TIGIT Inhibitors Market

- T-cell immunoreceptor with Ig and ITIM domains (TIGIT) is one of the most recent immune checkpoints to be investigated as an immunotherapeutic target.

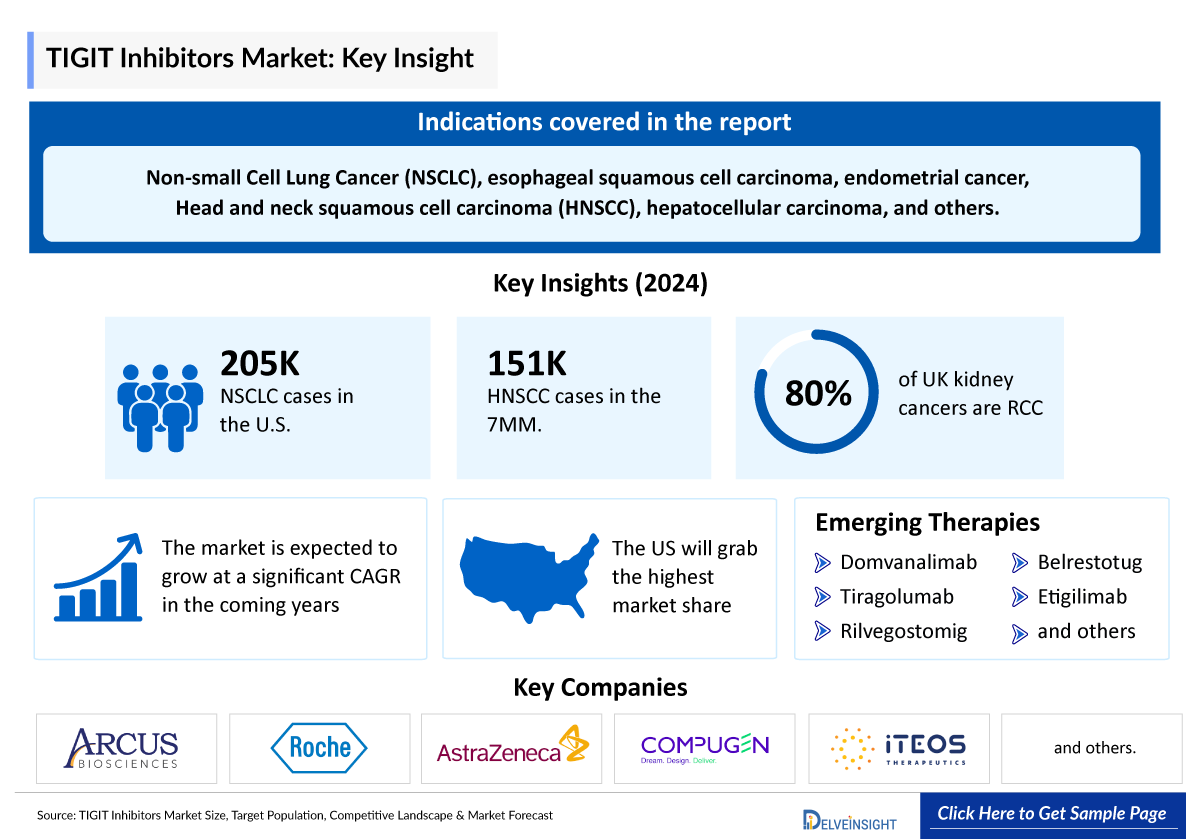

- TIGIT inhibitors are effective treatments for Non-small Cell Lung Cancer (NSCLC), esophageal squamous cell carcinoma, endometrial cancer, Head and neck squamous cell carcinoma (HNSCC), hepatocellular carcinoma, and other indications.

- Although there is no approved TIGIT inhibitor till now, several companies, including Roche, Merck, AstraZeneca, iTeos Therapeutics, Arcus Biosciences, and others are engaged in developing TIGIT inhibitors, with many emerging drugs in their late stages.

- The current potent emerging drugs targeting TIGT include rilvegostomig (AstraZeneca & Compugen), domvanalimab (Arcus Biosciences), tiragolumab (Roche), belrestotug (iTeos Therapeutics), and many other drugs.

- At ASCO 2025 conference, as part of poster presentations, AstraZeneca shared early data for rilvegostomig in combination with the ADC DATROWAY in first-line advanced NSCLC and in combination with chemotherapy in first-line advanced biliary tract cancer.

- AstraZeneca's wide-reaching plans to develop rilvegostomig as a next-generation alternative to existing PD-1/PD-L1 inhibitors could open up a major new revenue opportunity for Compugen.

- TIGIT inhibitors have the potential to meet the need for a more targeted therapeutic approach to treat various types of cancers. Future research should focus on discovering novel biomarkers or different approaches for targeting TIGIT, such as bispecific antibodies, antibody-drug conjugates, and CAR-T cells targeted at TIGIT.

