PEComa Market

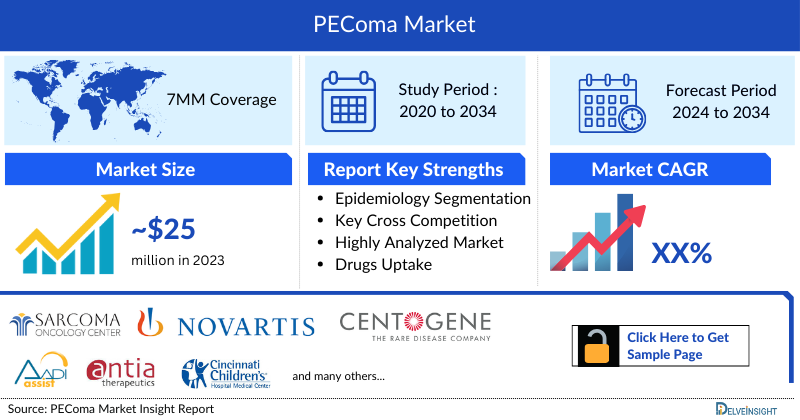

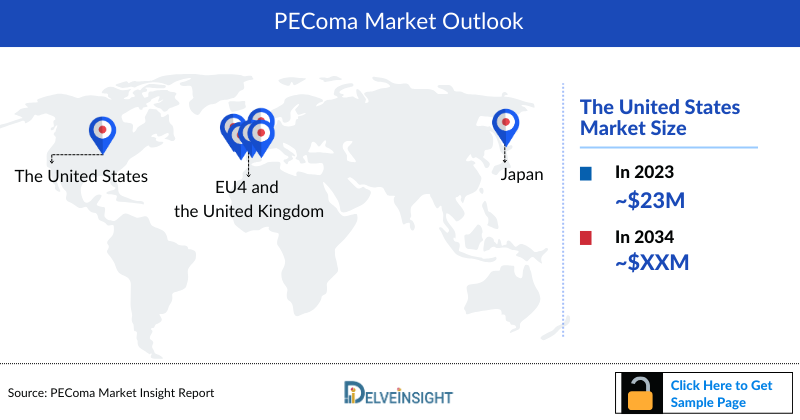

- In 2023, the PEComa Market Size was highest in the US among the 7MM, accounting for approximately USD 23 million, which is further expected to increase by 2034.

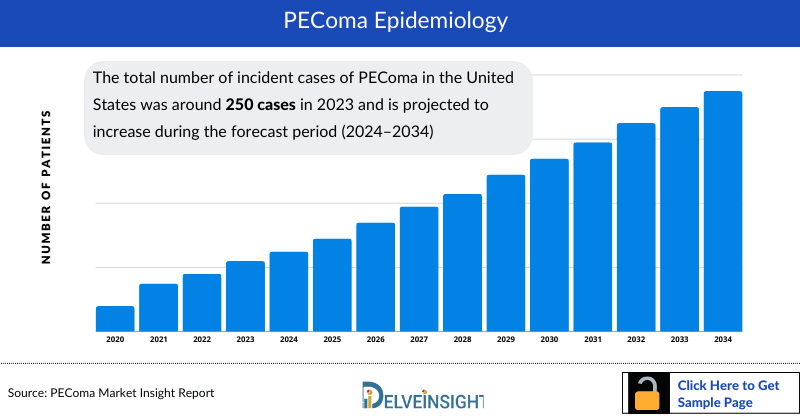

- The total number of PEComa Incident cases in the United States was around 250 cases in 2023 and is projected to increase during the forecast period (2024–2034).

- Aadi Bioscience’s FYARRO is the only approved therapy for PEComa.

- In May 2022, Aadi Bioscience received notification of a product-specific, permanent J-code for FYARRO (sirolimus protein-bound particles for injectable suspension) (albumin-bound) for intravenous use for the treatment of adult patients with locally advanced unresectable or metastatic malignant PEComa. Under the Healthcare Common Procedure Coding System (HCPCS), the J-code (J9331) became effective on July 1, 2022.

