TROP-2 Inhibitors Market

- TROP-2 is a transmembrane glycoprotein overexpressed in various cancers, where it promotes tumor growth, proliferation, and metastasis. TROP-2 inhibitors are therapeutic agents that target and block this protein’s activity and downstream signaling, aiming to suppress cancer progression.

- Currently, there are only two approved TROP-2 inhibitors available on the market is TRODELVY (sacituzumab govitecan) and DATROWAY (datopotamab deruxtecan).

- Upon approval, TRODELVY (sacituzumab govitecan), which is a TROP-2 inhibitor, drew attention by becoming the first treatment for metastatic triple-negative breast cancer shown to improve progression-free survival and overall survival.

- TRODELVY generated approximately USD 1.3 billion in revenue globally in 2024, with a growth rate of 24% reflecting higher demand in the United States and Europe.

- In 2020, Gilead acquired Immunogenics for approximately USD 21 billion in aggregate. As a result of the acquisition, Gilead added TRODELVY, a first-in-class antibody-drug conjugate approved to treat triple-negative breast cancer, with promise in other forms of breast cancer and additional solid tumors in its pipeline.

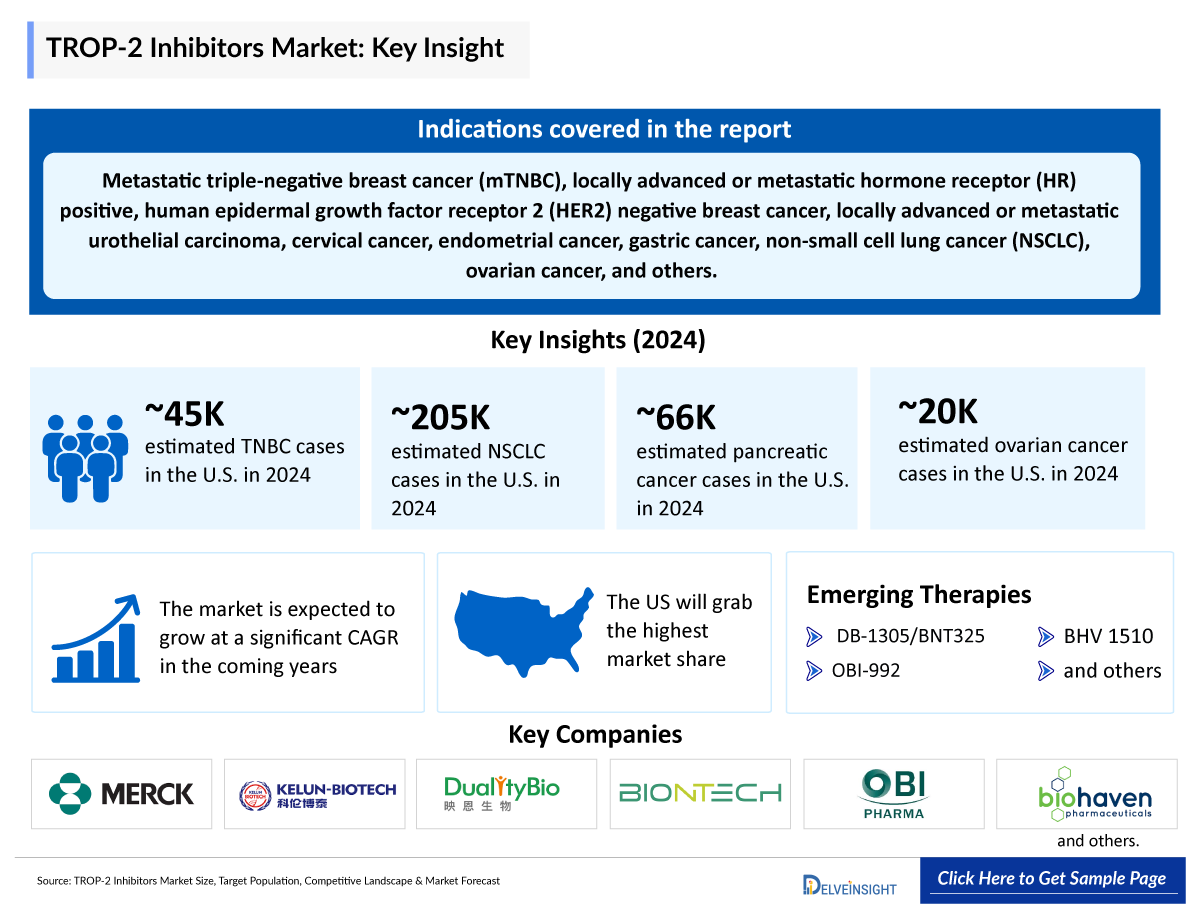

- TROP-2 targeted ADCs are currently indicated for the treatment of metastatic triple-negative breast cancer (mTNBC), locally advanced or metastatic hormone receptor (HR) positive, human epidermal growth factor receptor 2 (HER2) negative breast cancer, locally advanced or metastatic urothelial carcinoma, and are also being developed for cervical cancer, endometrial cancer, gastric cancer, non-small cell lung cancer (NSCLC), ovarian cancer, and other solid tumors.

