Smart Medical Devices Market Summary

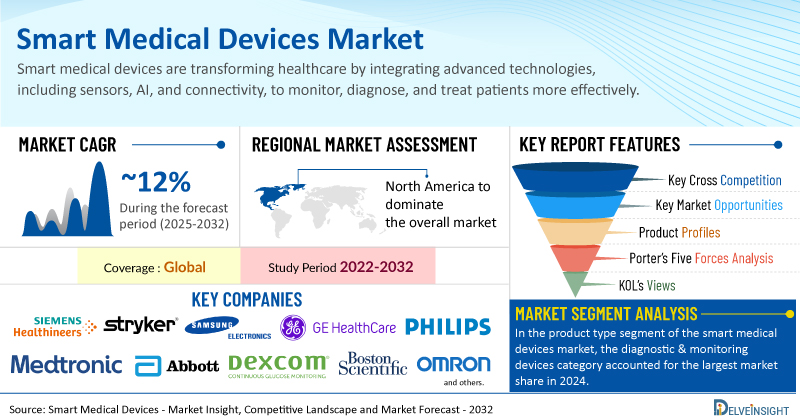

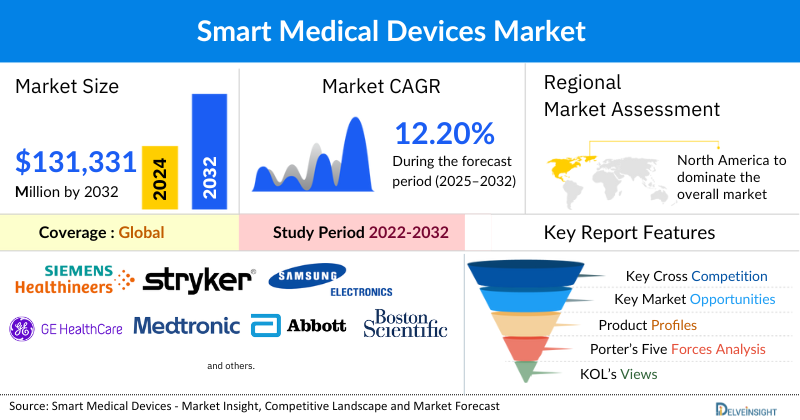

- The global smart medical devices market is expected to increase from USD 52,736.23 million in 2024 to USD 131,331.58 million by 2032, reflecting strong and sustained growth.

- The global smart medical devices market is growing at a CAGR of 12.20% during the forecast period from 2025 to 2032.

- The global smart medical devices market is growing due to the rising prevalence of chronic diseases and an aging population, which is increasing the demand for continuous health monitoring. This trend is fueled by rapid technological advancements in AI and IoT, enabling more accessible and affordable remote patient care. These innovations are driving a shift from traditional healthcare to a more proactive, home-based model, offering greater convenience and personalized treatment options.

- The leading companies operating in the smart medical devices market include Siemens Healthineers, Stryker, Samsung Electronics Co., Ltd., GE HealthCare, Koninklijke Philips N.V., Medtronic, Abbott Laboratories, Dexcom, Inc., Boston Scientific Corporation, OMRON Corporation, Apple Inc., B. Braun, iRhythm Technologies, Inc., Fresenius Kabi AG, Vital Connect, Inc., Masimo Corporation, Insulet Corporation, Zoll Medical Corporation, ResMed, F. Hoffmann-La Roche Ltd, Ypsomed, and Others.

- The North America smart medical devices market is dominating the global landscape due to several key factors. The region boasts a highly developed healthcare infrastructure and a strong emphasis on technological innovation. Favorable government regulations and reimbursement policies, particularly in the United States, encourage the adoption of digital health solutions like remote patient monitoring. Additionally, the presence of major industry players, coupled with high consumer awareness and a willingness to embrace new technologies, drives significant investment in research and development. This environment, combined with the rising prevalence of chronic diseases among a large, aging population, solidifies North America's leading position.

- In the product type segment of the smart medical devices market, the diagnostic & monitoring devices category is estimated to account for the largest market share in 2024.

Request for unlocking the report of the @Smart Medical Devices Market

Request for unlocking the report of the @Smart Medical Devices Market

Factors Contributing to the Growth of the Smart Medical Devices Market

- Rising prevalence of chronic diseases and aging population leading to a surge in the smart medical devices market: The increasing incidence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders is a major market driver. These conditions require continuous monitoring and long-term management. Smart medical devices offer a solution by providing a constant stream of data on vital signs like heart rate, blood pressure, and blood glucose, enabling:

-

- Chronic Disease Management: Conditions like diabetes, cardiovascular diseases, and respiratory disorders require continuous monitoring. Smart devices such as continuous glucose monitors (CGMs), smart blood pressure monitors, and connected inhalers enable patients to manage their conditions effectively from home, reducing the need for frequent hospital visits.

- Growing Geriatric Population: As the global population ages, there is an increased need for healthcare solutions that can help manage age-related health issues. Smart medical devices empower older adults to maintain their independence and receive care in the comfort of their own homes.

