Pelvic Floor Stimulation Devices

Pelvic Floor Stimulation Devices Market By Product Type (Fixed And Mobile), By Application (Urinary Incontinence, Neurodegenerative Diseases, Sexual Dysfunction, And Others), By End-User (Hospitals & Clinics, Homecare Setting, And Others), and by geography expected to grow at a steady CAGR forecast till 2030 owing to the increasing prevalence of neurodegenerative disorders and rising demand for non-invasive treatments

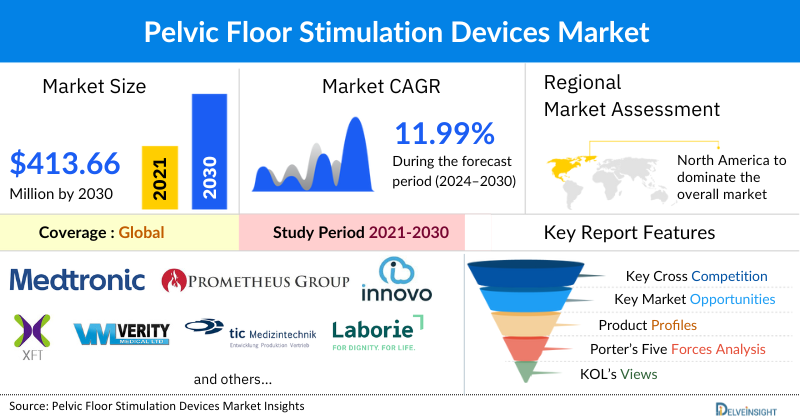

The global pelvic floor stimulation devices is estimated to grow at a CAGR of 11.99% during the forecast period from 2024 to 2030 to reach USD 413.66 million by 2030. The demand for pelvic floor stimulation devices is being boosted by the increasing prevalence of urinary incontinence, neurodegenerative diseases, and others. Further, the increasing prevalence of risk factors such as diabetes, hypertension, obesity, and others which is the root cause of urinary incontinence can propel the demand for pelvic floor stimulation devices. Further, the rising geriatric population, rising product launches, and approvals, surging demand for home healthcare, and innovation in product development, among others are thereby contributing to the overall growth of the pelvic floor stimulation devices market during the forecast period from 2024-2030.

Pelvic Floor Stimulation Devices Market Dynamics:

The pelvic floor stimulation devices market is witnessing a growth in product demand owing to various factors, one of the key factors being the increase in the prevalence of urinary incontinence. For instance, according to the National Association for Continence 2019, up to 40 million women in America have experienced bladder leakage issues at some point in their lives. As per the same study in 2019, almost half of new mothers experience incontinence following a normal delivery and about one in six following a cesarean section.

Additionally, as per the study mentioned by the American Academy of Family Physicians in 2019, urinary incontinence (UI) is a common issue, with a prevalence of 51% among adult women in the United States.

Further, as per the data provided by the Continence Foundation of Australia in 2023, over 5 million Australians – 1 in 4 people aged 15 years or over – experienced bladder or bowel control problems in the same year, and 80% of people with urinary incontinence are women. Similar trends in likely to be observed in other regions of the world.

Thus, the increasing cases of urinary incontinence, bowel control problems, and overactive bladder, among others will propel the demand for pelvic floor stimulation devices.

Also, due to the rise in the geriatric population across the globe, the market is expected to grow during the forecast period. According to the UN Report, World Population Ageing 2020 Highlights, globally, there were about 727 million people aged 65 years and above in 2020. Also, as per the same source, over the next three decades, the number of older people worldwide is projected to more than double, reaching approximately 1.5 billion by 2050. Thus, the increase in the aging population will lead to the development of urinary incontinence, mainly stress urinary incontinence, thereby leading to the weakening of the pelvic floor requiring treatment using pelvic floor stimulation devices. Thus, the increasing number of cases of urinary incontinence will increase the demand for pelvic floor stimulation devices.

Moreover, another key factor aiding the growth of pelvic floor stimulation devices is the growing demand for non-invasive treatments. This can be attributed to the realization of advantages associated with minimally invasive approaches such as faster healing time and significantly fewer complications compared to conventional techniques. Non-invasive devices are now designed to stimulate muscle pathways and nerves. For instance, in 2020, Innovo, a non-invasive wearable device by Atlantic Therapeutics received the US Food and Drug Administration (FDA) approval for its over-the-counter (OTC) distribution. It is a muscle electrical stimulator that targets weakened pelvic floor muscles to treat stress urinary incontinence.

Therefore, the above-mentioned factors are expected to further drive the growth of pelvic floor stimulation devices during the forecast period (2024-2030).

However, the availability of alternative treatment methods and others may prove to be challenging factors for the pelvic floor stimulation devices market growth.

The pelvic floor stimulation devices market experienced a period of a temporary setback as lockdown restrictions were enforced as a necessary step to curb the spread of COVID-19. One of the major steps during the COVID surge was the suspension of elective healthcare procedures and outpatient visits which reduced the demand for these devices in the market as the healthcare system guidelines across the globe temporarily focused all their efforts on the management of COVID-19 infection patient load during the initial lockdown period. Nevertheless, the ease of lockdown restrictions, resumption of manufacturing activities across the healthcare sector, and with the upturn of patients in hospitals and clinics for treatment and diagnosis of various chronic diseases lead to an increased demand for pelvic floor simulation devices and is anticipated to do the same during the forecast period from 2023 – 2030.