DelveInsight’s “T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitors Target Population, Competitive Landscape, and Market Forecast 2034” report delivers an in-depth understanding of the TIGIT inhibitors, historical and competitive landscape as well as the TIGIT inhibitors’ market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The TIGIT inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM TIGIT inhibitor market size from 2020 to 2034. The report also covers current TIGIT inhibitor treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan |

|

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitors Epidemiology |

Segmented by:

|

|

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitors Key Companies |

|

|

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitors Key Therapies |

|

|

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitors Market |

Segmented by:

|

|

Analysis |

|

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitors Understanding and Treatment Algorithm

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitors Overview

There are various checkpoint Inhibitory Receptors (IRs) targeted with immune checkpoint blockade in the clinic, specifically, TIGIT. It is a promising new target for cancer immunotherapy. It is upregulated by immune cells, including activated T cells, natural killer cells, and regulatory T cells. TIGIT binds to two ligands, CD155 (PVR) and CD112 (PVRL2, nectin-2), that are expressed by tumor cells and antigen-presenting cells in the tumor microenvironment. A TIGIT inhibitor is a co-inhibitory molecule and immune checkpoint inhibitor, with potential immune checkpoint inhibitory and antineoplastic activities. Upon administration, TIGIT inhibitor M6223 targets and binds to TIGIT expressed on various immune cells, particularly on tumor-infiltrating T-lymphocytes (TILs), thereby preventing the interaction of TIGIT with its ligands CD112 and CD155. This enhances the interaction of CD112 and CD155 with the costimulatory receptor CD226, which is expressed in immune cells, such as Natural Killer (NK) cells and CD8+ T-cells. This leads to CD226 dimerization and CD226-mediated signaling and activates the immune system to exert a T-cell-mediated immune response against cancer cells. TIGIT, a member of the Ig superfamily (IgSF) and an immune inhibitory receptor, plays a key role in the suppression of T-cell proliferation and activation; it is involved in tumor cell immune evasion and the inhibition of antiviral immune responses.

Further details related to country-based variations are provided in the report

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitors Market Overview

TIGIT is linked with PD-1 expression, and it can synergize with PD-1/PD-L1 blockade to enhance tumor rejection. Preclinical studies have demonstrated the potential benefits of co-inhibition of TIGIT and PD-1/PD-L1 in enhancing anti-tumor immunity and improving treatment outcomes in several cancer types. Emerging drugs that inhibit TIGIT include domvanalimab, rilvegostomig, tiragolumab, and others. Numerous clinical trials are currently underway to investigate their effectiveness, safety, and tolerability in various neurological conditions, including myasthenia gravis and other neurological disorders such as lung cancer, hepatocellular carcinoma, NSCLC, and esophageal cancer.

Further details related to country-based variations are provided in the report…

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitors Epidemiology

The TIGIT inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases of selected indications for TIGIT inhibitors, total eligible patient pool of selected indication for TIGIT inhibitors, total treated cases in selected indications for TIGT inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- In 2024, the total incident cases of NSCLC in the US were around 204,820.

- The most common type of kidney cancer is Renal Cell Carcinoma (RCC) which accounts for 80% of cases in the UK.

- In Europe, lung cancer is the most common cancer followed by colorectal cancer.

- The total incident cases of HNSCC in the 7MM were approximately 150,900 in 2024, which is expected to increase in the upcoming years.

- Till the age of 50, females have approximately twice the incidence of melanoma as males, but thereafter this, difference changes, and by the age of 60 males have twice the incidence of females and by age 70 this difference rises to three times as great for males.

- The cases of NSCLC in Japan in 2024 were estimated to be nearly 121,910.

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitor Drug Chapters

The drug chapter segment of the TIGIT inhibitors’ reports enclose a detailed analysis of approved TIGT inhibitors’ late-stage (Phase III and Phase II) TIGIT inhibitors. It also helps understand the TIGIT inhibitor’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Emerging Drugs

Domvanalimab: Arcus Biosciences

It is a humanized IgG1 monoclonal antibody that targets the co-inhibitory molecule and immune checkpoint inhibitor TIGIT, with potential immune checkpoint inhibitory activity. Upon administration, it prevents its interaction with CD112 and CD155, molecules that promote immune suppression and tumor evasion. This blockade boosts CD112 and CD155 binding to CD226 on NK cells and CD8+ T cells, triggering CD226-mediated signaling. This activation enhances the immune response against cancer cells. Domvanalimab is currently being evaluated for NSCLC and upper gastrointestinal tract malignancies.