- Shift Towards Remote Patient Monitoring and Home Healthcare: Healthcare systems are moving away from traditional in-clinic care models towards more convenient and cost-effective remote options. This shift has been significantly accelerated by events like the COVID-19 pandemic. Smart devices are at the heart of this trend, enabling:

-

- Remote Patient Monitoring (RPM): Healthcare providers can monitor patients' health data from a distance, allowing for timely interventions and reducing the need for frequent hospital visits or readmissions.

- Telehealth and Telemedicine: Data from smarts can be seamlessly integrated into telehealth platforms, providing a more comprehensive view of a patient's health during virtual consultations.

- Increased convenience and accessibility: Patients, especially those in rural areas or with limited mobility, can receive quality care without the logistical challenges of traveling to a clinic.

- Advancement in Technology: Continuous innovation in hardware and software is making smart medical devices more accurate, reliable, and user-friendly. Key technological advancements include:

-

- Internet of Medical Things (IoMT) and Connectivity: The widespread adoption of IoMT allows smart medical devices to connect and share data seamlessly. This connectivity, powered by technologies like Bluetooth, Wi-Fi, and 5G, enables real-time monitoring and remote patient care.

-

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms are making devices smarter and more effective. They can analyze vast amounts of patient data to provide more accurate diagnostics, predict health events, and personalize treatment plans. AI-enabled devices are used for everything from analyzing medical images to assisting with robotic surgery.

- Miniaturization and Improved Sensor Technology: Advances in sensor technology and micro-electronics have led to the creation of smaller, more comfortable, and highly accurate wearable and implantable devices. This makes continuous monitoring less intrusive and more widely accepted by patients.

- Big Data and Predictive Analytics: Smart medical devices generate massive amounts of data. The ability to collect, analyze, and interpret this "big data" allows healthcare providers to identify trends, improve population health management, and develop more effective treatments.

Smart Medical Devices Market Report Segmentation

This smart medical devices market report offers a comprehensive overview of the global smart medical devices market, highlighting key trends, growth drivers, challenges, and opportunities. It covers detailed market segmentation by Device Type [Diagnostic & Monitoring Devices (Vital Sign Monitoring Devices, Blood Glucose Monitors, Cardiac Monitoring Devices, Respiratory Monitoring Devices, and Others), Therapeutic Devices (Drug Delivery Devices, Implantable Therapeutic Devices, Connected Therapy Devices, Neuromodulation & Pain Management Devices, Rehabilitation & Assistive Devices, and Others)], Product Type (Wearables, Implantables, Portable/point-of-care devices, Stationary/bedside devices, and Others), Application (General Health and Fitness, Remote Patient Monitoring, Diagnostics, Therapeutics, and Home Healthcare), End-Users (Hospitals & Clinics, Ambulatory Surgical Centers, Diagnostic Centers, Home Healthcare, and Others), and Geography. The report provides valuable insights into the competitive landscape, regulatory environment, and market dynamics across major markets, including North America, Europe, and Asia-Pacific. Featuring in-depth profiles of leading industry players and recent product innovations, this report equips businesses with essential data to identify market potential, develop strategic plans, and capitalize on emerging opportunities in the rapidly growing smart medical devices market.

Smart medical devices are a transformative category of healthcare tools that represent a significant evolution from traditional medical equipment. They are a critical component of the Internet of Medical Things (IoMT), an interconnected ecosystem of medical devices, software, and health services that work together to improve patient care, diagnosis, and treatment. Unlike conventional devices that operate in isolation, smart medical devices are intelligent, connected, and data-driven, allowing for more proactive, personalized, and efficient healthcare. They differ from conventional devices by integrating features such as Sensors and Actuators, Wireless Connectivity, Data Analytics and Artificial Intelligence (AI), Integration with Health Information Systems, and User Interface.

The global smart medical devices market is experiencing significant growth driven by a combination of factors. The rising prevalence of chronic diseases and the rapidly aging global population are creating a higher demand for continuous monitoring and personalized care solutions. Simultaneously, rapid advancements in digital health technologies, including the Internet of Things (IoT), artificial intelligence (AI), and improved wireless connectivity, are making these devices more effective and accessible. This technological convergence enables a shift towards remote patient monitoring and telemedicine, which offers greater convenience, reduces healthcare costs, and empowers patients to take a more active role in managing their own health from the comfort of their homes.

Get More Insights into the Report @Smart Medical Devices Market

What are the latest Smart Medical Devices Market Dynamics and Trends?

The smart medical devices market is experiencing rapid growth driven by a combination of technological advancements, demographic shifts, and changing healthcare priorities. The convergence of these factors is transforming healthcare from a reactive, hospital-centric model to a proactive, personalized, and patient-focused system.

The global smart medical devices market is undergoing rapid transformation as miniaturized MEMS sensors, AI-driven analytics, and ubiquitous high-speed connectivity converge to shift healthcare from episodic interventions to continuous monitoring and therapy.

