Pertussis Market

- The Pertussis Market is expected to strengthen as awareness of the disease increases and more effective interventions are being developed.

- The leading Pertussis Companies include Serum Institute of India, LG Chem, ILiAD Biotechnologies, Dynavax Technologies, Tianjin CanSino Biotechnology, Faron Pharmaceuticals, Kymab, BioNet, and others

Request for unlocking the CAGR of the Pertussis Treatment Market

DelveInsight’s “Pertussis Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the Pertussis, historical and forecasted epidemiology as well as the Pertussis market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Pertussis Treatment Market report provides current treatment practices, emerging drugs, Pertussis market share of the individual vaccines, and current and forecasted Pertussis market size from 2020 to 2034, segmented by seven major markets. The report also covers current Pertussis treatment market practices/algorithms and Pertussis unmet needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Pertussis Drugs Market |

|

|

Pertussis Market Size | |

|

Pertussis Companies |

|

Pertussis Treatment Market

The DelveInsight’s Pertussis treatment market report gives a thorough understanding of Pertussis by including details such as disease definition, symptoms, causes, pathophysiology, diagnosis, prevention, and treatment. Pertussis, meaning “a violent cough,” also known as whooping cough, is an acute respiratory infection caused by Bordetella pertussis (B. pertussis). There are three different stages of pertussis: catarrhal, paroxysmal, and convalescent.

Pertussis Diagnosis

The accurate and timely diagnosis of pertussis is challenging. Different diagnostic tests are performed to diagnose Pertussis, such as culture, Polymerase chain reaction (PCR), paired sera, and single sera. The sensitivity and specificity of every test are different, and paired sera is the most accurate test among them.

Pertussis Prevention and Treatment

The first and most important rule of pertussis prevention is to “vaccinate.” Two vaccines in the United States help prevent whooping cough: DTaP and Tdap. During their lives, all adolescents and adults should have received at least three documented doses of tetanus and diphtheria toxoids-containing vaccine (i.e., DTaP, DTP, DT, or Td). Macrolide antibiotics (e.g., erythromycin, clarithromycin, or azithromycin) have been effective and constitute the mainstay of treatment for patients with pertussis and PEP. Although erythromycin has been recommended to treat pertussis or PEP, undesirable adverse events have led to poor medication adherence and increased prescribing of newer macrolides.

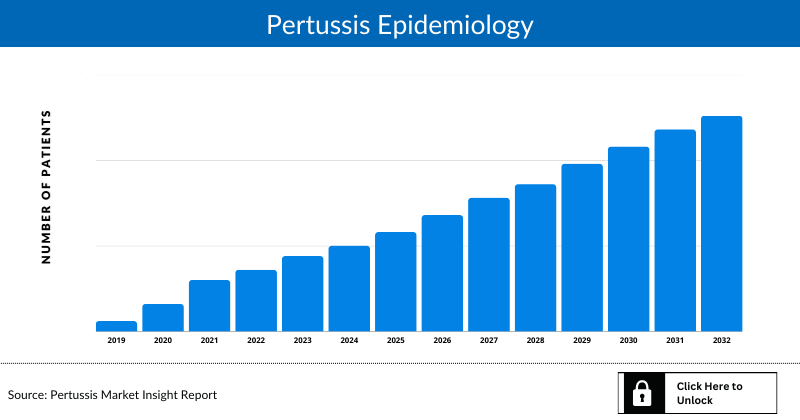

Pertussis Epidemiology

The Pertussis epidemiology section provides insights into the historical and current Pertussis patient pool and forecasted trends for seven individual major countries. It helps recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. This part of the Pertussis report also provides the diagnosed patient pool, its trends, and assumptions undertaken.

Key findings

- For determining the vaccination coverage for each dose of the DTP vaccine, the WHO/UNICEF Joint Reporting Form on Immunization (JRF), along with the country-specific organization, research studies have been considered for the 7MM.

- Pertussis vaccination coverage in the US was approximately 19 million in 2022. In the US, maximum vaccination coverage was in the 18 and older age group in 2022, i.e., approximately 5 million.

- Among the 7MM, vaccination coverage for children is reported to be high; in comparison, booster vaccination compliance among adults is reported to be low owing to the fact. With the increasing awareness, the updation of immunization recommendations and the entry of emerging vaccines are expected to increase the vaccination coverage rate.

- As per DelveInsight’s estimate, the total Pertussis vaccinated population in the 7MM was approximately 34 million in 2022 and is projected to increase during the forecast period (2024–2034).

