Substance Use Disorder Market Summary

- The Substance Use Disorder market size is anticipated to grow with a significant CAGR during the study period (2020-2034).

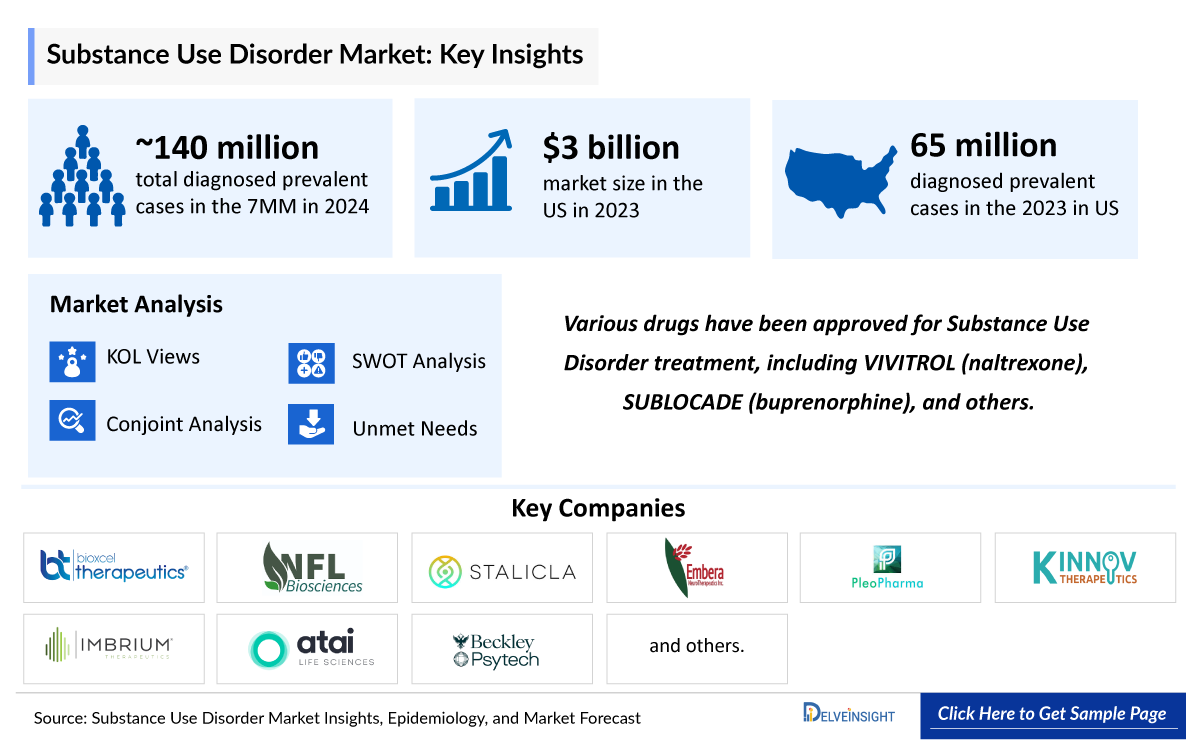

- The United States generated the revenue of approximately USD 3000 million in 2023.

- In 2023, France accounted for the highest market size, approximately USD 494 million, among the EU4 and the UK in 2023.

- The leading Substance Use Disorder companies developing therapies include - BioXcel Therapeutics, NFL Biosciences, STALICLA, Embera NeuroTherapeutics, PleoPharma, Kinnov Therapeutics, Imbrium Therapeutics, Atai Life Sciences, Beckley Psytech, and others.

Substance Use Disorder Market and Epidemiology Insights:

- In the 7MM, the US accounted for approximately 65 million diagnosed prevalent cases of Substance Use Disorder in 2023, the highest number among the countries.

- Substance Use Disorder is a condition marked by an inability to control substance use despite negative consequences. Symptoms are grouped into four categories: impaired control (cravings, failed attempts to quit), social problems (neglecting responsibilities), dangerous use (substance use in risky situations), and drug effects (tolerance and withdrawal).

