Surgical Robotic System Market Summary

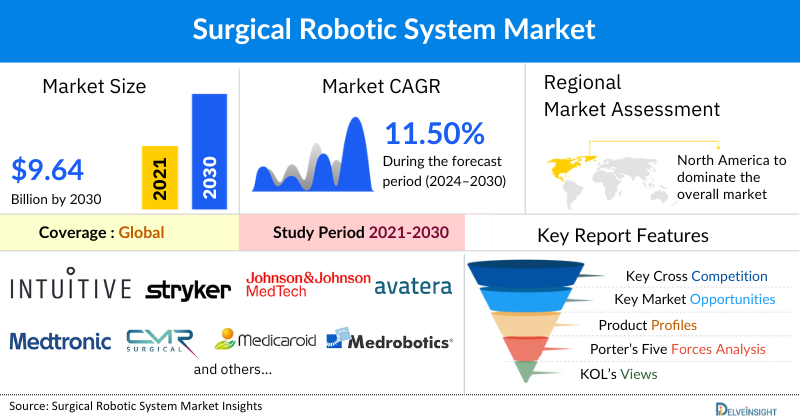

- The Global Surgical Robotic System Market Size is expected to increase from USD 11,082.32 million in 2024 to USD 29,785.13 million by 2032, reflecting strong and sustained growth.

- The Global Surgical Robotic System Market is growing at a CAGR of 13.21% during the forecast period from 2025 to 2032.

Request for Unlocking the Sample Page of the "Surgical Robotic System Market"

Key Factors Driving the Surgical Robotic System Market Growth

Key Factors Driving the Surgical Robotic System Market Growth

-

Rising Preference for Minimally Invasive Surgeries

Increasing demand for minimally invasive procedures due to reduced blood loss, shorter hospital stays, faster recovery times, and lower postoperative complications is significantly boosting the adoption of surgical robotic systems across multiple specialties.

-

Technological Advancements in Robotic Platforms

Continuous innovations in robotic systems, including enhanced 3D visualization, improved instrument dexterity, AI-assisted navigation, haptic feedback, and integration with advanced imaging technologies, are expanding the clinical capabilities and applications of robotic surgery.

-

Growing Burden of Chronic and Complex Diseases

The increasing prevalence of cancer, cardiovascular disorders, urological conditions, gynecological diseases, and orthopedic disorders is driving the need for precise and complex surgical interventions, where robotic systems offer superior accuracy and consistency.

-

Improved Surgical Outcomes and Precision

Surgical robotic systems enable greater precision, stability, and control compared to conventional techniques, reducing human error and improving clinical outcomes, which is encouraging wider acceptance among surgeons and healthcare providers.

-

Rising Surgeon and Patient Acceptance

Increasing awareness, structured training programs, and growing surgeon proficiency with robotic-assisted procedures, coupled with higher patient acceptance due to perceived safety and efficacy, are accelerating market penetration.

-

Expansion of Indications across Specialties

The use of surgical robots is expanding beyond urology and gynecology into general surgery, orthopedics, neurosurgery, cardiothoracic surgery, and ENT procedures, broadening the overall market scope.

-

Favorable Reimbursement and Economic Benefits

Gradual improvements in reimbursement frameworks for robotic-assisted procedures and the potential for long-term cost savings through reduced complications and readmissions are contributing to market growth.

-

Strategic Collaborations and Product Launches

Ongoing collaborations between medical device manufacturers, healthcare institutions, and technology companies, along with frequent product upgrades and new system launches, are intensifying market expansion.

-

Rising Demand for Precision and Standardization in Surgery

The growing emphasis on standardized surgical outcomes, reproducibility, and enhanced ergonomics for surgeons is further driving the adoption of surgical robotic systems globally.

Surgical Robotic Systems Market by Component (System, Instruments & Accessories, and Services), Application (Urology, Gynecology, Neurosurgery, Orthopedics, and Others), End-User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the rising incidence of chronic disorders, increasing number of surgical procedures, and increasing product developmental activities among the key market players across the globe.

The global Surgical Robotic Systems Market was valued at USD 11,082.32 million in 2024, growing at a CAGR of 13.21% during the forecast period from 2025 to 2032 to reach USD 29,785.13 million by 2032. The rising incidence of chronic disorders such as cancer, cardiovascular diseases, and orthopedic conditions is significantly boosting the demand for advanced surgical interventions, thereby propelling the growth of the Surgical Robotic Systems Market. As chronic conditions often require complex, high-precision surgeries, robotic-assisted procedures offer enhanced accuracy, minimal invasiveness, and quicker recovery times, making them highly suitable for treating such ailments. Simultaneously, the increasing number of surgical procedures globally, driven by a growing aging population and a higher prevalence of lifestyle-related health issues, is further escalating the need for efficient and precise surgical tools. In response, key Surgical Robotic System Companies are heavily investing in product development activities, focusing on innovations such as compact robotic platforms, AI integration, and enhanced visualization systems. These advancements not only expand the scope of robotic surgery across specialties but also improve surgical outcomes, thereby contributing to the growth of the Surgical Robotic Systems Market Forecast Period from 2025 to 2032.

