persistent corneal edema market

Key Highlights

- Persistent corneal edema is a chronic corneal condition caused by sustained endothelial cell loss or dysfunction, leading to fluid buildup, corneal thickening, and progressive visual impairment. It is clinically distinct from other corneal disorders, and diagnosis relies on tools such as specular microscopy, pachymetry, and anterior-segment imaging to confirm endothelial damage and assess disease severity.

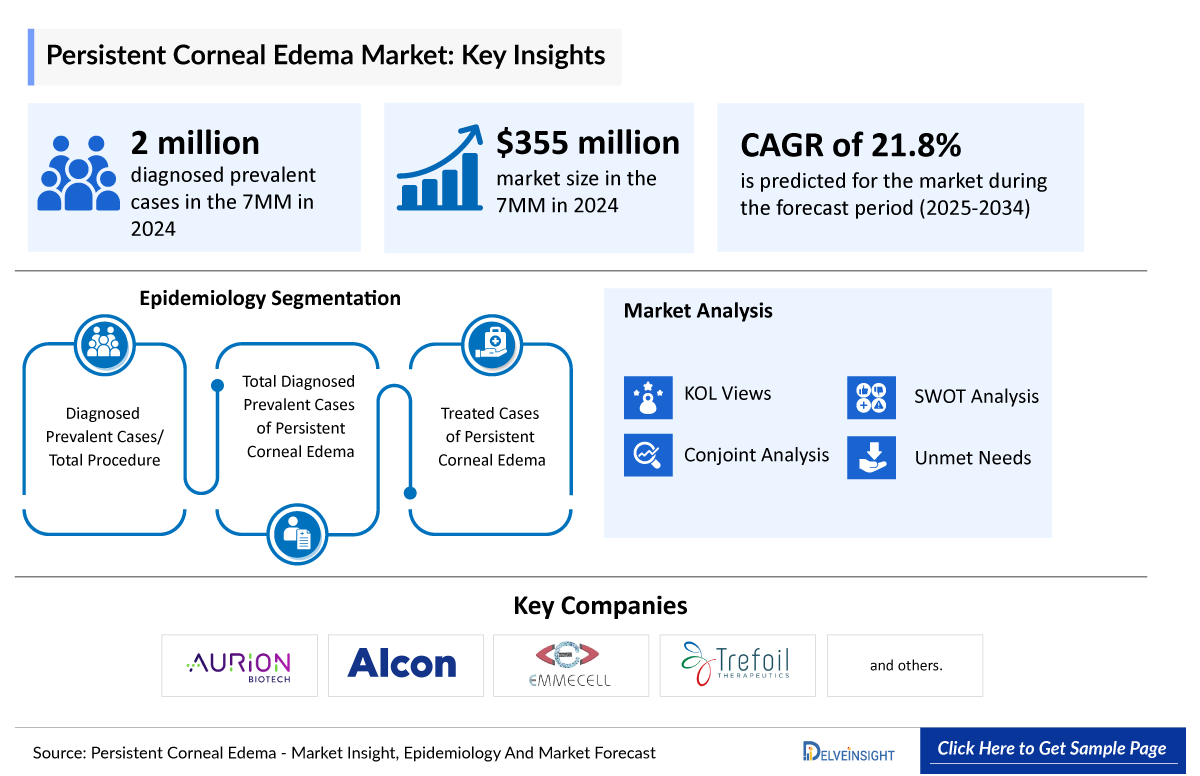

- In 2024, DelveInsight estimated more than 2 million diagnosed prevalent cases of persistent corneal edema across the 7MM, underscoring its rising clinical significance and the growing recognition of surgery-related and endothelial-driven corneal complications.