- Most patients with advanced HR-positive, HER2-negative breast cancer disease develop endocrine resistance during their treatment and have to face the prospect of one or several lines of chemotherapy, but TROP-2 inhibitors have the potential to provide these patients an efficacious and better-tolerated alternative to conventional chemotherapy.

- TROP-2 inhibitors have a scarce pipeline consisting of products such as sacituzumab tirumotecan (MK-2870), DB-1305, OBI-992, BHV 1510, and others, which are in different clinical phases.

- Merck/Kelun biotech, Dualitybio/BioNTech, OBI Pharma, Biohaven Pharmaceuticals, and several other companies are currently engaged in the development and production of TROP-2 inhibitors, which have the potential to significantly impact and enhance the TROP-2 inhibitors market.

- In January 2025, DATROWAY was approved by the US Food and Drug Administration (FDA) for patients with previously treated metastatic HR-positive, HER2-negative breast cancer and was also granted Priority Review for patients with previously treated advanced EGFR-mutated NSCLC.

DelveInsight’s “Trophoblast Cell Surface Antigen Inhibitors (TROP-2i) – Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the TROP-2, historical and Competitive Landscape as well as the TROP-2 inhibitor market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The TROP-2 inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM TROP-2 inhibitors market size from 2020 to 2034. The report also covers current TROP-2 treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

TROP-2 Inhibitor Epidemiology |

Segmented by:

|

|

TROP-2 Inhibitor Key Companies |

|

|

TROP-2 Inhibitor Key Therapies |

|

|

TROP-2 Inhibitor Market |

Segmented by:

|

|

Analysis |

|

TROP-2 Inhibitor Understanding

TROP-2 Inhibitor Overview

TROP-2, or tumor-associated calcium signal transducer 2, is a transmembrane glycoprotein encoded by the TACSTD2 gene. While its full physiological function is still being uncovered, current research suggests it plays a role in calcium-dependent signaling pathways. Notably, TROP-2 influences key cancer-related signaling routes, such as the MAPK and PI3K/AKT pathways, which are involved in cell growth, survival, migration, and invasion core processes in cancer development and progression.

Although TROP-2 is normally expressed in various epithelial tissues, its abnormal overexpression has been widely observed in a range of cancers. High TROP-2 levels are closely linked with aggressive tumor behavior and poorer clinical outcomes in several solid tumors, including breast, gastric, pancreatic, and ovarian cancers. Beyond solid tumors, increased expression of TROP-2 has also been reported in certain blood cancers, such as acute leukemias, extranodal NK/T-cell lymphoma (ENKTL), and non-Hodgkin lymphomas (NHL), highlighting its relevance as a broad-spectrum cancer biomarker and potential therapeutic target.

Due to its high expression in tumors compared to normal tissues and its presence on the cell surface, TROP-2 presents an attractive target for cancer therapies. A wide range of TROP-2-targeted treatments are being developed, including monoclonal antibodies, bispecific antibodies, and antibody-drug conjugates (ADCs). Emerging platforms such as virus-like particles, nanoparticle-based delivery systems, photoimmunotherapy, and radioimmunotherapy are also under investigation to enhance tumor-specific effects and reduce harm to healthy tissues. Additionally, combining TROP-2-targeted therapies with traditional chemotherapy or immune checkpoint inhibitors is showing promise, opening new doors in the pursuit of more precise and effective cancer treatment.

Further details related to country-based variations are provided in the report…

TROP-2 Inhibitor Epidemiology

The TROP-2 inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases of selected indication for TROP-2 inhibitor, total eligible patient pool for TROP-2 inhibitor in selected indication, total treated cases in selected indication for TROP-2 inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- Among the 7MM countries, Spain accounted for the least number of incident cases of TNBC, i.e., 5,300 cases in 2024.

- In the US, the incidence of NSCLC cases was 115,500 in males and 89,200 in females in 2024.

