Tumor-Infiltrating Lymphocytes Market Summary

Key Highlights

- TIL therapy represents a paradigm shift in solid-tumour immunotherapy, enabling effective targeting where CAR-T approaches have fallen short, expanding treatment options beyond PD-1 and BRAF/MEK inhibitors in metastatic melanoma, and supporting broad clinical exploration across NSCLC, HNSCC, CRC, pancreatic, prostate, cervical, and other cancers.

- Prostate cancer represents the largest TIL therapy target, followed by NSCLC, driven not only by high incidence but also by extremely low immunogenicity, low response to checkpoint inhibitors, and limited effective post-standard-of-care options, highlighting a significant unmet clinical opportunity.

- AMTAGVI (lifileucel) has established first-mover leadership as the first approved individualized TIL therapy, securing accelerated FDA approval in post-PD-1 advanced melanoma, though its premium one-time price of USD 515,000 positions it at the upper end of the cell therapy cost spectrum and may raise reimbursement sensitivity.

- TIL therapy developers are primarily targeting the US market, driven by Iovance’s first-in-class approval in the world’s largest commercial market, while development in Asia, particularly Japan, remains limited; ReproCELL’s Phase II program represents an early local effort that, if successful, could leverage lower manufacturing costs and expand treatment options for Japanese patients.

- OBX-115’s FDA FTD and outpatient core needle biopsy-based TIL collection position it as a streamlined, potentially competitive alternative to lifileucel in PD-1/PD-L1-refractory melanoma.

- KSQ Therapeutics is advancing two next-generation TIL therapies, KSQ-001EX and KSQ-004EX, targeting multiple solid tumors with distinct mechanisms that could enhance potency, broaden tumor applicability, and improve response durability; if clinical results are positive, these therapies could compete with other TIL programs by offering superior efficacy, applicability across more tumor types, and potentially longer-lasting responses.

- Key TIL therapy developers, including Iovance, Obsidian, KSQ, Intima, CuraCell, and REPROCELL, are advancing diverse, next-generation platforms, largely targeting melanoma while exploring broader solid tumors; Iovance’s push to position TIL therapy in earlier-line settings could significantly reshape both the treatment landscape and competitive dynamics.

DelveInsight’s “Tumor-infiltrating Lymphocytes (TIL) Therapies – Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of TIL therapies, historical and forecasted epidemiology, as well as TIL therapies market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The TIL therapies market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM TIL therapies market size from 2020 to 2034. The report also covers current TIL therapies, treatment practices/algorithms, and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

TIL therapies Epidemiology

|

Segmented by

|

|

TIL therapies key companies |

|

|

TIL therapies key therapies/drug |

|

|

TIL Therapies Market |

Segmented by

|

|

Analysis |

|

Tumor-infiltrating Lymphocytes (TIL) Therapies Overview

Tumor-infiltrating Lymphocytes (TILs) are T cells that are resident within tumors. TILs represent a heterogeneous collection of T cells that can recognize a broad range of cancer-associated antigens, including patient-specific neoantigens. TILs derived from resected tumors can be cultured away from the immunosuppressive tumor microenvironment and expanded ex vivo. Adoptive Cell Therapy (ACT) with TILs involves the infusion of these massively expanded, unmodified autologous T cells as a personalized immunotherapy. Recent clinical advances have extended the application of TIL therapy beyond melanoma to other solid tumors, including NSCLC, HNSCC, cervical carcinoma, breast cancer, colorectal cancer, and osteosarcoma.

Mechanism of TIL Therapies

TIL therapy is an adoptive cell therapy that harnesses a patient’s own immune cells to target cancer. TILs are isolated from resected tumor tissue, expanded ex vivo with interleukin-2, and reinfused into the patient after lymphodepleting chemotherapy. These expanded T cells are enriched for tumor-reactive clones that recognize tumor-specific antigens, enabling direct cytotoxic killing of cancer cells and restoration of anti-tumor immune responses within the tumor microenvironment.

Tumor-infiltrating Lymphocytes (TIL) Therapies Epidemiology

The TIL therapies epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total cases of selected indications in the 7MM, Indication wise target patient pool of TIL therapies in the 7MM, and Indication wise treated cases of TIL therapies in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

