Smoking Cessation and Nicotine Addiction Market Summary

Smoking Cessation And Nicotine Addiction Market and Epidemiology Analysis

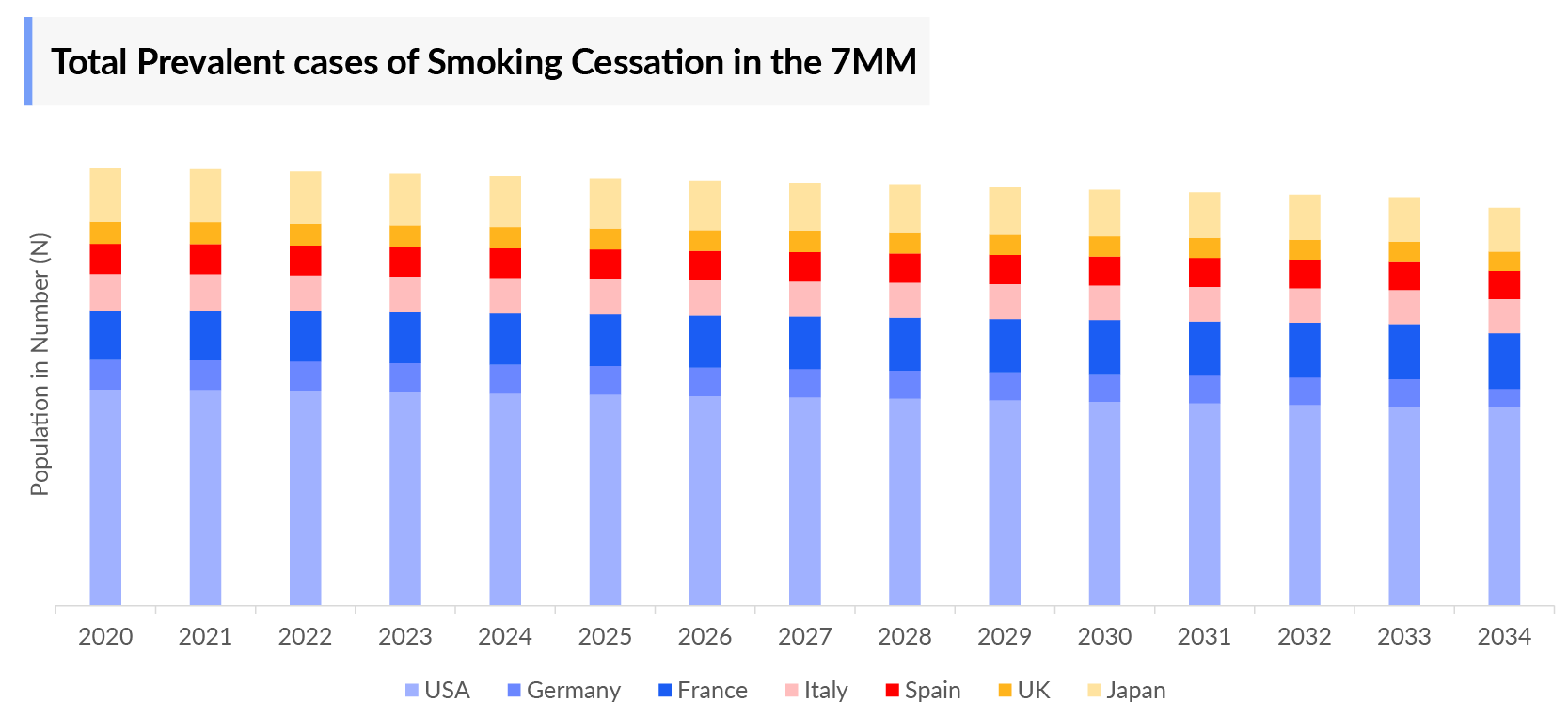

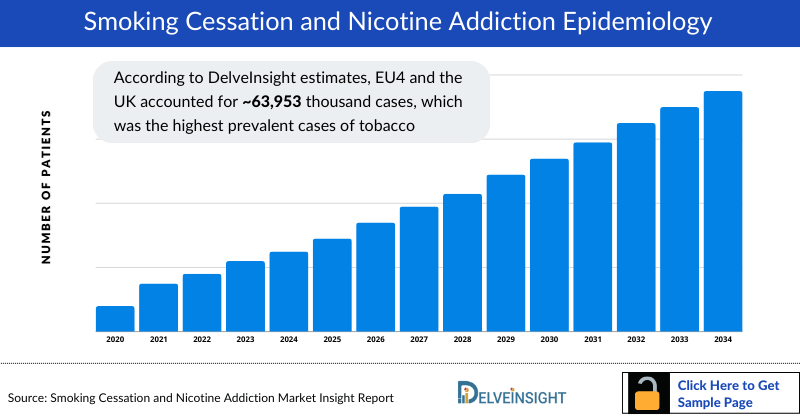

- The majority of Prevalent Cases of Smoking Cessation were estimated in the US, followed by EU4 the UK, and Japan whereas the highest