Phenylketonuria Market

Key Highlights:

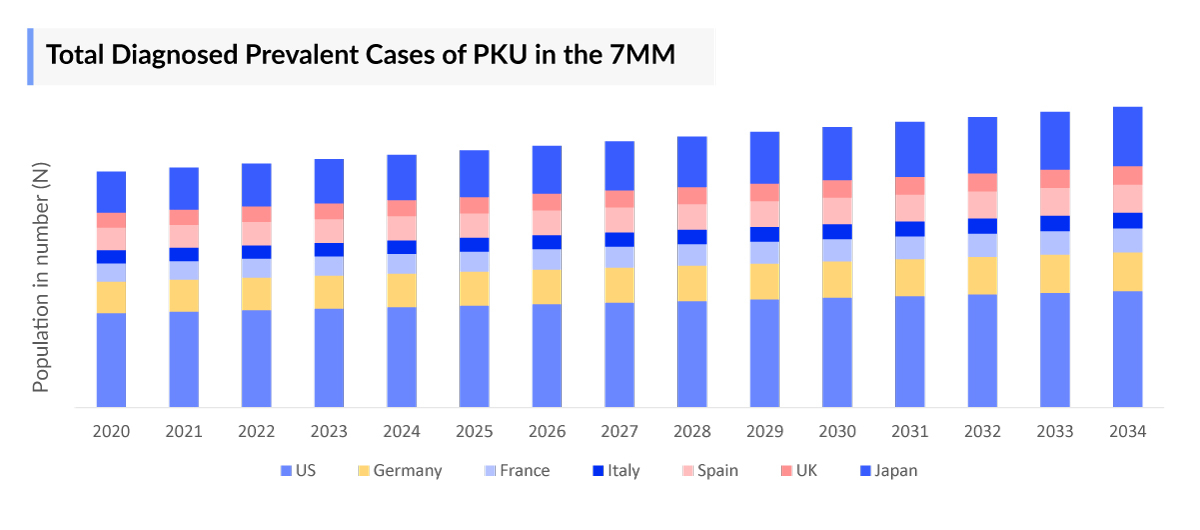

- Among the 7MM, the United States had highest number of diagnosed prevalent cases of phenylketonuria (PKU) with 18,000 cases in 2023.

- The age‐specific data revealed that the highest number of patients affected with PKU was found in the age group of <14 years.

- Newborn blood testing identifies almost all cases of phenylketonuria. PKU is diagnosed by Phe and Tyr’s evaluation in neonatal dried blood spot (DBS) using tandem mass spectrometry. Bacterial inhibition assay (Guthrie test) is another simple, inexpensive, and reliable test used for many decades.

- Currently, the market landscape offers only two approved therapies, both of which are owned by BioMarin. The first is KUVAN (sapropterin), a synthetic form of tetrahydrobiopterin (BH4), which acts by increasing phenylalanine hydroxylase (PAH) activity. The second therapy is PALYNZIQ (pegvaliase), a phenylalanine ammonia-lyase (PAL) enzyme that temporarily restores the levels of PAH and reduces blood phenylalanine concentrations.

- In March 2024, PTC submitted a Marketing Authorization Application (MAA) to the EMA for sepiapterin. Additionally, the company anticipates submitting a NDA to the FDA in the third quarter of 2024 and completing regulatory submissions in Japan within the same year

- The 7MM accounted for a market size of approximately 700 USD million in 2023.

- Another drug, Synlogic’s SYNB1934 (Currently in Phase II), is expected to become a key player during the forecast period (2024–2034), owing to its novel MoA, impressive efficacy data, and a patient compliant RoA.

- The expected launch of potential therapies may increase market size in the coming years, assisted by an increase in the diagnosed prevalent population of PKU.

Phenylketonuria Market Report Summary

- The report offers extensive knowledge regarding the epidemiology segments and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies and the elaborative profiles of late-stage (Phase III, Phase II, and Phase I) and prominent therapies that would impact the current treatment landscape and result in an overall market shift has been provided in the report.

