Postoperative Acute Pain Market

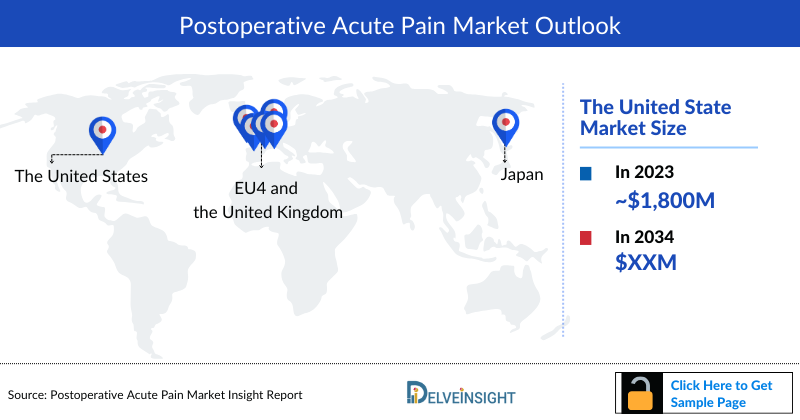

- The Postoperative Acute Pain market size in US was found to be ~USD 1,800 million in 2023.

- According to the medical evidence, less than half of patients report adequate postoperative pain relief. The presence of pain often indicates that something is still wrong, which can be best judged by the patient. Different types of pain are categorized into two forms, i.e., acute pain and chronic pain.

- Postoperative pain intensity, quality, and duration are primarily influenced by factors such as the surgical procedure's location, type, and duration, as well as the incision's type and extent. The patient's physical and mental state, including their approach to pain, along with preoperative psychological and pharmacological preparation, play crucial roles.

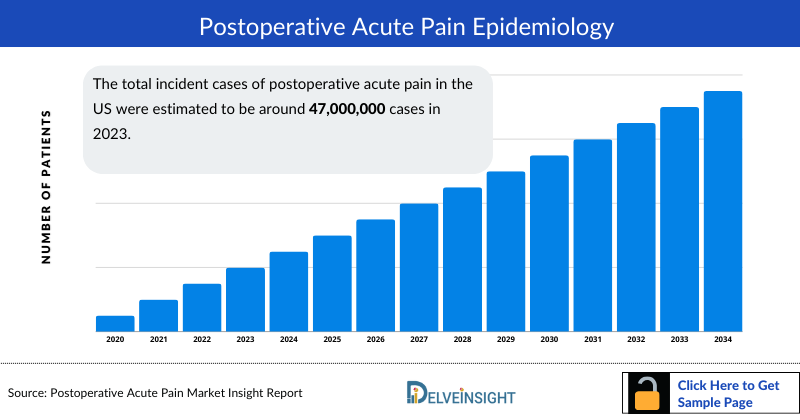

- The total incident cases of postoperative acute pain in the US were estimated to be around 47,000,000 cases in 2023.

- The growth of the postoperative acute pain disease market is expected to be mainly driven by the increasing market size due to improved survival, increasing awareness of postoperative acute pain disease, and increasing awareness.

- Pharmacologic therapies for postoperative pain involve various drug classes, including opioids, NSAIDs, acetaminophen, benzodiazepines, muscle relaxants, antidepressants, alpha-2 agonists, gamma-aminobutyric agonists, and cannabinoids. Topical agents like capsaicin and lidocaine are also utilized.

- Nonpharmacologic therapies for postoperative pain are gaining popularity to mitigate issues linked to medications. These include acupuncture, psychological approaches (cognitive-behavioral therapy, mindfulness-based stress reduction), chiropractic manipulation, physical therapy, transcutaneous electrical stimulation, massage therapy, exercise, and other complementary and alternative medicine therapies (CAM).

- In March 2024, Formosa Pharmaceuticals and AimMax Therapeutics announced FDA approval for clobetasol propionate ophthalmic suspension 0.05% (APP13007), to treat post-operative inflammation and pain after ocular surgery.

- Among the emerging therapies, VX-548 (suzetrigine) by Vertex is expected to lead the transformation of the postoperative acute pain market.

- In 2023, the United States accounted for the highest number of incident cases of Postoperative Acute Pain in the 7MM.

- In the United States, out of all severity-specific postoperative acute pain cases, moderate case were highest in 2023.