Country-wise Pertussis Epidemiology

Pertussis epidemiology covered in the report provides historical and forecasted Pertussis epidemiology, segmented as Pertussis Vaccination coverage in the 7MM covering the United States, EU4 (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Pertussis Prevalence

Pertussis Vaccine Chapters

The vaccine chapter segment of the Pertussis Therapeutics Market report encloses a detailed analysis of Pertussis marketed vaccines and late-stage (Phase III and Phase II) Pertussis Pertussis Pipeline Drugs Analysis. It also helps understand the Pertussis Clinical Trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included vaccine, and the latest news and press releases.

Pertussis Marketed Vaccines

- ADACEL: Sanofi Pasteur

ADACEL is a trivalent booster vaccine indicated for active immunization against pertussis, tetanus, and diphtheria. The vaccine is recommended from 4 years of age following primary immunization and is the first and only Tdap vaccine in the US. It is also available in 55 countries, including the US, Europe, Asia, and Latin America. In 2015, the company completed Phase III trials in China and Japan to generate additional safety and immunogenicity data to support the registration of the product in China and Japan.

After getting approval in 2005 in the US, the vaccine got label expansion in 2019 for ADACEL to include repeat vaccination to protect against pertussis, diphtheria, and tetanus. In Europe, it is marketed under the name REPEVAX. It is a combination vaccine that provides the same benefits as ADACEL and protects against polio.

- BOOSTRIX: GlaxosmithKline

BOOSTRIX (Diphtheria and Tetanus Toxoids and Acellular Pertussis) is indicated for active booster immunization against tetanus, diphtheria, and pertussis in individuals aged 10 and older. BOOSTRIX is administered as a 0.5 mL IM injection into the deltoid muscle of the upper arm and is routinely recommended in the US for the immunization of pregnant women. In 2005, US FDA approved BOOSTRIX for active booster immunization against tetanus, diphtheria, and pertussis in individuals 10–18 years of age, thereby adding a pertussis component to routine tetanus/diphtheria booster currently administered to teens. After that, in 2008 and 2011, it got label expansion for 19–64 years and 65 years and older, respectively. Boostrix, for tetanus, diphtheria, and pertussis vaccine, received approval in Europe for an expanded indication to include maternal immunization as per the company’s annual report.

Emerging Pertussis Vaccines

- BPZE1: ILiAD Biotechnologies

BPZE1 is an intranasal vaccine candidate and is an advanced pertussis vaccine that contains genetic modifications to eliminate, attenuate or inactivate three different B. pertussis toxins. Currently, it is being developed as a booster vaccine, with future development investigating its application as a primary vaccination in infants. Preclinical safety data also indicates that BPZE1 does not exacerbate airway pathology associated with allergen sensitization. According to Phase IIb data, BPZE1 met the primary endpoints of overall safety and mucosal immunity induction. BPZE1 prevented colonization from re-vaccination/challenge in 90% of subjects with no vaccine-related serious adverse effects events. In January 2022, US FDA granted Fast Track Designation to BPZE1 for active booster immunization against pertussis.

- BK1310/MT-2355: Mitsubishi Tanabe Pharma Corporation

DPT-IPV-Hib (BK1310/ MT-2355) vaccine is a 5-in-1 combination vaccine that protects against pertussis and other indications, including diphtheria, tetanus, and poliomyelitis, and prophylaxis of Hib infections in infants. The company has completed a Phase III trial in pertussis, and other indications include Diphtheria, Tetanus, Poliomyelitis, and Bacterial meningitis (In infants, in children, prevention) in Japan and plans to launch these five combined vaccines in Japan in FY2023.

Note: Detailed emerging vaccines assessment will be provided in the full report

Pertussis Market Outlook

The most important way to prevent pertussis is through complete immunization. The vaccine for pertussis is usually given with diphtheria and tetanus (often in combination with poliomyelitis, H. influenza, and hepatitis B). Three vaccine formulations are available to protect against these diseases. DTaP vaccine, Tdap vaccine, and Td; before 1980, whole-cell vaccines (wPV) were used. But the wPV caused rare but significant side effects such as triggering prolonged crying and febrile convulsions and, very rarely, hypotonic–hyporesponsive episodes. After that, more defined acellular vaccines (aPVs) were developed; aPVs have improved safety profile; the efficacy of aPV was slightly lower. Nevertheless, wPVs are still the most used vaccine globally, primarily because of the high cost of aPV, making it difficult to afford in resource-poor countries.

