Spinal Muscular Atrophy Market

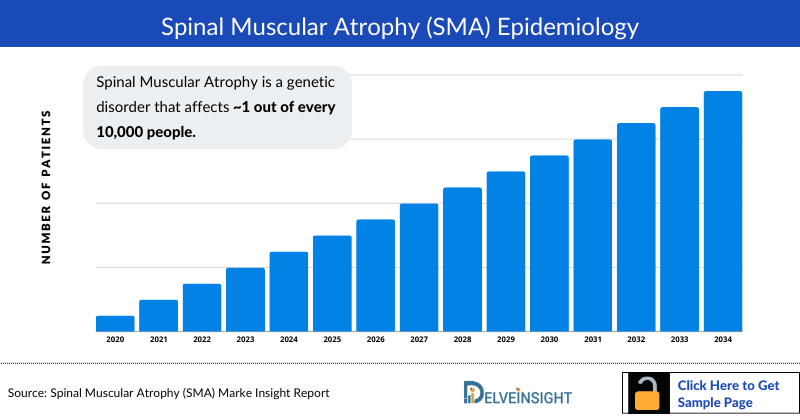

- Spinal Muscular Atrophy is a genetic disorder that affects approximately 1 out of every 10,000 people. Most cases of Spinal Muscular Atrophy occur when a segment of a gene called SMN1 is missing, resulting in the gene being unable to make protein.

- Given that Spinal muscular atrophy is a rare genetic disorder, the incidence of the disease is more accurately related to the birth prevalence or number of children born with Spinal muscular atrophy during a given period.

- The type of Spinal muscular atrophy includes SMA Type l, SMA Type ll, SMA Type lll, and SMA Type IV, and SMA I accounts for the highest number of Spinal muscular atrophy cases.

- Three treatments have recently been approved by the Food and Drug Administration (FDA). SPINRAZA increases the expression levels of the SMN protein using an antisense oligonucleotide to alter splicing of the SMN2 transcript. ZOLGENSMA is a gene therapy that utilizes an adeno-associated virus serotype 9 vector to increase low functional SMN protein levels. EVRYSDI is a small molecule that alters SMN2 splicing to increase functional SMN protein.

- Among the three FDA-approved therapies, SPINRAZA and ZOLGENSMA stand out as blockbuster drugs, with SPINRAZA capturing a significant market share among the 7MM. These groundbreaking treatments have not only transformed the landscape of Spinal Muscular Atrophy but have also yielded significant financial returns for the pharmaceutical companies behind their development.

- Currently, major pharmaceutical companies like Scholar Rock, Biohaven/ Bristol-Myers Squibb, F. Hoffmann-La Roche, NMD Pharma, and others are actively enhancing the treatment landscape for Spinal Muscular Atrophy. There's noticeable progress in their clinical research programs dedicated to addressing this indication. For instance, Scholar Rock is planning to disclose topline data of the apitegromab in the fourth quarter of 2024, and if the trial is successful, the company expects to initiate regulatory applications in the US and Europe If apitegromab is approved, the company is planning for commercial product launch in 2025.

- The new approval for the treatment of Spinal muscular atrophy in the market is surely going to be a transformative milestone.

DelveInsight's “Spinal Muscular Atrophy Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of Spinal Muscular Atrophy, historical and forecasted epidemiology as well as the Spinal Muscular Atrophy market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Spinal Muscular Atrophy market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM Spinal Muscular Atrophy market size from 2020 to 2034. The report also covers current Spinal Muscular Atrophy treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Spinal Muscular Atrophy Understanding and Treatment Algorithm

Spinal Muscular Atrophy Overview, Country-Specific Treatment Guidelines and Diagnosis

Spinal Muscular Atrophy refers to a group of hereditary diseases that can damage and kill specialized nerve cells in the brain and spinal cord (motor neurons). Motor neurons control movement in the arms, legs, face, chest, throat, and tongue, as well as skeletal muscle activity, such as speaking, walking, swallowing, and breathing. The most common form of Spinal Muscular Atrophy is caused by a mutated or missing gene known as the survival motor neuron gene 1 (SMN1), which is typically responsible for the production of a protein essential to motor neurons. There are four types of this form of Spinal muscular atrophy: SMA Type l, SMA Type ll, SMA Type lll, and SMA Type IV.