- The misdiagnosis and low awareness of PEComa might not have swift changes for several years and would certainly hinder the market growth for FYARRO. High-cost pricing could also be a setback for the drug, but apart from that, FYARRO aims to address a broad range of solid tumors with TSC1 or TSC2 mutations in the Phase II PRECISION 1 study. The company expects the full enrollment by first half of 2024.

- Findings from the first 40 patients, where 26% achieved a partial response with TSC1 alterations and 11% with TSC2 alterations, have been received with substantial disappointment by the market, although there is a sign of efficacy here. Aadi Bioscience’s guided in this update that they anticipate a full analysis of the PRECISION1 study in early 2025.

- Currently, there is no emerging drug in the pipeline targeting PEComa. However, the PEComa Market Dynamics might change in the coming years owing to quicker diagnosis and improved awareness of the disease. Pricing policies must also be considered to achieve great success in PEComa; this will further help launch an attractive product appropriate to the market.

Request for Unlocking the Sample Page of the "PEComa Treatment Market"

DelveInsight’s “Perivascular epithelioid cell neoplasm (PEComa) – Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the PEComa, historical and forecasted epidemiology as well as the PEComa market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The PEComa Treatment Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM PEComa market size from 2020 to 2034. The report also covers current PEComa Treatment Market practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024 to 2034 |

|

Geographies Covered |

|

|

PEComa Market |

|

|

PEComa Market Size | |

|

PEComa Companies |

|

PEComa Treatment Market: Understanding and Algorithm

Perivascular epithelioid cell neoplasms (PEComas) are rare soft tissue tumors. They often form around small blood vessels (perivascular spaces) in various body parts such as the lungs, GI tract, kidneys, liver, and uterus. PEComas comprise cells with an epithelioid (cuboidal) shape and share some features with melanocytes and smooth muscle cells. Melanocytes are cells normally found in the skin and produce melanin to give skin its color.

According to the WHO classification, in the PEComa NOS, both benign PEComa NOS and clinically challenging tumors with a higher degree of malignancy are included (malignant PEComa NOS). A malignant PEComa encountered by clinical oncologists in their practice is abdominopelvic perivascular epithelioid cell sarcoma — the so-called malignant PEComa.

PEComas are considered a group of tumors; however, within this group are specific tumors with unique features and more likely to form in certain body parts. These specific tumors include:

- Angiomyolipomas (AMLs)

- Clear cell sugar tumors (CCT)

- Primary extrapulmonary sugar tumor (PEST)

- Lymphangioleiomyomatosis (LAM)

- Clear-cell myomelanocytic tumor (CCMT) of the falciform ligament/ligamentum teres

- Primary cutaneous PEComa (CCCMT-cutaneous clear cell myomelanocytic tumor)

- PEComas not otherwise specified (NOS)

PEComa Diagnosis

PEComas may be detected by imaging with X-ray, CT scan, or MRI. Once a tumor is detected, a biopsy is needed to examine the cellular makeup and distinguish it from other tumors. Tissue samples from biopsies will have a characteristic appearance under the microscope to identify tumors as PEComas and differentiate them from other potential tumors. PEComas typically have mostly epithelioid cells around blood vessels. They also contain protein markers similar to melanocytes (melanin-producing cells) and smooth muscle cells. Malignant PEComas can be detected from biopsy as well. Malignancy is more likely in larger PEComas, to begin to grow into surrounding tissues, and have a higher percentage of actively growing cells. Genetic testing is available to identify patients with TSC at an increased risk of developing PEComas. For patients with LAM, a blood test for detecting increased levels of vascular endothelial growth factor D (VEGF-D) may aid in diagnosing this PEComa subtype. VEGF-D stimulates the growth of new blood vessels, and high levels may be involved in tumor spread.

