Primary Biliary Cholangitis Market

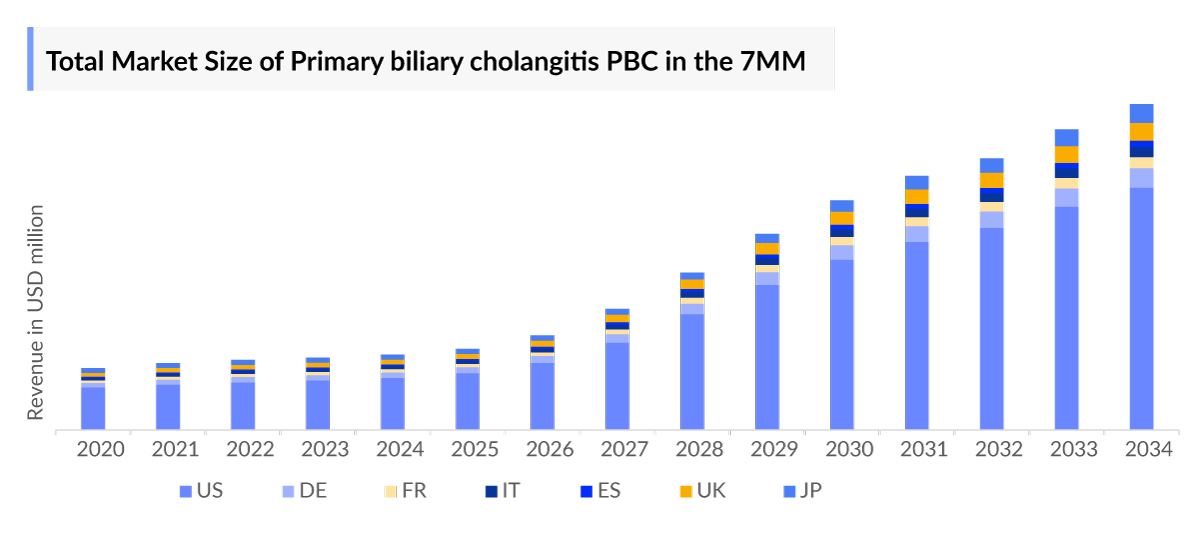

- By 2023, Primary Biliary Cholangitis Market saw a significant emergence of a dominant treatment modality, valued at approximately USD 1,150 million in the 7MM. This modality likely reflects advancements in therapeutic approaches such as first-line agents like ursodeoxycholic acid (UDCA), second-line treatments like obeticholic acid (OCA), and potentially emerging biologics or combination therapies aiming to address the complex pathophysiology of PBC, thus enhancing patient outcomes and market share.

- The Primary Biliary Cholangitis Epidemiology outlook considers various factors including historical data, demographic trends, risk factors, and advancements in diagnostic methods and treatments.

- The higher Primary Biliary Cholangitis Prevalence in females compared to males in the 7MM may be attributed to differences in genetic predisposition, hormonal influences, and environmental factors impacting disease development and progression.

- DelveInsight forecasts a steady increase in the Primary Biliary Cholangitis Market Size from 2024 to 2034, indicating a robust pipeline with potential for accelerated expansion with the introduction of novel therapies.

Request for Unlocking the Sample Page of the "Primary Biliary Cholangitis Treatment Market"

DelveInsight’s report titled “Primary Biliary Cholangitis Market Insights, Epidemiology, and Market Forecast – 2034” comprehensively analyzes Primary Biliary Cholangitis. The report provides a comprehensive analysis of historical and projected epidemiological data, covering Total Diagnosed Prevalent cases of Primary Biliary Cholangitis, Gender-specific Diagnosed Prevalent cases of Primary Biliary Cholangitis, and Age-specific Diagnosed Prevalent cases of Primary Biliary Cholangitis.