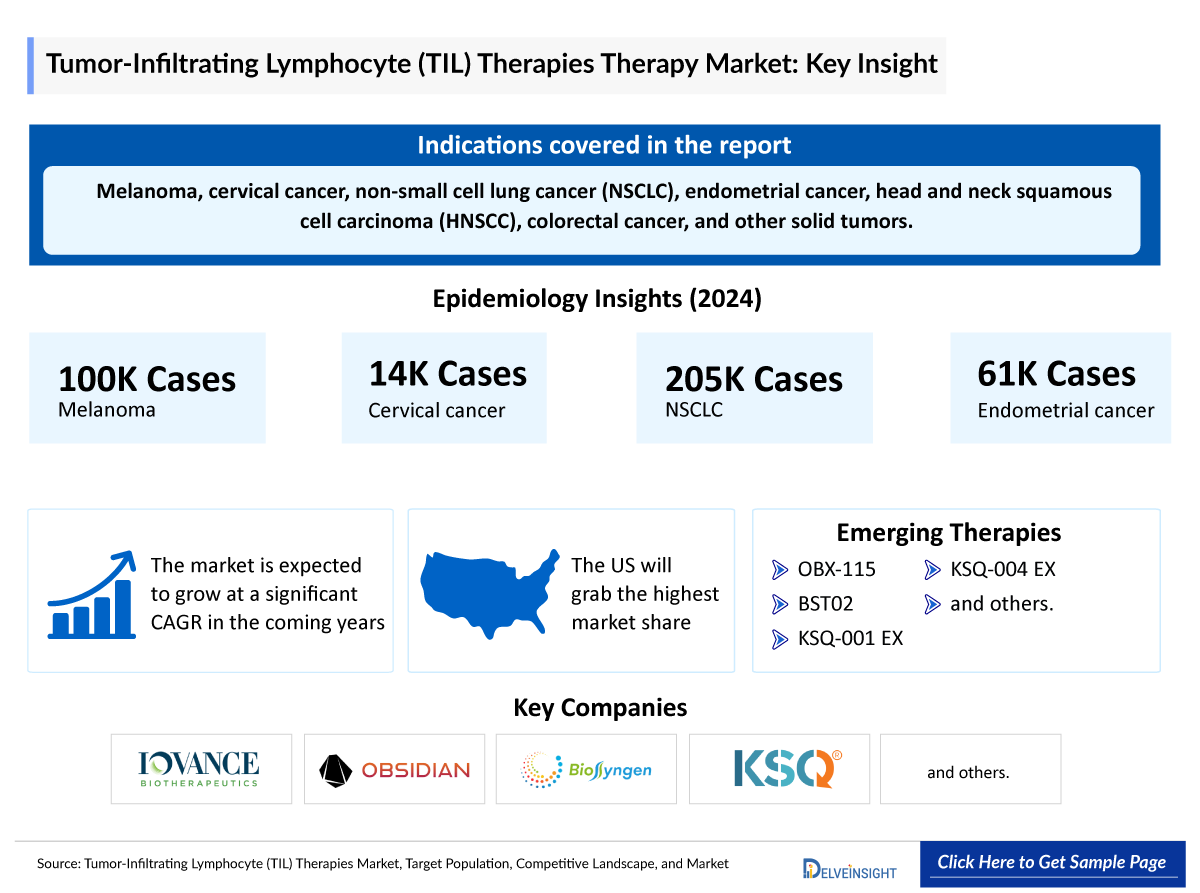

- In 2024, the total cases of selected indication were 4,520,00 in the 7MM, which is anticipated to increase by 2034.

- In the 7MM, Prostate Cancer accounted for the highest number of indication-wise eligible cases, i.e., 2,750,000 cases, in 2024. These cases are expected to increase during the study period (2020–2034).

- NSCLC had the second-highest number of incidence cases amongst the 7MM. Cervical cancer and endometrial cancer were the cancers with the fewest number of cases.

Drug Chapters

The drug chapter segment of the TIL therapies report encloses a detailed analysis of the marketed and mid and early-stage (Phase II and I/II) pipeline drugs. The marketed drugs segment encloses AMTAGVI (lifileucel) (Iovance Bioterapeutics) only. Furthermore, the current key players for the upcoming emerging drugs are LN-145 (Iovance Biotherapeutics), TIL therapy (REPROCELL), and others. The drug chapter also helps understand the TIL therapies clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases.

Marketed Drugs

Lifileucel (AMTAGVI/LN-144): Iovance Biotherapeutics

AMTAGVI is a tumor-derived autologous T-cell immunotherapy indicated for the treatment of adult patients with unresectable or metastatic melanoma previously treated with a PD-1 blocking antibody, and if BRAF V600 mutation positive, a BRAF inhibitor with or without a MEK inhibitor. This indication is approved under accelerated approval based on ORR. Continued approval for this indication may be contingent upon verification and description of clinical benefit in a confirmatory trial(s). At the end of 2024, more than 200 patients were treated with AMTAGVI during the first three quarters of launch.

- In November 2025, Iovance Biotherapeutics announced that potential approvals of AMTAGVI are anticipated in the United Kingdom and Australia in the first half of 2026 and in Switzerland in 2027.