- In 2024, among the age-specific contributions, those aged≥65 years are affected more by NSCLC than those aged <65 years.

- In EU4 and the UK, the incidence of ovarian cancer was highest in the UK in 2024. While the least number of cases were in Spain.

|

Epidemiology of Selected Indications | |

|

Indication |

Estimated Cases in the US (2024) |

|

TNBC |

~44,780 |

|

NSCLC |

~204,800 |

|

Pancreatic Cancer |

~65,800 |

|

Ovarian Cancer |

~19,700 |

Note: Indications are selected based on pipeline activity. The list is indicative and not exhaustive…

TROP-2 Drug Chapters

The drug chapter segment of the TROP-2 inhibitor reports encloses a detailed analysis of late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the TROP-2 inhibitor’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed TROP-2 Inhibitor

TRODELVY (sacituzumab govitecan): Gilead Sciences

TRODELVY (sacituzumab govitecan) is a first-in-class TROP-2-directed antibody and topoisomerase inhibitor conjugate, composed of the three components: the humanized monoclonal antibody, hRS7 IgG1κ (also called sacituzumab), which binds to TROP-2, the drug SN-38, a topoisomerase inhibitor & a hydrolysable linker (called CL2A), which links the humanized monoclonal antibody to SN-38.

TRODELVY is the first approved treatment by the FDA for metastatic TNBC, which shows improvement in Progression-Free Survival and Overall Survival. TRODELVY approval provided a new treatment option for people living with pre-treated HR+/HER2- metastatic breast cancer, and especially for those individuals whose tumor is no longer responding to endocrine-based therapies and who are facing a poor prognosis.

In November 2024, the FDA announced the final withdrawal of the approval of TRODELVY for adult patients with locally advanced or metastatic urothelial cancer who previously received a platinum-containing chemotherapy and either a programmed death receptor-1 (PD-1) or a programmed death-ligand 1 (PD-L1) inhibitor.

DATROWAY (datopotamab deruxtecan): Daiichi Sankyo

DATROWAY is a next-generation TROP-2 targeted ADC built on Daiichi Sankyo’s proprietary DXd ADC platform and co-developed with AstraZeneca. The molecule comprises a humanized IgG1 anti-TROP-2 monoclonal antibody linked via a tetrapeptide-based cleavable linker to a potent topoisomerase I inhibitor. Upon binding to TROP-2 on tumor cells, DATROWAY is internalized; enzymatic cleavage of the linker in lysosomes releases DXd, which induces DNA damage and cell death. The payload’s membrane-permeable properties also enable a bystander effect, targeting adjacent TROP-2 negative cancer cells.

A comprehensive global clinical development program is underway with more than 20 trials evaluating the efficacy and safety of DATROWAY across multiple cancers, including NSCLC, TNBC, and HR-positive, HER2-negative breast cancer, and others.

DATROWAY’s US approval (January 2025) and EU approval (April 2025) are indicated for adult patients with unresectable or metastatic hormone-receptor positive (HR+), HER2-negative breast cancer who have received prior endocrine-based therapy and ≥ 1 line of chemotherapy.

|

Product |

Company |

RoA |

Target |

Indication |

Approval |

|

TRODELVY (sacituzumab govitecan) |

Gilead Sciences |

IV |

TROP-2 inhibitor |

Locally Advanced or Metastatic Breast Cancer And Locally Advanced or Metastatic Urothelial Cancer |

US: 2020 EU: 2021 |

|

DATROWAY (datopotamab deruxtecan) |

AstraZeneca & Daiichi Sankyo |

IV |

TROP-2 inhibitor |

HR positive, HER2-negative breast cancer |

US: 2025 EU: 2025 |

Emerging TROP-2 Inhibitors

Sacituzumab tirumotecan (MK-2870/SKB-264): Merck/Kelun biotech

Sacituzumab tirumotecan (MK-2870/SKB-264) is a third-generation investigational antibody-drug conjugate that consists of an antibody-targeting TROP-2 linked to a belotecan-derived payload. It acts by targeting cells expressing trophoblast antigen (TROP-2). It is being developed as monotherapy and/or in combination with KEYTRUDA (pembrolizumab). It is designed by Merck in collaboration with Sichuan Kelun-Biotech.

It is under development for the treatment of endometrial cancer, non-small cell lung cancer, gastroesophageal cancer, esophageal squamous cell carcinoma, triple negative breast cancer, epithelial ovarian cancer, gastric adenocarcinoma, endometrial carcinoma, HER2 negative breast cancer, head and neck cancer squamous cell carcinoma, adenocarcinoma of the gastroesophageal junction, nasopharyngeal carcinoma, metastatic cervical cancer, metastatic castration-resistant prostate cancer, urothelial cancers etc.