Technological Progress as a Growth Catalyst

Advances in Micro-Electro-Mechanical Systems (MEMS) have enabled the development of compact, wearable, and implantable devices that measure a broad spectrum of vital signs, from continuous glucose monitoring (CGM) and high-resolution ECG recordings to sleep quality and respiratory function. These hardware breakthroughs are being amplified by artificial intelligence (AI) and machine learning (ML), which transform raw sensor data into predictive, actionable insights. For instance, AI can flag early signs of atrial fibrillation or forecast hypoglycemic episodes, enabling earlier clinical interventions and improving patient safety.

The rollout of 5G and modern mobile broadband further enhances the utility of smart medical devices, providing low-latency, high-bandwidth communication essential for real-time remote patient monitoring (RPM) and cloud-based analytics. According to GSMA, nearly one-third of global mobile connections will be 5G by 2025, making continuous RPM viable at scale. In the U.S., the RPM user base is projected to surpass 71 million (~26% of the population) by 2025, with DelveInsight estimating hospital readmissions could be reduced by up to 75% when digital monitoring is integrated into chronic-care pathways.

Demand Drivers: Rising Chronic Disease Burden

This surge in adoption is not merely a technology trend but a direct response to the escalating prevalence of chronic and lifestyle-related conditions.

· Diabetes: 589 million adults in 2024, projected to reach 853 million by 2050.

· Hypertension: 1.3 billion individuals, with poor management rates.

· Atrial fibrillation: 53-59 million patients worldwide, a growing cardiovascular threat.

· Sleep disorders: Up to 936 million adults are affected by obstructive sleep apnea, many undiagnosed.

These conditions highlight the urgent need for smart diagnostic and therapeutic devices that enable continuous management, early detection, and personalized interventions.

Despite exponential growth, several challenges constrain the market’s full potential:

· Data security & privacy risks: Smart devices collect sensitive health data, making them prime targets for cyberattacks. The absence of harmonized global regulations for health data governance undermines consumer trust.

· Affordability & reimbursement gaps: Clinical-grade devices remain costly, and inconsistent reimbursement frameworks limit accessibility in both developed and emerging markets.

· Technical limitations: Sensor accuracy may be affected by motion artifacts, skin pigmentation, or environmental noise; battery life constraints hinder compliance for continuous monitoring devices.

· Regulatory fragmentation: Divergent approval timelines, inconsistent safety standards, and a lack of interoperability standards delay commercialization and integration into healthcare ecosystems.

Overall, the smart medical devices market is positioned as a cornerstone of decentralized, preventive, and personalized healthcare. While technical advancements and clinical adoption trends are expected to accelerate penetration, resolving affordability, regulatory, and interoperability challenges will be critical to unlocking the next wave of large-scale adoption.

Smart Medical Devices Market Segment Analysis

Smart Medical Devices Market by Device Type [Diagnostic & Monitoring Devices (Vital Sign Monitoring Devices, Blood Glucose Monitors, Cardiac Monitoring Devices, Respiratory Monitoring Devices, and Others), Therapeutic Devices (Drug Delivery Devices, Implantable Therapeutic Devices, Connected Therapy Devices, Neuromodulation & Pain Management Devices, Rehabilitation & Assistive Devices, and Others)], Product Type (Wearables, Implantables, Portable/point-of-care devices, Stationary/bedside devices, and Others), Application (General Health and Fitness, Remote Patient Monitoring, Diagnostics, Therapeutics, and Home Healthcare), End-Users (Hospitals & Clinics, Ambulatory Surgical Centers, Diagnostic Centers, Home Healthcare, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

By Device Type: Diagnostic & Monitoring Devices, the Market Leader

Diagnostic and monitoring devices are the key drivers of the global smart medical devices market, currently holding a dominant share of 65% in 2024. This is primarily fueled by the widespread adoption of wearables and remote patient monitoring (RPM) systems, which include popular at-home devices like continuous glucose monitors (CGMs), wearable ECG patches, and oximeters. These devices have gained immense traction due to their high unit volumes, lower costs, and streamlined regulatory approval processes, making them accessible to a broad spectrum of users in both consumer and clinical environments.

The dominance of this segment is rooted in its ability to address some of the most critical challenges in modern healthcare. By providing a continuous stream of real-time, actionable data, these devices are essential for managing long-term chronic conditions such as diabetes and cardiovascular diseases. This constant data flow empowers both patients and healthcare providers to track health trends, make informed treatment decisions, and intervene proactively, fundamentally shifting the healthcare model from reactive to preventive. Furthermore, the global trend towards telehealth and RPM, which was accelerated by recent global health crises, has made these at-home tools indispensable by offering a convenient, cost-effective alternative to frequent and expensive hospital visits. This not only reduces the overall burden on the healthcare system but also significantly improves patient outcomes and quality of life. The synergy of medical necessity, technological innovation, and consumer convenience, often driven by the widespread use of smartwatches and fitness trackers with medical-grade features, has solidified the leading position of diagnostic and monitoring devices in the market.