The Primary Biliary Cholangitis Treatment Market Report provides a comprehensive insight into different facets concerning the patient population, encompassing diagnosis, prescribing trends, physician viewpoints, market accessibility, therapy, and forthcoming market advancements across seven major markets: the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan spanning from 2020 to 2034. The Primary Biliary Cholangitis Therapeutics Market Report examines current treatment methodologies and algorithms for Primary Biliary Cholangitis, assessing the overall market potential, identifying business prospects, and addressing pertinent unmet medical requirements.

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

|

|

Primary Biliary Cholangitis Epidemiology |

|

|

Primary Biliary Cholangitis Therapeutics Market |

|

|

Primary Biliary Cholangitis Market Analysis |

|

|

Primary Biliary Cholangitis Companies |

|

|

Primary Biliary Cholangitis Market Growth Barriers |

Market expansion for Primary Biliary Cholangitis faces challenges such as insufficient awareness among both healthcare providers and patients, intricate diagnostic processes resulting in under-recognition, and the affordability hurdle posed by treatment choices. Overcoming these hurdles necessitates extensive educational initiatives, simplified diagnostic pathways, and creative pricing approaches to improve therapy accessibility. |

Primary Biliary Cholangitis Overview

Primary Biliary Cholangitis is an autoimmune liver disease where the immune system attacks bile ducts, causing inflammation and scarring. Symptoms include fatigue, itching, and abdominal discomfort. Diagnosis involves blood tests and imaging studies. Treatment aims to slow disease progression with medications like UDCA. Regular monitoring is crucial, and research continues to improve outcomes for patients. Support groups offer assistance for coping with the condition.

Primary Biliary Cholangitis Diagnosis and Treatment Algorithm

Diagnosing Primary Biliary Cholangitis usually entails a comprehensive approach, combining blood tests, imaging studies, and occasionally liver biopsy. Elevated liver enzymes and the presence of specific antibodies like anti-mitochondrial antibodies (AMA) in blood tests are indicative. Imaging techniques such as ultrasound help assess liver and bile duct health, while liver biopsy offers deeper insights into inflammation and scarring.

Challenges in diagnosis stem from the diverse symptom presentation and the necessity to distinguish PBC from other liver ailments. Addressing these challenges involves enhancing healthcare provider awareness, adopting updated diagnostic criteria, and leveraging advanced imaging technologies to ensure accurate diagnosis.

Treating PBC focuses on slowing disease advancement, alleviating symptoms, and averting complications. The cornerstone therapy, ursodeoxycholic acid (UDCA), enhances liver function and could defer the necessity for liver transplantation. Nonetheless, some patients might not respond well to UDCA or encounter intolerable side effects. Treatment hurdles include the limited effectiveness of current therapies for certain patients and the risk of disease progression despite treatment.

Addressing these challenges entails ongoing exploration of alternative treatments like obeticholic acid and emerging immunomodulatory agents. Personalized management approaches, tailored to disease severity and individual patient factors, also hold promise. Additionally, diligent monitoring and multidisciplinary care are vital for optimizing treatment outcomes and enhancing the quality of life for PBC patients.

To be continued in the report…..

Primary Biliary Cholangitis Epidemiology

The epidemiology section on Primary Biliary Cholangitis offers an analysis of past and present patient populations, along with projected trends across the seven major countries (7MM). Drawing from multiple studies and expert opinions, it aims to elucidate the underlying factors driving current and anticipated trends. Additionally, this segment of the report presents data on the diagnosed patient population, highlighting trends and underlying assumptions.

Key Findings

- DelveInsight’s forecasting report of Primary Biliary Cholangitis includes the Epidemiology analysis and forecast of the US, EU4 and the UK, and Japan. As per our analysis, the US had the highest Primary Biliary Cholangitis diagnosed prevalent cases in 2023, which are expected to rise, at a decent CAGR during the forecasted period (2024–2034).