Surgical Robotic Systems Market Segment Analysis

Surgical Robotic Systems Market by Component (System, Instruments & Accessories, and Services), Application (Urology, Gynecology, Neurosurgery, Orthopedics, and Others), End-User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World).

In the component segment of the Surgical Robotic Systems Market, the system category is projected to grow significantly during the forecast period. Robotic systems as a core component are significantly boosting the overall market of surgical robotic systems by driving technological advancement, enhancing procedural efficiency, and expanding the range of surgical applications. These systems, which consist of robotic arms, advanced sensors, 3D high-definition vision systems, and precision control interfaces, enable surgeons to perform complex and minimally invasive procedures with greater accuracy, flexibility, and control than traditional methods.

Additionally, the integration of artificial intelligence (AI), machine learning algorithms, and haptic feedback into robotic systems is revolutionizing the surgical landscape by reducing the risk of human error and improving patient outcomes. For instance, in March 2024, Intuitive, a global technology leader in minimally invasive care and a pioneer of robotic-assisted surgery, announced that the U.S. Food and Drug Administration (FDA) had granted 510(k) clearance for da Vinci 5, the company’s next-generation multiport robotic system.

Thus, as hospitals and surgical centers increasingly adopt robotic platforms like the da Vinci Surgical System, ROSA, and others, the demand for high-performance robotic components continues to grow. Furthermore, innovations such as compact and modular robotic units are making these systems more accessible and easier to integrate into existing healthcare infrastructures. The scalability and upgrade potential of robotic systems allow institutions to future-proof their investments, making them more willing to adopt and expand their use. In addition, the ability of robotic systems to support various surgical specialties ranging from urology and gynecology to cardiology and orthopedics is broadening their market appeal.

This growing reliance on robotic components for precision and efficiency in surgery is a key factor fueling the robust growth of the Surgical Robotic Systems Market globally. Thus, all the above-mentioned factors are expected to boost the market of this category, thereby intensifying the overall Surgical Robotic Systems Market.

Get More Insights into the Report @ Surgical Robotic Systems Market Trends

What are the latest Surgical Robotic Systems Market Dynamics and Trends?

According to British Heart Foundation, Global Heart & Circulatory Diseases Factsheet (2024), it stated that around 200 million people are living with coronary artery disease (CAD) around the world.

Cardiac surgeries are another major area boosting the demand for surgical robotic systems. As per the study “The Global Cardiac Surgical Volume and Gaps”, over one million cardiac surgeries were performed annually. High-income countries reported an average of 123.2 cardiac surgeries per 100,000 people per year. Thus, surgical robotic systems are playing a crucial role in meeting this demand by offering greater precision, control, and dexterity in delicate cardiovascular procedures. These systems enable surgeons to perform complex cardiac interventions—such as mitral valve repair, coronary artery bypass, and atrial fibrillation treatments—through small incisions, resulting in reduced trauma, shorter recovery times, and fewer post-operative complications.

Additionally, the global rise in surgical procedures driven by an aging population, increasing prevalence of chronic conditions, and improved access to healthcare are significantly boosting the market for surgical robotic systems. As more patients undergo surgeries for conditions such as cancer, cardiovascular diseases, urological issues, and orthopedic disorders, there is a growing demand for advanced surgical solutions that offer better precision, reduced invasiveness, and faster recovery times. According, to the data provided by the OECD (2023), the average rate of hip replacements was 172 per 100,000 population, and knee replacements average was 119 per 100,000 population in countries like Switzerland, Germany, Finland, and Austria. These countries had reported some of the highest rates globally. As hospitals aim to improve clinical outcomes and patient satisfaction, they are increasingly investing in robotic systems to handle the rising volume of surgeries efficiently. This upward trend in surgical procedures is directly contributing to the expansion and adoption of surgical robotic systems.

Furthermore, product developmental activities by the market key players are likely to boost the Surgical Robotic Systems Market. For example, in October 2024, CMR Surgical obtained FDA marketing approval for its Versius robotic surgical system, designed to assist surgeons in performing cholecystectomies on adult patients aged 22 and above. Thus, due to all the above-mentioned factors highlighting the rising number of disorders globally, their increasing demand for treatment, and increasing product developmental activities, are expected to boost the market of surgical robotic systems Forecast Period. Despite these promising growth factors, the Surgical Robotic Systems Market faces challenges. The high cost of equipment and maintenance of surgical robots for low and middle-income countries and the availability of traditional alternative surgery methods are significant constraints that could potentially hinder market growth during the forecast period.

