SERMS Market Forecast

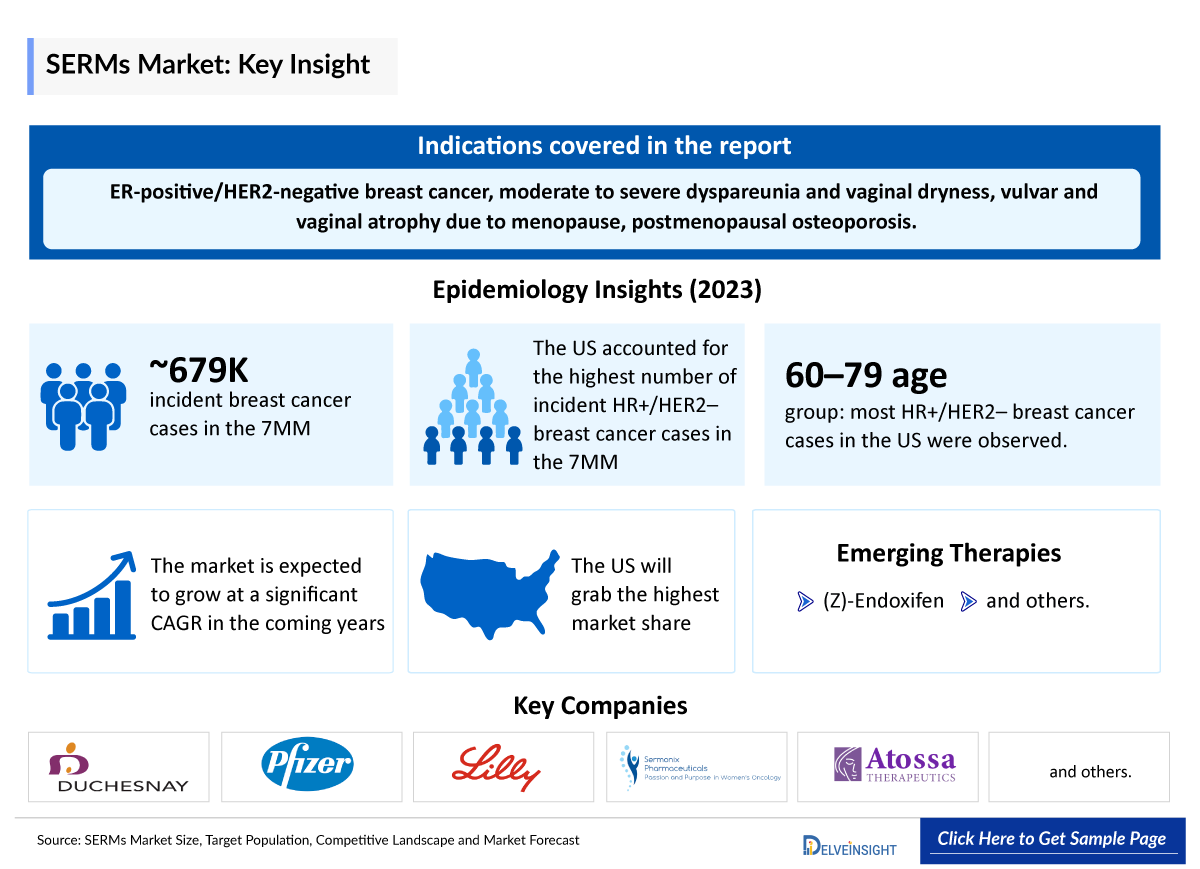

- SERMs, or selective estrogen receptor modulators, are pivotal in treating ER-positive/HER2-negative breast cancer, moderate to severe dyspareunia and vaginal dryness, symptoms of vulvar and vaginal atrophy, due to menopause, prevention of postmenopausal osteoporosis.

- Several companies, including Duchesnay, Pfizer, Eli Lilly, Sermonix Pharmaceuticals, and Atossa Therapeutics, are engaged in the development of SERM.

- Pfizer's combination of conjugated estrogens with bazedoxifene, approved in the US under the brand name DUAVEE and in Europe under the brand name DUAVIVE, effectively addresses moderate to severe vasomotor symptoms linked with menopause and serves as a preventive measure against postmenopausal osteoporosis.

- Lasofoxifene, marketed as FABLYN, received approval from the European Commission in 2009 for the treatment of osteoporosis in postmenopausal women, yet its approval process in the US is still underway, indicating ongoing development efforts.