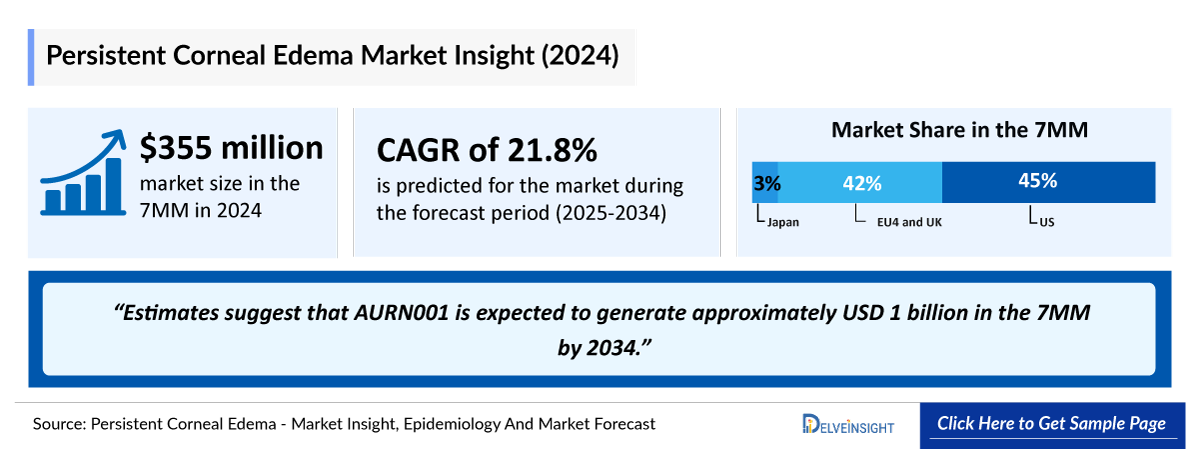

- According to DelveInsight’s 2024 analysis, the persistent corneal edema market across the 7MM was valued at approximately USD 355 million, reflecting rising clinical awareness, improved postoperative monitoring, and growing focus on endothelial dysfunction related complications.

- Persistent corneal edema lacks any approved, targeted drug therapy, leaving patient care dependent on supportive options rather than true disease modification. Standard treatments topical corticosteroids, hypertonic saline, ROCK inhibitors, and other symptomatic agents provide only short-lived relief and fail to correct the underlying endothelial dysfunction, underscoring a significant unmet need for effective restorative therapies.

- The persistent corneal edema pipeline is advancing with three notable emerging therapies: AURN001, EO2002, and TTHX1114. These candidates reflect a focused and growing effort to restore corneal clarity by directly targeting the underlying endothelial dysfunction that defines the condition.

DelveInsight’s “Persistent Corneal Edema – Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the persistent corneal edema, historical and projected epidemiological data, competitive landscape as well as persistent corneal edema market tends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The persistent corneal edema market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM persistent corneal edema market size from 2020 to 2034. The report also covers emerging persistent corneal edema treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

Persistent Corneal Edema Epidemiology |

|

|

Persistent Corneal Edema Key Companies |

|

|

Market Analysis |

|

|

Persistent Corneal Edema Key Companies |

|

|

Future Opportunity |

The future of persistent corneal edema therapy is shifting toward targeted, regenerative, and mechanism-driven innovations as insights into corneal endothelial biology advance. Rather than relying primarily on surgical procedures, next-generation strategies focus on directly restoring or replacing dysfunctional endothelial cells through allogeneic cell therapies, bioengineered factors, and agents designed to strengthen endothelial resilience and repair. Emerging therapeutics such as AURN001, EO2002, and TTHX1114 reflect this evolution, aiming to reverse the fundamental causes of corneal decompensation instead of simply managing downstream effects. Simultaneously, improvements in imaging technologies, endothelial assessment tools, and early diagnostic capabilities are enhancing precision in patient detection and disease staging. Collectively, these scientific and technological advancements underscore a strong future opportunity for durable, targeted, and individualized treatment pathways for persistent corneal edema. |

Persistent Corneal Edema Understanding and Treatment Algorithm

Persistent Corneal Edema Overview

Persistent corneal edema is a chronic ophthalmic condition marked by sustained corneal endothelial dysfunction, which impairs the eye’s ability to regulate fluid balance and maintain corneal clarity. When endothelial cells are damaged or depleted, fluid accumulates within the corneal stroma, resulting in persistent swelling, visual distortion, and, in more advanced cases, significant vision loss. Although often secondary to surgery, endothelial disease, or trauma, persistent corneal edema remains clinically significant due to its substantial impact on visual functioning, daily activities, and overall quality of life. Growing advances in corneal endothelial biology and regenerative science have deepened understanding of the cellular and molecular mechanisms underlying this condition, supporting diagnosis that is more accurate and the development of targeted, cell-based therapeutic approaches. While gaps remain in early recognition, consistent diagnosis, and access to specialized care, persistent corneal edema continues to be an area of active innovation, reshaping the future of corneal medicine and precision ocular therapies.