PEComa Treatment

The treatment for localized PEComa is wide surgical resection, and no consensus guidelines exist for systemic therapy in localized disease. Apart from a single robust response to cytotoxic chemotherapy (doxorubicin and ifosfamide), reporting an 80% reduction in tumor size in a patient with extremity soft-tissue PEComa, other cases utilizing cytotoxic chemotherapy regimens for localized PEComa have reported either tumor progression while on therapy or the presence of viable residual tumor following resection. There is little clinical or pathologic information for neoadjuvant radiation alone in PEComas, but it can be managed like other localized high-grade sarcomas. As in most STS subtypes, the role of adjuvant chemotherapy treatment for PEComa is unclear. Reports on anthracycline-based regimens given adjuvantly in patients with resected PEComa describe disease recurrence in most cases, with a median follow-up of fewer than 2 years.

Nearly 20% of newly diagnosed patients present with metastatic disease, and approximately 70% of patients with localized malignant PEComa will develop metastases. However, given the unpredictable natural history of PEComa, certain patients, especially in cases with isolated/oligometastatic disease or a long recurrence-free period, may benefit from surgical resections of metastatic disease, which could offer long-term disease-free periods and effective disease control. Traditional cytotoxic chemotherapy regimens in STS have consistently shown little efficacy in advanced PEComa. No objective responses were reported with anthracycline-based regimens, ifosfamide, paclitaxel, gemcitabine, or dacarbazine.

PEComa Epidemiology

As the market is derived using a patient-based model, the PEComa epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total incident cases of PEComa, PEComa cases by Gender, PEComa cases by Stage, PEComa cases by Clinical Presentation, and PEComa cases by Age in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

- The United States contributed to the largest incident population of PEComa, acquiring ~64% of the 7MM in 2023. Whereas EU4 and the UK, and Japan accounted for around 28% and 8% of the total population share, respectively, in 2023.

- Among the EU4 countries, Germany accounted for the largest number of PEComa cases, i.e.~30 in 2023, whereas Spain accounted for the lowest number of cases in 2023, accunting for approximately 15 cases.

- According to DelveInsight estimates, in the US, benign stage PEComa was observed to be more prevalent than malignant PEComa, comprising of nearly 150 cases in 2023.

- In 7MM, approximately 70% of the patient share is attributed to females, whereas only 30% of males suffer from PEComa.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ PEComa Prevalence

PEComa Drug Chapters

The drug chapter segment of the PEComa therapeutics market report encloses a detailed analysis of PEComa-marketed drugs and late-stage (Phase III and Phase II) PEComa pipeline drugs analysis. Only one drug has been approved by the FDA for treating PEComa i.e. FYARRO and currently, there is no emerging drug in the pipeline targeting PEComa. It also helps understand the PEComa clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest PEComa news and press releases.

PEComa Marketed Drugs

- FYARRO (sirolimus protein-bound): Aadi Bioscience

FYARRO (sirolimus protein-bound particles for injectable suspension) (albumin-bound) is a prescription medicine for treating locally advanced unresectable or metastatic malignant PEComa in adult patients. FYARRO had been designed to fight cancer cells. In advanced malignant PEComa, perivascular epithelioid cells grow out of control. FYARRO blocks one of the signals in the cancer cells causing it to grow out of control, helping stop cancer from growing or spreading. It is a targeted cancer treatment and not a chemotherapy treatment. FYARRO (sirolimus protein-bound) differs from other mTOR inhibitors because it uses nanoparticle technology to help FYARRO get more of the drug inside tumors to help turn more mTOR switches off.

The drug is bound to be welcomed by doctors as the only approved therapy for patients with advanced malignant PEComa. FYARRO aims to address a broad range of solid tumors with TSC1 or TSC2 mutations, leading to a significant value for the FYARRO franchise since the initial estimates are that approximately 12,000 patients in the United States carry these gene alterations.