- Acamprosate MOA involves restoring neurotransmitter balance by modulating glutamate and GABA activity, helping reduce alcohol dependence and cravings effectively.

- Common substances involved in Substance Use Disorder include alcohol, opioids, stimulants, Cocaine hallucinogens, tobacco, and others. Each substance can have unique effects and risks associated with its use, and overdose can be potentially fatal if untreated.

- Various drugs have been approved for Substance Use Disorder treatment, including VIVITROL (naltrexone), SUBLOCADE (buprenorphine), and others.

- In October 2024, Indivior announced that the FDA granted Priority Review for its Prior Approval Supplement (PAS) for SUBLOCADE rapid Induction/Alternative Injection Site. The Prescription Drug User Fee Act (PDUFA) action date is set for February 7, 2025

- In the United States, tobacco use disorder was reported as the most prevalent substance-specific case in 2023, with approximately 26 million cases.

- Numerous drugs are currently in development for the treatment of Substance Use Disorder, with a particular emphasis on Alcohol Use Disorder (AUD), including promising therapies like mavoglurant, EMB-001, NFL-101, TMP-301, and others, which are set to launch in the 7MM during the forecast period (2024–2034).

- In January 2025, Awakn Life Sciences Corp. announced a positive outcome from its Pre-IND meeting with the FDA, which took place on December 16, 2024. The company, focused on therapeutics for substance use and mental health disorders, received encouraging feedback for its development program.

- In November 2024, PleoPharma presented the positive Phase Ib results from its clinical trial on cannabis withdrawal at the American Academy of Addiction Psychiatry (AAAP) Annual Meeting.

- In September 2024, Kinnov Therapeutics was present at the ENCP Congress, where they presented the results of their Phase II clinical trials for KT-110.

- The growing number of emerging therapies in development highlights a critical push towards advancing treatment options for Substance Use Disorder.

Request a sample to unlock the CAGR for "Substance Use Disorder Market Forecast"

Key Factors Driving Substance Use Disorder Market:

-

Rising Prevalence of Substance Use Disorders: Increasing rates of opioid, alcohol, and stimulant use disorders globally are expanding the patient pool and driving demand for effective treatment options.

-

Growing Adoption of Medication-Assisted Treatment (MAT): Wider acceptance of MAT approaches, including buprenorphine, methadone, and naltrexone, is improving treatment outcomes and fueling market growth.

-

Government Initiatives and Supportive Policies: Increased public funding, awareness campaigns, and policy reforms aimed at addressing the opioid crisis are enhancing access to SUD treatment services.

-

Advancements in Long-Acting and Novel Therapies: Development of extended-release formulations, abuse-deterrent medications, and therapies targeting new neurobiological pathways is strengthening the treatment landscape.

-

Expansion of Digital Health and Integrated Care Models: Growth in telemedicine, digital therapeutics, and integrated behavioral health programs is improving treatment accessibility, adherence, and continuity of care.

DelveInsight’s “Substance Use Disorder Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Substance Use Disorder, historical and forecasted epidemiology, as well as the Substance Use Disorder therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Substance Use Disorder market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Substance Use Disorder market size from 2020 to 2034. The report also covers Substance Use Disorder treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Scope of the Substance Use Disorder Market | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Substance Use Disorder Market |

|

|

Substance Use Disorders Market Size | |

|

Substance Use Disorder Companies |

BioXcel Therapeutics, NFL Biosciences, STALICLA, Embera NeuroTherapeutics, PleoPharma, Kinnov Therapeutics, Imbrium Therapeutics, Atai Life Sciences, Beckley Psytech, and others. |

|

Substance Use Disorder Epidemiology Segmentation |

|

Substance Use Disorder Disease Understanding

Substance Use Disorder Overview

Substance Use Disorder is a complex condition marked by the uncontrolled use of substances, such as alcohol, tobacco, or other psychoactive drugs, despite harmful consequences. Individuals with Substance Use Disorder often become addicted, developing an intense focus on using these substances to the point where their daily functioning is impaired. Continued use leads to changes in brain function, particularly in areas related to judgment, decision-making, and behavioral control. These changes can cause cravings, distorted thinking, and behavioral shifts, even long after the immediate effects of intoxication wear off. Tolerance can develop, requiring larger amounts of the substance to achieve the desired effect, and withdrawal symptoms, including anxiety, may occur when use is discontinued.

