PROTAC Market

- PROTAC Market Forecast technology is a groundbreaking therapeutic approach with significant clinical potential for degrading disease-inducing proteins within targeted cells.

- Several PROTAC molecules are currently under evaluation in clinical trials. One such example is vepdegestrant, a joint development by Pfizer and Arvinas.

- Vepdegestrant is an investigational PROTAC protein degrader designed to target and degrade the estrogen receptor (ER) protein. Currently, vepdegestrant is being evaluated as a monotherapy in the second-line setting in the ongoing Phase III VERITAC-2 clinical trial and the first-line setting in combination with palbociclib in the ongoing study lead-in cohort of the Phase III VERITAC-3 clinical trial.

- PROTAC molecules work by the ubiquitin-proteasome system, which is the natural cellular protein degradation system to break the proteins. There are promising opportunities for research in the field of PROTAC molecules.

- In February 2024, vepdegestrant received FDA Fast Track Designation for the treatment of adult patients with ER+/HER2- locally advanced or metastatic breast cancer that received prior treatment with endocrine-based therapy as a monotherapy.

- In February 2024, Arvinas Announced the first-in-human dosing of ARV-102, an investigational PROTAC protein degrader for neurodegenerative disease. It is designed to cross the blood-brain barrier and target leucine-rich repeat kinase 2 (LRRK2).

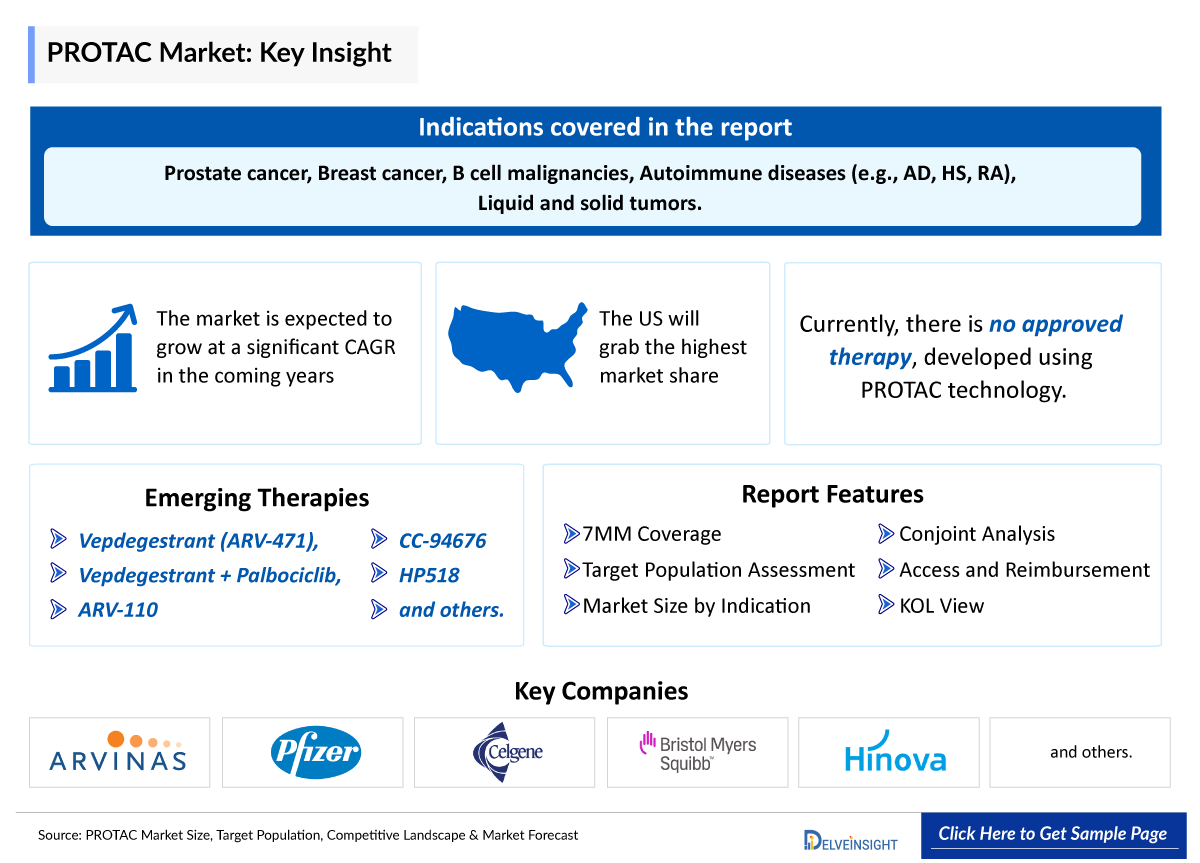

- Pfizer/Arvinas, Celgene/Bristol Myers Squibb, Hinova Pharmaceuticals, and several other companies are currently engaged in the development and production of selective PROTAC which have the potential to significantly impact and enhance the PROTAC market.