cases of tobacco use were in EU4 and the UK among these regions.

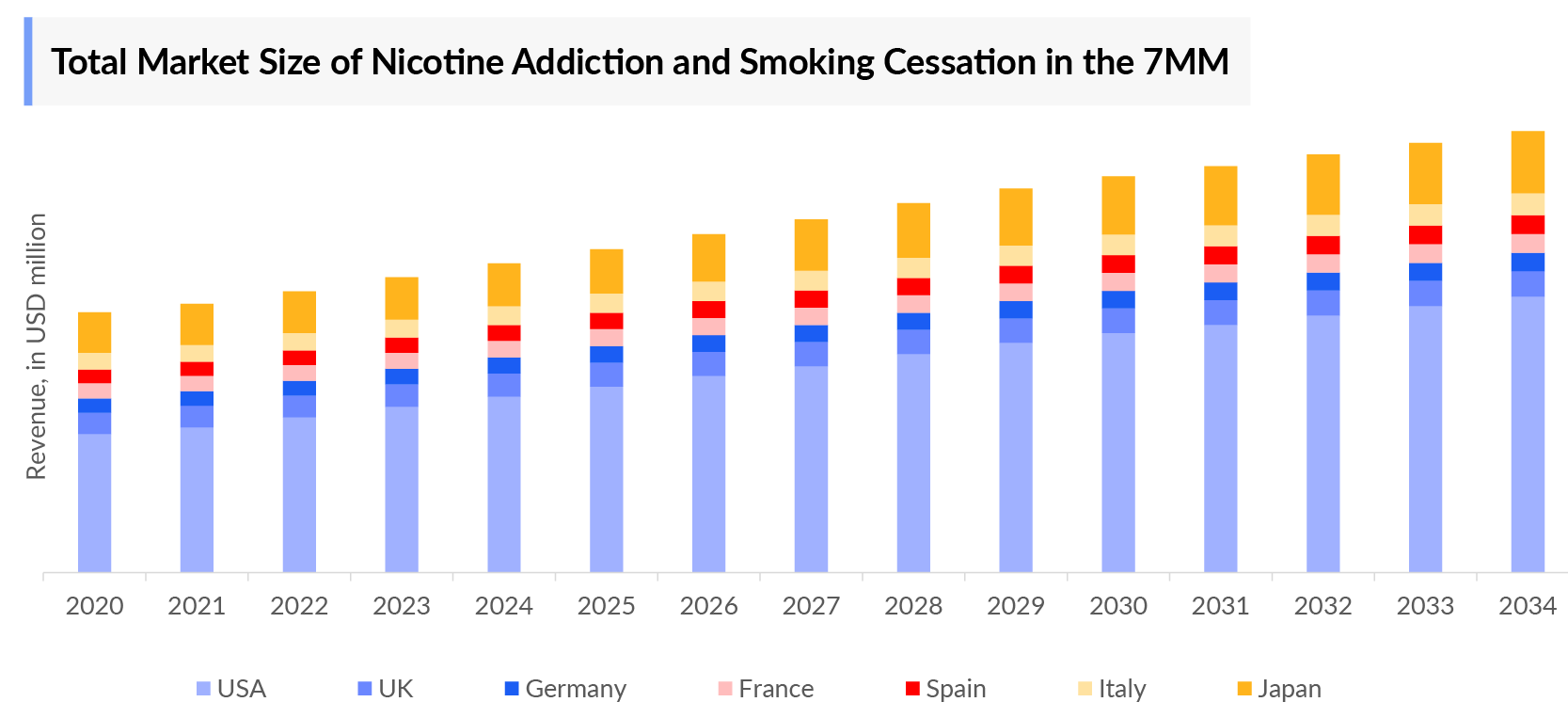

- In 2023, the Smoking Cessation and Nicotine Addiction Market Size was highest in the US among the 7MM, accounting for approximately USD 1,472 million, and lowest in Germany with USD 46 million which is further expected to increase by 2034.

