Resorbable Vascular Scaffolds Market

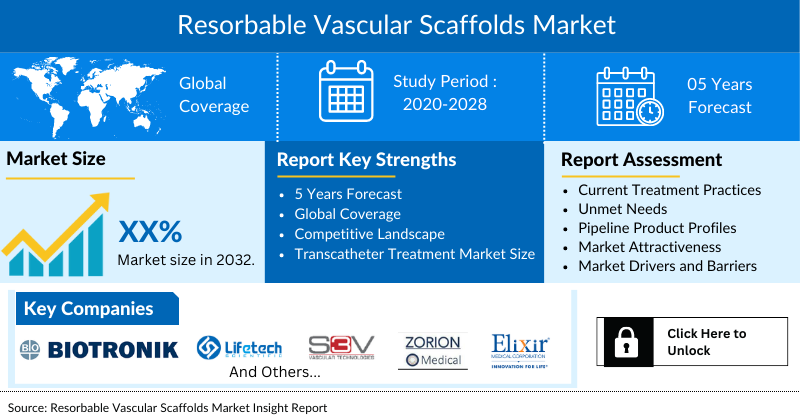

Resorbable Vascular Scaffolds Market by Product Type (Everolimus-Eluting Devices, Sirolimus-Eluting Devices, Novolimus-Eluting Devices, and Paclitaxel-Eluting Devices), Material Type (Polymer-Based Scaffolds and Metal-Based Scaffolds), End-User (Hospitals, Ambulatory Surgical Centers (ASCs), and Specialty Clinics), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the rising prevalence of cardiovascular diseases, technological advancements in scaffold design, rising awareness among physicians and patients, and increase in product development activities across the globe.

The global resorbable vascular scaffolds market is estimated to grow at a CAGR of 5.43% during the forecast period from 2025 to 2032. The rising prevalence of cardiovascular diseases globally has significantly increased the demand for advanced treatment options like resorbable vascular scaffolds. Technological advancements in scaffold design, including the development of bioresorbable materials, enhance the efficacy and safety of these devices, making them a preferred choice among healthcare professionals. Additionally, growing awareness among physicians and patients about the benefits of resorbable vascular scaffolds, such as reduced long-term complications and natural vessel restoration, is driving adoption. Coupled with an increase in product development activities and regulatory approvals, these factors are expected to collectively propel the growth of the resorbable vascular scaffolds market worldwide during the forecast period from 2025 to 2032.

Resorbable Vascular Scaffolds Market Dynamics:

According to the World Heart Federation (2024), approximately 60 million population were affected by atrial fibrillation which was one of the most common types of irregular heartbeat, or arrhythmia. It can increase the risk of blood clots, heart failure, and stroke. Additionally, as per the same source people with atrial fibrillation are 5X times more likely to suffer a stroke.

Furthermore, according to recent data provided by the British Heart Foundation (2024), globally, around 56 million women and 45 million men were stroke survivors. It's estimated that at least 13 million people worldwide live with congenital heart disease, with potentially millions more undiagnosed. Atrial fibrillation increases the risk of thrombus formation, leading to ischemic strokes, and often necessitates interventions to restore and maintain vascular health. Resorbable vascular scaffolds offer an innovative approach to treating arterial blockages associated with AF-related complications. Their ability to provide temporary structural support to vessels and dissolve over time reduces the long-term risks associated with permanent implants, such as inflammation and late stent thrombosis. Additionally, stroke patients often require vascular interventions to address underlying blockages or repair damaged vessels, and resorbable vascular scaffolds are increasingly being recognized for their potential to enhance vascular healing in these scenarios thereby boosting the overall market across the globe.

Additionally, advancements in drug-eluting technologies enable these scaffolds to deliver therapeutic agents effectively during the critical initial healing phase, mitigating risks of restenosis and thrombosis. For example, Abbott's Absorb GT1 Bioresorbable Vascular Scaffold (BVS) is a notable example that integrates drug-eluting technology with advanced procedural imaging. The Absorb scaffold is designed to gradually resorb into the body over approximately three years, while eluting everolimus, an anti-proliferative drug, during the critical early phase to reduce restenosis risk. Additionally, the introduction of real-time imaging techniques, such as optical coherence tomography (OCT), during scaffold implantation further optimizes deployment accuracy, thereby improving clinical outcomes and escalating the overall market.

Moreover, the increase in strategic activities among the key market players is further boosting the market of restorable vascular scaffolds across the globe. For instance, in April 2024, Abbott announced that the U.S. Food and Drug Administration (FDA) had approved the Esprit™ BTK Everolimus Eluting Resorbable Scaffold System (Esprit BTK System), a breakthrough innovation for people with chronic limb-threatening ischemia (CLTI) below-the-knee (BTK). The Esprit BTK System is designed to keep arteries open and deliver a drug (Everolimus) to support vessel healing before completely dissolving.

