Peripherally Inserted Central Catheter Devices Market

Peripherally Inserted Central Catheter (PICC) Devices by Product Type (Power Injected Peripherally Inserted Catheters and Non-Power Injected/ Conventional Peripherally Inserted Central Catheters), Design (Single Lumen, Double Lumen, and Triple Lumen), End-User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2030 owing to the rising burden of chronic diseases such as cancer, renal failure, diabetes, infection and others and increase in product developmental activities by the key market players across the globe.

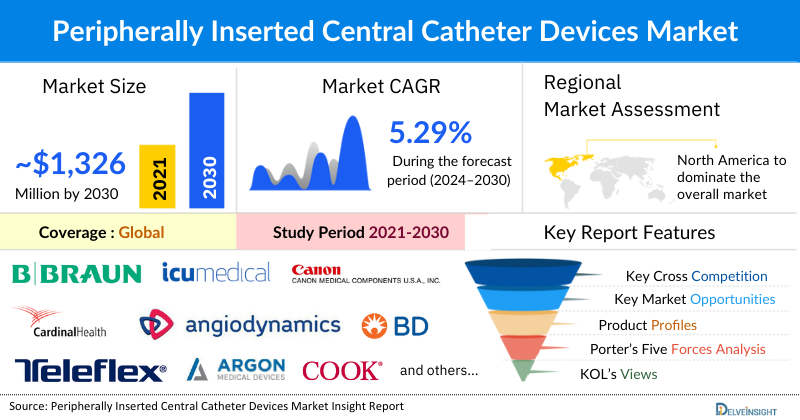

The Peripherally Inserted Central Catheter (PICC) Devices market was valued at USD 976.13 million in 2023, growing at a CAGR of 5.29% during the forecast period from 2024 to 2030 to reach USD 1,326.59 million by 2030. The rising burden of chronic diseases such as cancer, renal failure, diabetes, and infections is driving the market for PICC devices, as these conditions often require long-term intravenous access to treatments like chemotherapy and nutrient infusions. The demand is further fueled by ongoing product innovations in catheter design and insertion techniques, which enhance patient safety and comfort. As healthcare providers increasingly recognize the benefits of PICCs in managing chronic diseases, coupled with technological advancements, the adoption of PICC devices is expected to grow significantly from 2024 to 2030.

Peripherally Inserted Central Catheter (PICC) Devices Market Dynamics:

According to the latest data from the Global Cancer Observatory, in 2022, the estimated number of new leukemia cases worldwide was 487,000, with projections indicating an increase to 746,000 by 2045. Additionally, there were approximately 83,000 new cases of Hodgkin lymphoma in 2022, expected to rise to 109,000 by 2045. For Non-Hodgkin lymphoma, the estimated number of new cases in 2022 was 553,000, with forecasts predicting an increase to 890,000 by 2045.

The rise in cases of leukemia, Hodgkin lymphoma, and Non-Hodgkin lymphoma is expected to significantly drive the demand for PICC devices. These types of cancers often require prolonged and frequent administration of chemotherapy, intravenous antibiotics, and other treatments, which makes the need for reliable and efficient venous access critical. PICC devices offer a less invasive alternative to traditional central venous catheters, reducing the risk of infection and providing easier access to long-term therapy. As the incidence of these cancers increases, healthcare providers are likely to turn to PICC devices to improve patient comfort and treatment efficiency, thereby boosting the overall market for these devices.

Additionally, as per the recent data and stats provided by the World Health Organization (2023), in 2022, approximately 10.6 million individuals were diagnosed with tuberculosis (TB) globally, comprising 5.8 million men, 3.5 million women, and 1.3 million children. TB ranks as the second most lethal infectious disease following COVID-19.

Tuberculosis, particularly multidrug-resistant (MDR) and extensively drug-resistant (XDR) forms, often require prolonged treatment regimens that can last several months or even years. PICCs provide a reliable and stable venous access point for administering the extended courses of antibiotics required for these advanced forms of TB. This consistent access helps in managing the long-term therapy effectively thereby boosting the overall market of PICC devices globally.

