Spinal Cord Stimulators Market Summary

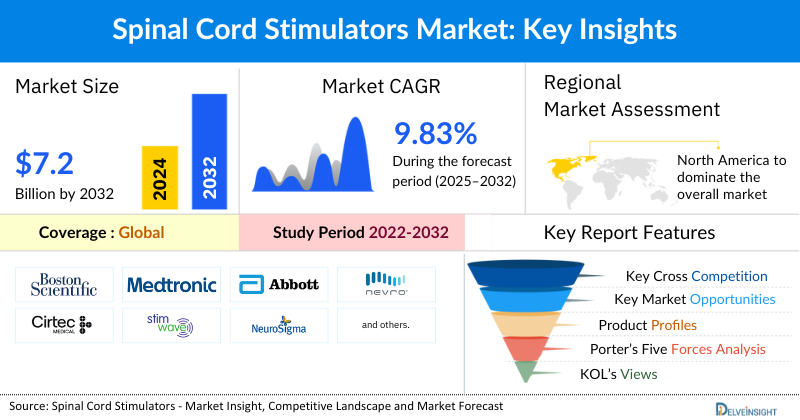

- The Global Spinal Cord Stimulator Market Size is expected to increase from ~USD 3437 Million in 2024 to ~USD 7243.98 Million by 2032, reflecting strong and sustained growth.

- The Global Spinal Cord Stimulator Market is growing at a CAGR of 9.83% during the forecast period from 2025 to 2032.

Spinal Cord Stimulator Market Trends & Insights

- The Spinal Cord Stimulator Market is witnessing steady growth driven by the rising prevalence of chronic pain conditions, increasing adoption of minimally invasive neuromodulation therapies, and ongoing technological advancements in implantable medical devices.

- The leading Spinal Cord Stimulator Companies such as Boston Scientific Corporation, Medtronic, Abbott, Nevro Corp, Cirtec Medical, Stimwave LLC, NeuroSigma, Inc., Synapse Biomedical, Inc., Greatbatch, Inc., Saluda Medical Pty Ltd., Beijing PINS Medical Co., Ltd., and others.

Spinal Cord Stimulator Market Size and Forecasts

- 2024 Market Size: USD 3,437.62million

- 2032 Projected Market Size: USD 7,243.98 million

- Growth Rate (2025-2032): 9.83% CAGR

- Largest Market: North America

- Fastest Growing Market: Asia-Pacific

- Market Structure: Moderately Consolidated

Request for Unlocking the Sample Page of the "Spinal Cord Stimulator Market Trends"

Key Factors Impacting the Spinal Cord Stimulator Market Growth

- Rising Prevalence of Chronic Pain Disorders: The increasing global burden of Chronic Pain conditions, such as failed back surgery syndrome, Complex Regional Pain Syndrome, Neuropathic Pain, and degenerative spinal disorders, is a primary driver of the spinal cord stimulator market. As chronic pain significantly impacts quality of life and productivity, demand for long-term, effective pain management solutions continues to rise.

- Growing Preference for Minimally Invasive Pain Management: Spinal cord stimulators offer a minimally invasive alternative to long-term pharmacological therapy and repeat surgical interventions. Their ability to reduce pain without extensive surgery or prolonged hospitalization has made them an attractive option for both patients and clinicians, supporting wider adoption.

- Technological Advancements in Neurostimulation Devices: Continuous innovation in spinal cord stimulator technology, including rechargeable systems, wireless programming, closed-loop stimulation, and high-frequency and burst stimulation modes, has enhanced treatment efficacy and patient comfort. These advancements are expanding the eligible patient pool and improving long-term outcomes.

- Limitations and Risks Associated With Opioid Therapy: Growing awareness of the adverse effects, dependency risks, and regulatory restrictions associated with opioid-based pain management is accelerating the shift toward non-opioid alternatives. Spinal cord stimulators are increasingly positioned as a safer, long-term solution for chronic pain control.

