma, with a Phase III program in planning.

- In March 2025, Amgen and Kyowa Kirin announced positive results from the Phase III IGNITE study, part of the ROCKET program evaluating rocatinlimab for moderate to severe atopic dermatitis. The study met its co-primary and all key secondary endpoints, showing statistically significant efficacy for both dose strengths of rocatinlimab versus placebo. The study included 769 adults, including patients with prior biologic or JAK inhibitor treatment, and confirmed rocatinlimab’s potential as a T-cell rebalancing therapy targeting the OX40 receptor.

- In September 2024, Kyowa Kirin announced positive top-line results from its Phase III ROCKET HORIZON trial evaluating rocatinlimab, an investigational therapy targeting the OX40 receptor, for atopic dermatitis. The study met its co-primary endpoints at week 24. Further positive results reported from the IGNITE and SHUTTLE studies in March 2025, establish the efficacy of OX40/OX40L targeting therapies

- In March 2024, Sanofi announced positive results from Part II of the Phase IIb STREAM-AD study show amlitelimab provides sustained improvement in moderate to severe atopic dermatitis for 28 weeks in adults who previously responded to treatment. High responder rates were also seen in patients who stopped therapy. Amlitelimab remained well-tolerated with no new safety concerns. These findings, presented at the AAD 2024 Conference, support continued investigation of a 250 mg quarterly dose (with 500 mg loading dose) in the Phase III OCEANA program.

DelveInsight’s “OX40 Ligand Inhibitors – Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the OX40 ligand inhibitors, historical and Competitive Landscape as well as the OX40 ligand inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The OX40 ligand inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM OX40 ligand inhibitors market size from 2020 to 2034. The report also covers current OX40 ligand inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

OX40 Ligand Inhibitors Disease Understanding and Treatment Algorithm

OX40 Ligand Inhibitors Overview

OX40 ligand (OX40L) inhibitors represent a promising class of immunomodulatory therapies aimed at dampening overactive T-cell responses in various chronic inflammatory and autoimmune diseases. OX40 ligand inhibitors are primarily monoclonal antibodies that block the binding of OX40 to OX40L, thereby suppressing T-cell co-stimulation and inflammatory responses. By blocking the interaction between OX40 and OX40L, these inhibitors can reduce T-cell proliferation, cytokine production, and the persistence of memory T cells—key drivers of sustained inflammation. This mechanism holds particular relevance in conditions such as atopic dermatitis, asthma, systemic sclerosis, alopecia areata, and celiac disease, where dysregulated T-cell activity underpins disease pathology. Unlike OX40 agonists, which enhance immune activation for cancer therapy, OX40L inhibitors offer a targeted strategy to restore immune balance in non-malignant settings.

Further details related to country-based variations are provided in the report

OX40 Ligand Inhibitors Market Overview

The market for OX40 ligand (OX40L) inhibitors is gaining momentum as the demand for targeted immunotherapies in chronic inflammatory and autoimmune diseases continues to rise. With growing recognition of the OX40–OX40L pathway’s role in T-cell-driven disorders, pharmaceutical companies are increasingly investing in this niche. Key players such as Sanofi, Amgen, and Astria Therapeutics are leading development efforts, aiming to address high-burden conditions like atopic dermatitis, asthma, and systemic sclerosis. The market is still in early stages, with most candidates in preclinical or early clinical phases, yet the potential for disease-modifying effects drives strong interest. As clinical data emerge, OX40L inhibitors could carve out a distinct space within the broader immunotherapy landscape, complementing biologics like IL-4R and JAK inhibitors. Strategic partnerships and regulatory milestones will be critical to shaping this evolving market.

Further details related to country-based variations are provided in the report…

OX40 Ligand Inhibitors Potential Patient Pool

This chapter focuses on the potential patient pool for OX40 ligand inhibitors, covering nearly 10 key indications where OX40 ligand-targeted therapies may be applicable. It provides both historical and projected data on the total number of cases, the eligible population for treatment, and estimated treated patients across the 7 major markets (the United States, EU4 – Germany, France, Italy, and Spain – the United Kingdom, and Japan) from 2020 to 2034.

OX40 Ligand Inhibitor Drug Chapters

The drug chapter segment of the OX40 ligand inhibitors reports encloses a detailed analysis of late-stage (Phase III and Phase II) OX40 ligand inhibitors. It also helps understand the OX40 ligand inhibitor’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

OX40 Ligand Inhibitor Emerging Drugs

Rocatinlimab (AMG 451 / KHK4083): Amgen/ Kyowa Kirin

Rocatinlimab is an anti-OX40 human monoclonal antibody being investigated for the treatment of moderate to severe atopic dermatitis. Rocatinlimab has the potential to be the first and only T-cell rebalancing therapy that inhibits and reduces pathogenic T cells by targeting the OX40 receptor. Rocatinlimab is also being studied for moderate to severe atopic dermatitis, uncontrolled asthma, prurigo nodularis and potentially other conditions where T-cell imbalance is a root cause of inflammation. The initial antibody was discovered in collaboration between Kyowa Kirin and La Jolla Institute for Immunology.

In June 2021, Kyowa Kirin and Amgen entered into an agreement to jointly develop and commercialize rocatinlimab. Under the terms of the agreement, Amgen will lead the development, manufacturing, and commercialization for KHK4083/AMG 451 for all markets globally, except Japan, where Kyowa Kirin will retain all rights. If approved, the companies will co-promote the asset in the United States and Kyowa Kirin has opt-in rights to co-promote in certain other markets including Europe and Asia.