DelveInsight’s “ PROTAC Market Forecast, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the PROTAC, historical and forecasted epidemiology, competitive landscape as well as the PROTAC market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The PROTAC market size report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM PROTAC market size from 2024 to 2034. The report also covers current PROTAC treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

Dive into exclusive data with a sample page from our report. Get your sneak peek now @ Protac Market Forecast

PROTAC Market Size Understanding and Treatment Algorithm

PROTAC (PROteolysis TArgeting Chimera) is a drug development technology that is currently garnering significant attention. PROTACs are heterobifunctional molecules that degrade target proteins by hijacking the ubiquitin-proteasome system. Unlike traditional small molecules, PROTACs inhibit the entire biological function of the target protein by binding to it and inducing subsequent proteasomal degradation.

Researchers categorize PROTACs into different types based on their composition and mechanism of action. PROTACs can be classified into three primary types:

- Traditional small-molecule PROTACs: These are heterobifunctional molecules that consist of two covalently linked protein-binding molecules. One of these molecules is capable of engaging an E3 ubiquitin ligase, and the other binds to a target protein meant for degradation.

- BioPROTACs: These are PROTACs composed of peptides or other biological products. They function similarly to traditional small-molecule PROTACs but utilize biological molecules for target protein engagement.

- Hybrid PROTACs: These PROTACs contain both peptide and traditional small-molecule “warheads”. They leverage the advantages of both small molecules and peptides to achieve efficient and selective protein degradation.

This makes the technology about 23 years old as of 2024. In 2013–2014, Yale University licensed the PROTAC Oncology Marekt to Arvinas. By 2019, Arvinas had conducted two PROTAC clinical trials: bavdegalutamide (ARV-110), an androgen receptor degrader, and vepdegestrant (ARV-471), an estrogen receptor degrader.

This technology has since emerged as a paradigm-shifting approach in small molecule drug discovery and has been driving unprecedented innovations in drug development in the past several years. Excitingly, multiple PROTACs are being evaluated in phase I, II, and III clinical trials.

The main advantages of PROTAC are targeted degradation of “unavailable drug targets” such as KRAS, STAT3, etc., overcoming tumor drug resistance, and prolonging the action time. PROTAC can not only affect the enzyme activity function of the protein but also regulate the non-enzyme activity function.

With these advances, PROTAC technology is increasingly poised to lead to new targeted therapies that benefit patients with lung cancer.

|

DRUG NAME* |

TARGET |

INDICATION |

SPONSOR |

|

ARV-110 |

Androgen receptor |

Prostate cancer |

Arvinas |

|

CC-94676 |

Androgen receptor |

Prostate cancer |

BMS |

|

ARV-471 |

Estrogen receptor |

Breast cancer |

Arvinas/Pfizer |

|

AC682 |

Estrogen receptor |

Breast cancer |

Accutar Biotech |

|

NX-2127 |

BTK |

B cell malignancies |

Nurix therapeutics |

|

NX-5948 |

BTK |

B cell malignancies and autoimmune diseases |

Nurix therapeutics |

|

DT2216 |

BCL-xL |

Liquid and solid tumors |

Dialectic Therapeutics |

|

ARV-766 |

Androgen receptor |

Prostate cancer |

Arvinas |

|

KT-474 |

IRAK4 |

Autoimmune diseases (e.g., AD, HS, RA) |

Kymera/Sanofi |

PROTAC Oncology Market Treatment

PROTAC Drug Chapters

PROTAC Oncology Market Emerging Drugs

- ARV-471 (vepdegestrant): Arvinas/Pfizer

- ARV 110 (bavdegalutamide): Arvinas

|

List of Emerging Drugs | |||||

|

Vepdegestrant (ARV-471) |

Arvinas/Pfizer |

ER+/HER2-Breast Cancer

|

PROTAC |

III |

NCT05654623 |

|

Vepdegestrant (ARV-471) + Palbociclib |

Arvinas/Pfizer |

ER+/HER2-Breast Cancer |

PROTAC |

III |

NCT05909397 |

|

ARV-110 |

Arvinas |

Prostate Cancer Metastatic |

PROTAC |

II |

NCT03888612 |

|

CC-94676 (BMS-986365) |

Celgene/BMS |

Advanced Solid Tumor |

PROTAC |

I |

NCT04428788 |

|

HP518 |

Hinova Pharmaceuticals |

Metastatic Castration-resistant Prostate Cancer |

PROTAC |

I |

NCT05252364 |

Note: The emerging drug list is indicative, the full list will be given in the final report.