Recent product launches exemplify this trend. For instance, Abbott's launch of the FreeStyle Libre 2 Plus CGM system offers one-minute glucose readings and customizable alarms, empowering millions of people with diabetes to monitor their status in real time. Similarly, the approval and launch of Dexcom's G6 continuous glucose monitoring system in Singapore marked a significant expansion of access to this technology in Southeast Asia. In Europe, Wellysis's S-Patch Ex, a wearable ECG patch with both EU and U.S. FDA clearance, is being distributed to multiple countries, bringing clinical-grade cardiac monitoring into a convenient wearable form factor. These launches highlight how ongoing advances in sensor precision, less-invasive technology, and supportive regulatory approvals are enabling diagnostic devices to spread rapidly across homes and clinics, reinforcing their market leadership.

By Product Type: Wearables Category Dominates the Market

Wearable devices, which include smartwatches, fitness trackers, biosensors, and adhesive patches, already held the largest share 47% in 2024, thanks to their mass adoption for consumer health, fitness, and clinical monitoring applications. Their transition from niche medical gear to mainstream must-haves has been solidified by companies like Apple and Samsung embedding medical-grade features such as ECG and SpO₂ monitoring into their flagship smartwatch lines, making health tracking part of daily routines. Their dominance is further underscored by recent product breakthroughs; for instance, Dexcom’s G7 15-Day CGM system was cleared by the FDA in April 2025, extending sensor wear time and improving convenience for users. In India, Abbott launched the FreeStyle Libre 2 Plus in August 2025, which sends real-time glucose data every minute, without manual scanning, with up to 15 days of wearable use.

These product approvals reflect accelerating innovation in sensor accuracy, wear duration, and connectivity. Together with improvements in battery life, miniaturization, seamless smartphone integration, and regulatory boosts (e.g., approvals of more wearable medical devices), wearables are becoming more accurate, comfortable, and user-friendly. All this underpins their leading position in the smart medical devices market, particularly for remote patient monitoring and chronic-condition management, as patients and payers push for preventive care and less frequent hospital visits.

By End-Users: Hospitals Dominate the Market

Hospitals & Clinics dominate the global smart medical devices market with an estimated 43% share in 2024, owing to their central role in delivering both acute and chronic care with the highest level of clinical accuracy and reliability. They serve as the primary sites for deploying advanced smart medical technologies such as connected infusion pumps, wearable ECG monitoring systems, and bedside telemetry devices, which require integration with electronic health records (EHRs) and centralized data management systems. Hospitals also benefit from larger budgets, better reimbursement coverage, and the need to comply with stringent regulatory standards, making them early adopters of innovative diagnostic and therapeutic devices. The increasing global burden of chronic diseases, such as the 1.3 billion people living with hypertension and 589 million with diabetes as of 2024, further cements hospitals’ position as the dominant end user segment, as they are best equipped to handle complex cases that demand continuous, multi-parameter monitoring and advanced intervention.

Smart Medical Devices Market Regional Analysis

North America Smart Medical Devices Market Trends

North America, led by the U.S., accounted for a dominant ~43% share of the global smart medical devices market in 2024. This dominance is driven by a combination of a well-established healthcare system, high healthcare expenditure, and a strong presence of key industry players. The market is not only growing in size, but also evolving in its application and underlying technology.

The key trends shaping the North American smart medical devices market:

Shift to Wearables and Remote Patient Monitoring: The market is heavily influenced by the rise of wearable medical devices, such as smartwatches, fitness trackers, and continuous glucose monitors (CGMs). These devices are becoming mainstream tools for both consumers and clinicians, allowing for real-time monitoring and proactive health management. The trend of remote patient monitoring (RPM) has accelerated, allowing healthcare providers to continuously track patients with chronic diseases (like diabetes and cardiovascular conditions) from the comfort of their homes. This shift is reducing hospital visits, lowering healthcare costs, and improving patient outcomes. The US, in particular, is a leader in this area, with favorable reimbursement policies and a large pool of patients who need continuous monitoring.

Integration of AI and IoT: The next generation of smart medical devices in North America is defined by the integration of Artificial Intelligence (AI) and the Internet of Medical Things (IoMT). AI algorithms are used to analyze the vast amounts of data collected by these devices, providing predictive analytics and personalized health insights. This allows for early disease detection and more precise treatment plans. The IoMT framework connects various devices, enabling a seamless flow of data between patients, clinicians, and hospital systems. This enhanced connectivity is improving the efficiency of healthcare operations and fostering a more integrated healthcare ecosystem.

Focus on Therapeutic Devices: While diagnostic and monitoring devices are currently dominant, the therapeutic segment is poised for significant growth. This category includes smart insulin pumps, neurostimulation devices, and connected inhalers. The trend is towards developing smart therapeutic devices that not only administer treatment but also collect data on their effectiveness and a patient's response. For example, smart inhalers for asthma or COPD can track usage patterns and provide data to doctors to optimize treatment. This focus on connected therapeutic solutions is a key area of investment and innovation for major players in the region.