- The total Smoking Cessation and Nicotine Addiction Treatment Market Size is anticipated to experience growth during the forecast period (2024-2034) due to emerging treatments that include cytisinicline, AXS-05, and NFL-101.

- Gender-specific prevalent cases of tobacco use were higher in males (around 31,040 thousand cases) as compared to females (around 19,846 thousand) in 2023 in the US.

Request for Unlocking the Sample Page of the "Smoking Cessation and Nicotine Addiction Treatment Market"

Key Factors Impacting the Smoking Cessation And Nicotine Addiction Market Growth

-

Rising Global Smoking Prevalence and Nicotine Dependence

The continued prevalence of tobacco smoking and the increasing use of alternative nicotine products, including e-cigarettes and heated tobacco devices, are significantly expanding the target population for smoking cessation therapies. Growing awareness of nicotine addiction as a chronic, relapsing condition is further driving long-term demand for effective treatment solutions.

-

Strong Government Regulations and Anti-Smoking Initiatives

Stringent tobacco control policies, higher taxation on tobacco products, public smoking bans, and graphic health warnings are encouraging smokers to quit. National smoking cessation programs and reimbursement support for cessation therapies in several countries are accelerating market uptake.

-

Increasing Awareness of Smoking-Related Health Risks

The rising burden of smoking-associated diseases such as lung cancer, cardiovascular disorders, and chronic respiratory conditions is prompting both patients and healthcare providers to prioritize smoking cessation. Preventive healthcare focus and early intervention strategies are supporting sustained market growth.

-

Advancements in Pharmacological Therapies

Ongoing innovation in nicotine replacement therapies, non-nicotine prescription drugs, and combination treatment approaches is improving quit rates and patient adherence. Enhanced formulations, flexible dosing options, and improved safety profiles are making therapies more accessible and effective.

-

Growth of Digital and Behavioral Support Solutions

The integration of digital health tools, mobile apps, telehealth platforms, and AI-driven behavioral support programs is transforming smoking cessation management. These solutions offer personalized guidance, real-time monitoring, and continuous motivation, expanding reach beyond traditional clinical settings.

-

Shift Toward Personalized and Integrated Treatment Approaches

Healthcare systems are increasingly adopting personalized cessation strategies that combine pharmacotherapy with behavioral counseling. This holistic approach is improving long-term abstinence rates and strengthening the overall value proposition of smoking cessation solutions.

-

Expanding Focus on Preventive Healthcare and Wellness

Rising investments in preventive healthcare, workplace wellness programs, and employer-sponsored cessation initiatives are creating new growth avenues for the smoking cessation and nicotine addiction market across developed and emerging economies.

DelveInsight's “Smoking Cessation and Nicotine Addiction Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the Smoking Cessation and Nicotine Addiction, historical and forecasted epidemiology as well as the Smoking Cessation and Nicotine Addiction market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The Smoking Cessation and Nicotine Addiction Treatment Market Report provides current treatment practices, emerging drugs, and market share of the individual therapies, current and forecasted 7MM Smoking Cessation and Nicotine Addiction market size from 2020 to 2034. The report also covers current Smoking Cessation and Nicotine Addiction treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Scope of the Smoking Cessation and Nicotine Addiction Market | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024 to 2034 |

|

Geographies Covered |

|

|

Smoking Cessation And Nicotine Addiction Market |

|

|

Smoking Cessation And Nicotine Addiction Market Size | Request for Sample Page |

|

Smoking Cessation And Nicotine Addiction Companies |

|

Smoking Cessation And Nicotine Addiction Understanding

Smoking Cessation and Nicotine Addiction Overview

Nicotine dependence encompasses behavioral, cognitive, and physiological phenomena that arise from repeated tobacco use, marked by a strong desire to use tobacco, difficulty in controlling its use, persistence despite harmful consequences, prioritizing tobacco over other activities, increased tolerance, and withdrawal symptoms. The primary source of nicotine is tobacco, commonly administered through smoking, chewing, and snorting, with cigarette smoking being the most prevalent and harmful. Factors contributing to nicotine addiction include inadequate enforcement of smoking bans, lack of education, insufficient motivation to quit, inadequate training among mental health professionals, and inadequate treatments, particularly in underdeveloped countries. Habitual tobacco use leads to neuroadaptation and tolerance, with withdrawal symptoms such as irritability, anxiety, increased appetite, and dysphoria upon cessation, further reinforced by conditioning. These dynamics underscore the global health burden posed by tobacco addiction.