PEComa Drugs Market Insights

The existing PEComa treatment is mainly dominated by classes such as Anthracycline-based regimens, Gemcitabine-based chemotherapy, VEGFR inhibitors, mTOR inhibitors, and systemic therapies and radiotherapy. mTOR has long been known as an important target in cancer, and drugs approved from this class include sirolimus, everolimus, etc. However, these drugs did not become as widely accepted as initially hoped. Limitations were driven primarily by poor PK (how the drug acts in the body), inadequate absorption (highly variable), narrow therapeutic index (cannot up the dose to get an optimal amount of drug into the tumor), and poor target suppression.

Thus, with FYARRO (nab-sirolimus), management hopes to finally deliver on the broad potential of mTOR inhibition by overcoming all of these limitations (can get very high drug levels into the tumor and have a very wide therapeutic index and therefore greater target suppression and ultimately better efficacy). Compared to other mTOR inhibitors, nab-sirolimus has a very long half-life and higher tumor penetration in order of magnitude. They have almost complete suppression at the target level, which is impossible to achieve with other mTOR inhibitors.

The drug (FYARRO) is on the market as of February 2022, and the launch is off to a strong start, with more penetration expected in the first line of the setting. Acceptance of clinical profile has been strong across the oncology community in the US (the most differentiating feature is the durability of responses, which is not seen with first-generation mTOR inhibitors). The safety profile is predictable and manageable.

PEComa Market Outlook

PEComas are rare soft tissue tumors. They often form around small blood vessels (perivascular spaces) in various body parts such as the lungs, GI tract, kidneys, liver, and uterus. Unfortunately, there are no specific guidelines on the use of surgery and radiation therapy in treating PEComas. There is no consensus regarding the possible role of neo-adjuvant/adjuvant therapy in patients with malignant PEComa an ultimate diagnosis is not possible until after surgical resection in most. Patients treated by neoadjuvant therapy are limited, and chemotherapy appears more useful in the treatment of local recurrences and distant metastases.

Among systemic therapies, mTOR inhibitors are the most frequently used across different lines, either as a curative intent treatment combined with a radical treatment (surgery or radiotherapy) or in the palliative setting. The NCCN guidelines list sirolimus, temsirolimus, and everolimus as agents with activity in advanced PEComa, although given the absence of prospective data on the efficacy of mTOR inhibitors in PEComa, this recommendation is based upon lower-level evidence.

However, these drugs did not become as widely accepted as initially hoped. Limitations were driven primarily by poor PK (how the drug acts in the body), inadequate absorption (highly variable), narrow therapeutic index (cannot up the dose to get an optimal amount of drug into the tumor), and poor target suppression. FYARRO (nab-sirolimus), approved in November 2021, has a very long half-life and, in order of magnitude, higher tumor penetration. They have almost complete suppression at the target level, which is impossible to achieve with other mTOR inhibitors.

Since PEComas are ultrarare, it is usually challenging to get any commercial pharma interest to pursue them. We have not given the market of surgery. Currently, there is no emerging drug in the pipeline targeting PEComa. The landscape of the PEComa market is poised to shift in the upcoming years due to advancements in diagnosis speed and increased awareness of the condition. Additionally, careful consideration of pricing strategies is essential for achieving significant success in the PEComa space, facilitating the introduction of an appealing product tailored to market demands. All these factors will help build a strong market-fit product.

- The total PEComa Treatment Market Size in the 7MM is approximately USD 25 million in 2023 and is projected to increase during the forecast period (2024–2034).

- Among EU4 countries, Germany accounted for the maximum PEComa Treatment Market Size in 2023, while Spain occupied the bottom of the ladder in 2023.

- In 2023, the US accounted for the maximum share of the total market in the 7MM, i.e., approximately 90%.