Substance Use Disorder Diagnosis

The diagnosis of Substance Use Disorder begins with a comprehensive evaluation by a healthcare professional, often initiated by concerns raised by family members, friends, or the individual themselves. The process typically involves an intake assessment, which may occur at a drug rehab facility or through a physician or addiction specialist. The clinician will ask about the frequency of substance use, its impact on the person's life, and whether it has caused problems in social, occupational, or educational functioning. They will also assess whether physical dependence, withdrawal symptoms, and tolerance are present. Using the criteria outlined in the Diagnostic and Statistical Manual of Mental Disorders, Fifth Edition (DSM-V), the physician evaluates whether the individual meets at least two of the 11 diagnostic criteria for Substance Use Disorder within a one-year period. Based on the number of criteria met, the severity of the disorder is classified as mild (2-3 criteria), moderate (4-5), or severe (6 or more). This diagnostic evaluation helps determine the extent of the disorder and guides the treatment recommendations.

Substance Use Disorder Treatment

Treatment for substance use disorder typically involves a combination of individual, group, and family therapy to develop skills for sobriety and navigate situations without turning to substances. Common therapeutic approaches include Cognitive Behavioral Therapy (CBT) to address negative thought patterns, Contingency Management (CM) to encourage sobriety with rewards, Motivational Interviewing (MI) to resolve ambivalence, and Dialectical Behavioral Therapy (DBT) to regulate emotions and reduce cravings. Other methods like Eye Movement Desensitization and Reprocessing (EMDR) for trauma, Rational Emotive Behavior Therapy (REBT) for healthier thinking, and Seeking Safety for trauma and substance misuse are also used. The Substance Use Disorder Treatment Market is expanding due to rising addiction cases, innovative therapies, and increasing government initiatives worldwide.

The Matrix Model, 12-Step Facilitation, and the Gottman Method for couples are additional strategies to promote recovery and prevent relapse. In addition to these therapies, medications such as buprenorphine, naltrexone and others are commonly used to treat substance use disorders, especially in managing opioid dependence. The US Substance Use Disorder Treatment Market is expanding due to rising addiction cases, advanced therapies, and increasing government initiatives.

Further details related to treatment and management are provided in the report…

Substance Use Disorder Epidemiology

The Substance Use Disorder epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Diagnosed Prevalent Cases of Substance Use Disorder, Substance type-specific Cases of Substance Use Disorder, Total Treated Cases of Substance Use Disorder in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Substance Use Disorder Epidemiological Analyses and Forecast

- Among the 7MM, the United States accounted for the highest number of cases of substance use disorder in 2023, with nearly 65 million cases. These cases are anticipated to increase by 2034.

- In 2023, the US recorded the highest prevalence of Tobacco use disorder, with ~26 million cases, followed by Cannabis use disorder, which accounted for ~19 million cases. These cases are expected to increase by 2034.

- In the 7MM, the United Kingdom accounted for the least number of treated cases of Substance Use Disorder in 2023, with approximately USD 1.17 million cases.

- Among the EU4 and the UK, France accounted for approximately USD 16.2 million diagnosed prevalent cases in 2023, the highest, while the United Kingdom accounted for approximately USD 8.2 million, the least.

Substance Use Disorder Epidemiology Segmentation

- Total Diagnosed Prevalent Cases of Substance Use Disorder

- Substance type-specific Cases of Substance Use Disorder

- Total Treated Cases of Substance Use Disorder

Recent Developments In the Substance Use Disorder Treatment Landscape

- In January 2025, Awakn Life Sciences Corp. announced a positive outcome from its Pre-IND meeting with the FDA, which took place on December 16, 2024. The company, focused on therapeutics for substance use and mental health disorders, received encouraging feedback for its development program.