Smoking Cessation and Nicotine Addiction Diagnosis

Metabolites of nicotine such as cotinine, nicotine, and anabases can be detected in urine and blood; these tests can test compliance with withdrawal therapy or nicotine toxicity. Another method to assess nicotine is COa level; this method is related to cotinine. Some questionnaires can measure nicotine dependence, such as the Fagerström Test for Nicotine Dependence, the Wisconsin Inventory of Smoking Dependence and Motives, and the Smokeless Tobacco Dependence Scale.

Smoking Cessation and Nicotine Addiction Treatment

Effective treatment for smoking cessation and nicotine addiction involves a multifaceted approach combining pharmacotherapy, behavioral therapy, and support systems. Pharmacotherapeutic options include nicotine replacement therapies (NRTs) like patches, gums, and lozenges, which help reduce withdrawal symptoms and cravings by delivering controlled doses of nicotine. Medications such as varenicline and bupropion act on neural pathways to diminish the pleasure derived from smoking and alleviate withdrawal effects. Behavioral therapies, including cognitive-behavioral therapy (CBT) and motivational interviewing, address the psychological aspects of addiction by helping individuals develop coping strategies, set goals, and enhance motivation to quit. Support systems, such as counseling, support groups, and helplines, provide continuous encouragement and resources, significantly improving quit rates. Combining these treatments increases the likelihood of successful smoking cessation by addressing both the physiological and psychological components of nicotine addiction.

Smoking Cessation and Nicotine Addiction Epidemiology

As the market is derived using a patient-based model, the Smoking Cessation and Nicotine Addiction epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Prevalent Cases of Tobacco Use, Gender-specific Prevalent Cases of Tobacco Use, Age-specific Prevalent Cases of Tobacco Use, Prevalent Cases of Tobacco Use by Product Type, Prevalent Nicotine Dependent Cases Among Cigarette Smokers, and Prevalent Cases of Smoking Cessation in the 7MM covering, the United States, EU4 countries (Germany, France, Italy, and Spain), United Kingdom, and Japan from 2020 to 2034.

- According to DelveInsight estimates, EU4 and the UK accounted for approximately 63,953 thousand cases, which was the highest prevalent cases of tobacco use, followed by the US with around 50,886 thousand cases, and Japan with around 20,185 thousand cases in 2023. These cases are expected to decrease in the US, EU4 the UK, and Japan by 2034.

- Among the EU4 and the UK, Germany had the highest prevalent cases of tobacco use (approximately 18,101 thousand cases), followed by France (approximately 16,429 thousand cases) in 2023. On the other hand, the UK (8,788 thousand cases) had the lowest prevalent cases of tobacco use in EU4 and the UK countries and the 7MM.