Usually, the blood test is available to look for mutations or deletions of the SMN1 gene. This test identifies at least 95% of Spinal muscular atrophy Types I, II, and III, and also may reveal if a person is a carrier.

The Spinal muscular atrophy report provides an overview of Spinal muscular atrophy pathophysiology, diagnostic approaches, and detailed treatment algorithm along with a real-world scenario of a patient’s journey beginning from the first symptom, the time taken for diagnosis to the entire treatment process.

Further details related to country-based variations in diagnosis are provided in the report...

Spinal Muscular Atrophy Treatment

There is no complete cure for Spinal muscular atrophy. Treatment consists of managing the symptoms and preventing complications. Currently, the US FDA has approved SPINRAZA, ZOLGENSMA, and EVRYSDI for the treatment of Spinal muscular atrophy.

Physical therapy, occupational therapy, and rehabilitation may help to improve posture, prevent joint immobility, and slow muscle weakness and atrophy. Stretching and strengthening exercises may help reduce contractures, increase the range of motion, and keep circulation flowing. Proper nutrition and calories are essential to maintaining weight and strength while avoiding prolonged fasting.

Spinal Muscular Atrophy Epidemiology

The Spinal Muscular Atrophy epidemiology chapter in the report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. The Spinal muscular atrophy epidemiology is segmented with detailed insights into diagnosed prevalent cases of Spinal muscular atrophy, gender-specific diagnosed prevalent cases of Spinal muscular atrophy, type-specific diagnosed prevalent cases of Spinal muscular atrophy, and age-specific diagnosed prevalent cases of Spinal muscular atrophy

- According to the findings, Spinal Muscular Atrophy has a carrier frequency of 1 in 40–50 and an estimated incidence of 1 in 10,000 live births, Spinal muscular atrophy is the second most common autosomal recessive disorder.

- The traditional types of Spinal Muscular Atrophy are caused by biallelic mutations in the survival motor neuron 1 (SMN1) gene located on chromosome 5 that result in a lack of SMN proteins. A second gene, called SMN2, also produces SMN proteins but they are usually truncated and only 10%-20% are viable.

- It is estimated that roughly 60% of Spinal muscular atrophy newborns have Spinal muscular atrophy type I while types II and III make up the remaining 40%.

Spinal Muscular Atrophy Recent Developments

- In March 2025, Scholar Rock announced that the U.S. Food and Drug Administration (FDA) has accepted its Biologics License Application (BLA) for apitegromab. This investigational muscle-targeted treatment aims to improve motor function in people with spinal muscular atrophy (SMA) who are already receiving SMN-targeted treatment.

- In February 2025, Genentech, a member of the Roche Group, announced that the FDA approved a New Drug Application (NDA) for an Evrysdi® (risdiplam) tablet for individuals living with spinal muscular atrophy (SMA).

- In January 2025, Scholar Rock announced the submission of a Biologics License Application (BLA) to the U.S. Food and Drug Administration (FDA) for apitegromab. This muscle-targeted therapy aims to provide significant motor function improvements in patients with SMA who are undergoing SMN-targeted treatments.

- In January 2025, Biogen announced that the FDA has accepted its supplemental New Drug Application (sNDA) and the EMA has validated the application for a higher dose regimen of nusinersen for spinal muscular atrophy (SMA).

- On September 4, 2024, Biogen Inc. announced positive topline data from Part B of the Phase 2/3 DEVOTE study. This pivotal trial evaluated a higher dose regimen of nusinersen in treatment-naïve, symptomatic infants with spinal muscular atrophy (SMA). The new regimen includes a rapid loading phase with two 50 mg doses 14 days apart, followed by a higher maintenance dose of 28 mg every 4 months, compared to the current nusinersen regimen (SPINRAZA).