Substance Use Disorder Drug Analysis

The section dedicated to drugs in the Substance Use Disorder report provides an in-depth evaluation of late-stage Substance Use Disorder pipeline drugs (Phase II) related to Substance Use Disorder drugs market. The drug chapters section provides valuable information on various aspects related to clinical trials of Substance Use Disorder, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting Substance Use Disorder. The Naltrexone Buprenorphine market is expanding due to rising opioid dependence, increasing treatment demand, and ongoing pharmaceutical advancements. Acamprosate MOA involves restoring neurotransmitter balance by modulating glutamate and GABA activity, helping reduce alcohol dependence and cravings effectively.

Substance Use Disorder Marketed Drugs

VIVITROL (naltrexone): Alkermes

VIVITROL developed by Alkermes, is a prescription medication used for the treatment of OUD and alcohol dependence. It is an opioid receptor antagonist that works by blocking the effects of opioids in the brain, which helps to reduce cravings and prevent the rewarding effects of opioid use. This action is particularly beneficial in preventing relapse and supporting patients in maintaining abstinence from opioids and alcohol. VIVITROL is administered as an intramuscular injection, providing a convenient once-monthly dosing regimen. VIVITROL was approved in the US in 2006.

In August 2023, Alkermes announced a settlement with Teva regarding patent litigation, granting Teva a license to market a generic version of VIVITROL in the US starting January 15, 2027, or earlier under certain conditions.

BRIXADI (buprenorphine): Braeburn

BRIXADI is an extended-release formulation of buprenorphine developed by Braeburn, approved in May 2023 by US FDA, administered via subcutaneous injection. It functions as a partial agonist at the mu-opioid receptor, providing a controlled modulation of opioid effects, which helps manage cravings and withdrawal symptoms in OUD. As a small molecule, BRIXADI is designed to penetrate cell membranes effectively and offer a long-lasting therapeutic effect. The subcutaneous injection route allows for sustained, steady release of the drug, enhancing patient compliance and supporting consistent treatment outcomes in the management of opioid dependence.

In June 2024, Braeburn, announced the publication of a post hoc analysis in JAMA Network Open, evaluating data from the Phase III trial comparing BRIXADI (buprenorphine) extended-release injection to daily sublingual buprenorphine/naloxone in patients with moderate to severe OUD, including those with fentanyl use.

Emerging Substance Use Disorder Therapies

Mavoglurant (STP7/AFQ056): STALICLA

STP7 (mavoglurant) is a selective nonallosteric mGluR5 antagonist. mGluR5 has been tied to mood disorders, addiction, and rare and common forms of autism. The product is believed to block a certain protein in the brain, which research has shown is related to people’s craving to use drugs like cocaine. A clinical Phase II study showed mavoglurant-induced abstinence in CUD patients through inhibition of mGluR5, with no evidence of withdrawal liability. The company plans to advance mavoglurant into Phase III development to treat CUD, which will be covered by the US National Institute on Drug Abuse (NIDA). Also, the company will use its precision neurobiology Drug Development Platform (DEPI) to detect subgroups of high-responder patients with rare and common neurodevelopmental disorders where mavoglurant can be an effective treatment, as guided by earlier clinical studies.

In May 2024, STALICLA announced the First Patient First Visit (FPFV) for the company’s Drug-drug Interaction (DDI) study of STP7 (Mavoglurant), licensed to STALICLA by Novartis. The DDI study is the last regulatory requirement in a comprehensive Phase II program, and completion is expected to trigger the initiation of a Phase III study in the US in 2025.

BPL-003 (Mebufotenin): Atai Life Sciences/ Beckley Psytech

BPL-003, developed by Beckley Psytech, is an innovative therapeutic designed for the treatment of AUD. It belongs to a class of small molecules and is primarily categorized under antidepressants, mood stabilizers, and tryptamines. The product acts as a serotonin receptor modulator, targeting specific receptors in the brain to potentially influence mood regulation and reduce alcohol cravings. Administered intranasally, BPL-003 offers a non-invasive and efficient delivery route, enabling rapid absorption and a quick onset of action. The product is being developed to address AUD, utilizing its mechanism of action to modulate serotonin pathways, which are crucial in regulating mood and behavior, ultimately aiding in alcohol cessation and recovery. Currently, it is in Phase II of development for the treatment of AUD.