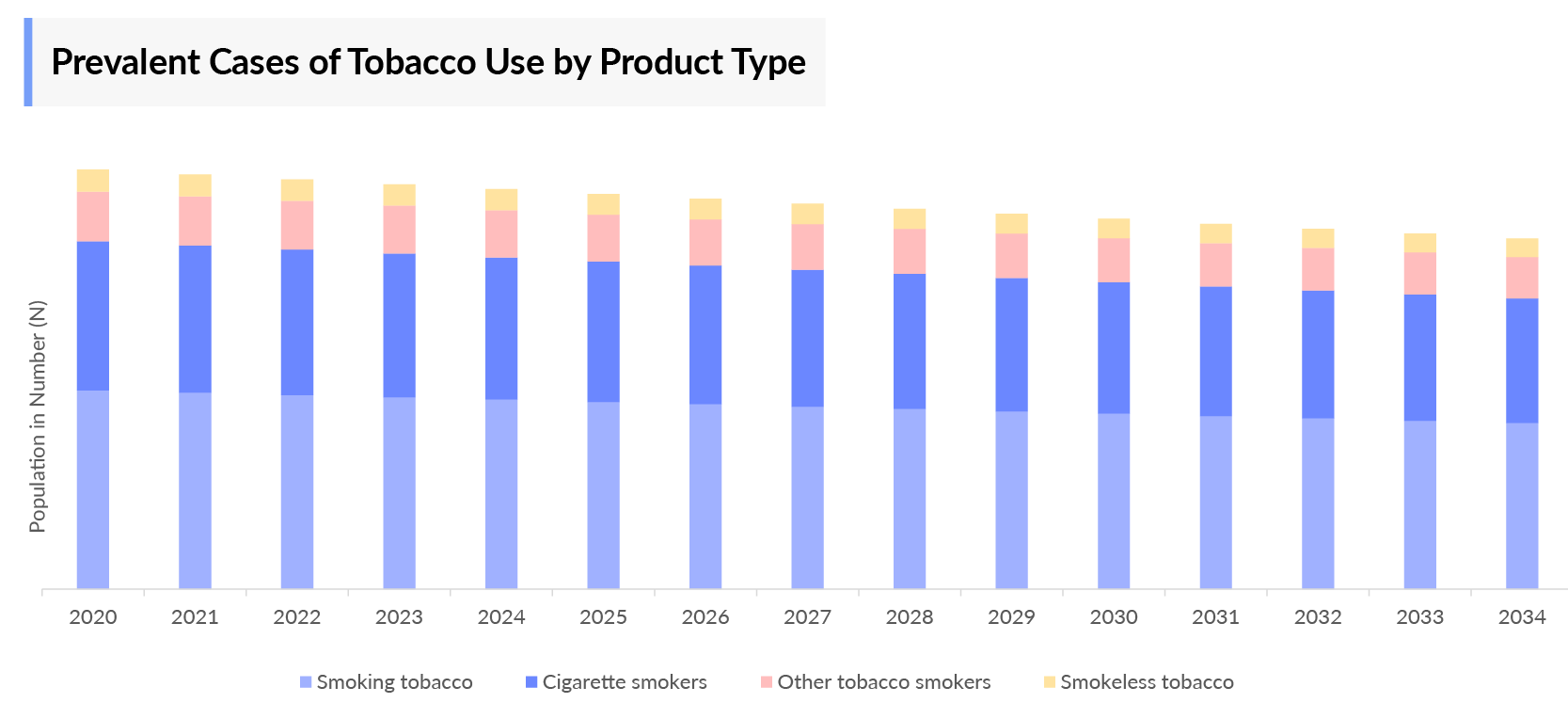

- Tobacco use has been identified as male-dominant; in our analysis, the number of males suffering was higher than females. In 2023, ~59% of prevalent cases tobacco use of were of males, while ~41% of cases were of females in the 7MM.

Smoking Cessation and Nicotine Addiction Epidemiology Segmentation in the 7MM

- Prevalent Cases of Tobacco Use

- Gender-specific Prevalent Cases of Tobacco Use

- Age-specific Prevalent Cases of Tobacco Use

- Prevalent Cases of Tobacco Use by Product Type

- Prevalent Nicotine Dependent Cases Among Cigarette Smokers

- Prevalent Cases of Smoking Cessation

Smoking Cessation and Nicotine Addiction Market Recent Breakthroughs and Developments

- In September 2025, Achieve Life Sciences announced FDA acceptance of its New Drug Application (NDA) for cytisinicline, a treatment for smoking cessation in adults. A PDUFA action date has been set for June 20, 2026.

- In June 2025, NFL Biosciences SAS announced a Phase I clinical study involving 24 smokers to evaluate its tobacco cessation candidate, NFL-101. The investigational therapy, composed of a nicotine-free extract of tobacco proteins, is designed to reduce cigarette craving both immediately after administration and for up to one week following each injection.