Persistent Corneal Edema Diagnosis

Diagnosis of persistent corneal edema relies on a detailed clinical evaluation combining slit-lamp examination, Intraocular Pressure (IOP) measurement, and assessment of edema patterns to identify the underlying cause. Specialized imaging including pachymetry, anterior segment Optical Coherence Tomography (OCT), and specular microscopy helps quantify corneal thickness and evaluate endothelial integrity. Careful review of surgical history, inflammation, or structural abnormalities is essential to differentiate persistent edema from transient postoperative changes or mimicking conditions such as Toxic Anterior Segment Syndrome (TASS), herpetic endotheliitis, or endophthalmitis.

Persistent Corneal Edema Treatment

Persistent corneal edema treatment focuses on restoring corneal clarity and improving visual function by addressing the underlying loss or dysfunction of corneal endothelial cells. Current approaches primarily aim to reduce corneal swelling and improve vision by stabilizing the corneal environment, although these measures do not correct the root cellular deficit. Emerging therapies, particularly regenerative and cell-based interventions, are increasingly targeting the endothelial layer directly, with the goal of replacing or rejuvenating damaged cells rather than offering temporary symptomatic relief. This mechanism-driven shift marks a significant advancement in how the condition is understood and managed, offering the potential for more durable improvements in corneal transparency, visual performance, and overall quality of life for individuals living with persistent corneal edema.

Further details related to disease overview are provided in the report…

Persistent Corneal Edema Epidemiology

The persistent corneal edema epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented diagnosed prevalent cases/total procedure, total diagnosed prevalent cases of persistent corneal edema and treated cases of persistent corneal edema in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

- In 2024, DelveInsight estimated that approximately 4.1 million cataract surgeries were performed in the US, with around 45,000 diagnosed prevalent cases of persistent corneal edema. While cataract surgery is not the primary driver of the condition, these figures illustrate how the large procedural volume still contributes meaningfully to the overall burden of persistent corneal edema linked to postoperative endothelial injury.

- In 2024, DelveInsight estimated approximately 940,000 total diagnosed prevalent cases of persistent corneal edema across the EU4 and the UK, highlighting its meaningful clinical burden in these regions and their continued influence in shaping the evolving therapeutic landscape for persistent corneal edema.

- In 2024, DelveInsight estimated that among the EU4 and the UK, Germany recorded the highest number of Fuchs Endothelial Corneal Dystrophy (FECD) cases, with approximately 2.5 million individuals affected, followed by Italy with around 1.9 million cases. Based on these estimates, around 10% of FECD cases progress to persistent corneal edema, highlighting the substantial clinical impact of disease progression across major European markets.

- In Japan, DelveInsight’s 2024 assessment indicated that persistent corneal edema linked to glaucoma drainage implants (GDI) represents the smallest burden among major etiologies, with a little over 1,000 cases. This low volume reflects Japan’s comparatively limited treated GDI population and the modest overall contribution of device-related endothelial failure to the national persistent corneal edema landscape.

Persistent Corneal Edema Drug Chapters

The drug chapter segment of the persistent corneal edema reports encloses a detailed analysis of persistent corneal edema late-stage (Phase III and Phase I) and early stage pipeline drugs. It also helps understand the persistent corneal edema clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest news and press releases.

Emerging Drugs

AURN001: Aurion Biotech/Alcon

AURN001, developed by Aurion Biotech, is an intracameral, cell-based regenerative therapy designed to restore endothelial function in patients with corneal edema caused by endothelial cell loss. By delivering cultured human corneal endothelial cells directly into the anterior chamber, it enables endothelial repopulation, reestablishes pump activity, and reduces stromal swelling to improve visual clarity, offering a novel disease-modifying alternative to corneal transplantation.

- In October 2025, Aurion Biotech reported that AURN001 met all primary, secondary, and exploratory endpoints at 12 months in the Phase I/II CLARA trial, supporting advancement of the high-dose regimen into a Phase III trial planned for early 2026, along with parallel clinical development planning in the EU.

- In March 2025, Alcon acquired a majority interest in Aurion Biotech to advance AURN001, its innovative allogeneic cell therapy for corneal endothelial disease, strengthening Alcon’s position in regenerative ophthalmology and accelerating the global development and commercialization of next-generation cell-based treatments for corneal disorders.

- In December 2024, Aurion Biotech reported positive topline data from its Phase I/II clinical trial of AURN001, an allogeneic cell therapy product candidate for the treatment of corneal edema secondary to corneal endothelial dysfunction.