- In 2023, among EU4 (Germany, France, Italy, and Spain) and the United Kingdom, Germany accounted for the highest number of diagnosed prevalent cases of PBC i.e. around 34 thousand cases which is expected to increase by 2034.

- The Primary Biliary Cholangitis Incidence rises with age, and is particularly higher among individuals aged 40 to 70 years. Our estimates for 2023 indicate a distribution of cases by age groups: approximately 14 thousand cases were observed in individuals under 40 years old, with numbers increasing steadily with age. The highest number of cases, totaling 87 thousand, occurred in the 40–70 age bracket, while 43 thousand cases were reported in individuals aged 70 and above in the US.

- Our analysis indicates a higher prevalence of PBC among females compared to males, with distribution rates of 82% and 18% respectively, in the US in 2023.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Primary Biliary Cholangitis Incidence

Primary Biliary Cholangitis Recent Developments

- In October 2025, Science 37 successfully completed its third FDA inspection of its Direct-to-Patient clinical trial site, receiving a No Action Indicated (NAI) rating. The inspection reviewed a Phase 3 primary biliary cholangitis study, where Science 37 enrolled 47% of U.S. patients, affirming quality, data integrity, and patient safety compliance.

- In June 2025, GSK plc (LSE/NYSE: GSK) announced the FDA has accepted the NDA for linerixibat, an IBAT inhibitor for treating cholestatic pruritus in primary biliary cholangitis (PBC). The PDUFA goal date is March 24, 2026.

- In Jan 2025, COUR Pharmaceuticals announced that the FDA granted Orphan Drug Designation to CNP-104 for the treatment of primary biliary cholangitis (PBC).

- In December 2024, Gilead Sciences, Inc.announced that the U.S. Food and Drug Administration (FDA) has granted accelerated approval for Livdelzi® (seladelpar) to treat primary biliary cholangitis (PBC). The drug is approved for use in combination with ursodeoxycholic acid (UDCA) in adults who have had an inadequate response to UDCA or as a monotherapy for patients who cannot tolerate UDCA. However, Livdelzi is not recommended for individuals with or who develop decompensated cirrhosis.

- In December 2024, the FDA reported serious liver injury cases in Primary Biliary Cholangitis patients treated with obeticholic acid (Ocaliva) who did not have cirrhosis. The FDA’s review of a clinical trial showed that patients without cirrhosis had a significantly higher risk of liver injury, including cases requiring a liver transplant, compared to those on a placebo.

- In October 2024, Intercept Pharmaceuticals, Inc. announced that the FDA is still reviewing the supplemental New Drug Application (sNDA) for full approval of OCALIVA® (obeticholic acid, OCA) for treating patients with Primary Biliary Cholangitis. The expected decision under the Prescription Drug User Fee Act (PDUFA), originally set for October 15, 2024, has been postponed. The FDA has not provided a new expected action date.

- On September 20, 2024, Ipsen announced the conditional approval from the European Commission for Iqirvo® (elafibranor) 80 mg tablets. This treatment is indicated for Primary Biliary Cholangitis in adults who either do not respond adequately to ursodeoxycholic acid (UDCA) or cannot tolerate it. Iqirvo is a first-in-class oral peroxisome proliferator-activated receptor (PPAR) agonist, targeting PPARα and PPARδ, which are believed to play crucial roles in regulating bile acid, inflammation, and fibrosis.

- On August 14, 2024, the FDA granted accelerated approval for Livdelzi® (seladelpar) for treating Primary Biliary Cholangitis. Livdelzi can be used with ursodeoxycholic acid (UDCA) in adults who don't respond adequately to UDCA, or as a standalone therapy for those intolerant to UDCA. It is not recommended for patients with decompensated cirrhosis.

Primary Biliary Cholangitis Drug Chapters

The drug chapter segment of the Primary Biliary Cholangitis report encloses the detailed analysis of Primary Biliary Cholangitis marketed drugs, mid-phase, and late-stage pipeline drugs. It also helps to understand the Primary Biliary Cholangitis clinical trials details, expressive pharmacological action, agreements and collaborations, approval, and patent details of each included drug, and the latest news and press releases.