- Expanding Geriatric Population: The rising elderly population, which is more prone to chronic pain, spinal disorders, and nerve-related conditions, is contributing significantly to market growth. Older patients often seek durable pain relief options that minimize systemic side effects, favoring neuromodulation therapies.

- Improving Reimbursement and Healthcare Infrastructure: Improved reimbursement coverage in developed markets and the gradual strengthening of healthcare infrastructure in emerging economies are facilitating greater access to spinal cord stimulation therapies. This trend is supporting higher procedure volumes and market expansion.

- Increasing Clinical Evidence and Physician Awareness: Growing clinical validation of spinal cord stimulators, supported by long-term outcome data and real-world evidence, is boosting physician confidence. Enhanced training programs and awareness initiatives are further driving adoption across pain management and neurosurgical settings.

Spinal Cord Stimulators Market by Product Type (Rechargeable, Non-Rechargeable, and Others), Application (Failed Back Syndrome (FBS), Degenerative Disk Disease (DDD), Complex Regional Pain Syndrome (CRPS), and Others), End-User (Hospitals, Clinics, and Ambulatory Surgical Centers), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to advance at a decent CAGR forecast till 2032 owing to the growing burden of chronic pain, degenerative spine conditions, and rising product developmental activities across the globe.

The spinal cord stimulators market was valued at USD 3,437.62 million in 2024, growing at a CAGR of 9.83% during the forecast period from 2025 to 2032 to reach USD 7,243.98 million by 2032. The spinal cord stimulator market is experiencing significant growth due to the increasing number of patients suffering from chronic pain and neuropathic pain, particularly in areas such as the shoulders, legs, and knees. Moreover, the degenerative spine conditions, such as Diabetic Neuropathy, spinal cord injury, and Failed Back Surgery Syndrome, among others, are other contributing factors for market growth. Additionally, favorable government regulations have played a crucial role in accelerating the commercialization and launch of advanced spinal cord stimulation devices. The rising geriatric population, which is more susceptible to chronic and neuropathic conditions, is also contributing to market expansion. These factors, collectively, are expected to propel the growth of the spinal cord stimulator market throughout the forecast period from 2025 to 2032.

Scope of the Spinal Cord Stimulators Market Report

| |

|

Report Metrics |

Details |

|

Study Period |

2022 to 2032 |

|

Forecast Period |

2025-2032 |

|

CAGR |

9.83% (Request Sample To Know More) |

|

Spinal Cord Stimulators Market |

~USD 7243.98 Million by 2032 |

|

Key Spinal Cord Stimulatorss Companies |

Boston Scientific Corporation, Medtronic, Abbott, Nevro Corp, Cirtec Medical, Stimwave LLC, NeuroSigma, Inc., Synapse Biomedical, Inc., Greatbatch, Inc., Saluda Medical Pty Ltd., Beijing PINS Medical Co., Ltd., and others. |

What are the latest Spinal Cord Stimulators Market Dynamics and Trends?

According to the World Health Organization (2023), there were 619 million cases of lower back pain (LBP), and this number was projected to rise to 843 million by the year 2050. As per data by the European Pain Federation (2023), it was stated that 740 million people globally experience an episode of severe pain at some point in their lives on average. For approximately 20% of these individuals, the pain persists for longer than three months, thereby categorizing it as chronic pain. This growing patient population underscores the urgent need for effective pain management solutions. Spinal cord stimulators offer a minimally invasive, drug-free, and reversible option for pain management by delivering electrical impulses to the spinal cord, effectively blocking pain signals before they reach the brain. Hence, the surge in chronic pain will fuel the market for spinal cord stimulators.