Strong Regulatory Environment and Strategic Collaborations: The North American market, particularly the US, is characterized by a strong and evolving regulatory framework. The FDA's push for "Software as a Medical Device" (SaMD) guidelines and its support for innovative technologies are enabling new products to enter the market more quickly. Major industry players like Medtronic, Abbott, and Johnson & Johnson are actively engaged in strategic collaborations, mergers, and acquisitions to expand their product portfolios and technological capabilities. These partnerships, often between medical device companies and tech giants like Apple and Google, are driving innovation and market expansion.

Overall, the North American smart medical devices market is defined by a rapid move towards a more decentralized, data-driven, and patient-centric healthcare model. It is a dynamic market where technology is not just an add-on but a fundamental component of healthcare delivery

Europe Smart Medical Devices Market Trends

The European smart medical devices market is a major global player, characterized by a unique set of trends driven by its established healthcare systems and distinct regulatory environment. While it shares the global trends of increasing adoption of wearables and a focus on remote patient monitoring, the European market is particularly influenced by its stringent Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR). These regulations, which were designed to enhance patient safety and product performance, have created a complex landscape for manufacturers but have also fostered a reputation for high-quality, reliable devices. The market is seeing a notable surge in the therapeutic devices segment, including smart insulin pumps and neurostimulation devices, as it shifts towards integrated, data-driven treatment solutions. This is supported by Europe's aging population and the high prevalence of chronic diseases, which are creating a strong demand for technologies that enable continuous management of conditions outside of traditional clinical settings. Furthermore, while offline distribution channels like pharmacies and hospitals remain dominant, the market is experiencing rapid growth in online sales, driven by the expansion of telehealth and a rising consumer preference for at-home care.

Asia-Pacific Smart Medical Devices Market Trends

The Asia-Pacific smart medical devices market is experiencing rapid growth, driven by a confluence of demographic, economic, and technological factors. A key trend is the region's aging population, particularly in countries like Japan and China, and the rising prevalence of chronic diseases, which are increasing the demand for cost-effective, long-term care solutions. This has led to a surge in the adoption of wearable devices and home-based monitoring systems, as they empower patients to manage their conditions remotely and reduce the burden on overstretched healthcare facilities. The market is also benefiting from increased healthcare spending, particularly in emerging economies like India and China, and a growing middle class with rising disposable incomes. Technologically, the integration of AI, IoT, and big data analytics is accelerating the development of more sophisticated and personalized smart devices. While North America and Europe have a more established market for high-end, complex devices, the Asia-Pacific region is a leader in the volume and affordability of smart medical devices, with a focus on a more decentralized and patient-centric healthcare model. Finally, the diverse and evolving regulatory landscape across the region, while posing a challenge, is also encouraging local innovation and the development of solutions tailored to specific national markets.

Who are the major players in the Smart Medical Devices Market?

The following are the leading companies in the Smart Medical Devices market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens Healthineers

- Stryker

- Samsung Electronics Co., Ltd.

- GE HealthCare

- Koninklijke Philips N.V.

- Medtronic

- Abbott Laboratories

- Dexcom, Inc.

- Boston Scientific Corporation

- OMRON Corporation

- Apple Inc.

- B. Braun

- iRhythm Technologies, Inc.

- Fresenius Kabi AG

- Vital Connect, Inc.

- Masimo Corporation

- Insulet Corporation

- Zoll Medical Corporation

- ResMed

- F. Hoffmann-La Roche Ltd

- Ypsomed

- Others

How is the competitive landscape shaping the Smart Medical Devices Market?

The competitive landscape of the smart medical devices market is best described as a moderately concentrated oligopoly with a significant influx of new entrants. Established medical technology giants like Medtronic, Abbott Laboratories, and Johnson & Johnson hold a dominant market share, particularly in high-value, complex devices like implantables and advanced surgical systems. Their strength lies in a massive installed base, deep R&D budgets, and well-established regulatory pathways. However, the market is not a closed ecosystem. It's becoming increasingly competitive due to the entry of tech-focused companies like Apple and Samsung, which have leveraged their consumer electronics expertise to capture the rapidly expanding market for wearable diagnostic and monitoring devices. This influx of new players, including a host of agile startups, is fueling innovation, especially in software-as-a-medical-device (SaMD) solutions and specialized health tracking applications. The resulting landscape is a dynamic one where traditional MedTech leaders are competing fiercely with technology giants and niche innovators, driving down costs and accelerating the pace of innovation across the board.

Recent Developmental Activities in the Smart Medical Devices Market

- In September 2025, B. Braun acquired True Digital Surgery, a company specializing in digital robotic-assisted 3D surgical microscopy. This move reinforces B. Braun's commitment to digital microsurgery.

- In May 2025, Medicalgorithmics S.A. received FDA clearance for DeepRhythmAI, a cardiovascular device, further highlighting the growing use of AI in cardiac monitoring and diagnostics.