- In April 2025, Atossa Therapeutics announced that the US Patent and Trademark Office (USPTO) had granted a new patent (US Patent No. 12,275,684) directed to enteric oral formulations comprising (Z)-Endoxifen as well as methods of treating subjects with those oral formulations.

(Z)-endoxifen, a next-generation anti-estrogen, shows best-in-class potential by significantly reducing tumor proliferation and recurrence, positioning Atossa Therapeutics to accelerate its use in earlier-stage breast cancer where unmet need is high. - The development of novel SERMs targeted to the estrogen receptor in recent years has led to significant progress in the identification of therapeutic agents for the management of postmenopausal conditions related to estrogen deficiency, particularly osteoporosis.

- Given the current limitations in the pipeline, it is crucial to prioritize the development of drugs in this class, as they show significant promise in treating breast cancer and postmenopausal osteoporosis, highlighting the need for dedicated efforts in this area.

Don't lag behind. Request a sample report page and discover the insights that will put you ahead of the competition @ SERMS Market Size

DelveInsight’s “SERM – Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the SERM, historical and Competitive Landscape as well as the SERM inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The SERM market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM SERM market size from 2020 to 2034. The report also covers current SERM treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2025-2034 |

|

Geographies Covered |

|

|

SERMs Market |

|

|

SERMs Market Size |

~USD XX Million by 2034 |

|

SERMs Companies |

Duchesnay, Eli Lilly and Company, Pfizer, Atossa Therapeutics, and others. |

|

SERMs Epidemiology Segmentation |

|

SERMS Market Insights Understanding and Treatment Algorithm

SERM Overview

Selective estrogen receptor modulators (SERMs), also known as estrogen receptor agonists/antagonists (ERAAs), are a class of drugs that act on the estrogen receptor (ER). A characteristic that distinguishes these substances from pure estrogen receptor agonists and antagonists (full agonists and silent antagonists) is that their action is different in various tissues, thereby granting the possibility to selectively inhibit or stimulate estrogen-like action in various tissues. The estrogen receptor has two subunits (α and β chains), and SERMs interact with either of these subunits. This interaction results in a certain level of target-site specificity and tissue specificity for SERM action. This differential behavior of SERMs depends on eliciting varying signaling properties from the tissue-specific estrogen receptor, and such effects have profound physiological effects and are not dictated at the DNA level. Regarding bone loss and osteoporosis, the action of SERMs on the estrogen receptor affects bone homeostasis by downregulating the activity of osteoclasts in a transforming growth factor-β3-dependent manner and reducing bone resorption. This effect allows for the prevention and treatment of osteoporosis.

Further details related to country-based variations are provided in the report

SERM Treatment

SERMs are used for various estrogen-related diseases, including the treatment of ovulatory dysfunction in the management of infertility, the treatment and prevention of postmenopausal osteoporosis, the treatment and reduction in risk of breast cancer, and the treatment of dyspareunia due to menopause. SERM is also used in combination with conjugated estrogens, indicated for the treatment of estrogen deficiency symptoms and vasomotor symptoms associated with menopause. SERMs are used depending on their pattern of action in various tissues, Tamoxifen is a first-line hormonal treatment of ER-positive metastatic breast cancer. It is used for breast cancer risk reduction in women at high risk and as an adjuvant treatment of axillary node-negative and node-positive ductal carcinoma in situ. Tamoxifen treatment is also useful in the treatment of bone density and blood lipids in postmenopausal women. Toremifene, a chlorinated tamoxifen derivative, and causes fewer DNA adducts in the liver than seen with tamoxifen in preclinical studies and was developed to avoid hepatic carcinomas. It is used as endocrine therapy in women with ER/PR-positive stage 4 or recurrent metastatic breast cancer and has demonstrated similar efficacy compared to tamoxifen as adjuvant treatment of breast cancer and in the treatment of metastatic breast cancer.

Further details related to country-based variations are provided in the report…

SERMS Market Epidemiology

The SERMs epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases of selected indication for SERM, total eligible patient of selected indication, total treated cases in selected indication for SERMs in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- The total incident cases of breast cancer in the 7MM comprised around 670,500 cases in 2024.

- The total incident cases of HR+/HER2– breast cancer in the 7MM comprised approximately 480,000 cases in 2024.

- Among 7MM, the United States accounts for the highest number of incident cases of HR+/HER2− breast cancer, with approximately 211,580 in 2024.

- Among EU4 and the UK, Germany had the highest incident cases, followed by France of HR+/HER2– breast cancer.

- In the United States, the maximum number of HR+/HER2− breast cancer patients lies in the age group of 60–79 years.