- In June 2024, Iovance Biotherapeutics submitted a centralized MAA to the European Medicines Agency, or the EMA, for lifileucel. In August 2024, the MAA was validated and accepted for review by the EMA. But in July 2025, Iovance Biotherapeutics withdrew its application for the treatment of melanoma in adults in Europe. The company withdrew the application on July 22, 2025.

- As per the 2025 Q1 presentation, AMTAGVI is a preferred second-line or subsequent therapy in the National Comprehensive Cancer Network guidelines (NCCN) for the treatment of cutaneous melanoma.

|

Details of Marketed Drug | |||||

|

Drug |

Company |

Indication |

MoA |

RoA |

Approval |

|

Lifileucel (AMTAGVI/LN-144) |

Iovance Biotherapeutics |

Refractory metastatic melanoma |

TIL therapy |

IV infusion |

US: 2024 |

Emerging Drugs

LN-145: Iovance Biotherapeutics

LN-145 is called “autologous tumor infiltrating lymphocytes” (TIL) therapy. It activates white blood cells to attack the tumor. LN-145 is made by collecting and growing specialized white blood cells (called T-cells) that are collected from the patient's tumor. LN-145-S1 is made using a modified process that chooses a specific portion of the T-cells. The T cells may specifically recognize, target, and kill the tumor cells.

- In November 2025, Iovance announced that it expects the IOV-LUN-202 trial to complete enrollment in 2026 and support a supplemental BLA for lifileucel in nonsquamous NSCLC, with a potential launch in 2027.

- In November 2025, Iovance announced that initial results from the IOV-END-201 clinical trial of lifileucel in previously treated advanced endometrial cancer are on track for early 2026.

TIL therapy: REPROCELL

TIL therapy is a type of adoptive immunotherapy in which immune cells called TILs, contained in a patient’s cancer tissue, are harvested and cultured in large numbers outside the body, and then the TILs are returned to the patient.

- In June 2023, REPROCELL announced that it had entered into a joint research agreement with Keio University regarding “transfer of technology for the production of TIL for Advanced Medicine B - a Phase II clinical trial for patients with cervical cancer with TIL therapy and low-dose interleukin-2.”

|

Comparison of Emerging Drugs Under Development | ||||

|

Drug Name |

Company |

Highest Phase |

Indication |

MoA |

|

LN-145 |

Iovance Biotherapeutics |

II |

NSCLC, HNSCC, Melanoma, and others |

Activate WBC to attack the tumor |

|

TIL therapy |

REPROCELL |

II |

Recurrent, metastatic, or persistent cervical cancer (2L+) |

TIL therapy |

|

IOV-3001 |

Iovance Biotherapeutics |

I/II |

Advanced melanoma |

TIL therapy |

|

IOV-4001 |

Iovance Biotherapeutics |

I/II |

Melanoma, NSCLC |

TIL therapy |

|

CC-38 |

Curacell Holding |

I/II |

Metastatic colorectal or prostate cancer (2L+) |

TIL therapy |

|

CISH inactivated TIL |

Intima Bioscience |

I/II |

Metastatic NSCLC and gastrointestinal cancers (2L+) |

TIL therapy |

|

KSQ-001EX |

KSQ Therapeutics |

I/II |

Advanced solid tumors (melanoma and NSCLC [2L+]; HNSCC [2─4L]) |

SOCS1 Single-edit eTIL |

|

KSQ-004EX |

KSQ Therapeutics |

I/II |

Advanced solid tumors (melanoma, colorectal, pancreatic cancer, and cervical cancer [2─4L]; NSCLC and HNSCC [2─5L]) |

SOCS1/Regnase-1 dual-edit eTIL |

|

OBX-115 |

Obsidian Therapeutics |

I/II |

Advanced solid tumors (NSCLC [2L+]; melanoma [2─3L]) |

IL2-sparing engineered TIL cell therapy |

Drug Class Insights

TIL-based therapies under development encompass a range of adoptive cell therapy approaches, including conventional autologous TIL products (LN-145, CC-38), next-generation engineered or edited TILs (CISH-inactivated TILs, KSQ-001EX [SOCS1 single-edit eTIL], KSQ-004EX [SOCS1/Regnase-1 dual-edit eTIL], IOV-3001, and IOV-4001), cytokine-optimized platforms (OBX-115, an IL-2–sparing engineered TIL therapy), and highly selected tumor-reactive T-cell populations (AGX148, enriched for CD39?CD103?CD8? cells).

Note: Detailed insights will be provided in the final report.

Market Outlook

The development of TIL therapy began in the 1980s when Steven Rosenberg described LAK cells and TILs, with 1986 marking the first IL-2–expanded TILs showing superior tumor regression in preclinical models.