In April 2024, atai Life Sciences announced the publication of Beckley Psytech’s Phase I study of BPL-003 in the Journal of Psychopharmacology. This publication highlights key findings on the safety, tolerability, and pharmacokinetic profile of BPL-003, an investigational treatment for AUD.

Substance Use Disorder Market Outlook

The treatment landscape for Substance Use Disorder has advanced significantly with the approval of several medications, including VIVITROL (naltrexone), SUBLOCADE (extended-release formulation of naltrexone), and others, which help manage addiction by blocking opioid receptors and reducing cravings. These drugs play a critical role in supporting recovery. In addition to established therapies, emerging drug combinations such as gabapentin + nabilone and cyproheptadine + prazosin show promise for further improving Substance Use Disorder treatment. These combinations target various pathways involved in addiction, aiming to reduce cravings, manage withdrawal symptoms, and prevent relapse. As research progresses, these novel therapies may offer more personalized and effective treatment options, particularly for patients who have not responded well to traditional pharmacotherapies. The market for Substance Use Disorder treatment is expected to grow as new molecules and combination therapies are developed, paving the way for more successful interventions.

Substance Use Disorder Market Insights

- A few key players are leading the treatment landscape of Substance Use Disorder, such as Imbrium Therapeutics, Kinnov Therapeutics, Alkermes, Indivior and others. The details of the country-wise and therapy-wise market size have been provided below.

- In the 7MM, the United States accounted for the highest market share, i.e. more than 60% in 2023, followed by France and the Germany.

- The United States generated the revenue of approximately USD 3000 million in 2023.

- Among the EU4 and the UK, France accounted for highest market size in 2023 with approximately USD 490 million.

- The United Kingdom accounted for the least market size, approximately USD 250 million, among the EU4 and the UK in 2023.

Substance Use Disorder Competitive Landscape

The Substance Use Disorder (SUD) competitive landscape is characterized by a mix of established pharmaceutical companies, specialty biotech firms, and digital health providers focused on improving treatment outcomes. Current competition centers on medication-assisted treatments (MAT) such as buprenorphine, methadone, naltrexone, and acamprosate, alongside behavioral and psychosocial interventions. Emerging players are advancing long-acting formulations, abuse-deterrent therapies, and novel neurobiological targets to address relapse and adherence challenges. Increasing adoption of digital therapeutics, telehealth platforms, and integrated care models, combined with strong government support and reimbursement initiatives, is reshaping competition and expanding access to SUD treatment.

Key Substance Use Disorder Companies

The Key Substance Use Disorder companies actively involved in the Substance Use Disorder treatment landscape include -

- BioXcel Therapeutics

- NFL Biosciences

- STALICLA

- Embera NeuroTherapeutics

- PleoPharma

- Kinnov Therapeutics

- Imbrium Therapeutics

- Atai Life Sciences

- Beckley Psytech, and others

In summary, numerous therapies have already been approved for the management of Substance Use Disorder, with several effective medications currently available. While ongoing research continues to explore new treatments, many approved therapies are already making a significant impact in the Substance Use Disorder treatment landscape. The forecast period (2024–2034) is expected to bring further advancements, with emerging therapies enhancing existing treatment options. As healthcare spending continues to increase worldwide, the Substance Use Disorder treatment space is anticipated to see a positive shift, with more accessible and effective therapies becoming available to patients in need.

Further details are provided in the report…

Bladder Cancer Drugs Uptake

This section focuses on the rate of uptake of the potential Bladder cancer drugs recently launched in the Bladder cancer treatment market or expected to get launched in the market during the study period 2020-2034. The analysis covers Bladder cancer market uptake by drugs; patient uptake by therapies; and sales of each drug.

Bladder cancer Drugs Uptake helps in understanding the drugs with the most rapid uptake, reasons behind the maximal use of new drugs, and allow the comparison of the drugs on the basis of Bladder cancer market share and size which again will be useful in investigating factors important in market uptake and in making financial and regulatory decisions.