PROTAC Market Outlook

Targeted Protein Degradation (TPD) is an emerging therapeutic modality with the potential to tackle disease-causing proteins that have historically been highly challenging to target with conventional small molecules.

PROTAC is a type of targeted protein degradation and in the 20 years since the concept of PROTAC molecule harnessing the ubiquitin-proteasome system to degrade a target protein was reported, it has moved from academia to industry, where numerous companies have disclosed programs in preclinical and early clinical development.

Close to 90 protein degradation-based leads are currently under evaluation. Nearly 20% of pipeline drugs are in the clinical phase of development, while the rest are in the preclinical/discovery stage. At present, PROTACs account for more than 30% of the pipeline drugs.

The market for PROTAC is expected to grow significantly in the coming years. This is due to the increasing number of PROTAC-designed drugs that are under clinical trials by various companies. Currently, there is no approved therapy, developed using PROTAC technology.

- In 2019, the first PROTAC molecule ARV-110 entered clinical testing. In 2020, these trials provided the first clinical proof-of-concept for the modality against two well-established cancer targets: the estrogen receptor (ER) and the androgen receptor (AR).

- Currently, Pfizer, in collaboration with Arvinas is testing vepdegestrant in clinical trials as a monotherapy and as in combination therapy with other drugs for the treatment of various diseases such as ER+/HER2-Breast Cancer and others.

- Several key players, including Pfizer/Arvinas, Celgene/BMS, Hinova, and others, are involved in developing drugs for PROTAC for various indications such as ER+/HER2-Breast Cancer, Prostate Cancer Metastatic, Metastatic Castration-resistant Prostate Cancer and others.

- Overall, this is an exciting new class of agents with great potential for development. The maturation of current studies over the next few years will lead to a better understanding of PROTAC molecules and define their role in the therapy of cancer and other diseases.

Request a sample page of our report to understand the market's potential and opportunities @ Protac Market Size

PROTAC Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging PROTAC expected to be launched in the market during 2020–2034.

PROTAC Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for TROPAC market growth over the forecasted period.

Pipeline development activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for PROTAC emerging therapies.

The increasing strategic collaborations among major market players to enhance the growth of their pipeline products are anticipated to drive market expansion. For example, in July 2021, Arvinas and Pfizer announced a global collaboration to develop and commercialize vepdegestrant (investigational, oral PROTAC protein degrader).

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on PROTAC's evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM.

Their opinion helps understand and validate current and emerging therapy treatment patterns or PROTAC market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“Several promising novel agents for hormone receptor-positive breast cancer beyond selective estrogen receptor degraders (SERDs). These include proteolysis-targeting chimeras [PROTACs] like ARV-471 (vepdegestrant) and selective estrogen receptor covalent antagonists (SERCAs) like H3B-6527 which may more potently inhibit estrogen receptor signaling.” |

|

“Data support further development of vepdegestrant, and two ongoing Phase III studies are evaluating the agent in patients with ER-positive/HER2-negative advanced breast cancer.” |

- Many Pharma companies presented the data of their PROTAC during the ASCO GU 2024 conference including Hinova Pharmaceuticals and others. Hinova study’s concluded that HP518 is a novel AR PROTAC degrader and shows favorable safety/tolerability and efficacy signals in unselected mCRPC patients. AR LBD mutations may indicate potential benefit from HP518, warranting further investigation.

- In February 2024, vepdegestrant received FDA Fast Track Designation for the treatment of adult patients with ER+/HER2- locally advanced or metastatic breast cancer that received prior treatment with endocrine-based therapy as a monotherapy.

- In February 2024, Arvinas Announced the first-in-human dosing of ARV-102, an investigational PROTAC protein degrader for neurodegenerative disease. It is designed to cross the blood-brain barrier and target leucine-rich repeat kinase 2 (LRRK2).

- The Protac Market Forecast Report covers a segment of key events, an executive summary, and a descriptive overview of PROTAC, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the PROTAC market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM PROTAC market.

- PROTAC Targeted Patient Pool

- Therapeutic Approaches

- PROTAC Pipeline Analysis

- PROTAC Market Size and Trends

- Existing and future Market Opportunity

- Eleven years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT)

- What was the PROTAC market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for PROTAC?

- Which drug type segment accounts for maximum PROTAC sales?

- What are the pricing variations among different geographies for emerging therapies?

- What are the risks, burdens, and unmet needs of treatment with PROTAC? What will be the growth opportunities across the 7MM for the patient population of PROTAC?

- What are the key factors hampering the growth of the PROTAC market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for PROTAC?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

Reasons to buy the PROTAC Oncology Market Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the PROTAC Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Visit delveinsight latest blogs @ Latest Delveinsight Blogs