Spinal Muscular Atrophy Drug Chapters

The drug chapter segment of the Spinal muscular atrophy report encloses a detailed analysis of Spinal muscular atrophy marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into the Spinal muscular atrophy pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Spinal Muscular Atrophy Marketed Drugs

SPINRAZA: Biogen

SPINRAZA, manufactured by Biogen is an approved drug for the treatment of Spinal muscular atrophy in adults and children. The active ingredient of the drug is Nusinersen. It is a modified oligonucleotide with 2’¬ hydroxyl groups of the ribofuranosyl rings that are replaced with 2’-O-2-methoxyethyl groups and the phosphate linkages that are replaced with phosphorothioate linkages. Nusinersen targets the intronic splicing silencer N1 (ISS-N1) of exon 7 of the SMN2 transcript. It blocks the ISS-N1 which results in the destabilization of an inhibitory stem-loop RNA structure in intron 7, close to the end of exon 7 and thus leads to increased exon inclusion. The drug is approved across the 7MM for treatment of Spinal muscular atrophy.

ZOLGENSMA (onasemnogene abeparvovac-xioi): Novartis

ZOLGENSMA is an adeno-associated virus (AAV) vector-based gene therapy indicated for the treatment of pediatric patients less than 2 years of age with spinal muscular atrophy with bi-allelic mutations in the survival motor neuron 1 gene. Intravenous administration of ZOLGENSMA results in cell transduction and expression of the survival motor neuron protein was observed in human case studies. This therapy was approved in the US in May 2019 and in Europe and Japan in May 2020 and March 2020, respectively.

Currently, Novartis is conducting a clinical trial to evaluate the safety and tolerability of ZOLGENSMA in older and heavier patients and the Phase III data revealed that ZOLGENSMA is clinically beneficial for older and heavier patients with Spinal muscular atrophy, many of whom have had prior treatment with another disease-modifying therapy.

EVRYSDI (risdiplam): Genentech/ F. Hoffmann-La Roche

EVRYSDI is a survival of motor neuron 2 splicing modifier designed to treat patients with spinal muscular atrophy caused by mutations in chromosome 5q that lead to survival of motor neuron protein deficiency in patients two months of age and older. The drug received US FDA approval in August 2020 and the EC granted marketing authorization to the drug in March 2021.

In June 2023, Roche released compelling data from the FIREFISH study, affirming the enduring efficacy and safety of EVRYSDI in children diagnosed with Type I spinal muscular atrophy. The FIREFISH study, conducted in two parts with infants aged 1-7 months at enrollment, demonstrated that after four years of EVRYSDI treatment, many of these infants, now progressing into young children, sustained improvements in their ability to sit, stand, and walk independently.

|

Therapy Name |

Company Name |

ROA |

MOA |

Molecular Type |

|

SPINRAZA |

Biogen |

Intrathecal injection |

RNA interference |

Oligoneuclotide |

|

ZOLGENSMA |

Novartis |

Intravenous infusion |

Gene Transference |

Gene-vector |

|

EVRYSDI |

Genentech/ F. Hoffmann-La Roche |

Oral |

Protein modulators |

Small molecule |

Note: Detailed current therapies assessment will be provided in the full report of Spinal muscular atrophy...

Spinal Muscular Atrophy Emerging Drugs

Apitegromab (SRK-015): Scholar Rock

Apitegromab (SRK-015) is a selective inhibitor of the activation of latent myostatin and is an investigational product candidate for treating patients with Spinal muscular atrophy. Rather than the traditional approach of blocking already-activated, mature myostatin or the receptor, Apitegromab selectively targets the precursor, or inactive, form of myostatin to block its activation in the muscle. The US FDA has granted Orphan Drug Designation, Fast Track designation, and Rare Pediatric Disease designation while the European Commission also granted Orphan Medicinal Product Designation to the drug and the EMA has granted Priority Medicines (PRIME) Designation to apitegromab for the treatment of Spinal muscular atrophy.

Currently, it is under Phase III of its clinical development for the treatment of Spinal muscular atrophy and two trials are running by NCT ID NCT05156320 and NCT05626855.