Thus, the factors mentioned above are expected to boost the overall market of resorbable vascular scaffolds across the globe during the forecast period from 2025 to 2032.

However, the presence of already established alternative products and the occurrence of thrombosis risk from resorbable vascular scaffolds hinder the future market of resorbable vascular scaffolds across the globe during the forecasted period.

Resorbable Vascular Scaffolds Market Segment Analysis:

Resorbable Vascular Scaffolds Market by Product Type (Everolimus-Eluting Devices, Sirolimus-Eluting Devices, Novolimus-Eluting Devices, and Paclitaxel-Eluting Devices), Material Type (Polymer-Based Scaffolds and Metal-Based Scaffolds), End-User (Hospitals, Ambulatory Surgical Centers (ASCs), and Specialty Clinics), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product type segment of the resorbable vascular scaffolds market, the everolimus-eluting devices segment is expected to hold a significant share in 2024. Everolimus-eluting devices are playing a pivotal role in boosting the overall market for resorbable vascular scaffolds by leveraging their unique combination of drug delivery and bioresorbable technology to address critical needs in cardiovascular care. Everolimus, a potent immunosuppressive agent, is widely recognized for its efficacy in preventing restenosis, a common complication in stent-treated vessels. When integrated into resorbable vascular scaffolds, the drug is gradually released to inhibit the proliferation of vascular smooth muscle cells, reducing the risk of restenosis without hindering the natural healing process of the vessel. This targeted drug delivery enhances the long-term efficacy of resorbable vascular scaffolds, making them a preferred choice among interventional cardiologists for complex cases where restenosis risk is high.

Additionally, the bioresorbable nature of these devices eliminates the long-term complications associated with permanent metal stents, such as chronic inflammation, late stent thrombosis, and mechanical interference with future interventions. Everolimus-eluting RVS caters to a growing demand for advanced cardiovascular treatments that not only provide immediate support but also restore the natural functionality of the artery over time. Their use has gained traction among patients and physicians who are increasingly prioritizing minimally invasive and biocompatible solutions. Furthermore, the combination of everolimus-eluting technology with RVS has driven significant innovation and investment in the field, as manufacturers strive to improve scaffold designs, drug formulations, and delivery mechanisms. For instance, in April 2024, Abbott announced that the U.S. Food and Drug Administration (FDA) had approved the Esprit™ BTK Everolimus Eluting Resorbable Scaffold System (Esprit BTK System), a breakthrough innovation for people with chronic limb-threatening ischemia (CLTI) below-the-knee (BTK). The Esprit BTK System was designed to keep arteries open and deliver a drug (Everolimus) to support vessel healing before completely dissolving.

Thus, the factors mentioned above are expected to boost the segment thereby boosting the overall market of resorbable vascular scaffolds across the globe.

|

Report Metrics |

Details |

|

Study Period |

2021 to 2030 |

|

Forecast Period |

2024-2030 |

|

CAGR | |

|

Resorbable Vascular Scaffolds Market |

USD XX million by 2030 |

|

Key Resorbable Vascular Scaffoldss Companies |

S3V Vascular Technologies, BIOTRONIK Group of Companies, Meril Life Sciences Pvt. Ltd., Kyoto Medical Planning Co., Ltd., Zorion Medical, Arterial Remodeling Technologies, LEPU Medical Technology (Beijng) Ltd, Elixir Medical Corporation, Lifetech Scientific, and others |

North America is expected to dominate the overall resorbable vascular scaffolds market:

North America is expected to account for the highest proportion of the resorbable vascular scaffolds market in 2024, out of all regions. The region is anticipated to dominate the overall resorbable vascular scaffolds market due to the high prevalence of cardiovascular diseases, a well-established healthcare infrastructure, and robust adoption of advanced medical technologies. The region benefits from strong research and development activities, substantial funding, and collaborations between academic institutions and manufacturers to drive innovation in resorbable vascular scaffolds. Additionally, increasing awareness among physicians and patients regarding the benefits of bioresorbable scaffolds, along with favorable regulatory support and early adoption of novel therapies, further enhance the market's growth potential in North America.

According to recent data from the Centers for Disease Control and Prevention (2024), approximately 4.9% of adults were diagnosed with coronary heart disease in 2022. Furthermore, by 2023, an estimated 12.1 million individuals in the United States were projected to have atrial fibrillation. Additionally, each year, over 795,000 people in the U.S. experience a stroke, with around 610,000 of these being first-time strokes. Notably, nearly 185,000 of these strokes, or about one in four, occur in individuals who have previously had a stroke. Resorbable vascular scaffolds offer a revolutionary approach in such cases by providing temporary support to the artery while gradually resorbing, leaving no permanent implant behind. This reduces long-term complications such as inflammation or late thrombosis, which are critical concerns in AF and stroke management.