Additionally, as per the recent study published under NIH (2023), failed back surgery syndrome WAS reported to affect between 10 to 40% of patients following back surgery. Failed Back Surgery Syndrome (FBSS) occurs when patients continue to experience chronic back or leg pain after one or more spinal surgeries. As spinal surgeries increase globally due to conditions like herniated discs and spinal stenosis, FBSS cases are also rising. Since repeated surgeries pose higher risks and often fail to relieve pain, spinal cord stimulators have emerged as a preferred, minimally invasive, and effective treatment option for managing pain in FBSS patients.

Furthermore, the rising product development activities worldwide among market key players for spinal cord stimulators also push forward the overall market. For example, in December 2022, Abbott Laboratories announced the U.S. Food and Drug Administration (FDA) approval for the Eterna spinal cord stimulation system, which was recognized as the smallest implantable, rechargeable spinal cord stimulator that is available for the treatment of chronic pain. Therefore, all the factors stated above collectively will drive the spinal cord stimulators market throughout the forecast period from 2025 to 2032. However, the high cost of spinal cord stimulator procedures, complications associated with technologically advanced devices, and others may halt the market growth of spinal cord stimulators.

Recent Developmental Activities in the Spinal Cord Stimulators Market

- In December 2025, Boston Scientific Corporation conducted a study to assess the effectiveness of FAST-SCS, a fast-acting, paresthesia-free therapy, along with additional spinal cord stimulation (SCS) options in patients with chronic pain using the WaveWriter SCS Systems.

- In December 2025, Wake Forest University Health Sciences announced a study to evaluate lead movement during spinal cord stimulator trials based on different securing methods at the time of placement. As SCS trial leads remain external and are susceptible to migration, the study compares the extent of movement when leads are secured using sutures, tape, or a combination of both.

- In December 2025, the Hugo W. Moser Research Institute at Kennedy Krieger Inc. initiated a study to determine whether melatonin, a naturally occurring hormone, can help manage symptoms of DEE-SWAS, a rare Epilepsy-associated developmental disorder in children. The study evaluates higher-than-standard doses of melatonin, focusing on safety and its effects on abnormal and normal brain activity, including changes observed on EEG and sleep-related brain patterns.

- In November 2025, the TriCity Research Center announced a clinical study assessing the therapeutic efficacy and feasibility of BurstDR spinal cord stimulation using Abbott’s Proclaim XR and Eterna systems in patients with painful diabetic neuropathy (PDN). Following a one-week temporary SCS trial, patients achieving at least a 50% reduction in pain will receive permanent implantation, with outcomes evaluated through multiple clinical and patient-reported measures over a six-month follow-up period to assess real-world effectiveness, safety, and feasibility in a rural PDN population.

Spinal Cord Stimulators Market Segment Analysis

Spinal Cord Stimulators market by Product Type (Rechargeable, Non-Rechargeable, and Others), Application (Failed Back Syndrome (FBS), Degenerative Disk Disease (DDD), Complex Regional Pain Syndrome (CRPS), and Others), End-User (Hospitals, Clinics, and Ambulatory Surgical Centers), and Geography (North America, Europe, Asia-Pacific, and Rest of the World). In the product type segment of the spinal cord stimulators market, the rechargeable category is expected to have a significant revenue share in the year 2024. The rapid growth of this product segment can be attributed to their growing demand due to significant cost savings with the use of rechargeable stimulators, as they are leading to high adoption of these devices.

Additionally, the miniaturization of these devices ensures minimal invasiveness, enhancing patient comfort and reducing recovery time. Remote monitoring and programming capabilities allow healthcare providers to adjust therapy settings without requiring in-person visits, making it convenient for both patients and doctors. These features collectively make rechargeable spinal cord stimulators a valuable tool in treating chronic pain conditions such as failed back surgery syndrome (FBSS), complex regional pain syndrome (CRPS), and neuropathic pain, offering a sustainable and effective alternative to traditional pain management methods.