- The overall prevalence of osteoporotic fractures among postmenopausal females was 82.2% (osteoporosis: 37.5% and osteopenia: 44.7%).

- In EU4 and the UK, dyspareunia prevalence was reported as nearly 7.5% in 2024.

- In the US, dyspareunia is estimated to affect 10 to 20% of women in 2024.

SERMS Drugs Market Chapters

The drug chapter segment of the SERM reports encloses a detailed analysis of SERM-marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also helps to understand the SERM’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

SERMS Marketed Drugs

OSPHENA (ospemifene): Duchesnay

OSPHENA, an estrogen agonist/antagonist, is indicated for the treatment of moderate to severe dyspareunia, a symptom of vulvar and vaginal atrophy resulting from menopause. It also addresses moderate to severe vaginal dryness, another symptom of vulvar and vaginal atrophy due to menopause. Initially approved by the US Food and Drug Administration in 2013, OSPHENA was marketed in the US by Shionogi. In 2015, it received approval from the European Commission for distribution in the EU. In 2017, Duchesnay acquired exclusive rights to market and distribute OSPHENA (ospemifene) in the US and Canada from Shionogi.

DUAVEE (conjugated estrogens/bazedoxifene): Pfizer

DUAVEE is a combination of conjugated estrogens with an estrogen agonist/antagonist indicated for the treatment of several conditions in women. These include the treatment of moderate to severe vasomotor symptoms associated with menopause and the prevention of postmenopausal osteoporosis. Marketed under the brand name DUAVEE in the US and DUAVIVE in the EU, this combination was approved for medical use in the United States in October 2013 and in the European Union in December 2014.

|

Comparison of Key Marketed Drugs | ||||

Note: Detailed current therapies assessment will be provided in the full report of SERM.

SERMS Market Emerging Drugs

- (Z)-Endoxifen: Atossa Therapeutics

(Z)-Endoxifen, developed by Atossa Therapeutics, is a nonsteroidal selective estrogen receptor modulator (SERM) of the triphenylethylene group. It is under development for the treatment of estrogen receptor-positive breast cancer. Endoxifen has the potential to work in all three areas of the breast cancer paradigm, to mitigate breast cancer risk (by reducing the density of breast tissue), to reduce the cancer cell activity before surgery, and to reduce the risk of recurrent or new breast cancer after the initial treatment. Currently, it is Phase II. Atossa plans to advance its lead program, (Z)-Endoxifen, to target metastatic breast cancer.

- In April 2025, Atossa Therapeutics announced that the US Patent and Trademark Office (USPTO) had granted a new patent (US Patent No. 12,275,684) directed to enteric oral formulations comprising (Z)-Endoxifen as well as methods of treating subjects with those oral formulations.

- In December 2024, Atossa presented three posters at the San Antonio Breast Cancer Symposium (SABCS) highlighting pharmacokinetic (PK) and tolerability data from the Phase II EVANGELINE trial.

Lasofoxifene: Sermonix Pharmaceuticals

Lasofoxifene is an investigational novel endocrine therapy in clinical development that has demonstrated robust target engagement as an ESR1 antagonist in the breast, particularly in the presence of ESR1 mutations. Lasofoxifene has demonstrated anti-tumor activity as monotherapy and in combination with a CDK4/6 inhibitor in Phase 2 studies and has unique tissue selectivity distinguishing it from other current and investigational endocrine therapies, with beneficial effects seen on vagina and bone in previous clinical studies. Currently, it is Phase II of its development.

- In April 2025, Sermonix Pharmaceuticals and Quantum Leap Healthcare Collaborative today broadly announced that in the Phase II clinical trial evaluating lasofoxifene as a neoadjuvant endocrine therapy in molecularly selected HR+/HER2-, locally advanced breast cancer, the investigational drug was well tolerated and demonstrated promising early activity in suppressing the Ki67 protein in both premenopausal and postmenopausal patients.

- In January 2025, Sermonix Pharmaceuticals announced the publication of an article entitled “Effects of Lasofoxifene Versus Fulvestrant on Vaginal and Vulvar Symptoms in Patients with ESR1-Mutated, ER+/HER2-, Metastatic Breast Cancer from the ELAINE-1 Study,” in the peer-reviewed journal Clinical Breast Cancer.

|

Product |

Note: Detailed emerging therapies assessment will be provided in the final report.

Get access to actionable data and analysis. Request a sample page today and transform your approach with informed decisions @ SERMS Drugs Market

SERM Market Outlook

The market for SERMs is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with cancer, the growing awareness of SERMs, and the increasing number of SERMs that are under clinical trials and filed for approval by various companies.