Smoking Cessation and Nicotine Addiction Drug Analysis

The drug chapter segment of the Smoking Cessation and Nicotine Addiction Therapeutics Market Report encloses a detailed analysis of Smoking Cessation and Nicotine Addiction off-label drugs and late-stage (Phase-III and Phase-II) pipeline drugs. It also helps to understand the Smoking Cessation and Nicotine Addiction clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Smoking Cessation And Nicotine Addiction Marketed Drugs

-

CHANTIX/ CHAMTIX (varenicline): Pfizer

CHANTIX, known chemically as varenicline tartrate, is a nicotinic receptor partial agonist used as an aid for smoking cessation. Unlike nicotine replacement therapies, CHANTIX works by blocking the pleasurable effects of smoking and reducing cravings and withdrawal symptoms. The US FDA approved varenicline in May 2006 as the first oral non-nicotine smoking cessation treatment. It has also been approved in the EU4, the UK, and Japan for the same purpose. In May 2007, Pfizer announced that NICE recommended CHAMTIX (varenicline) for use in the UK's National Health Service for adult smokers wishing to quit. In August 2021, the FDA approved the first generic version of CHANTIX, developed by Par Pharmaceutical, offering 0.5 mg and 1 mg tablets. This milestone provides a more accessible option for individuals seeking to overcome nicotine addiction.

-

ZYBAN (bupropion): GlaxoSmithKline

ZYBAN (bupropion hydrochloride) sustained-release tablets are a non-nicotine aid for smoking cessation. Chemically unrelated to nicotine or other treatments for nicotine addiction, ZYBAN was initially developed as an antidepressant under the names WELLBUTRIN and WELLBUTRIN SR. Bupropion is a selective inhibitor of the neuronal reuptake of catecholamines (noradrenaline and dopamine) with minimal effect on serotonin reuptake, and it does not inhibit monoamine oxidase. The precise mechanism by which ZYBAN aids in smoking cessation is unclear but is believed to involve noradrenergic and/or dopaminergic pathways. Initially introduced in 1989 as an antidepressant, bupropion was later produced in a sustained-release (SR) formulation in 1996. Its smoking cessation properties were identified in 1997, leading to its recognition as a first-line anti-smoking agent in the US and UK. In May 2010, Mylan Pharmaceuticals received FDA approval for a generic version of ZYBAN, providing a cost-effective option for those seeking to quit smoking.

Note: Detailed marketed therapies assessment will be provided in the final report.

Smoking Cessation And Nicotine Addiction Emerging Drugs

-

Cytisinicline (cytisine): Achieve Life Sciences

Cytisinicline (cytisine) is an oral, plant-based alkaloid with a high binding affinity to the nicotinic acetylcholine receptor. It is an established smoking cessation treatment approved and marketed in Central and Eastern Europe for over 20 years. Cytisinicline has completed a Phase III study, evaluating the efficacy and safety of 3 mg cytisinicline thrice a day for a treatment duration of 42 days/6 weeks in adult smokers cytisinicline. In addition to this trial, the company is conducting another Phase III study, ORCA-OL, which is in progress as per the company’s pipeline. Achieve Life Sciences is also evaluating cytisinicline in Phase II for the e-cigarette user population.

-

NFL-101: NFL Biosciences SAS

NFL-101, a patented botanical drug candidate, aims to improve smoking cessation rates. It involves two subcutaneous injections one week apart, with optional injections at three and six months if needed. A Phase I/II trial confirmed its safety and efficacy for long-term cessation without compensatory smoking. Unlike varenicline (Chantix/Champix) and nicotine replacement therapies, NFL-101 contains minimal nicotine and is derived from natural tobacco leaf proteins. In February 2023, NFL Biosciences collaborated with the CEA to study NFL-101's mechanism using molecular imaging. In November 2021, they partnered with Diverchim to develop GMP-compliant active ingredients for NFL-101 and NFL-201 for treating tobacco and cannabis addiction. This supports the production of essential components for the CESTO II (Phase II/III) clinical study. Results from the Phase IIb efficacy study (CESTO 2) are expected in July 2024.

-

EMB-001: Embera NeuroTherapeutics, Inc.