In December 2024, Merck, known as MSD outside of the US, announced that the FDA had granted Breakthrough Therapy designation to sacituzumab tirumotecan for the treatment of patients with advanced or metastatic nonsquamous NSCLC with epidermal growth factor receptor (EGFR) mutations.

DB-1305/BNT325: Dualitybio/BioNTech

DB-1305/BNT325 is a novel TROP-2–targeting ADC being co-developed by DualityBio and BioNTech. It is designed to deliver potent cytotoxic agents specifically to TROP-2–expressing cancer cells, leveraging the overexpression of TROP-2 in a wide range of solid tumors.

DB-1305 is currently under clinical development in Phase I/II trials for multiple advanced solid tumors, including ovarian cancer (2nd‑line+) and NSCLC (2nd‑line+), progressing into combination trials across multiple solid tumors, including cervical cancer and TNBC. It has also received FDA Fast Track Designation in February 2024 for ovarian cancer.

|

Product |

Company |

RoA |

Phase |

Target |

Indication |

|

Sacituzumab tirumotecan (MK-2870/SKB-264) |

Merck/Kelun Biotech |

IV |

III |

TROP-2 inhibitor | Breast cancer Cervical cancer Endometrial cancer Gastric cancer NSCLC Ovarian cancer |

|

II | Biliary tract cancer Bladder cancer Colorectal cancer Neoplasm malignant Pancreatic cancer | ||||

|

DB-1305/BNT325 |

Dualitybio/BioNTech |

IV |

I/II |

TROP-2 inhibitor |

Solid Tumors |

|

OBI-992 |

OBI Pharma |

IV |

I/II |

TROP-2 inhibitor |

Solid Tumors |

|

BHV 1510 |

Biohaven Pharmaceuticals |

IV |

I/II |

TROP-2 inhibitor |

Advanced or metastatic epithelial tumors |

Note: A Detailed emerging therapies assessment will be provided in the final report.

TROP-2 Inhibitor Market Outlook

TROP-2 inhibitors have emerged as a critical class of ADCs in oncology, offering targeted cytotoxic delivery to a wide range of epithelial-derived solid tumors. TROP-2, a transmembrane glycoprotein overexpressed in various malignancies, is associated with poor prognosis, increased metastasis, and chemoresistance, making it a compelling therapeutic target. The first breakthrough in this space was TRODELVY, developed by Gilead Sciences, which received FDA approval in 2020 for TNBC, HR positive, HER2-negative breast cancer and later expanded to include urothelial carcinoma, with EU approval following in 2021. As the first approved TROP-2-targeting ADC, TRODELVY has set the clinical and commercial benchmark for this class.

The competitive landscape has intensified with the recent 2025 FDA approval of DATROWAY, a next-generation TROP-2 ADC developed by AstraZeneca and Daiichi Sankyo, for HR-positive, HER2-negative breast cancer. Leveraging Daiichi Sankyo’s proprietary DXd linker-payload platform, DATROWAY offers enhanced efficacy and potentially improved tolerability compared to earlier ADCs, signaling a new wave of innovation in TROP-2 targeting strategies. Notably, both TRODELVY and DATROWAY are actively being evaluated in ongoing clinical trials across a broad spectrum of solid tumors, aiming to expand their indications beyond current approvals and further solidify their place in the treatment landscape.

Several high-potential candidates are progressing through late-stage development. Among them, sacituzumab tirumotecan from Merck and Kelun Biotech is in Phase III trials for multiple high-burden indications, including breast, cervical, endometrial, gastric, non-small cell lung (NSCLC), and ovarian cancers, and in Phase II trials for biliary tract, bladder, colorectal, pancreatic cancers, and other advanced solid tumors. With a broad development program and a novel camptothecin payload, this candidate has the potential to challenge both TRODELVY and DATROWAY, particularly in tumor types beyond breast and urothelial cancers.

Meanwhile, DB-1305, a next-generation TROP-2 ADC developed by DualityBio and BioNTech, is advancing through Phase II trials in solid tumors, leveraging differentiated linker and payload chemistry to potentially improve efficacy and safety over earlier agents. In addition to these late- and mid-stage contenders, OBI-992 (from OBI Pharma) and BHV 1510 (from Biohaven Pharmaceuticals) are both in Phase I/II trials as intravenous TROP-2 inhibitors for solid tumors. These early-phase agents further underscore the growing interest in diversifying the TROP-2 ADC pipeline and expanding its applicability across a wide spectrum of solid tumor indications.