Scope of the Surgical Robotic Systems Market | |

|

Study Period |

2022 to 2032 |

|

Base Year |

2022 |

|

Forecast Period |

2025 to 2032 |

|

CAGR | |

|

Surgical Robotic System Market Size |

~USD 9 billion by 2032 |

|

Surgical Robotic System Companies |

Intuitive Surgical Inc, Stryker, JOHNSON & JOHNSON MEDICAL DEVICES COMPANIES, Medtronic, avateramedical GmbH, CMR Surgical Ltd., Medicaroid Corporation, Medrobotics Corp, Asensus Surgical US, Inc, Globus Medical, Microport Scientific Corporation, Smith & Nephew PLC., Accuray Incorporated, THINK Surgical., Renishaw plc, Zimmer Biomet, Corindus, Inc (Siemens Healthineers), Preceyes BV., MicroSure, Memic Innovative Surgery Ltd and others. |

The Surgical Robotic Systems Market Size is anticipated to be dominated by North America

North America is projected to account for the largest share of the Surgical Robotic Systems Market in 2024. This dominance can be attributed to several key factors, including the high instances of surgical procedures, increasing chronic conditions such as cancer, and growing product developmental activities such as regulatory approvals. Additionally, the presence of leading market players and the availability of well-developed infrastructure are the factors that are responsible for robust growth for surgical robotic systems during the forecast period from 2025 to 2032.

According to the American Academy of Orthopaedic Surgeons (2024), in 2021 more than 100,000 shoulder replacement surgeries were performed annually in the U.S., encompassing total shoulder replacement, hemiarthroplasty, and reverse total shoulder replacement. As per the same source, it projected that by 2025, the number of shoulder replacement procedures in the U.S. could range between 174,000 and 350,000. In such cases, surgical robotic systems enhance visualization and control, facilitating accurate implant placement while reducing soft tissue damage. The technology also helps complex procedures, such as reverse total shoulder replacement, to be performed safely.

Moreover, the product developmental activities in the region are anticipated to boost the market for the Surgical Robotic Systems Market. For example, in November 2024, Johnson & Johnson MedTech, a global leader in cardiovascular, orthopedic, surgical, and vision care solutions, announced that the U.S. Food and Drug Administration (FDA) granted Investigational Device Exemption (IDE) approval for its OTTAVA™ robotic surgical system. This approval allowed the company to initiate clinical trials at sites across the United States. With this milestone, Johnson & Johnson MedTech began preparing clinical trial locations, enrolling patients, and initiating surgical procedures using the OTTAVA system.

The prompt and well-established healthcare services and infrastructure further contribute to the growth of the regional Surgical Robotic Systems Market growth. The presence of key Surgical Robotic System Companies such as Johnson & Johnson Services, Inc., Stryker, Medtronic, and Zimmer Biomet with their strong distribution networks ensure widespread availability and accessibility of these surgical robotic systems across the region increasing their revenue shares in the market, and supportive reimbursement programs providing immense growth opportunities for the same.

Surgical Robotic Systems Companies

The leading Surgical Robotic Systems Companies such as Intuitive Surgical Inc., Stryker, Johnson & Johnson Services, Inc., Medtronic, avateramedical GmbH, CMR Surgical Ltd., Medicaroid Corporation, Medrobotics Corp., Asensus Surgical US, Inc., Globus Medical, Microport Scientific Corporation, Smith & Nephew plc., Accuray Incorporated, THINK Surgical, Renishaw plc., Zimmer Biomet, Siemens Healthineers, Preceyes BV, MicroSure, Memic Innovative Surgery Ltd., and others.

Recent Developmental Activities in the Surgical Robotic Systems Market:

- In May 2025, SS Innovations International (Nasdaq: SSII) announced plans to submit a De Novo Classification Request to the FDA in July for its SSi Mantra 3 surgical robotic system, aimed at making robotic surgery more affordable and globally accessible.

- In April 2025, Medtronic announced that its Expand URO Investigational Device Exemption (IDE) clinical study, the largest of its kind for robotic-assisted urologic surgery, met both primary safety and effectiveness endpoints. The multi-center, single-arm study involved 137 patients who underwent urologic procedures using the Hugo™ robotic-assisted surgery (RAS) system.

- In May 2025, SS Innovations International, Inc., a developer of surgical robotic technologies, announced plans to submit a De Novo classification request to the U.S. Food and Drug Administration (FDA) for its SSi Mantra 3 surgical robotic system in July 2025. With a current market valuation of $1.96 billion, the company experienced a 190% increase in its stock price over the past six months, according to data from InvestingPro. If approved, the De Novo request would allow SS Innovations to market the SSi Mantra 3 system in the United States.

- In April 2025, Intuitive (Nasdaq: ISRG) announced FDA clearance of its SP SureForm 45 stapler for use with the da Vinci SP system in thoracic, colorectal, and urologic surgeries.

Key Takeaways from the Surgical Robotic Systems Market Report Study

- Surgical Robotic System Market Size analysis for the current market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the Surgical Robotic Systems Market.

- Various opportunities available for the other competitors in the Surgical Robotic Systems Market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current Surgical Robotic Systems Market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the Surgical Robotic Systems Market growth in the coming future?

Target Audience Who Can be benefited from this Surgical Robotic Systems Market Report Study

- Surgical robotic systems product providers

- Research organizations and consulting Surgical Robotic System Companies

- Surgical robotic systems-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up Surgical Robotic System Companies, venture capitalists, and private equity firms

- Distributors and traders dealing in surgical robotic systems

- Various end-users who want to know more about the Surgical Robotic Systems Market and the latest technological developments in the Surgical Robotic Systems Market.

Stay updated with us for Recent Articles @ New DelveInsight Blogs