Rilvegostomig: AstraZeneca

It is a bispecific antibody directed against the negative immunoregulatory human cell receptor PD-1 and the co-inhibitory molecule and immune checkpoint inhibitor T-cell immunoreceptor with Ig TIGIT, with potential immune checkpoint inhibitory and antineoplastic activities. Upon administration, it targets and inhibits PD-1 and TIGIT, key immune checkpoint receptors. Inhibition of PD-1 restores T-cell function by preventing its interaction with PD-L1 and PD-L2, which otherwise suppresses immune responses. TIGIT inhibition blocks its interaction with CD112 and CD155, thereby enhancing CD226-mediated signaling on NK cells and CD8+ T cells. This dual inhibition activates the immune system, promoting T-cell-mediated immune responses against cancer cells. Rilvegostomig is currently being evaluated for NSCLC, head and neck squamous cell carcinoma, biliary tract cancer, and solid tumors.

|

Table 2: Comparison of Key Emerging Drugs | ||||

|

Drug name |

Company |

RoA |

Phase |

Indication |

|

Domvanalimab |

Arcus Biosciences |

IV |

|

|

|

Tiragolumab |

Roche |

IV |

|

|

|

Rilvegostomig |

AstraZeneca and Compugen |

IV |

|

|

|

Belrestotug (EOS-448) |

iTeos Therapeutics |

IV |

|

|

|

Etigilimab |

Mereo BioPharma |

IV |

|

|

|

Casdozokitug (CHS-388) |

Coherus Biosciences |

IV infusion |

|

|

|

COM902 |

Compugen |

IV |

|

|

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitor Market Outlook

The market for TIGIT inhibitors is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with NSCLC, RCC, colorectal cancer, lung cancer, and many more indications; the growing awareness of TIGIT inhibitors, and the increasing number of emerging drugs that are under clinical trials and filed for approval by various companies.

The development of the TIGIT class in NSCLC has been hampered by the fact that several high-profile TIGIT clinical studies have revealed underwhelming results. Effective combinations to augment current immune checkpoint inhibitors have historically been challenging as seen with Merck's and Roche's recent anti-TIGIT/PD-1 disappointment.

Several key players, including AstraZeneca, Arcus Biosciences, Roche, and others, are involved in developing drugs for TIGIT inhibitors for various indications such as NSCLC, hepatocellular carcinoma, lung cancer, gastrointestinal cancer, and others. Overall, this is an exciting new class of agents with great potential for development. The maturation of current studies over the next few years will lead to a better understanding of TIGIT inhibitors and define their role in the therapy of autoimmune and neurological disorders.

Key Findings

- Arcus Biosciences to present overall survival data from the Phase II EDGE-Gastric study, evaluating domvanalimab plus zimberelimab and chemotherapy in upper gastrointestinal adenocarcinomas in the fall of 2025.

- iTeos Therapeutics plans to provide multiple TIGIT clinical data readouts throughout 2025, including >400 patients from two Phase II trials and one Phase I/II assessing belrestotug + dostarlimab in 1L NSCLC and 1L HNSCC.

- In January 2025, Coherus BioSciences announced final data from its Phase II open-label clinical trial evaluating casdozokitug for the treatment of naïve patients with unresectable locally advanced or metastatic hepatocellular carcinoma at the 2025 American Society of Clinical Oncology Gastrointestinal Cancers Symposium (ASCO-GI).

- In November 2024, Roche provided an update on the Phase III SKYSCRAPER-01 study, evaluating tiragolumab combined with TECENTRIQ compared to TECENTRIQ alone for patients with PD-L1-high, locally advanced or metastatic NSCLC.

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging TIGIT inhibitors expected to be launched in the market during 2025–2034.

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitor Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for TIGIT inhibitors' market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for TIGIT inhibitor therapies.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on TIGIT inhibitors' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or TIGIT inhibitor market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“Investigators believe TIGIT plays a crucial role in inhibiting adaptive and innate immune responses against tumor cells, making it a promising anticancer target, particularly in combination with other immunotherapeutic strategies, such as immune checkpoint inhibitors directed at PD-1/PD-L1.” MD, Emory University, US |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

The abstract list is not exhaustive, will be provided in the final report

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of the TIGIT inhibitor, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the TIGIT inhibitor market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM TIGIT inhibitor market.

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitor Report Insights

- TIGIT inhibitors Targeted Patient Pool

- Therapeutic Approaches

- TIGIT Inhibitor Pipeline Analysis

- TIGIT Inhibitor Market Size and Trends

- Existing and future Market Opportunities

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitor Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

T cell Immunoreceptor with Immunoglobulin and ITIM Domain (TIGIT) Inhibitor Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint)

Key Questions

- What was the TIGIT inhibitor total market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for TIGIT inhibitors?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape has for TIGIT inhibitors evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with TIGIT inhibitors? What will be the growth opportunities across the 7MM for the patient population of TIGIT inhibitors?

- What are the key factors hampering the growth of the TIGIT inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for TIGIT inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the TIGIT inhibitor market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.