- In May 2025, Masimo Corporation received FDA 510(k) clearance for its Masimo W1 watch. This approval expanded the watch's indications to include continuous and spot-check measurements of heart rate and oxygen saturation (SpO2), making it a viable option for a range of clinical settings.

- In April 2025, WHOOP, Inc. obtained FDA clearance for its WHOOP ECG feature. This clearance validates the feature's ability to provide a single-lead electrocardiogram, enabling it to detect and provide notifications for certain heart rhythm irregularities. This approval represents a significant step for a consumer-grade device moving into a more medical-focused space.

- In April 2025, VitalConnect, Inc. received FDA 510(k) clearance for its VitalRhythm biosensor. The approval validates the device's ability to continuously monitor and record an ECG, heart rate, and respiratory rate, enhancing its utility for remote patient monitoring.

- In September 2024, Siemens Healthineers received FDA clearance for its Sleep Apnea Notification Feature (SANF) on the Apple Watch. This feature analyzes sleep data to provide a notification if a user's sleep patterns suggest a potential for sleep apnea, encouraging them to seek a professional diagnosis.

- In June 2024, Abbott received FDA clearance for its Libre Rio CGM System. This over-the-counter continuous glucose monitor is the first of its kind, specifically cleared for adults with Type 2 diabetes who do not use insulin. This marks a major shift in making medical-grade glucose monitoring accessible without a prescription.

- In May 2024, Dexcom received FDA clearance for its Stelo CGM System. Similar to Abbott's product, the Stelo is a prescription-free CGM aimed at non-insulin-dependent adults with diabetes, broadening the market for continuous glucose monitoring.

- In May 2024, Huawei received CE Mark certification in the European Union for its Huawei Watch D. The device is cleared as a medical device for blood pressure monitoring and ECG analysis, marking a significant step for the Chinese tech giant in expanding its health-focused smart products in the European market.

In May 2024, Huawei received CE Mark certification in the European Union for its Huawei Watch D. The device is cleared as a medical device for blood pressure monitoring and ECG analysis, marking a significant step for the Chinese tech giant in expanding its health-focused smart products in the European market.

| Category | Highlights (2022–2025) |

|---|---|

| Product Launches | - Dexcom G7 (2022, EU & US) launched as next-gen continuous glucose monitor; in 2025 upgraded to 15.5-day wear. - Abbott’s FreeStyle Libre 3 global expansion (2023–2024). - Nanoleaf LED Light Therapy Mask launched at CES 2025 (FDA Class II). - Apple Watch health upgrades (2022–2024) including irregular rhythm notifications & non-invasive health sensors. |

| Regulatory Approvals | - CooperVision DreamLite® Ortho-K lenses EU approval (2021 baseline). - Multiple AI-enabled diagnostic tools approved by FDA in 2025 (Aidoc, Hyperfine, Roche). - FDA approval for ring-shaped pulse oximeter for sleep apnea monitoring (May 2025). - Dexcom G7 15-day CGM FDA clearance (Apr 2025). |

| Partnerships | - Medtronic + Nvidia (2023) partnership for AI-assisted surgical platforms. - Google & Fitbit integration in clinical research collaborations (2022–2023). - Philips & Masimo collaborations in patient monitoring ecosystems (2024). |

| Acquisitions | - Abbott’s acquisition of Walk Vascular (2022) to strengthen cardiovascular device pipeline. - Siemens Healthineers completed acquisition of Varian (2022) expanding smart oncology solutions. - GE Healthcare acquiring AI-health startups (2023–2024) to boost smart imaging. |

| Company Strategy | - Big tech (Apple, Google, Amazon) advancing into digital health ecosystems with wearable integration. - Medtronic pivoting to AI-driven smart devices in surgery & diabetes care. - Dexcom expanding wear duration & integration with insulin pumps (2024–2025). |

| Setbacks | - Philips CPAP & ventilator recall continued into 2022–2023, impacting brand trust. - Cybersecurity vulnerabilities flagged in connected insulin pumps (2023). - FDA rejections/delays for some AI-based cardiac monitoring devices (2024). |

| Emerging Technology | - AI-integrated imaging & diagnostics (FDA wave of approvals in 2025). - Non-invasive glucose monitoring prototypes (Apple, Samsung, startup pipelines 2023–2025). - Smart rings for continuous health monitoring (Oura, Movano, 2023–2025). - Wearable patches for multi-sensor vitals tracking (2024). - Cybersecure cloud-connected devices emphasized in 2025 regulatory agendas. |