Furthermore, the increasing number of product development activities in the region is further going to accelerate the growth of the resorbable vascular scaffolds market. For instance, in November 2024, R3 Vascular Inc., a medical device company dedicated to developing and providing novel, best-in-class bioresorbable scaffolds for treating peripheral arterial disease (PAD), announced that the U.S. Food and Drug Administration (FDA) granted investigational device exemption (IDE) approval to initiate the ELITE-BTK pivotal trial of its next-generation drug-eluting bioresorbable scaffold, MAGNITUDE®, for below-the-knee pads. By offering a novel, bioresorbable solution with drug-eluting capabilities, MAGNITUDE® could address key challenges in PAD treatment, including restenosis and the long-term risks associated with permanent implants. The successful progression of this trial could drive increased adoption of RVS in clinical settings, potentially opening new avenues for treating vascular diseases. As a result, the approval may instigate greater investment and product development, accelerating the growth of the resorbable vascular scaffolds market globally.

Thus, the above-mentioned factors are expected to escalate the market of resorbable vascular scaffolds in the region.

Resorbable Vascular Scaffolds Market Key Players:

Some of the key market players operating in the resorbable vascular scaffolds market include Abbott, Boston Scientific Corporation, Reva Medical, R3 Vascular Inc., Elixir Medical, BIOTRONIK, Meril Life Sciences, Zeus Industrial Products, Inc., Terumo Corporation, Kyoto Medical, B. Braun Melsungen AG, Zorion Medical Inc., MicroPort Scientific Corporation, Lombard Medical, Inc., Amaranth Medical, Inc. (US), and others.

Recent Developmental Activities in the Resorbable Vascular Scaffolds Market:

- In July 2024, Reflow Medical enrolled the first patients in a pilot study of coronary sirolimus-eluting retrievable scaffold system (spur elute)

- In September 2023, Zeus launched next-generation tubing Absorv™ XSE, for bioresorbable vascular scaffolds.

Key Takeaways From the Resorbable Vascular Scaffolds Market Report Study

- Market size analysis for current resorbable vascular scaffolds size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the resorbable vascular scaffolds market.

- Various opportunities available for the other competitors in the resorbable vascular scaffolds market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current resorbable vascular scaffolds market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for resorbable vascular scaffolds market growth in the coming future?

Target Audience Who Can be Benefited From This Resorbable Vascular Scaffolds Market Report Study

- Resorbable vascular scaffold product providers

- Research organizations and consulting companies

- Resorbable vascular scaffolds -related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in resorbable vascular scaffolds

- Various end-users who want to know more about the resorbable vascular scaffolds market and the latest technological developments in the resorbable vascular scaffolds market.

Frequently Asked Questions for the Resorbable Vascular Scaffolds Market:

1. What are resorbable vascular scaffolds?

- Resorbable Vascular Scaffolds (RVS) are temporary devices implanted into blood vessels to restore blood flow in conditions like cardiovascular or peripheral artery disease. Unlike traditional stents, they dissolve over time, reducing long-term complications and promoting natural vessel healing.

2. What is the market for resorbable vascular scaffolds?

- The global resorbable vascular scaffolds market is estimated to grow at a CAGR of 5.43% during the forecast period from 2025 to 2032.

3. What are the drivers for the global resorbable vascular scaffolds market?

- The rising prevalence of cardiovascular diseases globally has significantly increased the demand for advanced treatment options like resorbable vascular scaffolds. Technological advancements in scaffold design, including the development of bioresorbable materials, enhance the efficacy and safety of these devices, making them a preferred choice among healthcare professionals. Additionally, growing awareness among physicians and patients about the benefits of resorbable vascular scaffolds, such as reduced long-term complications and natural vessel restoration, is driving adoption. Coupled with an increase in product development activities and regulatory approvals, these factors are expected to collectively propel the growth of the resorbable vascular scaffolds market worldwide during the forecast period from 2025 to 2032.

4. Who are the key players operating in the global resorbable vascular scaffolds market?

- Some of the key market players operating in the resorbable vascular scaffolds are Abbott, Boston Scientific Corporation, Reva Medical, R3 Vascular Inc., Elixir Medical, BIOTRONIK, Meril Life Sciences, Zeus Industrial Products, Inc., Terumo Corporation, Kyoto Medical, B. Braun Melsungen AG, Zorion Medical Inc., MicroPort Scientific Corporation, Lombard Medical, Inc., Amaranth Medical, Inc. (US), and others.

5. Which region has the highest share in the global resorbable vascular scaffolds market?

- North America is expected to account for the highest proportion of the resorbable vascular scaffolds market in 2024, out of all regions. The region is anticipated to dominate the overall resorbable vascular scaffolds market due to the high prevalence of cardiovascular diseases, a well-established healthcare infrastructure, and robust adoption of advanced medical technologies. The region benefits from strong research and development activities, substantial funding, and collaborations between academic institutions and manufacturers to drive innovation in resorbable vascular scaffolds. Additionally, increasing awareness among physicians and patients regarding the benefits of bioresorbable scaffolds, along with favorable regulatory support and early adoption of novel therapies, further enhance the market's growth potential in North America.