- The report also encompasses a comprehensive analysis of the phenylketonuria market, providing an in-depth examination of its historical and projected market size (2020–2034). It also includes the market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The report also includes drug outreach coverage in the 7MM region.

- The report includes qualitative insights that provide an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM phenylketonuria market.

The table given below further depicts the key segments provided in the report:

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

Epidemiology |

Segmented by: · Region

· Total Diagnosed Prevalent Cases of PKU

· Mutation Type-specific Cases of PKU

· Age-specific Cases of PKU

· Severity-specific Cases of PKU |

|

Market |

Segmented by: · Region

· Therapies |

|

Market Analysis |

· KOL Views

· SWOT Analysis

· Reimbursement

· Conjoint Analysis |

Phenylketonuria Disease Understanding and Treatment

Phenylketonuria Overview

Phenylketonuria (PKU) is a rare genetic condition that causes an amino acid called phenylalanine to build up in the body; amino acids are the building blocks of protein. Phenylalanine is found in all proteins and some artificial sweeteners. PKU symptoms can range from mild to severe. The most severe form of this disorder is known as classic PKU. An infant with classic PKU may appear normal for the first few months. A less severe form of PKU is called variant PKU or non-PKU hyperphenylalaninemia. This occurs when the baby has too much phenylalanine in its body. Infants with this form of the disorder may have only mild symptoms.

Phenylketonuria Diagnosis

Phenylketonuria (PKU) diagnosis is achieved soon after birth by neonatal screening in most developed countries. In the countries where expanded newborn screening has been adopted, PKU is diagnosed by Phe and Tyr’s evaluation in neonatal dried blood spot (DBS) using tandem mass spectrometry. Bacterial inhibition assay (Guthrie test) is another simple, inexpensive, and reliable test used for many decades; however, it is a manual, semi-quantitative test and is being replaced by other methods in all screening laboratories. Some laboratories use a fluorimetric test that is quantitative, automated, and reliable.

Further details related to country-based variations are provided in the report…

Phenylketonuria Treatment

Sapropterin dihydrochloride, a synthetic form of tetrahydrobiopterin (BH4), has been introduced as a supplemental treatment to dietary Phe control for Phenylketonuria (PKU). BH4 is a naturally occurring compound cofactor for PAH and other enzymes. Several subsequent studies have found that BH4 supplementation effectively lowers blood serum Phe levels in some individuals with PKU.

KUVAN (sapropterin) is approved for PKU, which is a synthetic form of BH4, the cofactor for phenylalanine hydroxylase (PAH). PAH hydroxylates Phe through an oxidative reaction to form tyrosine. In patients with PKU, PAH activity is absent or deficient. Treatment with BH4 can activate residual PAH enzyme activity, improve the normal oxidative metabolism of Phe, and decrease Phe levels in some patients