Smart Medical Devices Market Segmentation

- Smart Medical Devices by Device Type Exposure

-

- Diagnostic & Monitoring Devices

§ Vital Sign Monitoring Devices

§ Blood Glucose Monitors

§ Cardiac Monitoring Devices

§ Respiratory Monitoring Devices

§ Others

-

- Therapeutic Devices

§ Drug Delivery Devices

§ Implantable Therapeutic Devices

§ Connected Therapy Devices

§ Neuromodulation & Pain Management Devices

§ Rehabilitation & Assistive Devices

§ Others

- Smart Medical Devices by Product Type Exposure

-

- Wearables

- Implantables

- Portable/point-of-care devices

- Stationary/bedside devices

- Others

- Smart Medical Devices Application Exposure

-

- General Health and Fitness

- Remote Patient Monitoring

- Diagnostics

- Therapeutics

- Home Healthcare

- Smart Medical Devices End-Users Exposure

-

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

- Home Healthcare

- Others

- Smart Medical Devices Geography Exposure

-

- North America Smart Medical Devices Market

§ United States Smart Medical Devices Market

§ Canada Smart Medical Devices Market

§ Mexico Smart Medical Devices Market

-

- Europe Smart Medical Devices Market

§ United Kingdom Smart Medical Devices Market

§ Germany Smart Medical Devices Market

§ France Smart Medical Devices Market

§ Italy Smart Medical Devices Market

§ Spain Smart Medical Devices Market

§ Rest of Europe Smart Medical Devices Market

-

- Asia-Pacific Smart Medical Devices Market

§ China Smart Medical Devices Market

§ Japan Smart Medical Devices Market

§ India Smart Medical Devices Market

§ Australia Smart Medical Devices Market

§ South Korea Smart Medical Devices Market

§ Rest of Asia-Pacific Smart Medical Devices Market

-

- Rest of the World Smart Medical Devices Market

§ South America Smart Medical Devices Market

§ Middle East Smart Medical Devices Market

§ Africa Smart Medical Devices Market

Startup Funding & Investment Trends in Smart Medical Devices

| Company Name | Total Funding | Main Products / Focus | Stage of Development | Core Technology |

|---|---|---|---|---|

| Butterfly Network | US $530 million | Smartphone-connected portable ultrasound devices | Growth / Late-stage | Handheld imaging hardware + AI-enabled diagnostics |

| Enable Injections | US $347 million | Wearable bolus injection systems for drugs | Growth / Late-stage | Drug delivery devices (reconstitution + injection) |

| eXo Imaging | US $307.6 million | High-performance handheld ultrasound with AI for imaging & therapy | Growth / Late-stage | Ultrasound imaging + AI-enhanced processing |

| Glooko | US $301 million | Diabetes management platform | Growth / Late-stage | Data integration, remote monitoring software |

| Oura Health | US $223.3 million (total) | Smart rings for sleep and health tracking | Late-stage / Pre-IPO | Wearable sensors + biometric analytics |

| Eko Health / Eko | US $169–173 million | AI-enabled digital stethoscopes and heart/lung diagnostics | Growth / Late-stage | Acoustic sensors + AI murmur/ECG analysis |

| Eight Sleep | ~US $162 million total | Smart mattress/sleep tracker (Pod) | Growth / Late-stage | Sleep tracking + thermal regulation + AI agent |

| Scopio Labs | US $52 million (Series D) | AI-powered automated blood analyzer (CBM) | Growth-stage (Series D extension) | High-resolution imaging + AI blood smear analysis |

| Biofourmis | US $463.6 million | AI-driven personalized health monitoring (chronic care) | Growth / Late-stage | Predictive analytics + wearable RPM platforms |

| Forward Health | US $325 million | Intelligent remote health clinics (integrated biometrics) | Growth / Late-stage | Remote clinic devices + biometrics + AI analytics |

| Sully.ai | US $13–25 million | “AI Medical Employees” (scribe, triage, receptionist) | Seed to Series A | NLP-based clinical documentation automation |

| Quibim | US $50 million (Series A) | AI-based imaging biomarkers (e.g., prostate MRI AI) | Early growth (Series A) | Radiomics + AI image analysis |

| LightHearted AI Health | US $3 million | Laser-based home cardiology diagnostics | Early-stage | Laser scanner + AI diagnostics (digital stethoscope) |

| STENTiT | US $1.98 million total | Resorbable AI-enabled cardiovascular stents (RFS) | Preclinical / Early-stage | Biodegradable scaffold + regenerative tech |

| Qure.ai | Not specified (Series D, India ~US$65M) | AI diagnostic imaging (e.g., chest X-ray, TB detection) | Growth / Late-stage | AI-powered imaging algorithms (multiple FDA indications) |

| DeepTek.ai | Not specified | AI chest X-ray diagnostics (multiple lung conditions) | Growth / Late-stage | AI imaging detection for X-rays (CE MDR Class IIb) |

| See-Mode Technologies | Not specified | AI thyroid ultrasound reporting | Growth / Late-stage | AI ultrasound analysis (FDA 510(k) clearance) |

Impact Analysis

AI-Powered Innovations and Applications:

AI-powered innovations are profoundly transforming the smart medical devices market by fundamentally enhancing their capabilities across diagnostics, monitoring, and therapy. AI is no longer a futuristic concept but a core component, enabling devices to analyze complex data with unprecedented speed and accuracy, leading to earlier disease detection and more precise diagnoses in areas like diagnostic imaging. This technology is also central to the shift towards personalized medicine, where AI algorithms analyze data from wearable sensors to tailor treatment plans and predict potential health events, such as a hypoglycemic episode, with proactive alerts. In surgical robotics, AI enhances precision and control, while in therapy, it powers devices like smart insulin pumps and neurostimulators for adaptive, patient-specific care.