EMB-001, a patented combination of metyrapone and oxazepam, targets the stress response system to address addiction and relapse by reducing stress-induced cravings and loss of control. It aims to maximize efficacy by affecting multiple pathways and promoting long-term abstinence across various addictions. In 2019, Embera NeuroTherapeutics received substantial grants to advance EMB-001 into Phase II clinical studies for cocaine use disorder and smoking cessation. The National Institute on Drug Abuse (NIDA) provided part of a USD 11.1 million grant for a Phase II study on cocaine use disorder, while the Rose Research Center (RRC) in North Carolina received funding to evaluate EMB-001 for smoking cessation, supported by the Foundation for a Smoke-Free World. In the nicotine study, EMB-001 also demonstrated a statistically significantly greater effect relative to varenicline (CHANTIX), the clinical market leader for smoking cessation efficacy.

|

Drug |

MoA |

RoA |

Company |

Logo |

Phase |

|

Cytisinicline (cytisine) |

α4β2 nicotinic receptor partial agonist |

Oral |

Achieve Life Sciences |

III | |

|

NFL-101 |

Immunomodulator |

Subcutaneous |

NFL Biosciences SAS |

III | |

|

EMB-001 |

Cortisol synthesis inhibitor + GABA A receptor agonists |

Oral |

Embera NeuroTherapeutics, Inc. |

II | |

|

XXX |

XXX |

Oral |

XXX |

III |

Smoking Cessation and Nicotine Addiction Market Outlook

There are effective treatments that support tobacco cessation, including both behavioral therapies and FDA-approved medications. Several distinct products and services are available today for smoking cessation, alongside smoking alternatives that are not specifically indicated for cessation. FDA-approved pharmacotherapies include various forms of nicotine replacement therapies (NRTs) in the form of transdermal patches, gums, nasal sprays, oral inhalers, and lozenges.

The US FDA has approved two smoking cessation products that do not contain nicotine. They are CHANTIX (varenicline tartrate), and ZYBAN (bupropion hydrochloride). Both products are available in tablet form and by prescription only. In the past years, the generic of both approved drugs has entered the market. Both are widely available in the US and the European market. In Japan, varenicline (CHAMPIX), NRT, and some off-label therapies are used for smoking cessation. Bupropion-SR is not licensed in Japan for smoking cessation.

Major Smoking Cessation And Nicotine Addiction Companies such as Achieve Life Sciences (Cytisinicline), Axsome Therapeutics (AXS-05), and NFL Biosciences (NFL-101) and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of smoking cessation and nicotine addiction.

- The Smoking Cessation and Nicotine Addiction Market Size in the 7MM was approximately USD 2,318 million in 2023 and is projected to increase during the forecast period (2024-2034)

- The Smoking Cessation and Nicotine Addiction Market Size in the 7MM will increase at a significant CAGR due to increasing Smoking Cessation And Nicotine Addiction Prevalent Cases of the disease and the launch of the emerging therapies.

- Among EU4 and the UK, France accounted for the maximum Smoking Cessation And Nicotine Addiction Market Size in 2023 while the UK occupied the bottom of the ladder in 2023.

- The UK and Italy had comparable market sizes in 2023, but these dynamics are expected to change in the forecasted years.

Smoking Cessation and Nicotine Addiction Drugs Uptake

This section focuses on the rate of uptake of the potential Smoking Cessation and Nicotine Addiction drugs expected to be launched in the market during the study period 2020-2034. For example, for cytisinicline, we expect the drug uptake to be slow-medium with a probability-adjusted peak share of 18% years to peak is expected to be 7 years from the year of launch.

Smoking Cessation and Nicotine Addiction Clinical Trials Activities

The Smoking Cessation and Nicotine Addiction Therapeutics Market Report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Smoking Cessation And Nicotine Addiction Companies involved in developing targeted therapeutics.

Smoking Cessation and Nicotine Addiction Pipeline Development Activities

The Smoking Cessation And Nicotine Addiction Therapeutics Market Report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Smoking Cessation and Nicotine Addiction emerging therapies.

Latest KOL Views on Smoking Cessation And Nicotine Addiction

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on Smoking Cessation and Nicotine Addiction evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including KOL from the Department of Psychiatry and Behavioral Sciences, Johns Hopkins University, the US; Loma Linda University Cancer Center, Loma Linda, CA, the US Medical/scientific writers, Medical Professors, Industry experts, and Others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or Smoking Cessation and Nicotine Addiction market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Smoking Cessation And Nicotine Addiction Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Smoking Cessation And Nicotine Addiction Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global Smoking Cessation And Nicotine Addiction Drug Market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment. The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Smoking Cessation And Nicotine Addiction Market Report Scope

- The Smoking Cessation And Nicotine Addiction Therapeutics Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Smoking Cessation and Nicotine Addiction Treatment Market, historical and forecasted Smoking Cessation And Nicotine Addiction Market Size, market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The Smoking Cessation And Nicotine Addiction Therapeutics Market Report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Smoking Cessation and Nicotine Addiction Drugs Market.