- In September 2024, Aurion Biotech reported its participation at the 42nd European Society of Cataract and Refractive Surgeons (ESCRS) Congress and the Ophthalmology European Futures Forum, presenting clinical data and business updates on AURN001, its allogeneic cell therapy for corneal endothelial diseases.

- In June 2024, Aurion Biotech reported that it received both Breakthrough Therapy Designation (BTD) and Regenerative Medicine Advanced Therapy (RMAT) Designation from the US FDA for its drug candidate AURN001.

EO2002: Emmecell

EO2002 is an investigational cell therapy designed to promote corneal endothelial regeneration in patients with endothelial dysfunction, a major cause of corneal edema and vision loss. By stimulating the proliferation and functional recovery of remaining endothelial cells, it aims to restore clarity and improve vision without invasive transplantation. Through targeted cellular repair, EO2002 offers a promising, nonsurgical approach that addresses the underlying endothelial loss and has the potential to reshape the treatment landscape.

- In November 2024, it reported positive topline results from its randomized, double-masked clinical trial evaluating EO2002, a groundbreaking nonsurgical cell therapy for corneal edema.

TTHX1114: Trefoil Therapeutics

TTHX1114, developed by Trefoil Therapeutics, is a recombinant engineered FGF-1 analog designed to stimulate corneal endothelial cell proliferation, migration, and survival. Delivered via intracameral injection, it supports endothelial regeneration and accelerates corneal deturgescence in conditions such as Fuchs’ endothelial corneal dystrophy, with the goal of restoring clarity, improving vision, and reducing the need for corneal transplantation. A topical formulation is also in development to address epithelial disorders involving ocular surface damage, broadening its therapeutic potential across corneal diseases.

- In May 2023, Trefoil Therapeutics reported Phase II STORM trial data showing that TTHX1114 improved visual recovery following Descemet Stripping Only, with results presented at the 2023 ASCRS Annual Meeting.

- In April 2023, Trefoil Therapeutics reported TTHX1114 Data Presentations at the Annual Association for Research in Vision and Ophthalmology (ARVO) Meeting.

|

Drug |

MoA |

RoA |

Company |

Phase |

|

TTHX1114 |

FGF-1 analog |

Intracameral |

Trefoil Therapeutics |

II |

|

AURN001 |

Promotes corneal endothelial regeneration |

Intracameral as a one-time procedure |

Aurion Biotech/Alcon |

I/II |

|

EO2002 |

Promote corneal endothelial regeneration |

Magnetic cell delivery to the posterior cornea |

Emmecell |

I |

|

XXX |

XXX |

X |

XXX |

X |

Drug Class Insights

The persistent corneal edema treatment landscape is shifting from symptomatic relief toward targeted, mechanism-driven interventions that address the root cause of endothelial dysfunction. Traditional approaches including hypertonic saline, corticosteroids, and bandage contact lenses offer only temporary or partial reduction in corneal swelling and do not restore endothelial cell function, highlighting the need for therapies with true regenerative potential.

Emerging modalities focused on endothelial repair and regeneration are redefining the future of persistent corneal edema care. Regenerative cell therapies such as AURN001, alongside next-generation candidates like EO2002 and TTHX1114, aim to restore endothelial integrity by repopulating or stimulating surviving endothelial cells. These therapies move beyond short-term symptomatic control by targeting the biological basis of corneal edema, offering the possibility of durable corneal clarity and reducing the need for invasive corneal transplantation.

Persistent Corneal Edema Market Outlook

The market for persistent corneal edema is entering a period of rapid expansion as clinical understanding, diagnostic capabilities, and therapeutic innovation continue to advance. Growing awareness of endothelial dysfunction as the central driver of corneal edema, along with the rising burden of age-related diseases such as FECD and the increasing volume of cataract and glaucoma surgeries, is steadily enlarging the treatable patient population. With current approaches such as hypertonic saline, corticosteroids, and supportive care offering only temporary relief, the unmet need for targeted, disease-modifying therapies remains substantial.

A new generation of mechanism-based and regenerative therapies is poised to redefine the treatment landscape. Investigational candidates such as AURN001, EO2002, and TTHX1114 introduce differentiated strategies focused on restoring endothelial integrity, promoting cellular repair, and accelerating corneal deturgescence. By targeting the underlying biology rather than providing symptomatic relief, these therapies have the potential to deliver long-lasting corneal clarity, improved visual outcomes, and reduced dependence on invasive transplantation.