Additionally, companies are amplifying their production of PICC devices thereby strategically expanding their market presence and driving further growth. For instance, in February 2022, Zeus launched PTFE Sub-Lite-Wall™ multi-lumen tubing for steerable catheters, featuring average max wall thicknesses from 0.002” to 0.005” (0.051 mm to 0.127 mm). The product offered ultra-thin walls, high structural integrity, improved planarity, high lubricity, and excellent dielectric strength. It was biocompatible (certified USP Class VI) and withstood working temperatures up to 260 °C (500 °F).

Thus, the factors mentioned above are likely to boost the market of PICC devices during the forecasted period.

However, the risks associated with PICC devices such as thrombosis, catheter occlusion, infection, and other discomforts related to devices, and the stringent regulatory approval may hinder the future market of PICC Devices.

Peripherally Inserted Central Catheter (PICC) Devices Market Segment Analysis:

Peripherally Inserted Central Catheter (PICC) Devices by Product Type (Power Injected Peripherally Inserted Catheters and Non-Power Injected/ Conventional Peripherally Inserted Central Catheters), Design (Single Lumen, Double Lumen, and Triple Lumen), End-User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the design segment of the peripherally inserted central catheter devices market, the triple lumen category held a revenue share of 52.26% in the year 2023. This can be ascribed to the various advantages associated with triple-lumen peripherally inserted central catheter (PICC) devices.

Triple lumen PICC are suitable for use when multiple infusions are required to be performed. It allows running several different infusions with only one access site. It offers separate infusions for each channel. It has three channels and lumens present at different positions on the distal cannula which provide ports for simultaneous drug infusion, blood drawing, and central venous pressure (CVP) monitoring.

Moreover, triple-lumen catheters are the most preferred ICU settings for their three infusion channels that allow for simultaneous administration of multiple therapies. Triple-lumen catheters are routinely employed for the delivery of medications and other necessary fluids to patients with esophageal cancer.

In patients under intensive care and patients undergoing bone marrow transplants (BMT), triple-lumen catheters are mostly preferred over other types. For example, Poly Per-Q-Cath3 by BD is an example of a triple-lumen catheter indicated for short or long term peripheral access to the central venous system for intravenous therapy and blood sampling.

In addition, new product approvals and launches are also likely to upsurge the triple-lumen PICC devices market during the forecasted period. For instance, in May 2022, Access Vascular, Inc. (AVI) announced that it received FDA 510(k) clearance for its HydroPICC® TRIPLE-Lumen catheter. Utilizing the same proprietary hydrophilic biomaterial as its single-lumen HydroPICC® and HydroMID® catheters, the dual-lumen device demonstrated a significant reduction in complications such as occlusions, replacements, Deep Vein Thrombosis, and phlebitis in recent studies.

Hence, all the above-mentioned factors are expected to generate considerable revenue for the segment pushing the overall growth of the global PICC devices market during the forecast period.

North America is expected to dominate the overall Peripherally Inserted Central Catheter (PICC) Devices Market:

In the PICC devices market, North America is expected to hold the largest share of 46.65% in the year 2023. This can be ascribed to the increasing prevalence of cancer and infection across the region, the increase in technological advancement, and the presence of key market players engaged in mergers, acquisitions, product launches, and other market activities across the region are expected to escalate the market of PICC devices during the forecast period.

According to recent data from the Global Cancer Observatory, in 2022, there were an estimated 184,000 new cases of colorectal cancer and 53,300 new cases of rectal cancer. These numbers are projected to increase to 250,000 and 68,100, respectively, by 2045. Colorectal and rectal cancers often require prolonged and frequent chemotherapy sessions. PICCs are commonly used to facilitate the administration of chemotherapy drugs, as they provide a reliable and less invasive means of long-term venous access compared to other central venous catheters thereby boosting the overall market of PICC devices across the region.

Additionally, according to the recent reports and data provided by the American Association of Medical Colleges (2023), each year, 1.7 million people in the United States develop sepsis which is a potentially deadly immune response to infection. Patients with sepsis often require rapid and frequent administration of antibiotics, fluids, and other critical medications. PICCs provide a reliable and stable access point for these treatments, especially when prolonged or continuous administration is necessary thereby boosting the overall market of PICC devices across the region.