Marketed Therapies for Primary Biliary Cholangitis

Despite significant advances in the overactive bladder landscape, the PBC disease paradigm lacks effective treatments mainly including off-label drugs as the current management.

OCALIVA: Intercept Pharmaceuticals

OCALIVA offers a novel treatment approach for PBC by targeting FXR and has shown efficacy in reducing ALP levels and improving outcomes for patients who have not responded to or cannot tolerate UDCA, highlighting its significance as an alternative therapy in the management of PBC. OCALIVA has received accelerated approval from the FDA for the treatment of PBC, demonstrating its potential to address serious conditions and providing earlier patient access to promising new drugs while confirmatory trials are ongoing.

Get More Insights of this Report @ OCALIVA Market

Emerging Therapies for Primary Biliary Cholangitis

Seladelpar: CymaBay Therapeutics

Seladelpar, developed by CymaBay Therapeutics, is an oral, selective peroxisome proliferator-activated receptor (PPAR) delta agonist aimed at treating Primary Biliary Cholangitis. It regulates crucial metabolic and liver disease pathways, impacting bile acid synthesis, inflammation, fibrosis, and lipid metabolism. Clinical studies demonstrate its efficacy in reducing biomarkers associated with adverse outcomes in PBC, alongside improving pruritus. Unlike other PPAR agonists, seladelpar acts on various liver cell types, uniquely affecting PBC pathobiology. It has garnered FDA Breakthrough Therapy Designation and EMA Priority Medicines (PRIME) status, with an NDA submitted to the FDA for PBC treatment, underscoring its promising potential and regulatory recognition.

See More Insights of this Report @ SELADELPAR Market

Saroglitazar Magnesium: Zydus Therapeutics

Zydus Therapeutics' flagship drug candidate, saroglitazar, acts as a liver-selective dual agonist for PPAR alpha/gamma. With Fast Track and orphan drug designations from the FDA for treating PBC, it shows promising potential. Moreover, saroglitazar's existing approvals for dyslipidemias and hypertriglyceridemia have cemented its market presence, providing a strategic advantage for market penetration.

Check More Insights @ SAROGLITAZAR Market

Elafibranor: Genfit

Elafibranor is a dual agonist of PPARα and PPARδ in PBC. The FDA has granted Priority Review for the New Drug Application (NDA) for elafibranor in PBC, while the European Medicine Agency (EMA) has validated the Marketing Authorization Application (MAA) for the same. The acceptance of these applications triggers a significant milestone payment. Additional milestones are anticipated upon the launch of elafibranor in the US and Europe, which is projected for the second quarter of 2024 in the US (with the FDA PDUFA action date set for June 10, 2024) and the second half of 2024 in Europe.

Know More Insights @ ELAFIBRANOR Market

Linerixibat: GlaxoSmithKline

Linerixibat (GSK2330672) is a medication in development for patients with Primary Biliary Cholangitis who suffer from itchiness. As a minimally absorbed small molecule inhibitor of the ileal bile acid transporter (IBAT), it is administered orally in tablet form. By impeding the reabsorption of bile acids in the small intestine, linerixibat diminishes the presence of pruritic bile acids in circulation. Additionally, it has shown promise in improving glucose and lipid levels in diabetic patients, although a notable incidence of gastrointestinal adverse effects, such as diarrhea, has been observed. The efficacy of GSK-2330672 specifically for patients with PBC experiencing itch (pruritus) is under investigation in a Phase III trial.