AMTAGVI (lifileucel) represents a landmark entry in oncology as the first FDA-approved T-cell therapy for a solid tumor. This personalized, one-time TIL-based immunotherapy is approved for adults with unresectable or metastatic melanoma who have previously received standard of care front-line PD-1 therapy and targeted therapy with a proto-oncogene BRAF or BRAF/MEK inhibitor, if BRAF-V600 mutation is positive, addressing a high-unmet, late-line population.

The accelerated FDA approval in February 2024 established AMTAGVI’s first-mover advantage, translating quickly into early market uptake and encouraging revenue momentum in 2024 and beyond.

Post-approval of AMTAGVI in melanoma, the competitive landscape has broadened, with Obsidian Therapeutics (OBX-115) and KSQ Therapeutics (KSQ-001EX, KSQ-004EX) advancing next-generation TIL therapies.

- The therapeutic market size of TIL therapies in the 7MM was approximately USD 103 million in 2024.

- The market size in the 7MM will increase at a CAGR of 37% due to increasing awareness of the disease, better diagnosis, and the launch of the emerging therapy.

- The United States accounted for the highest market size of TIL therapies, approximately 75% of the total market size in 7MM in 2034, in comparison to the other major markets, i.e., EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- With the expected launch of upcoming therapies, such as LN-145, OBX-115, and others, the total market size of TIL therapies is expected to show a change in the upcoming years.

Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2025–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

AMTAGVI’s uptake is highly dependent on expanding the authorized treatment centers network; insufficient center onboarding could slow adoption and revenue growth.

Further detailed analysis of emerging therapies, drug uptake in the report…

Tumor-infiltrating Lymphocytes (TIL) Therapies Activities

The report provides insights into different therapeutic candidates in the Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for intra-tumoral cancer therapies and emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from key industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/Scientific writers, Professors, and others.

Delveinsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the University of Pittsburgh Cancer Institute, MD Anderson Cancer Center, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or TIL market trends.

|

KOL Views | |

|

United States |

“TIL therapy represents a promising treatment option for patients with solid tumors. To date, CAR T-cell therapies and other adoptive cell therapies have shown limited success in solid malignancies. In contrast, tumor-infiltrating lymphocytes, by their biological nature and tumor specificity, are supported by decades of clinical experience, demonstrating comparatively greater effectiveness in the treatment of solid tumors.” |

|

United Kingdom |

“Adoptive cell therapy with TILs is a personalized autologous treatment that involves the ex vivo outgrowth and expansion of tumor-resident T cells and subsequent intravenous adoptive transfer of the cells after preparative lymphodepleting chemotherapy, which is supported by the administration of IL-2 to enhance the in vivo expansion of the cells and augment antitumor responses.” |

Qualitative Analysis

We perform qualitative and market intelligence analysis using various approaches, such as SWOT analysis and analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

Market Access refers to the ability of all patients to have access to a given product quickly, conveniently, and affordably. Reimbursement is the negotiation of a price between the manufacturer and payer that allows the manufacturer access to that market. It is provided to reduce the high costs and make essential drugs affordable.

IovanceCares Patient Support Programs

IovanceCares provides comprehensive support to patients, caregivers, and healthcare providers throughout the Iovance treatment journey. IovanceCare includes the IovanceCares Portal, IovanceCares Reimbursement, and Patient Support.

Patient Assistance Program

Patients who are uninsured or underinsured may qualify for other financial assistance.

Co-pay Support Program

Through the Copay Program, IovanceCares will cover out-of-pocket costs up to a certain limit for Iovance products for Commercial patients. Covers expenses for approved Iovance products only.

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of TIL therapies, explaining their causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of the diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborate profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the TIL therapies market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM TIL therapies market.

Tumor-infiltrating Lymphocytes (TIL) Therapies Report Insights

- Patient population

- Therapeutic approaches

- TIL Therapies pipeline analysis

- TIL Therapies market size and trends

- Existing and future market opportunity

Tumor-infiltrating Lymphocytes (TIL) Therapies Report Key Strengths

- 10-year forecast

- The 7MM coverage

- TIL Therapies epidemiology segmentation

- Key cross competition

- Drug uptake and key market forecast assumptions

Tumor-Infiltrating Lymphocytes (TIL) Therapies Report Assessment

- Current treatment practices

- Unmet needs

- Conjoint Analysis

- Pipeline product profiles

- Market attractiveness

- Qualitative analysis (SWOT)

FAQs

- What is the historical and forecasted TIL Therapies patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- What was the TIL Therapies total market size, the market size by therapies, market share (%), distribution in 2024, and what would it look like by 2034? What are the contributing factors for this growth?

- Which therapy is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and off-label therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the TIL Therapies market.

- Insights on patient burden/disease cases, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and PAPs.

- To understand key opinion leaders’ perspectives on the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights into the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.