Amlitelimab: Sanofi

Amlitelimab is a fully human non-T cell depleting monoclonal antibody that blocks OX40-Ligand, a key immune regulator, and has the potential to be a first- or best-in-class treatment for a range of immune-mediated diseases and inflammatory disorders, including moderate-to-severe atopic dermatitis (phase III), asthma (phase II), hidradenitis suppurativa (phase II), systemic sclerosis (phase II), celiac disease (phase II), and alopecia (phase II). By targeting OX40-Ligand, amlitelimab aims to preserve the balance between pro-inflammatory and regulatory T cells. Amlitelimab is currently under clinical investigation, and its safety and efficacy have not been evaluated by any regulatory authority.

In 2021, Sanofi acquired Kymab, a clinical-stage biotech focused on immune-mediated diseases and immuno-oncology, for approximately USD 1.1 billion upfront and up to USD 350 million in milestone payments. The transaction resulted in Sanofi having full global rights to KY1005 (Amlitelimab).

|

Table 2: Comparison of Key Emerging Drugs | |||||

|

Product |

Company |

RoA |

Phase |

Designation |

Indication |

|

Rocatinlimab |

Amgen |

SC |

III |

N/A |

|

|

Amlitelimab |

Sanofi |

SC |

III |

N/A |

|

Note: Detailed emerging therapies assessment will be provided in the full report of OX40 ligand inhibitors

OX40 Ligand Inhibitor Market Outlook

The OX40 ligand inhibitor market is gaining serious momentum, propelled by a rising tide of immune-related diseases like atopic dermatitis, asthma, alopecia areata, celiac disease and others. As chronic, T-cell-driven inflammation takes center stage in drug development, OX40 inhibitors are emerging as one of the most promising new classes in immunology.

Industry heavyweights like Sanofi, Amgen, and Astria Therapeutics are doubling down, advancing candidates across a spectrum of indications. With a growing pipeline and heightened clinical interest, these targeted therapies could redefine standards of care—if they can overcome key hurdles such as long-term safety validation, precision patient selection, and market access challenges. The next few years will be pivotal in shaping the future of OX40 innovation.

OX40 Ligand inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging OX40 Ligand inhibitors expected to be launched in the market during 2020–2034.

OX40 Ligand Inhibitor Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for OX40 ligand inhibitors market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for OX40 ligand inhibitor therapies.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on OX40 ligand inhibitors' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers. Their opinion helps understand and validate current and emerging therapy treatment patterns or OX40 ligand inhibitor market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“Blocking the OX40/OX40L pathway is a promising strategy in atopic dermatitis (AD), with agents like amlitelimab and rocatinlimab under investigation. These therapies aim to reduce acute flares by limiting T cell expansion and prevent recurrence by targeting memory T cells, offering potential for both immediate relief and long-term disease modification—marking a shift from symptom control to durable management.” |

|

“The evidence thus far points to OX40-OX40L inhibitors as a future efficient and safe option for the treatment of atopic dermatitis. Their potential disease-modifying effect could be ground-breaking and life-changing for our patients. Peer-reviewed information and further investigation with large phase 3 trials will be fundamental to understanding this class of drugs’ positioning in the atopic dermatitis therapeutic armamentarium.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Key Updates on OX40 Ligand Inhibitor

- In April 2025, Sanofi announced preliminary Phase II results for amlitelimab in moderate-to-severe asthma. While the primary endpoint was not met at the highest dose, the medium dose showed nominally significant and clinically meaningful reductions in exacerbations. Notably, a biomarker-defined subgroup saw over 70% reduction in exacerbations and improvements in lung function and asthma control. These findings support amlitelimab’s potential in treating heterogeneous inflammatory asthma, with a Phase III program in planning.

- In March 2025, Amgen announced that the top-line results from the HORIZON study—previously disclosed—will be presented as a late-breaking abstract at the 2025 American Academy of Dermatology Annual Meeting. Additionally, results from the IGNITE, SHUTTLE, and VOYAGER trials, all part of the ongoing Phase III ROCKET program evaluating rocatinlimab, are expected to be shared at upcoming scientific congresses or published in peer-reviewed journals.

The abstract list is not exhaustive, will be provided in the final report

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of the OX40 ligand inhibitors, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the OX40 ligand inhibitor market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM OX40 ligand inhibitor market.

OX40 ligand inhibitor Report Insights

- OX40 ligand inhibitors Targeted Patient Pool

- Therapeutic Approaches

- OX40 ligand inhibitor Pipeline Analysis

- OX40 ligand inhibitor Market Size and Trends

- Existing and future Market Opportunity

OX40 ligand inhibitor Report Key Strengths

- Ten-Year Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

OX40 ligand inhibitor Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the OX40 ligand inhibitor total market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for OX40 ligand inhibitors?

- What are the pricing variations among different geographies for approved therapies?

- What are the risks, burdens, and unmet needs of treatment with OX40 ligand inhibitors? What will be the growth opportunities across the 7MM for the patient population of OX40 ligand inhibitors?

- What are the key factors hampering the growth of the OX40 ligand inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for OX40 ligand inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the OX40 ligand inhibitor market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.