- In the US, in 2023, among all the therapies for PEComa, the highest revenue was generated by FYARRO (sirolimus protein bound), i.e nearly USD 18 million.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ PEComa Treatment Drugs

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on PEComa evolving PEComa treatment market landscape, patient reliance on conventional therapies, patient’s therapy switching acceptability, and drug uptake along with challenges related to accessibility, include Medical/scientific writers, Medical Oncologists, and Professors, Department of Medical Oncology, Strasbourg-Europe Cancer Institute, Dana-Farber Cancer Institute, and others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers such as MD Anderson Cancer Center, Texas from UT Southwestern Medical Center in Dallas, Cancer Research UK Barts Centre in London, MD Anderson Cancer Center, etc., were contacted. Their opinion helps understand and validate current therapy treatment patterns or PEComa market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

PEComa Therapeutics Market: Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving PEComa Treatment Market Landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in PEComa trials, one of the most important primary outcome measures is the overall survival (OS), progression-free survival (PFS), duration of response (DoR), and overall response rate (ORR).

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

PEComa Therapeutics Market Access and Reimbursement

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

FYARRO (sirolimus protein-bound particles for injectable suspension) received notification of a product-specific, permanent J-code (albumin-bound) for IV use to treat adult patients with locally advanced unresectable or unresectable or metastatic malignant PEComa. Under the Healthcare Common Procedure Coding System (HCPCS), the J-code (J9331) came into effect on July 1, 2022. J-codes are permanent, product-specific reimbursement codes assigned to outpatient and physician-administered “buy and bill” products under Medicare Part B and are used by commercial insurers and government payers to facilitate and standardize claims submissions and reimbursements for medications like FYARRO (also known as nab-sirolimus).

When the permanent J-code goes into effect, all hospital outpatient departments, ambulatory surgery centers, and physician offices in the United States will have one consistent Healthcare Common Procedure Coding System (HCPCS) code to standardize the submission and payment of FYARRO insurance claims across Medicare, Medicare Advantage, Medicaid and commercial plans.

PEComa Therapeutics Market Report Scope

- The PEComa therapeutics market report covers a segment of key events, an executive summary, descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current therapies will impact the PEComa Treatment Market Landscape and upcoming market.

- A detailed review of the PEComa Therapeutics Market, historical and forecasted PEComa Treatment Market Size, PEComa Drugs Market Share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The PEComa Therapeutics Market Report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM PEComa Drugs Market.

PEComa Therapeutics Market Report Insights

- Patient-based PEComa Market Forecasting

- Therapeutic Approaches

- PEComa Market Size and Trends

- Existing and Future PEComa Drugs Market Opportunity

PEComa Therapeutics Market Report Key Strengths

- 11 Years PEComa Market Forecast

- The 7MM Coverage

- PEComa Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- Drugs Uptake and Key PEComa Market Forecast Assumptions

PEComa Therapeutics Market Report Assessment

- Current PEComa Treatment Market Practices

- PEComa Unmet Needs

- PEComa Drugs Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

PEComa Treatment Market Insights:

- What was the PEComa market size, the PEComa Treatment Market Size by therapies, PEComa drugs market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors for this growth?

- How will mTOR inhibitors as a class affect the treatment paradigm in PEComa?

- What kind of uptake mTOR inhibitor will FYARRO witness PEComa patients in the coming 10 years?

- Which class is going to be the largest contributor in 2034?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

PEComa Epidemiology Insights:

- What are the disease risk, burdens, and PEComa Unmet Needs? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to PEComa?

- What is the historical and forecasted PEComa patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Why do only limited patients appear with symptoms? Why is the current year diagnosis rate not high?

- Which type of molecular alterations associated with PEComas contributes the most in patients affected with PEComa?

- What is the contribution of benign and malignant cases in total incident cases of PEComa?

Current PEComa Treatment Market Scenario, Marketed Drugs, and Emerging Therapies:

- What are the current options for the PEComa Treatment? What are the current treatment guidelines for treating PEComa in the US and Europe?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitation of existing therapies?

- What is the reimbursement scenario of the approved therapies for PEComa?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

- What are the 7MM historical and forecasted market of PEComa?

Reasons to Buy

- The PEComa therapeutics market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the PEComa Drugs Market.

- Insights on patient burden/disease PEComa Incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet need of the existing market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles