Tinnitus Medical Devices Market

Tinnitus Medical Devices By Product Type (Sound Masking Devices, Notched- Music Devices, Hearing Aids, And Others), By Distribution Channels (Hospital And Retail Pharmacy, Specialty Clinics, And Others), and by geography is expected to grow at a steady CAGR forecast till 2030 owing to the increasing prevalence of tinnitus and increasing number of tinnitus risk causing factors worldwide

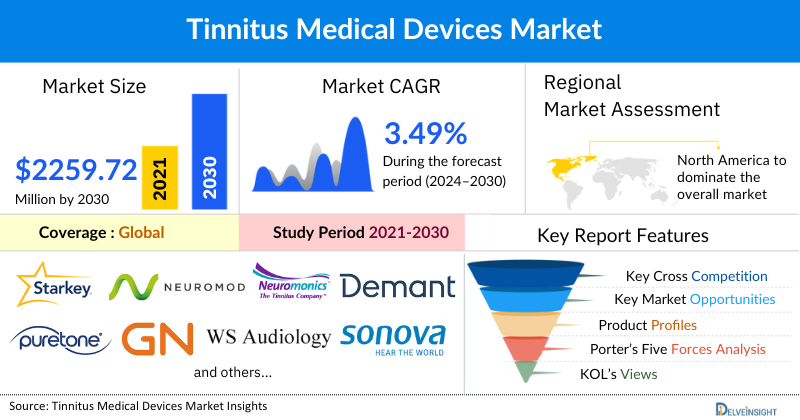

The global tinnitus medical devices market was valued at USD 1855.18 million in 2023, growing at a CAGR of 3.49% during the forecast period from 2024 to 2030 to reach USD 2259.72 million by 2030. The tinnitus medical devices market is witnessing positive growth owing to various factors such as the rising number of tinnitus, and its causative and risk factors such as meningitis, hearing loss, deafness, otosclerosis, Meniere’s disease, and others. Further, escalating burden of geriatric patients will also spur the market of tinnitus medical devices as the elderly patients are more prone to auditory disorders. Additionally, increasing cases of accidents, trauma, and injuries and increasing exposure to loud music and sound will also drive the market of tinnitus medical devices. Further, increasing regulatory approvals and launches across the globe will further increase the overall growth of the tinnitus medical devices market. Therefore, the market for tinnitus medical devices is estimated to grow at a significant CAGR during the forecast period from 2024 to 2030.

Tinnitus Medical Devices Market Dynamics:

One of the main driver for the tinnitus medical devices market is the increasing prevalence of tinnitus and hearing loss globally.

For instance, as per the data published by Centers for Disease Control and Prevention (CDC) 2020, it was estimated that about 10% of the United States adult population, or about 25 million Americans, have experienced tinnitus lasting at least five minutes in the past years. The increasing prevalence of tinnitus will increase the demand of tinnitus management device, thereby anticipated to propel the overall market of the tinnitus medical devices.

Furthermore, the increasing risk factors responsible for causing tinnitus such as traumatic brain injury, Meniere’s disease, sclerosis, head injury, damage to vestibulocochlear nerve, and others will also increase the demand for tinnitus medical devices. For instance, traumatic brain injury (TBI) is often associated with the occurrence of tinnitus and according to Centers for Disease Control and Prevention (NINDS) 2022, around 223,135 TBI-related hospitalizations happened in the United States in 2019. As per the same source, people aged 75 and above accounted for 32% of the TBI-related hospitalizations in the United States in 2019.

Furthermore, the rising prevalence of meningitis causing tinnitus in severe cases is another factor leading to a rise in the tinnitus medical devices market growth. According to the World Health Organization (WHO) 2021, about one in five people suffering from bacterial meningitis faces severe complications related to auditory health.

Additionally, the time spent in leisure time noises and duration of occupational loud noises are targetable risk factors for the development of tinnitus.

Thus, the above-mentioned facts illustrated the rising number of tinnitus, its risk-factors, and other factors ultimately leading to an increased demand for tinnitus medical devices across the globe. Therefore, driving the overall market of tinnitus medical devices during the forecast period from 2024-2030.

However, high cost of device, limitations associated with tinnitus medical devices, and others, can hinder the global tinnitus medical devices market growth.

The COVID-19 pandemic has slightly impacted the market for tinnitus medical devices. The outbreak of the pandemic led to the cancellation of outpatient visits and the suspension of non-emergency hospitals and the ENT departments, ENT clinics, audiology centers, and others were closed during the pandemic in order to stop the spread of the disease among the patients and hospital staff. Moreover, due to lack of resources and man-power manufacturing of the devices was halted. Also, tinnitus medical devices such as hearing aid, and others were not categorized into emergency needs and thus were not easily accessible to the tinnitus patients. This decreased the demand of the tinnitus medical devices during the pandemic. However, in the lateral stage of pandemic, the market for most of the medical devices including tinnitus medical devices started to recover owing to resumption of activities in industries including the healthcare sector, thereby bringing the demand for device on track in the tinnitus medical devices market.

Tinnitus Medical Devices Market Segment Analysis:

Tinnitus Medical Devices by Product Type (Sound Masking Devices, Notched- Music Devices, Hearing Aids, and Others), Distribution Channels (Hospital and Retail Pharmacy, Specialty Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product type segment of the tinnitus medical devices, the sound masking devices is expected to have a significant revenue share in the year 2021. This was primarily owing to the various advantages associated with sound masking devices, rising number of product launches, and increasing regulatory approvals across the globe.

Sound masking devices are electronic devices that efficiently mask the ringing sounds of tinnitus by the emission of low-band or broad-band noise at low levels. Various advantages associated with the use of sound masking devices such as adjustable sound frequency, relief from constant disturbing sounds, increased productivity, and others is expected to drive the demand for sound masking devices.

Moreover, the rising number of product launches and regulatory developments are expected to boost the market for sound masking devices.

For instance, in March 2020, AtlasIED, manufacturer of the next generation communication systems and commercial audio/video products, launched the sound masking speaker including a non-repeatable pink noise generator and GPIO control port for remote level sound adjustments.

Also, in June 2020, Multiflex Tinnitus Technology, manufactured by Starkey Laboratories, Inc. had received approval from the US Food and Drug Administrcliation (FDA). The Multiflex Tinnitus Technology, creates a comforting and customizable sound stimulus that can soothe the irritating sounds of the ear.

Therefore, due to the aforementioned reasons such as the growing product launches, regulatory developments, and above mentioned advantages, the sound masking devices segment is expected to witness substantial growth in the tinnitus medical devices market during the given forecast period, thereby propelling the overall market growth of the tinnitus medical devices.

North America is expected to dominate the overall Tinnitus Medical Devices Market:

Among all the regions, North America is expected to dominate the global tinnitus medical devices in the year 2021 and is expected to do the same during the forecast period from 2024-2030. The increasing prevalence of hearing disorders, escalating burden of geriatric population, and the increasing number of product launches along with the growing number of government initiatives made for the safety, and wellbeing of the population’s hearing healthcare in the North America, is expected to drive the demand for the North America’s tinnitus medical devices market during the forecast period of 2022 - 2030.

For instance, according to the Statistics Canada 2021, approximately three in five adults (60%) had hearing loss (23%), tinnitus (22%), or both conditions (14%) in the year 2020. As per the same source, in Canada, overall, 38% of adults aged 20 to 79 years were suffering from hearing loss, while 37% had tinnitus in the year 2020.

The rising cases of hearing loss, deafness, otosclerosis, Meniere’s disease, and others may also increase the prevalence of tinnitus as the aforesaid disorders can be one of the causative factor for tinnitus. For example, according to the American Hearing Research Foundation 2021, in the year 2020 more than 3 million people in the United States had otosclerosis. Further, according to Hearing Health Foundation 2022, it was estimated that there were 600,000-750,000 cases of Meniere’s disease in the United States in the year 2021, with 45,000 to 60,000 new cases were diagnosed annually. Thus, the increasing prevalence of risk factors will increase the prevalence of tinnitus, thereby spurring the demand of tinnitus medical devices in the market.

Additionally, according to the survey done by the hear-it organization in the year 2020, it was observed that 70 percent of people in Mexico listen to MP3 players and loud music. Also, 72 percent of Mexican adults listen to these devices for 1-4 hours or more. It is scientifically proven that continuous exposure to a very loud sound on a regular basis can cause tinnitus and other auditory disorders in some people.

Therefore, the interplay of the aforementioned factors above would provide a conducive growth environment for the North American region in the tinnitus medical devices, thereby propelling the overall market growth of the tinnitus medical devices in the upcoming years.