Read More Insights @ LINERIXIBAT Market

|

Drug |

MoA |

RoA |

Company |

Logo |

Phase |

|

Seladelpar |

PPARδ receptor agonist |

Oral |

CymaBay Therapeutics |

|

III |

|

Saroglitazar Magnesium |

PPAR agonists |

Oral |

Zydus Therapeutics |

|

II |

|

Elafibranor |

PPAR agonists |

Oral |

Genfit |

|

II/III |

|

Linerixibat |

IBAT inhibitor |

Oral |

GlaxoSmithKline |

|

III |

|

Setanaxib |

NOX1 protein inhibitors |

XX |

XXX |

|

I/II |

Primary Biliary Cholangitis Market Outlook

PBC, an autoimmune condition, progressively damages bile ducts in the liver, causing bile buildup, inflammation, and liver cell damage. UDCA remains the primary treatment due to its efficacy, safety, and affordability. OCA, a synthetic bile acid derivative, is recommended for patients who don't respond to UDCA. Bezafibrate, a PPAR agonist, has shown positive results as a third-line treatment. Other drugs like budesonide and symptomatic relief options exist. Research for new treatments focuses on targeting cholestasis and its related effects, with emphasis on anti-inflammatory, anti-fibrotic, and immunomodulatory approaches. However, individualized therapy and combination treatments are likely needed for effective management.

Primary Biliary Cholangitis Market Segmentation

DelveInsight’s ‘Primary Biliary Cholangitis Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a detailed outlook of the current and future Primary Biliary Cholangitis market, segmented within countries and by therapies. Further, the market of each region is then segmented by each therapy to provide a detailed view of the current and future market share of all therapies.

Primary Biliary Cholangitis Market Size by Countries

The total Primary Biliary Cholangitis market size is analyzed for individual countries (the United States Market, EU4 (Germany, France, Italy, and Spain) and the UK market, and Japan). The United States accounted for a larger portion of the 7MM market for Primary Biliary Cholangitis in 2023 due to the increasing prevalence of the condition and treatment demand. This dominance is predicted to continue with the potential early entry of new products.

Primary Biliary Cholangitis Market Size by Therapies

Treatment distribution for Primary Biliary Cholangitis varies based on factors like disease severity, patient response to therapy, and physician discretion. Ursodeoxycholic acid (UDCA) remains the first-line treatment for most patients, with a significant portion achieving biochemical response. For those who do not adequately respond or cannot tolerate UDCA, second-line therapies such as obeticholic acid (OCA) are considered. OCA has shown efficacy in improving liver biochemistry and histology in clinical trials, positioning it as a promising option for non-responsive patients. Additionally, fibrates and other off-label medications may be utilized in select cases. Treatment decisions are often individualized, considering patient factors and therapeutic goals, ultimately aiming to mitigate disease progression and improve patient outcomes.

The total Primary Biliary Cholangitis Market Size based on currently prescribed therapies as well as emerging therapies, in the US, is expected to grow by 2034. DelveInsight assessment of the emerging therapies indicates that the Primary Biliary Cholangitis Drugs Market will experience a slow steady shift in the market with the launch of several therapies during the forecast period (2024-2034).

Key Findings

- The Primary Biliary Cholangitis Treatment Market Size in the seven major markets was over further expected to increase by 2034 at a significant Compound Annual Growth Rate (CAGR) for the study period (2020–2034).

- The United States accounts for the largest Primary Biliary Cholangitis Market Size, in comparison to the EU4 (Germany, Italy, France, Spain) and the United Kingdom, and Japan, accounting for largest share in 2023.

- Germany boasted the largest Primary Biliary Cholangitis Market Size among European countries, comprising with nearly USD 88 million of market in 2023. Projections suggest this lead will continue to grow, with Germany anticipated to dominate the market, followed closely by Italy and the UK, by the year 2034.

- The Primary Biliary Cholangitis Market Size in Japan was valued at around USD 78 million in 2023. It is expected that the market will increase mainly due to the launch of upcoming therapy during the forecast period (2024–2034).

- The launch of potential therapies, Elafibranors, and others is expected to increase the market size in the coming years, assisted by the increase in the Primary Biliary Cholangitis Diagnosed Prevalent Population.