Taldefgrobep Alfa (BHV-2000): Biohaven/ Bristol-Myers Squibb

Taldefgrobep Alfa, a myostatin inhibitor, myostatin is a natural protein that normally works to regulate skeletal muscle growth, an important process in healthy muscular development. In patients with neuromuscular diseases, over-active myostatin can critically limit the growth needed to achieve normal developmental and functional milestones. Myostatin inhibition is a potential therapeutic strategy for children and adults with a range of neuromuscular conditions for whom active myostatin can limit the skeletal muscle growth needed to achieve developmental and functional milestones. Recently generated data showed that the taldefgrobep alfa-myostatin complex is stable and blocking myostatin activity and signaling has been shown to improve muscle function and strength in several disease models for neuromuscular wasting along with physical and metabolic changes important to individuals living with overweight and obesity. Blocking activin contributes to decreased adipose tissue and improved glucose homeostasis. Clinical studies have confirmed that taldefgrobep improved lean body mass directly through an increase in contractile muscle and loss of adipose tissue as demonstrated in both normal healthy volunteers and in patients with Duchenne muscular dystrophy.

The US FDA has granted ODD and FTD to the taldefgrobep Alfa for the treatment of Spinal muscular atrophy, and currently, the drug is in Phase III of its clinical development, and Biohaven entered into a worldwide license agreement with Bristol Myers Squibb for the global development and commercialization rights to taldefgrobep alfa.

|

Therapy Name |

Company Name |

ROA |

MOA |

Phases |

Any Special Status |

|

Apitegromab |

Scholar Rock |

Intravenous infusion |

Myostatin inhibitors |

III |

ODD/ FTD/ Rare Pediatric Disease designation(RPDD) |

|

Taldefgrobep alfa (BHV-2000) |

Biohaven/ Bristol-Myers Squibb |

Subcutaneous injection |

Myostatin inhibitors |

III |

FTD/ ODD |

|

GYM329/RG6237 |

F. Hoffmann-La Roche |

Intravenous infusion |

Myostatin inhibitors |

II/III |

NA |

|

NMD670 |

NMD Pharma |

Oral |

CLC-1-channel-antagonists |

II |

NA |

Note: Detailed emerging therapies assessment will be provided in the final report...

Spinal Muscular Atrophy Market Outlook

Key players, such as Scholar Rock, Biohaven/ Bristol-Myers Squibb, F. Hoffmann-La Roche, NMD Pharma, and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of Spinal muscular atrophy.

Spinal muscular atrophy Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report...

Spinal Muscular Atrophy Activities

The report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Spinal muscular atrophy emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging treatment patterns of Spinal muscular atrophy. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Spinal Muscular Atrophy Market Report

- The report covers a segment of key events, an executive summary, descriptive overview of Spinal muscular atrophy, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Spinal muscular atrophy market, historical and forecast market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Spinal muscular atrophy market.

Spinal Muscular Atrophy Report Insights

- Spinal Muscular Atrophy Patient Population

- Spinal Muscular Atrophy Therapeutic Approaches

- Spinal muscular atrophy Pipeline Analysis

- Spinal muscular atrophy Market Size and Trends

- Existing and future Market Opportunity

Spinal Muscular Atrophy Report Key Strengths

- 10 Years Forecast

- 7MM Coverage

- Spinal muscular atrophy Epidemiology Segmentation

- Inclusion of Country specific treatment guidelines

- KOL’s feedback on approved and emerging therapies

- Key Cross Competition

- Conjoint analysis

- Spinal Muscular Atrophy Drugs Uptake

- Key Spinal Muscular Atrophy Market Forecast Assumptions

Spinal Muscular Atrophy Report Assessment

- Current Spinal Muscular Atrophy Treatment Practices

- Spinal Muscular Atrophy Unmet Needs

- Spinal Muscular Atrophy Pipeline Product Profiles

- Spinal Muscular Atrophy Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Spinal Muscular Atrophy Market Drivers

- Spinal Muscular Atrophy Market Barriers

FAQs

- What is the growth rate of the 7MM Spinal muscular atrophy treatment market?

- What was the Spinal muscular atrophy total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends? Although multiple expert guidelines recommend testing for targetable mutations before therapy initiation, why do barriers to testing remain high?

- What are the current and emerging options for the treatment of Spinal muscular atrophy?

- How many companies are developing therapies for the treatment of Spinal muscular atrophy?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient/physician acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy Spinal Muscular Atrophy Market Report

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Spinal muscular atrophy Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-pipeline.png&w=256&q=75)

.png&w=256&q=75)