Treatment of pertussis is largely supportive, including oxygen, suctioning, hydration, and avoidance of respiratory irritants. Parenteral nutrition may be necessary as the disease tends to have a prolonged course. The treatment for whooping cough is usually antibiotics; the primary goal of antibiotic treatment is to decrease the carriage and spread of the disease. Erythromycin (40–50 mg/kg per day, maximum 2 g per day, in 2–3 divided doses) is the first-line treatment for pertussis. Azithromycin (10 mg/kg per day on Day 1 followed by 5 mg/kg on Days 2–5) and clarithromycin (15 mg/kg per day in two divided doses) are alternative treatments.

The Food and Drug Administration (FDA) licensed 12 combination vaccines for use in the United States to help protect against diphtheria and tetanus. Pentaxim, Infanrix, Pentacel, Vaxelis, and others are approved in the US. Although vaccination programs against pertussis are very effective in Europe, some studies show that the disease is still widespread among middle-aged adults in various European countries.

Key findings

This section includes a glimpse of the Pertussis Therapeutics Market in the 7MM.

- With high DTP vaccination rates in the 7MM among infants and children, and instances of pertussis re-emergence in the post-vaccination period, as well as an increased trend in yearly incidence cases in some countries, demand for DTP vaccinations, particularly new and improved vaccines, is high. Due to high immunization coverage, the market potential for new and improved vaccinations is enormous as older-generation vaccines are expected to be phased out.

- There are a lot of competitive pressures in Europe and the United States since many vaccines are currently being used. PEDIARIX and PENTACEL, two well-known vaccines in the United States, are doing well. However, with the recent availability in the United States of a hexavalent vaccination called Vaxelis, these vaccines are expected to be replaced in the coming years. Regarding Tdap vaccinations or adult booster shots, Adacel/Repevax/Adacel-Polio and Boostrix are the only major alternatives in EU4, the UK, and the US. For GSK and Sanofi, lifetime vaccination is unquestionably a growth sector and development potential.

- According to the DelveInsight assessment, Mitsubishi is leading the Japanese vaccination market with TETRABIK.

- The total Pertussis Treatment Market Size in the 7MM was 3.5 billion in 2022, and the US was the major contributor in the 7MM, followed by Germany.

Pertussis Vaccine Uptake

This section focuses on the rate of uptake of the potential vaccine recently launched in the Pertussis market or expected to be launched during the study period 2020–2034. The analysis covers the Pertussis drugs market uptake by the vaccine, patient uptake by the vaccine, and sales of each vaccine. This will help in understanding the Pertussis vaccines with the most rapid uptake and the reasons behind the maximal use of new Pertussis pipeline drugs and allows the comparison of the drugs based on Pertussis drugs market share and size, which again will be useful in investigating factors important in the Pertussis drugs market uptake and in making financial and regulatory decisions.

Pertussis Pipeline Development Activities

The Pertussis drugs market report provides insights into different vaccines in Phase II and III. It also analyses Pertussis Companies involved in developing vaccines.

Development Activities

The Pertussis therapeutics market report covers detailed information on collaborations, acquisitions, and mergers, licensing patent details, and other information for Pertussis emerging vaccines.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Pertussis Treatment Drugs

Reimbursement Scenario

Approaching reimbursement can positively impact both during the late stages of product development and after product launch. In the report, we consider reimbursement to identify economically attractive indications and market opportunities. When working with finite resources, the ability to select the markets with the fewest reimbursement barriers can be a critical business and price strategy.

KOL Views

To keep up with current epidemiology and market trends, we take KOLs and SMEs’ opinions working in the Pertussis domain through primary research to fill the data gaps and validate our secondary research. Their opinion helps understand and validate current and emerging vaccines and treatment patterns along with Pertussis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the Pertussis unmet needs.

DelveInsight’s analyst connected with 20+ KOLs (pulmonologists, physicians, researchers, principal investigators, etc.) across the 7MM and gathered insights from 10+ KOLs. We contacted experts from the centers such as the Department of Pediatrics, David Geffen School of Medicine at UCLA; Department of Prevention, ASL of Taranto, Italy; Department of Health Sciences, University of Genoa, Italy; and others to understand and validate current and emerging vaccines treatment patterns or Pertussis market trends.

Competitive Intelligence Analysis

We perform competitive and market intelligence analysis of the Pertussis market using various competitive intelligence tools, including SWOT analysis, Market entry strategies, etc. The inclusion of the analysis entirely depends upon the data availability.