In addition, new product approvals further upsurge the spinal cord stimulators market. For instance, in August 2023, Medtronic announced that it received CE Mark approval for the Inceptive closed-loop rechargeable spinal cord stimulator. This marks the first Medtronic spinal cord stimulator device to incorporate a closed-loop feature that continuously senses individual biological signals and dynamically adjusts stimulation in real-time, ensuring that the therapy remains synchronized with the patient’s daily activities. Therefore, the presence of a robust product portfolio for the rechargeable category with a wide range of features and applications is expected to witness considerable growth, eventually contributing to the growth of the overall spinal cord stimulators market during the forecast period from 2025 to 2032.

Spinal Cord Stimulators Market Size is anticipated to be dominated by North America

Among all the regions, North America is expected to dominate the spinal cord stimulators market in the year 2024. This regional dominance is primarily driven by a sharp increase in chronic pain cases, which is fueling the demand for advanced pain management therapies. Moreover, growing government efforts, such as awareness programs focused on educating the public about available treatment options, are contributing significantly to market expansion. In parallel, leading industry players are intensifying their product development and innovation activities, bringing next-generation spinal cord stimulators to market. Favorable reimbursement policies further enhance patient access to these therapies. Together, these factors are expected to propel strong growth in the spinal cord stimulators market in the region during the forecast period from 2025 to 2032.

According to data from the Centers for Disease Control and Prevention (2023), it reported that there were 51.6 million US adults who were suffering from chronic pain. In addition to this, 17.1 million individuals had experienced high-impact chronic pain (i.e., chronic pain that results in substantial restriction to daily activities). Moreover, as per data from the Public Health Agency of Canada (2023), 8 million individuals live with chronic pain in Canada. Thus, the rising instances of chronic pain among individuals across the region necessitate the need for pain management, thereby boosting the market for spinal cord stimulators.

Rising government initiatives in the region, such as the awareness programs in the US aimed at addressing chronic pain, focus on education, prevention, and early detection, also boost the market of spinal cord stimulator market as public awareness campaigns educate individuals about the importance of regular screenings and preventive measures. For example, September is designated as Pain Awareness Month in the US, during which various organizations, including the National Institute of Health (NIH), participate and promote awareness through campaigns, events, and educational materials. These efforts emphasize the importance of managing chronic pain.

Further, the US represents the largest market worldwide, supported by a large number of key players present in the region. Rising product launches and commercialization agreements among key manufacturers and other companies are anticipated to boost market growth. For example, in December 2022, Saluda Medical Pty Limited, a global leader in medical devices transforming the neuromodulation space, announced the launch of the Evoke® System, the first and only SmartSCS™ available in the United States. Therefore, the interplay of all the factors mentioned above would provide a conducive growth environment for the North America region in the spinal cord stimulators market during the forecast period from 2025 to 2032.

Who are the major players in Spinal Cord Stimulators?

The following are the leading companies in Spinal Cord Stimulator. These Spinal Cord Stimulator Companies collectively hold the largest Spinal Cord Stimulator market share and dictate industry trends.

- Boston Scientific Corporation

- Medtronic

- Abbott

- Nevro Corp

- Cirtec Medical

- Stimwave LLC

- NeuroSigma Inc.

- Synapse Biomedical Inc.

- Greatbatch Inc.

- Saluda Medical Pty Ltd.

- Beijing PINS Medical Co. Ltd.

Key takeaways from the Spinal Cord Stimulators Market report study

- Spinal Cord Stimulator Market size analysis for the current spinal cord stimulators market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/services developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the spinal cord stimulators market

- Various opportunities available for the other competitors in the spinal cord stimulators market space

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current spinal cord stimulators market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for spinal cord stimulators market growth in the future?

Target audience who can benefit from this Spinal Cord Stimulators Market report study

- Spinal cord stimulator providers

- Research organizations and consulting companies

- Spinal cord stimulators-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in spinal cord stimulators

- Various end-users who want to know more about the spinal cord stimulators market and the latest developments in the spinal cord stimulators market

Stay updated with us for Recent Articles @ New DelveInsight Blogs