The market outlook for SERMs in the treatment of breast cancer and postmenopausal osteoporosis appears promising, indicating a notable shift in therapeutic strategies. However, the current pipeline lacks robustness, with few ongoing clinical trials. Notably, Atossa Therapeutics is advancing (Z)-Endoxifen through clinical trials, signaling potential progress in this area. Additionally, Sermonix Pharmaceuticals' FABLYN has gained approval in Europe, though its developmental process in the US is ongoing. Sermonix Pharmaceuticals announced it was granted a US patent that expands its intellectual property portfolio for lasofoxifene, its lead investigational drug. The newly issued patent covers methods for treating aromatase inhibitor (AI)-resistant, estrogen receptor-positive (ER+) breast cancer in the absence of ESR1 mutations. In terms of marketed drugs, there have not been recent approvals; OSPHENA, DUAVEE, EVISTA, and FABLYN were all approved considerably earlier. This suggests a need for further research and development to enhance the landscape of SERMs for breast cancer and osteoporosis treatment.

Several key players, including Atossa Therapeutics, Sermonix Pharmaceuticals, and others are involved in developing drugs for SERMs for various indications such as breast cancer, dyspareunia and vaginal dryness, and others. Overall, this is an exciting new class of agents with great potential for development.

SERM Drugs Market Uptake

This section focuses on the uptake rate of potential approved and emerging SERMs expected to be launched in the market during 2025–2034.

SERM Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for SERMs market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for SERM therapies.

KOL View

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on SERMs' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or SERM market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

SERMS Drugs Market Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

SERMS Market Size Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Request a sample page of our report and see how our insights can drive your business forward. Get started now @ SERMS Market Insights

Key Updates on SERMS Market Size

- In April 2025, Sermonix Pharmaceuticals and Quantum Leap Healthcare Collaborative today broadly announced that in the Phase II clinical trial evaluating lasofoxifene as a neoadjuvant endocrine therapy in molecularly selected HR+/HER2-, locally advanced breast cancer, the investigational drug was well tolerated and demonstrated promising early activity in suppressing the Ki67 protein in both premenopausal and postmenopausal patients.

- In April 2025, Atossa Therapeutics announced that the US Patent and Trademark Office (USPTO) had granted a new patent (US Patent No. 12,275,684) directed to enteric oral formulations comprising (Z)-Endoxifen as well as methods of treating subjects with those oral formulations.

- In December 2024, Atossa presented three posters at the San Antonio Breast Cancer Symposium (SABCS) highlighting pharmacokinetic (PK) and tolerability data from the Phase II EVANGELINE trial.

- In July 2024, Sermonix Pharmaceuticals announced it was granted a US patent that expands its intellectual property portfolio for lasofoxifene, its lead investigational drug. The newly issued patent covers methods for treating aromatase inhibitor (AI)-resistant, estrogen receptor-positive (ER+) breast cancer in the absence of ESR1 mutations.

- In April 2024, Atossa Therapeutics, and Quantum Leap Healthcare Collaborative announced the initiation of a new study to evaluate Atossa’s proprietary (Z)-Endoxifen in combination with abemaciclib (VERZENIO in women with ER+/HER2- breast cancer.

- In March 2024, Atossa Therapeutics announced that the pre-menopausal, ER+/ HER2-, breast cancer patient who received neoadjuvant and adjuvant (Z)-Endoxifen therapy under an FDA-approved "expanded access" program has completed five years of treatment. The patient remains cancer-free and has reported no significant safety or tolerability issues over the course of her treatment.

The abstract list is not exhaustive, will be provided in the final report

Scope of the SERMS Drugs Market Report

- The SERMS Market Insights Report covers a segment of key events, an executive summary, and a descriptive overview of the SERM, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the SERM market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM SERM market.

SERM Report Insights

- SERM Targeted Patient Pool

- Therapeutic Approaches

- SERM Pipeline Analysis

- SERM Market Size and Trends

- Existing and future Market Opportunity

SERM Report Key Strengths

- Eleven years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

SERM Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the SERMS market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for SERMs?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape has for SERMs evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with SERMs? What will be the growth opportunities across the 7MM for the patient population of SERMs?

- What are the key factors hampering the growth of the SERM market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for SERMs?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy the SERMS Market Insights Report

- The SERMS Market Insights report will help develop business strategies by understanding the latest trends and changing dynamics driving the SERM Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Visit delveinsight latest blogs @ Latest Delveinsight Blogs