Tinnitus Medical Devices Market Key Players:

Some of the key market players operating in the tinnitus medical devices include Starkey Laboratories, Inc., Neuromod, Neuromonics, Demant A/S, Puretone Ltd., GN Store Nord A/S, WS Audiology A/S, Sonova, MDHearing, Elkon Pvt. Ltd., Audina Hearing Instruments, Inc., Arphi Electronics Private Limited, Foshan Vohom Technology Co., Ltd., KIND GmbH & Co. KG, RION Co., Ltd., Istok Audio Trading LLC, Eargo Inc., AlgorKorea Co., Ltd., Lisound Hearing Aid (Fuzhou) Co., Ltd., Guangzhou Melison Medical Instrument Co., Ltd., and others.

Recent Developmental Activities In The Tinnitus Medical Devices:

- In August 2022, GN Hearing, a global leader in intelligent audio solutions, had announced the launch of ReSound OMNIA that provides significantly better hearing in noisy environments, with optimal comfort having a seamless connection to the devices.

- In May 2022, Neuromod Devices Ltd, develop and commercialize a treatment for chronic tinnitus, reached an agreement with HØR AS, Norway’s largest private provider of hearing and tinnitus care, to make its Lenire tinnitus treatment device available in Norway.

- In March 2022, Starkey, a privately held, global hearing technology company headquartered in Eden Prairie, Minnesota, announced that its newest and most advanced family of hearing aids, Evolv AI, is available for the people in the market.

Key Takeaways from the Tinnitus Medical Devices Market Report Study

- Market size analysis for current tinnitus medical devices (2023), and market forecast for 5 years (2024-2030)

- The effect of the COVID-19 pandemic on this market is significant. To capture and analyze suitable indicators, our experts are closely watching the tinnitus medical devices

- Top key product/services/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the global tinnitus medical devices

- Various opportunities are available for the other competitor in the tinnitus medical devices space.

- What are the top-performing segments in 2023? How these segments will perform in 2030.

- Which are the top-performing regions and countries in the current tinnitus medical devices scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for tinnitus medical devices growth in the coming future?

Target Audience who can be benefited from this Tinnitus Medical Devices Market Report Study

- Tinnitus medical devices providers

- Research organizations and consulting companies

- Tinnitus medical devices -related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in tinnitus medical devices

- Various end-users who want to know more about the tinnitus medical devices and the latest technological developments in the tinnitus medical devices

Frequently Asked Questions for Tinnitus Medical Devices:

1. What are tinnitus medical devices?

Tinnitus medical devices, is a device which can lessen the perceived intensity, omnipresence, and burden of tinnitus, and help individuals manage their condition. These devices are available different product types with several features to assist in tinnitus. Different product types include wearable sound generators, tinnitus masking devices, hearing aids, tinnitus relief pillow, notched-music devices, and others.

2. What is the market for tinnitus medical devices?

The global tinnitus medical devices market was valued at USD 1855.18 million in 2023, growing at a CAGR of 3.49% during the forecast period from 2024 to 2030 to reach USD 2259.72 million by 2030.

3. What are the drivers for the tinnitus medical devices market?

The tinnitus medical devices is witnessing a positive market growth owing to the factors such as increasing prevalence of tinnitus, escalating burden of geriatric population, increasing risk factors for tinnitus, and increasing product developmental and regulatory activities pertaining to the tinnitus medical devices.\

4. Who are the key players operating in the tinnitus medical devices market?

Some of the key market players operating in the tinnitus medical devices include Starkey Laboratories, Inc., Neuromod, Neuromonics, Demant A/S, Puretone Ltd., GN Store Nord A/S, WS Audiology A/S, Sonova, MDHearing, Elkon Pvt. Ltd., Audina Hearing Instruments, Inc., Arphi Electronics Private Limited, Foshan Vohom Technology Co., Ltd., KIND GmbH & Co. KG, RION Co., Ltd., Istok Audio Trading LLC, Eargo Inc., AlgorKorea Co., Ltd., Lisound Hearing Aid (Fuzhou) Co., Ltd., Guangzhou Melison Medical Instrument Co., Ltd., and others.

5. Which region has the highest share in tinnitus medical devices market?

North America is expected to dominate the global tinnitus medical devices market. Factors such as the surging prevalence of tinnitus, hearing loss, otosclerosis, Meniere’s disease, and other hearing disorders in the region. Moreover, the rising burden of the geriatric population associated with hearing problems, and others which are contributing to the growth of the tinnitus medical devices in the North America region.