Furthermore, as per the data provided by the Centre for Disease Control and Prevention (2024), in 2022, the United States reported 8,331 cases of tuberculosis, representing a rate of 2.5 cases per 100,000 persons. The rising incidence of tuberculosis (TB) can significantly boost the market for Peripherally Inserted Central Catheter (PICC) devices due to the extended treatment regimens required for managing both drug-sensitive and multidrug-resistant forms of the disease. TB treatments, especially for severe or resistant strains, often involve prolonged courses of intravenous antibiotics, necessitating reliable and stable venous access. PICC devices offer an ideal solution for this need, providing consistent access for the administration of long-term therapies while reducing the discomfort and complications associated with repeated needle sticks thereby escalating the overall market of PICC devices across the region.

The increasing number of product development activities in the region is further going to accelerate the growth of the PICC devices market. In November 2023, BD introduced a new needle-free blood draw technology called the PIVO™ Pro, which received FDA 510(k) clearance. This device, designed to work with integrated and long peripheral IV catheters like the Nexiva™ Closed IV Catheter System with NearPort™ IV Access, aims to support the company’s goal of a ""One-Stick Hospital Stay.""

Therefore, the above-mentioned factors are expected to bolster the growth of the PICC devices market in North America during the forecast period.

Key Peripherally Inserted Central Catheter Devices Companies In The Market:

Some of the key market players operating in the peripherally inserted central catheter devices market include B. Braun Melsungen AG, AngioDynamics, Cardinal Health, BD, Teleflex Incorporated, Argon Medical, Cook Group, ICU Medical Inc., Medical Components Inc., Access Vascular, Vygon, Meditech Devices, Biowy Corporation, Polymedicure, Footprint Medical Inc., SILMAG GROUP, pfm medical gmbh, Healthline Medical Products, INSUNG MEDICAL Co., Ltd., Equipos de Biomedicina de Mexico, S.A. de C.V, and others.

Recent Developmental Activities in the Peripherally Inserted Central Catheter (PICC) Devices Market:

- In July 2023, Access Vascular, Inc. (AVI) announced the publication of a peer-reviewed study on its HydroPICC® in the Journal of Materials Science: Materials in Medicine. The study showed that HydroPICC significantly reduced clot formation and failures compared to traditional polyurethane PICCs.

- In July 2022, B. Braun Medical Inc. launched the Introcan Safety 2 IV Catheter, designed to enhance safety for clinicians by reducing the risk of needlestick injuries and exposure to blood. This new catheter features one-time blood control and is fully automatic, offering better protection than semi-automatic and manual safety devices.

| Report Metrics | Details |

| Study Period | 2020 to 2030 |

| Forecast Period | 2024 to 2030 |

|

CAGR | 5.29% |

| Peripherally Inserted Central Catheter Market Size | USD 1,326.59 million by 2030 |

| Key PICC Companies | AngioDynamics, B. Braun Melsungen AG, Becton, Dickinson and Company, Teleflex Incorporated., Argon Medical Devices, Inc., Cook, Theragenics Corporation, ICU Medical, Inc., Medical Components, Inc., Access Vascular, Vygon, Biowy Corporation, Polymedicure, Footprint Medical Inc., Novamed Medical Systems, INSUNG MEDICAL Co., Ltd., SILMAG, pfm medical ag, Equipos de Biomedicina de México, S.A. de C.V, Healthline Medical Products, and others. |

Key Takeaways from the Peripherally Inserted Central Catheters (PICC) Market Report Study

- Market size analysis for current peripherally inserted central catheter devices size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the peripherally inserted central catheter devices market.

- Various opportunities available for the other competitors in the peripherally inserted central catheter devices market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current peripherally inserted central catheter devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for peripherally inserted central catheter devices market growth in the coming future?

Target Audience who can be benefited from the Peripherally Inserted Central Catheters (PICC) Market Report Study

- Peripherally inserted central catheter devices product providers

- Research organizations and consulting companies

- Peripherally inserted central catheter devices -related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in peripherally inserted central catheter devices

- Various end-users who want to know more about the peripherally inserted central catheter devices market and the latest technological developments in the peripherally inserted central catheter devices market.