Further details related to treatment and management are provided in the report…

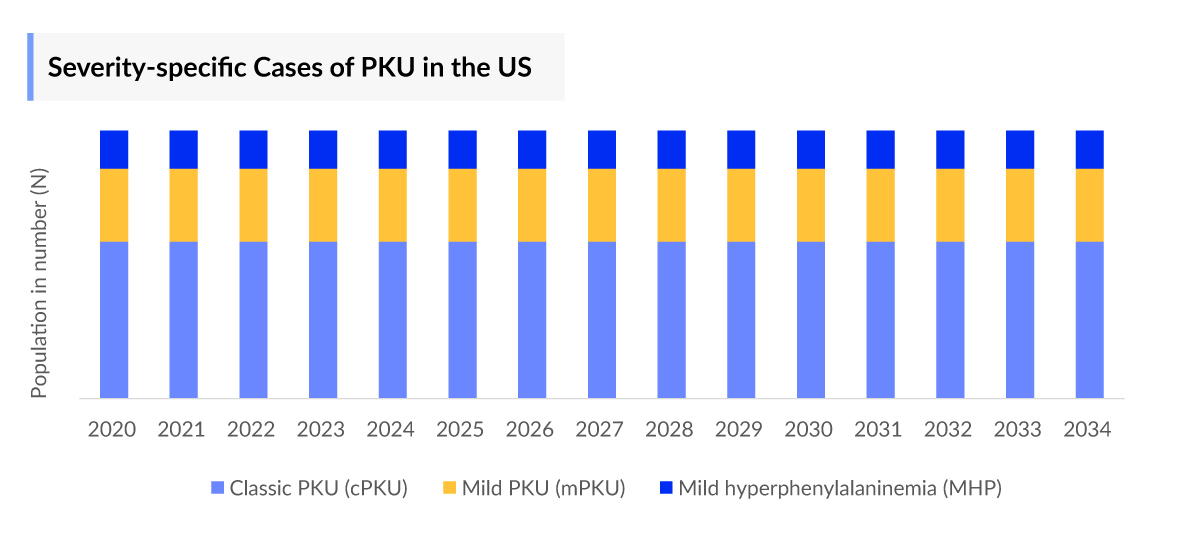

Phenylketonuria Epidemiology

The phenylketonuria (PKU) epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Diagnosed Prevalent Cases of PKU, Mutation Type-specific Cases of PKU, Age-specific Cases of PKU, and Severity-specific Cases of PKU in the United States, EU4 (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

- The majority of PKU cases are diagnosed in infants due to the high rate of newborn screening. The age‐specific data revealed that most patients affected with PKU were ≤14 years, with nearly 60% cases in the 7MM in 2023.

- According to DelveInsight’s estimates, missense mutation cases accounted for 60%, and nonsense mutations for 5% of the total diagnosed prevalent cases of PKU in 2023 in the 7MM.

- In EU4 and the UK, Germany had the highest number of diagnosed prevalent cases of PKU, followed by France. While Spain had the least number of cases in 2023.

- In 2023, classical PKU recorded the highest number of cases with approximately 11,000 cases based on severity-specific cases of PKU in the United States.

Further details related to epidemiology will be provided in the report…

Phenylketonuria Market

- Various key players are leading the treatment landscape of phenylketonuria, such as Asubio-Pharma/BioMarin-Pharmaceutical, PTC Therapeutics, Synlogic, and others. The details of the country-wise and therapy-wise market size have been provided below.

- In 2023, the United States accounted for the largest market size among the 7MM, making ~60% of the total market size of the 7MM.

- Synlogic’s SYNB1934 is expected to become a key player of the PKU market during the forecast period (2024–2034).

- Among the EU4 and the UK, Germany had the largest market size with ~USD 70 million in 2023, while Spain had the smallest market size of PKU.

Phenylketonuria Recent Developments

- In July 2025, the FDA approved SEPHIENCE™ (sepiapterin) by PTC Therapeutics for the treatment of hyperphenylalaninemia (HPA) in adults and children aged 1 month and older with sepiapterin-responsive phenylketonuria (PKU).

Phenylketonuria Drug Chapters

The section dedicated to drugs in the phenylketonuria report provides an in-depth evaluation of late-stage pipeline drugs (Phase III and Phase II) related to phenylketonuria.

The drug chapters section provides valuable information on various aspects related to clinical trials of phenylketonuria, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting phenylketonuria.

Marketed Therapies

KUVAN (Sapropterin Hydrochloride): Asubio-Pharma/BioMarin-Pharmaceutical

KUVAN is indicated to reduce blood phenylalanine (Phe) levels in patients with hyperphenylalaninemia (HPA) due to tetrahydrobiopterin (BH4) responsive PKU and is to be used in conjunction with a Phe-restricted diet. In August 2021, NICE issued final draft guidance which recommends sapropterin (also called KUVAN) as an option for treating PKU in pregnant women until they give birth and for treating the condition in people until they turn 22.

PALYNZIQ (pegvaliase-pqpz/rAvPAL-PEG/BMN 165): BioMarin Pharmaceutical

PALYNZIQ (pegvaliase-pqpz) injection is the first FDA-approved enzyme substitution therapy for adults with PKU who have uncontrolled blood Phe levels above 600 µmol/L (10 mg/dL) on their current treatment. PALYNZIQ is a once-daily self-administered therapy that acts independently of the phenylalanine hydroxylase (PAH) enzyme, so it is an option for all eligible adult patients living with PKU. In October 2020, the US FDA approved the supplemental biologics license application to increase the maximum allowable dose of 60 mg with PALYNZIQ Injection for treating adults with PKU.