Furthermore, AI boosts operational efficiency by automating data entry and providing real-time analytics for population health management. While challenges remain concerning data privacy and regulation, AI's ability to provide enhanced analytics, personalized care, and improved efficiency solidifies its role as a key driver of growth and innovation in the smart medical devices market.

U.S. Tariff Impact Analysis on the Smart Medical Devices Market:

The new wave of U.S. tariffs is having a profound and complex impact on the global smart medical devices market, creating significant challenges for manufacturers and potentially affecting patient access. The most immediate consequence is a rise in costs, as a new baseline tariff of 10% on most imports, with much higher rates on certain countries, has been implemented. This directly impacts the global supply chain, which is heavily reliant on components and materials from abroad, even for products "Made in the USA."

In response to this financial burden, major players like Johnson & Johnson and Abbott Laboratories have publicly noted multi-million dollar tariff-related expenses. The uncertainty and increased costs are forcing companies to adopt strategic shifts, including diversifying their supply chains away from heavily-tariffed countries and exploring costly but long-term reshoring initiatives.

Industry groups such as AdvaMed and MedTech Europe are actively lobbying for tariff exemptions, arguing that medical technologies are life-saving essentials and should not be subject to trade disputes that could limit innovation and raise prices for patients. This dynamic landscape is not only disrupting established business models but also has the potential to alter global competition, as some manufacturers outside the U.S. may gain an unintentional advantage.

How This Analysis Helps Clients

- Cost Management: By understanding the tariff landscape, clients can anticipate cost increases and adjust pricing strategies accordingly, ensuring profitability.

- Supply Chain Optimization: Clients can identify alternative sourcing options and diversify their supply chains to reduce dependency on high-tariff regions, enhancing resilience.

- Regulatory Navigation: Expert guidance on navigating the evolving regulatory environment helps clients maintain compliance and avoid potential legal challenges.

- Strategic Planning: Insights into tariff impacts enable clients to make informed decisions about manufacturing locations, partnerships, and market entry strategies.

Key takeaways from the smart medical devices market report study

● Market size analysis for the current smart medical devices market size (2024), and market forecast for 8 years (2025 to 2032)

● Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

● Key companies dominating the smart medical devices market.

● Various opportunities available for the other competitors in the smart medical devices market space.

● What are the top-performing segments in 2024? How these segments will perform in 2032?

● Which are the top-performing regions and countries in the current smart medical devices market scenario?

● Which are the regions and countries where companies should have concentrated on opportunities for the smart medical devices market growth in the future?

Frequently Asked Questions for the Smart Medical Devices Market

- What is the growth rate of the smart medical devices market?

Ø The smart medical devices market is estimated to grow at a CAGR of 12.20% during the forecast period from 2025 to 2032.

- What is the market for smart medical devices?

Ø The smart medical devices market was valued at USD 52,736.23 million in 2024, and is expected to reach USD 131,331.58 million by 2032.

- Which region has the highest share in the smart medical devices market?

Ø The North America smart medical devices market is dominating the global landscape due to several key factors. The region boasts a highly developed healthcare infrastructure and a strong emphasis on technological innovation. Favorable government regulations and reimbursement policies, particularly in the United States, encourage the adoption of digital health solutions like remote patient monitoring. Additionally, the presence of major industry players, coupled with high consumer awareness and a willingness to embrace new technologies, drives significant investment in research and development. This environment, combined with the rising prevalence of chronic diseases among a large, aging population, solidifies North America's leading position.

- What are the drivers for the smart medical devices market?

Ø The global smart medical devices market is experiencing significant growth driven by a combination of factors. The rising prevalence of chronic diseases and the rapidly aging global population are creating a higher demand for continuous monitoring and personalized care solutions. Simultaneously, rapid advancements in digital health technologies, including the Internet of Things (IoT), artificial intelligence (AI), and improved wireless connectivity, are making these devices more effective and accessible. This technological convergence enables a shift towards remote patient monitoring and telemedicine, which offers greater convenience, reduces healthcare costs, and empowers patients to take a more active role in managing their own health from the comfort of their homes.

- Who are the key players operating in the smart medical devices market?

Ø Some of the key market players operating in the smart medical devices market include Siemens Healthineers, Stryker, Samsung Electronics Co., Ltd., GE HealthCare, Koninklijke Philips N.V., Medtronic, Abbott Laboratories, Dexcom, Inc., Boston Scientific Corporation, OMRON Corporation, Apple Inc., B. Braun, iRhythm Technologies, Inc., Fresenius Kabi AG, Vital Connect, Inc., Masimo Corporation, Insulet Corporation, Zoll Medical Corporation, ResMed, F. Hoffmann-La Roche Ltd, Ypsomed, and Others.