Looking ahead, TRODELVY is expected to retain its leadership in breast and bladder cancer for the near term, particularly with expanded indications in hormone receptor-positive disease. However, DATROWAY and sacituzumab tirumotecan are likely to reshape the competitive landscape as they broaden the addressable population and demonstrate superior or differentiated clinical profiles. While the pipeline of novel TROP-2 inhibitors remains relatively limited, currently approved drugs—especially TRODELVY and DATROWAY—are being extensively evaluated across multiple tumor types, highlighting a strategic focus on maximizing existing assets. Meanwhile, DB-1305 and other pipeline entrants will continue to drive diversification within the TROP-2 class, particularly in difficult-to-treat tumors where existing therapeutic options are inadequate.

TROP-2 Drug Uptake

This section focuses on the uptake rate of potential emerging TROP-2 expected to be launched in the market during 2025–2034.

TROP-2 Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs at different stages is expected to generate immense opportunities for the TROP-2 inhibitor market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for TROP-2 inhibitor therapies.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on TROP-2 Inhibitor's evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center, UCSF Health, Memorial Sloan Kettering Cancer Center, , Memorial Sloan Kettering Cancer Center, Edinburgh Cancer Research UK Centre at the University of Edinburgh, Division of Hematology & Oncology, University of Illinois Health, Memorial Sloan Kettering Cancer Center, Oncology Department at San Luigi Hospital Center for Thoracic Cancers at the Massachusetts General Hospital, Dana-Farber Brigham Cancer Center, and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or TROP-2 market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“TROP-2 ADCs like sacituzumab govitecan have opened a new chapter for patients with metastatic breast cancer. The survival benefit in both triple-negative and hormone receptor–positive subtypes is significant. These agents are becoming essential in late-line settings.” MD, Memorial Sloan Kettering Cancer Center, US |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and a payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs) and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on TROP-2 Inhibitors

- In May 2025, Gilead presented data from the pivotal Phase 3 ASCENT-04/KEYNOTE-D19 study in which KEYTRUDA plus TRODELVY reduced the risk of disease progression or death by 35% versus standard of care KEYTRUDA plus chemotherapy in first-line PD-L1+ metastatic TNBC.

- In May 2025, Sacituzumab tirumotecan showed promising anti-tumor activity and a manageable safety profile as a first-line treatment for patients with unresectable locally advanced/metastatic TNBC, according to results of the Phase II OptiTROP-Breast05 study presented as an abstract at the 2025 American Society of Clinical Oncology Annual Meeting.

- In April 2025, DualityBio presented Preliminary clinical data of the ongoing global Phase I/II trial (NCT05438329) for the combination of BNT325/DB-1305 with BNT327 involving 67 patients with advanced/metastatic solid tumors at the 2025 American Association for Cancer Research (AACR) Annual Meeting.

- In December 2024, DATROWAY was granted Breakthrough Therapy Designation by the US FDA for patients with previously treated advanced EGFR-mutated NSCLC.

- In December 2024, the US FDA granted Breakthrough Therapy Designation to TRODELVY for the second-line treatment of extensive-stage small cell lung cancer.

- In August 2024, OBI Pharma announced that the US FDA had granted Orphan Drug Designation to OBI-992 TROP2 ADC for the treatment of gastric cancer, including gastroesophageal junction cancer (GEC).

The abstract list is not exhaustive and will be provided in the final report.

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of the TROP-2, explaining its mechanism and therapies (emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of emerging therapies and the elaborate profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the TROP-2 market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM TROP-2 market.

TROP-2 Inhibitor Report Insights

- TROP-2 Targeted Patient Pool

- Therapeutic Approaches

- TROP-2 Pipeline Analysis

- TROP-2 Market Size and Trends

- Existing and Future Market Opportunities

TROP-2 Inhibitor Report Key Strengths

- Ten-Year Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

TROP-2 Inhibitor Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint)

Key Questions

- What was the TROP-2 inhibitor total market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for TROP-2 Inhibitor?

- What are the risks, burdens, and unmet needs of treatment with TROP-2-based/targeting therapies? What will be the growth opportunities across the 7MM for the patient population of TROP-2-based/targeting therapies?

- What are the key factors hampering the growth of the TROP-2 Inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for TROP-2 inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the TROP-2 Inhibitor Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.