This shift is reinforced by strong R&D momentum, increasing investment from biotechnology companies, and a growing emphasis on cell-based regeneration and growth factor–mediated repair. As clinical evidence matures and regulatory expectations become more clearly structured, the persistent corneal edema market is positioned for meaningful transformation. Supported by high unmet clinical need and rapid innovation in regenerative ophthalmology, persistent endothelial dysfunction is increasingly viewed as a modifiable condition, setting the stage for a new era of restorative, non-surgical treatment options.

- The total market size of persistent corneal edema in the 7MM was approximately USD 355 million in 2024 and is projected to grow steadily throughout the forecast period (2025–2034).

- The market size for persistent corneal edema in the US exceeded USD 160 million in 2024 and is projected to expand further with the introduction of novel, mechanism-based therapies targeting the underlying neurobiology of the disorder.

- The total market size of persistent corneal edema in the EU4 and the UK was nearly USD 148 million in 2024, accounting for around 42% of the total 7MM market revenue, and is expected to grow steadily by 2034.

- In 2024, the total market size of persistent corneal edema in Japan was approximately USD 47 million, which is anticipated to increase during the forecast period.

- Estimates suggest that AURN001 is expected to generate approximately nearly USD 1 billion in the 7MM by 2034.

Persistent Corneal Edema Uptake

This section focuses on the uptake rate of potential emerging persistent corneal edema expected to be launched in the market during 2020–2034.

Persistent Corneal Edema Pipeline Development Activities

The report provides insights into different therapeutic candidates in preregistration, Phase III, and early stage molecule. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for persistent corneal edema market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for persistent corneal edema emerging therapies.

KOL Views

To keep up with current and future market trends, we take industry experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on persistent corneal edema evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers like the University of Maryland School of Medicine, US; University of Heidelberg, Germany; Lille University Hospital, France; University of Pisa, Italy; University of Valencia, Spain; Cardiff University, UK; University of Toyama, Japan; among others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or persistent corneal edema market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

As per KOL from the US, “The most common risk factor for postoperative persistent corneal edema is FECD, with iatrogenic endothelial cell loss further increasing susceptibility after cataract surgery. Preoperative counseling is essential to set realistic expectations, inform patients about the potential for endothelial decompensation, and prepare them for the management steps needed to support optimal recovery.”

As per KOL from the UK, “Contact lens induced corneal edema can significantly impact the accuracy of intraocular pressure assessment, leading to underestimation with Pascal DCT and overestimation with Goldmann applanation tonometry. These findings underscore the importance of considering corneal biomechanical alterations when interpreting IOP readings in patients with corneal edema. Notably, the ocular pulse amplitude provided by the Pascal DCT remains stable despite edema, highlighting its potential reliability in such clinical contexts.”

As per KOL from Japan, “Persistent corneal edema, caused by endothelial dysfunction or injury, leads to chronic corneal swelling and vision loss due to impaired fluid regulation. Increasing evidence suggests a functional interplay between corneal epithelial and endothelial cells in maintaining corneal clarity. ROCK inhibitors such as Y-27632 enhance endothelial regeneration and epithelial healing, highlighting their potential to restore corneal transparency and offering a promising therapeutic direction for persistent corneal edema beyond transplantation.”

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

The report further details country-wise reimbursement and accessibility status, cost-effectiveness assessments, patient assistance initiatives that improve affordability, and insights into coverage under government prescription drug programs.

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of persistent corneal edema, explaining their mechanism and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will affect the current landscape.

- A detailed review of the persistent corneal edema market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM persistent corneal edema market.

Persistent Corneal Edema Report Insights

- Persistent Corneal Edema Targeted Patient Pool

- Persistent Corneal Edema Therapeutic Approaches

- Persistent Corneal Edema Pipeline Analysis

- Persistent Corneal Edema Market Size and Trends

- Existing and Future Market Opportunity

Persistent Corneal Edema Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Key Cross Competition

- Attribute Analysis

- Drugs Uptake and Key Market Forecast Assumptions

Persistent Corneal Edema Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the persistent corneal edema total market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for persistent corneal edema?

- Which drug accounts for maximum persistent corneal edema sales?

- What are the risks, burdens, and unmet needs of treatment with persistent corneal edema? What will be the growth opportunities across the 7MM for the patient population persistent corneal edema?

- What are the key factors hampering the growth of the persistent corneal edema market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for persistent corneal edema?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the persistent corneal edema Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis, ranking of indication-wise current, and emerging therapies under the attribute analysis section to provide visibility around leading indications.

- To understand key opinion leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

.png)