Emerging Therapies

Sepiapterin (PTC923): PTC Therapeutics

PTC923 is an oral formulation of synthetic sepiapterin, a precursor to intracellular tetrahydrobiopterin, which is a critical enzymatic cofactor involved in the metabolism and synthesis of numerous metabolic products. Sepiapterin reductase plays an enzymatic role in the biosynthesis of tetrahydrobiopterin, which is reported in limited studies to regulate the progression of several tumors.

PTC has submitted an MAA to the EMA for sepiapterin for the treatment of PKU in March 2024. The company also expects to submit an NDA to the FDA for sepiapterin by the third quarter of 2024 and to complete regulatory submissions in Japan in 2024.

SYNB1934: Synlogic

SYNB1934 is an orally administered, non-systemically absorbed drug candidate being studied as a potential biotherapeutic for phenylketonuria (PKU), an inherited metabolic disease marked by an inability to break down the amino acid phenylalanine (Phe), which can be neurotoxic.

In July 2023, the US FDA has granted fast track designation to labafenogene marselecobac (previously known as SYNB1934) for the treatment of phenylketonuria (PKU). Currently, it is being investigated under Phase III clinical trial.

Note: Detailed assessment will be provided in the final report of Phenylketonuria…

Phenylketonuria Market Outlook

The goal of treatment for PKU is to keep plasma phenylalanine levels within 120−360 µmol/L (2−6 mg/dL). This is generally achieved through a carefully planned and monitored diet.

In 2007, the US FDA approved KUVAN (sapropterin hydrochloride) to treat PKU. KUVAN is an oral pharmaceutical formulation of BH4, the natural cofactor for the PAH enzyme, which stimulates the activity of the residual PAH enzyme to metabolize phenylalanine into tyrosine. KUVAN is to be used in conjunction with a phenylalanine-restricted diet. KUVAN is manufactured by BioMarin Pharmaceutical; however, it does not work for everyone with PKU. It is most effective in children with mild cases of PKU.

Researchers and other scientists are exploring additional treatments for PKU. These treatments include large neutral amino acid supplementation, which may help prevent phenylalanine from entering the brain, and enzyme replacement therapy, which uses a substance similar to the enzyme that usually breaks down phenylalanine.

Studies have shown that the treatment of PKU is multifaceted. The pipeline of PKU possesses a few potential drugs as monotherapies. Overall, the PKU therapeutics market is expected to grow in the forecast period (2024–2034).

KOL Views

To stay abreast of the latest trends in the market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research.

We have reached out to industry experts to gather insights on various aspects of phenylketonuria, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at Delveinsight connected with more than 15 KOLs across the 7MM. We contacted institutions such as the Lurie Children’s Hospital of Chicago, Ramón y Cajal Health Research Institute, Universitario Virgen del Rocío, Jichi Medical School, etc., among others. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the phenylketonuria market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in trials for phenylketonuria, one of the most important primary endpoints were the percentage mean Phe (D5-Phe) reduction in plasma and fasting levels of plasma Phe. Based on these, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Phenylketonuria Report Insights

- Patient Population

- Therapeutic Approaches

- Phenylketonuria Market Size and Trends

- Existing Market Opportunity

Phenylketonuria Report Key Strengths

- Eleven-year Forecast

- The 7MM Coverage

- Phenylketonuria Epidemiology Segmentation

- Patient-based Forecasting

- Key Cross Competition

Phenylketonuria Report Assessment

- Current Treatment Practices

- Reimbursements

- Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis)

Key Questions

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in phenylketonuria management recommendations?

- Would research and development advances pave the way for future tests and therapies for phenylketonuria?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of phenylketonuria?

- What kind of uptake will the new therapies witness in coming years in phenylketonuria patients?

.jpg)

.png&w=256&q=75)