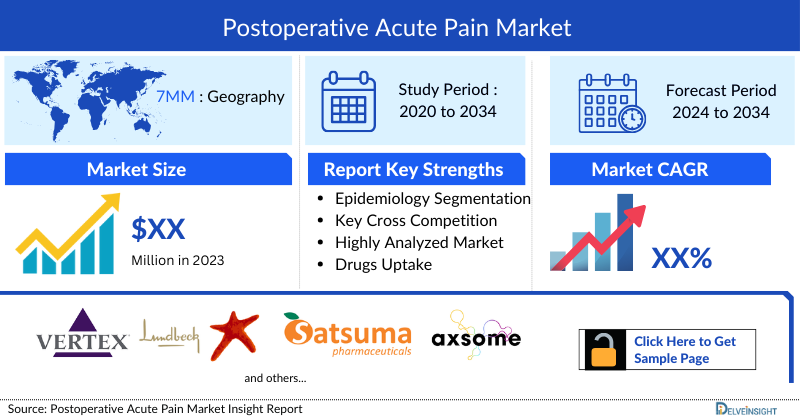

Postoperative Acute Pain Market Report Summary

- The Postoperative acute pain market report offers extensive knowledge regarding the epidemiology segments and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies and the elaborative profiles of late-stage (Phase III and Phase II) and prominent therapies that would impact the current treatment landscape and result in an overall Postoperative acute pain market shift has been provided in the report.

- The report also encompasses a comprehensive analysis of the Postoperative acute pain market, providing an in-depth examination of its historical and projected market size (2020 – 2034). It also includes Postoperative acute pain market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The Postoperative acute pain market report also includes drug outreach coverage in the 7MM region.

- The Postoperative acute pain market report includes qualitative insights that provide an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM Postoperative acute pain market.

The table given below further depicts the key segments provided in the report:

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

Postoperative acute pain Epidemiology |

Segmented by:

|

|

Postoperative acute pain Market |

Segmented by:

|

|

Postoperative acute pain Market Analysis |

|

Postoperative Acute Pain Treatment Market

Various key players are leading the treatment of Postoperative acute pain, such as Pacira Pharmaceuticals, Hyloris Pharmaceuticals/AFT Pharmaceuticals, Heron Therapeutics, Ocular Therapeutix, Bausch & Lomb, and others. The details of the country-wise and therapy-wise market size have been provided below.

- The Postoperative Acute Pain market size in US was found to be ~USD 1,800 million in 2023.

- NSAIDS/Corticosteroids is the current market leader among approved products, which generated a revenue of ~USD 460 million in 2023.

- In 2023 while the second-highest revenue generator was Opioids with ~USD 518 million.

- With the approval of several emerging drugs, the Postoperative acute pain market size is set to show an extensive jump in the forecasted period (2024-2034).

Postoperative acute pain Drug Chapters

The section dedicated to drugs in the Postoperative acute pain market report provides an in-depth evaluation of late-stage pipeline drugs (Phase III and Phase II) related to Postoperative acute pain.

The drug chapters section provides valuable information on various aspects related to clinical trials of Postoperative acute pain , such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting Postoperative acute pain.

Postoperative Acute Pain Marketed Therapies

EXPAREL (bupivacaine liposome injectable suspension): Pacira BioSciences

EXPAREL (bupivacaine liposome injectable suspension) is indicated for single-dose infiltration in adults to produce postsurgical local analgesia and as an interscalene brachial plexus nerve block to produce postsurgical regional analgesia. Safety and efficacy have not been established in other nerve blocks. The product combines bupivacaine with DepoFoam, a proven product delivery technology that delivers medication over a desired period. EXPAREL represents the multivesicular liposome local anesthetic that can be utilized in the peri- or postsurgical setting. By utilizing the DepoFoam platform, a single dose of EXPAREL delivers bupivacaine over time, providing significant reductions in cumulative pain scores with up to a 78% decrease in opioid consumption; the clinical benefit of the opioid reduction was not demonstrated.

EXPAREL was approved by the FDA in October 2011 and was commercially launched in April 2012. EXPAREL is currently indicated for single-dose infiltration in adults to produce postsurgical local analgesia and an interscalene brachial plexus nerve block to produce postsurgical regional analgesia.

DSUVIA (sufentanil): AcelRx Pharmaceuticals

DSUVIA, known as DZUVEO, contains sufentanil, an opioid agonist, and is indicated for use in adults in a certified medically supervised healthcare setting, such as hospitals, surgical centers, and emergency departments, for the management of acute pain severe enough to require an opioid analgesic and for which alternative treatments are inadequate. The recommended dosage of DSUVIA is 30 mcg sublingually as needed, with a minimum of 1 h between doses; do not exceed 12 tablets in 24 h. The maximum cumulative dose is 360 mcg or 12 tablets (12 tablets × 30 mcg/dose).