Smoking Cessation and Nicotine Addiction Market Report Insights

- Patient-based Smoking Cessation And Nicotine Addiction Market Forecasting

- Therapeutic Approaches

- Smoking Cessation and Nicotine Addiction Pipeline Analysis

- Smoking Cessation and Nicotine Addiction Market Size and Trends

- Existing and Future Smoking Cessation And Nicotine Addiction Drugs Market Opportunity

Smoking Cessation and Nicotine Addiction Market Report Key Strengths

- 11 years Smoking Cessation And Nicotine Addiction Market Forecast

- The 7MM Coverage

- Smoking Cessation and Nicotine Addiction Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Smoking Cessation And Nicotine Addiction Drugs Uptake

- Key Smoking Cessation And Nicotine Addiction Market Forecast Assumptions

Smoking Cessation and Nicotine Addiction Market Report Assessment

- Current Smoking Cessation And Nicotine Addiction Treatment Practices

- Smoking Cessation And Nicotine Addiction Unmet Needs

- Smoking Cessation And Nicotine Addiction Pipeline Drugs Profiles

- Smoking Cessation And Nicotine Addiction Drugs Market Attractiveness

- Smoking Cessation And Nicotine Addiction Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions Answered in the Smoking Cessation And Nicotine Addiction Market Report

Smoking Cessation And Nicotine Addiction Market Insights

- What was the Smoking Cessation and Nicotine Addiction market size, the market size by therapies, and market share (%) distribution in 2020, and how it would all look in 2034? What are the contributing factors for this growth?

- Will the coverage of drugs depend on their efficacy in Smoking Cessation and Nicotine Addiction?

- What will be the impact on the market with the launch of emerging drugs?

- How is AXS-05 going to compete with NFL-101 being launched in the same year?

- Which is going to be the largest contributor to the market in 2034?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Smoking Cessation And Nicotine Addiction Epidemiology Insights

- What are the disease risks, burdens, and Smoking Cessation And Nicotine Addiction unmet needs? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Smoking Cessation and Nicotine Addiction?

- What is the historical and forecasted Smoking Cessation and Nicotine Addiction patient pool in the United States, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan?

- Why do patients develop persistent Smoking Cessation and Nicotine Addiction symptoms? Why is the current year diagnosis rate not high?

- Which type of severity is the largest contributor in patients affected with Smoking Cessation and Nicotine Addiction?

- What factors are affecting the increase in the diagnosis of Smoking Cessation and Nicotine Addiction?

Current Smoking Cessation And Nicotine Addiction Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of Smoking Cessation and Nicotine Addiction? What are the current treatment guidelines for the treatment of Smoking Cessation and Nicotine Addiction in the US and Europe?

- How many companies are developing therapies for the treatment of Smoking Cessation and Nicotine Addiction?

- How, many emerging therapies are in the mid-stage and late stage of development for the treatment of Smoking Cessation and Nicotine Addiction?

- What are the recent novel therapies, targets, Smoking Cessation And Nicotine Addiction mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the key designations that have been granted for the emerging therapies for Smoking Cessation and Nicotine Addiction?

- What will be the impact on the market after the expected patent expiry of the emerging drug?

- What is the cost burden of off-label therapies on patients?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of recommended therapies? Focus on reimbursement policies.

- What are the 7MM historical and forecasted Smoking Cessation and Nicotine Addiction Market?

Reasons to Buy the Smoking Cessation And Nicotine Addiction Market Report

- The Smoking Cessation And Nicotine Addiction Therapeutics Market Report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Smoking Cessation and Nicotine Addiction Market.

- Insights on patient burden/disease, Smoking Cessation and Nicotine Addiction Incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing Smoking Cessation and Nicotine Addiction Drugs Market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the Smoking Cessation and Nicotine Addiction Drugs Market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and potential of current and emerging therapies under the conjoint analysis section to provide visibility around leading emerging drugs.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Smoking Cessation and Nicotine Addiction Drugs Market so that the upcoming players can strengthen their development and launch strategy.

Stay updated with us for Recent Articles