Pelvic Floor Stimulation Devices Market Segment Analysis:

Pelvic Floor Stimulation Devices Market by Product Type (Fixed and Mobile), Application (Urinary Incontinence, Neurodegenerative Diseases, Sexual Dysfunction, and Others), End-User (Hospitals & Clinics, Homecare Setting, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product type segment of the pelvic floor stimulation devices market, the mobile pelvic floor stimulation device category is expected to amass significant revenue share in the year 2023. This can be ascribed to the advantages offered by the category.

Mobile pelvic floor stimulator devices offer quick and non-invasive treatments being small, portable, and easy to use aiming at the comfort of the patients.

Further, the increasing product launches and approvals will in turn propel the demand for mobile pelvic floor stimulators. For instance, in 2023?TENA launched a non-invasive smart Kegel trainer, known as Emy, which provides a discrete at-home solution to combat bladder issues. The smart device was designed to be paired with an app that can be downloaded on smartphones.

Also, Pelvic Muscle Trainer XFT-0010 plus, developed by Shenzhen XFT Medical Limited helps with urinary incontinence and sexual dysfunction in women and helps them regain stronger pelvic floor muscles.

Therefore, the advantages offered by mobile pelvic floor stimulation devices are predicted to contribute to the increasing demand for this product type thereby driving the growth of the overall pelvic floor stimulation devices market during the forecast period.

North America is expected to dominate the overall Pelvic Floor Stimulation Devices Market:

Among all the regions, North America is estimated to account for the largest share of the global pelvic floor stimulation devices market in the year 2023. Owing to key growth factors such as the rising prevalence of urinary incontinence, especially among the elderly population, neurodegenerative diseases, and increasing various government and nonprofit organization initiatives driving the North American pelvic floor stimulation devices market are expected to witness positive growth. Furthermore, increasing demand for technologically advanced devices and growing regulatory approvals, are helping the market to grow in this region.

As per the Centers for Disease Control and Prevention (CDC) (2022), it was reported in 2019 that approximately 28.7 million people, almost 8.7% of the US population had been diagnosed with diabetes. People with diabetes, who regularly have high blood glucose levels suffer from urinary incontinence as high blood sugar can cause nerve damage (neuropathy) if not bought under control. Thus, the increasing prevalence of diabetes will increase the prevalence of urinary incontinence, thereby increasing the demand for pelvic floor stimulation devices.

Moreover, the rising prevalence of neurodegenerative diseases like Alzheimer’s is also considered a key factor in the growing demand for pelvic floor stimulation devices. As per the data provided by the Alzheimer’s Association (2022), in 2023? more than 6 million Americans of all ages had Alzheimer’s, among which 73% of the patient population were aged 75 or older. Non-surgical treatments, such as pelvic floor stimulation exercises as well as electrical stimulation devices are being used to treat patients suffering from Alzheimer’s for overactive bladder treatment. Thus, the rising prevalence of neurodegenerative diseases will increase the demand for pelvic floor stimulation devices.

The increasing number of product development activities in the region is going to positively impact the growth of the pelvic floor stimulation devices market. For example, Axonics, in 2019 announced FDA approval for its Sacral Neuromodulation System for the treatment of overactive bladder in women and the elderly.

Thus, the increasing prevalence of urinary incontinence and rising product developmental activities help to increase the demand for pelvic floor stimulation devices, thereby driving the North America pelvic floor stimulation devices market forward during the forecast period.

Pelvic Floor Stimulation Devices Market Key Players:

Some of the key market players operating in the pelvic floor stimulation devices market include Medtronic, The Prometheus Group, INNOVO, Shenzhen XFT Medical Limited, Verity Medical Ltd., Tic Medizintechnik GmbH & Co. KG, Laborie, PZmed, TensCare Ltd., Renovia Inc., Novuqare, GymnaUniphy, InControl Medical, Athena Feminine Technologies, Inc., Creo Medical, and others.

Recent Developmental Activities in the Pelvic Floor Stimulation Devices Market:

- In February 2022, Medtronic announced FDA approval for the InterStim X™ system, which delivers sacral neuromodulation (SNM) therapy. These devices are used to treat overactive bladder (OAB), chronic fecal incontinence (FI), and non-obstructive urinary retention.

- In August 2020, Pelvital announced FDA clearance for its Flyte device, a first-of-its-kind, non-invasive, intravaginal home-use device designed to strengthen pelvic floor muscles, to help women with stress urinary incontinence.

- In March 2019, InControl Medical got FDA approval for Attain, the first over-the-counter (OTC) non-implantable muscle stimulator, which was designed for at-home use to treat approximately 60 million women in the US, suffering from stress, urge, mixed urinary incontinence, and/or bowel incontinence.

Key Takeaways from the Pelvic Floor Stimulation Devices Market Report Study

- Market size analysis for current pelvic floor stimulation devices market size (2023), and market forecast for 5 years (2024-2030)

- Top key product/services/technology developments, mergers, acquisitions, partnerships, and joint ventures happened for the last 3 years

- Key companies dominating the global pelvic floor stimulation devices market.

- Various opportunities are available for the other competitor in the pelvic floor stimulation devices market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current pelvic floor stimulation devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for pelvic floor stimulation devices market growth in the coming future?

Target Audience who can be benefited from this Pelvic Floor Stimulation Devices Market Report Study

- Pelvic floor stimulation devices products providers

- Research organizations and consulting companies

- Pelvic floor stimulation devices-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders dealing in pelvic floor stimulation devices

- Various End-users who want to know more about the pelvic floor stimulation devices market and the latest technological developments in the pelvic floor stimulation devices market.

.