In January 2021, AcelRx announced an investigator-initiated study with University Hospitals Cleveland Medical Center to evaluate the postoperative use of the drug in a prospective cohort of patients undergoing cardiac surgery with cardiopulmonary bypass following a specialized enhanced recovery protocol. In August 2020, an investigator-initiated study with Cleveland Clinic was initiated to assess the effects of DSUVIA on postoperative recovery from orthopedic surgery. This double-blind study compares DSUVIA to IV fentanyl for patients undergoing knee arthroscopy.

Postoperative Acute Pain Emerging Therapies

OCS-01 (dexamethasone cyclodextrin nanoparticle ophthalmic suspension 1.5%): Oculis

OCS-01 is a novel, high-concentration, preservative-free, topical formulation of dexamethasone. It was developed using Oculis’ proprietary Soluble NanoParticle technology (SNP), which acts as an ocular drug carrier to enhance the bioavailability of drugs. It has been developed using the OPTIREACH solubilizing technology, a proprietary platform that enables the formulation of drugs as noninvasive topical treatments, a longer residence time on the eye surface, and enhances their bioavailability in the relevant eye tissues.

In August 2023, Oculis Holding AG made an announcement regarding the positive top-line results from its Phase III OPTIMIZE trial with OCS-01 eye drops. OCS-01 represents a novel, once-daily, high concentration, preservative-free, topical OPTIREACH formulation of dexamethasone designed for treating inflammation and pain following ocular surgery.

VX-548: Vertex Pharmaceuticals

VX-548 is a selective oral inhibitor of NaV1.8 that is highly selective for NaV1.8 relative to other NaV channels. NaV1.8 is a voltage-gated sodium channel that plays a critical role in pain signaling in the peripheral nervous system. NaV1.8 is a genetically validated target for the treatment of pain, and Vertex has previously demonstrated clinical proof-of-concept with a small molecule investigational treatment targeting NaV1.8 in multiple pain indications, including acute pain, neuropathic pain, and musculoskeletal pain.

Currently, the company is evaluating VX-548 in three Phase III trials (NCT05661734, NCT05558410, and NCT05553366) to evaluate the safety and effectiveness of treating acute pain. These trials are anticipated to complete by 2024.

Note: Detailed assessment will be provided in the final report Postoperative acute pain……

Postoperative acute pain Market Outlook

The treatment pattern currently consists of different approaches classified into pharmacologic and nonpharmacological therapies. The pharmacological therapies include analgesics that are further segregated into opioids, nonsteroidal anti-inflammatory drugs (NSAIDs), acetaminophen, corticosteroids, anesthetics, etc. Acute pain is also managed by the use of benzodiazepines, muscle relaxants, antidepressants, alpha-2 agonists, gamma-aminobutyric agonists, and cannabinoids. Further, nonpharmacological therapies include acupuncture, psychological approaches (cognitive behavioral therapy, mindfulness-based stress reduction), chiropractic manipulation, physical therapy, transcutaneous electrical stimulation, massage therapy, exercise, and other complementary and alternative medicine therapies (CAM). All these involve the concept known as multimodal analgesia.

Many new molecules with novel mechanisms, like selective NaV1.8 inhibitor, Steroid receptor agonist, Reversibly inhibits the voltage-gated sodium channels in nerve fibers, Binding to the alpha 2-delta subunit of voltage-gated calcium channels, among others, are being developed for the treatment of Postoperative acute pain by key players like Nevakar, Viatris Teikoku Pharma, Neumentum, Formosa Pharmaceuticals among others.

In conclusion, despite the lack of appropriate treatment in the current treatment landscape, many potential therapies with novel mechanisms are expected to enter the market, resolving a dire unmet need and leading to significant improvement in the treatment outcome of Postoperative acute pain patients. Hence, with the upcoming availability of new treatment options and increasing healthcare spending across the 7MM, the treatment scenario is expected to experience significant growth during the forecast period (2024–2034).

Further details are provided in the report…

Postoperative acute pain Treatment Market

Postoperative Acute Pain Overview

Acute postoperative pain or postoperative pain occurs most commonly in patients who undergo surgical procedures. According to the medical evidence, less than half of patients report adequate postoperative pain relief. The presence of pain often indicates that something is still wrong, which can be best judged by the patient. Different types of pain are categorized into two forms, i.e., acute pain and chronic pain.