Pertussis Therapeutics Market Report Scope

- Descriptive overview of Pertussis, disease overview, patient journeys, treatment algorithms, diagnosis, and currently available vaccines for prevention

- Comprehensive insight into the Pertussis epidemiology and forecasts in the 7MM

- An all-inclusive account of both the current and Pertussis emerging vaccines, along with the assessment of new Pertussis vaccines, expected to have an impact on the current Pertussis treatment market landscape

- Exhaustive analysis of the Pertussis treatment market; historical and forecasted covering vaccine outreach in the 7MM

- Detailed patient-based Pertussis market forecasting determines the trends shaping and driving the global Pertussis drugs market

Pertussis Therapeutics Market Report Highlights

- In the coming years, the Pertussis therapeutics market is set to change due to the rising awareness of the disease and incremental healthcare spending across the world; which would expand the size of the market to enable the vaccine manufacturers to penetrate more into the Pertussis treatment market

- The Pertussis Companies and academics are working to assess challenges and seek opportunities that could influence Pertussis R&D. The vaccines under development are focused on novel approaches to prevent the disease condition

- Pertussis Companies are involved in developing Pertussis vaccines, such as Mitsubishi Tanabe Pharma Corporation, ILiAD Biotechnologies, and others. The launch of emerging vaccines will significantly impact the Pertussis market

- A better understanding of Pertussis pathogenesis will also contribute to the development of effective vaccines for Pertussis

- Our in-depth analysis of the Pertussis pipeline assets across different stages of development (Phase III and Phase II), emerging trends, and comparative analysis of pipeline products with detailed Pertussis clinical trials profiles, key cross-competition, launch date along with product development activities will support the clients in the decision-making process regarding their therapeutic portfolio by identifying the overall scenario of the research and development activities

Pertussis Therapeutics Market Report Insights

- Patient-based Pertussis Market Forecasting

- Therapeutics Approaches

- Pertussis Pipeline Drugs Analysis

- Pertussis Market Size and Trends

- Pertussis Drugs Market opportunities

- Impact of upcoming Pertussis Vaccines

Pertussis Therapeutics Market Report Key Strengths

- 10 years Pertussis Market Forecast

- The 7MM Coverage

- Pertussis epidemiology segmentation

- Key cross competition

- KOL views

- Pertussis Vaccine Uptake

Pertussis Therapeutics Market Report Assessment

- Current Pertussis Treatment Market Practices

- Pertussis Unmet needs

- Pertussis Pipeline Drugs Analysis profiles

- Pertussis Drugs Market Attractiveness

Key Questions

Pertussis Treatment Market Insights:

- What would be the Pertussis Drugs Market Growth till 2034, and what will be the resultant market size in 2034?

- What was the Pertussis Drugs Market Share (in percentage) distribution in 2024, and how would it look in 2034?

- What are the key findings of the Pertussis Drugs Market across the 7MM, and which class will have the largest market share during the forecast period (2024–2034)

- How would the unmet needs affect the Pertussis market dynamics and subsequent analysis of the associated trends?

- Variation in Vaccine uptake in children vs. adults?

Pertussis Epidemiology Insights:

- What are the disease risk, burden, and regional/ethnic differences of Pertussis?

- What is the historical and forecasted Pertussis patient pool in the 7MM, and where can one observe the highest patient population and growth opportunities?

- What are the key factors driving the epidemiology trends for seven major markets covering the United States, EU4 (Germany, Spain, France, Italy) and the UK, and Japan?

Current Pertussis Treatment Market Scenario, Marketed Drugs, and Emerging Vaccines

- What are the current prevention guidelines and treatment options, in addition to approved vaccines for Pertussis in the US, EU4 and the UK, and Japan?

- What are the key collaborations (Industry–Industry, Industry-Academia), mergers and acquisitions, and licensing activities related to Pertussis vaccines?

- What are the recent vaccines, targets, Pertussis Mechanisms of Action, and technologies being developed to overcome the limitation of existing vaccines?

- What are the clinical studies for Pertussis, its status, and the challenges faced?

Reasons to Buy

- The Pertussis Therapeutics Market Report will help in developing business strategies by understanding trends shaping and driving the Pertussis drugs market

- Organize sales and marketing efforts by identifying the best opportunities for Pertussis in the US, EU4 (Germany, Spain, Italy, France) and the UK, and Japan

- Identification of strong upcoming players in the Pertussis Drugs Market that will help devise strategies that will help in getting ahead of competitors

- This Pertussis therapeutics market report provides market insight about the top next-generation pertussis vaccines

Stay Updated with us for Recent Articles

- Merck’s Sotatercept Trial Result; PARP Rivals Closing in on AstraZeneca and Merck’s Lynparza; FDA Clears GSK’s Boostrix for Pertussis

- Pertussis Vaccines: Whole-cell & Acellular Vaccines, Different Types & Manufacturers along with the Regimen in Various Age Groups

- What is Driving the Pertussis Treatment Market Forward?

- Pertussis Market Infographics

- Latest DelveInsight Blogs