Note: Detailed market segment assessment will be provided in the final report.

Primary Biliary Cholangitis Drugs Uptake

This section focuses on the sales uptake of potential Primary Biliary Cholangitis drugs that have recently launched or are anticipated to be launched in the Primary Biliary Cholangitis market between 2020 and 2034. It estimates the market penetration of the Primary Biliary Cholangitis drugs for a given country, examining their impact within and across classes and segments. It also touches upon the financial and regulatory decisions contributing to the drug’s probability of success (PoS) in the Primary Biliary Cholangitis market.

Note: Detailed assessment of drug uptake will be provided in the full report on Primary Biliary Cholangitis.

Primary Biliary Cholangitis Pipeline Development Activities

The Primary Biliary Cholangitis Therapeutics Market Report provides insights into therapeutic candidates in Phase II and III stages. It also analyzes Primary Biliary Cholangitis Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Primary Biliary Cholangitis Therapeutics Market Report covers information on collaborations, acquisition and merger, licensing, patent details, and other information for emerging Primary Biliary Cholangitis therapies.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ Approved Drugs for Primary Biliary Cholangitis

KOL Views

To keep up with current Primary Biliary Cholangitis market trends and fill gaps in secondary findings, we interview KOLs and SMEs working in the Primary Biliary Cholangitis domain. Their opinion helps understand and validate current and emerging therapies and treatment patterns or Primary Biliary Cholangitis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the Primary Biliary Cholangitis unmet needs.

Primary Biliary Cholangitis: KOL Insights

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. These KOLs were from organizations, institutes, and hospitals, such as MD, California Pacific Medical Center, San Francisco, CA,US; Division of Gastroenterology and Hepatology, UC Davis School of Medicine, University of California Davis, Sacramento, CA, US; MD, Medical Clinic and Polyclinic I, University Hospital Bonn, Bonn, Germany; NIHR Birmingham Biomedical Research Centre, Birmingham, UK; Department of Gastroenterology, Graduate School of Medicine, Chiba University, Chiba, Japan; and others.

“No medication is officially recommended for Primary Biliary Cholangitis in the United Kingdom, however, there is observed utilization of off-label medications for managing the condition.”

Note: Detailed assessment of KOL Views will be provided in the full report of Primary Biliary Cholangitis.

Primary Biliary Cholangitis Therapeutics Market: Qualitative Analysis

We perform Qualitative and Primary Biliary Cholangitis Therapeutics Market Intelligence analysis using various approaches, such as SWOT analysis, and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Primary Biliary Cholangitis treatment market landscape.

Conjoint Analysis is done to analyze multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Note: Detailed assessment of SWOT analysis and conjoint analysis will be provided in the full report of Primary Biliary Cholangitis

Primary Biliary Cholangitis Therapeutics Market Access and Reimbursement

Reimbursement is a crucial point for any drug after its approval. Many drugs or therapies are not properly recognized by the reimbursement body and may fail to get reimbursed or their reimbursement process gets delayed. DelveInsight’s ‘Primary Biliary Cholangitis Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a descriptive overview of the market access and reimbursement scenario of Primary Biliary Cholangitis.

This section includes a detailed analysis of the country-wise healthcare system for each therapy, enlightening the market access, reimbursement policies, and health technology assessments. The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Note: Detailed assessment of Market Access and Reimbursement will be provided in the full report on Primary Biliary Cholangitis

Primary Biliary Cholangitis Therapeutics Market Report Scope

- The Primary Biliary Cholangitis therapeutics market report covers a segment of key events, an executive summary, descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression along with treatment guidelines

- Additionally, an all-inclusive account of both the current and emerging therapies along with the elaborative profiles of late-stage and prominent therapies will have an impact on the current treatment landscape

- A detailed review of the Primary Biliary Cholangitis therapeutics market; historical and forecasted Primary Biliary Cholangitis treatment market size, Primary Biliary Cholangitis drugs market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach

- The Primary Biliary Cholangitis therapeutics market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preference that help in shaping and driving the 7MM Primary Biliary Cholangitis Drugs Market

Primary Biliary Cholangitis Therapeutics Market Report Insights

- Patient-based Primary Biliary Cholangitis Market Forecasting

- Therapeutic Approaches

- Primary Biliary Cholangitis Pipeline Drugs Analysis

- Primary Biliary Cholangitis Market Size and Trends

- Existing and future Primary Biliary Cholangitis Drugs Market Opportunity

Primary Biliary Cholangitis Therapeutics Market Report Key Strengths

- 11 Years Primary Biliary Cholangitis Market Forecast

- 7MM Coverage

- Primary Biliary Cholangitis Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- Drugs Uptake and Key Primary Biliary Cholangitis Market Forecast Assumptions

Primary Biliary Cholangitis Therapeutics Market Report Assessment

- Current Primary Biliary Cholangitis Treatment Market Practices

- Primary Biliary Cholangitis Unmet Needs

- Primary Biliary Cholangitis Pipeline Drugs Analysis Profiles

- Primary Biliary Cholangitis Drugs Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

Primary Biliary Cholangitis Drugs Market Insights:

- What was the Primary Biliary Cholangitis market size, the Primary Biliary Cholangitis treatment market size by therapies, and Primary Biliary Cholangitis drugs market share (%) distribution in 2020, and how it would all look in 2034? What are the contributing factors for this growth?

- What are the unmet needs are associated with the current Primary Biliary Cholangitis Treatment Market?

- How are emerging therapies going to contribute to the Primary Biliary Cholangitis Drugs Market after approval?

- Which drug is going to be the largest contributor in 2034?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the Primary Biliary Cholangitis Market Dynamics and subsequent analysis of the associated trends?

Epidemiology Insights:

- What are the disease risk, burden, and Primary Biliary Cholangitis Unmet Needs? What will be the growth opportunities across the 7MM concerning the patient population of Primary Biliary Cholangitis?

- What is the historical and forecasted Primary Biliary Cholangitis patient pool in the United States, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan?

- Why do only limited patients appear for diagnosis? Why is the current year diagnosis rate not high?

- What factors are affecting the diagnosis and treatment of the indication?

Current Primary Biliary Cholangitis Treatment MarketScenario, Marketed Drugs, and Emerging Therapies:

- What are the current options for the Primary Biliary Cholangitis Treatment?

- What are the current treatment guidelines for the treatment of Primary Biliary Cholangitis in the US and Europe?

- How many companies are developing therapies for the treatment of Primary Biliary Cholangitis?

- How many emerging therapies are in the mid-stage and late stage of development for the treatment of Primary Biliary Cholangitis?

- What are the recent novel therapies, targets, Primary Biliary Cholangitis Mechanisms of Action, and technologies developed to overcome the limitation of existing therapies?

- What are the key designations that have been granted for the emerging therapies for Primary Biliary Cholangitis?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies? Focus on reimbursement policies.

- What are the 7MM historical and forecasted Primary Biliary Cholangitis Drugs Market?

Reasons to Buy

- The Primary Biliary Cholangitis Therapeutics Market Report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Primary Biliary Cholangitis Drugs Market

- Insights on patient burden/disease Primary Biliary Cholangitis Prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- To understand the existing Primary Biliary Cholangitis Drugs Market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the Primary Biliary Cholangitis Drugs Market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the Conjoint analysis section to provide visibility around leading classes

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs

- To understand the perspective of Key Opinion Leaders’ around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in future.

- Detailed insights on the unmet need of the existing Primary Biliary Cholangitis Drugs Market so that the upcoming players can strengthen their development and launch strategy

Read Our Recent Articles

-in-the-7MM.jpg)

-in-the-US-(2020–2034).jpg)

.jpg)