Bladder Cancer Clinical Trial Activities

The Bladder cancer pipeline report provides insights into Bladder cancer Clinical Trials within Phase II, and Phase III stage. It also analyses Bladder cancer key players involved in developing targeted therapeutics.

Bladder Cancer Pipeline Development Activities

The Bladder cancer clinical trials analysis report covers the detailed information of collaborations, acquisition, and merger, licensing, patent details, and other information for Bladder cancer emerging therapies.

Latest KOL Views on Substance Use Disorder Market Report

To stay abreast of the latest trends in the market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research.

We have reached out to industry experts to gather insights on various aspects of Substance Use Disorder, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at Delveinsight connected with more than 15 KOLs across the 7MM. We contacted institutions. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the Substance Use Disorder market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Substance Use Disorder Report Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in trials for Substance Use Disorder, one of the most important primary endpoints was achieving Change in anxiety as measured by heart rate, Change in blood pressure and anxiety, and others. Based on these, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Substance Use Disorder Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Substance Use Disorder Market Report

- The Substance Use Disorder treatment market report covers the descriptive overview of Substance Use Disorder, explaining its causes, signs and symptoms, pathophysiology, diagnosis and currently available Substance Use Disorder therapies

- Comprehensive insight has been provided into the Substance Use Disorder epidemiology and treatment in the 7MM

- Additionally, an all-inclusive account of both the current and emerging therapies for Substance Use Disorder is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape

- A detailed review of the Substance Use Disorder treatment market; historical and forecasted is included in the report, covering drug outreach in the 7MM

- The Substance Use Disorder treatment market report provides an edge while developing business strategies, by understanding trends shaping and driving the global Substance Use Disorder market.

Substance Use Disorder Report Summary

- The report offers extensive knowledge regarding the epidemiology segments and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies and the elaborative profiles of late-stage (Phase II and Phase I) and prominent therapies that would impact the current treatment landscape and result in an overall market shift has been provided in the report.

- The report also encompasses a comprehensive analysis of the Substance Use Disorder market, providing an in-depth examination of its historical and projected market size (2020–2034). It also includes the market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The report also includes drug outreach coverage in the 7MM region.

- The report includes qualitative insights that provide an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM substance use disorder market.

Substance Use Disorder Market Report Insights

- Substance Use Disorder Patient Population

- Substance Use Disorder Therapeutic Approaches

- Substance Use Disorder Market Size and Trends

- Existing Market Opportunity

Substance Use Disorder Market Report Key Strengths

- Eleven-year Forecast

- The 7MM Coverage

- Substance Use Disorder Epidemiology Segmentation

- Key Cross Competition

- Substance Use Disorder Drugs Uptake

Substance Use Disorder Market Report Assessment

- Current Substance Use Disorder Treatment Practices

- Substance Use Disorder Market Reimbursements

- Substance Use Disorder Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet needs)

- Substance Use Disorder Market Drivers

- Substance Use Disorder Market Barriers

Key Questions Answered In The Substance Use Disorder Market Report:

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in Substance Use Disorder management recommendations?

- Would research and development advances pave the way for future tests and therapies for Substance Use Disorder?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of Substance Use Disorder?

- What kind of uptake will the new therapies witness in the coming years in Substance Use Disorder patients?

Reasons to buy Substance Use Disorder Market Report

- The Substance Use Disorder treatment market report will help in developing business strategies by understanding trends shaping and driving the Substance Use Disorder market

- To understand the future market competition in the Substance Use Disorder market and Insightful review of the key market drivers and barriers

- Organize sales and marketing efforts by identifying the best opportunities for Substance Use Disorder in the US, Europe (Germany, Spain, Italy, France, and the United Kingdom) and Japan

- Identification of strong upcoming Substance Use Disorder companies in the Substance Use Disorder drugs market will help in devising strategies that will help in getting ahead of competitors

- Organize sales and marketing efforts by identifying the best opportunities for Substance Use Disorder market

- To understand the future market competition in the Substance Use Disorder market

-pipeline.png&w=256&q=75)