Acute Pain is a type of pain that typically lasts less than 3–6 months or is directly related to soft tissue damage such as a sprained ankle or a paper cut. The pain is of short duration, but it gradually resolves as the injured tissues heal. Acute pain usually does not last longer than 6 months; it goes away when there is no longer an underlying cause for the pain. On the other hand, chronic pain is ongoing and usually lasts longer than 6 months. In several cases, it has been seen that pain continues even after healed illness. Pain signs remain active in the nervous system for weeks, months, or years. Some people suffer chronic pain even when there is no past injury or apparent body damage.

Further details are provided in the report…

Postoperative Acute Pain Diagnosis

In order to treat pain efficiently, it needs to be properly diagnosed, measured, and documented. Only by this procedure optimal analgesia may be achieved, which is a mild and tolerable sensation of pressure in the surgical wound with minimal adverse effects. Proper diagnosis of the type and intensity of pain is crucial for an adequate and targeted treatment of acute pain. It requires a highly professional approach in terms of expertise, psychology, and ethics. Some methods by which patient can express their level of pain are-Medical history, physical examination, and specific evaluation of pain, Measuring pain, Various grading scales, Verbal methods, Nonverbal methods.

Further details related to country-based variations are provided in the report…

Postoperative Acute Pain Treatment Market

Postoperative pain management aims not only to decline pain intensity but also to increase patient comfort and to improve postoperative outcomes. Effective pain control is achieved through multiple combinations of regional analgesic techniques and systemic administration of analgesic agents. Pharmacologic therapies for pain include drugs from several drug classes. Pain-relieving analgesics include opioids, nonsteroidal anti-inflammatory drugs (NSAIDs), and acetaminophen. Providers also elect to manage acute pain with benzodiazepines, muscle relaxants, antidepressants, alpha-2 agonists, gamma-aminobutyric agonists, and cannabinoids. Topical agents, such as capsaicin and lidocaine are also used. Non-pharmacologic therapies for pain are becoming more widely used to avoid problems associated with pharmacologic therapies. Examples of nonpharmacologic therapies include acupuncture, psychological approaches (cognitive behavioral therapy, mindfulness-based stress reduction), chiropractic manipulation, physical therapy, transcutaneous electrical stimulation, massage therapy, exercise, and other complementary and alternative medicine therapies (CAM).

Further details related to treatment and management are provided in the report…

Postoperative acute pain Epidemiology

The Postoperative acute pain epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Incident Cases, Visit-specific Cases of Surgeries, Severity-specific cases of Postoperative acute pain in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

- In 2023, total visit-specific cases of surgeries in the United States were ~58,700,000 cases in which inpatient surgeries accounted for more cases than outpatient surgeries.

- In 2023, the highest severity-specific cases of postoperative acute pain were found to be in the moderate type with ~45% of the total cases, followed by severe and mild type, respectively, in the 7MM.

- In the United States the total number of incident cases of postoperative acute pain in 2023 were found to be ~47,000,000 cases.

Further details related to epidemiology will be provided in the report…

KOL Views

To stay abreast of the latest trends in the Postoperative acute pain market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research.

We have reached out to industry experts to gather insights on various aspects of Postoperative acute pain, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at Delveinsight connected with more than 15 KOLs across the 7MM. We contacted institutions such as the Massachusetts General Hospital, University of Utah, University of Michigan, The Johns Hopkins University etc., among others. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the Postoperative acute pain market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Postoperative Acute Pain Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging Postoperative acute pain therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in trials for Postoperative acute pain, important primary endpoints are serial numerical rating scales (NRS) for pain with activity (coughing, ambulation) and opioid consumption, NRS pain intensity scores, multiple local and systemic safety, wound healing etc. is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, a final weightage score is decided, based on which the emerging therapies are ranked.

Postoperative Acute Pain Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

The Postoperative acute pain market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Postoperative acute pain Report Insights

- Postoperative acute pain Patient Population

- Postoperative acute pain Therapeutic Approaches

- Postoperative acute pain Market Size

- Postoperative acute pain Market Trends

- Existing Postoperative acute pain Market Opportunity

Postoperative acute pain Report Key Strengths

- Eleven-year Forecast

- The 7MM Coverage

- Postoperative acute pain Epidemiology Segmentation

- Key Cross Competition

Postoperative acute pain Report Assessment

- Current Postoperative acute pain Treatment Practices

- Reimbursements

- Postoperative acute pain Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet needs)

Key Questions

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in Postoperative acute pain management recommendations?

- Would research and development advances pave the way for future tests and therapies for Postoperative acute pain?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of Postoperative acute pain?

- What kind of uptake will the new therapies witness in coming years in Postoperative acute pain patients